Академический Документы

Профессиональный Документы

Культура Документы

10 Facts About Health Insurance You Should Never Ignore

Загружено:

Kristine Reyes0 оценок0% нашли этот документ полезным (0 голосов)

105 просмотров12 страниц1) The document discusses 10 important facts about health insurance in India that policyholders should be aware of before purchasing insurance.

2) Some key facts include understanding limitations of room rent coverage, the benefits of cashless claims over reimbursement, and rules around no-claim bonuses.

3) It also provides tips such as taking advantage of tax deductions for health insurance premiums and the benefits of family floater plans for young families.

Исходное описание:

Health Insurance

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документ1) The document discusses 10 important facts about health insurance in India that policyholders should be aware of before purchasing insurance.

2) Some key facts include understanding limitations of room rent coverage, the benefits of cashless claims over reimbursement, and rules around no-claim bonuses.

3) It also provides tips such as taking advantage of tax deductions for health insurance premiums and the benefits of family floater plans for young families.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

105 просмотров12 страниц10 Facts About Health Insurance You Should Never Ignore

Загружено:

Kristine Reyes1) The document discusses 10 important facts about health insurance in India that policyholders should be aware of before purchasing insurance.

2) Some key facts include understanding limitations of room rent coverage, the benefits of cashless claims over reimbursement, and rules around no-claim bonuses.

3) It also provides tips such as taking advantage of tax deductions for health insurance premiums and the benefits of family floater plans for young families.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 12

10 Facts About

Health Insurance

You Should Never Ignore

www.savers.moneylife.in

Join

10 Facts About Health Insurance You Should Never Ignore

ediclaim is a contract between the insurance company and the

insured. Buying mediclaim should be an informed decision based

on the numerous aspects of mediclaim. The devil lies in the fine

print. The more informed you are about your mediclaim policys clauses,

the easier it will be to get your claim paid when the time comes. You must

make every attempt to understand the intricacies of the contract, so that

you can fight for your right in case the insurer rejects any claims unfairly.

This ebook will discuss the ten most important facts about Mediclaim that

everyone should know before buying a policy.

This ebook is part of the finest knowledge base on personal finance in India which Moneylife group has developed since

2006. Moneylife Smart Savers is not a financial planner or distributor. We research and shortlist safe and smart products

for members. To know our unique ethical and commission-free model click here.

Join

10 Facts About Health Insurance You Should Never Ignore

Does mediclaim need 24-hour hospitalisation?

nsurance companies have been

have a valid point that surgeries

known to reject claims when

like laparoscopy are often more

hospitalisation for a treatment

expensive than conventional

is less than 24 hours. But today,

surgery. However, there can be

with technological advancement,

a limit up to which these can be

hospitals often do not need to keep reimbursed, instead of an outright

the insured for 24 hours in many

denial of the claim. Some insurers

cases. The Insurance Regulatory

are keeping up with the times and

Development Authority (IRDA)

have expanded the list of day-

should direct insurance companies

care procedures they cover. It is

to analyse claims realistically rather

important to evaluate the list of

than mechanically rejecting claims.

such day-care procedures before

Meanwhile, insurance companies

signing up for a mediclaim product.

Join

10 Facts About Health Insurance You Should Never Ignore

How does the room rent limit affect claims?

any hospitals charge

claim based on your room rent

different amounts

and the actual room you availed.

for doctors visits,

For example, if the room rent limit

investigation and other charges,

is 1% of the sum insured (SI) and

for different classes of rooms. If

assuming an SI of Rs1 lakh, your

you avail of a room that costs more

room rent limit would be Rs1,000

than what your cover allows, the

per day. In case you use a room

insurance company will not just

costing Rs2,000 in rent, your full

disallow the difference in room

claim amount will pro-rated to

rent, but also the differnece in

pay only half of the claim, and

the other charges. Some policies

the remaining half will have to be

specify that they will pro-rate the

borne by you.

Join

10 Facts About Health Insurance You Should Never Ignore

Cashless is better than reimbursement of claim

deally, you should apply

surgical procedure, you need to

for cashless hospitalisation

insist on cashless approval before

for pre-planned medical

hospitalisation, irrespective of

procedures. Even though cashless

what the TPA, agent or insurance

hospitalisation is in your interest,

company may tell you. Keep aside

the insurance company may

two or three days for the process of

try to push you to apply for

cashless approval for pre-planned

reimbursement. You may be told

procedures, to ensure all queries

that an application for cashless

are resolved. While some in-house

hospitalisation may be made only

claims processing departments of

on the day of the procedure. If

insurers may be open 24x7 and

you dont want to risk rejection

round the year, we cannot say the

for a planned and non-emergency

same about TPAs.

