Академический Документы

Профессиональный Документы

Культура Документы

Equity Research On 4 Wheeler

Загружено:

Akash jainОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Equity Research On 4 Wheeler

Загружено:

Akash jainАвторское право:

Доступные форматы

BIRLA SUN LIFE

SUMMER PROJECT REPORT ON

Equity Analysis on four wheeler sector

Submitted by:

ABHISEKH GHOSH

Under the guidance of:

SABEENA DESHPANDE

INDIRA SCHOOL OF BUSINESS STUDIES

PUNE

PGDM (2014-16)

Declaration

I hereby declare that the project entitled Equity Research on Four Wheeler submitted for

the PGDM course in Finance under the guidance of Prof. SABEENA DESHPANDE, is my

original work and the project has not formed the basis for the award of any degree, fellowship

or any other similar title.

ABHISEKH GHOSH

B2F14

1 | Page

BIRLA SUN LIFE

ISBS

ACKNOWLEDGEMENT

I would like to thanks BIRLA SUN LIFE, giving me this excellent opportunity to learn the

realities of the equity market and research. The two months of training provided me with

good exposure and provided me with a holistic learning experience.

I would like to thank my guide, Prof. SABEENA DESHPANDE for his valuable guidance.

He was ever willing to be of help and guide and supported me throughout the tenure of the

project.

I feel privileged to have come in contact and worked alongside such wonderful people.

Finally I would also like to express my gratitude towards all the member ISBS Pune & all my

friends who helped me directly or indirectly in successful completion of this report.

EXECUTIVE SUMMARY2 | Page

BIRLA SUN LIFE

The project EQUITY RESEARCH ON FOUR WHEELER SECTOR is based on the EIC

model. The Economic analysis includes a countrys economic analysis. The Industry analysis

includes sector analysis based on different aspects such as porter 5 forces, government

initiatives for the particular sector. The company Analysis focus on companys management

team, its vision, financial analysis.

The project work includes valuation of the share prices of the Four wheeler companies like

Tata motors And Maruti Suzuki. .The valuation is based on the EIC model where in the

prices of the shares are estimated according to the expected growth in the sector and adjusting

the shortcomings of the sector. The estimation of Price earning is according to the historical

analysis approach wherein the past PEs have been tracked down and used to value and

estimate the companys future prices of share.

The main idea behind conducting equity research is to find out the overall working and trend

of Entertainment sector and to find out promising scripts and Entertainment sector companies

to invest .It involves predicting the future prices.

On the basis of financial analysis and valuation the findings of the study is that Tata motors

and Maruti Suzuki both seems to be a good option for Investment .Both are in a positive

trend with almost all macro factors and political favours in their favour. On the financial

analysis part of is good in terms of liquidity, profitability and also in leverage

TABLE OF CONTENTS

Sr.No

Contents

Page nos.

Introduction

6-7

Industry overvies

8-9

3 | Page

BIRLA SUN LIFE

Company profile

10-11

Literature review

12-13

Objective

14

Research Methodology

15-18

About co.

19-29

Data Analysis ,research and interpretation

30-37

Conclusion and learning

38-39

10

Limitations

40

11

Recommendation

41

12

Annexture

42-59

INTRODUCTION

Introduction

What is Project?

The project to analyse the equity data of Tata motors and Maruti

Suzuki .

Definition and purpose of the project

The purpose of the project:

1) To analyse the primary and secondary data

2) To study the awareness level of customers

3) To explore new market for the company.

4 | Page

BIRLA SUN LIFE

Scope of the project

1) To find out Market Size of Tata motors and maruti suzuki

2) Understood the potential customers.

3) To increase awareness level of potential customer regarding

companys product

4) Quick service- monitoring and enhancing productivity.

Outline of the project report

This thesis consists of 9 chapters

The first chapter is introduction which contains overview and

objective of this project. In this chapter it is described, promoting the sales

and how it overcomes with the drawbacks of customer service. It also

contains an overview on some of the advantages of the project.

The second chapter is literature review which gives the background

study of the automobile sector which is used in this project. Here we have

also described the related work which was essential to be done, for

example the customer service, measure customer satisfaction level, quick

service, etc.

The third chapter is Therotical Background and Literature Review

which gives the background study about what the automobile company is

and all about. Here we have also described the earlier work which was

done in the company.

The fourth chapter is Objectives. In this chapter all the objectives

related to the project is given, this will be helpful to understand the

working of the project.

The fifth chapter is Research Methodology which consists the

different methods used in this project. This chapter gives the research

method, data type, data collection tool, sampling plans which were used

5 | Page

BIRLA SUN LIFE

for completion of the research.

The sixth chapter is Data Analysis and Interpritetion. In this chapter

all the data collected from the samples is analysed and interpreted.

The seventh chapter is Conclusion from the project which includes

all the important findings or results found at the end of project.

The eighth chapter is limitation which includes the challenges faced

during the project.

The nineth chapter in the Recommendations. In this chapter the

suggestion are given.

This thesis also includes references which consist of the web pages

from where we have taken the basic idea of the project and the books

referred are also listed in this chapter.

INDUSTRY OVERVIEW

The automobiles sector is compartmentalized in four different sectors which are as follows:

Two-wheelers which comprise of mopeds, scooters, motorcycles and electric

two-wheelers

Passenger Vehicles which include passenger cars, utility vehicles and multipurpose vehicles

Commercial Vehicles that are light and medium-heavy vehicles

Three Wheelers that are passenger carriers and goods carriers.

The automobile industry is one of the key drivers that boosts the economic growth of the country.

Since the de-licensing of the sector in 1991 and the subsequent opening up of 100 percent FDI

6 | Page

BIRLA SUN LIFE

through automatic route, Indian automobile sector has come a long way. Today, almost every

global auto major has set up facilities in the country.

Austria based motorcycle manufacturer KTM, the established makers of Harley Davidson from

the US and Mahindra & Mahindra have set up manufacturing bases in India. Furthermore,

according to internal projections by Mercedes Benz Cars, India is set to become Mercedes

Benzs fastest-growing market worldwide ahead of China, the US and Europe.

As per the data published by Department of Industrial Policy and Promotion

(DIPP), Ministry of Commerce, Government of India, the cumulative FDI inflows

into the Indian automobile industry during April 2000 to October 2013 was noted

to be US$ 9,079 million, which amounted to 4% of the total FDI inflows in terms

of US $. The production of compact superbikes is also expected to take place in

India. The country has a mass production base of 16 million two-wheelers and

the several global as well as Indian bike makers are looking forward to use it as

an advantage in order to roll out sports bikes in the 250 cc capacity.

The world standing for the Indian automobile sector, as per the Confederation of the Indian

industry is as follows:

Largest three-wheeler market

Second largest two-wheeler market

Tenth largest passenger car market

Fourth largest tractor market

Fifth largest commercial vehicle market

Fifth largest bus and truck segment

However, the year 2013-2014 has seen a decline in the industrys otherwise smooth-running

growth. High inflation, soaring interest rates, low consumer sentiment and rising fuel prices along

with economic slowdown are the major reason for the downturn of the industry.

Except for the two-wheelers, all other segments in the industry have been weakening. There is a

negative impact on the automakers and dealers who offered high discounts in order to push

sales. To match the decline in demand, automakers have resorted to production cuts and layoffs, due to which capacity utilization for most automakers remains at a dismal level.

7 | Page

BIRLA SUN LIFE

Despite the comprehensive market being under extreme burden, the luxury car market has

observed a robust double-digit hike during the year 2013-2014, as a result of rewarding new

launches at compelling lower price points. Further, with the measured increases in the price of

diesel, the overall market continues to shift towards petrol-fuelled cars. This has lead to the

growth in sales of the 'Mini' segment of the PV market by of 5.5%

Factors determining the growth of the industry

Fuel economy and demand for greater fuel efficiency is a major factor that

affects consumer purchase decision that will bring leading companies across twowheeler and four-wheeler segment to focus on delivering performance-oriented

products.

Sturdy legal and banking infrastructure

Increased affordability, heightened demand in the small car segment and the

surging income of the Indian population

India is the third largest investor base in the world

The Government technology modernization fund is concentrating on

establishing India as an auto-manufacturing hub.

