Академический Документы

Профессиональный Документы

Культура Документы

Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)

Загружено:

Shyam SunderИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)

Загружено:

Shyam SunderАвторское право:

Доступные форматы

II

V-GUARD INDUSTRIES LIMITED

Registered Office:42/962, Vennala High School Road,

Vennala P.O., Kochi - 682 028, Kerala, India

Tel: +91 4843005000,

2005000

Fax: +91 4843005100

Email: mail@vguard.in

CIN:L31200KL1996PLC010010

www.vguard.in

Ref: VGL/SEC/BSE/456

29.01.2016

The Bombay Stock Exchange Limited

zs" Floor,

P.J.Towers,

Dalal Street, Mumbai-400001

Dear Sir,

st

Sub: Submission of Unaudited Financial Results for the Quarter ended 31 December, 2015 pursuant to

Regulation 30 of SEBI (LODR) Regulations, 2015.

Ref: BSEScrip Code: 532953

This is to inform you that the Board of Directors at their meeting held on zs" January, 2016 have approved

st

and adopted the Unaudited Financial Statements of the Company for the quarter ended 31 December, 2015.

Please find enclosed herewith a copy of the Unaudited Financial Results for the quarter ended si" December,

2015 along with the Limited Review Report issued by M/s. S R Batlibo.i & Associates, Chartered Accountants,

the Statutory Auditors of the Company.

The aforesaid meeting commenced at 11.45 a.m. and concluded at 3.30 p.m.

Kindly take the documents on record.

Thanking You,

Yours sincerely,

For V-Guard Industries Limited

Mithun K Chittilappilly

Managing Director

S.R. BATLIBOI & ASSOCIATES LLP

Chartered Accountants

9th Floor, "ABAD Nucleus"

NH-49, Maradu PO

Kochi-6B2 304, India

Tel: +91 484 304 4000

Fax: +91 4842705393

Limited Review Report

Review Report to

The Board of Directors

V-Guard Industries Limited

I.

We have reviewed the accompanying

statement of unaudited financial results of V-Guard Industries

Limited ('the Company') for the quarter and nine months ended December 31, 2015 (the "Statement"). This

Statement is the responsibility

of the Company's management and has been approved by the Board of

Directors. Our responsibility is to issue a report on the Statement based on our review.

2.

We conducted our review in accordance with the Standard on Review Engagements (SRE) 2410, Review of

Interim Financial Information Performed by the Independent Auditor of the Entity issued by the Institute of

Chartered Accountants

of India. This standard requires that we plan and perform the review to obtain

moderate assurance as to whether the Statement is free of material misstatement.

A review is limited

primarily to inquiries of company personnel and analytical procedures applied to financial data and thus

provides less assurance than an audit. We have not performed an audit and accordingly, we do not express

an audit opinion.

3.

Based on our review conducted as above, nothing has come to our attention that causes us to believe that

the accompanying

Statement

of unaudited

financial results prepared in accordance

with applicable

accounting

standards and other recognised

accounting

practices and policies has not disclosed the

information required to be disclosed in terms of Regulation 33 of the SEBI (Listing Obligations and

Disclosure Requirements)

Regulations, 2015 including the manner in which it is to be disclosed, or that it

contains any material misstatement.

For S.R. BATLIBOI & ASSOCIATES

LLP

ICAI Firm registration number: 101049W

Chartered Accountants

per Aditya Vikram Bhauwala

Partner

Membership No.: 208382

Place: Kochi

Date: January 29, 2016

S.R. Batliboi & Associates LLP, a Limited Liability Partnership with LLP Identity No. AAB-4295

Regd. Office: 22. Camac Street. Block 'C'. 3rd floor. Kolkata700 016

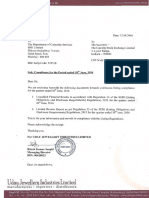

V-GUARD INDUSTRIES LIMITED

.~

Registered Office:42/962, Vennala High School Road,

Vennala P.O., Kochi - 682 028, Kerala, India

Tel: +91 4843005000,2005000

Fax: +914843005100

Email: mail@vguard.in

CIN:L31200KL1996PLC010010

------www.vguard.in

STATEMENT

OF UNAUDITED

FINANCIAL

RESULTS

FOR THE QUARTER

AND NINE MONTHS

ENDED 31.12.2015

({ in Lakhs)

PART

I

3 months ended

31.12.2015

Particulars

(Unaudited)

I

Income from operations

(a) Net sales/income from operations (Net of excise duty)

