Академический Документы

Профессиональный Документы

Культура Документы

Starting A Probate Instructions

Загружено:

godardsfanОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Starting A Probate Instructions

Загружено:

godardsfanАвторское право:

Доступные форматы

RESOURCE CENTER for SELF-REPRESENTED LITIGANTS

Stanley Mosk Courthouse, 110 North Grand Avenue, Los Angeles, CA 90012

STARTING A PROBATE OR OBTAINING

LETTERS OF ADMINISTRATION

NOTE: These instructions provide the basic information you need to start a general probate case.

These instructions do not provide legal advice or take the place of consulting with a lawyer. The

forms can be found at www.courts.ca.gov or as indicated.

REQUIREMENTS TO FILE IN CALIFORNIA

Decedent lived in CA when he/she died

Decedent did not have a valid trust

Decedent died owning more than $150,000 worth of assets

KEY WORDS/ PHRASES

Decedent

Administrator

Legal Representative

Letters of Administration

Heirs

Estate

the person who died

the person the COURT appointed to be responsible for the Probate

the person the COURT appointed to be responsible for the Probate

court document signed by the Judge confirming the appointment of

an administrator or representative

relatives that by law will receive a portion of decedents estate

the real and personal property owned by the decedent at the time of

death

FORMS:

DE-111, Petition for Probate

DE-121, Notice of Petition to Administer Estate

PRO010, Probate Case Cover Sheet

WHAT IS PROBATE?

Probate is the Court Supervised process of collecting the decedents assets, paying those that are owed

money to and distributing what is left to their heirs. Usually, if the decedent died without a valid

trust, lived in California when they died, and owned real property (house or vacant land), or other

assets totaling $150,000 or more, then a probate must be completed to transfer the property to their

heirs or beneficiaries.

Letters of Administration is the form that the Judge signs confirming that he has given that person

legal authority to represent the estate. Sometimes the bank will require this form before releasing

funds.

Los Angeles Superior Court - Central

Revised 8/2014

Page 1 of 4

RESOURCE CENTER for SELF-REPRESENTED LITIGANTS

Stanley Mosk Courthouse, 110 North Grand Avenue, Los Angeles, CA 90012

However, Letters of Administration are not needed when the decedent died owning less than $150,000

in assets. If this is the case, the heirs may complete a small estate affidavit. These can be obtained in

the Probate filing room or from your local financial institution.

HOW LONG DOES IT TAKE TO COMPLETE PROBATE?

Probate can take anywhere from 6 months to several years to complete.

COMPLETING THE PETITION FOR PROBATE, DE-111

Write your name and address in the top left box. In the box that reads Estate of, write the name of

the decedent. Leave the box that reads case number, hearing date, Dept, blank. You will get this

information when you file your paperwork with the Probate filing window.

Check the appropriate box next to PETITION FOR:

Probate of Will and for Letters Testamentary- if the decedent had a Will to be offered

for probate and the person seeking to be appointed administrator is named in the Will.

Probate of Will and for Letters of Administration with Will Annexed- if the decedent

had a Will to be offered for probate but the person seeking to be appointed the

administrator is not named in the Will.

Letters of Administration- if the decedent died without a Will.

Letters of Special Administration- if you are seeking to preserve the decedents assets

before a permanent administrator can be appointed or you are asking for a particular power

(example- to represent the estate in civil litigation, to collect certain assets or manage a

particular part of the decedents estate).

o With general powers- general powers allow a special administrator to sell real

property or reject creditors claims

Authorization to Administer Under the Independent Administration of Estates ActThis box is often checked. Do not check this box if you have a Will that prevents one

from performing under this act or if you are asking for Special Administration.

o Limited authority- means more Court supervision. With limited authority a

representative must have a court order to sell property or borrow money from the

estate. The bond amount shall be the value of cash on hand in the estate.

o Full authority - means acting with less court supervision. You may sell real

property or borrow money but must notify the heirs first. Heirs may object to your

proposed action. In order to act with full authority you need to be bonded for the

full value of the estate. Do not check limited authority if you would like full

authority. Leave this box blank.

