Академический Документы

Профессиональный Документы

Культура Документы

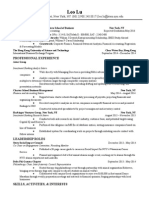

WSO Resume 119861

Загружено:

John Mathias0 оценок0% нашли этот документ полезным (0 голосов)

123 просмотров1 страницаResume book

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документResume book

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

123 просмотров1 страницаWSO Resume 119861

Загружено:

John MathiasResume book

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

JOHN E.

DOE

## xxxxxx Lane, Town, ST (xxx) xxx-xxx non_target@non.target.edu

EDUCATION

Non- Target College

Town, ST

BBA - Finance, Computer Science Minor

September 2011 - Present

GPA 3.5, Deans List 2013

Relevant coursework: Corporate Finance, Investments, Financial Modeling, International Finance

Honors: President - XX Investment Club, Football Team, 2013 Outstanding Business Student

WORK & LEADERSHIP EXPERIENCE

Large Custody Bank

Boston, MA

OTC Derivatives Intern

Summer 2013

Process and book bilateral swaps including IRS/CDS/TRS and other credit derivatives for Goldman

Sachs Asset Management in a high pressure, time sensitive environment

Issue wires to respective parties based on underwriting agreements of the deal/contract

Responsible for computing cross-currency accrued interest and prices for numerous swaps

Created job manual to guide new hires step by step on booking swaps on the companys software

Trained and supervised 2 new hires in use of companys software, procedures, and booking of trades

Medium Sized Real Estate Company

Boston, MA

Winter Analyst

Winter Break 2012 & 2013

Analyzed year-end financial statements of a $275M privately-held Retail Real Estate provider

Forecasted year-end budget reports for 250+ tenants based off a 3-year moving average of accrued

expenses and historical revenues, took out all non-recurring expenses and extraordinary items

Prepared an income statement for each tenant and analyzed _________ ability to manage cost as a

percent of revenue. Reported back to senior management with tenants that didnt meet firms criteria

Handled more than $500,000 in daily checks to be deposited or credited to Wilders account

Non-Target College Investment Club

Town, MA

President

September 2012 - Present

Outperformed the appropriate benchmark by 4.59% as of April 30th, 2013 | Portfolio Value: $98,000+

o Diversified the portfolio: index funds, REITs, bonds, commodities, emerging market exposure

o Evaluate investments using models such as discounted cash flows and relative valuation models

o Head the discussion of macro outlook, market currents and position analysis

Led two presentations to Non-Target College Board of Trustees

o Resulted in additional endowment of $25,000 and funding for annual trip to NYC Financial District

o Organized trip to NYC-Financial District: NYSE, Bloomberg HQ, SMBC Capital Markets

\

Change the reputation and dynamic of the XX Investment Club

o Increased membership by 250%, currently 33 active members which meet on a weekly basis

o Brought in guest speakers from KPMG, Affiliated Managers Group, Choate Investments

o Directed school-wide stock simulator competition and investing 101 class to spike interest

SKILLS & INTERESTS

Languages: Conversational Proficiency in French; Beginner in Mandarin

Skills: DCF Valuation, Bloomberg Certified, Excel Modeling, C++, HTML/CSS

Awards: 1st place EC Trading Competition, 2nd place DECA Business Ethics Competition

Interests: Fitness, Sports, Poker, Reading, Cars, Personal Investing

Вам также может понравиться

- The Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondОт EverandThe Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondОценок пока нет

- WSO Resume 8Документ1 страницаWSO Resume 8Devin MaaОценок пока нет

- Chris Warley ResumeДокумент1 страницаChris Warley ResumechriswarleyОценок пока нет

- Private Equity Unchained: Strategy Insights for the Institutional InvestorОт EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorОценок пока нет

- WSO Resume Nov3Документ1 страницаWSO Resume Nov3John MathiasОценок пока нет

- David Ketelhut Resume 2018Документ2 страницыDavid Ketelhut Resume 2018api-385647154Оценок пока нет

- UofMaryland Smith Finance Assoc Resume Book (1Y)Документ46 страницUofMaryland Smith Finance Assoc Resume Book (1Y)Jon CannОценок пока нет

- Quantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskОт EverandQuantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskРейтинг: 3.5 из 5 звезд3.5/5 (1)

- JChiang ResumeДокумент1 страницаJChiang Resumemancision100% (1)

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingОт EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingОценок пока нет

