Академический Документы

Профессиональный Документы

Культура Документы

Spe 121256 MS

Загружено:

Guillermo Lira GuzmánОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Spe 121256 MS

Загружено:

Guillermo Lira GuzmánАвторское право:

Доступные форматы

SPE 121256

Application of the Monte Carlo Simulation in Calculating HC-Reserves

Zsolt Komlosi, Julia Komlosi, SPE, Partners for MOL

Copyright 2009, Society of Petroleum Engineers

This paper was prepared for presentation at the 2009 SPE EUROPEC/EAGE Annual Conference and Exhibition held in Amsterdam, The Netherlands, 811 June 2009.

This paper was selected for presentation by an SPE program committee following review of information contained in an abstract submitted by the author(s). Contents of the paper have not been

reviewed by the Society of Petroleum Engineers and are subject to correction by the author(s). The material does not necessarily reflect any position of the Society of Petroleum Engineers, its

officers, or members. Electronic reproduction, distribution, or storage of any part of this paper without the written consent of the Society of Petroleum Engineers is prohibited. Permission to

reproduce in print is restricted to an abstract of not more than 300 words; illustrations may not be copied. The abstract must contain conspicuous acknowledgment of SPE copyright.

Abstract

One of the key features of E&P companies is their proved reserves in hydrocarbon deposits. Reserve estimation requires

knowledge of Initial Hydrocarbon in Place, technical reserves and economic conditions including annual cash flow estimation

in the forecast period. Since all parameters used in evaluation procedure are burdened by rather more than less certainty.

Therefore, in a sophisticated evaluation process, there should be determined not the expected values only (deterministic way),

but errors/uncertainty of estimation as well (stochastic way) applying Monte Carlo simulation.

The estimation procedure comprises three main stages (the third stage /economic modeling/ is not discussed in this paper). In

the first stage, key input data (e.g., area, thickness, porosity, and so on) are treated as statistical variables, and the result of the

simulation is probability distribution function of HCIIP. This is an input of next stage.

In the second stage technical reserves (recoverable resources) should be estimated. There could be several assumptions for

production procedure for a reservoir (as e.g., drive mechanism, hydrodynamic system, phase behavior of reservoir fluids, well

spacing, water injection, presence of pressure barriers etc). Each regime (i.e. scenario) can be modeled applying input

parameters as statistical variables. This method is named a multiscenario method in the literature. Simulation result for each

scenario is a probability distribution function (PDF). While, expected value of PDF reconstructs the deterministic result and

gives a basis for project evaluation, the width of PDF is proportional with uncertainty of the estimation. Estimating

probability of each scenario a combined technical reserve PDF can be derived. Its first percentile can yield proved reserve for

booking procedure after economic limit test.

Authors show some case histories how to apply method after a brief theoretical summary referring to SPE-PRMS accepted.

Introduction

The fundamental issue in reserve estimation is the volume of hydrocarbon that can be economically recovered from the

reservoir. This is a complex task. Experts of several disciplines should closely cooperate for reaching a good solution

moreover, we will always have only limited amount of information. This is the reason why we focus on the Monte Carlo

simulation (MCS) procedures in this paper (except the economic modeling). We expect that both experts of geo-sciences and

petroleum engineers will be interested.

As this paper will not cover profitability estimation, we can not speak about reserves according to international standards

but only about recoverable resources. But we wish to highlight that the subject of our analysis is closer to reserves than to

resources, therefore we will use the term of technical reserve as formerly used in the industrial practice: technical reserve is a

resource, which can be economically recovered using regular production technologies by expectation of technical experts, but

the profitability was not specifically analyzed.

Theoretical background

We will approach the problem in two directions in order that the goal set out in the title can be accomplished. First we will

describe the reserve assessment process, and, as a result, we will present some types of reserves and resources Secondly, we

will briefly describe the simulation method used for the stochastic modeling, and, within that, for the Monte Carlo simulation.

Finally, we will combine the said two directions through case studies.

We must admit that extremely wide and theoretically sound financial and banking processes were first considered when the

methods were developed, but in this process we had to realize that we had no chance for developing such a theoretical system.

We were striving for implementing a practical and user-friendly solution managing complexity of the problem and the limited

amount of information available. The authors have the view that any process description can only be developed through

permanent application and regular and sector-level analysis of results and lift it among international standards finally.

SPE 121256

Reserve estimation

There are several national and international standards for reserve estimation and qualification. Always the given company

decides which method it intends to apply depending regulation of the countries where company is operating. The authors have

the view that the Petroleum Resources Management System (see SPE (2007), Ross (2007)) can be deemed as the best method

to follow. The standard applies the following three key words or categories:

Reservoir [in-place volumes]; Project [production/cash flow]; Property [ownership/contract terms].

