Академический Документы

Профессиональный Документы

Культура Документы

House Loans 2

Загружено:

mitangiИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

House Loans 2

Загружено:

mitangiАвторское право:

Доступные форматы

1

HOME LAONS

BACHELOR OF COMMERCE

BANKING & INSURANCE

SEMESTER V

ACEDEMIC YEAR 2015-16

SUBMITTED

IN PARTIAL FULFILLMENT OF THE

REQUIREMENTS FOR THE AWARD OF DEGREE

OF BACHELOR OF COMMERCE

BANKING & INSURANCE

BY

MST. VIRAL BOHRA

UNDER THE GUIDANCE OF:

PROF KAPIL BUDHDEV

SEAT No.

JAI HIND COLLEGE

A ROAD, CHURCHGATE, MUMBAI 400 020

DECLARATION

I, Ms. CHARMI AJMERA, student of B. Com. BANKING &

INSURANCE Semester V (2015-16) hereby declare that I have

completed the Project on BANKING OMBUDSMAN SCHEME.

The information submitted is true & original to the best of my

knowledge.

Signature

Ms. ___________

SEAT NO.

JAI HIND COLLEGE

A ROAD, CHURCHGATE, MUMBAI - 400 020

CERTIFICATE

This is to certify that VIRAL BOHRA of B.Com. BANKING &

INSURANCE Semester V (2015-16) has successfully completed the

project on HOME LOANS under the guidance of Prof.

KAPIL BUDHDEV.

Course Co-ordinator

Principal

Internal Examiner

Examiner

External

College Seal

ACKNOWLEDGEMENT

I am indeed thankful to all the people who have helped me to complete

the project.

I am gratefully indebted to Prof. KAPIL BUDHDEV, my project guide,

for providing me all the necessary help and required guidelines for the

completion of my project and also the valuable time she gave me from

her schedule.

I also feel heartiest sense of obligation to my library staff members &

seniors, who helped me in the collection of data & resource material &

also in its processing as well as drafting manuscript.

Last but not the least I am thankful to all my friends, who have been a

constant source of inspiration and information for me. I thank the

Almighty for showering his blessings.

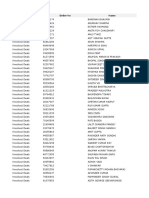

INDEX

Sr No.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

13

Contents

TYPES OF LOANS

INTRODUCTION TO HOME LOANS

CHARECTERISTICS OF HOME LOANS

TYPES OF HOME LOANS

BENEFITS OF HOME LOANS TO BORROWERS

STEPS IN PLANNING FOR A HOME LOAN

POINTS TO REMEMBER

FAIR PRATICE CODE TO BE FOLLOWED BY BANKERS

PROCEDURE OF A HOME LOAN

DOCUMENTATION

INTREST RATES AND THEIR CALCULATION

SECURITY FOR HOME LOAN

REPAYMENT OPTIONS

HOME LOAN WITH INSURANCE COVER

RECOMMENDATIONS FOR BANKERS

COMPARISON BETWEEN HOM E LOANS

SURVEY

CONCLUSION

Reasons for rejection of complaints

EXECUTIVE SUMMARY

Banking system in the world has emerged many centuries ago and in India it rooted

its seed with t h e e x i s t e n c e o f t h e G e n e r a l B a n k o f I n d i a i n t h e y e a r

1 7 8 6 . I n e a r l i e r d a y s b a n k s w e r e t h e Financial Institutions dealing

in day to day services i.e. accepting deposits and lending money. B u t

now it has spread its wings to various others sectors like it first

started lending to

b i g business entities and has also entered into the retail banking sector i.e. it starte

d lending for purchasing car, for education, marriage and most importantly for

purchasing a house. To own a house is every mans desire. But more than

that, shelter is a basic human need next only to food and clothing in

importance. Yet every year more and more people continue to be added to

the category of homeless. Though a basic need of all a significant section of the

society is severely handicapped in getting shelter at affordable cost. This

need for housing finance for individuals was only fulfilled with the

advent of National Housing Bank (NHB), Housing and Urban

Development Corporation (HUDCO), Housing Development Finance

Corporation, etcand most particularly with the entry of commercial banks in the

housing finance sector. In Tune with the conservative traditions in lending,

commercial banks played a very limited

rolei n p r o v i d i n g h o u s i n g f i n a n c e t i l l t h e e a r l y s e v e n t i e s . H o w e v e r

, n o w a s p e r R e s e r v e B a n k guidelines, housing finance is part of

priority sector lending schemes for banks. There has been progressive

increase in housing finance disbursed by commercial banks since

1979.T h e h o u s i n g f i n a n c e i n d u s t r y i s g e t t i n g i n c r e a s i n g l y c o m m o

d i t i s e d . C o m p e t i t i o n w i t h i n t h e sector is ensuring that players offer

consumers flexibility and features to choose from.

Featuress u c h a s a d j u s t a b l e r a t e p l a n s , l o w e r p r o c e s s i n g f e e s / m o n t

h l y r e s t / i n t e r e s t r a t e s / E M I / m a r g i n money, no pre- payment penalty

have become common across the industry.

AIM

My aim through this project is: To understand the working of HOME LOANS for better use in future.

To suggest improvements or changes required.

To spread awareness about HOME LOANS.

TYPES OF LOANS

Loan refers to a sum of money borrowed at a particular interest rate.

More generally, it refers

toa n y t h i n g g i v e n o n c o n d i t i o n o f i t s r e t u r n o r r e p a y m e n t o f

i t s e q u i v a l e n t . A l o a n m a y b e acknowledged by a bond, a

promissory note, or a mere oral promise to repay. Banks grants 3 types of

loans which are as follows:Commercial loans or Industrial loans, Consumer loans

and Mortgage loans

1)Commercial loans:

Commercial loans are mainly provided to the business and industrial firms.

These can be divided into:

Short term loans:

Short term loans are mainly given for a period up to 1 year and

usuallygranted to the business and industrial firms to meet the working

10

capital requirements. For e.g.: Cash credit, Bank overdraft etc. (loans to finance

the purchase of material or labour)

Long term loans:

Long term loans are granted for a period above 5 years and are granted

tomeet capital expenditure. For e.g. project finance, Education loan etc.

(loans to purchasemachinery and equipments). Most commercial bank

offers a variable interest rate on theseloans, which means that the interest rate

can change over the course of loan. Sanction of loand e p e n d s u p o n t h e cr e d i t

a n d l o a n hi s t o r y o f t h e b o r r o w e r, t h e b or r o w e r a b i l i t y t o

m a k e scheduled loan payment, the amount of capital the borrower

has invested in the business, thecondition of the economy and the value

of the collateral the borrower pledges to give the bank if the loan payments

are not made.

2)Consumer Loans:

One of the important areas of bank financing in recent years is

towards purchase of consumer durables like TV sets, Washing Machines etc. Ban

ks also providel i b er a l c a r f i n a n c e . Th e s e d a y s b a n k s a r e c o mp e t i n g

w i t h o n e a n o t h e r t o l e n d m o n ey f o r these purposes as default of

payment is not high in these areas as the borrowers are usuallysalaried

persons as default of payment is not high in these areas as the borrowers

are usuallysalaried persons having regular income. Further, banks

interest rate is also higher. For e.g.Housing Loan, Medical Loan, Car Loan,

Education Loan.

11

There are two types of consumer loans:

Closed ended credit :

Closed ended loan are for fixed period of time, fixed amount of

loan, but not for a fixed purpose. The items purchased by the consumer serve

as collateral for theloan.

Open ended credit :

Open ended loan are for variable amount of money and it does

n o t r e q u i r e t h e b or r o w e r t o s p e c i f y t h e p u r p o s e o f t h e l o a n . F o r

e.g. Credit cards. Most open e n d e d l o a n s c a r r y f i x e d i n t e r e s t

rate and it requires no collateral but interest or

o t h e r penalties or fees may be charged. Open end credit interest rates usually

exceed close end rate because open end loans are not backed by collateral.

3)Mortgage loans:

T h e s e ar e u s u a l l y l o n g t e r m l o a n s a n d t h e i n t e r e s t r a t e s c h a r ge d

c a n b e e i t h e r a v ar i a b l e or a fixed rate for the term of the loan which

often ranges from 15- 30 years. These loans are used to purchase land or

building such as household and factories which serves as the collateral for theloan.

