Академический Документы

Профессиональный Документы

Культура Документы

Lecture 1 - General Principles

Загружено:

Lovenia MagpatocАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Lecture 1 - General Principles

Загружено:

Lovenia MagpatocАвторское право:

Доступные форматы

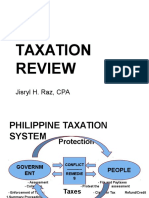

Lecture 1: GENERAL PRINCIPLES

I.

Inherent Powers of the State

1. Police Power power to make and implement laws for the general welfare

2. Taxation Power power to enforce contribution to raise government funds; it is an inherent power by

which the sovereign through its law-making body raises revenue to defray the necessary expenses of the

government.

3. Eminent Domain Power power to take private property for public use with just compensation

II. Similarities and Differences

POLICE

TAXATION

EMINENT DOMAIN

Power to MAKE and

IMPLEMENT laws for the

general welfare

Power to ENFORCE

contribution to raise

government funds

Power to TAKE private

property for public use with

just compensation

Broader in application

Plenary, comprehensive, and

supreme BUT NOT

ABSOLUTE

Merely to take private property

Property is taken or destroyed

to promote general welfare

Money is taken to support the

government

Property is taken for public

use

Can be expressly delegated

Cannot be delegated, if

delegated, it should be to the

legislative department of the

LGU (e.g. to make ordinances)

Can be expressly delegated

Limited to the cost of

regulation, license and other

necessary expense

Generally,

amount

No imposition as to amount,

instead, it is the Government

which is to compensate the

property taken.

Relatively

FREE

from

Constitutional limitations

Subject to Constitutional

and Inherent limitations

Superior to Non-Impairment

Clause

Inferior

Clause

to

NO

limit

on

Superior to and may override

Constitutional

impairment

provision

Non-Impairment

III. Concept of Taxation

1. Principles or Canons of a Sound Taxation System (FEA)

a. Fiscal Adequacy sufficiency to meet government expenditures and other public needs (Government

Budget Balance). This is in consonance of the Lifeblood Theory.

a.1. Budget Deficit = Government Revenues < Government Expenditures

a.2. Budget Surplus = Government Revenues > Government Expenditures

b. Equality or Theoretical Justice based on the taxpayers ability to pay; must be progressive

c. Administrative Feasibility capability of being effectively enforced. Tax laws should not obstruct

business growth and economic development.

2. Purpose

a. Primarily, to raise revenue

b. To regulate (inflation, economic and social stability, social control, etc.)

c. To compensate the benefits provided by the government to the people

3. Characteristics (ILS)

a. Inherent power of the state.

b. Exclusively lodged with the legislative body

c. Subject to inherent and constitutional limitations

4. Nature

a. Plenary full and complete in all respect

b. Comprehensive it covers persons, businesses, activities, professions, rights and privileges.

c. Supreme it is supreme ONLY insofar as the selection of the subject of taxation is concerned

d. Not Absolute it is subject to limitations

5. Limitations in Taxation Power

a. Inherent Limitations (PENTI)

a.1. Public purpose

a.2. Exemption of the Government

a.3. Non-delegability of the power to tax

Lecture 1: GENERAL PRINCIPLES

a.4. Territoriality

a.5. International Comity

b. Constitutional Limitations

b.1. Due process clause

b.2. Equal protection clause

b.3. Freedom of speech and of the press

b.4. Non-impairment of contracts

b.5. Rule requiring that appropriations, revenue and tariff bills shall originate exclusively from the

House

of Represenatatives (Congress)

b.6. Uniformity, equality, and progressivity of taxation

b.7. Tax exemption of the properties actually, directly and exclusively used for religious, charitable and

educational purposes.

b.8. Voting requirement (2/3) in connection with the legislative grant of tax exemption

b.9. Non-impairment of the jurisdiction of the Supreme Court in tax cases

b.10. Exemption from taxes of the revenues and assets of educational institutions, including grants,

endowments, donations and contributions

b.11. Power of the Presidentto veto any particular item (item veto) or items in an appropriation,

revenue

or tariff bill (pocket veto).

b.12. Necessity of an appropriation before money may be paid out of the public treasury

b.13. Non-appropriation of public money or property for the use, benefit or support of any sect, church

or system of religion

IV. Double Taxation

- It is taxing the same property twice when it should be taxed once.