- WSO ResumeДокумент1 страницаWSO ResumeJohn MathiasОценок пока нет

- Dardenresume PEДокумент36 страницDardenresume PEkk235197Оценок пока нет

- Resume ExampleДокумент1 страницаResume ExampleDavid Bonnemort100% (13)

- Yan Zhichao John CVДокумент1 страницаYan Zhichao John CVJohn MathiasОценок пока нет

- WSO Resume 24Документ1 страницаWSO Resume 24John MathiasОценок пока нет

- Careers Guide: MUTIS Finance Society Investments Team 2016Документ18 страницCareers Guide: MUTIS Finance Society Investments Team 2016alzndlОценок пока нет

- CHAPTER 5 - Wharton MBA Career Management - University of ...Документ13 страницCHAPTER 5 - Wharton MBA Career Management - University of ...joes100% (1)

- Merger and Inquisition Resume TemplateДокумент1 страницаMerger and Inquisition Resume Templatekari555Оценок пока нет

- VP Equity Analyst CVДокумент5 страницVP Equity Analyst CVZolo ZoloОценок пока нет

- Investment Banking Cover Letter TemplateДокумент2 страницыInvestment Banking Cover Letter TemplateMihnea CraciunescuОценок пока нет

- Cover Letter TemplateДокумент2 страницыCover Letter Templatemagicgero100% (4)

- PDP ResumeДокумент1 страницаPDP Resumeapi-349990269Оценок пока нет

- Couchbase IncДокумент9 страницCouchbase IncMuhammad ImranОценок пока нет

- Annotated Investment Banking Graduate Job Covering LetterДокумент1 страницаAnnotated Investment Banking Graduate Job Covering LetterNuttyahОценок пока нет

- VP Operational Risk Finance in Seattle WA Resume Mary RiskiДокумент4 страницыVP Operational Risk Finance in Seattle WA Resume Mary RiskiMaryRiski2Оценок пока нет

- Investment Banking Cover Letter TemplateДокумент2 страницыInvestment Banking Cover Letter TemplateBrian OuОценок пока нет

- Senior Certified Financial Planner in Charlotte NC Resume Russell HeuchertДокумент2 страницыSenior Certified Financial Planner in Charlotte NC Resume Russell HeuchertRussellHeuchertОценок пока нет

- Joycemengresume PDFДокумент2 страницыJoycemengresume PDFDanishevОценок пока нет

- Hes Resume Cover Letter GuideДокумент21 страницаHes Resume Cover Letter GuideMattia AmbrosiniОценок пока нет

- Investment Banking Cover Letter TemplateДокумент1 страницаInvestment Banking Cover Letter Templatetamas-heim-8812Оценок пока нет

- Lu Leo ResumeДокумент2 страницыLu Leo ResumeLeo LuОценок пока нет

- Investment Banking Resume II - AfterДокумент1 страницаInvestment Banking Resume II - AfterbreakintobankingОценок пока нет

- M&A Course SyllabusДокумент8 страницM&A Course SyllabusMandip LuitelОценок пока нет

- Cover Letter For Stanford - Mutemi-1Документ1 страницаCover Letter For Stanford - Mutemi-1Sitche ZisoОценок пока нет

- Wharton MBAДокумент23 страницыWharton MBANur Al AhadОценок пока нет

- Primer On Investment BankingДокумент2 страницыPrimer On Investment BankingRaul KoolОценок пока нет

- Ibig 04 08Документ45 страницIbig 04 08Russell KimОценок пока нет

- Resume Book 2006Документ127 страницResume Book 2006Edwin WangОценок пока нет

- Ross Career Services: Real EstateДокумент9 страницRoss Career Services: Real EstateNia SaransiОценок пока нет

- Careers In: Financial MarketsДокумент71 страницаCareers In: Financial MarketsHemant AgrawalОценок пока нет

- Wso Experienced Deals Resume Templatev4Документ2 страницыWso Experienced Deals Resume Templatev4John GonesОценок пока нет

- WSO ReviewДокумент1 страницаWSO ReviewJohn MathiasОценок пока нет

- Career Guides - Leveraged Finance & Credit Risk Management Free GuideДокумент9 страницCareer Guides - Leveraged Finance & Credit Risk Management Free GuideRublesОценок пока нет

- Investment Banking Cover Letter TemplateДокумент1 страницаInvestment Banking Cover Letter Templateasdfa0% (1)

