Академический Документы

Профессиональный Документы

Культура Документы

caCAF 01 Suggested Solution Autumn 2014

Загружено:

shahroozkhanАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

caCAF 01 Suggested Solution Autumn 2014

Загружено:

shahroozkhanАвторское право:

Доступные форматы

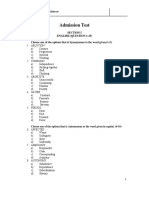

RISE SCHOOL OF ACCOUNTANCY

Certificate in Accounting & Finance Examination

Autumn 2014

2 September 2014

CAF 1 Introduction to Accounting

Introduction to Accounting

Suggested Solution

CAF-01

Introduction To Accounting

Prepared by: Adnan Rauf, ACA

Reviewed by: Mr. Naveed Ansari, FCA

Adnan Rauf, ACA

Adnan Rauf, ACA qualified CA in 2008. He completed his articles from A. F. Ferguson & Co,

Chartered Accountants. After qualification, he served the same firm at managerial level. Then, he

joined the teaching profession on full time basis. Currently, he is teaching the subjects of

Introduction to Accounting, Financial Accounting and Reporting-1 and Principles of Taxation

to the students of CA in RISE School of Accountancy (RAET approved by ICAP). 3 of his students

have received certificate of merits. He has authored 2 books.

Naveed Ansari, FCA

He is Principal at Garden Town Campus, Rise School of Accountancy. He has taught thousands of

students of professional qualifications like CA and ACCA. 5 of his students have got distinctions in

various papers. He has authored 1 book.

Introduction to Accounting

I Page 2 of 8

Answer-1

i)

ii)

iii)

iv)

v)

vi)

vii)

viii)

Completeness/ Materiality

Materiality

Separate entity concept

True and fair view

Matching concept

Prudence

Going concern

Consistency

Answer-2

Dr.

Opening balance (Dr.)

Sale

Bill receivable (dishonored)

Cr.

Debtor Control Account

1,744,500

10,796,300 Sale return (144,400 - 22,000)

30,900 Cash

Discount allowed

Bad debt

Bill received

Creditor control account (contra)

Closing balance (bal.)

Dr.

122,400

9,404,300

348,000

16,000

508,400

35,000

2,137,600

Cr.

1,366,000

8,166,600

Creditor Control Account

Opening balance

315,900 Purchases

7,236,300

204,800

35,000

277,700

30,000

1,432,900

Purchase return

Cash (7,210,300 + 26,000)

Discount received

Debtor control account (contra)

Bill given to supplier

Posting error

Closing balance (bal.)

Answer-3

Comments

In my opinion the concept of distribution of loss of a partner is not in syllabus as it is not mentioned anywhere

in study text or question bank.

Ali

b/d

Capital-Zahid (W)

Realisation (loss)

Cash (bal.)

229,619

449,378

617,303

Partners capital accounts

Zahid

194,400 b/d

172,215

Realisation (cost)

337,034

337,034 Cash

527,797

Capital-Zia, Ali(bal)

Zia

Ali

1,296,300

Zia

864,200

172,845

Zahid

129,600

401,834

By: Adnan Rauf, ACA

Debtors

Stock

Furniture

Cash

- Creditors (2,484,600 +21,600)

Capital Zia (Dissolution cost)

(see below)

Commission payable to Zia

Realisation Account

1,706,800 Creditors

2,592,600 Provision for doubtful debt

259,300

Cash

- Debtor

2,506,200 - Stock

- Furniture

172,845

Loss on revaluation

- Capital Ali (1,123,445 x 40%)

- Capital Zia (1,123,445 x 30%)

- Capital Zahid (1,123,445 x 30%)

(1,306,300 + 1,944,500 + 206,100) x 5%

I Page 3 of 8

2,549,400

108,000

1,306,300

1,944,500

206,100

449,378

337,034

337,034

172,845

Cash Account

64,800

b/d

Realisation a/c

- Debtor

- Stock

- Furniture

Capital Zahid

1,306,300

1,944,500

206,100

129,600

Realisation a/c

- Creditor

Capital Ali

Capital Zia

Note: Relaisation expenses are ignored in the solution because these are to be borne by Mr. Zia.

