Академический Документы

Профессиональный Документы

Культура Документы

VAluing and Early Stage Biotechnology Investment As A Rainbow Option

Загружено:

Pulkit AggarwalОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

VAluing and Early Stage Biotechnology Investment As A Rainbow Option

Загружено:

Pulkit AggarwalАвторское право:

Доступные форматы

V O LU M E 2 3 | N U M B E R 2 | S P RIN G 2 0 1 1

Journal of

APPLIED CORPORATE FINANCE

A MO RG A N S TA N L E Y P U B L I C AT I O N

In This Issue: Risk and Valuation

Downsides and DCF: Valuing Biased Cash Flow Forecasts

CARE/CEASA Roundtable on Managing Uncertainty and Risk

8

18

Richard S. Ruback, Harvard Business School

Panelists: Steve Galbraith, Maverick Capital; and

Neal Shear. Moderated by Trevor Harris, Columbia University

How the U.S. Army Analyzes and Copes with Uncertainty and Risk

34

Major Hugh Jones, U.S. Military Academy

Accounting for Sovereign Risk When Investing in Emerging Markets

41

V. Ravi Anshuman, Indian Institute of Management

Bangalore, John Martin, Baylor University, and Sheridan

Titman, University of Texas at Austin

Accounting for Risk and Return in Equity Valuation

50

Stephen Penman, Columbia Business School

Morgan Stanleys Risk-Reward Views: Unlocking the Full Potential of Fundamental

Analysis

59

Guy Weyns, Juan-Luis Perez, Barry Hurewitz, and

How Corporate Diversity and Size Influence Spinoffs and Other Breakups

69

Vlad Jenkins, Morgan Stanley

Gregory V. Milano, Steven C. Treadwell, and Frank Hopson,

Fortuna Advisors LLC

The Three-Factor Model: A Practitioners Guide

77

Javier Estrada, IESE Business School

Valuing Companies with Cash Flow@Risk

85

Franck Bancel, ESCP Europe, and Jacques Tierny, CFO,

Gemalto

Valuing an Early-Stage Biotechnology Investment as a Rainbow Option

Terminal Value, Accounting Numbers, and Inflation

94

104

Peter A. Brous, Seattle University

Gunther Friedl, Technische Universitt Mnchen, and

Bernhard Schwetzler, HHL Leipzig Graduate School

of Management

Comment on Terminal Value, Accounting Numbers, and

Inflation by Gunther Friedl and Bernhard Schwetzler

113

Michael H. Bradley, Duke University, and

Gregg A. Jarrell, University of Rochester

Valuing an Early-Stage Biotechnology Investment

as a Rainbow Option

by Peter A. Brous, Seattle University

n an article published in this journal in 2003,

Richard Shockley and three of his students

presented a detailed valuation of an early-stage

biotechnology investment using a binomial lattice

option pricing model.1 The article does a commendable job of

showing how investments with multiple stages can be treated

as compound sequential optionsthat is, a series of options

in which investment in one option provides the opportunity

to invest in the next in the series. The sequence continues

until the final decision to spend resources to produce and

distribute the product.

Any kind of investment opportunity that requires the

success of several costly developmental phases to create and

bring a product to market can be viewed as a sequential

compound option. Although such investments are especially

common in biotechnology, pharmaceuticals, technology, and

natural resources exploration, they are typically involved in

the development of most kinds of new products.

One of the simplifying assumptions in the analysis

presented by Shockley et al. is the possibility of capturing all

the risks associated with this type of investment in a single

measure, the standard deviation of the returns on the underlying asset. This assumption is standard when valuing either

financial or real options using either the Black-Scholes

Option Pricing Model or binomial option pricing models. But

as I argue in this article, this assumption becomes problematic

when analyzing an investment that faces idiosyncratic (or

firm-specific) risks such as uncertainty about the resolution of

some technology issue, FDA approval for a drug candidate, or

discovery of a natural resource. Such risks are also referred to

as unsystematic risks, and one of the most notable characteristics of such risks is their tendency to decrease over time until

they are eventually resolved. In this sense, the profile of such

risks is very different from that of systematic risksrisks

that are associated with uncertainty about the product market

and the broad economywhere the potential for extreme

outcomes typically increases with longer periods of time.

Because of this fundamental difference, the widespread

use of a single measurethe standard deviation of asset

returnsto capture both product market and technology

risks raises doubt about the reliability of the model. As Tom

Copeland and Vladimir Antikarov argue in their Practitioners Guide to Real Options,

1. R. Shockley, S. Curtis, J. Jafari, and K. Tibbs, The Option Value of an Early-Stage

Biotechnology Investment, Journal of Applied Corporate Finance, Vol. 15, No. 2 (Winter 2003), pp. 44-55.

2. T. Copeland and V. Antikorov, Real Options: A Practitioners Guide (New York, NY:

Texere 2001), page 270.

BI

94

Journal of Applied Corporate Finance Volume 23 Number 2

We need to build an event tree that reflects the actual resolution of the uncertainty over time so that we can get optimal

execution of the available real options and correct ROA valuation. The way to do this is to keep the major uncertainties separate

and to model the interaction and effect on the projects value

explicitly.2

In the pages that follow, we use the same business case

analyzed by Shockley et al. (hereafter referred to as Shockley)

to demonstrate how to value this early-stage biotechnology

investment by separately modeling the two types of risks:

technology and product market. An option that has two

distinct kinds of risk that develop differently over time is

known as a rainbow option. The key adjustment to the

option pricing model required to value such an option is that,

in place of the standard binomial option pricing model with

two outcomes at each point in time, we employ a quadranomial option pricing model with four outcomes at each point

in time. Instead of the outcomes being either an uptick or a

downtick in the product market, we now have four possibilities: an upturn in the economy combined with a technology

success; a downturn with technology success; an upturn with

technology failure, and a downturn with technology failure.