1. Direct Duplicate Taxation double taxation in the objectionable or prohibited sense; not allowed in the

Philippines. This constitutes a violation of substantive due process.

Elements:

i.

Same property or subject matter is taxed twice

ii.

Same purpose

iii.

Same taxing authority

iv.

Same jurisdiction

v.

Same taxing period

vi.

Same kind or character of tax

2. Indirect Duplicate Taxation legal/permissible. The absence of one or more of the above-mentioned

elements.

V. Theories of Taxation

1. Necessity Theory (Theory of Taxation) the power to tax is an attribute of sovereignty emanating from

necessity (national defense, health, education, public facilities, etc.).

2. Lifeblood Theory (Importance of Taxation) without taxes, the government would be paralyzed for lack

of the motive power to activate and operate it.

3. Benefits Protection Theory/ Reciprocal Duties (Basis of Taxation) there is a symbiotic relationship

between the State and the citizens whereby in exchange of the protection and benefits that the citizens

received from the State, taxes are paid.

VI. Aspects of Taxation (shared by both executive and legislative body)

1. Levy the imposition or making of tax laws

2. Assessment similar to audit

3. Collection enforcement of tax

Note:

a. Levy is often called as tax legislation.

b. Assessment and collection are collectively termed as tax administration.

c. Levy and assessment comprise the impact of taxation, while tax collection comprises the incidence

of taxation.

d. An impact of taxation is a point on which tax is originally imposed.

e. An incident of taxation is a point on which the tax burden finally rests or settles down.

VII. Doctrines of Taxation

1. May the court interfere with tax legislation?

Answer: As long as the legislature, in imposing a tax, does not violate applicable constitutional limitations

or restrictions, it is not within the province of the courts to inquire into the wisdom or policy of the exaction,

the motives behind it, the amount to be raised or the persons, property or other privileges to be taxed. The

courts power is limited only to the application and interpretation of the law.

Lecture 1: GENERAL PRINCIPLES

2. Is the doctrine of equitable recoupment followed in the Philippines?

Answer: No. A tax presently being assessed against a taxpayer may not be recouped or set-off against an

overpaid tax, the refund of which is already barred by prescription.

3. May a tax be subject of compensation or set-off?

Answer: Generally, no. Taxes cannot be the subject of compensation or set-off. Taxes are not contractual

obligations but one arising out of duty to the government.

4. What is a taxpayer suit?

Answer: It is a case fied by a bona fide taxpayer impugning the validity, legality or constitutionality of a tax

law or its implementation.

5. What is the nature of our tax laws?

Answer: Internal revenue laws are not political in nature. In times of war, they are deemed to be the laws

of the occupied territory and not of the occupying enemy. Tax laws are civil and not penal in nature,

although there are penalties provided for their violation.

6. A tax statute is construed against the government, liberally in favor of the taxpayer; while tax exemptions

are construed against the taxpayer and liberally in favor of the government.

7. Tax laws are special laws which prevail over a general law.

8. Tax laws operate prospectively unless the purpose of the legislature is to give a retrospective effect.

VIII.Concept of a Tax

1. It is an enforced proportional contribution from the persons and property levied by the law-making body

of the State.

2. Taxation vs. Tax

a. Taxation is the process or means of imposing and enforcing contributions.

b. Tax is the enforced contribution, itself, which generally payable in money.

3. Characteristics of Taxes

a. Forced charge

b. Generally payable in money

c. Exclusively levied by the legislative body

d. Assessed in accordance with some reasonable rule of apportionment (ability-to-pay principle)

e. Imposed by the State within its jurisdiction

f. Levied for public purpose

4. Classification of Taxes

a. As to subject matter:

i.

Personal tax imposed upon persons of certain class with fixed amount (e.g. Community tax or

poll tax)

ii.

Property tax assessed on property of certain class (e.g. Real Property tax)

iii.

Excise tax imposed on the exercise of privilege (e.g. income tax, donors tax, estate tax, etc.)

iv.

Custom duties charged upon the commodities being imprted into or exported from a country

(e.g. tariffs)

b. As to burden:

i.

Direct tax both incidence or liability for the payment of tax as well as the impact or burden of the

tax falls on the same person (e.g. income tax)

ii.