Reserve

Natural

conditions

HCIIP

Fluid

properties

Regional

environment

Reservoir rock

Rock

properties

Human

conditions

Technology

Depletion

technique

Geometry

Economics

Well pattern

Kuhn & Komlosi (1991) described the critical reserve factors

as it shown on Fig. 1. On the left side of the flowchart (blue cells)

one can see the (objective) parameters determined by nature,

while the right side (yellow cells) presents the parameters that

experts or decision-makers may select from with a certain

degree of freedom depending on natural conditions. So first we

have to estimate the volume of hydrocarbons assumed in the

reservoir, and then we should determine the projects we wish to

implement and the volume (i.e. the reserve) we expect to recover

as a result of these projects.

Fig. 1: Reserve critical factors flow chart

Term of reserves (and their categories) is a dynamic one. It is changing time by time as a function of project status and

information earned in the field development and production procedures. First we meet the initial status. We will gradually

obtain more and more information during the project development and production procedures, due to the logic of the system,

and it will enable us to determine the initial and actual status with much higher level of accuracy. This is clearly an iteration

process (first we can assume it is convergent). We will reach the ideal accuracy as we get closer to the finish of the production

process, in accordance with the rules of formal logic and as described in the professional literature (e.g. Garb 1988).

However, when Demirmen (2005) analyzed the relevant statistics he came to the conclusion that the said decreasing

uncertainty was a myth. The authors also share this view pursuant to their practical experiences. The most presumable reasons

behind is that reservoirs are so complex (and some reservoirs are much more complex) that if we really want to understand

them (and to prepare the 100% relevant exploitation model) the amount of the necessary information would need so much

expenses that makes entire production project uneconomic. Therefore experts should look for optimum solution between

information maximization and expenses minimization and dream about 100% accurate production model. Even at the end of

exploitation we cannot be assured in theoretical reserve figure since we dont know how much HC would have been produced

if we had selected another production regime or technology at the beginning.

Managing uncertainty of reserves there are defined some categories for reserves which can be applied for technical

reserves too as analogy. The most important category is the best estimate (2P). It is the basis for planning field development

and project profitability estimation. One part of the best estimate is the low estimate (1P) derived very conservatively. It has a

high probability (90%) occurrence and serves as an objective for company financial reporting (Etherington (2006)). Ratio of

low and best estimate shows some certainty index (CI) for reserve assessment. Being it is near to 100% that proves certainty of

best estimate reserve or, its a pity, weakness of simulation methodology applied.

The third category of reserves are the high estimate (3P) showing all hopes of experts with low probability occurrence

(10%).

Hydrocarbon initially in place (HCIIP)

Basically two kinds of approaches can be seen in practice. One of them strives for perfection; this is the isovol mapping

method, where the volumes of hydrocarbons over unit of area (=isovol) are calculated at a well on the basis of information and

measurement data obtained from the well or seismic processing. The process is as follows: (1) Isovols are determined well by

well (2) Isovols are interpolated to the area in between the wells and an isovol map is compiled with software or manually and

(3) Integral of the isovol map yields HCIIP.

Another solution is a simplified one. It can be used in lack of sufficient amount of data and/or time. It is a calculation of a

general-cylinder (having the same area as the reservoir) where the characteristic properties are represented by the average data

of the reservoir investigated:

HCIIP = A * h * POR * (1 SW ) / BHCi

Of course, the first solution provides a more reliable estimate on the HCIIP, yet at the same time, by showing the spatial

distribution of the storage properties of the formations, it provides key data for the production technology study as well.

Advantage of the simplified method is the flexibility and operability; furthermore it allows running Monte Carlo simulation.

SPE 121256

A third method could be the one when HCIIP is extrapolated from production history data. Result of these extrapolations is

uncertain too since measurement of volumes, temperatures, pressures are uncertain as well. Although, this is a good control for

data derived volumetrically.

Technical reserve (recoverable resource)

We can exploit only a part of the HCIIP (defined in the previous section). How big this part is, well, this is determined by

the relevant geo-technical circumstances and the selected technology. Several technologies can be applied under the given

conditions and each has its typical ultimate recovery ratio:

HCTR = HCIIP * UR

Such technology options, called scenarios have a development project has with own CAPEX needs. When we select the

method and/or the technology, we should take not only the produced volume into account but also expenses and profitability.

Any decision selecting a technology that offers higher reserve should be made on business basis. One must investigate whether

it that reserve secures higher profit as well.