Whats more, by distinguishing technology risks from product

market risks and allowing them to develop differently over

time, our analysis leads to a different decision about the initial

investment than the one produced by Shockleys model.

Description of the Investment Opportunity

Wahoo Genomics (not its real name), a privately held biotechnology firm, has developed a coat protein that will be used

in treating viral outbreaks in farm livestock. The decision at

hand, in April of 2002, is whether the firm should spend $2

million to start the preclinical trials. The series of sequential investments necessary to get this product to market are

depicted in Figure 1.

A Morgan Stanley Publication Spring 2011

Figure 1 Timeline of the Various Test Phases

Apr-02

Oct-02

Apr-03

Oct-03

Apr-04

Oct-04

Apr-05

Oct-05

Apr-06

Oct-06

Apr-07

Preclinical Testing

$2 million

18 months

5%

INADA

$1 million

6 months

75%

Field Trials

$5 million

24 months

25%

NADA

$0.5 million

12 months

75%

Market

$10 million

This investment opportunity is a classic example of a

sequential compound option. Initially, the firm must decide

whether to spend $2 million on preclinical testing that will

take 18 months to complete, with an assumed probability of

success of 5%. If successful, management has the option to

spend $1 million to complete the process for an Investigational

New Animal Drug Application (INADA). This process will

take six months to complete, and has a 75% chance of being

approved for the INADA. If the INADA is granted, the firm

has the option to spend $5 million to complete field trials over

the next 24 monthsand it is assumed there is a 25% chance

that the data collected from the field trials will allow them to

apply for a New Animal Drug Application (NADA). Given the

success of the field trials, the firm has the option of applying for

the NADA at a cost of $0.5 million. The application process

will take one year to receive approval with an assumed success

rate of 75%. As noted by Shockley, there is only a 0.7% (.05 x

.75 x .25 x.75) probability that the firm will be successful in all

four phases, creating the opportunity to spend $10 million to

exercise the final option to take this product to market.

Shockleys figures 2 and 3 (not presented here) lay out the

assumptions and cash flow estimations of the product, conditional upon the product being taken to market. The projected

after-tax cash flows start at $0.87 million in year 1 (ending

in April 2008) and grow to $14.71 million in year 10 (April

2017). Assuming a -20% long-term growth rate for the cash

Journal of Applied Corporate Finance Volume 23 Number 2

flows after 2017 and a risk-adjusted discount rate of 11%/year,

the current value (April 2002) of the future cash inflows generated by taking this new protein to market is $29.77 million. To

estimate the static NPV of this investment, one must consider

the five possible outcomes, the cumulative probabilities of

each outcome occurring, and their respective NPVs should the

outcomes occur. Figure 2 (of this paper) provides the inputs

used to estimate the static expected NPV of this investment.

The cumulative probability for the four failed outcomes

equals the probability of success for previous hurdles times the

probability of the outcome failing. For example, the cumulative

probability that the field trials will end in failure will require the

Preclinical Testing and the INADA to be successful before the

field trials failan outcome that has a 2.8% probability (.05 x

.75 x .75). The NPV of each outcome associated with a failure

is simply the present value of all of the costs incurred to get

to that point of failure. For example, if the field trials fail, the

company would have spent $2 million in April of 2002 for the

preclinical trials, $1 million in October of 2003 for INADA,

and $5 million in April of 2004 for the field trials, yielding an

expected NPV of -$6.91 million (NPV = -$2 - $1/(1.111.5) $5/(1.112)). Finally, the sum of the expected NPV is a negative

$2.03 million, which is the so-called static expected NPV of

taking on this investment opportunity.

Based on this number, Wahoo Geonomics would not

make the initial investment to conduct the preclinical

A Morgan Stanley Publication Spring 2011

95

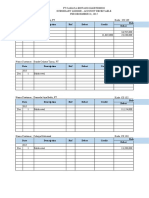

Figure 2 Static NPV Analysis: April 2002

Cumulative

Probability

Probability

of Success

of Outcome

NPV

NPV

5.0%

95.00%

-$2.00

-$1.90

Failure of INADA

75.0%

1.25%

-$2.86

-$0.04

Failure of Field Trials

25.0%

2.81%

-$6.91

-$0.19

Failure of NADA

75.0%

0.23%

-$7.24

-$0.02

0.70%

$16.57

Outcome

Failure of Preclinical Testing

Taking the Product to Market

Sum

Expected

$0.12

100.00%

-$2.03

Figure 3 Value Tree for Underlying Asset

Apr-02

Oct-02

Apr-03

Oct-03

Apr-04

Oct-04

Apr-05

Oct-05

Apr-06

Oct-06

Apr-07

35052.05

17283.07

8521.74

4201.80

2071.78

1021.53

503.68

248.35

122.45

60.38

29.77

29.77

14.68

503.68

122.45

60.38

7.24

122.45

29.77

7.24

29.77

7.24

1.76

29.77

14.68

7.24

3.57

1.76

0.87

122.45

60.38

14.68

3.57

503.68

248.35

60.38

14.68

3.57

503.68

122.45

29.77

2071.78

1021.53

248.35

60.38

14.68

2071.78

1021.53

248.35

8521.74

4201.80

7.24

3.57

1.76

0.87

0.43

1.76

0.87

0.43

0.21

0.43

0.21

0.10

0.10

0.05

0.03

trials. But what this calculation ignores is the reality that

management does not have to decide on making this series

of investments today, but can wait and incorporate any new

information into their investment decisions at the point in

time when it becomes necessary. A revised assessment can

be made based not only on whether they succeeded in the

previous test phase, but also on their perception of the value

of taking the product to market at that point in time.

