Академический Документы

Профессиональный Документы

Культура Документы

Booker Jones

Загружено:

Crystal Laksono PranotoИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Booker Jones

Загружено:

Crystal Laksono PranotoАвторское право:

Доступные форматы

BOOKER JONES

CRYSTAL PRANOTO

1. A. From comparing exhibit 1 & 2, we could see an increase in cost due

to the price of the barrels used, and cost of warehousing. This is due to

companys decision to increase the production, which increase the

need to use 20,000 more barrels. A barrel now cost $31,50, so 20,000

x $31.50 = 630,000 reduction in profit.

B. If barrels were considered as inventory, and not as other operating

costs, then we could move them out from income Statement, and

would only be mentioned when its actually sold. When it was sold, its

going to be states as Sold Whisky Cost, and match it with revenue.

Right now there is a lot of mismatching.

(i) Balance sheet at end of 1960

- If retroactive changes are made in 1959, then balance sheet of

1960 would look different because 1959 wouldnt show the barrels

in inventory, and 1960 would account the barrels in inventory.

- In 1959, there was 172,000 barrels each cost $31.5, resulting in

$5.4 million inventor.

172,000 x $31.5 = $5,418,000 increase in inventory

- Finished case whiskey (because they sat in barrels too, so additional

barrels)

175,000/35 = 5,000 x $31.5 = $158,000 increase in

inventory

- Bulk = 4,506,000 + 5,418,000 = 9,924

- Cased = 1,969,000 + 158,000 = 2,127

- So, Increase in Inventory = 12,051,000

- So, they need to debit Inventory by $5,600,000 (12,051,000(4,506,000+1,969,000))

- Credit Retained Earnings by the same amount (as Expense)

- Before they understated them

(ii) Balance sheet at end of 1961

- Company would increase the number of barrel from 172,000 to

192,000 as they need 20,000 more because of the increase in

production. Barrel inventory would increase by $192,000 x $21.5 =

$6.05 million

192,000 x $21.5 = $6,048,000 increase in Inventory

Bulk = 5,030 + 6,048,000 = $11,078,000

Cased Whiskey = 1,969,000 + 158,000 = $2,127,000

So, Increase in Inventory = $13,205,000

Inventory should increase by $6,252,261, and credit

Retained Earnings

(iii) Operating statement of 1960 > no effect.

Reconcile Retained Earnings, what happen before and after

adjustments?

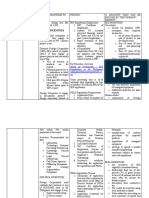

1960

RE beginning balance

Profit (loss)

RE End Balance

Before

Adjustment

2,794

462

3,256

Adjustment

5,576

5,576

After

Adjustment

8,730

462

8,832

As we can see, theres no change in Net Income.

2. No! I dont believe that Jones went from profit (1960) to loss (1961). He

invested for the future by increasing the production in 1961. If he

didnt increase the production from last year, his profits would be

comparable to the year before.

3. Use direct and variable costing. Even though barrels are not essential

fixed cost. Warning for variable costing, and you have products that

ages, its going blow up.

Jones should capitalize the number of barrels, then put them in the

inventory. It will make the number of the financial accounting looks

more profitable and a better reflection of the business performance.

GAAP > Finished goods warehouse, should be in SG&A (period cost).

But Bourbon becomes bourbon after 4 years, they use the barrels to

make the bourbon. Its Indirect Material cost > manufacturing OH and

should be production cost.

You need the warehouse in order to finish the bourbon, you need

the taster as well. They are all production costs. They should

have been capitalize too. You cant make the bourbon without

them, so they are production cost.

4. ROE = (Net Income / Shareholders Equity) x 100%

ROE = (462,000/RE + Common Stock) x 100%

ROE = 462,000/5,056,000 x 100%

ROE = 9.14% > their ROE looks terrible!

5. 633 + (3,462) = ($2,829)

Also include interest cost

They Probably need 3,000,000 more 3 year expansion. They

missed it by half.

6. Economic rate of return = (Current Value of Investment

Cost of Inv)/Cost of investmern * 100%

= 9,800,000 8,621,000 * 100%

= 13.7% economic rate of return

7. They might say no because they are going to show up with wrong

calculation (the loss), bank are going to know they understated the

loan. They cant do their accounting right. What if their projections

are not right? His market research might be wrong, and decided to

bump up production by 50%. Not to sophisticated. The bank is going

to finance the whole project. Zero equity for this expansion. Bank is

not going to be very impressed, no investment by Henry. They also

did no planning for the future.

If the bank is going to say yes, which is most likely the case. Its

because the company has strong profitable history, so, the bank

should be willing to lend Booker as there is small risk of default.

