Академический Документы

Профессиональный Документы

Культура Документы

Income and Expenditure Kenya PDF

Загружено:

crampingpaulИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Income and Expenditure Kenya PDF

Загружено:

crampingpaulАвторское право:

Доступные форматы

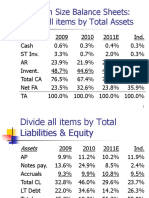

INCOME AND EXPENDITURE:

KENYA

Euromonitor International

July 2015

INCOME AND EXPENDITURE: KENYA

LIST OF CONTENTS AND TABLES

Chart 1

Chart 2

SWOT Analysis: Kenya ................................................................................ 1

Overview of Income and Consumer Expenditure in Kenya: 2014 ................ 1

Gross Income by Age ................................................................................................................... 2

Elderly Account for Three Quarters of Wealthiest Consumers ................................................. 2

Chart 3

Chart 4

Top Gross Income Band (US$150,000+) by Age: 2014 and 2030 ............... 3

Total Gross Income: 2014 ............................................................................ 3

Social Class Composition ............................................................................................................. 4

Poorer Social Classes To Post Fastest Growth ........................................................................ 4

Chart 5

Age Composition of Social Classes ABCDE: 2014 ...................................... 5

Household Income Distribution ..................................................................................................... 5

Large Income Gap Yawns Wider .............................................................................................. 5

Chart 6

Chart 7

Average Household Annual Disposable Income by Decile: 2014 and

2030 ............................................................................................................. 6

Household Income Distribution: 2014........................................................... 7

Consumer Expenditure by Category ............................................................................................ 7

Improving Living Standards To Boost fun Discretionary Categories....................................... 7

Chart 8

Chart 9

Real Growth Indices of Fastest Growing Consumer Spending

Categories: 2015-2030................................................................................. 8

Real Growth Indices of Slowest Growing Consumer Spending

Categories: 2015-2030................................................................................. 9

Consumer Expenditure by Region .............................................................................................. 10

Nairobi Well Ahead of the Pack .............................................................................................. 10

Chart 10

Chart 11

Total Consumer Expenditure by Region: 2014 ........................................... 10

Chart11 Per Household Consumer Expenditure by Region: 2014 ............. 11

Consumer Expenditure by Income Level .................................................................................... 12

Rich Outspend Poor Tenfold .................................................................................................. 12

Chart 12

Chart 13

Spending Patterns of Deciles 1, 5 and 10: 2014 ........................................ 13

Category Expenditure by Each Decile as a Proportion of Total

Category Spending: 2014 .......................................................................... 14

Definitions................................................................................................................................... 14

Deciles .................................................................................................................................... 14

Discretionary Spending........................................................................................................... 14

Disposable Income ................................................................................................................. 14

Gross Income ......................................................................................................................... 15

Mean Income .......................................................................................................................... 15

Median Income ....................................................................................................................... 15

Middle Class ........................................................................................................................... 15

Non-discretionary Spending ................................................................................................... 15

Social Class A ........................................................................................................................ 15

Social Class B ........................................................................................................................ 15

Social Class C ........................................................................................................................ 15

Social Class D ........................................................................................................................ 15

Social Class E ........................................................................................................................ 15

Euromonitor International

Passport

INCOME AND EXPENDITURE: KENYA

Euromonitor International

Passport

II

INCOME AND EXPENDITURE: KENYA

INCOME AND EXPENDITURE: KENYA

While Kenyans have the lowest incomes across 85 major global nations, projected growth

rates are impressive, as the government takes steps to improve the economy. Consequently,

consumer spending is on course to surge. Youth-leaning demographics have created a large

cohort of cost-conscious consumers open to budget buys, while the top income bracket is

overwhelmingly elderly. Stark income disparities persist, and Nairobians purchasing power

outstrips the sums elsewhere in the country.