Stochastic modeling, Monte Carlo simulation (MCS)

The data used for assessment are burdened by rather more than less certainty, as they (such as porosity, water saturation,

and area in case of HCIIP estimation) can only be determined with a level on inaccuracy. Therefore, the need has arisen to

assess the accuracy of the properties determined.

One of the solutions used in practice when in addition to the most probable version an optimist and pessimist version is

also calculated. However, is it sufficient? Let us take two parameters, porosity and thickness. Porosity may tend to follow the

best case, the worst case scenario or the realistic terms (these are 3 cases). Thickness may have the same three options (which

are further 3 cases). As porosity is not dependent on thickness, this yields 9 different options. When you take into account that

you work with a lot more than two parameters, quite a great number of versions required calculation.

It is not the calculation, which is difficult, as modern computers can cope with the task easily; more problematic is the

evaluation of the results. No decision maker can review and evaluate the several hundred versions calculated from the dozen

parameters.

The possible solution is the estimation of reserves using the stochastic modeling tool, Monte Carlo simulation that can also

be considered as a wide ranging combined sensitivity test as well. In the simulation process, key input data (area, thickness,

porosity, and so on) are treated as statistical variables, and the evaluation process uses not their most probable or expected

value, but with values sampled in accordance with their probability distribution. The foundation of MCS is the deterministic

calculation model.

During the preparatory phase, the analysts determine the probability distribution function (PDF) of the input parameters in

the light of the known geological and technical relationships. The probability theory describes several PDFs, but truly abstract

distributions that cannot be followed by the evaluator are better not to apply as they may distort the modeling efforts. It is

advisable to apply triangular and the similar PERT distribution in addition to the uniform distribution, normal distribution and

lognormal distribution. In the PERT case the occurrence probability of minimum and maximum parameter values equals zero,

and there is a maximum probability occurrence value in between the two. There is a curve resembling to the normal or

lognormal distribution obtained between the three respective points. A benefit of this approach is that the tailings outside the

minimum - maximum interval will not appear. (Fig. 2 shows the distribution function of lognormal and Pert distributions).

Not all of the parameters are independent from each other. For instance, in most formation larger porosity will entails

lower water saturation level under similar circumstances. The software

Pert

used by the authors (@RISK) allows for the definition of a correlation

Lognorm al

coefficient between any pair of parameters and sampling is being made

Min-Mod-Max

with due attention paid to this coefficient during the iteration process.

During the simulation procedures, the software will calculated several

hundred or several thousand times as programmed the HCIIP taking

samples in accordance with the predefined input probability functions and

it will gather the calculated results as well.

Finally after the run of all the cycles a frequency function is complied

using the calculated results, which can be used to derive characteristic

properties such as expected value, standard deviation, any percentile, and

so on.

0

100

200

300

400

Fig. 2: Comparison Pert and lognormal probability

distribution functions

In other words, the outcome of the calculations will not be one figure, the volume of the HCIIP but its PDF and any

properties derived from it.

SPE 121256

Useful service of MCS is sensitivity analysis which is a multivariable stepwise regression analysis showing how strong

is impact of an input on an output parameter. When regression co-efficient is near zero then no effect when it is near +1 or -1

then effect is strong by the given input parameter to the result. Coefficients are displayed in form of tornado charts (see later).

The complete procedure described above can be repeated for technical reserve estimation (and further for reserve

estimation or even for profitability modeling) running with relevant evaluation input parameters as HCIIP probability

distribution function, ultimate recoveries and production forecasts for various scenarios which can be defined by production

technology selected. The only speciality is at (technical) reserve assessment modeling, that some input variables are not

continuous. E.g. whether is there water drive or not, which can be assumes as two scenarios as mentioned by Ross (2007).

Analyst should develop two models: one for water drive and one for closed reservoir, and the results will be two PDFs.

Estimating probability occurrences of scenarios a final PDF valid for entire field can be derived.

Case histories

In the past years, estimation of HCIIP was carried out in a number of fields. The deterministic HCIIP was estimated by

mapping isovol parameters in accordance with the practice of MOL.

The simulation models were based on deterministic models in each case using the average values, standard deviations or

various percentiles derived from data (as porosity, net pay, water saturation, BHCi) applied for isovol mapped.

Authors assume these cases arent finished yet. Results are to be discussed by experts of the field and of various disciplines

and, finally, the model and/or input values should be justify. Each case is supplied with some comments (i.e. critics) showing

weakness of MCS modeling.

Supporting this analysis, there are some assumptions which can be applied as rules of thumb e.g.: (1) Volume/area is the

strongest uncertainty drive; (2) Water saturations error is bigger than porositys error in clastic reservoirs; (3) Water saturation

correlates with porosity at various confidential levels; (4) Porosity error is significant in low porosity reservoirs.