They have never been unprofitable. They make good products. The

collateral is so good for this loan, which guarantees the safety of the

bank. They also have Liquid Assets if they go bankrupt and need to

pay back the loan (building, barrels, whisky, equipment) It also

seems that the manager is doing well in trying to increase the sales

revenue. Their liabilities (long term ad short term) are already under

Ridgeview Bank. They should know that they are doing fine.

8. Do they have the production capacity to increase production? Are

they currently accounting for these extra costs? If they start

producing more whiskey will customers think that they have lower

quality bourbon? They are only 1.5% market. They are doing flat

pricing, all these time. If demand is truly climbing, they have the

chance to increase their prices. What about doing two different

quality of bourbon? 2 years bourbon and 4 years bourbon. Jones

could continue to expand the production, but change the financial

reporting, and capitalize the numbers of barrel, so it better reflects

the performance, and would give him the loans.

Вам также может понравиться

- Industry BackgroundДокумент1 страницаIndustry BackgroundDharline Abbygale Garvida AgullanaОценок пока нет

- Solution Manual Managerial Accounting Chapter 14Документ4 страницыSolution Manual Managerial Accounting Chapter 14ukandi rukmanaОценок пока нет

- Baldwin Bicycle CompanyДокумент19 страницBaldwin Bicycle CompanyMannu83Оценок пока нет

- CH 15 QuestionsДокумент4 страницыCH 15 QuestionsHussainОценок пока нет

- Preferential Quizers From ULДокумент21 страницаPreferential Quizers From ULFrie NdshipMaeОценок пока нет

- 6 AfarДокумент24 страницы6 AfarJM SonidoОценок пока нет

- IAS-37 Provisions, Contingent Liabilities and Contingent AssetsДокумент3 страницыIAS-37 Provisions, Contingent Liabilities and Contingent AssetsAbdul SamiОценок пока нет

- Financial Analysis Harley DavidsonДокумент5 страницFinancial Analysis Harley DavidsonAyu Eka Putri50% (2)

- The Home Depot: QuestionsДокумент13 страницThe Home Depot: Questions凱爾思Оценок пока нет

- Case Study: GarudaДокумент30 страницCase Study: Garudahaihien98livlyОценок пока нет

- For Boi IncentivesДокумент7 страницFor Boi Incentiveskimberly fanoОценок пока нет

- Past MA Exams by Lecture Topic - Questions PDFДокумент44 страницыPast MA Exams by Lecture Topic - Questions PDFbooks_sumiОценок пока нет

- Chapter 15Документ16 страницChapter 15kylicia bestОценок пока нет

- 1Документ2 страницы1blankОценок пока нет

- Cost of CapitalДокумент11 страницCost of CapitalJOHN PAOLO EVORAОценок пока нет

- Chap 005Документ97 страницChap 005Ahmed El KhateebОценок пока нет

- Brand Management1Документ3 страницыBrand Management1Muhammad JunaidОценок пока нет

- ABC QuestionsДокумент14 страницABC QuestionsLara Lewis Achilles0% (1)

- Practice Problem Set2 - Process Capacity AnalysisДокумент4 страницыPractice Problem Set2 - Process Capacity AnalysisMayuresh GaikarОценок пока нет

- Real Options and Capital Budgeting (I Wish I Had A Crystal Ball)Документ4 страницыReal Options and Capital Budgeting (I Wish I Had A Crystal Ball)Ian S. DaosОценок пока нет

- Cafe Monte BiancoДокумент21 страницаCafe Monte BiancoWilliam Torrez OrozcoОценок пока нет

- IAS 33 Earnings Per ShareДокумент9 страницIAS 33 Earnings Per ShareangaОценок пока нет

- Tugas FM FuzzyTronicДокумент7 страницTugas FM FuzzyTronicAnggit Tut PinilihОценок пока нет

- Assignment 9Документ17 страницAssignment 9Beenish JafriОценок пока нет

- FIN 600 - Midterm Sample With SolutionsДокумент22 страницыFIN 600 - Midterm Sample With SolutionsVipul0% (2)

- Case StudyДокумент6 страницCase Studyanhdu7Оценок пока нет

- Decentralized Performance Evaluation: Answers To QuestionsДокумент43 страницыDecentralized Performance Evaluation: Answers To QuestionsCharlene MakОценок пока нет

- BUS 201 Review For Exam 2Документ7 страницBUS 201 Review For Exam 2Brandilynn WoodsОценок пока нет