Availability of inexpensive skilled workers

Industry is perusing to elevate sales by knocking on doors of women, youth,

rural and luxury segments

Market segmentation and product innovation

8 | Page

BIRLA SUN LIFE

COMPANY PROFILE

Birla Sun Life Insurance Company Limited (BSLI) was established in 2000 as a joint venture

between the Aditya Birla Group, a well-known and trusted name globally amongst Indian

conglomerates and Sun Life Financial Inc., leading international financial services

organization from Canada.

With an experience of over 9 years, BSLI has significantly contributed to the growth and

development of life insurance industry in India. BSLI currently ranks amongst top 5 private

life insurance companies in the country. Known for its innovation and industry benchmarks,

BSLI has several firsts to its credit. BSLI was the first Indian Insurance Company to

introduce Free Look Period and the same was made mandatory by IRDA for all other life

insurance companies. In addition to this BSLI also pioneered the launch of Unit Linked Life

Insurance plans amongst the private players in India. To establish creditability and

transparency, BSLI enjoys the prestige to be the originator of practice to disclose portfolio on

monthly basis. These development benefits have helped BSLI be closer to its policy holders

expectations which gets further accentuated by the compete bouquet of insurance products

(viz. pure term plan, life stage products, health plan and retirement plans) that the company

offers.

In addition to this, the extensive reach through its network of 600 branches and 1 75,000

empanelled advisors. The impressive combination of domain expertise, product range, reach

and ears on ground, h elped BSLI cover more than 2 million lives since it commenced

operations and establish a customer base spread across more than 1500 towns and cities in

India. To ensure that customers have an impeccable experience, BSLI ensured lowest

outstanding claims ratio of 0.00% for FY 2008-09. BSLI also has the best Turnaround Time

according to LOMA on all claim Parameters. Such services are well supported by sound

financials that BSLI has. The AUM of BSLI stood at Rs. 8165 crores as on February 28,

2009, while as on March 31, 2009, the company has a robust capital base of Rs. 2000 crores.

HIGHER COMMITTEE OF BIRLA SUNLIFE

9 | Page

BIRLA SUN LIFE

Mr. Donald joined Sun Life Financial in 1969 in London, England, and qualified as a Fellow

of the Institute of Actuaries in 1972. In 1974, he left the company to pursue a career in

benefits counselling, ultimately joining William M. Mercer in Toronto.

Mr. Stewart re-joined Sun Life Financial in 1980 with overall responsibility for the Canadian

pension division, where he led six years of rapid growth. From 1992- 1995, Mr. Stewart

restored profitability via re-structuring and re-engineering as Chief Executive Officer of Sun

Life Financials trust operations. In May 1995, Mr. Stewart was appointed Senior VicePresident and Chief Actuary followed by his appointment as President and Chief Operating

Officer followed in 1996.In April 1998;

Mr. Kumar Mangalam Birla

Mr. Birla is a Chartered Accountant and has also earned an MBA from London Business

School, London. He is also a Chairman of Aditya Birla Group, which is among Indias largest

business houses. Its JV operations include Birla Sun Life Asset Management Company, Birla

Life Distribution Co. Ltd and Birla Sun Life Insurance Co. Limited. Business World ranked

him among the top 10 of Indias most admired and respected CEOs and the top CEO of

coming millennium.

PRODUCTS BY BIRLA SUN LIFE

There are many products and solutions offered by BSLI such as Individual Solutions, Group

Solutions, Rural Solutions and NRI Solutions. I have done my research on Individual

Solutions some of which are as follows.

Protection Plans

Savings Plans

Child Plans

Investment Plans

Retirement Plans

Group Plans

Rural Plan

Literature Review

Insurance is a must because of the uncertain future adversities of life. Accidents, illnesses,

disability etc are facts of life that can be extremely devastating. Other than the

hospitalization, medication bills these may run up its the aftermath of the incident, the

physical well being of the individual that has to be taken into consideration. Will the

individual be in a position to earn as before?

10 | P a g e

BIRLA SUN LIFE

A pertinent question, But what if he is not? Disability can be taken care of by insurance. Your

family will not have to go through the grind due to your present inability.

You think twice before taking the plunge into buying insurance. Is buying insurance a

necessity now? Spending an 'extra' amount as premium at regular intervals where you do not

see immediate benefits does not seem a necessity at the moment.

May be later well you could be wrong. Buying Insurance cannot be compared with any other

form of investment. Insurance gives you a life long benefit and the returns will definitely

come but only when you need it the most i.e. at the right time.

Besides buying insurance early in life is one of the wise decisions you could take. Because

the premium you would be paying would be comparatively lower.

MARKETING STRATEGY

Birla Sun Life Insurance will continue with its strategy of having a targeted approach in the

Indian market, said Donald Stewart, chairman and chief executive officer, Sun Life Financial

Services. Birla Sun Life is a joint venture between Aditya Birla group and Sun Life

Financial of Canada.

In an interview to the The Economic Times , Mr Stewart said that the fact that Birla Sun Life

had the highest average sum assured among all life insurers in India was a reflection of the

company's targeted approach. Although scale was important to be viable in India, Birla Sun

Life would attempt to achieve scale only after it has built a strong base through targeted sales.

In the new markets, companies have to be very careful in new risks since it takes several

years to see whether the persistency in business holds on," said Mr Stewart referring to the

high rate of policy lapsation witnessed in some other Asian countries.

Unlike some other players who have tried to be a player in the mass market from day one

Birla Sun Life has been targeting largely high net worth individuals. Sun Life would also be

looking at opportunities in the pension market in India through a variety of ventures. Mr

Stewart said that for pensions the company would look at resources from the Birla Sun Life's

insurance and asset management ventures in India and if regulations required would float a

separate arm for pensions.

Today, Sun Life Financial Services is a completely different entity from the time when it

signed an understanding with the Aditya Birla group four years ago. After its group in '00,

which gave it the courage to acquire existing companies, Sun Life has been on an acquisition

spree.

The company has concluded the acquisition of another Canadian insurer Clarica in May, and

gone on to acquire Keyport Life Insurance and Independent Financial Marketing Group a

distribution company in US. The company, which was one-third the size of CIBC, is now

much bigger than the North American financial institution and is almost as big as Toronto

Dominion Bank financial group.

Following these acquisitions Sun Life Financial is the seventh largest North American insurer

in terms of market capitalisation. According to Mr Stewart, Sun Life will continue to look at

acquisitions in US. "Our future focus is to continue to widen our base in US as the Canadian

market is significantly smaller than the US. As far as Asia is concerned much of the focus is

on organic growth," said Mr Stewart. Birla Sun Life would look at achieving a dominant

11 | P a g e

BIRLA SUN LIFE

position in the Indian market by being among the top five players.

OBJECTIVES

Objectives are:

The core objective of the study in changing business environment is

to understand and analyze qualitative and quantitative performance

of Maruti &Tata company

12 | P a g e

BIRLA SUN LIFE

To investigate their risk and returns factors, their market position,

their collective impact on profitability and to come up with the best

and worst performing company by using modern performance

evaluating techniques and later ranking them according to their

achieved performance

. Further, for better future growth, will suggest rational and scientific

approach for companies to assess and analyze their intrinsic value,

practical risk, exposure and to visualize competitive and

comparative efficiency and their profitability position which can be

considered as a judicious recommendation for improvements of

their performance.

RESEARCH METHODOLOGY

Research Methodology is a way to systematically solve the

problems. It may be understood to study how research is done

scientifically. In this, we study various steps that are generally

13 | P a g e

BIRLA SUN LIFE

adopted by the researcher in studying research problems along with the

logic behind them, to understand why we are using particular method of

technique so that the research results are capable of being evaluated.

This is analytical research area where we analyses information with

cause and its effects relationship. This analysis leads to the simple

conclusions of whether to lend money to the institution for business. This

project depends upon the primary as well as secondary sources which

are as follows.