Classification of Loans:

Loans given by bankers can also be classified broadly into the following

categories on the basisof security:

12

1.Clean Loans:

Advances for which are given on the personal security of the

d e b t o r, f o r which no tangible or collateral security is taken; this type of given

either when the amount of t h e a d v a n c e i s v e r y s m a l l , or w h e n t h e

b o r r o w e r i s k n o w n t o t h e b a n k e r a n d b a n k e r h a s complete confidence

in him.

2.Secured Loans:

Loans which are covered by tangible or collateral security. Bank

providessuch loan against different types of securities which a banker may accept

for such advance.

INTRODUCTION TO HOME LOAN

The sun at home warms better than sun elsewhere

.

Tru e i s n t i t , w h e r e e l s e d o y o u f i n d t h a t c o m f o r t t h a t m a k e s y ou

f e e l s o s p e c i a l e v er y d ay. Undoubtedly owning a house is the most important

phase in ones life. Not long ago, turning thisdream into a reality was a daunting

task for the common man with property rates going north allthe time. But now,

thanks to the proliferation of home loans and housing finance companies, onecan

aspire to own a roof over one's head. Many think it is an expensive affair

and beyond reach.Well, thats not always true. It takes a little planning and

awareness to get to that home you wantto call your own.Buying a home for the

first time can be daunting to any person but in todays time various banksa r e

l e n d i n g a h e l p i n g h a n d t o t h e p e o p l e t o p ur c h a s e t h e i r d r e a m

h o u s e . Th u s p e o p l e l o o k forward towards choosing a home loan.

13

. The primary concern of a housing finance company is todetermine the loan

amount that the borrower is comfortably able to repay. The most

popular method of financing a home purchase is with a mortgage. This is

a loan that is secured over thehome. There are a number of different

mortgage suppliers and people will have to shop aroundin order to get the

best deal.Home Loan is one of the fastest growing retail and mass banking area. It

forms an important partof the countrys priority in 5 year plans. Almost all

public and private sector banks are offering h o m e l o a n s a t a t t r a c t i v e

r a t e s f o r p ur c h a s i n g t h e i r dr e a m h o me . H o me l o a n u s u a l l y c o v er a

variety of types. All Banks have come out with home loan products

studded with features andvalue additions that make the schemes not only

attractive but also serve as a substantial source to the borrowers for owning

their dream home. B a n k s a s f i n a n c i a l s e r v i c e p r o vi d e r s a i ms a t

providing financial support from the bankingsystem to the needy

f o r p ur c h a s i n g a h o me t o t h e r e s i d e n t I n d i a n s a s w e l l a s n o n r e s i d e n t Indians. The main emphasis is that every needy person is provided with

an opportunity to pursueh o m e l o a n w i t h t h e f i n a n c i a l s u p p o r t f r o m t h e

b a n k i n g s y s t e m w i t h a ffo r d a b l e t e r ms a n d conditions

14

CHARACTERISTICS OF HOME LOAN

Home Loans are the consumer loans.

Home loans are long term loans provided by various banks.

T h e s e ar e l a rge a mo u n t l o a n s w h i c h pr o v i d e f i n a n c i a l s u p p o r t t o

t h e p e o p l e w h o w a n t t o purchase their dream home.

Home loans are secured loans.

T h e b o r r o w e r s g e t t o o w n t h e i r d r e a m h o m e a n d p a y f o

r i t i n e a s y a n d a f f o r d a b l e installments.

Banks and Financial Institutions offers home loans at cost-effective rates.

Tax concessions make home loans more attractive than other loan products.

The borrowers can get tax deduction on repayment of the principal amount of a

loan taken to buy or construct a house.

The interest paid on a loan is deductible from 'income from property',

even if it has not been paid during the year.

I n t e r e s t p a i d o n a n e w l o a n t a k e n t o r e p ay t h e o r i g i n a l h o u s i n g

l o a n i s a l s o a l l o w e d a s deductio

15

TYPES OF HOME LOANS

Lending institutions like banks offer different types of home loans for a

wide gamut of housingactivities. Some of the popular home loans are:

Home Purchase Loans:

There are the basic home loans for the purchase of a new

home.

Home Improvement Loans:

T h e s e l o a n s a r e g i v e n f o r i m p l e m e n t i n g r e p a i r w o r k s a n d ren

ovations in a home that has already been purchased by the borrower.

Home Construction Loans:

These loans are available for the construction of a new home.

Home Extension Loans:

T h e s e a r e g i v e n f o r e x p a n d i n g or e x t e n d i n g a n e x i s t i n g h o me .

F o r example addition of an extra room, etc.

Land Purchase Loans:

These loans are available for purchase of land for both

h o m e construction or investment purposes.

Bridge Loans:

Bridge Loans are designed for people who wish to sell the existing home

and purchase another. The bridge loan helps finance the new home, until a buyer

is found for the oldhome.

16

Balance Transfer:

Balance Transfer loans help the borrower to pay off an existing home

loanand avail the option of a loan with a lower rate of interest.

Refinance Loans:

These loans helps to pay off the debt the borrower have incurred from

privatesources such as relatives and friends, for the purchase of your present home.

Home Conversion Loans:

These loans are for those people who have financed the

p r e s e n t h o m e w i t h a h o me l o a n a n d w i s h e s t o p u r c h a s e / m o v e t o

a n o t h e r h o m e f o r w h i c h s o me e x t r a finances are required. In Home

Conversion Loan, the existing loan is transferred to new home including

the extra amount required, eliminating need for pre-payment of the previous loan.

Stamp Duty Loans:

These loans are sanctioned to pay the stamp duty amount that needs to

be paid on the purchase of property.

Loans to NRIs:T h e s e l o a n s a r e g i v e n t o t h e N R I s t o

build/buy a home in India.

BENEFITS OF HOME LOANS TO BORROWERS

Food, clothing, shelter -- these are the basic needs of every individual.

But to most, owning ahome is just a dream. The real estate boom and

steadily rising capital values are now making itnext to impossible for

17

most people to fund their own homes. Banks and financial institutions

areoffering aggressively competitive rates on home loans, making it

possible for more people toown the home of their dreams. Many builders have

tie-ups with banks or financial institutions sothat prospective buyers are

assured of housing loans without any hassles. Taking a home loanserves

two purposes. One, of course, is that the borrower gets to buy his/her

own home and payfor it in easy installments. The other is that the

borrowers get several benefits under the IncomeTax Act.

TAX BENEFITS

1) For Resident Indians

There are certain tax benefits for the resident Indians based

o n t h e p r i n c i p a l a n d i n t e r e s t component of a loan under the Income

Tax Act, 1961. It may help one get tax benefit up to Rs.50,490 p.a.

(approx) if interest repayment of Rs. 1, 50,000 p.a. is paid. In addition to

this, onealso is eligible for getting tax benefits under section 80C on repayment of

Rs. 1, 00,000 p.a. thatfurther reduces the tax liability by Rs.33.660 p.a.These

deductions are available to assesses, who have taken a loan to either buy or build a

house,under Section 24(b). However, interest on borrowed capital is deductible up

to Rs. 150,000 if thefollowing conditions are fulfilled:

Capital is borrowed for acquiring or constructing a property on or after April 1,

1999.

T h e a c q u i s i t i o n a n d c o n s t r u c t i o n s h o u l d b e c o m p l e t e d w i t h i n 3

y e ar s f r o m t h e e n d o f t h e financial year in which capital was borrowed.

18

The person, extending the loan, certifies that such interest is payable in respect of

the amountadvanced for acquisition or construction of the house.9

A loan for refinance of the principle amount outstanding under an earlier

loan taken for suchacquisition or construction.If the conditions stated above are

not fulfilled, then the interest on borrowed capital is deductibleup to Rs 30,000

though the following conditions have to be satisfied:

Capital is borrowed before April 1, 1999 for purchase, construction,

reconstruction repairs or renewal of a house property.

Capital should be borrowed on or after April 1, 1999 for reconstruction,

repairs or renewalsof a house property.

If the capital is borrowed on or after April 1, 1999, but construction

is not completed within3 years from the end of the year, in which capital is

borrowed.I n a d d i t i o n t o t h e a b o v e , pr i n c i p a l r e p a y m e n t o f t h e

l o a n / c a p i t a l b or r o w e d i s e l i g i b l e f o r a deduction of up to Rs 100,000

under Section 80C from assessment year 2006-07.

