Академический Документы

Профессиональный Документы

Культура Документы

New Vendor Info Form

Загружено:

Sathyaprakash HsАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

New Vendor Info Form

Загружено:

Sathyaprakash HsАвторское право:

Доступные форматы

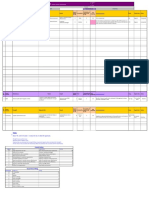

NV100 07/10R

EPRI NEW/UPDATED VENDOR INFORMATION

The information requested on this form is designed to help EPRI identify the types of work your company may be qualified to

perform and to flag areas that may require further discussion prior to awarding a contract. The intent of this form is to expedite

the contracting process by identifying potential issues early in the contracting process. You are not restricted to the below

space and pages. Please add pages or expand lines wherever necessary. This information is considered confidential but may

be shared internally at EPRI.

(Answering No to any of the questions will not disqualify a vendor from doing business with EPRI. Incomplete or blank boxes

will result in unnecessary delays and the form may be rejected. Please be as thorough as possible. )

List the EPRI Requester or Designate for your Service or Goods:

A. Business Information

. Business Name

. Business Address

. Website

. Payee Identification (List only one)

Federal Tax ID #:

Social Security #:

Last 4 digits only

C

. Type of Organizational Structure

Corporation

Partnership

Sole Proprietor

LLC

Type

Non-Profit

. Parent Company

. Type of Organization (Please check all that apply)

Service

R&D Firm

United States Government Agency

Consulting

Manufacturing

Foreign Gov`t Agency

Staffing/Temp Agency

Construction

University

Utility

Retailer

Other

. Describe the nature of products/services provided and country where products/services to be performed.

Country services/work to be performed:

. Fiscal Year End date if other than calendar year end of 12/31

Current Year

Prior Year

Two Years Ago

. Number of Employees in Company

. Years in Business

Not applicable to foreign entities

Yes

No *

http://www.ccr.gov

. Are you registered at Central Contractor Registration (CCR)?

* If you answer NO and anticipate receiving a Federally funded contracts (i.e. ARRA), you must register immediately to avoid

undue delays. Obtaining a DUNS and registering are required to receive awards utilizing ARRA funding.

. Company Size (Per Small Business Administration standards, Federal Regulation, Title 13, Part 121)

Small Business

Large Business

. Diversification (The business is owned at least 51% by a minority, woman or disabled veteran)

Minority-Owned

Women-Owned

Disabled Veteran-Owned

EPRI NV100 07/10R

1 of 14

. Provide a summary organization chart on a separate attachment or list web link.

URL

Yes

No

Yes

No

. Does your insurance coverage meet EPRI's requirement?

. General Commercial Liability

$2,000,000 per occurrence Minimum

Automobile Liability

$1,000,000 per accident Minimum

Employer's Liability

$1,000,000 per accident Minimum

Workers Compensation [Not applicable to foreign entitie

Statutory Limits Minimum

. Does your Software Quality Assurance Program meets EPRI standards? Refer to

#6 and #7 at:

http://mydocs.epri.com/docs/SDRWeb/processguide/index.html

. Is the work to be performed Nuclear-related? If so, please check the "Yes" box at

right and refer to the green tab at the bottom of this worksheet.

.

.

.

.

.

.

.

Do you have a registered and certified ISO 9000:2000 Quality Assurance Program?

Do you or your company have a Health & Safety Program?

Do you or your company have a Drug Screening Program?

Do you or your company perform employee background checks?

Do you or your company adhere to a code of ethics?

Have you or your company performed work under a U.S. Government funded program?

Do you or your company have U.S. Government approved billing rates?

. Federal Contracting Suspension/Debarment: Is your company or any of its principals

debarment, declared ineligible, or voluntarily excluded from covered transactions by any

U.S. Government department or agency?

. Contractor certifies funds from EPRI will not be used for lobbying activities and will

comply with 10 CFR Part 601, New Restrictions on Lobbying. [Not applicable to foreign entities.]