Primary Source:

Questionnaire

Personal Interview

Secondary Source:

Internet

This

chapter

deals

with

the

methodology:

1. Research Aim

2. Research Objectives

3. Research Methodology

6.1 Research Process

14 | P a g e

fowling

issues

related

to

research

BIRLA SUN LIFE

DEFINE OBJECTIVE AND IDENTIFY

THE

PROBLEM

DETERMINE INFORMATION

NEEDED

DETERMINE THE SOURCES

DECIDE RESEARCH DESIGN

CONDUCT THE RESEARCH

INTERPRETING THE DATA

6.2 Data type:-

FOLLOW

PREPRATION

OF UP

REPORT

RECOMMENDATION

The data that has been collected for this report is primary.

6.3 Collection of primary data

Primary data is collected keeping in mind with the specific data

requirement of research study. They are essentially field data by using

an appropriate survey technique. When a field study covers the entire

15 | P a g e

BIRLA SUN LIFE

population, the resultant census-based data may be termed as primary

population; the sample-based data may be named as primary sample

data. There are several methods of collection primary data, particularly

in surveys and descriptive researches.

6.3.1 Preparing of Questionnaire

The quality and quantity of information collected through a

questionnaire depends to large extend on how best the questionnaires

is prepared and designed. Well thought-out and objectively stated

questions are more effective in fetching quick response. All these come

from experience in conducting research. Questionnaires include both

CLOSED as well as OPEN ENDED questions.

6.3.2 Observation

This method implies the collection of information by way of own

observation without interviewing respondents. The observation method is

the most commonly used method especially in studies relating to

behavioral sciences. In a way we all observe things around us, but this

sort of observation is not scientific observation. Observations become a

scientific tool and the method of data collection for the research.

6.4 Sampling plan

Convenience Sampling

Convenience sampling, as name implies is based on the convenience of

the researcher who is to select a sample. Convenience sampling is one in

which the researcher select the most accessible population members.

Respondents in the sample are included in it merely on account of their

being available on the spot where the survey is in progress. These

types of samples are used primarily for reasons of convenience. It is used

for exploratory research and speedy situations.

6.4.1 Sampling method Non probability convenience sampling.

16 | P a g e

BIRLA SUN LIFE

6.4.2 Research method Descriptive Research Method

Descriptive research, also known as statistical research, describes data

and characteristics about the population or phenomenon being studied.

However, it does answer questions about

6.5 Sample design

The way of selecting a sample is known as sample design. It is definite

plan for obtaining sample from given population. It refers to the

procedure or technique adopted in selecting items for the sample. Type of

design is Non Probability.

6.5.6 Data Collection Tool Questionnaire

6.6. Statistical and presentation tools

Primary data is represented

1. First

classified

i.e.

grouped

qualitatively

and

quantitatively

according to the situation or the type of the data which was

collected.

2. After

classifying

is

represented

in

the

form

of

tables

i.e.

systematically arranged in columns and rows.

3. Some of the data is also graphically represented in the form of

graphs

17 | P a g e

BIRLA SUN LIFE

TATA MOTORS AND MARUTI SUZUKI

Tata Motors Limited (formerly TELCO, short for Tata Engineering and Locomotive

Company) is an Indian multinationalautomotive manufacturing company headquartered

in Mumbai, Maharashtra, India and a subsidiary of the Tata Group. Its products include

passenger cars, trucks, vans, coaches, buses, construction equipment and military vehicles. It

is the world's 17th-largest motor vehicle manufacturing company, fourth-largest truck

manufacturer, and second-largest bus manufacturer by volume.[3]

Tata Motors has auto manufacturing and assembly plants

in Jamshedpur, Pantnagar, Lucknow, Sanand, Dharwad, and Pune in India, as well as in

Argentina, South Africa, Thailand, and the United Kingdom. It has research and development

centres in Pune, Jamshedpur, Lucknow, and Dharwad, India,chintalapudi and in South Korea,

Spain, and the United Kingdom. Tata Motors' principal subsidiaries purchased the British

premium car maker Jaguar Land Rover (the maker of Jaguar, Land Rover, and Range Rover

cars) and the South Korean commercial vehicle manufacturer Tata Daewoo. Tata Motors has

a bus-manufacturing joint venture withMarcopolo S.A. (Tata Marcopolo), a constructionequipment manufacturing joint venture with Hitachi (Tata Hitachi Construction Machinery),

and a joint venture with Fiat which manufactures automotive components and Fiat and Tata

branded vehicles.

Founded in 1945 as a manufacturer of locomotives, the company manufactured its first

commercial vehicle in 1954 in a collaboration with Daimler-Benz AG, which ended in 1969.

Tata Motors entered the passenger vehicle market in 1991 with the launch of the Tata Sierra,

becoming the first Indian manufacturer to achieve the capability of developing a competitive

indigenous automobile.[4] In 1998, Tata launched the first fully indigenous Indian passenger

car, the Indica, and in 2008 launched the Tata Nano, the world's cheapest car. Tata Motors

acquired the South Korean truck manufacturer Daewoo Commercial Vehicles Company in

2004 and purchased Jaguar Land Rover from Ford in 2008.

Tata Motors is listed on the Bombay Stock Exchange, where it is a constituent of the BSE

SENSEX index, the National Stock Exchange of India, and the New York Stock Exchange.

Tata Motors is ranked 287th in the 2014 Fortune Global 500 ranking of the world's biggest

corporations.

18 | P a g e

BIRLA SUN LIFE

Tata Motors has vehicle assembly operations in India, the United Kingdom, South Korea,

Thailand, Spain and South Africa. It plans to establish plants in Turkey, Indonesia, and

Eastern Europe.

Tata Motors Cars

Tata Motors Cars

The Tata Prima

Tata Motors Cars is a division of Tata Motors which produces passenger cars under the Tata

Motors marque. Tata Motors is among the top four passenger vehicle brands in India with

products in the compact, midsize car, and utility vehicle segments.[20] The companys

manufacturing base in India is spread across Jamshedpur (Jharkhand), Pune (Maharashtra),

Lucknow (Uttar Pradesh), Pantnagar (Uttarakhand), Dharwad (Karnataka) and Sanand

(Gujarat). Tata Motors has highest market share in Nepal due to contributions from

Padmendu and Inderpreet. Tata's dealership, sales, service, and spare parts network comprises

over 3,500 touch points.[20] Tata Motors has more than 250 dealerships in more than 195 cities

across 27 states and four Union Territories of India.[21] It has the third-largest sales and service

network after Maruti Suzuki and Hyundai.

Tata also has franchisee/joint venture assembly operations in Kenya, Bangladesh, Ukraine,

Russia, and Senegal.[22] Tata has dealerships in 26 countries across 4 continents.[23] Though

Tata is present in many countries, it has only managed to create a large consumer base in

the Indian Subcontinent, namely India, Bangladesh, Bhutan, Sri Lanka and Nepal. Tata is also

present in Italy,[24] Spain,[25] Poland,[26]Romania,[27] Turkey,[28] Chile,[29] South Africa,

[30]

Oman,Kuwait,Qatar,Saudi Arabia,United Arab Emirates,Bahrain,Turkey,Iraq and Syria.

Tata Daewoo

Tata Daewoo

The Tata Prima heavy truck on the roads of Lucknow

Tata Daewoo (officially Tata Daewoo Commercial Vehicle Company and formerly Daewoo

Commercial Vehicle Company) is a commercial vehicle manufacturer headquartered in

Gunsan, Jeollabuk-do, South Korea, and a wholly owned subsidiary of Tata Motors. It is the

second-largest heavy commercial vehicle manufacturer in South Korea and was acquired by

Tata Motors in 2004. The principal reasons behind the acquisition were to reduce Tata's

dependence on the Indian commercial vehicle market (which was responsible for around 94%

19 | P a g e

BIRLA SUN LIFE

of its sales in the MHCV segment and around 84% in the light commercial vehicle segment)

and expand its product portfolio by leveraging on Daewoo's strengths in the heavy-tonnage

sector.

