Академический Документы

Профессиональный Документы

Культура Документы

Ques Paper Final Exam 2012-13

Загружено:

Anshuman GuptaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ques Paper Final Exam 2012-13

Загружено:

Anshuman GuptaАвторское право:

Доступные форматы

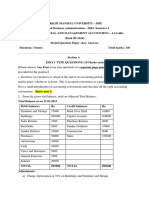

Final Exam 2012-13

Class XI

Subject Business Studies

Date 8th February 2013

Maximum Marks : 90

Time : 3 hrs

General Instructions:

(i) Answers to questions carrying 1 mark may be from one word to one sentence

(ii) Answers to questions carrying 3 marks may be from 50-75 words.

(iii) Answers to questions carrying 4-5 marks may be about 150 words.

(iv) Answers to questions carrying 6 marks may be about 200 words.

(v)Attempt all parts of a question together and in sequence.

Section A ( 1 mark each)

1.Name the economic activity where specialized knowledge is used.

2. Under which cause the risk due to earthquake is covered?

3.What is unlimited liability?

4. Name the document which invites subscription of shares from public?

5.What minimum percentage of shares government should own in a company to be called a government company?

6.To which insurance policy the principle of subrogation does not apply?

7.What is sweat shopping?

8. Why is cost of production in small business very low?

9. Why are the chances of dead stock reduced in case of chain stores?

Section B ( 3 marks each )

10. Explain the classification of sources of funds on the basis of period.

11. Explain three steps taken by business enterprises for environmental protection.

12. Explain three arguments for social responsibility .

13.Explain the benefits of joint venture enterprises.

14.Differentiate between Life , Fire and Marine insurance on the basis of subject matter, insurable

interest and duration.

Section C ( 4 marks each)

15. Diferentiate between partnership firm and company on the basis of regulating act, legal entity , liability and

number of members.

16. Discuss four formalities involved in getting an export licence.

17. Discuss two problems of public sector enterprises and two reforms in the new industrial policy 1991.

18. Explain the following documents related to export :

(a)Certificate of origin (b) Mates receipt (c) Bill of lading (d) Letter of credit

Section D ( 5 marks each)

19. Write three advantages and two disadvantages of commercial banks as a source of funds.

20. Explain any five problems being faced by small business in India.

21. Evaluate two needs of outsourcing and discuss its three limitations.

22.Define a wholesaler and a retailer. Now explain two functions each of wholesaler to retailer and of

retailer to consumer.

Section E ( 6 marks each)

23. Explain six characteristics of business ?

Or

23. Describe six factors to be considered before starting a new business ?

24. Ramesh an automobile engineer and Suresh an electrical engineer are friends, having worked in an MNC they

have made substantial savings. Now they want to start a business of car repair. Which form of business

organization is suitable for them ? Justify your answer by stating three advantages and disadvantages each of your

decision.

Or

24. Explain six important steps of capital subscription in the formation of a public limited company?

25. A factory owner gets his stock of goods insured , but he hides the fact that the electricity board has issued him a

statutory warning letter to get his factory`s wiring changed. Later on , the factory catches fire due to short circuit

of wiring. Can he claim compensation from the insurance company ? Explain the principle which supports your

decision .

Or

25. Ram has a property of Rs One and half lakh. He gets an insurance policy for Rs 1 lakh with insurer X & Co

and Rs.50,000 with insurer Y & Co. A loss of Rs.75,000 occurs to the house due to fire. Can Ram claim the loss of

Rs75,000 from both the insurance companies ? How much can he claim from both the insurance companies?

Explain the principle under which such claims can be settled?

26. Explain in detail the following sources of finance:

(i) GDR (ii) FCCB (iii) Public Deposit (iv) Debentures (v) ICD (vi) Retained profit

Or

26. Vishal Engineering Ltd., a reputed profit making firm has recently declared dividend to its shareholders. Now

it is planning to takeover another firm Ace Construction, then set up a new factory to expand the business for

which it needs funds and also to increase the stocks of its spare parts for the tractor division

What sources of finance do you think will be the best for each of the above mentioned requirements and why?