Next, complete the form by checking the appropriate box or filling in the requested information. The

following sections are those that may be difficult to answer without explanation. The information that

follows may be helpful.

Los Angeles Superior Court - Central

Revised 8/2014

Page 2 of 4

RESOURCE CENTER for SELF-REPRESENTED LITIGANTS

Stanley Mosk Courthouse, 110 North Grand Avenue, Los Angeles, CA 90012

1. Publication- publication is required when filing for Letters of Administration. You either may

arrange for publication with a newspaper in the Courthouse by marking publication requested or

arrange for publication in a newspaper located outside of the Courthouse.

2. Character and estimated value of the property.- this section must be completed.

Personal property-write the total resale value of furniture, clothing, cars, etc. owned by

the decedent at the time of death. Personal property also includes cash.

Annual gross income from real property-If decedent owned rental property, write the

yearly amount of rental income received by the decedent.

Annual gross income from personal property- This includes the yearly income received

from the sale or exchange of personal property.

The gross fair market value of real property- Estimate the fair market value of

decedents home.

Encumbrances- Write the full amount of the mortgage on the property or the amount of

any other loan, lien, claim, or financial interest in the property that would prevent it from

passing free and clear.

Net Value of Real Property- Subtract the encumbrances from the fair market value and

write on line (6).

Dont forget to add line (6) to line (3).

3. Waiver of Bond. Section 3.d. concerns waiving bond. If any of the statements in 3d apply please

mark them.

4. Intestacy. Section 3.e.concerns intestacy. If decedent died without a will, he died intestate. If this

is true, check this box. If decedent had a will that is to be attached to the petition and probated,

then check (2) and write the date.

5. Appointment of Personal Representative.- Section 3.f. concerns appointment of representatives. If

you are probating a will check the appropriate box under 3. f. (1). Executor is the person named

in a will. If you are not probating a will, check the appropriate box under 3.f. (2). If you are

seeking to be appointed as the special administrator check 3.f. (3).

6. Heirs. Section 5 and 6 concerns living relatives and next of kin. Everyone must complete 5.

Complete 6, if the decedent died and was not survived by a spouse and kids or if the decedent

died survived by only a spouse (check only a or b).

Complete the remainder of the form. Date, print and sign your name in two places on the bottom

of page 4.

Once you have completed this form, copy it and turn it into the filing window in Room 429 along with 1)

the Probate Case Cover Sheet and 2) the original and copy of the will, if there is one and 3) your filing fee

of $435 or a Request for Fee Waiver, FW-001 and FW-003.

Los Angeles Superior Court - Central

Revised 8/2014

Page 3 of 4

RESOURCE CENTER for SELF-REPRESENTED LITIGANTS

Stanley Mosk Courthouse, 110 North Grand Avenue, Los Angeles, CA 90012

You may contact the Los Angeles County Bar Association at (213) 243-1525 for attorney referrals.

THIS AREA INTENTIONALLY BLANK

Los Angeles Superior Court - Central

Revised 8/2014

Page 4 of 4

Вам также может понравиться

- Digital Evidence Courtroom InstructionsДокумент2 страницыDigital Evidence Courtroom Instructionsgodardsfan100% (1)

- USC Apps GuideДокумент26 страницUSC Apps GuidegodardsfanОценок пока нет

- CCAPGДокумент14 страницCCAPGgodardsfanОценок пока нет

- Rules of The Supreme Court 2019Документ85 страницRules of The Supreme Court 2019John OxОценок пока нет

- Metrolink ArrowДокумент15 страницMetrolink ArrowgodardsfanОценок пока нет

- Dream Maker GrantДокумент2 страницыDream Maker GrantgodardsfanОценок пока нет

- Glossary of Court Terms in CaliforniaДокумент8 страницGlossary of Court Terms in CaliforniagodardsfanОценок пока нет