Join

10 Facts About Health Insurance You Should Never Ignore

TPA v/s In-house claims processing

t is better for customers to

claims, admissions and make

deal with insurance companies

recommendations about payments

which have their own in-house

to the insurer, provided that

claims processing team. The

detailed guidelines are given by

team can interact both with the

the insurer to the TPA for claims,

customers and hospitals directly

assessments and admissions. The

to ensure that policyholders

insurer will make direct payments

get prompt service. This helps

to the hospital and policyholder

address customer issues much

(not through the TPA). Cheques

faster. Based on the public-

will have to be written by the

interest litigation filed by Gaurang

insurer and sent to the hospital (for

Damani, a social activist, IRDA

cashless hospitalisation) and to the

has said that a TPA may handle

policyholder (for reimbursements).

Join

10 Facts About Health Insurance You Should Never Ignore

Saves Taxes on your Health Insurance Premium

f you want to take advantage of

than Rs10,000, you can get the

a preventive healthcare program

full benefit of the Rs5,000 limit for

(PHP), the government gives you

PHP. The limit of 80D for senior

tax deductions for expenditures

citizens is Rs20,000. So, in case you

upto Rs5,000. If you are in the

are paying mediclaim premium

highest tax bracket and spend

for your parents as well as for

Rs5,000 on PHP, you will effectively

yourself, spouse and children then

be spending only Rs3,500 due to

you can have upto Rs35,000 in

tax savings. Just ensure that you

tax deductions under Section 80D

do not cross the Section 80D limit

(Rs20,000 for senior citizen parents

of Rs15,000. For example, if your

and Rs15,000 for yourself and your

health insurance premium is less

family).

Join

10 Facts About Health Insurance You Should Never Ignore

Rules governing No-Claim-Bonus (NCB)

nsurers may offer cumulative

claims free year, with a maximum

bonuses on indemnity-based

of a 50% NCB. This means that

health insurance policies. If a

every claims free year will increase

claim is made, the cumulative

the insurance cover by 5%, but the

bonus accrued may be reduced by

premium will be charged only for

the same rate at which it is accrued. the base sum insured. If your base

Earlier customers would avoid

sum insured (SI) is Rs2 lakh then

claiming small amounts because

after 10 claims free years, the NCB

that would reset the NCB to zero.

will give a benefit of an additional

For instance, many mediclaim

50% of the base SI, which is Rs1

policies offer a 5% NCB for every

lakh.

Join

10 Facts About Health Insurance You Should Never Ignore

Intimate the time of hospitalisation and claims

nsurers have been getting

used as an excuse for rejecting

strict about intimation of

genuine cases. Moreover, only in a

hospitalisation and deadlines for

few cases, the insurance company

claims. For example, United India

follows-up with the hospital to

expects the policyholder or family

verify if hospitalisation has actually

to intimate TPAs within 24 hours

taken place. Insurers are taking

of hospitalisation and the claim

a close look at the fine print

must be filed within seven days of

whenever there is a claim. Since

being discharged from hospital.

consumer courts or ombudsmen

They assume that chances of fraud

take a long time to provide relief,

are higher if the claim is submitted

insurers tend to reject claims in

a long time after discharge. While

borderline cases. So, make sure

this is a valid concern, it may be

you stick to the insurers timeline.

Join

10 Facts About Health Insurance You Should Never Ignore

Family floater is fine for a young family

ost floater policies cover

lakh will be partially covered. But, if

the husband, wife and a

your family had a Rs6 lakh floater,

couple of children; some

the big claim of Rs6 lakh would be

floaters may cover the parents too.

covered (if there is no other claim

The coverage for the entire family

for the family during the year).

is limited to the sum insured. The

Therefore, a family floater makes

premium for family floater plans is

more sense for a young family

typically less than what would be

because each one in a family gets

incurred if one bought separate

a higher cover and the probability

insurance policies for each family

of more than one family member

member. If you have mediclaim of

getting hospitalised in the same

Rs3 lakh for two, a big claim of Rs6

year is relatively low.