(W) Journal entry for distribution of loss

Dr.

Capital Ali (401,834 x 4/7)

229,619

Capital Zia (401,834 x 3/7)

172,215

Capital Zahid

(Loss of Zahid is distributed between Zia and Ali in their profit sharing ratios)

Answer-4

i)

ii)

iii)

iv)

v)

vi)

vii)

viii)

2,506,200

617,303

527,797

Cr.

401,834

Machine purchased by paying cash of Rs. 14,600.

Cash received from debtors amounted to Rs. 4,100.

Machine purchased costing Rs. 61,600. Cash paid amounted to Rs. 16,000 and Rs. 45,600 are still

payable.

Goods retuned to creditors amounted to Rs. 66,100.

Cash received from owner amounted to Rs. 68,400.

Machine purchased costing Rs. 9,600 on credit.

Owner withdrew cash for personal purpose amounting to Rs. 22,000.

Contra settlement of Rs. 15,000 is made between debtors and creditors.

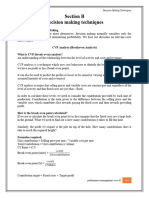

Answer-5

Chart of accounts

Chart of accounts is a list of account names and numbers used in accounting to mange accounting records into

various heads such as expenses, incomes, liabilities, assets and capital.

Purpose of creating chart of accounts

1. Each account has distinct serial number

Introduction to Accounting

I Page 4 of 8

2. A detailed track in record keeping system can be made.

3. Classification of all transaction in their respective heads can easily be made.

4. Errors and mistakes can be easily traced.

Answer-6

Comments

In my opinion the concept of preparing inventory ledger card under periodic system is not in syllabus as it is

not mentioned anywhere in study text or question bank.

(a)

Cost of inventory Rs. 2,226,000

Purchases

Qty.

1-Aug

12-Aug

15-Aug

28-Aug

30-Aug

b)

20,000

20,000

75

78

Value

20,000

20,000

PUC

75

78

Stock

Qty.

PUC

Value

30,000

71.6667

2,150,000

20,000

74.2000

1,484,000

1,500,000

1,560,000

Cost of inventory Rs. 2,197,500

Purchases

Qty.

1-Aug

12-Aug

28-Aug

31-Aug

PUC

Sales

Value

Qty.

40,000

60,000

30,000

50,000

30,000

Sales

PUC

70

71.6667

71.6667

74.2000

74.2000

Value

2,800,000

4,300,000

2,150,000

3,710,000

2,226,000

Stock

Qty.

PUC

Value

50,000

73.2500

3,662,500

1,500,000

1,560,000

Qty.

40,000

60,000

80,000

30,000

PUC

70

71.6667

73.2500

73.2500

Value

2,800,000

4,300,000

5,860,000

2,197,500

Answer -7

Comments

Trade discount does not appear anywhere in books of accounts. Therefore trade discount appearing in trial

balance is assumed as cash discount.

Mr. Salman

Statement of Comprehensive income

for the year ended June 30, 2014

Rs. In 000

Sales

353,300

Less: Sale return

(10,000)

Net sales

343,300

Less: Cost of sales

Opening Stock

127,762

Purchases less returns

(330,530 -500)

330,030

Carriage in

10,420

Closing Stock

(237,500)

(230,712)

Gross Profit

112,588

Less: Admin Expenses

Salary to Salman

(150 x 12)

1,800

Depreciation - plant and machinery

(45,000 + 500) x 10%

4,550

By: Adnan Rauf, ACA

Depreciation - factory building

Interest expense

Power and utility charges

Discount

Salaries and wages

Rent and rate

Insurance

Advertisement

Miscellaneous expense

Provision for doubtful debt

(42,400 x 5%)