Indirect tax the incidence or liability for the payment of tax falls on one person but the impact or

burden of the tax falls on another person (e.g. VAT)

c.

i.

ii.

As to purpose

General tax levied for the general or ordinary purposes of the government

Special tax levied for special purpose

d. As to measure of application

i.

Specific tax imposes a specific sum by the head or number or by some standard of weight or

measurement (e.g. excise tax on cigarettes)

ii.

Ad Valorem tax tax upon the value of the article or thing subject to taxation (e.g. VAT of 12%

regardless of the value of sales)

e. As to taxing authority

i.

National tax levied by the National Government (e.g. income tax, business taxes, transfer taxes)

ii.

Local tax imposed by the Local Government (e.g. Poll tax, real property taxes)

f.

As to rate

Lecture 1: GENERAL PRINCIPLES

i.

ii.

iii.

Progressive tax rate or amount of tax increases as the amount of income increases (e.g.

normal/tabular/schedular tax of 5% - 32%, tabular tax for donors tax and estate tax)

Regressive tax rate dcreases as the amount of income to be taxed increases (not applicable in

the Philippines)

Proportionate tax based on fixed proportion or rate of the value of the property assessed (e.g.

VAT of 12%)

5. Impositions Other Than Tax

a. Toll charged for the cost and maintenance of the property used

b. Penalty punishment for the commission of a crime

c. Compromise Penalty amount collected in lieu of criminal prosecution in cases of tax violation

d. Special Assessment levied on land based entirely on the benefit accruing thereon as a result of the

improvements or public works undertaken by the government within the vicinity

e. License or Fee regulatory imposition in the exercise of the police power

f. Margin Fee exaction designed to stabilize the currency

g. Debt a sum of money due upon contract or one which is evidenced by judgment

h. Subsidy a legislative grant of money in aid of a private enterprise deemed to promote the public

welfare

i. Custom Duties and fees duties charged upon commodities on their being transported into or

exported from the country.

j. Impost in general sense, it signifies any tax, tribute or duty; in limited sense, it means a duty on

imported goods and merchandise

k. Tithe contributions given to a church or sect

l. Tribute imposed by a monarch.

IX. Escape from Taxation

1. Tax Avoidance (Tax Planning) legal and permissible means

a. Shifting the process by which the tax burden is transferred from the statutory taxpayer to another

without violating the law.

b. Transformation the manufacturer or producer pays the tax imposed upon him and endeavors to

recoup himself by improving his process of production, thereby turning out his units of production at a

lower cost.

c. Capitalization a mere increase in the value of the property is not an incoem but merely an

unrealized increase in capital.

d. Tax-exemption a grant of immunity to a particular persons or corporations from the obligation to pay

taxes

2. Tax Evasion (Tax Dodging) the use of illegal or fraudulent means to defeat or lessen the payment of tax

X. Tax Laws, BIR Rulings and Revenue Regulations

1. Tax laws

- A tax law is a set of rules that provide means for the State to raise revenues.

- All revenue bills must originatefrom the House of Representatives (Congress). After passing 3

readings by a majority vote in technical committee, it shall be elevated to the Senate which needs to

pass the same 3 readings. The Presidents signature is necessary so that the bill becomes a law.

- In case of doubt, tax statutes are construed against the Government in favor of the taxpayer.

- In case of doubt, tax exemptions are construed against the taxpayer in favor of the Government.

2. Revenue Regulations

- These are interpretations of an administrative body (BIR) intended to clarify or explain the tax laws and

carry into effect its general provisions by providing details of administration and procedure.

- It is promulgated (made) by the Secretary of Finance, upon the recommendation of the Commissioner

of Internal Revenue (quasi-legislative function).

- It must be reasonable, within the authority conferred, not contrary to laws, must be published and

prospective in application.

3. BIR Rulings

- The BIR issues a general interpretation of tax laws usually upon a requrest of a taxpayer to clarify a

provision of law.

TRUE OR FALSE:

1.

2.

3.

4.

5.

A taxpayer has a right to question illegal expenditures of public funds.

One of the essential characteristics of tax is that it is unlimited in amount.

A person may refuse to pay a tax on the ground that he receives no personal benefit from it.

The point on which a tax is imposed is impact of taxation.