(b) Other operating income

Total income from operations {net}

Expenses

(a) Cost of materials consumed

(b) Purchases of stock-in-trade

(e) Changes in inventories of finished goods, work-in-progress

and stock-in-trade

(d) Employee benefits expense

(e) Selling and Distribution expense

(f) Depreciation and amortisation expense

(g) Other expenses

Total Expenses

Profit I (Loss) from operations before other Income, finance cost and

Exceptional Items (1-2)

Other Income

Profit I (Loss) from ordinary

exceptional items (3 + 4)

6

7

Finance costs

Profit I (Loss) from ordinary

exceptional items (5 + 6)

8

9

Exceptional Jtems

Profit I (Loss) from ordinary

10

II

12

13

14

Tax expense

Net Profit! {Loss] for the period I year (9+10)

Pard-up equity share capital (Face value of t 10/ each)

Reserve excluding Revaluation Reserves as per balance sheet

Earninas per share (EPS) (of ~ tO/- each) (not annualised)

(a) Basic

(b) Diluted

See accomuanvma notes to the financial results

(Unaudited)

before

finance costs and

activities

after finance costs but before

activities

before tax (7 + 8)

Corresponding

3

months ended

31.12.2014

(Unaudited)

Year to date

figures for

current period

ended 31.12.2015

Year to date

figures for

previous period

ended 31.12.2014

Previous year

ended 31.03.2015

(Unaudited)

(Unaudited)

(Audited)

41.415.34

212.73

41.628.07

43,110.64

230.22

43,340.86

38,980.37

556.28

39,536.65

133.970.48

927.11

134,897,59

129,094.27

1,337.27

130,431.54

173,04743

1,544.64

174,592.07

12.219.20

17,161.00

(62001)

11,984.55

16.768.96

2.143.87

11,719.96

15.995.04

1,388.23

38,871.22

53,527.29

3,265.14

40.008.92

59.075.86

(2,853.97)

51.059.39

79,287.01

(1,338.45)

2,869.26

3,009.98

383.04

3,526.83

38,549.30

2.738.33

2,564.12

383.94

3,493.74

40,077.51

2.347.18

2.820.68

389.07

3,099.61

37,759.77

8,259.33

9,167.82

1.153.13

10.350.50

124,594,43

7.062.20'

8,565.78

1.140.71

8.797.62

121,797.12

9.448.22

10.788.91

1,543.91

12.045.70

162,834.69

3,078.77

3,263.35

1,776.88

10,303.16

8,634.42

11,757.38

115.33

513.78

287.72

448.71

182.07

activities

Preceding 3

months ended

30.09.2015

172.85

3,260.84

3,436.20

1,892.21

10,816.94

8,922.14

12,206.09

(147.52)

3,113,32

(22498)

3,211.22

(533 II)

1,359.10

(769.10)

10,047.84

(1,59840)

7,323.74

10,144.66

3,113.32

3,211.22

1,359.10

10,047.84

7,323.74

10,144.66

(965.00)

2,148.32

3,001.80

(904.94)

2,306,28

2,999.82

(436.09)

923.01

2.991.81

(3,077.15)

6,970,69

3,001.80

(2,258.75)

5,064.99

2,991.81

7.16

7.08

7.69

7.61

3.09

3.05

23.24

23.00

16.96

16.73

(2.061.43)

,

(3,072.51 )

7,072.15

2,99731

34,776.36

23.66

23.40

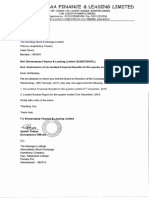

V-GUARD INDUSTRIES LIMITED

Registered Office:42/962, Vennala High School Road,

Vennala P.O., Kochi - 682 028, Kerala, India

Tel: +91 484 3005000, 2005000

Fax: +91484 3005100

Email: mail@vguard.in

CIN:L31200KL1996PLC010010

www.vguard.in

SECMENT

WISE REVENUE,

RESULTS

AND CAPITAL

3 months ended

31.12.2015

Preceding J

months ended

30.09.2015

Particulars

(Unaudited)

I

Corresponding

3

months ended

31.12.2014

(Unaudited)

10.989.72

28.997.80

1640.55

41.628.07

11.822.75

30,186.47

1331.64

Less Inter Segment Revenue

Income. from operations

41,628,07

unaudited

OUTIng the quarter

Employees

Figures

financial

results

ended

Stock Option

for the previous

penods

for the quarter

and nine months

and taken on record at the meeting

December

Scheme,

31, 2015,

(Unaudited)