I Page 5 of 8

2,120

800

6,500

2,432

40,400

6,992

1,350

4,512

4,130

1,288

(76,874)

(W-2)

(W-1)

Add: Other Income

Interest income

Other income

Net Profit

11,930

3,100

50,744

Mr. Salman

Statement of financial position

as on June 30, 2014

Capital and liabilities

Capital

Capital

Add: Net Profit

Less: Drawings

Rs. In 000

300,000

50,744

(28,700)

322,044

(30,500 - 150 x 12)

Non-current liabilities

Loan from bank

Current Liabilities

Trade Creditors

Bill payable

Accrued expenses

40,000

104,724

23,150

3,460

131,334

493,378

Assets

Non-Current Assets

Plant and machinery WDV

Factory building WDV

(45,000 + 500 - 4,550)

(42,400 - 2,120)

40,950

40,950

81,230

20,000

Goodwill

Current Assets:

Trade Debtors

Less: Provision for doubtful debts

Prepaid insurance

Stock

Bill receivable

Bank

Cash

(W-1)

109,420

(2,188)

107,232

650

237,500

32,526

13,512

728

392,148

493,378

Introduction to Accounting

Workings

(W-1)

(W-2)

Dr.

I Page 6 of 8

Provision for doubtful debt account

unadjusted cl.

P&L (Bal.)

closing balance (109,420 x 2%)

2,188

Cr.

900

1,288

Dr.

Unadjusted balance

Cr.

1,350

650

Insurance expense

2,000 P&L (Bal.)

Closing prepaid

Answer-8

Comments

Wherever the word cash payment is appearing in the question, it is assumed that it is paid through cheque, as it

is no where mentioned in the question that business has withdrawn cash from bank.

a)

Date

1-Jul

3-Jul

5-Jul

7-Jul

8-Jul

15-Jul

30-Jul

31-Jul

Description

Bank

Capital

(Owner brought capital)

Land

Building

Bank

Note Payable

(Land and building purchased)

Van a/c (10 x 300,000)

Bank

Payable for Van (bal.)

(Van purchased)

Payable for Van

Van

(Van returned)

Office equipment

Bank

(Office equipment purchased)

Security deposit

Bank

(Security deposit paid)

Bank (30,000 x 3)

Rent in advance

(Rent received in advance)

Payable for Van

Bank

(Payment for liability of van)

Dr.

20,000,000

Cr.

20,000,000

7,200,000

2,800,000

3,000,000

7,000,000

3,000,000

600,000

2,400,000

300,000

3000,000

2,400

2,400

15,000

15,000

90,000

90,000

1,000,000

1,000,000

b)