Valuation Approach Applying a Binomial Option

Pricing Model

Because the benefits of waiting and learning are not reflected

in the static expected NPV, Shockley suggests valuing this

96

Journal of Applied Corporate Finance Volume 23 Number 2

early-stage biotechnology investment as a compound sequential option. To value this phased investment opportunity

using a binomial option pricing model, a value tree for the

underlying asset must be developed. Shown in Figure 3, the

value tree for the underlying asset models the potential movement in the value of the underlying asset over time and is

generated based on the present value of the expected future

cash inflows of $29.77 million and an assumed volatility of

the underlying assets returns of 100% per year.

Given the development of the value tree for the underlying asset, the value tree for the sequential compound option is

developed based on the value of the underlying asset and the

various exercise prices (as shown in Figure 4). More specifiA Morgan Stanley Publication Spring 2011

Figure 4 Value Tree for Sequential Compound Option

Preclinical Testing

Apr-02

Oct-02

INADA

Apr-03

Oct-03

Field Trials

Apr-04

Oct-04

Apr-05

NADA

Oct-05

Apr-06

Oct-06

Apr-07

35042.05

17273.31

8512.22

4192.20

2061.76

2062.30

1012.25

489.80

234.41

48.12

19.81

5.41

1.83

51.32

0.00

0.00

8.18

0.00

0.59

0.20

0.07

19.77

6.68

1.76

3.14

1.19

112.45

50.62

20.88

22.56

9.63

493.68

238.59

112.44

113.37

18.96

19.72

7.83

238.58

52.71

2061.78

1011.77

493.67

494.15

109.52

109.92

49.73

1011.75

239.34

8511.74

4192.05

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

Result: Spend $2.0 million on the preclinical testing

Bold numbers suggest nodes in which options are excercised.

cally, the option value tree reflects the value of the option at

each node based on maximization of the value if the option

is exercised and the value if the option is not exercised.

The option value tree is generated by starting at the end

nodes (April 2007) and determining the larger of two values:

the value of exercising the option and taking the product to

market (option value = value of underlying asset minus exercise

price), or of not exercising and letting the option expire (option

value = 0). If the value of the cash inflows from taking the

product to market is greater than the cost of taking the product

to market ($10 million), the firm should exercise the option

and take the product to market. As presented in Figure 4, the

option to take the product to market will be exercised at the

top six end nodes but not at the bottom five nodes.

The specific equation used to value the sequential

compound option in prior nodes depends on whether the

node occurs at a point in time when a test phase is expected

to be resolved. If the node does occur when a test phase is

expected to be resolved and if the phase has been completed

successfully, the decision needs to be made whether to

exercise the option to invest in the next test phase. The

option value is determined by the maximum value of either

exercising the option to invest in the next test phase (option

Journal of Applied Corporate Finance Volume 23 Number 2

value = value of the option to invest minus exercise price),

or not exercising the option (option value = 0). To value the

option to invest at that point in time, we must calculate

the certainty equivalent value of the two uncertain future

option values.

For example, to estimate the option value at the top node

at the end of April 2006, we examine the value if the firm

exercises its option to spend $500,000 to submit a NADA and

the value if the firm does not exercise this option. If the firm

does exercise this option, they obtain either the value of this

rainbow option next period if there is an uptick ($17.3 billion)

or the value if there is a downtick ($4.2 billion). The certainty

equivalent value of these two future uncertain option values

in April of 2006 is $8.5 billion, and is calculated using the

following equation:

CEQ option value = {p*(Cu) + (1-p)*Cd} / (1 + Rf) (1)

CEQ Option Value = {.4472*$17,273.31 m +

(1-.4472)*$4,192.05 m} / (1 + .025) = $8,512.22

where;

CEQ is the certainty equivalent;

p is the risk-neutral probability of an uptick (p =

(Rf d) / (u d));

1 p is the risk-neutral probability of a downtick;

A Morgan Stanley Publication Spring 2011

97

Figure 5 Evolution of Risk Profile Technology Product/Project

Product/Market Risk

(Correlated with Market

Beta 0)

Technology Risk

(Independent of Market

Beta = 0)

Product/Market Risk

Research & Development

Phase 1

Phase 2

Phase 3

Rollout

Source: David Dufendach (2000).

Cu is the value of the call option if the value of the

underlying asset moves upward;

Cd is the value of the call option if the value of the

underlying asset moves downward;

Rf is the six month yield on a five-year Treasury Bond

in April 2002;

u is exponential raised to the power of the standard

deviation times square root of 1 divided by the number of

periods in a year (u = esd(sqrt(1/t)));

d is the inverse of u (d = 1/u).

In this case, the value of the option at the top node at the end

of April 2006 is maximized if the firm exercises the option to

spend $500,000 for the NADA:

CApril 2006 top node = Max [$8,512.22 m - $0.50 m, 0]

= $8.51 billion

At earlier nodes where the resolution of a specific test

phase does not occurfor example the nodes at the end of

October 2006the value of the option is simply equal to the

certainty equivalent value of the two uncertain option values

found at the subsequent nodes (calculated using equation 1).

The results of this model suggest that if the firm invests the

$2.0 million for preclinical testing, they would be acquiring

an option to invest worth $21.8 million (NPV with flexibility

= $19.81 million), and therefore the firm should invest.