Police power regulates both liberty and property while the power of eminent domain and taxation power

affect only the property rights.

Lecture 1: GENERAL PRINCIPLES

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

25.

26.

A state has the power to tax even if not granted by the constitution.

Due process of law in taxation under the constitution is a grant of power.

In the Philippines, there may be double taxation.

Special assessment is imposed regardless of public improvements.

The President is superior to Congress as he can veto any bill even if already approved by the Congress.

The power to tax is always a power to destroy.

Under the necessity theory, without taxes a government would be paralyzed for lack of power to activate

and operate, resulting in its destruction.

The Congress passed a law imposing on income earned out of a particular activity that was not previously

taxed. The law is valid when it taxed incomes already earned within the fiscal year when the law took

effect.

Money collected from taxation shall not be paid to any religious dignitary except when the religious

dignitary is assigned to the Philippine Army.

Under the inherent limitation, no power shall be imprisoned for debt or non-payment of tax.

Value-added tax is an example of a progressive tax.

Administrative Feasibility principle states that the more income earned by the taxpayer, the more tax he

has to pay.

Taxation is generally payable in money and it is not based on contract.

One of the two aspects of taxation is that it is an inherent power of the sovereign state.

Tax avoidance is an escape from taxation where the producer or manufacturer pays the tax and endeavors

to recoup himself by improving his process of production thereby turning out his units of products at a

lower cost.

The power to tax generally includes the power to destroy.

For the exercise of the power of taxation, the state can tax anything at any time.

Tax exemptions are strictly construed against the government.

When the tax law is not clear and there is doubt whether he is taxable or not, the doubt shall be settled

against the government.

The principal purpose of taxation is to raise revenues for governmental needs.

No appropriation of public money for religious purposes is a constitutional limitation on the power of

taxation.

Вам также может понравиться

- Tax Rates Effective January 1, 1998 Up To PresentДокумент8 страницTax Rates Effective January 1, 1998 Up To PresentJasmin AlapagОценок пока нет

- Main 3 - Claveria, Jenny PDFДокумент18 страницMain 3 - Claveria, Jenny PDFSheena marie ClaveriaОценок пока нет

- Tax Rates Description Tax Form Documentary Requirements Procedures Deadlines Related Revenue Issuances Codal Reference Frequently Asked QuestionsДокумент10 страницTax Rates Description Tax Form Documentary Requirements Procedures Deadlines Related Revenue Issuances Codal Reference Frequently Asked Questionsshawn7800Оценок пока нет

- Estate Tax RatesДокумент5 страницEstate Tax RatesJohn Carlos WeeОценок пока нет

- Transfer Taxes: Modes of Acquiring OwnershipДокумент31 страницаTransfer Taxes: Modes of Acquiring OwnershipMary Joy DenostaОценок пока нет

- TaxationДокумент84 страницыTaxationjojoОценок пока нет

- Documentary StampДокумент5 страницDocumentary Stamppretityn19Оценок пока нет

- Checklist of Requirements For Housing Loan Revaluation (HQP-HLF-168, V02)Документ1 страницаChecklist of Requirements For Housing Loan Revaluation (HQP-HLF-168, V02)Engr Edmond CorpuzОценок пока нет

- MORBДокумент1 142 страницыMORBwardinnalagОценок пока нет

- Non Taxable IncomeДокумент4 страницыNon Taxable IncomeSesshomaruHimuraОценок пока нет

- Reviewer On Tax Administration and Procedures (For Submission)Документ44 страницыReviewer On Tax Administration and Procedures (For Submission)Miguel Anas Jr.Оценок пока нет

- Shall File A Return Under OathДокумент17 страницShall File A Return Under OathMixx MineОценок пока нет

- Criminal Law Notes For Bar 2011 - Glenn TuazonДокумент159 страницCriminal Law Notes For Bar 2011 - Glenn TuazonCzarPaguioОценок пока нет

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsДокумент1 страницаBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaОценок пока нет

- Question BusinesstaxДокумент16 страницQuestion BusinesstaxJam SurdivillaОценок пока нет

- Estate Tax: Bantolo, Javier, MusniДокумент31 страницаEstate Tax: Bantolo, Javier, MusniPatricia RodriguezОценок пока нет