Date

31-Jul

Particulars

Balance c/d

Capital

Date

1-Jul

20,000,000

Debit

Particulars

Bank

Credit

20,000,000

By: Adnan Rauf, ACA

Date

1-Jul

30-Jul

Capital

Rent in advance

Date

3-Jul

Particulars

Bank and Note Payable

Date

3-Jul

Particulars

Particulars

Bank and Note Payable

Bank Account

Debit

Date

20,000,000 3-Jul

90,000 5-Jul

8-Jul

15-Jul

31-Jul

31-Jul

Particulars

Land and building

Van

Office equipment

Security deposit

Payable for van

Balance c/d

Land Account

Debit

Date

Particulars

7,200,000

31-Jul

Balance c/d

Date

5-Jul

Particulars

Bank and payable for van

Debit

3,000,000

Date

8-Jul

Date

15-Jul

Date

31-Jul

Particulars

Particulars

Bank

Particulars

Bank

Particulars

c/d

7,200,000

Credit

7,000,000

c/d

Van

Bank

c/d

Credit

2,800,000

Date

31-Jul

Date

7-Jul

31-Jul

31-Jul

Credit

3,000,000

600,000

2,400

15,000

1,000,000

15,472,600

Building Account

Debit

Date

Particulars

2,800,000

31-Jul

Balance c/d

Note Payable

Debit

Date

Particulars

7,000,000 3-Jul

Land and building

Particulars

I Page 7 of 8

Van

Date

7-Jul

31-Jul

Particulars

Payable for van

Balance c/d

Payable for van

Debit

Date

300,000 5-Jul

Van

1,000,000

1,100,000

Particulars

Office equipment

Debit

Date

Particulars

2,400

31-Jul

Balance c/d

Security deposit Account

Debit

Date

Particulars

15,000

31-Jul

Balance c/d

Rent in advance

Debit

Date

90,000 30-Jul

Bank

Particulars

Credit

Credit

300,000

2,700,000

Credit

2,400,000

Credit

2,400

Credit

15,000

Credit

90,000

Introduction to Accounting

I Page 8 of 8

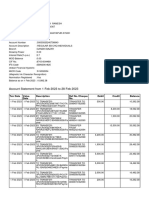

c)

Mr. Abdullah

Trial Balance as on July 31, 2014

Description

Capital

Bank Account

Land

Building account

Note payable

Van

Payable for van

Office equipment

Security deposit

Rent-in-advance

Dr.

Cr.

20,000,000

15,472,600

7,200,000

2,800,000

7,000,000

2,700,000

1,100,000

2,400

15,000

28,190,000

(THE END)

90,000

28,190,000

Вам также может понравиться

- Problem Set 7 (With Instructions) : Regression StatisticsДокумент6 страницProblem Set 7 (With Instructions) : Regression StatisticsLily TranОценок пока нет

- Seminar 2-3Документ8 страницSeminar 2-3Nguyen Hien0% (1)

- Final Accounts SumДокумент2 страницыFinal Accounts SumRohit Aswani25% (4)

- Assignment 4 - Variances - 50140Документ9 страницAssignment 4 - Variances - 50140Hafsa HayatОценок пока нет

- Oracle Applications Financials Interview Questions and Answers (FAQs)Документ95 страницOracle Applications Financials Interview Questions and Answers (FAQs)honeyvijay100% (3)

- F7 - Mock A - AnswersДокумент6 страницF7 - Mock A - AnswerspavishneОценок пока нет

- Practice Questions: Global Certified Management AccountantДокумент23 страницыPractice Questions: Global Certified Management AccountantThiha WinОценок пока нет

- Final Exam, s1, 2019 FINALДокумент12 страницFinal Exam, s1, 2019 FINALShivneel NaiduОценок пока нет

- Tutorial Questions Week 6Документ7 страницTutorial Questions Week 6julia chengОценок пока нет

- PM January 2021 Lecture 4 Worked Examples Questions (Drury (2012), P. 451, 17.17)Документ6 страницPM January 2021 Lecture 4 Worked Examples Questions (Drury (2012), P. 451, 17.17)KAY PHINE NGОценок пока нет

- BFA 713 Solution Past ExamДокумент17 страницBFA 713 Solution Past ExamPhuong Anh100% (1)

- BSES Sample Paper 11 6 12 PDFДокумент12 страницBSES Sample Paper 11 6 12 PDFshahroozkhanОценок пока нет

- Accounting Cycle of A Merchandising BusinessДокумент54 страницыAccounting Cycle of A Merchandising BusinessKim Flores100% (1)

- FDD - FCUBS12.0.3 - CASA - Amount BlockДокумент46 страницFDD - FCUBS12.0.3 - CASA - Amount BlockVoleti SrikantОценок пока нет

- F2 Mock 5Документ9 страницF2 Mock 5deepakОценок пока нет

- Practice Cases For Chapter 12 Case 1Документ3 страницыPractice Cases For Chapter 12 Case 1Lê Minh TríОценок пока нет

- Marginal and Absorption CostingДокумент8 страницMarginal and Absorption CostingEniola OgunmonaОценок пока нет

- IPRO Mock Exam - 2021 - QДокумент21 страницаIPRO Mock Exam - 2021 - QKevin Ch Li100% (1)