Terms and conditions for availing Tax benefits on Home Loans

1 . Tax d e d u c t i o n s c a n b e c l a i m e d o n h o u s i n g l o a n i n t e r e s t

p a y m e n t s , s u b j e c t t o a n u p p e r l i m i t of Rs 150,000 for a financial

year.2 . A n a d d i t i o n a l l o a n f o r

extension/improvement to the same house and

t h e i n d i v i d u a l ' s deductions on the existing loan are less than Rs

150,000; he can claim further benefits fromthe additional loan taken, subject

to the upper limit of Rs 150,000 for a financial year.3 . Tax b e n e f i t s u n d e r

19

S e c t i o n 2 4 a n d d e d u c t i o n u n d er s e c t i o n 8 0 C o f t h e I n c o me Tax

A c t c a n be claimed only when the payment is made. If an individual fails to

make EMI payments, hecannot claim tax benefits for the same.4.According to

the Income Tax Act, tax rebates can only be claimed by the loan

applicant.5 . T h e i n t e r e s t o n h o me l o a n s t a k e n f o r r e p a i r s , r e n e w a l s

o r r e c o n s t r u c t i o n , a l s o q u a l i f i e s f o r the deduction of Rs 150,000.6.A

husband and wife, both of whom are tax-payers with independent income

sources, get taxdeduction benefits, with respect to the same housing loan; to the

extent of the amount of loantaken in their own respective name.7 .I f a n

i n d i v i d u a l b u y s a h o u s e a n d s e l l s i t w i t h i n t h e s a me y e ar o r a f t e r

3 y e ar s , a n d i f a ny profit is made, then a capital gains tax liability arises on

the same for which the individual isliable to pay short-term capital gains tax

since the sale took place in the same year. But in10 c a s e , i f t h e s a l e h a d

t a k e n pl a c e a f t e r 3 y e ar s , t h e n a l o n g - t er m c a p i t a l g a i n s t a x

l i a b i l i t y would have arisen.8 . O n b e i n g p r o v e d t h a t t h e h o me l o a n i s

s i m p l y a n a r r a n g e m e n t b e t w e e n t h e l o a n - s e e k e r a n d the builder or

with a third party for the purpose of claiming tax benefits, then tax

benefitsw i l l n o t b e a l l o w e d a n d b e n e f i t s , p r e v i o u s l y c l a i me d , w i l l

b e c l u b b e d t o t h e i n c o me a n d taxed accordingly.Tax benefits on interest

on housing loans are allowable only for the original loan and accordingto

Section 24 (1), tax benefits can also be availed for a second loan taken

to repay the first loan but not for subsequent loans. This means that if the

borrower have already availed of one loan torefinance the original loan and

want to now avail a third loan to refinance the second loan, tax rebate on

interest payments will not be permissible.

2) For Non- Resident Indians

20

NRIs cannot claim tax benefits on home loans in India as they have to pay tax in t

he nationwhere they work and earn. Moreover, the borrowers need to file

tax returns to become eligiblefor home loans. However, if they pay tax in India

for income earned in India, they can claim taxrebate for the home loan.

STEPS IN PLANNING FOR A HOME LOAN

A)PURPOSE

The first step in planning for a home loan is to find out the purpose for which one

is planning totake the loan. Depending on the borrowers requirements,

home loans can be taken for a varietyof purposes such as to purchase a

new home, to implement repair works and renovations in ahome that has

already been purchased by the borrower, to construct a new home,

for expandingor e x t e n d i n g a n e x i s t i n g h o m e , t o p u r c h a s e l a n d f o r

b o t h h o m e c o n s t r u c t i o n o r i n v e s t m e n t purposes, etc. Hence finding out

the purpose of the loan is the first and foremost step in planningfor a home loan.

B)SELECTION OF A PARTICULAR HOME LOAN

The selection of a particular home loan depends on the affordability

position of the borrower.W h a t k i n d o f h o m e o n e c a n a f f o r d i s ,

m o r e o f t e n t h a n n o t , a f u n c t i o n o f h o w m u c h / t h e maximum one

can borrow?

How much one can afford/ the maximum one can borrow:

Banks follow a thumb rule whiledeciding the maximum a person can borrow:

the monthly repayment on the loan should not bemore than 40 per cent of

the net monthly income. This ratio is called the Income to

Installmentratio or IIR. Some lenders may even be more conservative.

21

One could expect to be allowed to borrow an even lower figure if they

consider an IIR of as low as 30 per cent of the net monthlyincome. They finance a

certain portion of the property value, typically 75-85 per cent. The rest isthe

borrowers contribution, usually called the down payment or the margin, and has to

come outof his (borrowers) own resources.

Down payment:

Another important determinant of the value of the house one can afford is

howmuch the borrower has saved up. Since banks only finance between

75 and 85 per cent of the property value, effectively the down payment can

determine the value of the home that one cang o f o r. O f c o u r s e , t h i s i s

s u b j e c t t o t h e l i mi t o n h o w m u c h o n e c a n r e p ay e v e r y m o n t h ,

a s determined by the IIR.

C)FINDING OUT COST OF THE HOUSE

Buying a home involves many financial considerations. Some home

buying expenses are one-t i m e c o s t s a n d o t h e r s ar e o n g oi n g

c o m mi t me n t s . I n a d d i t i o n , t h e r e a r e o t h e r c o s t s t h a t

t h e borrowers should take into consideration in calculating the cost of the house.

Below is ac h e c k l i s t o f a d d i t i o n a l e x p e n s e s t h a t t h e b o r r o w e r s n e e d

t o k e e p i n m i n d w h e n p ur c h a s i n g a home.

Home buying costsThe Down Payment:

22

A mi n i mu m d o w n p a y m e n t o f 1 5 % i s r e q u i r e d f o r a N o r ma l

H o u s i n g loan. The government offers Tax incentives for homebuyers.

The Payment:

A Home Loan Security is security for a loan on the property the borrower

own.It is repaid in regular monthly payments which are combined

payments. This means that

the payment includes the principal (amount borrowed) plus the interest (the charge

for borrowingmoney).

Checklist of Additional Expenses:

A d d i t i o n a l e x p e n s e s n e e d t o b e i n c u r r e d a f t e r o n e h a s moved in.

Maintenance costs:

T h e s e c o s t s a r e i n c ur r e d t o c o v e r t h e c o s t s o f a n t i c i p a t e d o r

u n e x p e c t e d repairs or replacement of such things as the painting or household

appliances.

Renovation and repairs costs:

These costs are incurred in cases where the need arises to repair the house

A home inspection may indicate that the home needs major structural repairs.

Property taxes

: Property taxes are always a certainty and needs to be taken into account

whenone plans to purchase a home.

Property insurance

23

: It is imperative for the borrowers to take insurance of the house they

plant o p u r c h a s e . Ad d i t i o n a l e x p e n s e s g o i n t o i n s u r i n g t h e h o u s e

l i k e p r e mi u m e x p e n s e s , l e g a l expenses, etc.

Service charges

: This includes the service charges levied by the banks and financial institutionsfor

processing the loan application.

Lawyer (notary) fees

: Even a straightforward home purchase requires a lawyer to review

theOffer to Purchase, search the title, draw up mortgage documents

and tend to the closing details.13

Lawyers fees for a Housing loan and purchase range widely depending

on the complexity of thedeal but will probably be at least Rs.500.

Moving costs

: This refers to the expenses incurred when one moves from one home to

another for example expenses incurred for hiring a truck..

Other Costs:

This is a list of possible extra costs involved in buying a home. Some of

them areone-time costs and others, such as maintenance fees and property

insurance, will be ongoingmonthly expenses.

D)SELECTION OF THE MOST SUITABLE BANK

Choosing the most suitable bank is a crucial stage in the home loan

process. It is imperative tochoose the financer with utmost care and

24

proper consideration of its past track record since thecustomer is entering in

a long-term relationship with the bank when he takes a home loan.A f t e r f i n d i n g

o u t t h e c o s t o f t h e h o u s e , o n e m u s t c o mp a r e b a n k s o n t h e b a s i s o f

c o s t t o s e e which loan is the cheapest. Besides cost factors, though, there

are some other factors that oneneed to consider. Evaluation of the lenders can

be done on the basis of the following factors:

Rate of interest:

This is where it all begins. Although the rate of interest offered by most

banksis more or less the same on paper, some degree of bargaining in

most cases, leads to a loweringo f r a t e s by a s mu c h a s 0 . 2 5 t o 0 . 5 0

p e r c e n t a g e p o i nt s a n d m o r e s o i f t h e b o r r o w e r s p r o f i l e happens to

match the requirements of the bank. The lowering of interest rate has a

significantimpact over the long term although the difference is not so

noticeable over the near term. Careneeds to be taken to ensure that the

difference is not being offset elsewhere by the bank under the guise of

other `charges'.

