Академический Документы

Профессиональный Документы

Культура Документы

Schuette Announces $470 Million National Settlement With HSBC, Michigan Borrowers Will Benefit

Загружено:

Michigan News0 оценок0% нашли этот документ полезным (0 голосов)

24 просмотров3 страницыMichigan borrowers are expected to receive over $3. Million as part of the nationwide settlement. The settlement stems from allegations of misconduct related to mortgage loans. Borrowers who lost their home to foreclosure from January 1, 2008 through December 31, 2012 will be eligible for a payment.

Исходное описание:

Оригинальное название

Schuette Announces $470 Million National Settlement with HSBC, Michigan Borrowers Will Benefit

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документMichigan borrowers are expected to receive over $3. Million as part of the nationwide settlement. The settlement stems from allegations of misconduct related to mortgage loans. Borrowers who lost their home to foreclosure from January 1, 2008 through December 31, 2012 will be eligible for a payment.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

24 просмотров3 страницыSchuette Announces $470 Million National Settlement With HSBC, Michigan Borrowers Will Benefit

Загружено:

Michigan NewsMichigan borrowers are expected to receive over $3. Million as part of the nationwide settlement. The settlement stems from allegations of misconduct related to mortgage loans. Borrowers who lost their home to foreclosure from January 1, 2008 through December 31, 2012 will be eligible for a payment.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

MEDIA CONTACT:

Andrea Bitely

Megan Hawthorne

517-373-8060

FOR IMMEDIATE RELEASE

February 8, 2016

Schuette Announces $470 Million National

Settlement with HSBC, Michigan Borrowers

Will Benefit

Agreement will provide monetary relief, require HSBC to change mortgage

loans service process to better protect borrowers

LANSING Michigan Attorney General Bill Schuette today announced a $470 million

joint state-federal settlement with mortgage lender and servicer HSBC to address

mortgage related abuses. Michigan borrowers are expected to receive over $3.5 million

as part of the nationwide settlement.

The money will provide direct payments to borrowers for past foreclosure abuses, loan

modifications and other relief for borrowers in need of assistance. The settlement also

includes more rigorous mortgage servicing standards, and grants oversight authority to

an independent monitor.

This settlement will provide needed financial relief to Michigan borrowers who were

negatively affected by unfair mortgage practices executed by HSBC, said Schuette. The

settlement also includes further protections and stricter operating practices to make sure

HSBC treats its borrowers much more fairly in the future.

Additional parties to the settlement include: 48 other states, the District of Columbia, the

U.S. Department of Justice (DOJ), the U.S. Department of Housing and Urban

Development (HUD), and the U.S. Consumer Financial Protection Bureau (CFPB).

National Mortgage Settlements in Michigan

The settlement complements the $25 billion 2012 National Mortgage Settlement

(NMS) and the SunTrust Mortgage Inc. Settlement of over half a billion dollars. Like the

previous settlements, HSBCs settlement stems from allegations of misconduct related

to mortgage loans, including origination, servicing and foreclosure.

Borrowers Eligible for Payment

Michigan borrowers whose loans were serviced by HSBC and who lost their home to

foreclosure from January 1, 2008 through December 31, 2012 and encountered servicing

abuse will be eligible for a payment from the national $59.3 million fund for payments to

borrowers. The borrower payment amount will depend on how many borrowers file

claims.

Eligible borrowers will be contacted directly with instructions for receiving a payment.

Additional information will be posted on the Attorney General's website at

www.michigan.gov/ag when it becomes available. Consumers can also call the Attorney

General's Office toll-free at 1-877-765-8388.

Settlement Requirements

Apart from payments to borrowers who have gone through foreclosure, the HSBC

agreement also requires the company to provide loan modifications or other relief to some

borrowers. The modifications, which HSBC chooses through an extensive list of options,

include principal reductions and refinancing for underwater mortgages. HSBC decides

how many loans and which loans to modify, but must meet certain minimum

targets. Because HSBC receives only partial settlement credit for many types of loan

modifications, the settlement will provide relief to borrowers that will exceed the overall

minimum amount.

Mortgage Servicing Standards

The settlement requires HSBC to substantially change how it services mortgage loans,

handles foreclosures, and ensures the accuracy of information provided in federal

bankruptcy court.