- Sales Tax QuestionДокумент3 страницыSales Tax QuestionKhushi SinghОценок пока нет

- SOLVED - IAS 7 Statement of Cash FlowsДокумент16 страницSOLVED - IAS 7 Statement of Cash FlowsMadu maduОценок пока нет

- Workshop F2 May 2011Документ18 страницWorkshop F2 May 2011roukaiya_peerkhanОценок пока нет

- December 2002 ACCA Paper 2.5 QuestionsДокумент11 страницDecember 2002 ACCA Paper 2.5 QuestionsUlanda2Оценок пока нет

- Chap 2Документ47 страницChap 2ADITYA JAIN100% (1)

- 05 DEC AnswersДокумент15 страниц05 DEC Answerskhengmai100% (5)

- IAS 16 Property Plant EquipmentДокумент4 страницыIAS 16 Property Plant EquipmentMD Hafizul Islam HafizОценок пока нет

- Ganesh Metal Industry Trial Balance, December 31, 2008 Account Debit (RS) Credit (RS)Документ11 страницGanesh Metal Industry Trial Balance, December 31, 2008 Account Debit (RS) Credit (RS)ayushsapkota907Оценок пока нет

- Revision Question BankДокумент134 страницыRevision Question Bankgohasap_303011511Оценок пока нет

- Jun 2006 - Qns Mod AДокумент11 страницJun 2006 - Qns Mod AHubbak Khan100% (2)

- Cambridge IGCSE: Accounting 0452/12Документ16 страницCambridge IGCSE: Accounting 0452/12Farrukhsg100% (1)

- Question 75: Basic Consolidation: Profit For The Year 9,000 3,000Документ5 страницQuestion 75: Basic Consolidation: Profit For The Year 9,000 3,000Lidya Abera100% (1)

- Financial Accounting Question SetДокумент24 страницыFinancial Accounting Question SetAlireza KafaeiОценок пока нет

- F9FM RQB Conts - j09klДокумент8 страницF9FM RQB Conts - j09klErclanОценок пока нет

- 13-ACCA-FA2-Chp 13Документ22 страницы13-ACCA-FA2-Chp 13SMS PrintingОценок пока нет

- 6int 2006 Dec QДокумент9 страниц6int 2006 Dec Qrizwan789Оценок пока нет

- Solution Practice 6 Consolidations 3Документ8 страницSolution Practice 6 Consolidations 3Mya Hmuu KhinОценок пока нет

- FR Tutorials 2022 - Some Theory Question SolutionДокумент26 страницFR Tutorials 2022 - Some Theory Question SolutionLaud Listowell100% (2)

- F 2Документ6 страницF 2Nasir Iqbal100% (1)

- Midlands State UniversityДокумент11 страницMidlands State UniversityIsheanesu MutusvaОценок пока нет

- Past Papers CSS Financial AccountingДокумент5 страницPast Papers CSS Financial AccountingMasood Ahmad AadamОценок пока нет

- ACC For Stock IssuesДокумент9 страницACC For Stock IssuesJasonSpringОценок пока нет

- IAS 02: Inventories: Requirement: SolutionДокумент2 страницыIAS 02: Inventories: Requirement: SolutionMD Hafizul Islam Hafiz100% (1)

- Acca - Chapter 1-9 SummaryДокумент5 страницAcca - Chapter 1-9 SummaryBianca Alexa SacabonОценок пока нет

- Dipifr Int 2010 Dec A PDFДокумент11 страницDipifr Int 2010 Dec A PDFPiyal HossainОценок пока нет

- B5: Problem Solving: P.O.Box 10378 Mwanza-TanzaniaДокумент9 страницB5: Problem Solving: P.O.Box 10378 Mwanza-TanzaniaSHWAIBU SELLAОценок пока нет

- Section VI: NRV Vs Fair Value: ExampleДокумент5 страницSection VI: NRV Vs Fair Value: ExamplebinuОценок пока нет