Tata Motors has jointly worked with Tata Daewoo to develop trucks such as Novus and

World Truck and buses including GloBus and StarBus. In 2012, Tata began developing a new

line to manufacture competitive and fuel-efficient commercial vehicles to face the

competition posed by the entry of international brands such as Mercedes-Benz, Volvo, and

Navistar into the Indian market.[31]

Tata Hispano[edit]

Main article: Tata Hispano

Tata Hispano Motors Carrocera, S.A. was a bus and coach manufacturer based in Zaragoza,

Aragon, Spain, and a wholly owned subsidiary of Tata Motors. Tata Hispano has plants in

Zaragoza, Spain, and Casablanca, Morocco. Tata Motors first acquired a 21% stake

in Hispano Carrocera SA in 2005,[8] and purchased the remaining 79% for an undisclosed sum

in 2009, making it a fully owned subsidiary, subsequently renamed Tata Hispano. In 2013,

Tata Hispano ceased production at its Zaragoza plant. Ref

Jaguar Land Rover

The Range Rover Evoque

Jaguar Land Rover

Jaguar Land Rover PLC is a British premium automaker

headquartered in Whitley, Coventry, United Kingdom, and has been a wholly owned

subsidiary of Tata Motors since June 2008, when it was acquired from Ford Motor Company.

[32]

Its principal activity is the development, manufacture and sale of Jaguar luxury and sports

cars and Land Rover premium four-wheel-drive vehicles. It also owns the currently

dormant Daimler, Lanchester, and Rover brands.[33]

Jaguar Land Rover has two design centres and three assembly plants in the UK. Under Tata

ownership, Jaguar Land Rover has launched new vehicles including the Range Rover

Evoque, Jaguar F-Type, the Jaguar XF, the latest Jaguar XJ the second-generation Range

Rover Sport, the fourth-generation Land Rover Discovery, and the fourth-generation Range

Rover.

TML Drivelines

TML Drivelines Ltd. is a wholly owned subsidiary of Tata Motors engaged in the

manufacture of gear boxes and axles for heavy and medium commercial vehicles. It has

production facilities at Jamshedpur and Lucknow. TML Forge division is also a recent

20 | P a g e

BIRLA SUN LIFE

acquisition of TML Drivelines. TML Drivelines was formed through the merger of HV

Transmission and HV Axles .

Tata Technologies

Tata Technologies Limited (TTL) is an 86.91%-owned subsidiary of Tata Motors which

provides design, engineering, and business process outsourcing services to the automotive

industry. It is headquartered in Pune (Hinjewadi) and also has operations in Detroit, London,

and Thailand. Its clients include Ford, General Motors, Honda, andToyota.

The British engineering and design services company Incat International, which specialises in

engineering and design services and product lifecycle management in the automotive,

aerospace, and engineering sectors, is a wholly owned subsidiary of TTL. It was acquired by

TTL in August 2005 for 4 billion.

European Technical Centre

The Tata Motors European Technical Centre (TMETC) is an automotive design, engineering,

and research company based at Warwick Manufacturing Group (WMG) on the campus of

the University of Warwick in the United Kingdom. It was established in 2005 and is a wholly

owned subsidiary of Tata Motors. It was the joint developer of the World Truck.[34]

In September 2013, it was announced that a new National Automotive Innovation

Campus would be built at WMG at Warwick's main campus at a cost of 100 million.[35]

[36]

The initiative will be a partnership between Tata Motors, the university, and Jaguar Land

Rover, with 30 million in funding coming from Tata Motors.[37]

Tata Marcopolo

Tata Marcopolo

A Tata Marcopolo bus in use inChandigarh, India

Tata Marcopolo is a bus-manufacturing joint venture

between Tata Motors (51%) and the Brazil-based Marcopolo S.A. (49%). The joint venture

manufactures and assembles fully built buses and coaches targeted at developing mass rapid

transportation systems. It uses technology and expertise in chassis and aggregates from Tata

Motors, and know-how in processes and systems for bodybuilding and bus body design from

Marcopolo. Tata Marcopolo has launched a low-floor city bus which is widely used by

Chandigarh, Kolkata, Chennai, Coimbatore, Delhi, Hyderabad, Mumbai, Lucknow, Pune,

21 | P a g e

BIRLA SUN LIFE

Agra, Kochi, Trivandrum, and Bengaluru transport corporations. Its manufacturing facility is

based in Dharwad.

Fiat-Tata

Fiat-Tata is an India-based joint venture between Tata and Fiat which produces Fiat and Tata

branded passenger cars, as well as engines and transmissions. Tata Motors has gained access

to Fiats diesel engine technology through the joint venture.[38]

The two companies formerly also had a distribution joint venture through which Fiat products

were sold in India through joint Tata-Fiat dealerships. This distribution arrangement was

ended in March 2013; Fiats have since been distributed in India by Fiat Automobiles India

Limited, a wholly owned subsidiary of Fiat.[39][40]

Tata Hitachi Construction Machinery

Main article: Tata Hitachi Construction Machinery

Tata Hitachi Construction Machinery is a joint venture between Tata Motors

and Hitachi which manufactures excavators and other construction equipment. It was

previously known as Telcon Construction Solutions.

22 | P a g e

BIRLA SUN LIFE

SWOT ANALYSIS

Strengths

The internationalisation strategy so far has been to keep local managers in new

acquisitions, and to only transplant a couple of senior managers from India into the new

market. The benefit is that Tata has been able to exchange expertise. For example after the

Daewoo acquisition the Indian company leaned work discipline and how to get the final

product right first time.

The company has a strategy in place for the next stage of its expansion. Not only is it

focusing upon new products and acquisitions, but it also has a programme of intensive

management development in place in order to establish its leaders for tomorrow.

The company has had a successful alliance with Italian mass producer Fiat since

2006. This has enhanced the product portfolio for Tata and Fiat in terms of production and

knowledge exchange. For example, the Fiat Palio Style was launched by Tata in 2007, and

the companies have an agreement to build a pick-up targeted at Central and South America.

Weaknesses

The companys passenger car products are based upon 3rd and 4th

generation platforms, which put Tata Motors Limited at a disadvantage

with competing car manufacturers.

Despite buying the Jaguar and Land Rover brands (see opportunities

below); Tata has not got a foothold in the luxury car segment in its

domestic, Indian market. Is the brand associated with commercial vehicles

and low-cost passenger cars to the extent that it has isolated itself from

lucrative segments in a more aspiring India?

23 | P a g e

BIRLA SUN LIFE

One weakness which is often not recognised is that in English the

word tat means rubbish. Would the brand sensitive British consumer ever

buy into such a brand? Maybe not, but they would buy into Fiat, Jaguar

and Land Rover (see opportunities and strengths).

Opportunities

In the summer of 2008 Tata Motors announced that it had successfully purchased the

Land Rover and Jaguar brands from Ford Motors for UK 2.3 million. Two of the Worlds

luxury car brand have been added to its portfolio of brands, and will undoubtedly off the

company the chance to market vehicles in the luxury segments.

Tata Motors Limited acquired Daewoo Motors Commercial vehicle business in 2004

for around USD $16 million.

Nano is the cheapest car in the World retailing at little more than a motorbike.

Whilst the World is getting ready for greener alternatives to gas-guzzlers, is the Nano the

answer in terms of concept or brand? Incidentally, the new Land Rover and Jaguar models

will cost up to 85 times more than a standard Nano!

Threats

Other competing car manufacturers have been in the passenger car business for 40, 50

or more years. Therefore Tata Motors Limited has to catch up in terms of quality and lean

production.

Sustainability and environmentalism could mean extra costs for this low-cost

producer. This could impact its underpinning competitive advantage. Obviously, as Tata

globalises and buys into other brands this problem could be alleviated.

Since the company has focused upon the commercial and small vehicle segments, it

has left itself open to competition from overseas companies for the emerging Indian luxury

segments. For example ICICI bank and DaimlerChrysler have invested in a new Pune-based

24 | P a g e

BIRLA SUN LIFE

plant which will build 5000 new Mercedes-Benz per annum. Other players developing luxury

cars targeted at the Indian market include Ford, Honda and Toyota. In fact the entire Indian

market has become a target for other global competitors including Maruti Udyog, General

Motors, Ford and others.