(Unaudited)

Kochi

29.01.2016

(Audited)

43,340.86

40,673.35

89,994.88

4229.36

134,897.59

41,798.32

84,865.76

3 767.46

130,431.54

174.592.07

43,340.86

39,536.65

134,897.59

130,431.54

174,592.07

917.50

818.20

292.68

2,028.38

533.11

5,357.84

5,100.85

552.52

11,011.21

4,501.84

4,444.69

397.88

9,344.41

1,598.40

5.758.84

6,418.46

456.99

12,634.29

2,061.43

136.17

the Company

ended

119.81

3,278.10

147.52

3,536.51

224.98

17.26

100.31

3,113.32

9,210.53

27,400.94

2,903.34

5612.05

45 126.86

December

held on January

allotted

19,884

1,455.85

1,900.28

180.38

54,887.03

114.606.55

5098.49

equity

31, 2015

769.10

194.27

422.27

428.20

3.211.22

1,359.10

10,047.84

7,323,74

10,144.66

8,173.62

30,149.91

3,206.61

I 282.84

42.812.98

8,484.69

29,231.52

3,430.25

13 802.61

37.343.85

9,210.53

27,400.94

2,903.34

5612.05

45 126.86

8,484.69

29,231.52

3,430.25

13802.61

37.343.85

8.168.91

28,691.49

3,083.35

12 170.08

37773.67

were reviewed

by the Audit Committee

at the meeting

held on January

shares

of face value

of Rs.1O each on exercise

of stock

options

by eligible

2013

have been regrouped

and I or reclassified

wherever

29. 2016 and

29, 2016.

necessary

to conform

with the current

period presentation.

For V-GUARD

Place'

Date:

1 ~ in Lakhs}

Previous year

ended 31.03.2015

10,313.23

27,609.37

1614.05

39,536.65

1.536.89

1.621.40

Total

by the Board of Directors

Year to dale

fi&u~ (or

previous period

ended 31.12.2014

,/

Segment Results

(Profit before tax & interest from each segment)

(a) Electronics

(b) Electrical I Electro-mechanical

(e) Others

Total

(Add) I Less : (i) Interest

(ii) Other un-allocable expense

net of un-aJlocable income

(iii) Exceptional items

Profit Befure Tax

Capital Employed

(Segment Assets - Segment Liabilities)

(a) Electronics

(b) Electrical/Electro-mechanical

(e) Others

1d) Unallccated

The above

Year 10 date

figures (or

current period

ended 31.12.2015

(Unaudited)

Seament Revenue

(a) Electronics

(b) Electrical I Electro-mechanical

(e) Others

To,aI

approved

EMPLOVED

INDUSTRIES

LIMITED

employees

under the

Вам также может понравиться

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Документ5 страницFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results With Results Press Release & Limited Review Report For June 30, 2015 (Company Update)Документ4 страницыFinancial Results With Results Press Release & Limited Review Report For June 30, 2015 (Company Update)Shyam SunderОценок пока нет

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Документ5 страницAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results For December 31, 2015 (Result)Документ3 страницыFinancial Results For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ7 страницFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Документ5 страницAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Документ3 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ2 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For June 30, 2015 (Result)Документ4 страницыFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ8 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Документ3 страницыAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ6 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Документ11 страницStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Документ6 страницStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- PDF Processed With Cutepdf Evaluation EditionДокумент3 страницыPDF Processed With Cutepdf Evaluation EditionShyam SunderОценок пока нет

- Standalone Financial Results For March 31, 2016 (Result)Документ11 страницStandalone Financial Results For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For September 30, 2016 (Result)Документ3 страницыStandalone Financial Results For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Investor Presentation For December 31, 2016 (Company Update)Документ27 страницInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderОценок пока нет

- Transcript of The Investors / Analysts Con Call (Company Update)Документ15 страницTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- FIN 350 - Business Finance Homework 3 Fall 2014 SolutionsДокумент6 страницFIN 350 - Business Finance Homework 3 Fall 2014 SolutionsGomishChawlaОценок пока нет

- Bigger Capital Letter To Sysorex ShareholdersДокумент26 страницBigger Capital Letter To Sysorex ShareholdersbiggercapitalОценок пока нет

- S Johnson Dominos PizzaДокумент11 страницS Johnson Dominos PizzaShalom ShajanОценок пока нет

- Master Class On Stock TradingДокумент163 страницыMaster Class On Stock TradingAbbasi Adrien100% (1)