Tot a l f i n a n c i n g c o s t :

This measure quantifies what the loan really costs. It

n o t o n l y incorporates interest cost but also combines the other costs

such as processing fees and other administrative charges collected

by lenders upfront. Looking for a bank not just with the lowestinterest rate

but the lowest total financing cost can help one in opting for the best deals.

National presence:

25

The bank should be present across the country or at least have branches

inall major metros and towns. This assumes importance if the current job

of an individual is of a14 transferable nature (e.g. bank jobs, defence

personnel) or if he needs to make long and frequentoutstation visits (e.g.

consultants, businessmen). The individual shouldn't be put through

theh a s s l e o f c o ur i e r i n g h i s c h e q u e s t o t h e r e s i d e n t br a n c h e v e r y

t i m e o r c o n t a c t i n g t h e r e s i d e n t branch each time he has a difficulty or

a query. So it helps if the bank is well networked acrossthe country.

Prepayment/Foreclosure benefits:

For many individuals, this plays a significant role in their decision to go

in for a particular bank. For example, many salaried individuals know for

a factthat their salaries would be revised every year. This means that they can pay

a higher EMI goingforward. Some of these individuals also know that they

would be getting a bonus, which theyc a n u t i l i s e t o p a y o f f t h e i r

home loan (either fully or partly). Some banks do not

c h a r g e individuals for making a prepayment/foreclosing his account.

Obviously such bank should get preference over other banks that do levy a

prepayment charge.

Calculation of the exact home loan amount:

Here the banks differ in their calculation of theloan amount to be

disbursed. Some banks calculate the amount to be disbursed on the basis

of,s a y , t h e g r o s s s a l a r y w h i l e s o m e b a n k s c a l c u l a t e i t o n t h e

n e t s a l a r y . T h i s m i g h t m a k e a difference to individuals as the loan

amount and the EMI will vary across banks. One needs tolook into this

26

and get a comparative analysis done across banks to understand which

bank offersthe best deal to the borrower.

Extent of funding:

Some banks fund only 60 to 75 per cent of the property value, while

othersf u n d h i g h e r a mo u n t s . I f t h e a m o u n t o f d o w n p a y m e n t o n e

h a v e s a v e d u p i s n o t e n o u g h , t h i s factor may tilt one lender's loan in ones

favour.

Flexibility of repayment plans.

S o m e b a n k s o ffe r s f l e x i b i l i t y i n t e r ms o f r e p ay me n t . Th ey could

have either have 'Step-up' plans in which the EMI is stepped up as the

tenure increases( s u i t a b l e f o r y o u n g b or r o w e r s j u s t s t a r t i n g t h e i r

c a r e e r s ) o r r e p ay me n t p l a n s t h a t a l l o w

t h e borrower to load payments upfront (suitable for borrowers who are close to ret

irement). Also,some banks allow borrowers to fix the monthly payment

themselves, especially when they take aloan far lower than what they are

eligible for and where repayments are very comfortable. Insuch a case,

the borrower himself can fix the loan tenure. If the profile fits one of

these cases,one can consider a bank who allows such flexibility.15

Property characteristics:

Some banks are wary about financing flats that are old (more than

30years). So it is important to check whether the bank will finance such a property.

27

Also, very few banks lend against properties that are sold by holders of power of

attorney on a property, rather than owners.

Collateral:

H o u s i n g l o a n s a r e a l r e a dy b a c k e d by c o l l a t e r a l - t h e h o u s e b e i n g

f i n a n c e d . I n addition to this, some banks ask for collateral such as life

insurance policies and fixed deposits.Since there are banks who will not

ask for such collateral and it is not particularly necessary tocough up

extra collateral, especially if the credit is good, one can look for a bank

that does notask for such collateral.

Service:

Some banks offer some extra services that make the loan process a whole

lot easier.They come to the applicants home and get the application form

filled by him; they drop thedisbursed check to the home or office of the

borrower. When there is a tie-up with the employer of the borrower, the

process becomes a whole lot easier.

Other factors:

Other factors like documentation, processing fees, document storage

facilitiesand several other factors can be considered. It is also important

to consider the time taken

to process the loan as well as special deals that a particular bank may have with a r

eal-estatedeveloper. For example, individuals do not like it if the

documentation is an irksome process or if the processing fees are exorbitant.

E) FOLLOW UP WITH BANKS PROCEEDS

28

After the application is submitted along with all supporting documents, the loan

officer conductsa formal interview where he assesses the creditworthiness

of the applicant and his repaymentc a p a b i l i t y, b a s e d o n t h e

i n f o r m a t i o n p r o v i d e d i n t h e f o r m a n d t h e a p p l i c a n t s

e x p l a n a t i o n s during the interview.The lender then conducts a credit

evaluation of the applicant, which also factors in the propertyvaluation

report from an independent valuer appointed by the lender himself. If the

loan officer has some queries, more documents and more explanations

may be needed. Based on the findingof the credit evaluation, a loan

amount is determined and sanctioned. A sanction letter is then sent to the

applicant who generally contains a disbursal plan.

POINTS TO REMEMBER ABOUT A HOME LOAN

1) The monthly installment or the EMI.

The housing loan is normally repaid by a monthlyinstallment. Usually

the monthly installment is an EMI (equated monthly installment),

an equalamount that, if paid every month over the tenure of the loan,

results in fully paying off the loant a k e n . P a r t o f t h e m o n t h l y

i n s t a l l m e n t i s i n t e r e s t ( c a l c u l a t e d a t t h e l o a n i nt e r e s t r at e o n

t h e principal outstanding for that month) and the remaining part is accounted for

as principal repaid.P r i n c i p a l r e p a i d i n t h e pr e v i o u s m o n t h i s r e d u c e d

f r o m o u t s t a n d i n g pr i n c i p a l a mo u n t e v er y month. Interest is calculated

29

in the above fashion on reducing principal. At the end of the loan tenure,

the principal reduces to zero.

2) The loan tenure:

Longer repayment tenure would mean more interest payments on the loan.B e f o r e

one sets out to complete the paperwork for a loan, the

c a l c u l a t i o n o f t h e E q u a t e d Monthly Installments (EMI) is important to

know how much one is expected to pay and whether the borrower have the

capacity to pay that in time.

3) How is the net monthly income calculated:

F o r a s a l a r i e d i n d i v i d u a l , t h e n e t m o n t h l y income is calculated as

salary minus all the statutory deductions. Statutory deductions are

itemslike insurance premiums, tax deductions, PF contributions, which

have to be deducted from

thes a l a r y o f a n i n d i v i d u a l . I n c a s e o f s e l f - e m p l o y e d p e r s o n

l e n d e r s l o o k f o r c a s h e a r n i n g s . T h e r e f o r e , t h e y a d d a p or t i o n o f

t h e d e p r e c i a t i o n c l a i m e d by t h e a p p l i c a n t t o t h e a p p l i c a n t s annual

net profit. This, divided by 12, gives the net monthly income for a self-employed

person. Not all lenders consider depreciation, though. So the loan amount may be l

ess than what onethought it would be if the lender does not consider

depreciation in the computation of net annualincome.

4) Monthly/Annual repayments:

It s important to know whether interest is being calculated onm o n t h l y r e s t s o r

a n n u a l r e s t s . Th e r e a s o n i s t h a t t h e b o r r o w er p a y s m o r e a s

30

i n t e r e s t o v e r t h e years in case of annual rests as compared to monthly

rests, even if the interest rate is the same.H o w d o e s t hi s h a p p e n? Th e

a n s w e r l i e s i n a s m a l l b u t i mp o r t a n t d i ffe r e n c e i n t h e m a n n e r i n

which principal repaid by the borrower as part of the monthly installment is

accounted for by the bank.In case of monthly rests, principal repaid in

the previous month is reduced from the

outstanding principal amount every month. Interest is calculated in

the above fashion on reducing principal.On the other hand, in case of annual

rests of principal, principal repayment every month is notaccounted for at

the end of every month but only credited at the end of the year. This

results inmore payment of interest by the borrower.If one bank quotes interest on

annual rests basis and another quotes on monthly rests basis, evenif the interest rate

is the same, effectively, the annual rests rate in monthly reducing terms

would be higher. So when banks give a rate of interest asking them the method of

computation would be helpful.