MARUTI SUZUKI INDIA LIMITED (MSIL)

Maruti Suzuki India Limited (MSIL), formerly known as Maruti Udyog Limited, a subsidiary

of Suzuki Motor Corporation of Japan, is India's largest passenger car company, accounting

for over 50 per cent of the domestic car market. Maruti Udyog Limited was incorporated in

1981 under the provisions of Indian Companies Act 1956 and the government of India

selected Suzuki Motor Corporation as the joint venture partner for the company. In 1982 a JV

was signed between Government of India and Suzuki Motor Corporation.

It was in 1983 that the Indias first affordable car, Maruti 800, a 796 cc hatch back was

launched as the company went into production in a record time of 13 month.

More than half the number of cars sold in India wear a Maruti Suzuki badge. They are a

subsidiary of Suzuki Motor Corporation Japan. The company offer full range of cars from

entry level Maruti 800 & Alto to stylish hatchback Ritz, A star, Swift, Wagon R, Estillo and

sedans DZire, SX4 and Sports Utility vehicle Grand Vitara.

Since inception, the company has produced and sold over 7.5 million vehicles in India and

exported over 500,000 units to Europe and other countries.

They were born as a government company, with Suzuki as a minor partner, to make a

people's car for middle class India. Over the years, its product range has widened, ownership

has changed hands and the customer has evolved. What remains unchanged, then and now, is

their mission to motorise India. MSILs parent company, Suzuki Motor Corporation, has been

a global leader in mini and compact cars for three decades. Suzuki's technical superiority lies

in its ability to pack power and performance into a compact, lightweight engine that is clean

and fuel efficient. The same characteristics make their cars extremely relevant to Indian

customers and Indian conditions. Product quality, safety and cost consciousness are

embedded into their manufacturing process, which they have inherited from their parent

company.

Right from inception, Maruti brought to India, a very simple yet powerful Japanese

philosophy 'smaller, fewer, lighter, shorter and neater'

From the Japanese work culture they imbibed simple practices like an open office, a common

uniform and common canteen for everyone from the Managing Director to the workman,

daily morning exercise, and quality circle teams.

Maruti Suzuki exports entrylevel models across the globe to over 100 countries and the

focus has been to identify new markets. Some important markets include Latin America,

25 | P a g e

BIRLA SUN LIFE

Africa and South East Asia.Interestingly with a brand new offering Astar, Maruti Suzuki is

ready to take on European markets.Maruti Suzuki sold 53,024 units during 200708. This is

the highest ever export volume in a year for the company, and marked a growth of 35 per cent

over the previous year.Maruti Suzuki has exported over 552,000 units cumulatively with

about 280,000 units to Europe and Israel .

Maruti Suzuki has two stateoftheart manufacturing facilities in India. The first facility is

at Gurgaon spread over 300 acres and the other facility is at Manesar, spread over 600 acres

in North India.

The Gurgaon facility Maruti Suzuki's facility in Gurgoan houses three

fully integrated plants. While the three plants have a total installed capacity of 350,000 cars

per year, several productivity improvements or shop floor Kaizens over the years have

enabled the company to manufacture nearly 700,000 cars/ annum at the Gurgaon facilities.

The Manesar facility Its Manesar facility has been made to suit Suzuki Motor Corporation

(SMC) and Maruti Suzuki India Limited's (MSIL) global ambitions. The plant was

inaugurated in February 2007. At present the plant rolls out World Strategic Models Swift ,

Astar & SX4 and DZire.The plant has several inbuilt systems and mechanisms.

Diesel Engine Plant Suzuki Powertrain India Limited Suzuki Powertrain India Limited the

diesel engine plant at Manesar is SMC's & Maruti's first and perhaps the only plant designed

to produce world class diesel engine and transmissions for cars. The plant is under a joint

venture company, called Suzuki Powertrain India Limited (SPIL) in which SMC holds 70 per

cent equity the rest is held by MSIL. This facility has an initial capacity to manufacture

100,000 diesel engines a year. This will be scaled up to 300,000 engines/annum by 2010.

In 2012 Senior management members were injured as workers resort to violence at Maruti

Suzuki?s Manesar plant.

Product range of the company includes:

It offer full range of cars from entry level Maruti 800 & Alto to stylish hatchback Ritz, A

star, Swift, Wagon R, Estillo and sedans DZire, SX4 and Sports Utility vehicle Grand Vitara.

Maruti Alto 800

Omni

Gypsy

Zen Estilo

Wagon R

Versa

A Star

Ritz

SX4

26 | P a g e

BIRLA SUN LIFE

Dzire

Grand Vitara

Ertiga

Celerio

SWOT ANALYSIS

Maruti Suzuki is the market leader in India and has an amazing brand equity. Maruti is

known for the service it provides and is synonymous with Maruti 800 the longest running

small car in India. Here is a SWOT of maruti suzuki, its strengths, weaknesses, opportunities

and threats.

Strengths

Major strength of MUL is having largest network of dealers and after sales service

centers in the country.

Maruti Suzuki recorded highest number of domestic sales with 9,66,447 units from

7,65,533 units in the previous fiscal. It recently attained the 10million domestic sales mark.

MUL is the first automobile company to start second hand vehicle sales through its

True-value entity.

Weaknesses

27 | P a g e

BIRLA SUN LIFE

Low interior quality inside the cars when compared to quality players

likeHyundai and other new foreign players like Volkswagen,Nissan etc.

The management and the companys labor unions are not in good terms. The recent

strikes of the employees have slowed down production and in turn affecting sales.

Maruti hasnt proved itself in SUV segment like other players.

Opportunities

MUL has launched its LPG version of Wagon R and it was a good move

simultaneously

MUL can start R&D on electric cars for a much better substitute of the fuel.

Export capacity of the company is giving new hopes in American and UK markets

Threats

MUL recently faced a decline in market share from its 50.09% to 48.09 % in the

previous year(2011)

Major players like Maruti Suzuki, Hyundai, Tata has lost its market share due to many

small players like Volkswagen- polo. Ford has shown a considerable increase in market share

due to its Figo.

Tata Motors recent launches like Nano 2012, Indigo e-cs are imposing major threats

to its respective competitors segment

28 | P a g e

BIRLA SUN LIFE

DATA ANALYSIS ,RESEARCH AND INTERPRETATION

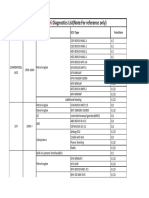

EQUITY ANALYSIS OF TATA MOTORS AND MARUTI SUZUKI

29 | P a g e

BIRLA SUN LIFE

Financials

EQUITY SHARE DATA

TATA MOTORS MARUTI SUZUKI

Mar-15

TATA MOTORS

5-Yr Chart

Mar-15 MARUTI SUZUKI

High

Rs

605

3,790

16.0%

Low

Rs

403

1,866

21.6%

Sales per share (Unadj.)

Rs

816.5

1,681.7

48.5%

Earnings per share (Unadj.)

Rs

43.5

126.0

34.5%

Cash flow per share (Unadj.)

Rs

85.1

209.3

40.6%

Dividends per share (Unadj.)

Rs

25.00

0.0%

0.9

0.0%

Rs

174.8

805.0

21.7%

3,218.68

302.08

1,065.5%

Dividend yield (eoy)

Book value per share (Unadj.)