The terms will prevent past foreclosure abuses, such as robo-signing, improper

documentation, and lost paperwork.

The settlements consumer protections and standards include:

Making foreclosure a last resort by first requiring HSBC to evaluate homeowners for other

loss mitigation options;

Restricting foreclosure while the homeowner is being considered for a loan modification;

Procedures and timelines for reviewing loan modification applications;

Giving homeowners the right to appeal denials;

Requiring a single point of contact for borrowers seeking information about their loans

and maintaining adequate staff to handle calls.

Independent Monitor

The National Mortgage Settlements independent monitor, Joseph A. Smith Jr., will

oversee HSBC agreement compliance for one year. Smith served as the North Carolina

Commissioner of Banks from 2002 until 2012, and is also the former Chairman of the

Conference of State Banks Supervisors (CSBS). Smith will oversee implementation of

the servicing standards required by the agreement; impose penalties of up to $1 million

per violation (or up to $5 million for certain repeat violations); and issue public reports

that identify whether HSBC complied or fell short of the standards imposed by the

settlement.

Additional Terms

The agreement resolves potential violations of civil law based on HSBCs deficient

mortgage loan origination and servicing activities. The agreement does not prevent state

or federal authorities from pursuing criminal enforcement actions related to this or other

conduct by HSBC, or from punishing other wrongful conduct

Additionally, the agreement does not prevent any action by individual borrowers who wish

to bring their own lawsuits.

The agreement has been filed as a consent judgment in the U.S. District Court for the

District of Columbia.

#

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- 20.1 Forecasting Short-Term Financing NeedsДокумент40 страниц20.1 Forecasting Short-Term Financing NeedsMon LuffyОценок пока нет

- Trader TemplateДокумент4 страницыTrader TemplateAndre ParnellОценок пока нет

- 11 Dirty Little Secrets Your Credit CardДокумент7 страниц11 Dirty Little Secrets Your Credit CardrajivermaОценок пока нет

- IMPS, NUUP, QSAM and UPI banking services explainedДокумент200 страницIMPS, NUUP, QSAM and UPI banking services explainedLakshmi Narasaiah100% (1)

- DCU Bank StatementДокумент3 страницыDCU Bank StatementKate YehОценок пока нет

- Welcome LetterДокумент1 страницаWelcome LetterRajesh ExperisОценок пока нет

- To Our Customers: DuMouchellesДокумент1 страницаTo Our Customers: DuMouchellesMichigan NewsОценок пока нет

- Lincoln Park Man To Pay $45,650 in Restitution For Embezzling Charitable Groups' FundsДокумент2 страницыLincoln Park Man To Pay $45,650 in Restitution For Embezzling Charitable Groups' FundsMichigan NewsОценок пока нет

- MPSC Fines DTE Energy $840,000 For Improper Billing, ShutoffsДокумент2 страницыMPSC Fines DTE Energy $840,000 For Improper Billing, ShutoffsMichigan NewsОценок пока нет

- Shots FiredДокумент2 страницыShots FiredMichigan NewsОценок пока нет

- Massage Therapist Summarily Suspended For Criminal Sexual ConductДокумент1 страницаMassage Therapist Summarily Suspended For Criminal Sexual ConductMichigan NewsОценок пока нет

- Schuette Files For Reinstatement of Charges Against CMU Sexual Assault Suspect, New Court Date SetДокумент1 страницаSchuette Files For Reinstatement of Charges Against CMU Sexual Assault Suspect, New Court Date SetMichigan NewsОценок пока нет

- Schuette Charges Two in Insurance Fraud Scheme After Joint Investigation With Department of Insurance and Financial ServicesДокумент2 страницыSchuette Charges Two in Insurance Fraud Scheme After Joint Investigation With Department of Insurance and Financial ServicesMichigan NewsОценок пока нет

- Michigan Liquor Control Commission Suspends Oakland County Gas Station's Liquor License For 102 DaysДокумент1 страницаMichigan Liquor Control Commission Suspends Oakland County Gas Station's Liquor License For 102 DaysMichigan NewsОценок пока нет

- Michigan's Statewide Graduation Rate Hits 80 Percent Graduation Rate Increases 0.53 Percent, Dropout Rate DeclinesДокумент3 страницыMichigan's Statewide Graduation Rate Hits 80 Percent Graduation Rate Increases 0.53 Percent, Dropout Rate DeclinesMichigan NewsОценок пока нет