Study one of the cases was extended to direction of technical reserve assessment. Various technologies were assumed as a

more or less reliable solution to exploit reservoirs. Each technology with its special conditions was named a scenario during

discussion.

HCIIP cases

General assumptions applied at each field: (1) No overestimation in uncertainty. Authors assumes in this stage of

methodology development we should rather call attention of relevant experts and decision makers than frighten away them

with horrible figures; (2) Uncertainty of BHCi derived from laboratory measurement statistics if any; (3) Input of porosity,

water saturation, and net pay are described as a truncated normal distribution derived from petrophysical data applied at

evaluation of each reservoir.

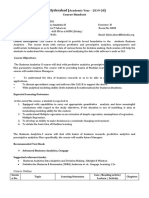

Key properties of the case study fields are contained in the Table 1.

Field #1

Mean values of porosity, net pay and water saturation levels and associated standard deviation for the purposes of

simulation were calculated from the values determined for the individual formation sections. When determining the area error,

we started from a simplified model stating that the error in gas-water contact will result in some area error, in other word a

deeper laying GWC will result in larger reservoir area. Calculating from the inclination of the strata, 1 meter of inaccuracy in

GWC will result 6% inaccuracy in area calculations (see Fig. 3).

Table 1

Feature

OWC/GWC

Formation

r

Age

Porosity

Type of porosity

Water saturation

dr

dLKH

Type of trap

Area

Fig. 3: Dependence between GWC and area

estimation (Angle is taken from a seismic cross Effective thickness

section)

Number of layers

Number of wells

In the simulation Pert distribution was used Formation content

for each parameter. The calculated mean B ; B

oi

gi

values of porosity, net pay and water HCIIP (best estimate)

saturation levels were used as the medium

Field:

Unit

m

%

%

km2

m

MMm3

1900

2265

2250

Shaly Sandstone

Basalt

Turbidities

Middle Pliocene

Miocene

Miocene

22.4

17.7

12.3

Primary

Double

Primary

22

85

46

Anticline

Lithological Lithological

3.5

1.4

5.6

27

63

43

6

1

8

7

9

6

Gas

Oil

Wet Gas

6.3

1.27

200

2670

1.74

880

SPE 121256

value of the function, while the minimum and maximum values were determined as the 30% and 70% percentiles,

corresponding to an interval in standard deviation of a normal distribution.

Best estimate was 2670 MMm3, while the low estimation was 2465 MMm3 (CI=92%). Probability distribution of the

HCIIP can be seen on Fig. 4 and the sensitivity tornado chart on Fig. 5.

Critics: (1) Net pay impact is overestimated, but if we assume that net pay regulates area as well it can be accepted. (2)

Relation of impacts porosity and saturation is questionable. Opposite habit were expected (uncertainty of SW estimation is

higher than uncertainty of porosity estimation).

X <= 2465

10%

X <= 2901

90%

0.87

h, m

0.35

A,km2

0.25

UR

0.20

POR

SW -0.01

2200

2400

2600

2800

3000

-0.2

3200

Sensitivity

0

0.2

0.4

0.6

0.8

Fig. 4-5: GIIP PDF for Field #1 and sensitivity coefficients

Field #2

There were no available PDF of porosity, water saturation and net pay, so an artificial method was applied. Several

versions were prepared from the deterministic estimate of OIIP using various porosity cut offs. This way, reserve calculation

variables (area, net pay, porosity) changes as a function of the porosity cut offs, which was described by linear regression.

A minimum error (+0.6%) was used for porosity determination. Due to the lithological character of the deposit, the water

saturation estimate was considered to be the most uncertain factor. Based on the processing of petrophysical data, the most

probable saturation level was 85%, but experts held the view that 78% or 92% saturation levels were just as much possible.

Every parameter was described with Pert PDF.

Best estimate was 1.91 MMm3, while the low estimation was 1.39 MMm3 (CI=72%). Probability distribution of the HCIIP

can be seen on Fig. 6 and the sensitivity tornado chart on Fig. 7.

Critics: (1) Water saturation impact is overestimated; (2) Impact of area and net pay is missing. Correction of MCS model

is required, but PDF of OIIP seems to be reliable.