- MACC 709 GROUP 3 ASSIGNMENT GROSS INCOME 2020 (2) Final SolutionДокумент8 страницMACC 709 GROUP 3 ASSIGNMENT GROSS INCOME 2020 (2) Final SolutionFadzai MhepoОценок пока нет

- Ias 40 Ias 40investment PropertyДокумент16 страницIas 40 Ias 40investment PropertyPhebieon MukwenhaОценок пока нет

- AFA2e Chapter03 PPTДокумент50 страницAFA2e Chapter03 PPTIzzy BОценок пока нет

- ACCA F7 MockДокумент17 страницACCA F7 MockayeshaghufranОценок пока нет

- ACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts NotesДокумент40 страницACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts NotesMuhammad AzamОценок пока нет

- Section B. Decision Making Techniques - TutorДокумент73 страницыSection B. Decision Making Techniques - TutorNirmal ShresthaОценок пока нет

- Statement of Cash Flows Lecture Questions and AnswersДокумент9 страницStatement of Cash Flows Lecture Questions and AnswersSaaniya AbbasiОценок пока нет

- BUSI 353 Assignment #5 General Instructions For All AssignmentsДокумент3 страницыBUSI 353 Assignment #5 General Instructions For All AssignmentsTanОценок пока нет

- Absorption and Marginal Costing Worked ExamplesДокумент5 страницAbsorption and Marginal Costing Worked ExamplesSUHRIT BISWASОценок пока нет

- f1 Answers Nov14Документ14 страницf1 Answers Nov14Atif Rehman100% (1)

- SBR Workbook Q & A PDFДокумент293 страницыSBR Workbook Q & A PDFJony Saiful100% (1)

- Cima C01 Samplequestions Mar2013Документ28 страницCima C01 Samplequestions Mar2013Abhiroop Roy100% (1)

- Practice Questions - Ratio AnalysisДокумент2 страницыPractice Questions - Ratio Analysissaltee100% (5)

- Financial Reporting Tutorial QSN Solutions 2021 JC JaftoДокумент31 страницаFinancial Reporting Tutorial QSN Solutions 2021 JC JaftoInnocent GwangwaraОценок пока нет

- ACN 201 - Course Outline, Summer 2017Документ6 страницACN 201 - Course Outline, Summer 2017saha sudipОценок пока нет

- Taxation of CompaniesДокумент10 страницTaxation of CompaniesnikhilramaneОценок пока нет

- FAR and IAs Quali Exams With AnswersДокумент17 страницFAR and IAs Quali Exams With AnswersReghis AtienzaОценок пока нет

- Corporate Financial Analysis with Microsoft ExcelОт EverandCorporate Financial Analysis with Microsoft ExcelРейтинг: 5 из 5 звезд5/5 (1)

- Solution: SAMPLE PAPER-3 (Solved) Accountancy Class - XIIДокумент8 страницSolution: SAMPLE PAPER-3 (Solved) Accountancy Class - XIIKumar GautamОценок пока нет

- Examination Registration FormДокумент3 страницыExamination Registration FormshahroozkhanОценок пока нет

- Group Ten Fixed Air UniversityДокумент21 страницаGroup Ten Fixed Air UniversityshahroozkhanОценок пока нет

- File NewДокумент1 страницаFile NewshahroozkhanОценок пока нет

- Pest Control Pensacola FL Florida Termite Inspection Exterminator CompaniesДокумент1 страницаPest Control Pensacola FL Florida Termite Inspection Exterminator CompaniesshahroozkhanОценок пока нет

- (If You Can Move The Question Mark One Step To The Left) : How Can So Many People Earn So Much Money?Документ1 страница(If You Can Move The Question Mark One Step To The Left) : How Can So Many People Earn So Much Money?shahroozkhanОценок пока нет

- (If You Can Move The Question Mark One Step To The Left) : How Can So Many People Earn So Much Money?Документ1 страница(If You Can Move The Question Mark One Step To The Left) : How Can So Many People Earn So Much Money?shahroozkhanОценок пока нет