Although this appears to be an excellent example of

the valuation of a sequential compound option using a

binomial model, the net result, to invest, seems unintuitive

98

Journal of Applied Corporate Finance Volume 23 Number 2

given the characteristics of the investment. The output of

the model suggests that the firm should invest $2 million,

with expected additional investments required if things go

well, with the aim of benefiting from a new product that is

expected to create future cash flows valued at $29.8 million,

even when there is only a 0.7% probability that the product will

be taken to market. In my opinion, most practitioners would

choose not to invest in this project, given the low probability

of taking the product to market and the expected value of

taking the product to market. And in the pages that follow,

I will argue that the models decision to invest is the result

of using an inappropriate method of incorporating risk into

the model.

In the binomial option pricing model presented by

Shockley, all of the risks associated with the value of the

underlying asset (both product market and technology) are

incorporated by applying the standard deviation of asset

returns, which is assumed to be constant over the life of

the investment. This assumption is applied in the creation

of both the value tree of the underlying asset (through the

size of the upticks and downticks in value) and the value

tree for the option (through the risk-neutral probabilities).

Wahoo Genomics investment opportunity, like most

phased investments, is subject to both standard product

market riskssuch as uncertain supply and demand for the

product under considerationand technology risks, notably

uncertainty about the firms ability to pass a series of tests

A Morgan Stanley Publication Spring 2011

Figure 6 Value Tree for Underlying Asset (SD = 50%/year)

Apr-02

Oct-02

Apr-03

Oct-03

Apr-04

Oct-04

Apr-05

Oct-05

Apr-06

Oct-06

Apr-07

1021.53

717.31

503.68

353.68

248.35

174.39

122.45

85.99

60.38

42.40

29.77

29.77

20.90

122.45

60.38

42.40

14.68

60.38

29.77

14.68

29.77

14.68

7.24

29.77

20.90

14.68

10.31

7.24

5.08

60.38

42.40

20.90

10.31

122.45

85.99

42.40

20.90

10.31

122.45

60.38

29.77

248.35

174.39

85.99

42.40

20.90

248.35

174.39

85.99

503.68

353.68

14.68

10.31

7.24

5.08

3.57

7.24

5.08

3.57

2.51

3.57

2.51

1.76

1.76

1.24

0.87

in the development process that are necessary to allow them

to bring the product to market.

As stated earlier, one important difference between these

two types of risk is that product market risks are systematic,

with the main source of uncertainty increasing over time (that

is to say, whatever the strength of product markets and the

general economy today, it is likely to be different in the future,

in some cases better, in some worse). By contrast, technology

risks, as illustrated in Figure 5, get resolved over time.

As a consequence, the use of a single constant measure of

uncertainty to reflect both of these types of risks is problematic. The purpose of this paper is to present an alternative

quadranomial option pricing model. This model incorporates

product market risks and technology risks separately, thereby

allowing them to develop differently over time.

Valuation Approach Applying a Quadranomial Option

Pricing Model

To apply this quadranomial model, we need a revised measure

of the standard deviation of the underlying assets returns

that reflects only product market risks and not technology

risks. Given the lack of correlation between product market

risks and technology risks, it is safe to assume that the revised

measure of the standard deviation should be significantly

lower than the 100% assumed when considering both types

of risk.

Journal of Applied Corporate Finance Volume 23 Number 2

Figure 6 presents a revised value tree for the underlying

asset that assumes the standard deviation of the underlying

assets returns is 50%/year because this measure of uncertainty now reflects only the product market risks. And

applying a lower standard deviation for the underlying asset

yields less extreme potential future values of the underlying

asset. The minimum and maximum values with a standard

deviation of 50% are $0.87 million and $1.02 billion, respectively, as compared to minimum and maximum values of

$0.03 million and $35.05 billion when assuming a standard

deviation of 100%.

A second, more subtle change in the value tree for the

underlying asset applies to nodes that represent a point in

time when a test phase is completed. In our approach, each

node yields four possible outcomes instead of two as under

the Shockley approach. The value of the underlying asset is

affected not only by an uptick or downtick in the product

market, but also by its success in dealing with technology

risk. These nodes expand to include four possibilities for the

value of the underlying asset: two cases where the technology

succeeds, one in combination with an uptick in the product

market and one with a downtick; and two cases representing

the situation in which the technology fails and the product

market either improves or worsens. Because the two nodes

in which the technology fails result in asset values of zero,

these nodes can be left off the value tree for the underlying

A Morgan Stanley Publication Spring 2011

99

Figure 7 Value Tree for Sequential Compound Rainbow Option

Preclinical Testing

Apr-02

Oct-02

INADA

Apr-03

Oct-03

Field Trials

Apr-04

Oct-04

Apr-05

NADA

Oct-05

Apr-06

Oct-06

Apr-07

1011.53

530.66

370.12

64.45

178.62

44.75

30.92

16.23

6.17

0.51

0.00

0.01

0.00

6.09

0.00

0.00

2.14

0.00

0.46

4.68

1.53

0.17

0.21

0.10

19.77

8.36

3.97

1.18

0.63

50.38

24.48

14.69

3.81

2.30

112.45

57.17

37.65

9.50

0.00

0.00

0.00

14.26

6.20

238.35

123.47

84.20

21.14

4.60

0.15

0.07

30.83

14.35

493.68

257.94

0.02

0.01

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

Result: Do not spend $2.0 million on the preclinical testing

0.00

Bold nodes are situations when the firm would exercise their option

assetbut they must be accounted for when determining

the option value tree that is based on the value tree of the

underlying asset.