X <= 1.39

10%

X <= 2.23

90%

-0.98

SW

-0.14

PORcut

-0.11

Boi

POR

1

1.5

2.5

0.07

Sensitivity

-1

-0.8 -0.6 -0.4 -0.2

0.2

Fig. 6-7: OIIP PDF for Field #2 and sensitivity coefficients

Field #3

For reasons of too few wells available and the poor information given by the 2D seismic interpretation materials two

deterministic model versions were prepared, one optimistic and one realistic (percentiles 10%, 90% and mean value of area are

shown on Fig. 8 for each reservoir). For the purposes of simulation, average porosity, net pay and water saturation levels were

calculated in every well with the associated standard deviation, using the well log interpretation results sampled by 20

centimeters.

SPE 121256

X <= 766

10%

10%

#Reservoir

X <= 996

90%

Mean

7

90%

6

Area, km2

Fig. 8: Area scenarios for reservoirs

of Field #3

600

800

1000

1200

Fig. 9: GIIP PDF for Field #3

Normal distribution was assumed with regard to porosity and water saturation for the purposes of the simulation, but only

values within the interval of the standard deviation were allowed to be processed (the out-of-range values were truncated).

When dealing with net pay, it was assumed that the extent of supposed error would change between 0.6 and 1.5 meter, as a

function of the net pay.

Using the two types (i.e. optimistic and realistic) of deterministic isovol values a mean and standard deviation were

calculated.

Input parameters were formulated for each and every sampling operation during the iteration process and isovol values

derived from them, which then were compared to deterministic isovol parameters. The area necessary for the reserves was

assumed to have a uniform probability distribution between the optimistic and realistic estimates.

Best estimate was 880 MMm3, while the low estimation was 766 MMm3 (CI=87%). Probability distribution of the HCIIP

can be seen on Fig. 9.

Critics: Missing sensitivities due to accumulation data of 8 reservoirs. Reorganization of MCS model can solve the

problem.

Technical reserve case

Solution before production or at the beginning

Now we will have a close look on case in Field #3. During the initial production phase we could give fairly high

probability to a recovery ratio between 53-69% and 60% as the most probable figure. In this case we get the probability

distribution as presented in Fig. 10, and, as a consequence, the best estimate (analog with 2P reserves) will be 531 MMm3 the

low estimate technical reserve (analog with proved, 1P reserve) will be 460 MMm3 (CI=86%). The technical reserve

sensitivity for two input parameters are displayed on Fig. 11.

X <= 460

10%

X <= 606

90%

GIIP,

MMm3

0.89

0.46

UR

Sensitivity

0

300

400

500

600

700

0.2

0.4

0.6

0.8

800

Fig. 10-11: Technical reserve PDF for Field #3 and sensitivity coefficients

Solution with some production history

A study was prepared at recovery of 20-30% in Field #3, where various production scenarios were analyzed using the

material balance method. Deciding questions in connection with scenarios are as follows: (1) If all wells are producing the

same reservoir or each well produces a reservoir separated from the others? (2) Are reservoirs closed or are there any water

drive? (3) Is it planned to drill a new producing well or not? Table 2 presents the parameters of the various scenarios. The

probability distribution of the technical reserves is defined as product of the GIIP probability distribution and relevant recovery

ratio.

SPE 121256

Lets see first the scenario 4. It is the only one which doesnt need additional investment (i.e. the cheapest solution). Result

PDF is shown on Fig. 12, the best estimate will be 624 MMm3 the low estimate technical reserve will be 551 MMm3

(CI=88%).

Table 2

X <=551

10%

X <=704

90%

Scenario

WaterDrive

500

700

4

Several

Closed

Open

New Well

300

One

Reservoir No

Ultimate recovery, %

84

59

55

55

T echn. Reserve,MMm 3

Probability of occurence, %

486

674

736

624

38

13

44

900

Fig. 12: Technical reserve PDF for Scenario 4 in Field #3

The probability distribution of the technical reserves for scenario 13 can be seen on Fig. 13. Dashed lines represent PDF

of each scenario separately, while the thick line represent their integrated PDF derived with probability of occurrence (see the

bottom row in Table 2), as these can be used for modeling the behavior of the technical reserve in the all scenarios.

When the material balance was prepared, the technical reserve was estimated with the expected line of pressure and

cumulative production data series. Since data points are not fitted on a line exactly, petroleum engineers derived a (wrapping)

line for minimum pressures and one line for maximum pressures in case of scenario 1 and 2. These lines yielded minimum and

maximum ultimate recoveries for both scenarios. Generating PERT distribution functions from those data-triads and

performing a simulation result PDF was yielded (see Fig. 14). One can see that in case of scenario 1 there is a good

coincidence between two PDFs, but dispersion of technical reserves derived from material balance is less in scenario 2 than

dispersion of PDF derived volumetrically.