- Solution Manual For Principles of Corporate Finance 12th Edition by BrealeyДокумент3 страницыSolution Manual For Principles of Corporate Finance 12th Edition by BrealeyNgân HàОценок пока нет

- Chart of Accounts: LiabilitiesДокумент4 страницыChart of Accounts: LiabilitiesMD. Monzurul Karim ShanchayОценок пока нет

- Trading Psychology, The 14 Stages of Investor EmotionsДокумент2 страницыTrading Psychology, The 14 Stages of Investor EmotionsqwerbngОценок пока нет

- CFA Level1 - Fixed Income - SS14 v2021Документ154 страницыCFA Level1 - Fixed Income - SS14 v2021Carl Anthony FabicОценок пока нет

- Balance Sheet of Everest Kanto CylinderДокумент2 страницыBalance Sheet of Everest Kanto Cylindersatya936Оценок пока нет

- CCCCCCCCCCCC Ê CCCCCCCCCC: CC C C C CC C CCC C C C CCC CC CC CC C C CC C CC C CC CC CДокумент19 страницCCCCCCCCCCCC Ê CCCCCCCCCC: CC C C C CC C CCC C C C CCC CC CC CC C C CC C CC C CC CC Cmohanraj0071988Оценок пока нет

- JLL Asia Pacific Property Digest 4q 2015Документ76 страницJLL Asia Pacific Property Digest 4q 2015limpuppyОценок пока нет

- Higher Financial Accounting by Reddy and MurthyДокумент8 страницHigher Financial Accounting by Reddy and Murthy20UCC098 YOGASHKUMAR.MОценок пока нет

- IFC Impact Notes: AAA-rated Alternative To US AgenciesДокумент2 страницыIFC Impact Notes: AAA-rated Alternative To US AgenciesaaaОценок пока нет

- Final Strategic MGTДокумент19 страницFinal Strategic MGTDebi Setyawati100% (1)

- 5 6188064231535936141Документ95 страниц5 6188064231535936141SRISAI SURYAОценок пока нет

- Tata MotorsДокумент18 страницTata MotorsManoranjan MallickОценок пока нет

- Rothschild Growth Equity Update For 2023 1702923530Документ21 страницаRothschild Growth Equity Update For 2023 1702923530Saul VillarrealОценок пока нет

- Treasury ManagementДокумент28 страницTreasury ManagementmarifeОценок пока нет

- 660 Strategic Management 4981 NRДокумент2 страницы660 Strategic Management 4981 NRSurjith NkОценок пока нет

- EC2066Документ49 страницEC2066Josiah KhorОценок пока нет

- Change Your Life Before Breakfast 2018 PDFДокумент24 страницыChange Your Life Before Breakfast 2018 PDFParnad Bhattacharjee100% (4)

- MAF307 - Trimester 2 2021 Assessment Task 2 - Equity Research - Group AssignmentДокумент9 страницMAF307 - Trimester 2 2021 Assessment Task 2 - Equity Research - Group AssignmentDawoodHameedОценок пока нет

- From Global Custodian Prime Brokerage Survey 2022 pg71Документ1 страницаFrom Global Custodian Prime Brokerage Survey 2022 pg71TomTomОценок пока нет

- Pengambilan Keputusan Investasi Pada Bank Pembangunan Daerah Yang Terdaftar Di Bursa Efek Indonesia Chairil AfandyДокумент17 страницPengambilan Keputusan Investasi Pada Bank Pembangunan Daerah Yang Terdaftar Di Bursa Efek Indonesia Chairil AfandySiapa KamuОценок пока нет

- Marketing Reality ShowДокумент13 страницMarketing Reality ShowLaxmi MainaliОценок пока нет

- COMM 220 Notes PDFДокумент42 страницыCOMM 220 Notes PDFTejaОценок пока нет

- Two Types of Decisions: Finance 701 Exam 1Документ15 страницTwo Types of Decisions: Finance 701 Exam 1burdickm38Оценок пока нет

- 201469ar 2013 Garuda Indonesia English VersionДокумент422 страницы201469ar 2013 Garuda Indonesia English VersionAgamPatraОценок пока нет

- Development Economics Chapter 4 ExercisesДокумент5 страницDevelopment Economics Chapter 4 ExercisesAllan Franklin SampangОценок пока нет

- International Business Environments and Operations, 13/e Global EditionДокумент20 страницInternational Business Environments and Operations, 13/e Global EditionMir Yamin Uddin ZidanОценок пока нет