- Activity 3 - Financial RatiosДокумент3 страницыActivity 3 - Financial RatiosNCF- Student Assistants' OrganizationОценок пока нет

- 05 - Navigating The LGU System (Report Period and User Accounts)Документ14 страниц05 - Navigating The LGU System (Report Period and User Accounts)Gerald BuslonОценок пока нет

- Basic Concepts of TaxationДокумент5 страницBasic Concepts of TaxationRhea Javed100% (1)

- Filing of Income Tax ReturnДокумент11 страницFiling of Income Tax Returnkirko100% (1)

- BACC105-1 Introduction To TaxationДокумент29 страницBACC105-1 Introduction To TaxationJunel MamarilОценок пока нет

- W2 Module 2 Tax Administration Part IДокумент53 страницыW2 Module 2 Tax Administration Part IElmeerajh JudavarОценок пока нет

- Chapter 23 QUESTIONS ANSWERSДокумент18 страницChapter 23 QUESTIONS ANSWERSDizon Ropalito P.Оценок пока нет

- PDAFДокумент37 страницPDAFeinel dc100% (1)

- Tax 2 - DST, ExciseДокумент11 страницTax 2 - DST, ExciseDINARDO SANTOSОценок пока нет

- Midterm Exam AnswersДокумент11 страницMidterm Exam AnswersMaha Bianca Charisma CastroОценок пока нет

- (D) Capital of The Surviving SpouseДокумент3 страницы(D) Capital of The Surviving SpouseAnthony Angel TejaresОценок пока нет

- SEC. 202. Final Deed To PurchaserДокумент14 страницSEC. 202. Final Deed To PurchaserweygandtОценок пока нет

- Filing of Estate ReturnsДокумент15 страницFiling of Estate ReturnsOneОценок пока нет

- Direction: Read and Study The Following ConceptsДокумент25 страницDirection: Read and Study The Following ConceptsChristopher Michael OnaОценок пока нет

- Module 1 - Overview of Government AccountingДокумент5 страницModule 1 - Overview of Government AccountingJebong CaguitlaОценок пока нет

- Tax Remedies Lecture1aДокумент7 страницTax Remedies Lecture1acmv mendozaОценок пока нет

- Traffic LawsДокумент4 страницыTraffic LawslhexОценок пока нет

- General Provisions: The Law On PartnershipДокумент38 страницGeneral Provisions: The Law On PartnershipJoe P PokaranОценок пока нет

- Apartheid Study Guide-1Документ9 страницApartheid Study Guide-1api-233191821Оценок пока нет

- Percentage Tax: o o o o o oДокумент11 страницPercentage Tax: o o o o o oMark Joseph BajaОценок пока нет

- Preamble: Constitution and By-Laws of TheДокумент10 страницPreamble: Constitution and By-Laws of TheJoseph Reposar GonzalesОценок пока нет

- 1b Rule 103Документ9 страниц1b Rule 103Ezra Denise Lubong RamelОценок пока нет

- Introduction To Income TaxationДокумент3 страницыIntroduction To Income TaxationescrowОценок пока нет

- Estate Tax ReviewerДокумент1 страницаEstate Tax ReviewerMariah Janey VicenteОценок пока нет

- Ad Valorem TaxДокумент4 страницыAd Valorem TaxManoj KОценок пока нет

- Bir Form 1603Документ3 страницыBir Form 1603Nava NavarreteОценок пока нет

- Payment Law 1.0Документ7 страницPayment Law 1.0VeeОценок пока нет

- Estate Tax - UstДокумент14 страницEstate Tax - UstKyle MerillОценок пока нет

- Fiscal Administration and Public EnterpriseДокумент13 страницFiscal Administration and Public EnterpriseptdwnhroОценок пока нет

- 2020 Bar Review: Banking and Allied LawsДокумент15 страниц2020 Bar Review: Banking and Allied LawssikarlОценок пока нет

- Process. Free Patent Applications PDFДокумент1 страницаProcess. Free Patent Applications PDFellis_NWU_09Оценок пока нет

- Statement: A Legally Adopted Child Who Is Not A Relative by Consanguinity of The 2 Statement: The Relatives by Consanguinity of The Wife Are Strangers As Far As DonorДокумент10 страницStatement: A Legally Adopted Child Who Is Not A Relative by Consanguinity of The 2 Statement: The Relatives by Consanguinity of The Wife Are Strangers As Far As DonorGlo GanzonОценок пока нет