- CH2 FinmaДокумент3 страницыCH2 Finmamervin coquillaОценок пока нет

- CH4 MinicaseДокумент4 страницыCH4 Minicasemervin coquillaОценок пока нет

- Zong BДокумент3 страницыZong BAbdul Rehman AmiwalaОценок пока нет

- Problems and Exercises in Introduction in Acctg and CVPДокумент4 страницыProblems and Exercises in Introduction in Acctg and CVPJanelleОценок пока нет

- FIN 500 TEST # 1 (CHAPTER 2-3-4) : Multiple ChoiceДокумент11 страницFIN 500 TEST # 1 (CHAPTER 2-3-4) : Multiple ChoicemarkomatematikaОценок пока нет

- Sample MAS 3rd Evals KEY Set AДокумент10 страницSample MAS 3rd Evals KEY Set AJoanna MОценок пока нет

- Genzyme DCF PDFДокумент5 страницGenzyme DCF PDFAbinashОценок пока нет

- Final Draft - MFIДокумент38 страницFinal Draft - MFIShaquille SmithОценок пока нет

- OpMan and TQM Chapter 1Документ48 страницOpMan and TQM Chapter 1Kadmiel CarlosОценок пока нет

- DMP3e CH12 Solutions 05.17.10 RevisedДокумент41 страницаDMP3e CH12 Solutions 05.17.10 Revisedmichaelkwok1Оценок пока нет

- Worksheet For Financial Acc. IДокумент5 страницWorksheet For Financial Acc. IFantay100% (1)

- CH 06Документ8 страницCH 06Tien Thanh DangОценок пока нет

- Latihan UTS AKUNДокумент32 страницыLatihan UTS AKUNchittamahayantiОценок пока нет

- BL - Banking LawsДокумент21 страницаBL - Banking LawsColeen CunananОценок пока нет

- QP PreparationДокумент10 страницQP Preparationpraveen gandiОценок пока нет

- Acct500 Mock Final Exam QuestionsДокумент177 страницAcct500 Mock Final Exam QuestionsDalal KwtОценок пока нет

- Singapore Institute of Management: University of London Preliminary Exam 2020Документ20 страницSingapore Institute of Management: University of London Preliminary Exam 2020Kəmalə AslanzadəОценок пока нет

- Assignment FinalДокумент6 страницAssignment Finalcecille maningoОценок пока нет

- F CFAS-EXAM - Docx 143874436Документ48 страницF CFAS-EXAM - Docx 143874436Athena AthenaОценок пока нет

- Wacc 5.52%Документ2 страницыWacc 5.52%Rica CatanguiОценок пока нет

- RFBT Compilation Week 1 6Документ155 страницRFBT Compilation Week 1 6Mitch MinglanaОценок пока нет

- Chapter - 15fggf Financial Accounting and Accounting StandardДокумент22 страницыChapter - 15fggf Financial Accounting and Accounting StandardOrlando ReyesОценок пока нет

- Cost Behavior Analysis Boris A. Sevilla: Egg Company Manufactures and Sells A Single Product. A PartiallyДокумент5 страницCost Behavior Analysis Boris A. Sevilla: Egg Company Manufactures and Sells A Single Product. A PartiallyCher NaОценок пока нет

- Shakey's 2021Документ69 страницShakey's 2021Megan CastilloОценок пока нет

- Case 11-2 Alfi Dan Yessy AKT 18-MДокумент4 страницыCase 11-2 Alfi Dan Yessy AKT 18-MAna KristianaОценок пока нет

- Titanium Dioxide ExhibitsДокумент7 страницTitanium Dioxide Exhibitssanjayhk7Оценок пока нет

- Ross Appendix19AДокумент7 страницRoss Appendix19ARichard RobinsonОценок пока нет

- Form A Form A - Annual Return of Company Having Share CapitalДокумент4 страницыForm A Form A - Annual Return of Company Having Share CapitalAimanОценок пока нет

- MAS RefExamДокумент7 страницMAS RefExamjeralyn juditОценок пока нет

- Absorption and Variable Costing: Quiz #1Документ2 страницыAbsorption and Variable Costing: Quiz #1Nicole Anne Santiago SibuloОценок пока нет

- Acca107 Preliminary ExaminationДокумент16 страницAcca107 Preliminary ExaminationNicole Anne Santiago SibuloОценок пока нет

- Badm 560 - Firm and Industry Analysis Problem Set Two QuestionsДокумент2 страницыBadm 560 - Firm and Industry Analysis Problem Set Two QuestionsRoger federerОценок пока нет

- Hussam Al Jezani: Sales Promotion & ManagementДокумент1 страницаHussam Al Jezani: Sales Promotion & ManagementKhadija Al AqqadОценок пока нет