5) Fixed or floating rate of interest:

T h e b o r r o w e r s ar e o f t e n f a c e d w i t h a c h o i c e b e t w e e n w h e t h e r t h e

l o a n s h o u l d b e a t a f i x e d r a t e or a f l o a t i n g r a t e . Th e r e a r e

a d v a n t a g e s t o b o t h . Afixed rate loan means that one will have certainty

of payments and even if interest rates rise inthe future the borrower will

still be paying the older, lower rate. The right time to pick a fixedrate

loan is at the bottom of the interest rate cycle form where it looks like

the rates have onlyone way to go. And that is up. On the other hand, the

right time to pick a floating rate is wheninterest rates are at their highest and

the interest rates look like they are on their way down.

31

6) Total financing costs:Apart from knowing how the interest rate is calculated, it

is importantto understand the impact of processing and administrative costs on the

loan cost. They add to thecosts as they have to be paid upfront. The total

financing cost determines what the loan reallycosts the borrower. Hence, a

thorough study of the total costs is important.

7) Co-applicant:

Sometimes the income of the borrower may not be enough to secure the

loanamount required by him. In that case, one can consider applying for the loan

with a co-applicant.Clubbing a co-applicants income and applying jointly

can help get one a higher loan amount.When property is jointly owned,

most banks insist that joint owners have to be co-applicants for a l o a n

a g a i n s t s u c h a pr o p e r t y. Al s o s o me t i me s , t h e l o a n o ffi c e r m i g h t

h a v e a v i e w t h a t t h e borrower doesnt have much of a chance of getting the

desired loan on his own strength and alsoi s n o t c o n v i n c e d o f t h e r e g ul a r i t y

a n d s u s t a i n a b i l i t y o f t h e a p p l i c a n t s i n c o me . I n t h a t c a s e , clubbing a

co-applicants income might just put that loan within ones reach.18

8) Tax advantages:

A h o u s i n g l o a n c o m e s w i t h s o me t a x b e n e f i t s . Th e s e b e n e f i t s

f u r t h e r reduce the cost of the borrowing. There are two heads under

which a borrower can claim tax benefits. One is an exemption for interest

paid on a housing loan. This exemption is available upto an interest paid of Rs 1

lakh per year. And the other is a 20 per cent rebate on principal repaidin the year

32

subject to a maximum rebate of Rs 4,000. That is, a 20 per cent rebate is available

ona maximum principal repaid of Rs 20,000.

9) Identification of the property:

It is not always necessary for the property to be identified

thea p p l i c a t i o n p r o c e s s f o r t h e l o a n s t a r t s . I n f a c t , b o t h

t h e p r o c e s s e s c a n b e c o n d u c t e d simultaneously. When the

borrower is clear about the value of the property to be financed andhave

zeroed in on the bank, he can get a pre-approval on the loan. The loan

pre-approval is a process where the bank conducts the credit evaluation and

sanctions a loan amount for which

the borrower is eligible. The sanction is generally valid for six months, during whic

h period the borrower has to identify the property and execute the property docume

nts; the payment will be released after this. Pre-approval saves time and improves

the bargaining position with the seller.

10) Pre-payment dilemma:

I f t h e b or r o w e r d e c i d e s t o r e p a y t h e l o a n b e f o r e t h e

s t i p u l a t e d period, he will be pre-paying the loan. Few banks charge a 0.5-2% of

the amount the borrower is pre-paying as pre-payment penalty. Some

banks don't have a pre-payment penalty provided the borrower is not paying off

the entire loan amount. That means when the loan is pre paid partly;t h e r e m a y

n o t b e a n y p e n a l t y or c h a rge s . Th e r e f o r e i t i s a d v i s a b l e t o b o r r o w

f r o m a b a n k wherever the pre-payment clause or Loan Redemption charge is

not harsh.

33

COMMITMENTS AND RESPONSIBILITIES ON THE PART OFTHE BANKERS

1 . T h e b a n k s / F I s s h o u l d a s s u r e t h a t t h ey s h a l l a c t f a i r l y a n d

r e a s o n a b l y i n a l l t h e i r d e a l i n g s with the customers on ethical

principles of integrity and transparency in respect of servicesthey offer,

and in the procedures and practices their staff follow and make sure

the productsand services meet relevant laws and regulations.

2.The banks/ FIs shall help the borrowers

t o u n d e r s t a n d h o w t h e f i n a n c i a l p r o d u c t s a n d services work by

giving information about them. They shall also provide the

operationalguidelines for Govt. accounts like PPF / pension etc. The

salient features of the products /services including the financial implications

should be highlighted in the product profile

3 . B e f o r e p e o p l e b e c o me s a c u s t o me r, t h e b a n k s / F I s s h a l l g i v e

c l e a r i n f o r m a t i o n e x p l a i n i n g the key features of the services

and products which the people are interested in and give theinformation on

any type of account facility which they have to offer

4.The banks/ FIs shall tell the customers what

i n f o r m a t i o n t h e y n e e d f r o m t h e b o r r o w e r s , before opening any

deposit a/c, to prove their identity and address and to comply with

legala n d r e g u l a t o r y r e q ui r e m e n t s , a n d r e q u e s t f o r a d d i t i o n a l i n f o r

mation about them, their

business/ profession and their family. The Bank before opening an

y deposit account shall carry out due diligence as required

under "Know Your Customer" (KYC) guidelines

issued by RBI and or such other norms or procedures adopted by

the Bank. This will involve s a t i s fy i n g a b o u t t h e i d e n t i t y o f

t h e p er s o n , v er i fi c a t i o n o f a d d re s s , s a t i s fy i n g a b o u t

34

h i s occupation and source of income, obtaining introduction

of the prospective depositor from

a person acceptable to the Bank and obtaining recent photograph

of the person/s opening /operating the account. In addition to

the due diligence requirements, under KYC norms the B a n k

i s re q u i re d b y l a w t o o b t a i n Pe r m a n e n t Ac c o u n t

N u m b e r ( PA N ) o r G e n e r a l I n d ex Register (GIR) Number

or alternatively declaration in Form No. 60 or 61

as specifi ed under the Income Tax Act / Rule

If the decision to open an account of a prospective depositor requires

clearance at a higher level, reasons for any delay in opening of the

account shall be informed and the final decision of the Bank shall be

conveyed at the earliest.

5 . T h e b a n k s / F I s s h a l l g i v e u p f r o n t d e t a i l s o f a ny i n t er e s t a n d / o r

c h a r ge s a p p l i c a b l e t o t h e products chosen by the borrowers.

6.The banks/ FIs shall seek specific consent of the borrowers for giving

details of their names,a d d r e s s e s s e t c . t o a ny t h i r d p a r t y i n c l u d i n g

o t h e r e n t i t i e s i n t h e i r g r o u p , f o r m a r k e t i n g purposes.

7 . T h e b a n k s / F I s s h a l l m a k e s u r e t h a t a l l a d v er t i s i n g a n d

p r o mo t i o n a l m a t e r i a l i s c l e a r, f a i r, reasonable and not misleading.

8.To help manage their account and check entries on it, the banks/ FIs

shall give the borrowerstheir account statements at regular intervals or Pass

Book for the type of account they have.

9 . T h e b a n k s / F I s s h a l l t e l l t h e b o r r o w e r s a b o u t t h e c l e a r i n g cy c l e ,

i n c l u d i n g w h e n t h e y c a n withdraw their money after lodging collection

instruments and when they will start earninginterest.

35

10.The banks/ FIs shall keep original cheques paid from the customers

account or copies, for such periods as required by law. If, within a

reasonable period after the entry has been madeon their statement, there

is a dispute about a cheque paid from their account, the lenders/ financial

institutions shall provide the customers with the necessary information for

evidence-subject to a possible charge for the same.

11.In the event the cheque book, passbook or ATM/Debit card has been

lost or stolen, or thatsomeone else knows the customers PIN (Personal

Identification Number) or other securityinformation, the banks/ FIs shall,

on notification, take immediate steps to try to prevent these from being

misused.

12.The customer information collected from the customers shall not be

used for cross selling of services or products among the banks, their

subsidiaries or affiliates.

The banks/ FIs shalltreat all the personal information of their customers

as private and confidential (even whent h e y a r e n o l o n g e r t h e i r

customer), including entities in their group, other than in

t h e following four exceptional circumstances for which the banks/ FIs are

permitted to do so :-a . I f t h e y ( i . e . t h e b a n k s / FI s ) h a v e t o g i v e t h e

i n f o r m a t i o n b y l a w. b.If there is a duty to the public to reveal the information

in the interest of the public at large.