Give two reasons each for your answer from the options below:

(i)

Trade credit or (ii) Long term bank loan (from IFCI) or (iii) Issue of equity shares

27. Explain in detail the following documents used in internal trade :

(i) FOB (ii) CIF (iii) Railway Receipt (iv) Invoice (v) Credit Note (vi) E & OE

Or

27. Explain four advantages and two disadvantages of vending machines. What are the four advantages and two

disadvantages of mail order business ?

Вам также может понравиться

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)От EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Рейтинг: 5 из 5 звезд5/5 (1)

- Moodys - Sample Questions 1Документ12 страницMoodys - Sample Questions 1iva100% (2)

- Vrio Analysis Pep Coc CPKДокумент6 страницVrio Analysis Pep Coc CPKnoonot126Оценок пока нет

- Venture Capital Firms, Finance Companies, and Financial Conglomerates ExplainedДокумент8 страницVenture Capital Firms, Finance Companies, and Financial Conglomerates ExplainedShuvro Rahman75% (12)

- Tutorial 2-5 Submitted BY:SULAV GIRI (40765)Документ6 страницTutorial 2-5 Submitted BY:SULAV GIRI (40765)Smarika ShresthaОценок пока нет

- Financial Performance and Credit Risk QuestionsДокумент133 страницыFinancial Performance and Credit Risk Questionsdenied1234Оценок пока нет

- Business Studies Terminal Exam QuestionsДокумент3 страницыBusiness Studies Terminal Exam Questionsmohit pandeyОценок пока нет

- Business Studies Class 12-2Документ5 страницBusiness Studies Class 12-2ayush pathakОценок пока нет

- Sqp319e PDFДокумент22 страницыSqp319e PDFvichmegaОценок пока нет

- B.ST XI QP For RevisionДокумент22 страницыB.ST XI QP For Revisionvarshitha reddyОценок пока нет

- STD 11 Business Studies ModelДокумент2 страницыSTD 11 Business Studies ModelArs BokaroОценок пока нет

- 11 Business Studies23 24sp01Документ6 страниц11 Business Studies23 24sp01niteshnotessinghОценок пока нет

- Annual BSTДокумент8 страницAnnual BSTNishantОценок пока нет

- Manava Bharati International School, Patna - Final Exam Question Paper LeakedДокумент8 страницManava Bharati International School, Patna - Final Exam Question Paper Leakedsomyasinha246Оценок пока нет

- Question Paper 2015 Outside Delhi CBSE Class 12 EntrepreneurshipДокумент5 страницQuestion Paper 2015 Outside Delhi CBSE Class 12 EntrepreneurshipAshish GangwalОценок пока нет

- 2015 11 Lyp Business Studies 01Документ2 страницы2015 11 Lyp Business Studies 01gmuthu2000Оценок пока нет

- CBSE Class 11 Business Studies Sample Paper-04Документ8 страницCBSE Class 11 Business Studies Sample Paper-04cbsestudymaterialsОценок пока нет

- SAMPLE PAPER-1 (Solved) Business Studies Class - XI: General InstructionsДокумент2 страницыSAMPLE PAPER-1 (Solved) Business Studies Class - XI: General InstructionsSanjay StarkОценок пока нет

- 10th Grade Commerce Test Paper 2Документ2 страницы10th Grade Commerce Test Paper 2afoo1234Оценок пока нет

- Business Studies PaperДокумент3 страницыBusiness Studies PaperRajat GandhiОценок пока нет

- G.classroom Assignment BSTДокумент11 страницG.classroom Assignment BSTthesonalinegi2021Оценок пока нет

- 11 Business Studies23 24sp01Документ12 страниц11 Business Studies23 24sp01Tech with Tesu100% (1)

- Calculate NPV of water supply project using discounted cash flow analysisДокумент8 страницCalculate NPV of water supply project using discounted cash flow analysisVijaya AgrawalОценок пока нет