- Rest and Meal Periods in CAДокумент2 страницыRest and Meal Periods in CAgodardsfanОценок пока нет

- Tax Cuts and Jobs Act Individuals 2018Документ4 страницыTax Cuts and Jobs Act Individuals 2018godardsfanОценок пока нет

- Phone Calls Emails Online Tip Reports: N H T H D RДокумент6 страницPhone Calls Emails Online Tip Reports: N H T H D RgodardsfanОценок пока нет

- Standards For Industry Research PartnersДокумент2 страницыStandards For Industry Research PartnersgodardsfanОценок пока нет

- 2017 Film Study v3-WEBДокумент28 страниц2017 Film Study v3-WEBgodardsfanОценок пока нет

- THE To Virtual AT: Complete Guide Networking EventsДокумент16 страницTHE To Virtual AT: Complete Guide Networking EventsgodardsfanОценок пока нет

- Chapter Three Civil Division Rules................................................................. 43Документ69 страницChapter Three Civil Division Rules................................................................. 43godardsfanОценок пока нет

- How To Conduct Discovery in Limited Civil Case PDFДокумент6 страницHow To Conduct Discovery in Limited Civil Case PDFgodardsfanОценок пока нет

- Manuale HP LP2475w PDFДокумент55 страницManuale HP LP2475w PDFElia ScagnolariОценок пока нет

- Israel Film FundДокумент1 страницаIsrael Film FundgodardsfanОценок пока нет

- HearsДокумент10 страницHearsgodardsfanОценок пока нет

- Manuale HP LP2475w PDFДокумент55 страницManuale HP LP2475w PDFElia ScagnolariОценок пока нет

- 10 Tips For WritsДокумент4 страницы10 Tips For WritsgodardsfanОценок пока нет

- CRBДокумент15 страницCRBgodardsfanОценок пока нет

- BingoДокумент3 страницыBingogodardsfanОценок пока нет

- 2019 Southern California Courts Primary Fee Schedule PDFДокумент1 страница2019 Southern California Courts Primary Fee Schedule PDFgodardsfanОценок пока нет

- HowTo Create and Maintain A TOCДокумент15 страницHowTo Create and Maintain A TOCluvkush123Оценок пока нет

- HowTo Create and Maintain A TOCДокумент15 страницHowTo Create and Maintain A TOCluvkush123Оценок пока нет

- Primer: Intellectual Property Right Fundamentals: Nancy FultonДокумент7 страницPrimer: Intellectual Property Right Fundamentals: Nancy FultongodardsfanОценок пока нет

- FedДокумент9 страницFedgodardsfanОценок пока нет

- Focus: Limited Jurisdiction Remains Trial Court After Filing of AppealДокумент2 страницыFocus: Limited Jurisdiction Remains Trial Court After Filing of AppealgodardsfanОценок пока нет

- 4DCA Div1 Handout On WritsДокумент9 страниц4DCA Div1 Handout On WritsBunny FontaineОценок пока нет

- Social Media For Nonprofits: E-GuideДокумент17 страницSocial Media For Nonprofits: E-GuidegodardsfanОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

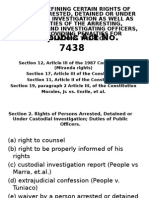

- Crim Fall 2011 ChecklistДокумент2 страницыCrim Fall 2011 ChecklistAlex LuriaОценок пока нет

- Consti Ra 7438Документ8 страницConsti Ra 7438Dondi Meneses100% (1)

- The Nanny Versus Former Uber Engineer Anthony LevandowskiДокумент81 страницаThe Nanny Versus Former Uber Engineer Anthony LevandowskiTechCrunchОценок пока нет

- Usag ConstitutionДокумент24 страницыUsag ConstitutionPapakofigyamfi RichieОценок пока нет

- Gst-Excus: Electronic Library For GST, Customs, Excise, Exim, Fema & Allied LawsДокумент2 страницыGst-Excus: Electronic Library For GST, Customs, Excise, Exim, Fema & Allied LawsAbhay DesaiОценок пока нет