36

c.If their interests require them to give the information (for

example, to prevent fraud) but

the banks/ FIs shall not use this as a reason for giving information

about its customers or their accounts (including their name

and address) to anyone else, including other companies

intheir group, for marketing purposes.d . I f th e c u s t o m e r s a s k s

t h e b a n k s / F I s t o re v e a l t h e i n f o rm a ti o n , o r i f t h e

b a n k s / F I s h a v e t h e c u s t o m e r s p e rm i s s i o n to p ro v i d e

s u c h i n f o rm a t i o n t o t h e i r g ro u p / a s so c i a t e / e n t i ti e s

o r companies when the lenders/ fi nancial institutions have

tie-up arrangements for providingother financial service

products

PARAMETERS IN RELATION TO HOME LOANS

Home loans are an important means of social mobility. Under home loans, the

eligibility criteria,documentation, interest rates, quantum of loan, margin

requirement, security, repayment etc andsuch other important parameters are

put into consideration by banks and financial

institutionsw h i l e g i v i n g l o a n s t o t h e b o r r o w e r s . T h e p a r a m e t e

r s p u t d o w n b y b a n k s a n d f i n a n c i a l institutions vary from

i n s t i t u t i o n t o i n s t i t u t i o n . H o w e v e r, t h e o v er a l l g u i d e l i n e s

f o l l o w e d b y them are given as below:

ELIGIBILITY CRITERIA

1) For Resident Indians

Home loan eligibility for Resident Indians depends upon the repayment

capacity of the loanapplicant. The maximum loan that can be sanctioned

37

varies with the banks and other housingfinance companies (HFC) and

generally, the maximum loan amount granted is 80 to 85% of thecost of the home.

i) Increasing the Home loan tenure:

O n e o f t h e b a s i c p r o c e s s o f e n h a n c i n g t h e h o m e l o a n eligibility is

by opting for a higher tenure. This is so because the EMI, which an

individual hasto pay, starts to decline as the tenure increases while the

interest rate as well as the principalamount remains the same. What changes

though, is the net interest outgo, which rises with a risein tenure. And since the

individual is paying a lower EMI now, his 'ability to pay' and thereforehis

loan eligibility automatically increase.

ii) Repaying other outstanding loans:

There might be adverse effect on home loan eligibility f o r i n d i v i d u a l s

w i t h o u t s t a n d i n g l o a n s l i k e c a r l o a n s or p e r s o n a l l o a n s . I n d u s t r y

standardssuggest that existing loans with over

1 2 u n p a i d i n s t a l l m e n t s a r e t a k e n i n t o a c c o u n t w h i l e computing the

home loan borrower's eligibility. In such a scenario, individuals have the

optionof prepaying in part/full their existing loans. This will ensure that

their eligibility for the homeloan purpose is unaffected.

iii) Clubbing of incomes:

Home loan eligibility can also be enhanced by clubbing incomes

of spouse, children (son or daughter) staying with the applicant and

having regular income andeven earning parents (father or mother) living

with the applicant. The eligibility in such casesw i l l b e c a l c u l a t e d o n

t h e c l u b b e d i n c o me o f b o t h t h e a p p l i c a n t s e n h a n c i n g t h e

i n d i v i d u a l ' s eligibility to the extent of the co-applicant's income.

iv) Step-Up loan:

38

Individuals can also enhance their loan eligibility by opting for step-up loans.A

step-up loan is a loan wherein an individual pays a lower EMI during the

initial years and thesame is enhanced during the rest of the loan tenure. HFCs

usually consider the lower EMI of thei n i t i a l y ea r s t o c a l c u l a t e h i s l o a n

e l i g i b i l i t y w h i l e t h e i n i t i a l l o w e r E MI h e l p s i n cr e a s e t h e individual's

'capacity to borrow'.

v) Perks:

Salaried individuals must ensure that variable sources of income like

performance-linked pay among others are taken into consideration while

computing their income. This in turnwill imply that the loan amounts they are

eligible for stand enhanced as well.However, potential investors

and borrowers must work out solutions best suited for their profilea f t e r

speaking to their home loan consultant and only then consider

a c t i n g o n t h e o pt i o n s d i s c u s s e d . B e c a u s e , i n c r e a s i n g l o a n

e l i g i b i l i t y c a n h a v e a n i mp a c t o n o t h e r a s p e c t s o f t h e i r financial

planning

2) For Non- Resident Indians

The eligibility criteria of NRIs differ from Resident Indians based on a

few parameters. The parameters include:

Age:

The loan applicant has to be 21 years of age.

Qualification:

The NRI loan seeker has to be a graduate.

Income:

39

The loan applicant has to have a minimum monthly income of $ 2,000

(although,

thisc r i t e r i o n m a y d i f f e r a c r o s s H F C s ) . T h e e l i g i b i l i t y i s a l s o

d e t e r m i n e d b y t h e s t a b i l i t y a n d continuity of your employment or

business.

Payment options:

The NRI also has to route his EMI (Equated Monthly Installments)

chequesthrough his NRE/ NRO account. He cannot make payments from another

source say, his savingsaccount in India.

Number of dependants:

The eligibility of the applicant is also determined by the number

of dependents, assets and liabilities.A n N R I a p p l i c a n t i s e l i g i b l e t o g e t a

h o m e l o a n r a n g i n g f r o m a m i n i mu m o f R s 5 l a k h s t o a maximum of

Rs 1 crore, based on the repayment capacity and the cost of the property,

whichalthough is variable by the priorities of the home loan provider.

Also Home Loan Tenure for NRIs is different from Resident Indians. An

applicant will be eligible for a maximum of 85% of the cost of the property or

the cost of construction as applicable and 75% of the cost of land in case

of purchase of land, based on the repayment capacity of the borrower.However, a

NRI can enhance his loan eligibility by applying for home loans with a coapplicantwho has a separate source of income. Also, the rate of interest for

home loans to NRIs is higher than those offered to Resident Indians. The

difference is to the income. Also, the rate of interestfor home loans

to NRIs is higher than those offered to Resident Indians. The difference

is to theextent of 0.25%-0.50%. Some HFCs also have an internally

earmarked 'negative criterion' for NRI home loans. As such, the NRIs

40

who hail from locations that are marked as being 'negative'in the books of HFCs,

find it difficult to get a home loan.

FAI R P R A C T I C E S C O D E TO B E F O L L O W E D B Y

B A N K E R S WHILE GIVING HOME LOANS

With a view to setting out fair lending practices in a transparent manner,

the RBI has advisedBanks and Financial Institutions (FIs) to adopt the following

as Lenders Fair Practices Code.The Fair Practices code applies to the following

areas:

A) Applications for loans and their processing

1) Standard schedule of fee/ charges relating to the loan application depending on

the segment tow h i c h t h e a c c o u n t s b e l o n g s h o u l d b e m a d e a v a i l a b l e

t o a l l t h e p r o s p e c t i v e b or r o w e r s i n a transparent manner, along with

the loan application, irrespective of the loan amount. Likewise,amount of

fee refundable in the event of non-acceptance of the application,

prepayment optionsand any other matter which affects the interest of the

borrower should also be made known tothe borrower at the time of

application.2) Receipt of completed application should be duly acknowledged.3 )

T h e a c k n o w l e d g e m e n t s h o u l d a l s o i n c l u d e t h e a p p r o x i ma t e d a t e

b y w h i c h t h e a p p l i c a n t should call on the Bank for preliminary discussions, if

deemed necessary.4) All loan applications will be disposed of within a stipulated

41

period from the date of receipt of duly completed loan applications i.e. with all the

requisite information/papers.5) In case of rejection of loan application,

irrespective of category of loans or threshold limits,the same should be

conveyed in writing along with the main reason(s), which led to rejection

of the loan application. The time frame for conveying the reason/s of

rejection should be as per theSchedules.

B) Loan appraisal and terms/conditions

1) In accordance with Banks prescribed risk based assessment procedures, each

loan applications h o u l d b e a s s e s s e d

a n d s u i t a b l e m a r gi n / s e c u r i t i e s s h o u l d b e s t i p u l a t e d b a s e d o n s u c h

r i s k assessment and Banks extant guidelines, however without compromising on

due diligence.2) The sanction of credit limit along with the terms and

conditions thereof is to be conveyed tothe loan applicant in writing

and applicants acceptance of such terms and conditions should

beobtained in writing. Such terms and conditions as have been mutually

agreed upon between the bank and borrower prior to the sanction will only be

stipulated.

3) Copy of loan documents, along with a copy of all

r e l e v a n t e n c l o s u r e s s h o u l d b e m a d e available to the loan

a p p l i c a n t o n s p e c i f i c r e q u e s t . S t a n d a r d s a n c t i o n l e t t er w o u l d

i n c l u d e i n s t a n c e s o f a p p r o v a l , d i s a l l o w a n c e , e t c . Th e b a n k i s

u n d e r n o l e g a l o b l i g a t i o n t o c o n s i d e r increase/additional limits/facilities

without proper review/assessment.