- POC PaperДокумент3 страницыPOC Paperaahmed459Оценок пока нет

- Syjc Ocm PrelimДокумент3 страницыSyjc Ocm PrelimjaijaibambholeОценок пока нет

- 10 Classc10 Full SyllabusДокумент2 страницы10 Classc10 Full SyllabusKhushnuma Shafi Shah100% (1)

- Public School Exam Half Yearly Business Studies Class XIIДокумент3 страницыPublic School Exam Half Yearly Business Studies Class XIImarudev nathawatОценок пока нет

- Bst. Set BДокумент8 страницBst. Set BAbel Soby JosephОценок пока нет

- Sample Question PaperДокумент3 страницыSample Question Paperanishnath7Оценок пока нет

- Xi BSTДокумент15 страницXi BSTShubham Gupta100% (1)

- B.ST 3Документ4 страницыB.ST 3Karamjeet SinghОценок пока нет

- Unit Test Nov2020 BST Grade 11Документ4 страницыUnit Test Nov2020 BST Grade 11DaraneeshR WSОценок пока нет

- Sample Questions MBAДокумент8 страницSample Questions MBAMike McclainОценок пока нет

- 50 TMRIIifq 6 Z NO59 N 4 Y3Документ11 страниц50 TMRIIifq 6 Z NO59 N 4 Y3kesar chouhan100% (1)

- Model Question Papers: Class 11Документ52 страницыModel Question Papers: Class 11Ronak SudhirОценок пока нет

- 11 Business Studies SP 1Документ11 страниц11 Business Studies SP 1Meldon17Оценок пока нет

- Business Studies Practice WorkДокумент8 страницBusiness Studies Practice WorkKUNAL SHARMAОценок пока нет

- Bs Full CourseДокумент4 страницыBs Full CourseSonali ChanglaОценок пока нет

- Half Yearly - ST IgnatiusДокумент16 страницHalf Yearly - ST IgnatiusuhhwotОценок пока нет

- Business Studies SA - 1Документ2 страницыBusiness Studies SA - 1tssuru9182Оценок пока нет

- Business Studies XIДокумент6 страницBusiness Studies XIAshish GangwalОценок пока нет

- Managerial Economics Sample QuestionsДокумент3 страницыManagerial Economics Sample QuestionsDinakaran Arjuna50% (2)

- 11 BSTДокумент4 страницы11 BSTMayank KumarОценок пока нет

- Answer Any ONE Question.: Section - CДокумент2 страницыAnswer Any ONE Question.: Section - CRavi KrishnanОценок пока нет

- BST11Документ2 страницыBST11malviyaparas27Оценок пока нет

- Mefa Imp+ Arryasri Guide PDFДокумент210 страницMefa Imp+ Arryasri Guide PDFvenumadhavОценок пока нет

- Gujarat Technological University: InstructionsДокумент2 страницыGujarat Technological University: InstructionspatelaxayОценок пока нет

- 3 Business Finance12Документ10 страниц3 Business Finance12Abdullah al MahmudОценок пока нет

- MB0041 MQP Answer KeysДокумент21 страницаMB0041 MQP Answer Keysajeet100% (1)

- MEFA Important QuestionsДокумент14 страницMEFA Important Questionstulasinad123Оценок пока нет

- HBC 2109 Insurance and Risk ManagementДокумент2 страницыHBC 2109 Insurance and Risk Managementcollostero6Оценок пока нет

- Human Activities Are of - Types (A) One (B) Two (C) Three (D) FourДокумент18 страницHuman Activities Are of - Types (A) One (B) Two (C) Three (D) FourIPU013479 mukul guptaОценок пока нет

- 5 6172620504097096522Документ6 страниц5 6172620504097096522Pushpinder KumarОценок пока нет

- Business Studies Test QuestionsДокумент18 страницBusiness Studies Test QuestionsAafiya YasirОценок пока нет