Join

10

10 Facts About Health Insurance You Should Never Ignore

Corporate mediclaim is Great But...

nsurers still bend over backwards hospitals that are part of their

for group insurance policies for

preferred provider network (PPN).

companies. Members of the

Some retail mediclaim products

group enjoy perks like maternity,

cover maternity, except after a

post-natal care, pre-existing

waiting period of 3-4 years. Those

diseases (PED) without the usual

part of a group mediclaim may

four-year waiting period, dental

like to avoid a separate cover. This

and ophthalmic care, and so on.

may not be wise. The employers

Plus, continuous coverage of

group mediclaim ceases, once you

cashless facility even at high-end

switch jobs or retire. Retirees dont

hospitals. Retail mediclaim from

have that option. Worse, it would

government insurers are offered

be difficult to obtain an individual

cashless facility only at the few

cover at an advanced age.

Join

11

10 Facts About Health Insurance You Should Never Ignore

Benefit of a Super top-up

top-up plan, provides

Rs3 lakh, the top-up amount will

additional cover to add

pay only for expenses above Rs3

to your existing cover in

lakh and upto Rs10 lakh. Super top-

an economical way. The thing to

up is also like a top-up policy. The

note here is an amount called the

difference: in the case of a top-up,

threshold level, also known as the

the expenses for a single treatment

compulsory deductible amount.

should be over a threshold,

This is the level above which the

whereas in a super top-up the total

top-up can be utilised to pay for

expenses in a year must be above

the expenses. For example, for a

the threshold level. Between a

top-up amount of Rs10 lakh and a

top-up and super top-up, the super

compulsory deductible amount of

top-up is more beneficial.

Join

12

Вам также может понравиться

- Health Insurance Ebook PDFДокумент29 страницHealth Insurance Ebook PDFPrashant Pote100% (1)

- Business Plan I. Business TitleДокумент3 страницыBusiness Plan I. Business TitleClaire Macaraeg100% (1)

- Calling Script FinalДокумент3 страницыCalling Script FinalPradeep NadarОценок пока нет

- A Beginner's Guide to Disability Insurance Claims in Canada: How to Apply for and Win Payment of Disability Insurance Benefits, Even After a Denial or Unsuccessful AppealОт EverandA Beginner's Guide to Disability Insurance Claims in Canada: How to Apply for and Win Payment of Disability Insurance Benefits, Even After a Denial or Unsuccessful AppealОценок пока нет

- Rapidcare Medical Billing ManualДокумент93 страницыRapidcare Medical Billing Manualapi-19789919100% (3)

- The Future of Jet EngineДокумент31 страницаThe Future of Jet EngineKristine ReyesОценок пока нет

- Omnitel Pronto Italia Case AnalysisДокумент8 страницOmnitel Pronto Italia Case AnalysisSnehal JoshiОценок пока нет

- Case Study IB With AnswerДокумент4 страницыCase Study IB With AnswerAnagha PranjapeОценок пока нет

- Electrical WiringДокумент11 страницElectrical WiringRasydan AliОценок пока нет

- Health Insurance in IndiaДокумент7 страницHealth Insurance in Indianetsavy71Оценок пока нет

- Guide To Group Health InsuranceДокумент20 страницGuide To Group Health InsuranceYatharth SahooОценок пока нет

- Health InsuranceДокумент27 страницHealth Insurancelittlemaster1982Оценок пока нет

- Health Insurance Term PaperДокумент4 страницыHealth Insurance Term Paperafdtslawm100% (1)

- Health Insurance 12 Points Check ListДокумент3 страницыHealth Insurance 12 Points Check ListmcsrОценок пока нет

- How Insurance WorksДокумент8 страницHow Insurance WorksKing4RealОценок пока нет

- Health Insurance MythsДокумент6 страницHealth Insurance Mythsnavneet1107Оценок пока нет

- Health InsuranceДокумент9 страницHealth InsurancetceterexОценок пока нет

- 7 Things To Check Before You Buy Your Income Protection PolicyДокумент2 страницы7 Things To Check Before You Buy Your Income Protection PolicytkeshavОценок пока нет

- Basics of A Health Insurance PolicyДокумент2 страницыBasics of A Health Insurance PolicyAshis Kumar MuduliОценок пока нет