4) In case of lending under consortium arrangement, the participating

banks would decide thetimeframe to complete appraisal of the proposal

42

and communication of the decision. The Bank will abide by the decision of

the consortium.

C) Disbursement of loans including changes in terms and conditions

1) Disbursement of loans sanctioned is to be made immediately on total

compliance of terms andconditions including execution of loan documents

governing such sanction.

2) Any change in terms and conditions, including interest rate and service

charges, should beinformed individually to the borrowers in case

of account specific changes and in case

of others by Public Notice/display on Notice Board at the branches/on the Banks

website/through Printand or other Media from time to time.

3) Changes in interest rates and service charges should be effected prospectively.4)

Consequent upon such changes any supplemental deeds, documents or

writings are requiredto be executed, the same shall also be advised.

Further, availability of facility will be subject toexecution of such deeds,

documents or writings.

D) Post disbursement supervision

1) Post disbursement supervision by Banks/ FIs, particularly in respect

of loans upto Rs. 2 lacs,should be constructive with a view to taking care

of any genuine difficulties that the borrower may face.2) Before taking

a decision to recall/accelerate payment or performance under

the agreement or seeking additional securities the Lenders should give

reasonable notice to the borrower.3) All securities pertaining to the loan

should be released by Banks/ FIs on receipt of full andfinal payment of

43

the loans subject to any legitimate right or lien and set off for any other

claimt h a t t h e B a n k / F i n a n c i a l I n s t i t u t i o n m a y h a v e a g a i n s t t h e

b o r r o w e r s . I f s u c h r i g h t i s t o b e exercised, borrowers should be given due

and proper notice with requisite details.

E) Other general guidelines

1) The Banks/ FIs should refrain from interference in the affairs of the borrower

except for whatis provided in the terms and conditions of loan sanction documents

(unless new information, notearlier disclosed by the borrower, has come to

the notice of the Bank as lender). However thisdoes not imply that

Banks right of recovery and enforcement of security under Law as well

asappointment of nominee directors, where required, is affected by this

commitment.2) While lending Banks/ FIs should not discriminate on the

grounds of gender, caste or religionin its lending policy and activity.3 ) I n

t h e c a s e o f r e c o v e r y, B a n k s / FI s s h o u l d r e s o r t t o t h e u s u a l

m e a s u r e s a s p e r l a i d d o w n guidelines and extant provisions and should

operate within the legal framework.4) F o r t h e p ur p o s e o f r e c o v er i n g

l o a n s , B a n k s / F I s s h o u l d h a v e a M o d e l P o l i cy o n C o d e

f o r Collection of Dues and Repossession of Security. They should not

resort to undue harassmentviz. persistently bothering the borrowers at odd

hours, use of muscle power, etc.

5) In case of request for transfer of borrowal accounts, either

f r o m t h e b or r o w e r or f r o m a Bank/FI, the Banks consent or otherwise

should be conveyed within a stipulated period fromthe date of receipt of

request.

44

6)T h e B r a n c h O ffi c i a l s s h o u l d i m m e d i a t e l y t a k e u p t h e m a t t e r f o r

r e d r e s s a l i n c a s e o f a n y complaint/grievance from the applicant/borrowers.27

7) In case of complaints received, the branch should take into consideration the

matter with fulldetails within a stipulated period from date of receipt and

take all necessary steps to redress andresolve the grievance/dispute within a

proper time frame.

TIPS WHILE BUYING A HOME

Buying a home is a dream of a lifetime for most of the people. Before applying for

a home loan,here are some tips that will be helpful when the borrowers are looking

for a house of their own.

1) While buying a flat from a promoter or buildera) With respect to the location

i. A proper check should be done for proper approach roads.ii. One should ensure

secured electricity and water connectionsiii. Ensuring that well laid

out drainage, sewerage and garbage disposal arrangements have

beenmade.iv. Checking out whether there is any pollution due to industries etc. in

the areav. f i n d i n g o u t t h e l e v e l o f d e v e l o p m e n t a l a c t i v i t i e s o f t h e

a r e a - a d e q u a t e p u bl i c t r a n s p o r t facilities and other vital amenities like

educational institutions, hospitals and shopping avenues

b) With respect to approvals

i . O n e s h o u l d c h e c k i f t h e b u i l d er / p r o mo t e r h a s

b e e n gr a n t e d d o c u me n t e d a p p r o v a l s f r o m Municipal Corporation,

Area Development Authorities, Electricity Boards, Water Supply

45

&Sewerage Boards, Airport Area Authorities, etcii. Checking out if the

builder/promoter has secured approvals from Pollution Control

Boards,Agriculture & Forest Authorities

c) With respect to the property

i.

Checking out for proper Development Agreements and

the authority for conveyance of title infavour of builder/promoter ii.

Obtaining a clear and marketable title of the propertyiii. Ensuring

execution of proper sale agreements on the initial paymentsiv. Having a

ii.

look at the sanctioned planv. Registration of the property

vi. Verification of the plinth and carpet area of the property

d) With respect to amenities

i. Checking for the condition of the building and the future life expectancyii.

Finding out whether drinking water is availableiii. Checking for natural lighting,

ventilation, water connection & sanitary connection

i . V er i f i c a t i o n o f t h e s p e c i f i c a t i o n s g i v e n b y t h e b u i l d e r r e g

a r d i n g i n c l u d i n g q u a l i t y o f construction and availability of drinking and

potable water have been deliveredii. Assessment of the natural lighting, ventilation,

water connection & sanitary connection statusof the prospective propertyiii.

Checking up the common service area charged and their reasonability

2) While buying a flat from a second ownera) With respect to the location

i. Checking for proper approach roadsii.

Checking for electricity and municipal water connectionsiii.

Finding out whether well laid out drainage, sewerage and garbage

disposal arrangements aremadeiv.

46

Finding out whether there is pollution due to industries etc in the areav.

Checking for the developmental activities of the areaS.

Public transport facilities in the area.

vii. Checking for educational institutions, hospitals, shopping avenues

nearby, green belts &rainwater drainage

b) With respect to approvals

D o c u m e n t e d a p p r o v a l s f r o m C i t y C o r p or a t i o n , A r e a D e v e l o p m e n t

A u t h o r i t i e s , E l e c t r i c i t y Boards, and Water Supply & Sewerage Boards

c) With respect to the property

i. Title deeds of the vendor of the propertyii. Previous title deeds covering a period

of 13 yearsiii. Sanctioned planiv. Encumbrance certificate for the past 13 yearsv.

Upto-date tax paid receiptsvi. Valuation of the property from a registered

valuer vii. Checking out if the flat/apartment is free from tenancyviii. Registration

of the property

d) With respect to amenities

i. Checking for the condition of the building and the future life expectancyii.

Finding out whether drinking water is availableiii. Checking for natural lighting,

ventilation, water connection & sanitary connection

3) While buying an independent house from a promoter/ builder With respect to

the locatioN

i. Checking for proper approach roadsii. Checking for electricity connectionsiii.

Finding out whether municipal water connections are

presenti v . F i n d i n g o u t w h e t h e r t h e r e i s w e l l l a i d o u t d r a i n a g e ,

47

s e w e r a g e a n d g a r b a g e d i s p o s a l arrangement madev. Finding out

whether there is pollution due to industries etc in the areavi. Checking for the

developmental activities of the areavii. Finding out the availability of public

transport facilities in the

areav i i i . C h e c k f o r e d u c a t i o n a l i n s t i t u t i o n s , h o s p i t a l s , s h o p p i n g a v

e n u e s n e a r b y, g r e e n b e l t s & rainwater drainage

b) With respect to approvals

Checking out if necessary approvals from City Corporation, Area

Development Authorities,Electricity Boards, Water Supply & Sewerage

Boards, and Airport Area Authorities have beenobtained

c) With respect to the property

i. Sale deed of the vendor of the propertyii. Clear & marketable title of the

propertyiii. Sanctioned planiv. Encumbrance certificate for the past 13 yearsv.