- WetFeet I-Banking Overview PDFДокумент3 страницыWetFeet I-Banking Overview PDFNaman AgarwalОценок пока нет

- Resume & Case Interview Workshop: MIT October 2003Документ27 страницResume & Case Interview Workshop: MIT October 2003MatthiasОценок пока нет

- Lazard - Analyst Recruitment Process For WebsiteДокумент3 страницыLazard - Analyst Recruitment Process For WebsiteAndor JákobОценок пока нет

- Spring Week GuideДокумент32 страницыSpring Week Guidevimanyu.tanejaОценок пока нет

- Factors Affecting Capitalization Rate of US Real EstateДокумент41 страницаFactors Affecting Capitalization Rate of US Real EstatemtamilvОценок пока нет

- Cover Letter TicketmasterДокумент1 страницаCover Letter TicketmasterJohanna WongОценок пока нет

- Investment Banking Resume III - AfterДокумент1 страницаInvestment Banking Resume III - AfterbreakintobankingОценок пока нет

- A Case For Senior LoansДокумент20 страницA Case For Senior LoansstieberinspirujОценок пока нет

- Nyu Stern Mpa Resume - Book 2011 SpringДокумент12 страницNyu Stern Mpa Resume - Book 2011 Springsamirnajeeb0% (1)

- Credit AnalysisДокумент3 страницыCredit AnalysisLinus ValenciaОценок пока нет

- Finance Manager in Atlanta GA Resume Benjamin HughesДокумент3 страницыFinance Manager in Atlanta GA Resume Benjamin HughesBenjaminHughesОценок пока нет

- NavДокумент2 страницыNavFaisal ZaheerОценок пока нет

- What Is The Difference Between P & L Ac and Income & Expenditure Statement?Документ22 страницыWhat Is The Difference Between P & L Ac and Income & Expenditure Statement?pranjali shindeОценок пока нет

- InheritanceДокумент17 страницInheritanceJohn MathiasОценок пока нет

- FinalProjectPresentationEvaluationForm ProfessorДокумент4 страницыFinalProjectPresentationEvaluationForm ProfessorJohn MathiasОценок пока нет

- FinalProjectPresentationEvaluationForm StudentДокумент1 страницаFinalProjectPresentationEvaluationForm StudentJohn MathiasОценок пока нет

- Final Project Presentation Grading RubricДокумент3 страницыFinal Project Presentation Grading RubricJohn MathiasОценок пока нет

- Generics 2Документ18 страницGenerics 2John MathiasОценок пока нет

- Final Written Summer2014Документ6 страницFinal Written Summer2014John MathiasОценок пока нет

- Garbage CollectionДокумент8 страницGarbage CollectionJohn MathiasОценок пока нет

- Generics 2Документ18 страницGenerics 2John MathiasОценок пока нет

- CSCI 201L Written Exam #2 Spring 2018 15% of Course GradeДокумент10 страницCSCI 201L Written Exam #2 Spring 2018 15% of Course GradeJohn MathiasОценок пока нет

- CSCI 201L Final Spring 2014 13% of Course GradeДокумент6 страницCSCI 201L Final Spring 2014 13% of Course GradeJohn MathiasОценок пока нет

- CSCI 201L - Final Project 30.0% of Course GradeДокумент9 страницCSCI 201L - Final Project 30.0% of Course GradeJohn MathiasОценок пока нет

- CSCI 201L Written Exam #2 Fall 2017 15% of Course GradeДокумент10 страницCSCI 201L Written Exam #2 Fall 2017 15% of Course GradeJohn MathiasОценок пока нет

- CSCI 201L Written Exam #2 Summer 2016 10% of Course GradeДокумент6 страницCSCI 201L Written Exam #2 Summer 2016 10% of Course GradeJohn MathiasОценок пока нет

- CSCI 201L Final - Written Fall 2014 12% of Course GradeДокумент7 страницCSCI 201L Final - Written Fall 2014 12% of Course GradeJohn MathiasОценок пока нет

- Csci 201L Final - Written Fall 2015 13% of Course Grade: SerialversionuidДокумент6 страницCsci 201L Final - Written Fall 2015 13% of Course Grade: SerialversionuidJohn MathiasОценок пока нет

- Final Written Spring2016Документ6 страницFinal Written Spring2016John MathiasОценок пока нет

- Final Written Spring2017Документ7 страницFinal Written Spring2017John MathiasОценок пока нет