- PDIL Enq Spec For Non Plant Building HURL G-207Документ721 страницаPDIL Enq Spec For Non Plant Building HURL G-207Tusar KoleОценок пока нет

- JD Edwards Enterpriseone 9.X: Release Highlights (Applications)Документ13 страницJD Edwards Enterpriseone 9.X: Release Highlights (Applications)alcajaОценок пока нет

- Security Spec For Adding Access To View Spool Output For Batch Jobs VSO - 5484501Документ8 страницSecurity Spec For Adding Access To View Spool Output For Batch Jobs VSO - 5484501Rumpa MukherjeeОценок пока нет

- En04 de 1 Kết Hợp KeyДокумент6 страницEn04 de 1 Kết Hợp KeyAn NguyễnОценок пока нет

- Consumer Preference Towards Different Branded Sports ShoesДокумент11 страницConsumer Preference Towards Different Branded Sports ShoesAnushka KharatОценок пока нет

- Residuary PowerДокумент7 страницResiduary PowerGaurav GehlotОценок пока нет

- Arid Agriculture University, Rawalpindi: Mid Exam / Spring 2020 (Paper Duration 48 Hours) To Be Filled by TeacherДокумент5 страницArid Agriculture University, Rawalpindi: Mid Exam / Spring 2020 (Paper Duration 48 Hours) To Be Filled by TeacherObaid Ahmed AbbasiОценок пока нет

- Goal Assure BrochureДокумент20 страницGoal Assure BrochureBharat19Оценок пока нет

- INCOME TAXATION Module 2 Tax Administration and Procedure - Copy-1Документ13 страницINCOME TAXATION Module 2 Tax Administration and Procedure - Copy-1Richel San Agustin100% (1)

- ISO IEC 27005-2022-FineДокумент70 страницISO IEC 27005-2022-FineMinh Ttn100% (1)

- Accounting Information Systems - Yola-170-171Документ2 страницыAccounting Information Systems - Yola-170-171dindaОценок пока нет

- Agrarian Reform HistoryДокумент17 страницAgrarian Reform HistoryMi Chael0% (1)

- BO Temporary KeysДокумент5 страницBO Temporary Keysamanblr12Оценок пока нет

- PS.06 - Claims Analysis Nested in Schedule UpdatesДокумент8 страницPS.06 - Claims Analysis Nested in Schedule UpdatesAhed NabilОценок пока нет

- Project Report ON " A Comprehensive Study On Financial Analysis"Документ41 страницаProject Report ON " A Comprehensive Study On Financial Analysis"corby24Оценок пока нет

- Explain Origin of Commercial BankingДокумент6 страницExplain Origin of Commercial Bankingዳግማዊ ጌታነህ ግዛው ባይህОценок пока нет

- (ACYFAR2) Toribio Critique Paper K36.editedДокумент12 страниц(ACYFAR2) Toribio Critique Paper K36.editedHannah Jane ToribioОценок пока нет

- LoanДокумент4 страницыLoanRichard Chinyama Chikeji NjolombaОценок пока нет

- Acc206 e ExamДокумент8 страницAcc206 e Examm2kxcg4gsxОценок пока нет

- Inv 0019Документ1 страницаInv 0019urkirannandaОценок пока нет

- Tesla Strategic AnalysisДокумент11 страницTesla Strategic AnalysisRahul Ramesh100% (4)

- Reading 20 Discounted Dividend ValuationДокумент55 страницReading 20 Discounted Dividend Valuationdhanh.bdn.hsv.neuОценок пока нет

- Under Irrevocable Confirmation Corporate Pay Order (Iccpo) : Payment Guarantee Letter (PGL) of UndertakingДокумент9 страницUnder Irrevocable Confirmation Corporate Pay Order (Iccpo) : Payment Guarantee Letter (PGL) of UndertakingEsteban Enrique Posan Balcazar100% (1)

- Case Study EcoДокумент4 страницыCase Study Econnannyak67% (15)

- Startegic Managemnt Assignment 1Документ16 страницStartegic Managemnt Assignment 1Syeda ZehraОценок пока нет

- Netarhat SwissДокумент2 страницыNetarhat SwissdharmendraОценок пока нет

- Minimum Wages Act - 1948Документ8 страницMinimum Wages Act - 1948Shaji Mullookkaaran100% (3)

- Cost Volume Profit Analysis Cost Accounting 2022 P1Документ6 страницCost Volume Profit Analysis Cost Accounting 2022 P1jay-an DahunogОценок пока нет

- Inventory ValuationДокумент4 страницыInventory ValuationMary AmoОценок пока нет