X <=533

10%

X <=779

90%

TR(1)@GIIP

TR(2)@GIIP

Scen-1-3

Scen-2

TR(1)@MatBal.

TR(2)@MatBal.

Scen-3

Scen-1

300

500

700

900

Fig. 13: Technical reserve for scenarios 1, 2, 3 (dashed lines)

separately and for all (thick line) in Field #3

300

500

700

900

Fig. 14: Comparison PDF of technical reserves derived

from GIIP and material balance evaluation for scenario 1

and 2 in Field #3

One can ask authors which technical reserve (see Fig. 15) is valid for

the Field #3? There is no one answer. There are answers depending on

circumstances (remember right side of Fig. 1) as follows:

(1) No decision-making yet scenario 14;

(2) Decided to drill a well scenario 13;

(3) Decided not to drill any well scenario 4.

Best estimate of the ultimate recovery in scenario 13 is higher by 53

MMm3 and in scenario 3 is higher by 112 MMm3 than best estimate of

technical reserves in scenario 4 (see Fig.15), but the latter one doesnt

requires additional investment (CAPEX). So profitability estimation helps

to make decision.

900

Tech.Reserve,

3

MMm

High

Best

Low

800

700

600

500

14

13

Scenario

Fig. 15: Technical reserve versions in Field #3

SPE 121256

Conclusions

Monte Carlo simulation is a good tool for (technical) reserve assessment. It generates reserve categories (1P, 2P, 3P)

objective on the basis of simulation model developed by (subjective) experts.

Introduction of this system should be done gradually since experts and decision makers have to get used it. Experiences

of introduction should be collected an analyzed in order to development good methodological regulation.

Certainty indices are fairly high (72-92%) due to underestimated uncertainty factors. Assuming reserve assessment

control statistics realistic approaches had to yield lower CI values.

PDF of volumes in place is a continuous function, while PDFs of (technical) reserves are multiplied by various scenarios,

but they can be combined (with simulation) into one PDF.

Dont forget basic rule: Monte Carlo simulations accuracy is determined by the reliability of the geo-technical model,

parameters and conditions forecasted (garbage in, garbage out).

Nomenclature

A

=

area, km2

=

formation volume factor (FVF) of HC

BHCi

CAPEX =

Capital expenditure, $m

dLKH

=

deviation of lowest known hydrocarbon, m

dr

=

deviation of radius of area, m

h

=

net pay, m =H*N/G

H

=

Gross reservoir thickness, m

HCIIP

=

Hydrocarbon initially in place, Mm3

HCTR

=

Hydrocarbon technical reserve, Mm3

MM

=

Million (prefix)

N/G

=

Net / gross thickness rate

PDF

=

probability density function

POR

=

porosity

SW

=

water saturation

UR

=

ultimate recovery

Acknowledgments

The author would like to thank Hungarian Oil and Gas Plc. (MOL) for permission to publish this paper.

References

Demirmen, F. (2005): Reliability and Uncertainty in Reserves: How the Industry Fails, and a Vision for Improvement SPE

HEES, Dallas 3-5 April (SPE 94680)

Etherington, J. (2006): Integrating Reserves and Resource Assessment with Portfolio Management A Hybrid Approach

SPE Distinguished Lecturer Series

Garb, F.A. (1988): Assessing Risk in Estimating Hydrocarbon Reserves and in Evaluating Hydrocarbon-Producing

Properties JPT jun. p.765-778. (SPE 15921)

Kuhn T. - Komlosi Zs. (1991): How to Estimate the Reliability of Reserves? Quick and Practical Solution 3rd International

Reservoir Characterization Technical Conference, Tulsa Nov. 3-5. PennWell Books, Tulsa, p.769-780.

Ross, J. (2007): Understanding and Applying SPE-PRMS Training Course Material prepared for MOL Group Exploration

& Production, Budapest, Hungary

SPE (2007): Petroleum Resources Management System Sponsored by SPE, AAPG, WPC and SPEE. March

Вам также может понравиться

- GrantPrideco Drill Pipe Data TablesДокумент24 страницыGrantPrideco Drill Pipe Data TablesMaximo Biarrieta RodriguezОценок пока нет

- Diccionario Ingles-Espanol PDFДокумент295 страницDiccionario Ingles-Espanol PDFJose Daniel ChamorroОценок пока нет

- CementДокумент2 страницыCementGuillermo Lira GuzmánОценок пока нет

- Fire ProtectionДокумент10 страницFire Protectionhector15013Оценок пока нет

- Análisis Del Comportamiento en Yacimientos de Gas de Baja PermeabilidadДокумент16 страницAnálisis Del Comportamiento en Yacimientos de Gas de Baja PermeabilidadGuillermo Lira GuzmánОценок пока нет