- Introduction To Business: The Association of Business Executives CertificateДокумент12 страницIntroduction To Business: The Association of Business Executives CertificateLweendo SikalumbaОценок пока нет

- Old Midterm For Posting On Class PageДокумент12 страницOld Midterm For Posting On Class PageJack KlineОценок пока нет

- FINA201 Main Exam paper June 2023 (3)Документ13 страницFINA201 Main Exam paper June 2023 (3)AyandaОценок пока нет

- BM Dec 2005Документ13 страницBM Dec 2005Vinetha KarunanithiОценок пока нет

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionДокумент10 страницMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionShawon ShanОценок пока нет

- GR Xi B.ST QP Term-2 2021-22Документ4 страницыGR Xi B.ST QP Term-2 2021-22anshikaОценок пока нет

- I Sem Cycle AccДокумент3 страницыI Sem Cycle AccAnshuman GuptaОценок пока нет

- Nature and Significance of Management: Unit 1Документ151 страницаNature and Significance of Management: Unit 1Anshuman GuptaОценок пока нет

- Chemistry Cbse Mock TestДокумент10 страницChemistry Cbse Mock TestHrityush ShivamОценок пока нет

- Chemistry XII ProjectДокумент15 страницChemistry XII ProjectGarima Jain63% (41)

- Revised Eco PaperДокумент1 страницаRevised Eco PaperAnshuman GuptaОценок пока нет

- SMS2-CW&TR ST PDFДокумент3 страницыSMS2-CW&TR ST PDFAnshuman GuptaОценок пока нет

- Practicals Guidelines 12physicsenglishДокумент8 страницPracticals Guidelines 12physicsenglishAnshuman GuptaОценок пока нет

- For DPS, GWLДокумент3 страницыFor DPS, GWLAnshuman GuptaОценок пока нет

- NCERT ENGLISH ELECTIVE SAMPLE PAPERДокумент6 страницNCERT ENGLISH ELECTIVE SAMPLE PAPERAnshuman GuptaОценок пока нет

- General Instructions: Sample Question Paper Class XII - Physics (Applicable For March 2016 Examination)Документ12 страницGeneral Instructions: Sample Question Paper Class XII - Physics (Applicable For March 2016 Examination)Anshuman GuptaОценок пока нет

- SQP2-QP CW &TRДокумент6 страницSQP2-QP CW &TRAnshuman GuptaОценок пока нет

- PE Curr. 2014-15 (Class XII)Документ3 страницыPE Curr. 2014-15 (Class XII)Anshuman GuptaОценок пока нет

- SQP2-QP CW &TRДокумент6 страницSQP2-QP CW &TRAnshuman GuptaОценок пока нет

- Marking Scheme Class Xii English Core Set B Time-3 Hr. M.M-100 Section A (READING) - 30 Marks Q1 (1x4 4)Документ10 страницMarking Scheme Class Xii English Core Set B Time-3 Hr. M.M-100 Section A (READING) - 30 Marks Q1 (1x4 4)Anshuman GuptaОценок пока нет

- Sample Question Paper Class Xii Chemistry Time: 3 Hrs MM: 70 General InstructionsДокумент14 страницSample Question Paper Class Xii Chemistry Time: 3 Hrs MM: 70 General InstructionsAnshuman GuptaОценок пока нет

- Managers Checklist New Empl IntegrationДокумент3 страницыManagers Checklist New Empl IntegrationRajeshОценок пока нет

- Internship Report on BankIslami Pakistan LimitedДокумент37 страницInternship Report on BankIslami Pakistan LimitedTalha Iftekhar Khan SwatiОценок пока нет

- Cell No. 0928-823-5544/0967-019-3563 Cell No. 0928-823-5544/0967-019-3563 Cell No. 0928-823-5544/0967-019-3563Документ3 страницыCell No. 0928-823-5544/0967-019-3563 Cell No. 0928-823-5544/0967-019-3563 Cell No. 0928-823-5544/0967-019-3563WesternVisayas SDARMОценок пока нет