- Health InsuranceДокумент11 страницHealth InsurancedishaОценок пока нет

- Unit 2 Health Insurance ProductsДокумент25 страницUnit 2 Health Insurance ProductsShivam YadavОценок пока нет

- Company Your Policy ExplainedДокумент34 страницыCompany Your Policy ExplaineddeonptОценок пока нет

- How To Choose The Best Health Insurance CompanyДокумент5 страницHow To Choose The Best Health Insurance CompanyPriyank GuptaОценок пока нет

- Your Policy ExplainedДокумент29 страницYour Policy ExplaineddeonptОценок пока нет

- Demystifying Medical Aid and InsuranceДокумент22 страницыDemystifying Medical Aid and InsuranceFang KenОценок пока нет

- Insurance BasicsДокумент25 страницInsurance BasicsGautam SandeepОценок пока нет

- 9 Things About Term Insurance You Always Wanted To KnowДокумент124 страницы9 Things About Term Insurance You Always Wanted To KnowRakesh BadayaОценок пока нет

- 1) Coverage Amount/Sum Insured (SI)Документ4 страницы1) Coverage Amount/Sum Insured (SI)shaileshОценок пока нет

- Insurance Term Admitted PaperДокумент8 страницInsurance Term Admitted PaperPayingSomeoneToWriteAPaperSingapore100% (1)

- Membership Guide: Health InsuranceДокумент58 страницMembership Guide: Health InsuranceMissh Queen100% (1)

- Terms of BusinessДокумент9 страницTerms of Businessksenos.ukОценок пока нет

- Medicare Term PaperДокумент4 страницыMedicare Term Paperafdtzvbex100% (1)

- Sisc Q AДокумент7 страницSisc Q Aapi-204910805Оценок пока нет

- FinanceДокумент25 страницFinanceShaun D'souzaОценок пока нет

- SBI General's Health Insurance Policy - Retail: Take Control of Your Family's Health. and Happiness TooДокумент2 страницыSBI General's Health Insurance Policy - Retail: Take Control of Your Family's Health. and Happiness ToobpshuОценок пока нет

- Company Profile: Bajaj Allianz General Insurance Company LinitedДокумент27 страницCompany Profile: Bajaj Allianz General Insurance Company Linitedsidhantha100% (1)

- Section 80d of Income TaxДокумент7 страницSection 80d of Income TaxBAJRANG LAL AgrawalОценок пока нет

- 3 Ways You Can Extend Your Health Insurance CoverДокумент1 страница3 Ways You Can Extend Your Health Insurance Coverekta rajoriaОценок пока нет

- Health Insurance Inforamtion, Individual Health Insurance, Family Health Insurance InformationДокумент7 страницHealth Insurance Inforamtion, Individual Health Insurance, Family Health Insurance Informationdjohnson418Оценок пока нет

- Financial Planning Financial Plan Life's Financial GoalsДокумент5 страницFinancial Planning Financial Plan Life's Financial GoalspeebeeyooОценок пока нет

- 7 Things You Need To Consider While Porting A Insurance Policy - The Economic TimesДокумент1 страница7 Things You Need To Consider While Porting A Insurance Policy - The Economic TimessubbaraokommuriОценок пока нет

- Mediclaim PoliciesДокумент1 страницаMediclaim PoliciesnavagatОценок пока нет

- 5854 Online Term BrochureДокумент5 страниц5854 Online Term BrochureanilmechОценок пока нет

- InsuranceДокумент4 страницыInsuranceParesh WarankarОценок пока нет

- Mu Sure Mu Sure: Succeed With Us!Документ6 страницMu Sure Mu Sure: Succeed With Us!mamemuОценок пока нет

- Insurance Proposal DefinitionДокумент5 страницInsurance Proposal DefinitionAnand RathiОценок пока нет

- Banking RPДокумент12 страницBanking RPElsa ShaikhОценок пока нет

- Life Insurance in India - 4Документ7 страницLife Insurance in India - 4Himansu S MОценок пока нет

- 2023 - 07 - Terms of Business v5.9 Live Date 04.09.2023Документ9 страниц2023 - 07 - Terms of Business v5.9 Live Date 04.09.2023Talib HussainОценок пока нет