- Schuette Seven Current and Former Police Officers Charged With 101 Felony Counts Related To Fraudulent Auto InspectionsДокумент3 страницыSchuette Seven Current and Former Police Officers Charged With 101 Felony Counts Related To Fraudulent Auto InspectionsMichigan NewsОценок пока нет

- ShootingsДокумент4 страницыShootingsMichigan NewsОценок пока нет

- Tuberculosis Exposure at Three Southeast Michigan Healthcare Facilities Being InvestigatedДокумент2 страницыTuberculosis Exposure at Three Southeast Michigan Healthcare Facilities Being InvestigatedMichigan NewsОценок пока нет

- $18M in Federal Grants Available To Public and Non-Profit Groups To Provide Services To Crime VictimsДокумент2 страницы$18M in Federal Grants Available To Public and Non-Profit Groups To Provide Services To Crime VictimsMichigan NewsОценок пока нет

- Detroit Crime Blotter For Thursday, March 21, 2018Документ18 страницDetroit Crime Blotter For Thursday, March 21, 2018Michigan NewsОценок пока нет

- West Michigan Physician Summarily Suspended For Alleged Criminal Sexual Conduct With PatientsДокумент1 страницаWest Michigan Physician Summarily Suspended For Alleged Criminal Sexual Conduct With PatientsMichigan NewsОценок пока нет

- State Police Motor Carrier Officers Join Forces To Fight Human TraffickingДокумент1 страницаState Police Motor Carrier Officers Join Forces To Fight Human TraffickingMichigan NewsОценок пока нет

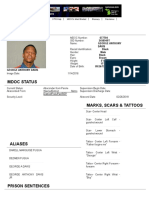

- Offender Tracking Information System (OTIS) - Offender ProfileДокумент2 страницыOffender Tracking Information System (OTIS) - Offender ProfileMichigan NewsОценок пока нет

- Lt. Gov. Calley: Nearly 5,700 Naloxone Orders Dispensed in Last Six Months 1,800 Through Standing OrderДокумент2 страницыLt. Gov. Calley: Nearly 5,700 Naloxone Orders Dispensed in Last Six Months 1,800 Through Standing OrderMichigan NewsОценок пока нет

- Livonia Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesДокумент2 страницыLivonia Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesMichigan NewsОценок пока нет

- Detroit Pharmacist Summarily Suspended For $6 Million Health Care and Wire FraudДокумент1 страницаDetroit Pharmacist Summarily Suspended For $6 Million Health Care and Wire FraudMichigan NewsОценок пока нет

- Southfield Physician's Controlled Substance License Summarily Suspended For OverprescribingДокумент1 страницаSouthfield Physician's Controlled Substance License Summarily Suspended For OverprescribingMichigan NewsОценок пока нет

- Schuette: Orchard Lake Restaurant Sushi Samurai Sentenced in Tax Embezzlement Scheme, Owners Will Pay Almost $1 Million in RestitutionДокумент2 страницыSchuette: Orchard Lake Restaurant Sushi Samurai Sentenced in Tax Embezzlement Scheme, Owners Will Pay Almost $1 Million in RestitutionMichigan NewsОценок пока нет

- Prosecutor Worthy Charges Police Officers With Murder, Misconduct and Other ChargesДокумент7 страницProsecutor Worthy Charges Police Officers With Murder, Misconduct and Other ChargesMichigan NewsОценок пока нет

- DNR Deer Poaching Investigation Results in Sentencing of Allegan County ManДокумент2 страницыDNR Deer Poaching Investigation Results in Sentencing of Allegan County ManMichigan NewsОценок пока нет

- 2018 Lake Sturgeon Season On Black Lake Begins Feb. 3 at 8 A.M.Документ3 страницы2018 Lake Sturgeon Season On Black Lake Begins Feb. 3 at 8 A.M.Michigan NewsОценок пока нет

- Detroit Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesДокумент1 страницаDetroit Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesMichigan NewsОценок пока нет

- Meijer Joins Growing Group of Retail Pharmacies To Integrate With MAPS To Prevent Opioid AbuseДокумент2 страницыMeijer Joins Growing Group of Retail Pharmacies To Integrate With MAPS To Prevent Opioid AbuseMichigan NewsОценок пока нет