Given the revised value tree for the underlying asset, we

can then generate a revised option value tree. The value of the

option tree at the end nodes are calculated using the same

equation as presented earlier when discussing the Shockley approach. The options value is the greater of the value

of exercising the option and taking the product to market

(option value = value of underlying asset minus exercise price)

and the value associated with letting the option expire (option

value = 0). If the value of the cash inflows from taking the

product to market is greater than the cost of so doing, the

decision rule is to exercise the option and take the product to

market. As presented in Figure 7, the option to take product

to market in April of 2007 will be exercised at the top seven

end nodes, but not in the bottom four nodes. (And keep in

mind that there is another set of end nodes, not shown in

the figure, that reflect the failure of the NADA for which the

option value is zero.)

To calculate the value of the option at the earlier nodes,

one must determine whether or not a test phase is expected

to be completed at that point, and understand how to adjust

100

Journal of Applied Corporate Finance Volume 23 Number 2

the valuation equation based on the type of uncertainty being

resolved over the next period (which determines the size of

the discount for risk). For those nodes that do not precede the

ending of a test phase (including April 2002, October 2002,

April 2004, October 2004, April 2005, and April 2006), only

product market uncertainty will be resolved over the coming

six-month period, and so one should apply a discount that

reflects only the product market risk. In such cases, the value

of the option can be calculated as the certainty equivalent

value of the future uncertain option values using binomial

risk-neutral probabilities based solely on the product risk. In

equation form,

CEQ option value = {p*(Cu) + (1-p)*Cd} / (1 + Rf) (2)

where;

CEQ is the certainty equivalent;

p is the binomial risk-neutral probability reflecting an

uptick in the product market (p = (Rf d) / (u d));

1-p is the binomial risk-neutral probability reflecting a

downtick in the product market;

Cu is the value of the call option if the value of the

underlying asset moves upward;

Cd is the value of the call option if the value of the

underlying asset moves downward;

A Morgan Stanley Publication Spring 2011

Figure 8 When to Apply Binomial or Quadranomial Risk Neutral Probabilities

Date

Technology Resolution

Risk Neutral Probability

Apr-02

Binomial

Oct-02

Binomial

Apr-03

Quadranomial based on Pre-Clinical Trial probabilities

Oct-03

Pre-Clinical Trial

Quadranomial based on INADA probabilities

Apr-04

INADA

Binomial

Oct-04

Binomial

Apr-05

Binomial

Oct-05

Apr-06

Quadranomial based on Field Trial probabilities

Field Trial

Oct-06

Apr-07

Binomial

Quadranomial based on NADA probabilities

NADA

Rf is the six-month yield on a five-year Treasury Bond

in April 2002:

u is exponential raised to the power of the standard

deviation times square root of 1 divided by the number of

periods in a year (u = esd(sqrt(1/t)));

d is the inverse of u (d = 1/u).

For nodes that do precede the ending of a test phase (April

2003, October 2003, October 2005, and October 2006), the

project is subjected to both product market and technology

risk over the next six-month period, and therefore a discount

reflecting both of these risks is required. This discount is determined by applying quadranomial risk-neutral probabilities

that reflect the specific test phase that is being completed.

CEQ option value = {p1*(Cu) + (p2)*Cd + p3*0 +

p4*0} / (1 + Rf)

(3)

where;

CEQ is the certainty equivalent;

p1 is the quadranomial risk-neutral probability reflecting an uptick in the product market and technology success

(p1 = (Rf d) / (u d) * prob of tech success);

p2 is the quadranomial risk-neutral probability reflecting a downtick in the product market and technology

success (p2 = (1- p1) * prob of tech success);

p3 is the quadranomial risk-neutral probability reflecting an uptick in the product market and technology failure

(p3 = (Rf d) / (u d) * prob of tech failure);

p4 is the quadranomial risk-neutral probability reflecting a downtick in the product market and technology

failure (p4 = (1 p3) * prob of tech failure);

Cu is the value of the call option if the value of the

underlying asset moves upward;

Cd is the value of the call option if the value of the

underlying asset moves downward;

Rf is the six-month yield on a five-year Treasury Bond

in April 2002;

Journal of Applied Corporate Finance Volume 23 Number 2

N/A

u is exponential raised to the power of the standard

deviation times square root of 1 divided by the number of

periods in a year (u = esd(sqrt(1/t)));

d is the inverse of u (d = 1/u).

Figure 8 provides a guideline for determining whether a

binomial or a specific set of quadranomial risk-neutral probabilities are appropriate for each node in the future based on

the upcoming periods risk exposure. Note that these probabilities will vary depending on the particular test phase to be

completed and its associated probability of success. Figure 9

provides the various risk-neutral probabilities based on the

particular phase being completed.

For example, to calculate the value of the option at the

top node on October 2006, a maximization equation is not

necessary because a test phase is not being completed at this

point in time, and so there is no decision as to whether or

not to exercise an option. But because the project is subject

to both product market and technology risks over the next

six months, there will be four possible outcomes at the end of

this six-month period. The possible outcomes are as follows:

NADA is successful and there is an uptick in the product

market ($1.01 billion); NADA is successful and there is a

downtick in the product market ($494 million); NADA is

unsuccessful and there is an uptick in the product market

($0), and NADA is unsuccessful and there is a downtick in

the product market ($0). Therefore, to calculate the certainty

equivalent of these four potential future outcomes, we use

quadranomial risk-neutral probabilities.