- Notes For 403Документ17 страницNotes For 403Inder KumarОценок пока нет

- JBSC BPi YEtrb 5 BaДокумент8 страницJBSC BPi YEtrb 5 Bamexop31426Оценок пока нет

- S - ALR - 87013180 Listing of Materials by Period StatusДокумент4 страницыS - ALR - 87013180 Listing of Materials by Period StatusAnandОценок пока нет

- 15 Joint VentureДокумент11 страниц15 Joint VentureJanani PriyaОценок пока нет

- Q2 FarДокумент2 страницыQ2 FarSHEОценок пока нет

- Company Accounts Issue of Shares Par Premium DiscountДокумент20 страницCompany Accounts Issue of Shares Par Premium DiscountDilwar Hussain100% (1)

- Flow Chart - What Is The Accounting CycleДокумент6 страницFlow Chart - What Is The Accounting Cyclematthew mafaraОценок пока нет

- RTP Financial Reporting CapiiiДокумент39 страницRTP Financial Reporting CapiiiManoj ThapaliaОценок пока нет

- Adjusted Trial Balance ProfittДокумент4 страницыAdjusted Trial Balance ProfittShesharam ChouhanОценок пока нет

- FreightДокумент37 страницFreightALLIA LOPEZОценок пока нет

- P L D 2019 Sindh 624 - MCB Case On Powers of Banking OmbudsmanДокумент28 страницP L D 2019 Sindh 624 - MCB Case On Powers of Banking OmbudsmanOmer MirzaОценок пока нет

- Process CostingДокумент29 страницProcess CostingAshish Lakwani100% (4)

- MODULE 3 - Part 3 Bank ReconciliationДокумент16 страницMODULE 3 - Part 3 Bank ReconciliationShaena Mae50% (2)

- Chart of Accounts ExplanationДокумент9 страницChart of Accounts Explanationellapot89Оценок пока нет

- Chapter 15 Partnerships - Formation, Operation, and Changes in MembershipДокумент35 страницChapter 15 Partnerships - Formation, Operation, and Changes in MembershipGweeenchanaОценок пока нет

- SssssДокумент7 страницSssssMark Domingo MendozaОценок пока нет

- Approach Paper: It-Enabled Financial InclusionДокумент28 страницApproach Paper: It-Enabled Financial InclusionAbdoul FerozeОценок пока нет

- F5 & F6 NotesДокумент125 страницF5 & F6 Notesmunashe shawnОценок пока нет

- AccountingДокумент4 страницыAccountingAnimaw YayehОценок пока нет

- MM Company Unadjusted Trial Balance December 31, 2020Документ22 страницыMM Company Unadjusted Trial Balance December 31, 2020KianJohnCentenoTurico100% (2)

- AuditДокумент78 страницAuditGuruKPO100% (5)

- 12 Accountancy ImpQ CH05 Retirement and Death of A Partner 01Документ18 страниц12 Accountancy ImpQ CH05 Retirement and Death of A Partner 01praveentyagiОценок пока нет

- Exercises For Accounting EquationДокумент7 страницExercises For Accounting EquationnorshaheeraОценок пока нет

- Review Session - NUS ACC1002 2020 SpringДокумент50 страницReview Session - NUS ACC1002 2020 SpringZenyuiОценок пока нет

- A Project Report On Financial Performance Based On Ratios at HDFC BankДокумент75 страницA Project Report On Financial Performance Based On Ratios at HDFC Banksudam merya100% (1)

- AFAR - PARTNERSHIPS - PPTX UM Digos Competency AppraisalДокумент34 страницыAFAR - PARTNERSHIPS - PPTX UM Digos Competency AppraisalDiana Faye CaduadaОценок пока нет

- Financial Acct2 2Nd Edition Godwin Test Bank Full Chapter PDFДокумент67 страницFinancial Acct2 2Nd Edition Godwin Test Bank Full Chapter PDFphongtuanfhep4u100% (10)