- Why Should Health Insurance Be Given Due Consideration?Документ4 страницыWhy Should Health Insurance Be Given Due Consideration?iqbalОценок пока нет

- Enumerate Eric Tyson's Three Laws in Buying Insurance and Explain Them in Your Own WordsДокумент3 страницыEnumerate Eric Tyson's Three Laws in Buying Insurance and Explain Them in Your Own WordsRhia shin PasuquinОценок пока нет

- Gim GimДокумент15 страницGim GimroyjeenaelizabethОценок пока нет

- HealthДокумент68 страницHealthKvvPrasadОценок пока нет

- How To Buy Health InsuranceДокумент3 страницыHow To Buy Health InsurancekalevaishaliОценок пока нет

- Pa Malpractice Insurance Summary-Recommendation ArticleДокумент3 страницыPa Malpractice Insurance Summary-Recommendation ArticleJeff Nicholson PhD, PA-CОценок пока нет

- Final Healthinsurance Lyst7034 PDFДокумент56 страницFinal Healthinsurance Lyst7034 PDFSammed VardhmanОценок пока нет

- Insurance For StudentsДокумент3 страницыInsurance For StudentsArmyboy 1804Оценок пока нет

- Irm CiaДокумент21 страницаIrm CiaMohammad HaiderОценок пока нет

- Reasons To Sell Life Insurance.: PortfolioДокумент2 страницыReasons To Sell Life Insurance.: PortfolioWin VitОценок пока нет

- Family Health Insurance Plans Buy Mediclaim Policy OnlineДокумент1 страницаFamily Health Insurance Plans Buy Mediclaim Policy OnlinesainithinvaddiОценок пока нет

- Health InsuranceДокумент21 страницаHealth Insuranceadhitya0% (1)

- The Economics of HC - Week 2Документ12 страницThe Economics of HC - Week 2Fernanda CárcamoОценок пока нет

- New Microsoft Office Word DocumentДокумент88 страницNew Microsoft Office Word DocumentNaveen KandukuriОценок пока нет

- What Is Corporate Health Insurance?Документ4 страницыWhat Is Corporate Health Insurance?Muhammad RamzanОценок пока нет

- LOCTITE Assembly SolutionsДокумент32 страницыLOCTITE Assembly SolutionsKristine ReyesОценок пока нет

- Characterization of Porous Materials: Gas & Vapor Sorption InstrumentsДокумент40 страницCharacterization of Porous Materials: Gas & Vapor Sorption InstrumentsKristine ReyesОценок пока нет

- Hydraulic Components Test Bench - Servo HydraulicsДокумент3 страницыHydraulic Components Test Bench - Servo HydraulicsKristine ReyesОценок пока нет

- Test Benches: MAXPRO Technologies IncДокумент2 страницыTest Benches: MAXPRO Technologies IncKristine ReyesОценок пока нет

- TCM Series: Motorized Test StandsДокумент7 страницTCM Series: Motorized Test StandsKristine ReyesОценок пока нет

- D Link DSL 2730 U WiFi Modem Configuration Guide For BSNL - MTNLДокумент20 страницD Link DSL 2730 U WiFi Modem Configuration Guide For BSNL - MTNLKristine ReyesОценок пока нет

- CAT 99 Percentilers Are Not Even Eligible To Appear For IIM InterviewsДокумент4 страницыCAT 99 Percentilers Are Not Even Eligible To Appear For IIM InterviewsKristine ReyesОценок пока нет

- High Pressure FiltersДокумент108 страницHigh Pressure FiltersKristine ReyesОценок пока нет

- Paper - 13 History of IndiaДокумент177 страницPaper - 13 History of IndiaKristine ReyesОценок пока нет

- Sofa BrochureДокумент10 страницSofa BrochureKristine ReyesОценок пока нет

- Books Which Are Recommended For Preparation of ISRO ExamДокумент2 страницыBooks Which Are Recommended For Preparation of ISRO ExamKristine ReyesОценок пока нет

- History of DelhiДокумент22 страницыHistory of DelhiKristine ReyesОценок пока нет

- Aero Space RivetsДокумент16 страницAero Space RivetsKristine ReyesОценок пока нет

- Rameshwaram Tour Easy Tourist GuideДокумент7 страницRameshwaram Tour Easy Tourist GuideKristine ReyesОценок пока нет

- 2009 FRN Average WeightsДокумент4 страницы2009 FRN Average WeightsKristine ReyesОценок пока нет