- GP Tool Joint Dimensional ValueДокумент3 страницыGP Tool Joint Dimensional ValuecalamarejoОценок пока нет

- GP Combined Torsion Tension To Yield Pipe TubesДокумент7 страницGP Combined Torsion Tension To Yield Pipe TubesDiego Zainea CamperosОценок пока нет

- SPE 166231 Design Verification, Optimization and Validation of Ultra-HPHT Completion and Production ToolsДокумент11 страницSPE 166231 Design Verification, Optimization and Validation of Ultra-HPHT Completion and Production ToolsGuillermo Lira GuzmánОценок пока нет

- Water Influx Models - PetroWikiДокумент11 страницWater Influx Models - PetroWikiGuillermo Lira GuzmánОценок пока нет

- Linear Water Influx of An Infinite AquiferДокумент9 страницLinear Water Influx of An Infinite AquiferGuillermo Lira GuzmánОценок пока нет

- Investment and Risk Analysis Applied To The Petroleum IndustryДокумент9 страницInvestment and Risk Analysis Applied To The Petroleum IndustryGuillermo Lira GuzmánОценок пока нет

- The Application of The Laplace TransformationДокумент1 страницаThe Application of The Laplace TransformationGuillermo Lira GuzmánОценок пока нет

- Rock Properties TheoryДокумент11 страницRock Properties TheoryGuillermo Lira GuzmánОценок пока нет

- Intech-Enhanced Oil Recovery in Fractured ReservoirsДокумент23 страницыIntech-Enhanced Oil Recovery in Fractured ReservoirsArii WAhyudiiОценок пока нет

- Drilling Risk OperationsДокумент10 страницDrilling Risk OperationsPrem KishanОценок пока нет

- Characterization of Carbonate ReservoirДокумент6 страницCharacterization of Carbonate ReservoirGuillermo Lira GuzmánОценок пока нет

- Completion & Protection Products: Smart Solutions. Powerful ProductsДокумент2 страницыCompletion & Protection Products: Smart Solutions. Powerful ProductsGuillermo Lira GuzmánОценок пока нет

- CTdoc VelocityStringДокумент1 страницаCTdoc VelocityStringkahutzed666Оценок пока нет

- Investment and Risk Analysis Applied To The Petroleum IndustryДокумент9 страницInvestment and Risk Analysis Applied To The Petroleum IndustryGuillermo Lira GuzmánОценок пока нет

- ProjectRAM APMДокумент11 страницProjectRAM APMYasman DavidОценок пока нет

- Petroleum Drilling and Production Operations in The Gulf of MexicoДокумент9 страницPetroleum Drilling and Production Operations in The Gulf of MexicoGuillermo Lira GuzmánОценок пока нет

- Linear Water Influx of An Infinite AquiferДокумент9 страницLinear Water Influx of An Infinite AquiferGuillermo Lira GuzmánОценок пока нет

- The Application of The Laplace TransformationДокумент1 страницаThe Application of The Laplace TransformationGuillermo Lira GuzmánОценок пока нет

- SPE-1020-PA Mueller T. and Witherspoon P.A. Pressure Interference Effects Within Reservoirs and AquifersДокумент4 страницыSPE-1020-PA Mueller T. and Witherspoon P.A. Pressure Interference Effects Within Reservoirs and AquifersGuillermo Lira GuzmánОценок пока нет

- Type Curves 4Документ58 страницType Curves 4edgardiaz5519Оценок пока нет

- Uncovering Mexico - JPTДокумент88 страницUncovering Mexico - JPTGuillermo Lira GuzmánОценок пока нет

- JPT2006 05 Tech BitsДокумент2 страницыJPT2006 05 Tech BitsGuillermo Lira GuzmánОценок пока нет

- Diccionario Ingles-Espanol PDFДокумент295 страницDiccionario Ingles-Espanol PDFJose Daniel ChamorroОценок пока нет

- CTDДокумент1 страницаCTDGuillermo Lira GuzmánОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Akash AgarwalДокумент2 страницыAkash AgarwalAkash AgarwalОценок пока нет

- Reliability Analysis of Composite Wing Subjected To Gust LoadsДокумент5 страницReliability Analysis of Composite Wing Subjected To Gust LoadsEric ChienОценок пока нет

- Van Der Veen 2018 Metrologia 55 670 Bayesian Type A UncertaintyДокумент16 страницVan Der Veen 2018 Metrologia 55 670 Bayesian Type A UncertaintyAlexander MartinezОценок пока нет