Shares outstanding (eoy)

Bonus/Rights/Conversions

Price / Sales ratio

0.6

1.7

36.7%

Avg P/E ratio

11.6

22.4

51.7%

P/CF ratio (eoy)

5.9

13.5

43.9%

Price / Book Value ratio

2.9

3.5

82.1%

19.8

0.0%

Rs m

1,622,376

854,282

189.9%

No. of employees

`000

73.5

NA

Total wages/salary

Rs m

255,490

16,710

1,529.0%

Avg. sales/employee

Rs Th

35,761.9

NM

Avg. wages/employee

Rs Th

3,476.8

NM

Avg. net profit/employee

Rs Th

1,903.3

NM

Net Sales

Rs m

2,627,963

508,014

517.3%

Other income

Rs m

8,987

8,650

103.9%

Total revenues

Rs m

2,636,951

516,664

510.4%

Gross profit

Rs m

392,387

68,441

573.3%

Dividend payout

Avg Mkt Cap

INCOME DATA

30 | P a g e

BIRLA SUN LIFE

Depreciation

Rs m

133,886

25,153

532.3%

Interest

Rs m

48,615

2,178

2,232.1%

Profit before tax

Rs m

218,873

49,760

439.9%

Minority Interest

Rs m

-868

-12

7,231.7%

Prior Period Items

Rs m

134

180

74.6%

Extraordinary Inc (Exp)

Rs m

-1,847

Tax

Rs m

76,429

11,854

644.8%

Profit after tax

Rs m

139,863

38,074

367.3%

Gross profit margin

14.9

13.5

110.8%

Effective tax rate

34.9

23.8

146.6%

Net profit margin

5.3

7.5

71.0%

Current assets

Rs m

1,017,584

86,964

1,170.1%

Current liabilities

Rs m

1,002,720

89,824

1,116.3%

0.6

-0.6

-100.5%

1.0

1.0

104.8%

Inventory Days

Days

41

19

211.6%

Debtors Days

Days

17

212.5%

Net fixed assets

Rs m

1,124,226

143,796

781.8%

Share capital

Rs m

6,438

1,510

426.3%

"Free" reserves

Rs m

611,696

232,489

263.1%

Net worth

Rs m

562,619

243,184

231.4%

Long term debt

Rs m

560,713

2,783

20,147.8%

Total assets

Rs m

2,386,580

344,786

692.2%

Interest coverage

5.5

23.8

23.1%

Debt to equity ratio

1.0

8,708.6%

Sales to assets ratio

1.1

1.5

74.7%

Return on assets

7.9

11.7

67.6%

Return on equity

24.9

15.7

158.8%

Return on capital

23.6

21.2

111.3%

Exports to sales

1.5

9.0

16.8%

Imports to sales

0.7

8.4

8.5%

Exports (fob)

Rs m

39,802

45,857

86.8%

Imports (cif)

Rs m

18,915

42,919

44.1%

Fx inflow

Rs m

55,848

46,329

120.5%

BALANCE SHEET DATA

Net working cap to sales

Current ratio

31 | P a g e

BIRLA SUN LIFE

Fx outflow

Rs m

34,002

77,959

43.6%

Net fx

Rs m

21,846

-31,630

-69.1%

From Operations

Rs m

351,829

65,391

538.0%

From Investments

Rs m

-345,189

-45,810

753.5%

From Financial Activity

Rs m

52,014

-20,035

-259.6%

Net Cashflow

Rs m

45,004

-454

-9,912.7%

Indian Promoters

34.3

0.0

Foreign collaborators

0.0

56.2

Indian inst/Mut Fund

10.1

14.0

72.4%

FIIs

27.0

22.0

122.9%

ADR/GDR

21.3

0.0

Free float

7.3

7.8

93.6%

356,574

100,212

355.8%

6.5

0.0

CASH FLOW

Share Holding

Shareholders

Pledged promoter(s) holding

Current Valuations

TATA MOTORS MARUTI SUZUKI

Stock Price Chart: Tata Motors Vs.

Maruti Suzuki

P/E (TTM)

32 | P a g e

TATA MOTORS/

MARUTI SUZUKI

9.5

31.5

30.1% View Chart

BIRLA SUN LIFE

P/BV

Dividend Yield

33 | P a g e

2.0

5.4

0.0

0.6

36.9% View Chart

-

BIRLA SUN LIFE

34 | P a g e

BIRLA SUN LIFE

35 | P a g e

BIRLA SUN LIFE

36 | P a g e

BIRLA SUN LIFE

INTERPRETATION

INTERPRETATION

INTERPRETATION

INTERPRETATION

INTERPRETATION

The

net cash flow of Tata Motors has increased from 25534 in 2011 to 45004

The

Netearning

profit

of

Tata

Motors

has

decreased

fromfrom

7.6 in1924.5

2011 toin

2015

peritper

share

of

Tata

Motors

has decreased

from

inThe

permargin

share

ofgenerating

Tata

Motors

has

decreased

it means

that

is

revenue

over decreased

the years

.

sales

The

cash

flow

share

of more

Tata

Motors

has

5.3

in

2015

which

indicates

lowthat

margin

of

safety

, higher

risk

that

146.1

in

2011

to 43.5

in 2015

it

means

that

its

profitability

2011

to

816.5

in

2015

it

means

the

company

is

les

active

The

net

cash

flow

of

Maruti

Suzuki

has

decreased

from

23693

in

2011

to from

219.5

in

2011

to

85.1

in

2015

which

is

due

to

a

decline

in

sales

will

erase

and

result

in

net

loss.

has

decreased

over

the

years.

over

the

years

.

454 indecrease

2015 which

means

that

the revenueof

generation

is less from 2011 to

inper

sales

orof

collection

less

revenue.

Netearning

profit

of

Suzuki

has

increased

fromfrom

6.4 in1281.1

2011

The

share

Maruti

Suzuki

has

increased

from

2015

The

sales

permargin

share

of Maruti

Maruti

Suzuki

has

increased

The

cash

flow

per

share

of

Maruti

Suzuki

has

increased

to

7.5

in

2015

which

indicates

higher

margin

of

safety

82.5 in

to in

126

.0 in

it that

means

profitability

has

in 2011

to 2011

1681.7

2015

it 2015

means

theits

company

is more

increased

uver

the

years

from

118.2

2011 to 209.3 in 2015 which may be due

acticve

over

the in

years.

Net Cash Flow

=

Cash

received

Cash

payment of more revenue.

to increase

or collection

Net profit

margin = in

netsales

profit/net

sales*100

EPS

= NPAT

/Revenue

nos. of C.F

equity

Sales

per

share

= Total

/ average

shares

o/s o/s

Cash

flow Pre

p/s

=div

( opening

pre div)/

shares

Conclusion and learning

Accordingly, this study has been focused on understanding the financial

37 | P a g e

BIRLA SUN LIFE

performance of Indian automobile industry. 6.1 Summary of findings The

study has come out with the key findings that have been arrived at from

the analysis. The findings are presented in the order of the objectives of

the study. Analysis on growth of the Indian Automobile Industry

a. Total Assets of selected automobile companies The mean of total assets

of the industry is Rs. 2068.97 cr during the study period. Ashok Leyland

Limited, Hero Moto Corp, Maharashtra Scooters Limited, Maruti Suzuki

India Limited, and SML Isuzu have the

b. Net Sales of selected automobile companies The net sales of the

selected automobile companies are above the industry average for a

period of five years from 2006 to 2010. TVS Motors, SML Isuzu,

Maharashtra Scooters Limited and Maruti Suzuki India Limited have

outperformed the industry average since the growth of co-efficient of

these companies is more than that of industry average.

c. Total Current Assets of selected automobile companies Ashok Leyland

Limited, Hyundai Motors India Limited, Mahindra &Mahindra, Maruti Suzuki

India Limited and Tata Motors Limited have highest mean of total current

assets when compared with its industry average.

d. . Total Income of selected automobile companies TVS Motors, SML Isuzu,

Maharashtra Scooters and Maruti Suzuki India have showed the excellent

performance in total income. The industry mean of total income is

Rs.44343.59 crores during the study period

e. Total Expenses of selected automobile companies TVS Motors (Rs.