- Final Written Spring2015Документ4 страницыFinal Written Spring2015John MathiasОценок пока нет

- Final Written Fall2016Документ6 страницFinal Written Fall2016John MathiasОценок пока нет

- Final Programming Section1 Spring2014Документ4 страницыFinal Programming Section1 Spring2014John MathiasОценок пока нет

- Final Programming Summer2016Документ4 страницыFinal Programming Summer2016John MathiasОценок пока нет

- Final Programming Spring2016Документ3 страницыFinal Programming Spring2016John MathiasОценок пока нет

- Final Programming Section2 Spring2014Документ4 страницыFinal Programming Section2 Spring2014John MathiasОценок пока нет

- Programming Exam #2: Submit MoveДокумент8 страницProgramming Exam #2: Submit MoveJohn MathiasОценок пока нет

- Jeffrey Miller, Ph.D. Jeffrey - Miller@usc - Edu: CSCI 201 Principles of Software DevelopmentДокумент13 страницJeffrey Miller, Ph.D. Jeffrey - Miller@usc - Edu: CSCI 201 Principles of Software DevelopmentJohn MathiasОценок пока нет

- Programming Exam #2 Grading Criteria: Part 1 - 4.0%Документ3 страницыProgramming Exam #2 Grading Criteria: Part 1 - 4.0%John MathiasОценок пока нет

- File IOДокумент9 страницFile IOJohn MathiasОценок пока нет

- Final Programming Fall2014Документ3 страницыFinal Programming Fall2014John MathiasОценок пока нет

- Welfare Facilities For WorkersДокумент2 страницыWelfare Facilities For WorkersKhushi GuptaОценок пока нет

- Financial SystemДокумент13 страницFinancial SystemIsha AggarwalОценок пока нет

- Manual Accounting Practice SetДокумент8 страницManual Accounting Practice SetVincent RuanОценок пока нет

- CIR v. MarubeniДокумент3 страницыCIR v. MarubeniCharmila SiplonОценок пока нет

- The University of Cambodia: Project Management (BUS649)Документ13 страницThe University of Cambodia: Project Management (BUS649)Chheang Eng NuonОценок пока нет

- As The Accountant For Monroe Trucking Company You Are PreparingДокумент1 страницаAs The Accountant For Monroe Trucking Company You Are PreparingDoreenОценок пока нет

- Theory of Accounts by MillanДокумент241 страницаTheory of Accounts by MillanRheu Reyes94% (53)

- TurnKey Investing Philosophy (TurnKey Investor Series)Документ12 страницTurnKey Investing Philosophy (TurnKey Investor Series)Matthew S. ChanОценок пока нет

- Management Final Paper 27062020 044941pm PDFДокумент8 страницManagement Final Paper 27062020 044941pm PDFHuzaifa KhanОценок пока нет

- Disposal of Subsidiary PDFДокумент9 страницDisposal of Subsidiary PDFCourage KanyonganiseОценок пока нет

- Royal British College, Inc.: Business FinanceДокумент4 страницыRoyal British College, Inc.: Business FinanceLester MojadoОценок пока нет

- Stakeholders, The Mission, Governance, and Business EthicsДокумент29 страницStakeholders, The Mission, Governance, and Business EthicsasmiОценок пока нет

- PDFДокумент10 страницPDFsakethОценок пока нет

- MR Ryan Chen-CargillДокумент10 страницMR Ryan Chen-CargillTRC SalesОценок пока нет

- Offensive and Defensive StrategiesДокумент21 страницаOffensive and Defensive StrategiesAMIT RAJОценок пока нет

- REGIONAL TRADE BLOCS PPT IntroductionДокумент14 страницREGIONAL TRADE BLOCS PPT IntroductionAnwar Khan100% (1)

- ARUN KUMAR.. DissertationДокумент52 страницыARUN KUMAR.. DissertationVinayKumar100% (1)

- Nature, Philosophy and Objectives of Human Resource DevelopmentДокумент12 страницNature, Philosophy and Objectives of Human Resource DevelopmentNor-ain Panolong100% (1)

- Birla Institute of Technology: Master of Business AdministrationДокумент16 страницBirla Institute of Technology: Master of Business Administrationdixit_abhishek_neoОценок пока нет

- CRMДокумент19 страницCRMBanpreet GillОценок пока нет

- Forces of Excellence in Kanji S Business Excellence Model PDFДокумент15 страницForces of Excellence in Kanji S Business Excellence Model PDFChar AzОценок пока нет