- MATLAB For Finance FRM CFAДокумент20 страницMATLAB For Finance FRM CFAShivgan JoshiОценок пока нет

- Penelope 2014 NeaДокумент408 страницPenelope 2014 NeaJonathan Cristhian Muñoz LeónОценок пока нет

- Monte Carlo SimulationДокумент7 страницMonte Carlo SimulationandreОценок пока нет

- Transporte de Particulas MCДокумент637 страницTransporte de Particulas MCBLADIMIR LENIS GILОценок пока нет

- 57R-09 Aace PDFДокумент24 страницы57R-09 Aace PDFmirakulОценок пока нет

- Bayesian AnalysisДокумент20 страницBayesian AnalysisbobmezzОценок пока нет

- PHD Dissertation Vardakos Ver 2 PDFДокумент180 страницPHD Dissertation Vardakos Ver 2 PDFMark EdowaiОценок пока нет

- ASPTA - Advanced Signal Processing: Tools and ApplicationsДокумент5 страницASPTA - Advanced Signal Processing: Tools and ApplicationsMohamed TahaОценок пока нет

- Particle FilterДокумент16 страницParticle Filterlevin696Оценок пока нет

- Monte Carlo MethodsДокумент92 страницыMonte Carlo MethodsRubens BozanoОценок пока нет

- Ungerer, Philippe - Tavitian, Bernard - Boutin, Anne-Applications of Molecular Simulation in The Oil and Gas Industry - Monte Carlo Methods-Editions Technip (2005) PDFДокумент310 страницUngerer, Philippe - Tavitian, Bernard - Boutin, Anne-Applications of Molecular Simulation in The Oil and Gas Industry - Monte Carlo Methods-Editions Technip (2005) PDFanellbmcОценок пока нет

- BA 2 Course Handout - EДокумент4 страницыBA 2 Course Handout - EShivam KhannaОценок пока нет

- AAA Photon Dose Calculation Model in Eclipse™Документ23 страницыAAA Photon Dose Calculation Model in Eclipse™dumitrescu emilОценок пока нет

- 4 Dtic: Reliability and Life Prediction Methodology M60 Torsion BarsДокумент60 страниц4 Dtic: Reliability and Life Prediction Methodology M60 Torsion BarsTabiXh AahilОценок пока нет

- CDO PricingДокумент40 страницCDO Pricingmexicocity78Оценок пока нет

- G. Whittle - Optimising Project Value and Robustness PDFДокумент10 страницG. Whittle - Optimising Project Value and Robustness PDFcristobal olaveОценок пока нет

- (Mathematical Modeling 5) B. v. Gnedenko, I. N. Kovalenko (Auth.) - Introduction To Queuing Theory (1989, Birkhäuser Basel)Документ326 страниц(Mathematical Modeling 5) B. v. Gnedenko, I. N. Kovalenko (Auth.) - Introduction To Queuing Theory (1989, Birkhäuser Basel)Jose Manuel Hernandez CarratalaОценок пока нет

- Using Pof Models To Predict System Reliability Considering Failure CollaborationДокумент8 страницUsing Pof Models To Predict System Reliability Considering Failure CollaborationKarthik KarunanidhiОценок пока нет

- Simulation Methods in Statistical Physics, Project Report, FK7029, Stockholm UniversityДокумент31 страницаSimulation Methods in Statistical Physics, Project Report, FK7029, Stockholm Universitysebastian100% (2)

- Structural Reliability Powered by Strurel: Sofistik 2020Документ75 страницStructural Reliability Powered by Strurel: Sofistik 2020Chris LumyОценок пока нет

- Determining Specular Radiant Flux DistributionsДокумент34 страницыDetermining Specular Radiant Flux DistributionsdomingocattoniОценок пока нет

- MIE1622H - Assignment 3Документ5 страницMIE1622H - Assignment 3Ricardo P. BurgaОценок пока нет

- Assessing Trading System Health BandyДокумент33 страницыAssessing Trading System Health Bandypappu6600100% (1)

- Operations ResearchДокумент323 страницыOperations ResearchSivaОценок пока нет

- Applied Quantitative Finance 5Документ423 страницыApplied Quantitative Finance 5rraghavus100% (3)

- Joint International Conference on Supercomputing in Nuclear Applications and Monte Carlo 2013 (SNA + MC 2013Документ12 страницJoint International Conference on Supercomputing in Nuclear Applications and Monte Carlo 2013 (SNA + MC 2013Jonathan Muñoz LeonОценок пока нет

- Ijpec100203 Rivera 146785last Version April19Документ38 страницIjpec100203 Rivera 146785last Version April19Michi HenaoОценок пока нет