Upto-date tax paid receiptsvi. Valuation of the property from a registered

valuer vii. Registration of the property

Procedure of home loan

T h e c r e d i t d o c u m e n t s c o mp r i s e d o c u m e n t s t o e s t a b l i s h i n c o me , a

g e , r e s i d e n c e , e mp l o y me n t , i n v e s t m e n t s , e t c . D ur i n g t h i s s t a g e , t h

e b a n k / f i n a n c i a l i n s t i t u t i o n c h e c k s t h e r e p ay m e n t c a p a c i t y o f t h e

c u s t o m e r. Th e r e p ay me n t c a p a c i t y i s d e t e r mi n e d by t a k i n g

intoconsideration factors such as income, age, qualifications, num

b e r o f d e p e n d a n t s , s p o u s e ' s income, assets, liabilities, stability and

continuity of occupation and savings history.

48

B. Personal Discussion with customer:

Some banks/FIs require the customer be present at thet i m e o f t h e

credi

a p p r a i s a l . S o me b a n k s / F I s m a y i n s i s t o n a p e r s o n a l i nt e r v i e w

w i t h t h e c u s t o me r a n d p e r f o r m a r e f e r e n c e c h e c k o n t h e r e f e r e n c e s

p r o v i d e d by t h e c u s t o m e r o n t h e application form. For the personal

discussion the customer needs to take with him all documents pertaining to the

information provided by him on the application form.:

c. field investigation by banks

The bank/FI validates

information provided by the customer on the application form. This stage revolve

s around two key aspects.Critically appraising the credit worthiness of the

customer and analyzing the risk in lending. It isn e c e s s a r y t o c a p t ur e a l l t h e

i n f o r m a t i o n r e q u i r e d t o c a t e r t o t h e s e a s p e c t s . I t i s i mp o r t a n t

t o verify that the information supplied by the customer is correct and

authentic. Banks achieve thismostly through external agencies. Also

the validity and authenticity of information can be donethrough

conducting checks on the residential address of the customer, the place

of employmentof the customer, and credentials of the employer,

verification of documentary proofs of income,age and other information. To

minimize the risk, it is necessary to check that the customer is nota fraud or black

listed within the bank or other institutions.

D. Credit Appraisal and loan sanction:

49

The next phase in the home loan process is the creditappraisal and loan

sanction. After checking the customer's repayment capacity, the

bank/FI setsnorms that define the customer's eligibility for a loan

amount. The loan then gets sanctionedalong with certain terms

and conditions. When evaluating the measurable aspects of home

loanrequests, an analyst addresses the following issues: the character of the

borrower, the use of loan proceeds, the amount needed, and the primary and

secondary sources of repayment. Therefore,the bank has to base its decisions more

on qualitative parameters rather than quantitative aspects.Credit analysis

therefore is distinct for each type of home loan scheme. Credit analysis is

themost popular methods of evaluating home loans.32

E. issue of offer letter of the customer

The bank/FI sends an offer letter tothe customer with the loan sanction details

which mention:

Loan amount

R a t e o f i nt e r e s t a n d w h e t h e r i t i s f i x e d / v a r i a b l e r a t e o f i n t e r e s t .

I f v ar i a b l e , p e r i o d a f t e r which the rate of interest would be reset - annual /

monthly reducing balance

Loan duration

Mode of Loan repayment

Scheme of the loan, if a special scheme has been offered to the customer

General terms and conditions of the loan

50

Special conditions, if any, which the customer needs to adhere to prior to

disbursement

Submission of the acceptance copy of the offer letter and a cheque for

administrative fees bythe customer

F. Submission of property / legal documents by the customer to the

bank/FI:

After the selection of the property, the customer is required to submit the original

documents pertaining tot h e pr o p e r t y b e i n g p u r c h a s e d or m o r t g a g e d ( i f

t h e p r o p e r t y p ur c h a s e d i s d i ffe r e n t f r o m t h e property mortgaged). The

bank/FI keeps the property documents as security for the loan amountgiven to

the customer till the time the loan is fully repaid.

G. Legal check on the property by the bank

: The bank/FI sends all the documents to their empanelled

Lawyer for a thorough scrutiny. On receiving the lawyer's report that the

documentsare clear, the bank/FI decides to disburse the loan

to the customer. If the documents sent to thel a wy e r a r e n o t e n o u g h t o

a r r i v e a t a j u d g me n t , t h e b a n k / FI r e q u e s t s t h e c u s t o me r t o

f u r n i s h additional documents.

H. Technical check on the property by the bank/financial institution:

Prior to disbursement,the bank/FI conduct a site visit to the customer's property to

verify the following:

In case of under construction property:

51

Quality of construction

Stage of construction: Whether it is the same as mentioned in the

payment notice given tothe customer by the builder 33

Progress of work

Layout of flats and area of property is within permission granted by the governing

authority

R e q u i s i t e c e r t i f i c a t e s h a v e b e e n r e c e i v e d b y t h e b ui l d e r t o s t a r t

construction at the site

In case of ready construction/ resale:

Age of the structure

Quality of construction

Whether the structure will last the tenure of the loan

External maintenance of the property

Internal maintenance of the property

Surrounding area (development)

R e q u i r e d c er t i f i c a t e s f r o m t h e g o v e r n i n g a u t h or i t y h a v e b e e n

r e c e i v e d b y t h e b u i l d e r f o r handing over possession of the flat

There is no existing lien or mortgage on the property

52

I. Disbursement:

After verifying that the property is legally and technically clear, the

bank/FIdisburses the loan amount on the basis of the stage of construction of the

property. The customer needs to pay the margin money from his own contribution

prior to the disbursement.

J. Repayment:

The repayment of the loan by the customer starts only

a f t e r t h e f u l l disbursement of the loan amount has been made by the

bank/FI. The loan is always repaid byw ay o f E MI s . Th e m o d e o f

r e p a y m e n t , h o w e v e r, d i ffe r s f r o m c a s e t o c a s e . I n c a s e o f a

l o a n r e p ay m e n t d o n e t h r o u g h D e d u c t i o n

A g a i n s t S a l ar y ( D A S ) , P o s t D a t e d C h e q u e s ( P D C s ) , Standing

Instructions (SI) and cash / Demand Draft (accepted only by some

banks/FIs). Thecustomer can deposit the amount of his EMI every month at the

bank/FIs office.

K. Interest tax certificate:

This certificate is given by the bank/FI to the customer to avail of tax

benefits that accrue through a

. The customer can submit this to his employer or chartered accountant to

account it while calculating the customer's tax liability.

L.Prepayment by the customer:

53

The customer can either partly or fully prepay his loan at anygiven point

of time. The loan could be partly or fully disbursed when the customer

wishes to34 prepay his loan. Most banks/FIs, however, have a limit on the

number of times that a person can prepay his loan. There is, normally, also a

minimum amount that a customer has to prepay eachtime he wishes to do so.

Whenever a customer makes a prepayment, the customer has an optionof

reducing his EMI by keeping his tenure constant or to reduce his tenure

by keeping the EMIconstant

QUANTUM OF LOAN

The quantum of loan is assessed based on the net monthly/ net

a n n u a l i n c o m e w i t h a d i r e c t bearing on age factor of the borrower.

A person of age in the range of 21 to 45 years is eligiblefor a maximum amount of

60 times of his Net Monthly Income (NMI)/ five times of Net AnnualIncome. In

case the age is above 45 years the quantum will be restricted to 48 times

of NMI/four times of Net Annual Income. Many banks have put a ceiling

on the maximum amount of home loan at Rs.50 lakhs. In order to assess

the quantum of finance income of spouse or close relative can also be

reckoned, provided that person becomes a co applicant.

Documentation refers to the documents needed to legally enforce the

loan

agreementa n d p r o p e r l y a n a l y z e t h e b o r r o w e r s f i n a n c i a l c a p a

c i t y . D o c u m e n t a t i o n i s a n e s s e n t i a l component from the point of

view of the safety of an advance. The ability to control arises fromthe

documentation of provisions, which confirm understanding on the basis

54

of which a creditfacility has been sanctioned. Documents should

be properly drafted, stamped and executed withn e c e s s a r y l e g a l

f o r m a l i t i e s , i f a ny. An e ffe c t i v e l o a n a p p r o v a l p r o c e s s e s t a b l i s h e s

m i n i mu m requirements for the information and analysis upon which a credit

decision is based.There are certain sets of documents that need to be

submitted at the time of application for ahome loan. The document sets

will vary according to the individual status - either resident or non resident

in India, as also the type of loan that the borrower may want to avail of.

Resident Indians / non resident indians

Income documents

Property documents

Personal documents

Income documents

Property documents

Personal documents

1) For Resident Indians

Documentation refers to the specific documents to be submitted by

Resident Indians as theya p p l y f o r h o me l o a n . Th e s e d o c u me n t s a r e

v e r y m u c h n e c e s s a r y f o r t h e b a n k s t o a v o i d a ny dispute and