. Check all boxes that identify the type of work or describe the services you will provide to EPRI.

Report Writing/Software Dev.

Lab Analyses

Mfg/Field Work

Yes

No

30a. For U.S. entities, has a signed Form W-9 been submitted to EPRI's Vendor Committee?

(See the yellow tab at the bottom of this worksheet, titled "W-9".)

30b. For non-U.S. Entities, has a signed Form W-8BEN been submitted to EPRI's Vendor Committee?

(See the orange tab at the bottom of this worksheet, titled "Foreign Tax Withhold".)

. Have you read and accept all EPRIs terms and conditions?

I accept

I do not accept

(See the blue tab at the bottom of this worksheet, titled "EPRI Terms and Conditions".)

B. Foreign Corrupt Practices Act (You may be able to skip this Section. See following.)

If business is conducted within the territory of the United States by a U.S. company this section does not need to be completed. If busines

. Please indicate whether any of the below persons is a current or former government official (including individuals

holding positions at government-owned or controlled companies), a political party official, a

Yes *

No

candidate for political office, or a relative of such official:

1a. Someone who has an ownership interest, direct or indirect, in your business?

1b. An employee, officer or director of your business?

1c. A relative of any employee(s), officer(s) or director(s) of your business?

Yes

No *

. I agree to immediately notify EPRI of any change that would impact the above answers.

Before you complete Question 3, please familiarize yourself with the

FCPA by going to the U.S. Department of Justice website at

EPRI NV100 07/10R

http://www.justice.gov/criminal/fraud/fcpa/

2 of 14

Yes

. I understand the requirements of the Foreign Corrupt Practices Act and agree to

comply with the anti-bribery requirements.

*

No *

If you checked "Yes" to any of the Questions 1 or if you checked "No" to Question 2 or 3, please contact afantoni@

C. Financial Data

. Provide a copy of your most current Annual Report or link to the report if posted on the internet.

URL

. Annual Revenue:

Check here if your

company is listed on the

NYSE, NASDAQ, or

other stock exchange

Listed

Total

EPRI

Commercial

Total

Fiscal Year Forecast

Prior Year Actuals

Two Years Ago

. Annual revenue last FY by Contract Type:

Cost Reimbursement

Time & Materials

Fixed Price

Other

Total

U.S. Government

D. Accounting and Billing Data

$

$

$

$

$

Yes

No

Yes

No

Yes

No

. Is the accounting system automated?

If YES, list the name of the software.

. Is there a conventional double entry accounting system with a general ledger and

supporting journals? If NO, explain below.

. Does the project cost report show overruns? If NO, explain below.

. Explain the source documents utilized in preparing invoices for the performance of the contractual effort.

Yes

No

. Are you aware that costs billed EPRI must be incurred and paid prior to billing EPRI?

E. Labor

. Who handles the payroll system?

. Payroll period:

Weekly

Bi-weekly

Semi-monthly

Monthly

Other (explain)

. When are pay raises normally given?

. What are the basis of raises?

. How is the billed labor rate calculated?

Salary divided by 2080 hours, if not explain below

. Are attendance records/employee hours worked controlled electronically?

. Does the timekeeping system account for all hours worked (including unpaid overtime and

compensatory time?) If No, explain below.

EPRI NV100 07/10R

or manually?

Yes

No

3 of 14

Yes

No

. Do you have written procedures for the control and approval of paid overtime?

a. Are you aware that paid overtime requires written authorization by EPRI?

b. Do you use compensatory time in lieu of payment? Please explain below.

F. Indirect Rate Data

(Please skip this section if you will NOT be performing work on a cost reimbursement basis.)

. Describe your indirect rate structure and allocation base(s). (Example: overhead and direct labor dollars base;

G&A and total cost input):

. Explain how indirect expenses are identified and separated from expenses charged directly to a project:

. If EPRI is to receive U.S. Government rates, please provide the following:

Cognizant U.S. Government Audit Agency

Name of Auditor

Phone No.