- WisdomTree ETC WisdomTree Bloomberg Brent Crude OilДокумент46 страницWisdomTree ETC WisdomTree Bloomberg Brent Crude OilKareemОценок пока нет

- SBM J22 Mark PlanДокумент38 страницSBM J22 Mark PlanWongani KaundaОценок пока нет

- Citrix Service Provider Program Guide: WelcomeДокумент31 страницаCitrix Service Provider Program Guide: WelcomeVikasОценок пока нет

- Istiqlal Ramadhan Rasyid - 11180820000040 - Latihan Soal AKM 1Ch.5Документ3 страницыIstiqlal Ramadhan Rasyid - 11180820000040 - Latihan Soal AKM 1Ch.5Istiqlal RamadhanОценок пока нет

- Sapm QBДокумент8 страницSapm QBSiva KumarОценок пока нет

- Innovation: 2 0 1 5 - 1 6 AnnualДокумент136 страницInnovation: 2 0 1 5 - 1 6 AnnualAnimesh ChoubeyОценок пока нет

- Company Profile Law Firm Getri, Fatahul & Co. English VersionДокумент9 страницCompany Profile Law Firm Getri, Fatahul & Co. English VersionArip IDОценок пока нет

- Eazi Buyer Pack 2023 08Документ3 страницыEazi Buyer Pack 2023 08Junaid AnthonyОценок пока нет

- Life-Cycle Cost Analysis in Pavement DesignДокумент1 страницаLife-Cycle Cost Analysis in Pavement DesignSergio McОценок пока нет

- CV2Документ6 страницCV2teclarteeОценок пока нет

- 8th Mode of FinancingДокумент30 страниц8th Mode of FinancingYaseen IqbalОценок пока нет

- REVIEWER UFRS (Finals)Документ5 страницREVIEWER UFRS (Finals)cynthia karylle natividadОценок пока нет

- Enterprise Structure OverviewДокумент5 страницEnterprise Structure OverviewAnonymous 7CVuZbInUОценок пока нет

- Case StudyДокумент21 страницаCase StudyVinu Thomas0% (1)

- Coal India LimitedДокумент92 страницыCoal India LimitedChanchal K Kumar100% (3)

- URC Financial Statement AnalysisДокумент17 страницURC Financial Statement AnalysisKarlo PradoОценок пока нет

- 2011 Aring Sup1 Acute CFA Auml Cedil Ccedil Ordm Sect Aring Ccedil Auml Sup1 BrvbarДокумент17 страниц2011 Aring Sup1 Acute CFA Auml Cedil Ccedil Ordm Sect Aring Ccedil Auml Sup1 BrvbarBethuel KamauОценок пока нет

- Feel Free To Contact Us +88 016 80503030 +88 016 80503030 Sani - IsnineДокумент1 страницаFeel Free To Contact Us +88 016 80503030 +88 016 80503030 Sani - IsnineJahidur Rahman DipuОценок пока нет

- BAE Systems PresentationДокумент19 страницBAE Systems PresentationSuyash Thorat-GadgilОценок пока нет

- MTO CSO Interview Customer Service TrendsДокумент4 страницыMTO CSO Interview Customer Service Trendsgl02ruОценок пока нет

- Chapter 1 ReviewerДокумент7 страницChapter 1 ReviewerClariña VirataОценок пока нет

- Registered Nurse Annual Performance ReviewДокумент7 страницRegistered Nurse Annual Performance Reviewhkthriller1Оценок пока нет

- Coca-Cola Union Dispute Over Redundancy ProgramДокумент11 страницCoca-Cola Union Dispute Over Redundancy ProgramNullumCrimen NullumPoena SineLegeОценок пока нет

- 2021 2022 First QuarterДокумент39 страниц2021 2022 First QuarterMehdi Hasan KhanОценок пока нет

- PRTC-FINAL PB - Answer Key 10.21 PDFДокумент38 страницPRTC-FINAL PB - Answer Key 10.21 PDFLuna VОценок пока нет