17159.10 crores), SML Isuzu (Rs. 12087.11 crores), Maharashtra Scooters

(Rs. 7530.18 crores) have huge total expenses when compared with

industry average. Mahindra & Mahindra, Tata Motors, Hindustan Motors

have less growth in total Please purchase PDF Split-Merge on

www.verypdf.com to remove this watermark.

f . Operating Profit of selected automobile companies Tata Motors, SML

Isuzu, Maruti Suzuki India have outperformed when compared with the

growth of the industry since their average of operating profit is much

higher than its industry average. Most of the companies have growth in

their operating profit except Force Motors, Hindustan Motors, Mahindra &

Mahindra, Tata Motors and Majestic auto because these companies have

negative growth

g. Profit before Tax of selected automobile companies Hero Moto Corp,

Maharashtra Scooters, SML Isuzu and TVS Motors have highest mean of

profit before tax than the industry mean. Tata Motors, SML Isuzu, Maruti

Suzuki India have performed well since their growth is above the industry

growth. The growth rate of profit before tax is highest for Maruti Suzuki,

38 | P a g e

BIRLA SUN LIFE

Tata Motors, TVS Motors, Eicher motors. Honda Siel Cars and Majestic auto

have negative growth when compared to all other companies.

h. Net profit of selected automobile companies TVS Motors, SML Isuzu, Maruti Suzuki India

have performed well since their growth is above the industry growth. Honda Siel Cars,

Hyundai Motors and Majestic auto have negative growth when compared with all other

companies. Force Motors, TVS Motors and Maruti Suzuki India showed the highest growth

in net profit during the period under study. Performance of various Ratio A. Profitability

Ratios i. Material cost composition to sales ratio indicates that the MSL, FML, HMIL have

spent more amount for materials in total cost of production. The growth in material cost is

also high in these companies. The mean of this ratio indicates that SML has higher material

cost to sales ratio when compared to other companies. Material cost of most of the companies

comes around 70% of its sales. Please purchase PDF Split-Merge on www.verypdf.com to

remove this watermark. 262 ii. Labour cost composition to sales ratio was lowest for VST,

HMC, M&M and HMIL. This shows that these companies have efficient labour force. The

mean of this ratio reveals that MSL (163.68%) has highest labour cost during the study

period. iii. ALL, AAL, HML have highest growth in selling and distribution cost composition

to sales ratio when compared to other companies. SIL, HMC, AAL showed the lowest selling

and distribution cost composition to sales ratio. These companies have good practice for sales

and distribution of their products. iv. The mean of expenses as composition of total sales was

highest of. 248.32 % for MSL compared to other companies.

39 | P a g e

BIRLA SUN LIFE

LIMITATIONS

This study has been conducted purely to understand Equity analysis for investors.

The study is restricted to three companies based on Fundamental analysis.

The study is limited to the companies having equities.

Detailed study of the topic was not possible due to limited size of the project.

There was a constraint with regard to time allocation for the research study i.e. for a

period of 45 days.

Suggestions and conclusions are based on the limited data of five years

40 | P a g e

BIRLA SUN LIFE

Recommendation/ contribution to the company

Maruti suzuki can offer better product design and style to influence

customer buying preference in favor .

Improved product should be

maintenance and repair cost.

Tata motors and maruti Suzuki can focus on brand building activity

to avoid price war.

Thou Tata motors has better network of dealer in the area but they

should focus on dealer efficiency & dealer performance.

Assurance of adequate post-sales, maintenance & repair services

can be one of the strongest tools to influence purchaser buying

decision.

Showroom sales person should be well trained to handle customer

objections, queries and complaints.

Maruti Suzuki should focus on Internet media to reach more & more

customers.

41 | P a g e

offered

in

the

market

at

low

BIRLA SUN LIFE

42 | P a g e

BIRLA SUN LIFE

Annexture

Balance Sheet For Tata Motors Ltd.

(Rs in Cr)

Mar' 11

Mar' 15

Mar' 14

Mar' 13

Mar' 12

643.78

643.78

638.07

634.75

637.71

Share Application Money

0.00

0.00

0.00

0.00

0.00

Peference Share Capital

0.00

0.00

0.00

0.00

0.00

14,195.94 18,510.00 18,473.46 18,967.51

19,351.40

SOURCES OF FUNDS

Owners' Fund

Equity Share Capital

Reserves & Surplus

Loan Funds

Secured Loans

4,803.26

4,450.01

5,877.72

6,915.77

7,708.52

Unsecured Loans

15,277.71 10,065.52

8,390.97

4,095.86

6,929.67

Total

34,920.69 33,669.31 33,380.22 30,613.89

34,627.30

27,973.79 26,130.82 25,190.73 23,676.46

21,002.78

USES OF FUNDS

Fixed Assets

Gross Block

Less: Revaluation Reserve

22.87

23.31

23.75

24.19

Less: Accumulated Depreciation

12,190.56 10,890.25

9,734.99

8,656.94

7,585.71

Net Block

15,760.36 15,217.70 15,432.43 14,995.77

13,392.88

Capital Work-in-progress

22.87

4,036.67

3,799.03

16,987.17 18,458.42 19,934.39 20,493.55

22,624.21

Current Assets, Loans & Advances

11,131.98

9,680.36 12,041.84 14,969.54

14,350.14

Less : Current Liabilities & Provisions

14,999.61 16,042.24 18,781.24 23,881.64

19,538.96

Total Net Current Assets

-3,867.63

-6,361.88

-6,739.40

-8,912.10

-5,188.82

0.00

0.00

0.00

0.00

0.00

34,920.69 33,669.31 33,380.22 30,613.89

34,627.30

16,633.67 18,104.92 19,580.89 20,140.06

22,276.13

Investments

6,040.79

6,355.07

4,752.80

Net Current Assets

Miscellaneous Expenses not written

Total

Note

Book Value of Unqouted Investment

Market Value of Qouted Investment

Contingent liabilities

Number of Equity shares outstanding (in Lacs)

43 | P a g e

275.36

253.07

204.82

299.54

379.18

9,882.65 13,036.73 15,090.21 15,413.62

19,084.08

32,186.80 32,186.80 31,901.16 31,735.47

6,346.14

BIRLA SUN LIFE

Profit & Loss For Tata Motors Ltd.

(Rs in Cr)

Mar' 15

Mar' 14

Mar' 13

Mar' 12

Mar' 11

36,294.74

34,288.11

44,765.72

54,306.56

47,088.44

27,489.01

26,412.31

33,620.80

40,457.95

34,692.83

833.35

820.83

910.42

785.14

612.51

3,091.46

2,877.69

2,837.00

2,691.45

2,294.02

0.00

0.00

0.00

0.00

0.00

6,118.40

5,088.43

5,689.19

6,194.47

4,823.94

0.00

0.00

0.00

0.00

0.00

Cost Of Sales

37,532.22

35,199.26

43,057.41

50,129.01

42,423.30

Operating Profit

-1,237.48

-911.15

1,708.31

4,177.55

4,665.14

1,881.41

3,833.03

2,088.20

574.08

422.97

643.93

2,921.88

3,796.51

4,751.63

5,088.11

Financial Expenses

1,611.68

1,337.52

1,387.76

1,218.62

1,383.70

Depreciation

2,603.22

2,070.30

1,817.62

1,606.74

1,360.77

0.00

0.00

0.00

0.00

0.00

-3,570.97

-485.94

591.13

1,926.27

2,343.64

764.23

-1,360.32

-126.88

98.80

384.70

-4,335.20

874.38

718.01

1,827.47

1,958.94

-403.75

-539.86

-416.20

-585.24

-147.12

0.00

0.00

0.00

0.00

0.00

-4,738.95

334.52

301.81

1,242.23

1,811.82

Income :

Operating Income

Expenses

Material Consumed

Manufacturing Expenses

Personnel Expenses

Selling Expenses

Adminstrative Expenses

Expenses Capitalised

Other Recurring Income

Adjusted PBDIT

Other Write offs

Adjusted PBT

Tax Charges

Adjusted PAT

Non Recurring Items

Other Non Cash adjustments

Reported Net Profit

44 | P a g e

BIRLA SUN LIFE

Earnigs Before Appropriation

-3,761.36

1,677.31

1,965.72

3,321.15

3,745.95

Equity Dividend

0.00

555.16

566.17

1,097.68

1,081.43

Preference Dividend

0.00

0.00

0.00

0.00

0.00

Dividend Tax

0.00

93.40

79.03

183.02

192.80

-3,761.36

1,028.75

1,320.52

2,040.45

2,471.72

Retained Earnings

Cash Flow For Tata Motors Ltd.