. List the current provisional rates and the past three years of actual rates that have been incurred.

Provide URL to rates if posted on internet.

Overhead

Provisional

Actual

G&A

Provisional

Actual

Other:

Provisional

Actual

Current Year

Prior Yr: 20__

2 Yrs: 20__

Government Rate?

. Are you aware the actual indirect rates should be submitted to the EPRI Audit Department

within 120 days from the close of your fiscal year or upon final rate determination with the

U.S. Government?

Yes

No

G. Vendor Authorized Representative's Acknowledgement & Signature

Required

By signing below, you acknowledge that the information provided on this form is correct.

Signature

Required*

Date

Print Name

Title

Phone

Cell

Fax

Complete the below if the Contact Person responsible for answering questions pertaining to the information on

this form is different from the above listed person.

Contact

Title

Phone

Cell

Fax

Have questions? You can contact an R&D Contract representative by clicking on the below links.

Environment

Generation

Nuclear Power

Power Delivery Utilization

EPRI NV100 07/10R

4 of 14

Email completed form to your EPRI Requester and / or Designate

*You may submit this form with an attached scanned copy of the last page with the signature, scan copy this

entire form with the signature, use an electronic signature, or fax to 650-855-8854.

EPRI NV100 07/10R

5 of 14

NV100 7/10R

EPRI NEW/UPDATED VENDOR INFORMATION

Nuclear Related Work

Please complete the below questionnaire if your work is Nuclear-related.

Yes

. Do you have a Nuclear safety-related (10CFR50 Appendix B and 10CFR21)

Quality Assurance Program?

. If yes, have you been audited by a U.S. Nuclear utility?

. Please identify the utility

. Please indicate the date of the last audit

Please attach a completed copy of this page if you are NOT submitting the excel version of this form.

No

NV100 6/10R

EPRI Standard Contract Terms & Conditions

The below two PDF files are the standard terms and conditions for EPRI contracts; cost

reimbursement and time & materials. Please read the appropriate document and mark either "I

accept" or "I don't accept" for question #31.

Cost Reimbursement Terms & Conditions Contract

Description: Cost-reimbursement types of contracts provide for payment of allowable incurred

costs, to the extent prescribed in the contract. These contracts establish an estimate of total cost

for the purpose of obligating funds and establishing a ceiling that the contractor may not exceed

(except at its own risk) without the approval of EPRI's Contracting Negotiator.

Time & Material Terms & Conditions Contract

Description: A time-and-materials contract provides for acquiring supplies or services on the

basis of(1) Direct labor hours at specified fixed hourly rates that include wages, overhead,

general and administrative expenses, and profit; and (2) Materials at cost, including, if

appropriate, material handling costs as part of material costs.

Please note that the above contract boilerplates are periodically updated. Please review your

contract for any changes before signing.

If you are a University, Independent or Foreign Contractor, please contact any of the

Representatives listed at the bottom of the New Vendor Information form for the specific contract

boilerplate.

NV100 2/10R

EPRI New Vendor Information

Request for Taxpayer Identification Number & Certification (W-9)

A. Please double click on below document image to open, fill, and print. You may also use the

following link to the IRS website for the fill-in form.

Request for Taxpayer Identification Number & Certification (W-9)

B. Please submit your completed W-9 form to EPRI Accounts Payable by one of the three ways

listed below;

1 Email

2 Fax

3 Mail

NV100 2/10R

ew Vendor Information

or Taxpayer Identification Number & Certification (W-9)

lease double click on below document image to open, fill, and print. You may also use the

ollowing link to the IRS website for the fill-in form.

Request for Taxpayer Identification Number & Certification (W-9)

lease submit your completed W-9 form to EPRI Accounts Payable by one of the three ways

sted below;

VendorCommittee@EPRI.com

650-855-8554

EPRI

Accounts Payable

P.O. Box 10412

3420 Hillview Avenue

Palo Alto, CA 94303-0813

NV100 2/10R

EPRI New Vendor Information

Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding (W-8BEN)

A. Please double click on below document image to open, fill-in, and print. You may also use the

following link to the IRS website for the fill-in form.

Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding (W-8BEN)

B. Please submit your completed W-8BEN form to EPRI Accounts Payable by one of

the three ways listed below;

1

VendorCommittee@EPRI.com

Fax

650-855-8554

EPRI

Accounts Payable

P.O. Box 10412

3420 Hillview Avenue

Palo Alto, CA 94303-0813

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- External Issue RegisterДокумент1 страницаExternal Issue RegisterSathyaprakash HsОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Upadesa SaramДокумент221 страницаUpadesa SaramSathyaprakash Hs100% (1)

- Internal Issue RegisterДокумент2 страницыInternal Issue RegisterSathyaprakash HsОценок пока нет

- The Demons of Indian Philosophy and Their Creators Part 02Документ3 страницыThe Demons of Indian Philosophy and Their Creators Part 02Sathyaprakash HsОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Turtle Diagrams - IATF - 16949 - 2016Документ8 страницTurtle Diagrams - IATF - 16949 - 2016Sathyaprakash Hs100% (1)

- Document Review Ver 00Документ8 страницDocument Review Ver 00Sathyaprakash HsОценок пока нет

- X-Bar, R and S ChartsДокумент3 страницыX-Bar, R and S ChartsSathyaprakash HsОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Mandatory Documents and Records Required by IATF 16949Документ3 страницыMandatory Documents and Records Required by IATF 16949Sathyaprakash Hs100% (2)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Mandatory Documents IATF 16949Документ10 страницMandatory Documents IATF 16949Jm Venki100% (10)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- My Turtle DiagramДокумент8 страницMy Turtle DiagramSathyaprakash HsОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- May AvadaДокумент4 страницыMay AvadaSathyaprakash HsОценок пока нет

- Shankara JayatheerthaДокумент4 страницыShankara JayatheerthaSathyaprakash HsОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- AgniДокумент5 страницAgniSathyaprakash HsОценок пока нет

- Secrets of RamayanaДокумент3 страницыSecrets of RamayanaSathyaprakash HsОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Manava Shrauta Sutra PDFДокумент238 страницManava Shrauta Sutra PDFSathyaprakash HsОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- परमहंस श्री मधुसूदन सरस्वति विरचित वॆदांत कल्पलतिकाДокумент3 страницыपरमहंस श्री मधुसूदन सरस्वति विरचित वॆदांत कल्पलतिकाSathyaprakash HsОценок пока нет

- बृहदारण्यक शांकर भाष्यДокумент2 страницыबृहदारण्यक शांकर भाष्यSathyaprakash HsОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- NC Machine Preventative Maintenance Check ListДокумент2 страницыNC Machine Preventative Maintenance Check ListSathyaprakash HsОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- 40 Rituals Religion HinduДокумент4 страницы40 Rituals Religion HinduSathyaprakash HsОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Soil Chapter 3Документ67 страницSoil Chapter 3Jethrone MichealaОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- TelfastДокумент3 страницыTelfastjbahalkehОценок пока нет

- 2023 VGP Checklist Rev 0 - 23 - 1 - 2023 - 9 - 36 - 20Документ10 страниц2023 VGP Checklist Rev 0 - 23 - 1 - 2023 - 9 - 36 - 20mgalphamrn100% (1)

- Ifm Product Innovations PDFДокумент109 страницIfm Product Innovations PDFJC InquillayОценок пока нет

- Grain Silo Storage SizesДокумент8 страницGrain Silo Storage SizesTyler HallОценок пока нет

- Exercise 8 BeveragewareДокумент9 страницExercise 8 BeveragewareMae Cleofe G. SelisanaОценок пока нет

- Course Syllabus Manufacturing Processes (1) Metal CuttingДокумент4 страницыCourse Syllabus Manufacturing Processes (1) Metal CuttingG. Dancer GhОценок пока нет