The certainty equivalent option value for the top node at

the end of October of 2006 equals:

CEQ option value = {.3354*$1,011.53 m +

.4146*$493.68 + .1118*0 + .1382*0} / (1 + .025)

= $530.66 m

The value of the option at the top node in April of 2006

would be calculated using binomial risk- neutral probabilities

A Morgan Stanley Publication Spring 2011

101

Figure 9 Various Quadranomial Risk Neutral Probabilities

Prob of

Success

Tech Success

& Uptick

(p1)

Preclinical Testing

0.05

0.0224

0.0276

0.4248

0.5252

INADA

0.75

0.3354

0.4146

0.1118

0.1382

Field Trials

0.25

0.1118

0.1382

0.3354

0.4146

NADA

0.75

0.3354

0.4146

0.1118

0.1382

Tech Success

& Downtick

(p2)

Tech Failure

& Uptick

(p3)

Tech Failure

& Downtick

(p4)

Quadranomial Probabilities are estimated using the following equations:

p1 = prob of success * RNP of uptick (0.4472)

p2 = prob of success * RNP of downtick (0.5528)

p3 = (1-prob of success) * RNP of uptick (0.4472)

p4 = (1-prob of success) * RNP of downtick (0.5528)

Figure 10 Sensitivity Analysis Based on

Standard Deviation of the Underlying Asset

Standard

Deviation

Value of

the Option

Investment

Decision

50%

$33,417

Do Not Invest

60%

45,947

Do Not Invest

70%

57,893

Do Not Invest

80%

$69,356

Do Not Invest

90%

$80,413

Do Not Invest

100%

$90,885

Do Not Invest

that reflect only the risk associated with the product market.

And a maximization equation is needed to determine if the

firm should exercise the option to spend $500,000 for the

NADA:

CApril 2006 top node = Max[.4472*$530.66 m +

(1-.4472)*$257.94 m - $0.50 m, 0] = $370.12 m

This process continues until the value on April 2002 is

calculated based on the following equation:

CApril 2002 = Max[.4472*$0.07 m + (1-.4472)*$0.0 m - $2.0

m, $0 m] = $0.0 m

This result suggests that Wahoo Genomics should not invest

in the preclinical testing because the option they would

acquire would be worth $33,417 (.4472*$0.07 m), which is

less than the cost of purchasing the option ($2 million). This

result is inconsistent with Shockleys results using the traditional binomial option pricing model, which suggested that

the value of the option was worth $21.8 million, and that the

firm should invest in starting the preclinical testing.

102

Journal of Applied Corporate Finance Volume 23 Number 2

Sensitivity Analysis

In my valuation of this early-stage biotechnology investment,

I assumed that the 100% standard deviation used in the

Shockley analysis should be reduced to 50% because the volatility measure in my revised model considers only the product

market risk and not the technology risks. When applying

the lower volatility measure, the revised model determined

that the value of the investment decreased to such an extent

that the firm should not take the initial step of developing

this new drug, the opposite recommendation provided by

Shockleys analysis.

But since the assumed level of volatility of 50% was

arbitrarily determined, it would be interesting to demonstrate

the effects of alternative assumptions regarding the volatility

of the underlying asset. Figure 10 presents the values of the

investment opportunity for various assumptions about the

volatility of the underlying asset when applying the revised

model presented in this paper. As the results show, the net

result of the modelthat the firm should not start this project

by investing in the pre-clinical trialsis not affected by the

assumption about the volatility of the underlying asset.

Conclusion

This article presents an alternative approach to one proposed

in 2003 by Richard Shockley and three of his students for

valuing an early stage biotechnology investment. Shockley et

al. presented an approach that uses a binomial option pricing

model in which all the risks or uncertainty associated with

investment is captured in the assumed standard deviation

of the underlying assets returns. The output of Shockleys

model suggested that the firm should invest $2 million to

start preclinical testing for a product with only a 0.7% probA Morgan Stanley Publication Spring 2011

ability of successfully completing all of the necessary test

phases required to bring the product to market. The expected

cost of taking the product to market is $10.0 million, with the

expectation that the value of the cash flows derived from this

product would be $29.8 million. The results from the alternative method presented in this paper suggest that the firm

should not invest the $2.0 million because the expected value

of the option they would be purchasing is worth considerably

less than $2.0 million.

The key difference between the two approaches is that

the approach taken in these pages takes the two main sources

of riskuncertainty about product market and uncertainty

associated with passing test phasesand models them

separately. Whereas the Shockley approach assumes that the

combined risk or uncertainty remains constant over the life

of the project, this alternative approach incorporates measures

of risk that vary over time based on the probability of successfully completing a test phase. Because the probabilities of

successfully completing the various sequential test phases

differ, a constant measure of risk does not seem appropriate.

Journal of Applied Corporate Finance Volume 23 Number 2

The alternative quadranomial option pricing model

presented in this article is well suited to the valuation of

options on underlying assets that have two major types of

riskalso known as rainbow optionsof which the early

stage biotechnology investment is a prime example. But

investments with this combination of product market and

technology risks can be found in almost all investments that

require major successful research and development efforts

before the firm has the ability to take the product to market.

The message from this paper is that investments in new

technology, natural resource exploration, and almost all new

product development investments are subject to both product

market and technology risks, and that such risks should be

modeled separately when determining the value of the investment opportunity.

peter a. brous is the Dr. Khalil Dibee Endowed Chair in Finance at

the Albers School of Business & Economics Seattle University, and can

be reached at pbrous@seattleu.edu.