- Luna, Joane LawДокумент6 страницLuna, Joane LawMarrie Chu100% (1)

- AA 4102 1st Hand OutДокумент9 страницAA 4102 1st Hand OutMana XDОценок пока нет

- Chapter One Mening and Scope of Public FinanceДокумент12 страницChapter One Mening and Scope of Public FinanceHabibuna Mohammed100% (1)

- Documentary Stamp TaxДокумент8 страницDocumentary Stamp TaxRam DerickОценок пока нет

- Bureau of TreasuryДокумент19 страницBureau of TreasuryAmir AuditorОценок пока нет

- Tax Rebyuwer MidtermДокумент12 страницTax Rebyuwer MidtermChua chua100% (1)

- Filipino Citizens and Their RightsДокумент5 страницFilipino Citizens and Their RightsMaria Cristela BrazilОценок пока нет

- TX10 Other Percentage TaxДокумент16 страницTX10 Other Percentage TaxAnna AldaveОценок пока нет

- Lectures of Atty. Japar B. Dimampao: Tax Notes (Legal Ground)Документ106 страницLectures of Atty. Japar B. Dimampao: Tax Notes (Legal Ground)Zaira Gem GonzalesОценок пока нет

- Land Titles PreBar 2015 - Atty. AbanoДокумент13 страницLand Titles PreBar 2015 - Atty. AbanoMaribeth ArandiaОценок пока нет

- Taxation Review LectureДокумент600 страницTaxation Review LectureRaz Jisryl79% (53)

- 2018 UDM Tax Law Review Part 1 - Lecture 1 Complete (July 02)Документ20 страниц2018 UDM Tax Law Review Part 1 - Lecture 1 Complete (July 02)Simeon SuanОценок пока нет

- Certification SLPДокумент2 страницыCertification SLPLovenia MagpatocОценок пока нет

- ST.1 Training Design - Poultry Starter KitsДокумент2 страницыST.1 Training Design - Poultry Starter KitsLovenia Magpatoc100% (2)

- Quali ExamДокумент7 страницQuali ExamLovenia Magpatoc50% (2)

- Prelim Day1 Overview of Cost Accounting 1. DefinitionДокумент6 страницPrelim Day1 Overview of Cost Accounting 1. DefinitionLovenia MagpatocОценок пока нет

- DAY 3 Cost AcctgДокумент7 страницDAY 3 Cost AcctgLovenia MagpatocОценок пока нет

- Resume and Cover Letter SampleДокумент3 страницыResume and Cover Letter SampleLovenia MagpatocОценок пока нет

- Application of Manufacturing OverheadДокумент1 страницаApplication of Manufacturing OverheadLovenia MagpatocОценок пока нет

- Lecture 2 - Income Taxation (Individual)Документ8 страницLecture 2 - Income Taxation (Individual)Lovenia Magpatoc100% (1)

- Nfjpia Mockboard 2011 APДокумент11 страницNfjpia Mockboard 2011 APShin GuevarraОценок пока нет

- Tax Review - Overview Vat and Opt (Quiz)Документ4 страницыTax Review - Overview Vat and Opt (Quiz)Lovenia Magpatoc100% (7)

- Lecture 3 - Income Taxation (Corporate)Документ8 страницLecture 3 - Income Taxation (Corporate)Lovenia Magpatoc50% (2)

- PRTC at Final PBДокумент14 страницPRTC at Final PBLovenia MagpatocОценок пока нет

- Review of The Accounting ProcessДокумент4 страницыReview of The Accounting ProcessMichael Vincent Buan Suico100% (1)

- 1st PB-ATДокумент12 страниц1st PB-ATLovenia MagpatocОценок пока нет

- Rin Case StudyДокумент4 страницыRin Case StudyReha Nayyar100% (1)

- Tourbier Renewal NoticeДокумент5 страницTourbier Renewal NoticeCristina Marie DongalloОценок пока нет

- Contemp Person Act.1Документ1 страницаContemp Person Act.1Luisa Jane De LunaОценок пока нет

- Zigbee Technology:19-3-2010: Seminor Title DateДокумент21 страницаZigbee Technology:19-3-2010: Seminor Title Dateitdep_gpcet7225Оценок пока нет