- State Police To Participate in Multi-State Commercial Vehicle Enforcement Operation Involving I-94Документ2 страницыState Police To Participate in Multi-State Commercial Vehicle Enforcement Operation Involving I-94Michigan NewsОценок пока нет

- West Nile Virus Found in Michigan Ruffed GrouseДокумент6 страницWest Nile Virus Found in Michigan Ruffed GrouseMichigan NewsОценок пока нет

- Have You Been The Victim of Sexual Harassment? Consider Filing A Complaint Under Michigan Civil Rights LawДокумент3 страницыHave You Been The Victim of Sexual Harassment? Consider Filing A Complaint Under Michigan Civil Rights LawMichigan NewsОценок пока нет

- Diaspora Bank Account Opening ManualДокумент5 страницDiaspora Bank Account Opening ManualayenewОценок пока нет

- Assessment of Credit Reference Bureaus On The Management of Nonperforming Loans in The Banking Industry in KenyaДокумент8 страницAssessment of Credit Reference Bureaus On The Management of Nonperforming Loans in The Banking Industry in KenyaAlexander DeckerОценок пока нет

- Buze Proposal NewДокумент19 страницBuze Proposal Newyared mulgetaОценок пока нет

- Final Project of Allahabad BankДокумент22 страницыFinal Project of Allahabad BankNipul Bafna33% (3)

- Speed Ratio of Trains PuzzleДокумент46 страницSpeed Ratio of Trains PuzzleBiswarup ChatterjeeОценок пока нет

- Domain Invoice for comunity.yoloax.comДокумент1 страницаDomain Invoice for comunity.yoloax.comHugo GijonОценок пока нет

- Statement 20231115Документ2 страницыStatement 20231115dbourke735Оценок пока нет

- Android Hacker-S HandbookДокумент2 страницыAndroid Hacker-S HandbookJack LeeОценок пока нет

- Cashless PDFДокумент48 страницCashless PDFManish Solanki0% (1)

- WP-26 enДокумент41 страницаWP-26 enSheza EjazОценок пока нет

- Loan Services of Trust BankДокумент19 страницLoan Services of Trust BankMd. Shahnewaz KhanОценок пока нет

- Jawaban Jurnal PenyesuaianДокумент20 страницJawaban Jurnal Penyesuaian36. Yayu SeptianiОценок пока нет

- Sedo GmbH Invoice for Order #3025091Документ1 страницаSedo GmbH Invoice for Order #3025091paul deaunaОценок пока нет

- Application of Islamic Contracts in Islamic BankingДокумент16 страницApplication of Islamic Contracts in Islamic BankingWan RuschdeyОценок пока нет

- Sangeeth General TradingДокумент1 страницаSangeeth General Tradinggm globalОценок пока нет

- Acct Statement - XX9665 - 05052022Документ40 страницAcct Statement - XX9665 - 05052022nosОценок пока нет

- MCQ Banking QuizДокумент8 страницMCQ Banking QuizRajivОценок пока нет

- Compromise Proposal For Rs. For Settlement of Loan Account No of M/s. / Shri / Smt.Документ2 страницыCompromise Proposal For Rs. For Settlement of Loan Account No of M/s. / Shri / Smt.Arvind VarmaОценок пока нет

- Reading 12 Monetary and Fiscal PolicyДокумент31 страницаReading 12 Monetary and Fiscal PolicyAbhishek KundliaОценок пока нет

- Application For PAN Through Online Services: Tax Information NetworkДокумент6 страницApplication For PAN Through Online Services: Tax Information NetworkGaurav GuptaОценок пока нет

- Mukesh Surana's Balance Sheet and Profit & Loss StatementДокумент5 страницMukesh Surana's Balance Sheet and Profit & Loss StatementSURANA1973Оценок пока нет

- Account Statement 081221 070122Документ52 страницыAccount Statement 081221 070122anandalogyОценок пока нет

- Business Studies Class 11 Project On BankingДокумент10 страницBusiness Studies Class 11 Project On BankingSubham Jaiswal100% (2)

- Change of Bank Details FormДокумент1 страницаChange of Bank Details FormbibzsОценок пока нет