A Morgan Stanley Publication Spring 2011

103

Journal of Applied Corporate Finance (ISSN 1078-1196 [print], ISSN

1745-6622 [online]) is published quarterly, on behalf of Morgan Stanley by

Wiley Subscription Services, Inc., a Wiley Company, 111 River St., Hoboken,

NJ 07030-5774. Postmaster: Send all address changes to JOURNAL OF

APPLIED CORPORATE FINANCE Journal Customer Services, John Wiley &

Sons Inc., 350 Main St., Malden, MA 02148-5020.

Information for Subscribers Journal of Applied Corporate Finance is published in four issues per year. Institutional subscription prices for 2011 are:

Print & Online: US$441 (US), US$529 (Rest of World), 343 (Europe),

271 (UK). Commercial subscription prices for 2010 are: Print & Online:

US$590 (US), US$703 (Rest of World), 455 (Europe), 359 (UK).

Individual subscription prices for 2010 are: Print & Online: US$105 (US),

59 (Rest of World), 88 (Europe), 59 (UK). Student subscription prices for 2011 are: Print & Online: US$37 (US), 21 (Rest of World), 32

(Europe), 21 (UK).

Prices are exclusive of tax. Australian GST, Canadian GST and European

VAT will be applied at the appropriate rates. For more information on current tax rates, please go to www.wileyonlinelibrary.com/tax-vat. The institutional price includes online access to the current and all online back files to

January 1st 2007, where available. For other pricing options, including

access information and terms and conditions, please visit www.wileyonlinelibrary.com/access

Journal Customer Services: For ordering information, claims and any inquiry

concerning your journal subscription please go to www.wileycustomerhelp.

com/ask or contact your nearest office.

Americas: Email: cs-journals@wiley.com; Tel: +1 781 388 8598 or

+1 800 835 6770 (toll free in the USA & Canada).

Europe, Middle East and Africa: Email: cs-journals@wiley.com;

Tel: +44 (0) 1865 778315.

Asia Pacific: Email: cs-journals@wiley.com; Tel: +65 6511 8000.

Japan: For Japanese speaking support, Email: cs-japan@wiley.com;

Tel: +65 6511 8010 or Tel (toll-free): 005 316 50 480.

Visit our Online Customer Get-Help available in 6 languages at

www.wileycustomerhelp.com

Production Editor: Joshua Gannon (email:jacf@wiley.com).

Delivery Terms and Legal Title Where the subscription price includes print

issues and delivery is to the recipients address, delivery terms are Delivered

Duty Unpaid (DDU); the recipient is responsible for paying any import duty or

taxes. Title to all issues transfers FOB our shipping point, freight prepaid. We

will endeavour to fulfil claims for missing or damaged copies within six months

of publication, within our reasonable discretion and subject to availability.

Back Issues Single issues from current and recent volumes are available at

the current single issue price from cs-journals@wiley.com. Earlier issues may

be obtained from Periodicals Service Company, 11 Main Street, Germantown, NY 12526, USA. Tel: +1 518 537 4700, Fax: +1 518 537 5899,

Email: psc@periodicals.com

This journal is available online at Wiley Online Library. Visit www.wileyonlinelibrary.com to search the articles and register for table of contents e-mail

alerts.

Access to this journal is available free online within institutions in the developing world through the AGORA initiative with the FAO, the HINARI initiative

with the WHO and the OARE initiative with UNEP. For information, visit

www.aginternetwork.org, www.healthinternetwork.org, www.healthinternetwork.org, www.oarescience.org, www.oarescience.org

Wileys Corporate Citizenship initiative seeks to address the environmental,

social, economic, and ethical challenges faced in our business and which are

important to our diverse stakeholder groups. We have made a long-term commitment to standardize and improve our efforts around the world to reduce

our carbon footprint. Follow our progress at www.wiley.com/go/citizenship

Abstracting and Indexing Services

The Journal is indexed by Accounting and Tax Index, Emerald Management

Reviews (Online Edition), Environmental Science and Pollution Management,

Risk Abstracts (Online Edition), and Banking Information Index.

Disclaimer The Publisher, Morgan Stanley, its affiliates, and the Editor

cannot be held responsible for errors or any consequences arising from

the use of information contained in this journal. The views and opinions

expressed in this journal do not necessarily represent those of the

Publisher, Morgan Stanley, its affiliates, and Editor, neither does the publication of advertisements constitute any endorsement by the Publisher,

Morgan Stanley, its affiliates, and Editor of the products advertised. No person

should purchase or sell any security or asset in reliance on any information in

this journal.

Morgan Stanley is a full-service financial services company active in

the securities, investment management, and credit services businesses.

Morgan Stanley may have and may seek to have business relationships with

any person or company named in this journal.

Copyright 2011 Morgan Stanley. All rights reserved. No part of this publication may be reproduced, stored or transmitted in any form or by any means

without the prior permission in writing from the copyright holder. Authorization to photocopy items for internal and personal use is granted by the copyright holder for libraries and other users registered with their local Reproduction Rights Organization (RRO), e.g. Copyright Clearance Center (CCC), 222

Rosewood Drive, Danvers, MA 01923, USA (www.copyright.com), provided

the appropriate fee is paid directly to the RRO. This consent does not extend

to other kinds of copying such as copying for general distribution, for advertising or promotional purposes, for creating new collective works or for resale.

Special requests should be addressed to: permissionsuk@wiley.com.