- SRS Document Battle Royale Origins - V2Документ36 страницSRS Document Battle Royale Origins - V2Talha SajjadОценок пока нет

- Zambia National FormularlyДокумент188 страницZambia National FormularlyAngetile Kasanga100% (1)

- TAC42055 - HO01 Edition I2.0: Section 1 Module 1 Page 1Документ69 страницTAC42055 - HO01 Edition I2.0: Section 1 Module 1 Page 1matheus santosОценок пока нет

- Trading Journal TDA Branded.v3.5 - W - Total - Transaction - Cost - BlankДокумент49 страницTrading Journal TDA Branded.v3.5 - W - Total - Transaction - Cost - BlankChristyann LojaОценок пока нет

- Participatory EvaluationДокумент4 страницыParticipatory EvaluationEvaluación Participativa100% (1)

- Key Performance Indicators - KPIsДокумент6 страницKey Performance Indicators - KPIsRamesh Kumar ManickamОценок пока нет

- Process Industry Practices Insulation: PIP INEG2000 Guidelines For Use of Insulation PracticesДокумент15 страницProcess Industry Practices Insulation: PIP INEG2000 Guidelines For Use of Insulation PracticesZubair RaoofОценок пока нет

- Mobile Services: Your Account Summary This Month'S ChargesДокумент3 страницыMobile Services: Your Account Summary This Month'S Chargeskumarvaibhav301745Оценок пока нет

- Comparitive Study of Fifty Cases of Open Pyelolithotomy and Ureterolithotomy With or Without Double J Stent InsertionДокумент4 страницыComparitive Study of Fifty Cases of Open Pyelolithotomy and Ureterolithotomy With or Without Double J Stent InsertionSuril VithalaniОценок пока нет

- April 2021 BDA Case Study - GroupДокумент4 страницыApril 2021 BDA Case Study - GroupTinashe Chirume1Оценок пока нет

- Auto Turn-Off For Water Pump With Four Different Time SlotsДокумент3 страницыAuto Turn-Off For Water Pump With Four Different Time SlotsKethavath Sakrunaik K100% (1)

- Yarn HairinessДокумент9 страницYarn HairinessGhandi AhmadОценок пока нет

- Waswere Going To Waswere Supposed ToДокумент2 страницыWaswere Going To Waswere Supposed ToMilena MilacicОценок пока нет

- Physico-Chemical Properties of Nutmeg (Myristica Fragrans Houtt) of North Sulawesi NutmegДокумент9 страницPhysico-Chemical Properties of Nutmeg (Myristica Fragrans Houtt) of North Sulawesi NutmegZyuha AiniiОценок пока нет

- Chapter 1 4Документ76 страницChapter 1 4Sean Suing100% (1)

- Negative Feedback AmplifierДокумент31 страницаNegative Feedback AmplifierPepОценок пока нет

- Anthony Robbins - Time of Your Life - Summary CardsДокумент23 страницыAnthony Robbins - Time of Your Life - Summary CardsWineZen97% (58)

- Uh 60 ManualДокумент241 страницаUh 60 ManualAnonymous ddjwf1dqpОценок пока нет

- What Is Product Management?Документ37 страницWhat Is Product Management?Jeffrey De VeraОценок пока нет

- AppcДокумент71 страницаAppcTomy lee youngОценок пока нет

- Biscotti: Notes: The Sugar I Use in France, Is CalledДокумент2 страницыBiscotti: Notes: The Sugar I Use in France, Is CalledMonica CreangaОценок пока нет

- Anviz T5 RFID ManualДокумент52 страницыAnviz T5 RFID ManualLuis Felipe Olaya SandovalОценок пока нет

- Roland Fantom s88Документ51 страницаRoland Fantom s88harryoliff2672100% (1)

- Functions PW DPPДокумент4 страницыFunctions PW DPPDebmalyaОценок пока нет

- 2001 Ford F150 ManualДокумент296 страниц2001 Ford F150 Manualerjenkins1100% (2)

- Property House Invests $1b in UAE Realty - TBW May 25 - Corporate FocusДокумент1 страницаProperty House Invests $1b in UAE Realty - TBW May 25 - Corporate FocusjiminabottleОценок пока нет