- Conduct Rules Ethics and Professional Practice m005Документ4 страницыConduct Rules Ethics and Professional Practice m005ColinОценок пока нет

- 12 Wellington Investment Inc V TrajanoДокумент9 страниц12 Wellington Investment Inc V TrajanoyousirneighmОценок пока нет

- Supreme Court: Republic of The PhilippinesДокумент12 страницSupreme Court: Republic of The PhilippinesJairus SociasОценок пока нет

- Complaint For Sum of MoneyДокумент3 страницыComplaint For Sum of MoneyLudica Oja0% (1)

- 34 Noell Whessoe, Inc. vs. Independent Testing Consultants, Inc.Документ2 страницы34 Noell Whessoe, Inc. vs. Independent Testing Consultants, Inc.Jem100% (1)

- Intellectual Property and DevelopmentДокумент3 страницыIntellectual Property and DevelopmentKrishnendu GuinОценок пока нет

- DPP V Orestus Mbawala (CAT)Документ25 страницDPP V Orestus Mbawala (CAT)RANDAN SADIQОценок пока нет

- Gilyard v. DOE, 4th Cir. (2000)Документ5 страницGilyard v. DOE, 4th Cir. (2000)Scribd Government DocsОценок пока нет

- Calderon Vs Carale DigestДокумент2 страницыCalderon Vs Carale DigestJustin Andre SiguanОценок пока нет

- City Treasurer and City of MAKATI Vs MERMAC INC.Документ2 страницыCity Treasurer and City of MAKATI Vs MERMAC INC.AngelОценок пока нет

- Netflix Motion To Dismiss - Colborn vs. NetflixДокумент29 страницNetflix Motion To Dismiss - Colborn vs. NetflixAngie BОценок пока нет

- DirectorsДокумент21 страницаDirectorsRamhmangaiha KhiangteОценок пока нет

- Francha Compilation Q and AДокумент53 страницыFrancha Compilation Q and ARuth Cinco ManocanОценок пока нет

- Romero vs. Estrada DigestДокумент1 страницаRomero vs. Estrada DigestNa-eehs Noicpecnoc Namzug100% (3)

- PUP Internship MOA 20210818Документ4 страницыPUP Internship MOA 20210818Efren Garcia FlorendoОценок пока нет

- Concepcion EO No. 025, Series of 2022 Provision of Technical Support To BADACДокумент2 страницыConcepcion EO No. 025, Series of 2022 Provision of Technical Support To BADACDilg ConcepcionОценок пока нет

- SPF Client Compliance Application BG SBLC MTN LTN MonetizationДокумент15 страницSPF Client Compliance Application BG SBLC MTN LTN MonetizationHugo Rogelio CERROSОценок пока нет

- Garcia V Pajaro DigestДокумент1 страницаGarcia V Pajaro DigestOtep Belciña Lumabas100% (1)

- Rule 81 - Warner vs. LuzonДокумент2 страницыRule 81 - Warner vs. LuzonMhaliОценок пока нет

- 8 Affidavit of Wintess John AlcantaraДокумент2 страницы8 Affidavit of Wintess John AlcantaraVОценок пока нет

- Balochistan Sales Tax Special Procedure (Transportation or Carriage of Petroleum Oils Through Oil Tankers) Rules, 2019Документ8 страницBalochistan Sales Tax Special Procedure (Transportation or Carriage of Petroleum Oils Through Oil Tankers) Rules, 2019Tax PerceptionОценок пока нет

- 12.1.1 Actus Reus: TheftДокумент8 страниц12.1.1 Actus Reus: TheftnasirapertoОценок пока нет

- OMA HandbookДокумент21 страницаOMA HandbookKayla Miller100% (1)

- Treaty of Amity and Cooperation in SE AsiaДокумент5 страницTreaty of Amity and Cooperation in SE AsiaFranklin BerdinОценок пока нет

- Environment ProtectionДокумент2 страницыEnvironment ProtectionsatyaminfosysОценок пока нет