This journal is printed on acid-free paper.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Case Study On Feasibility Analysis of Real Estate ProjectДокумент31 страницаCase Study On Feasibility Analysis of Real Estate ProjectPulkit Aggarwal83% (6)

- Assignment 1 Hollywood Rules DataДокумент8 страницAssignment 1 Hollywood Rules DataPulkit AggarwalОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Modern Money and Banking BookДокумент870 страницModern Money and Banking BookRao Abdur Rehman100% (6)

- Criminal Tribes Act 1871Документ13 страницCriminal Tribes Act 1871Pulkit AggarwalОценок пока нет

- Hilton Chapter 08 SolutionsДокумент65 страницHilton Chapter 08 SolutionsKaustubh Agnihotri75% (8)

- The Relevance of Sales Promotion To Business OrganizationsДокумент40 страницThe Relevance of Sales Promotion To Business OrganizationsJeremiah LukiyusОценок пока нет

- Nalsa Summary DanishДокумент3 страницыNalsa Summary DanishPulkit AggarwalОценок пока нет

- Water Purification in Urban and Rural IndiaДокумент6 страницWater Purification in Urban and Rural IndiaPulkit Aggarwal100% (1)

- Rag PickersДокумент1 страницаRag PickersPulkit AggarwalОценок пока нет

- Chlorine Dispenser System: Market AnalysisДокумент3 страницыChlorine Dispenser System: Market AnalysisPulkit AggarwalОценок пока нет

- Brealey. Myers. Allen Chapter 22 SolutionДокумент8 страницBrealey. Myers. Allen Chapter 22 SolutionPulkit Aggarwal100% (1)

- Enactus: Project KADAMДокумент6 страницEnactus: Project KADAMPulkit AggarwalОценок пока нет

- Inventory ProblemsДокумент4 страницыInventory ProblemsPulkit AggarwalОценок пока нет

- Legal Agreement LetterДокумент1 страницаLegal Agreement LetterJun RiveraОценок пока нет

- Fire Service Resource GuideДокумент45 страницFire Service Resource GuidegarytxОценок пока нет

- SWCH 01Документ12 страницSWCH 01mahakali23Оценок пока нет

- 386 - 33 - Powerpoint - Slides - Lipsey - PPT - ch07 (Autosaved)Документ46 страниц386 - 33 - Powerpoint - Slides - Lipsey - PPT - ch07 (Autosaved)Ayush KumarОценок пока нет

- © 2015 Mcgraw-Hill Education Garrison, Noreen, Brewer, Cheng & YuenДокумент62 страницы© 2015 Mcgraw-Hill Education Garrison, Noreen, Brewer, Cheng & YuenHIỀN LÊ THỊОценок пока нет

- BiogasForSanitation LesothoДокумент20 страницBiogasForSanitation LesothomangooooОценок пока нет

- Dak Tronic SДокумент25 страницDak Tronic SBreejum Portulum BrascusОценок пока нет

- Ahmed BashaДокумент1 страницаAhmed BashaYASHОценок пока нет

- Measure of Eco WelfareДокумент7 страницMeasure of Eco WelfareRUDRESH SINGHОценок пока нет

- BS Irronmongry 2Документ32 страницыBS Irronmongry 2Peter MohabОценок пока нет

- Latihan Soal PT CahayaДокумент20 страницLatihan Soal PT CahayaAisyah Sakinah PutriОценок пока нет

- EOQ HomeworkДокумент4 страницыEOQ HomeworkCésar Vázquez ArzateОценок пока нет

- Packing List PDFДокумент1 страницаPacking List PDFKatherine SalamancaОценок пока нет

- BIR Form 1707Документ3 страницыBIR Form 1707catherine joy sangilОценок пока нет

- Asiawide Franchise Consultant (AFC)Документ8 страницAsiawide Franchise Consultant (AFC)strawberryktОценок пока нет

- Arithmetic of EquitiesДокумент5 страницArithmetic of Equitiesrwmortell3580Оценок пока нет

- Zubair Agriculture TaxДокумент3 страницыZubair Agriculture Taxmunag786Оценок пока нет

- A Study On Performance Analysis of Equities Write To Banking SectorДокумент65 страницA Study On Performance Analysis of Equities Write To Banking SectorRajesh BathulaОценок пока нет

- Econ 140 Chapter1Документ5 страницEcon 140 Chapter1Aysha AbdulОценок пока нет

- Designing For Adaptation: Mia Lehrer + AssociatesДокумент55 страницDesigning For Adaptation: Mia Lehrer + Associatesapi-145663568Оценок пока нет

- CBIM 2021 Form B-3 - Barangay Sub-Project Work Schedule and Physical Progress ReportДокумент2 страницыCBIM 2021 Form B-3 - Barangay Sub-Project Work Schedule and Physical Progress ReportMessy Rose Rafales-CamachoОценок пока нет

- Feasibilities - Updated - BTS DropsДокумент4 страницыFeasibilities - Updated - BTS DropsSunny SonkarОценок пока нет

- What Is Zoning?Документ6 страницWhat Is Zoning?M-NCPPCОценок пока нет

- 3D2N Bohol With Countryside & Island Hopping Tour Package PDFДокумент10 страниц3D2N Bohol With Countryside & Island Hopping Tour Package PDFAnonymous HgWGfjSlОценок пока нет

- Pandit Automotive Pvt. Ltd.Документ6 страницPandit Automotive Pvt. Ltd.JudicialОценок пока нет

- Nissan Leaf - The Bulletin, March 2011Документ2 страницыNissan Leaf - The Bulletin, March 2011belgianwafflingОценок пока нет

- What Is InflationДокумент222 страницыWhat Is InflationAhim Raj JoshiОценок пока нет

- De Mgginimis Benefit in The PhilippinesДокумент3 страницыDe Mgginimis Benefit in The PhilippinesSlardarRadralsОценок пока нет