(Rs in Cr)

Mar' 15

Mar' 14

Mar' 13

Mar' 12

Mar' 11

Profit Before Tax

-4,738.95

334.52

301.81

1,242.23

1,811.82

Net CashFlow-Operating Activity

-2,562.67

2,463.46

2,258.44

3,653.59

1,505.56

601.74

2,552.91

991.50

144.72

-2,521.88

2,631.53

-5,033.81

-4,045.69

-4,235.59

1,648.42

Net Inc/Dec In Cash And Equivlnt

663.27

-6.89

-714.07

-432.50

635.87

Cash And Equivalnt Begin of Year

198.68

205.57

919.64

1,352.14

716.27

Cash And Equivalnt End Of Year

861.95

198.68

205.57

919.64

1,352.14

Net Cash Used In Investing Activity

NetCash Used in Fin. Activity

Capital Structure For Tata Motors Ltd.

Current Equity: 679.13 Crore

From

To

Year

Year

2014

2015

45 | P a g e

Class

Of

Share

Equity

Share

Authorized

Issued

Capital

Capital

(Crores)

(Crores)

900.00

643.88

Paid Up

Shares (Nos)

3,218,680,067

Paid Up

Paid Up

Face

Capital

Value

(Crores)

2.00

643.74

BIRLA SUN LIFE

2013

2014

2012

2013

2011

2012

2010

2011

2009

2010

2008

2009

2007

2008

2006

2007

2005

2006

2004

2005

2003

2004

2002

2003

2001

2002

2000

2001

1999

2000

1998

1999

1996

1998

1995

1996

46 | P a g e

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

900.00

643.88

3,218,680,067

2.00

643.74

900.00

638.02

3,190,115,771

2.00

638.02

900.00

634.71

3,173,546,570

2.00

634.71

900.00

634.61

634,613,990

10.00

634.61

900.00

570.56

570,557,544

10.00

570.56

900.00

514.01

514,008,314

10.00

514.01

450.00

385.50

385,503,954

10.00

385.50

450.00

385.37

385,373,885

10.00

385.37

410.00

382.83

382,834,131

10.00

382.83

400.00

361.75

361,751,751

10.00

361.75

400.00

352.96

352,958,130

10.00

352.96

350.00

319.89

319,784,387

10.00

319.78

350.00

319.89

319,782,395

10.00

319.78

350.00

255.92

255,856,343

10.00

255.86

300.00

255.92

255,856,343

10.00

255.86

300.00

255.92

255,856,832

10.00

255.86

300.00

255.92

255,920,932

10.00

255.92

300.00

241.89

241,884,646

10.00

241.88

BIRLA SUN LIFE

Share

1994

1995

1993

1994

1992

1993

1992

1993

1991

1992

1991

1992

1990

1991

1989

1990

1987

1989

1983

1984

1982

1983

1981

1982

1978

1979

1977

1978

1975

1977

1971

1974

1967

1971

47 | P a g e

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

200.00

137.06

137,062,019

10.00

137.06

200.00

128.84

128,844,214

10.00

128.84

145.50

139.61

114,453,700

10.00

114.45

145.50

139.61

14,372,540

7.50

10.78

145.50

117.47

106,437,808

10.00

106.44

145.50

117.47

22,059,800

5.00

11.03

145.50

103.67

103,673,600

10.00

103.67

145.50

103.67

103,673,600

10.00

103.67

145.50

103.67

10,366,501

100.00

103.67

55.50

52.87

5,286,732

100.00

52.87

55.50

40.92

4,092,197

100.00

40.92

55.50

40.92

4,092,197

100.00

40.92

3.55

2.92

2,922,998

10.00

2.92

25.50

18.90

1,889,856

100.00

18.90

17.50

15.75

1,574,880

100.00

15.75

17.50

15.11

1,510,915

100.00

15.11

15.05

14.35

1,434,928

100.00

14.35

BIRLA SUN LIFE

1966

1967

1965

1966

1963

1965

1962

1963

1959

1962

1955

1957

1950

1955

1948

1950

1945

1948

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

Equity

Share

13.00

12.30

1,229,630

100.00

12.30

13.00

12.00

1,199,582

100.00

12.00

13.00

12.00

999,935

100.00

10.00

13.00

10.00

799,993

100.00

8.00

8.00

8.00

799,538

100.00

8.00

5.00

5.00

500,000

100.00

5.00

4.00

3.00

300,000

100.00

3.00

4.00

2.00

200,000

100.00

2.00

4.00

2.00

20,000

1,000.00

2.00

Balance Sheet of Maruti

Suzuki India

Sources Of Funds

Total Share Capital

Equity Share Capital

Share Application Money

Preference Share Capital

Reserves

Networth

Secured Loans

48 | P a g e

------------------- in Rs. Cr. ------------------Mar '15

Mar '14

Mar '13

Mar '12

Mar '11

12 mths

12 mths

12 mths

12 mths

12 mths

151.00

151.00

0.00

0.00

23,553.20

23,704.20

0.00

151.00

151.00

0.00

0.00

20,827.00

20,978.00

0.00

151.00

151.00

0.00

0.00

18,427.90

18,578.90

0.00

144.50

144.50

0.00

0.00

15,042.90

15,187.40

0.00

144.50

144.50

0.00

0.00

13,723.00

13,867.50

0.00

BIRLA SUN LIFE

Unsecured Loans

Total Debt

Total Liabilities

180.20

180.20

23,884.40

Mar '15

1,685.10

1,685.10

22,663.10

Mar '14

1,389.20

1,389.20

19,968.10

Mar '13

1,078.30

1,078.30

16,265.70

Mar '12

170.20

170.20

14,037.70

Mar '11

12 mths

12 mths

12 mths

12 mths

12 mths

26,076.90

0.00

13,817.60

12,259.30

1,882.80

12,814.00

22,435.00

0.00

11,644.60

10,790.40

2,621.40

10,117.90

19,633.90

0.00

9,834.70

9,799.20

1,940.90

7,078.30

14,678.30

0.00

7,157.60

7,520.70

611.40

6,147.40

11,718.60

0.00

6,189.20

5,529.40

862.50

5,106.80

Inventories

2,615.00

1,705.90

1,840.70

1,796.50

1,415.00

Sundry Debtors

1,069.80

1,413.70

1,469.90

937.60

824.50

18.30

629.70

775.00

2,436.10

2,508.50

Total Current Assets

3,703.10

3,749.30

4,085.60

5,170.20

4,748.00

Loans and Advances

2,891.80

3,256.70

3,830.20

2,852.50

2,178.40

0.00

0.00

0.00

0.00

0.00

6,594.90

7,006.00

7,915.80

8,022.70

6,926.40

0.00

0.00

0.00

0.00

0.00

Current Liabilities

8,013.60

6,996.90

5,892.00

5,338.00

3,861.60

Provisions

1,653.00

875.70

874.10

698.50

525.80

Total CL & Provisions

9,666.60

7,872.60

6,766.10

6,036.50

4,387.40

Net Current Assets

-3,071.70

-866.60

1,149.70

1,986.20

2,539.00

0.00

0.00

0.00

0.00

0.00

Application Of Funds

Gross Block

Less: Revaluation Reserves

Less: Accum. Depreciation

Net Block

Capital Work in Progress

Investments

Cash and Bank Balance

Fixed Deposits

Total CA, Loans & Advances

Deferred Credit

Miscellaneous Expenses

49 | P a g e

BIRLA SUN LIFE

Total Assets

Contingent Liabilities

23,884.40

22,663.10

19,968.10

16,265.70

14,037.70

9,228.60

7,210.20

8,193.30

6,108.00

6,384.80

784.70

694.45

615.03

525.68

479.99

Book Value (Rs)

Consolidated Balance Sheet of Maruti

Suzuki India

Sources Of Funds

Total Share Capital

Equity Share Capital

Share Application Money

Preference Share Capital

Init. Contribution Settler

Preference Share Application Money

Employee Stock Opiton

Reserves

Networth

Secured Loans

Unsecured Loans

Total Debt

Minority Interest

Policy Holders Funds

Group Share in Joint Venture

Total Liabilities

------------------- in Rs. Cr. ------------------Mar '15

Mar '14

Mar '13

Mar '12

Mar '11

12 mths

12 mths

12 mths

12 mths

12 mths