- Rt33farzasp - Overview - Samsung IndiaДокумент3 страницыRt33farzasp - Overview - Samsung IndiaKristine ReyesОценок пока нет

- Parotta & KurmaДокумент3 страницыParotta & KurmaKristine ReyesОценок пока нет

- Ansys APDL and WBДокумент3 страницыAnsys APDL and WBKristine ReyesОценок пока нет

- Heat Treatment of SteelДокумент3 страницыHeat Treatment of SteelKristine ReyesОценок пока нет

- Swot Analysis of WestsideДокумент15 страницSwot Analysis of WestsideShweta Singh50% (4)

- Assignment #1theoryДокумент13 страницAssignment #1theoryNaila Mehboob67% (3)

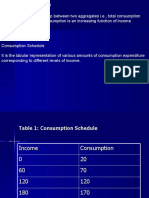

- Consumption FunctionДокумент15 страницConsumption FunctionRifaz ShakilОценок пока нет

- Consumer Behavior SyllabusДокумент2 страницыConsumer Behavior SyllabusKameswara Rao Poranki100% (2)

- MedimixДокумент2 страницыMedimixKomal MishraОценок пока нет

- Niche Market Vs Mass MarketДокумент14 страницNiche Market Vs Mass Marketbalaji_ram_4Оценок пока нет

- Colour Cosmetics in The Philippines: Euromonitor International July 2012Документ13 страницColour Cosmetics in The Philippines: Euromonitor International July 2012Miguel LucenaОценок пока нет

- Independent University, BangladeshДокумент93 страницыIndependent University, BangladeshShahriar HaqueОценок пока нет

- Sales Marketing of WaltonДокумент9 страницSales Marketing of Waltonabid.minar100% (1)

- Tutorial 5 - Derivative of Multivariable FunctionsДокумент2 страницыTutorial 5 - Derivative of Multivariable FunctionsИбрагим Ибрагимов0% (1)

- Media Planning Terms and ConceptsДокумент27 страницMedia Planning Terms and ConceptsAnton Kopytov100% (5)

- A8 BRM Stage 0Документ2 страницыA8 BRM Stage 0Puneet MishraОценок пока нет

- 1a895selection of Channel PartnersДокумент9 страниц1a895selection of Channel Partnersmanav badhwarОценок пока нет

- Liril Case - 1Документ13 страницLiril Case - 1Vishal Jagetia100% (3)

- Strategy Formulation of Shan FoodsДокумент3 страницыStrategy Formulation of Shan FoodsSadia Asif100% (2)

- Improving Consumer Mindset Metrics and Shareholder Value Through Social Media: The Different Roles of Owned and Earned MediaДокумент20 страницImproving Consumer Mindset Metrics and Shareholder Value Through Social Media: The Different Roles of Owned and Earned MediaIchaGunawanОценок пока нет

- Gatorade - Client BriefДокумент2 страницыGatorade - Client BriefMarie-Caroline CHAPIRONОценок пока нет

- Potter 5 ForceДокумент30 страницPotter 5 ForceVenusree Bobba100% (1)

- Canned Foods 2011Документ134 страницыCanned Foods 2011Rohan MhatreОценок пока нет

- Case Analysis SMДокумент6 страницCase Analysis SMMahesh TiwariОценок пока нет

- Product, Services, and Brands: Building Customer ValueДокумент39 страницProduct, Services, and Brands: Building Customer ValueSazzad Shuvo100% (2)

- 71-4-ET-V1-S1 Corporate Orientations Towards The MarketplaceДокумент2 страницы71-4-ET-V1-S1 Corporate Orientations Towards The MarketplaceVishal VijayanОценок пока нет

- Setting Advertising Objectives Setting The Advertising Budget Developing Advertising Strategy Evaluating Advertising CampaignsДокумент17 страницSetting Advertising Objectives Setting The Advertising Budget Developing Advertising Strategy Evaluating Advertising CampaignssravanОценок пока нет

- Disney HistoryДокумент3 страницыDisney HistoryAbdul SahimiОценок пока нет

- Design and Size of Sales TerritoriesДокумент26 страницDesign and Size of Sales TerritoriesImran Malik100% (1)

- Cummins B2BДокумент16 страницCummins B2BPaul Vinod100% (1)