- Buddahism ReportДокумент36 страницBuddahism Reportlaica andalОценок пока нет

- Current and Voltage Controls 3-Phase AC Max. Current Control Type S 178Документ3 страницыCurrent and Voltage Controls 3-Phase AC Max. Current Control Type S 178Felipe FarfanОценок пока нет

- 1 BSC Iriigation Engineering 2018 19 Std1Документ70 страниц1 BSC Iriigation Engineering 2018 19 Std1Kwasi BempongОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- D05 Directional Control Valves EngineeringДокумент11 страницD05 Directional Control Valves EngineeringVentas Control HidráulicoОценок пока нет

- Understanding Senior Citizens Outlook of Death Sample FormatДокумент14 страницUnderstanding Senior Citizens Outlook of Death Sample FormatThea QuibuyenОценок пока нет

- Compensation ManagementДокумент2 страницыCompensation Managementshreekumar_scdlОценок пока нет

- Final Manuscript GROUP2Документ102 страницыFinal Manuscript GROUP222102279Оценок пока нет

- Toaz - Info Fermentation of Carrot Juice Wheat Flour Gram Flour Etc PRДокумент17 страницToaz - Info Fermentation of Carrot Juice Wheat Flour Gram Flour Etc PRBhumika SahuОценок пока нет

- AQ-101 Arc Flash ProtectionДокумент4 страницыAQ-101 Arc Flash ProtectionYvesОценок пока нет

- Generic 5S ChecklistДокумент2 страницыGeneric 5S Checklistswamireddy100% (1)

- Brachiocephalic TrunkДокумент3 страницыBrachiocephalic TrunkstephОценок пока нет

- Edgie A. Tenerife BSHM 1108: Page 1 of 4Документ4 страницыEdgie A. Tenerife BSHM 1108: Page 1 of 4Edgie TenerifeОценок пока нет

- Cooling Tower (Genius)Документ7 страницCooling Tower (Genius)JeghiОценок пока нет

- Fittings: Fitting Buying GuideДокумент2 страницыFittings: Fitting Buying GuideAaron FonsecaОценок пока нет

- VOC & CO - EnglishДокумент50 страницVOC & CO - EnglishAnandKumarPОценок пока нет

- Harmonized Household Profiling ToolДокумент2 страницыHarmonized Household Profiling ToolJessa Mae89% (9)

- Aircaft Avionics SystemДокумент21 страницаAircaft Avionics SystemPavan KumarОценок пока нет

- Aliant Ommunications: VCL-2709, IEEE C37.94 To E1 ConverterДокумент2 страницыAliant Ommunications: VCL-2709, IEEE C37.94 To E1 ConverterConstantin UdreaОценок пока нет

- Editorship, Dr. S.A. OstroumovДокумент4 страницыEditorship, Dr. S.A. OstroumovSergei OstroumovОценок пока нет

- II092 - Horiz & Vert ULSs With Serial InputsДокумент4 страницыII092 - Horiz & Vert ULSs With Serial InputsJibjab7Оценок пока нет

- 2022.08.09 Rickenbacker ComprehensiveДокумент180 страниц2022.08.09 Rickenbacker ComprehensiveTony WintonОценок пока нет

- Human Rights Law - Yasin vs. Hon. Judge Sharia CourtДокумент7 страницHuman Rights Law - Yasin vs. Hon. Judge Sharia CourtElixirLanganlanganОценок пока нет

- Indiana Administrative CodeДокумент176 страницIndiana Administrative CodeMd Mamunur RashidОценок пока нет

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurОт Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurРейтинг: 4.5 из 5 звезд4.5/5 (3)

- Secrets of the Millionaire Mind: Mastering the Inner Game of WealthОт EverandSecrets of the Millionaire Mind: Mastering the Inner Game of WealthРейтинг: 4.5 из 5 звезд4.5/5 (1027)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeОт EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeРейтинг: 4.5 из 5 звезд4.5/5 (90)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsОт EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsРейтинг: 5 из 5 звезд5/5 (48)