- MR Symposium Program7 NovemberДокумент2 страницыMR Symposium Program7 NovemberfatafattipsblogОценок пока нет

- The PhilippinesДокумент15 страницThe PhilippinesKatherine AquinoОценок пока нет

- Organization of Commerce and Management March 2018 STD 12th Commerce HSC Maharashtra Board Question PaperДокумент2 страницыOrganization of Commerce and Management March 2018 STD 12th Commerce HSC Maharashtra Board Question PaperJijo AbrahamОценок пока нет

- (Jefferies) 2-14 ChinaTheYearoftheRamДокумент158 страниц(Jefferies) 2-14 ChinaTheYearoftheRamNgô Xuân TùngОценок пока нет

- Opre 3310 Final Exam Study Guide 2020Документ2 страницыOpre 3310 Final Exam Study Guide 2020An KouОценок пока нет

- Pfrs 16 Leases Lecture Notes 1Документ19 страницPfrs 16 Leases Lecture Notes 1Krazy ButterflyОценок пока нет

- Steampunk Settlement: Cover Headline Here (Title Case)Документ16 страницSteampunk Settlement: Cover Headline Here (Title Case)John DeeОценок пока нет

- 17 (Adil Mehraj)Документ8 страниц17 (Adil Mehraj)Sakshi AgarwalОценок пока нет

- HUD Settlement Statement - 221-1993Документ4 страницыHUD Settlement Statement - 221-1993Paul GombergОценок пока нет

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeОт EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeРейтинг: 4.5 из 5 звезд4.5/5 (90)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldОт Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldРейтинг: 5 из 5 звезд5/5 (20)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurОт Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurРейтинг: 4 из 5 звезд4/5 (2)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureОт EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureРейтинг: 4.5 из 5 звезд4.5/5 (100)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveОт EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveОценок пока нет

- Secrets of the Millionaire Mind: Mastering the Inner Game of WealthОт EverandSecrets of the Millionaire Mind: Mastering the Inner Game of WealthРейтинг: 4.5 из 5 звезд4.5/5 (1026)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryОт EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryРейтинг: 4 из 5 звезд4/5 (26)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeОт EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeРейтинг: 4.5 из 5 звезд4.5/5 (58)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizОт EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizРейтинг: 4.5 из 5 звезд4.5/5 (112)

- The Master Key System: 28 Parts, Questions and AnswersОт EverandThe Master Key System: 28 Parts, Questions and AnswersРейтинг: 5 из 5 звезд5/5 (62)

- Take Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyОт EverandTake Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyРейтинг: 5 из 5 звезд5/5 (22)

- Every Tool's a Hammer: Life Is What You Make ItОт EverandEvery Tool's a Hammer: Life Is What You Make ItРейтинг: 4.5 из 5 звезд4.5/5 (249)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsОт EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsРейтинг: 5 из 5 звезд5/5 (48)

- Summary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisОт EverandSummary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisРейтинг: 4.5 из 5 звезд4.5/5 (3)

- Your Next Five Moves: Master the Art of Business StrategyОт EverandYour Next Five Moves: Master the Art of Business StrategyРейтинг: 5 из 5 звезд5/5 (801)

- Enough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursОт EverandEnough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursРейтинг: 5 из 5 звезд5/5 (24)

- Rich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessОт EverandRich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessРейтинг: 4.5 из 5 звезд4.5/5 (407)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelОт EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelРейтинг: 5 из 5 звезд5/5 (51)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedОт EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedРейтинг: 4.5 из 5 звезд4.5/5 (38)

- Brand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleОт EverandBrand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleРейтинг: 4.5 из 5 звезд4.5/5 (48)

- Cryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyОт EverandCryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyРейтинг: 4.5 из 5 звезд4.5/5 (300)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andОт EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andРейтинг: 4.5 из 5 звезд4.5/5 (709)

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:От EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Рейтинг: 5 из 5 звезд5/5 (2)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeОт EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeРейтинг: 5 из 5 звезд5/5 (22)

- 100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziОт Everand100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziОценок пока нет

- Startup: How To Create A Successful, Scalable, High-Growth Business From ScratchОт EverandStartup: How To Create A Successful, Scalable, High-Growth Business From ScratchРейтинг: 4 из 5 звезд4/5 (114)