Chart 1

Source:

Chart 2

SWOT Analysis: Kenya

Euromonitor International

Overview of Income and Consumer Expenditure in Kenya: 2014

Euromonitor International

Passport

INCOME AND EXPENDITURE: KENYA

Source:

Euromonitor International from national statistics

GROSS INCOME BY AGE

Elderly Account for Three Quarters of Wealthiest Consumers

In 2014, Kenyan per capita annual gross income totalled KES80,988 (US$921), the lowest out

of 85 major world nations. Between 2009 and 2014, the indicator rose by 1.8% in real terms (or

an average real increase of 0.4% per year), the weakest performance in the Middle East and

Africa outside Kuwait during the timeframe. Per capita annual gross income registered modest

real annual gains of up to 1.0% in every year between 2009 and 2014, with the exception of a

real annual dip of 1.3% in 2013, the year of a disputed election. Earnings remained muted, as

severe drought; election-related strife; and occasional terrorist attacks kept economic growth

below its potential. Going forward, private sector expansion spurred by public investments in

energy, agriculture and transportation; oil discoveries in the northern Turkana region; and strong

gains in tourism, manufacturing and agriculture will boost per capita annual gross income. The

indicator is forecast to climb by 3.9% in real terms per year over the 2015-2030 period to stand

at KES145,463 (US$1,654), the second fastest growth rate in the Middle East and Africa during

the interval.

The uppermost income bracket is overwhelmingly the preserve of the 65+ age band:

In 2014, of the Kenyan population on an annual gross income of US$150,000+, a striking

73.8% were aged 65 or above, six times higher than the closest cohort (the 60-64 age bracket

on 12.3%). African culture holds elders in deep esteem, and individuals who attain high status

Euromonitor International

Passport

INCOME AND EXPENDITURE: KENYA

in the worlds of business, politics and the civil service typically do so after years of building

contact networks, influence and assets;

The expanding group of elderly consumers will tip the top earnings bracket even further in

favour of seniors. In 2030, the 65+ demographic will account for 80.8% of individuals earning

an annual gross income of US$150,000, underpinning potential take-up of high-end goods

and services targeted at seniors.

Chart 3

Source:

Note:

Top Gross Income Band (US$150,000+) by Age: 2014 and 2030

Euromonitor International from national statistics

Data for 2030 are forecasts.

Youth-leaning demographics underpin the large number of young Kenyans on modest

incomes:

One hot spot the red area denoting the highest total concentration of gross income

appears on Kenyas heat map for 2014. It indicates an age range of 15-28 with corresponding

per capita annual gross income of about US$400 to just over US$1,200, which increases

sharply with age and reaches a peak at 25;

The hot spot has its roots in Kenyas young demographics: 26.5% of the population

belonged to the 15-28 age band in 2014. A secondary factor at the younger end of the hot

spot is income uniformity, as Kenyans in their teens and early twenties typically either fill

menial roles in the workforce (sometimes for the family business) or are full-time students,

curbing their earning power. This creates a sizeable cohort of young, price-conscious

consumers, who form a promising market for affordable youth-friendly goods and services,

from domains such as mobile communications, gadgets and entertainment. With similar

patterns found in fellow African nations, such as South Africa and Nigeria, such ranges could

be suited to regional rollout.

Chart 4

Total Gross Income: 2014

Euromonitor International

Passport

INCOME AND EXPENDITURE: KENYA

Source:

Note:

Euromonitor International from national statistics

The horizontal axis depicts the age of individuals and the vertical axis the distribution of per capita

income by annual gross income brackets. The shading refers to the total income in thousand US$. The

closer to red, the larger the amount of total income in that age and income range.

SOCIAL CLASS COMPOSITION

Poorer Social Classes To Post Fastest Growth

Lower-income earners form a majority in Kenyas social class system:

In 2014, 38.7% of the population aged 15+ belonged to social class E (the lowest social

class). Social class D was second, on 25.5%;

The dominance of the agricultural sector; inadequate infrastructure; restricted employment

and educational opportunities; adverse weather conditions; widespread corruption; ethnic

tensions; steep unemployment (which stood at 35.7% of the economically active population in

2014); and outbreaks of terrorism have fostered high poverty rates in Kenya, especially in

rural areas, inflating the lower social classes. Between 2009 and 2014, the social class

distribution shifted marginally to the extremes: social classes E and A were the most dynamic,

recording growth of 16.6% and 15.8% respectively; while the inner social classes advanced

by slightly cooler rates of between 14.5% (social class D) and 14.8% (social class B);

Social class E is overwhelmingly young. In 2014, the 15-19 cohort accounted for 25.8% of

social class E, with the 20-24 age band constituting another 14.5%. This results from a

combination of Kenyas young population and the muted earning power of consumers in their

Euromonitor International

Passport

INCOME AND EXPENDITURE: KENYA

teens and early twenties, as noted above. The spread underlines the commercial promise of

targeting price-sensitive young consumers with affordable buys;

Through to 2030, the social class system will grow more rapidly at its poorer end. Between

2015 and 2030, social classes E, D, C, B and A will increase by 55.5%, 55.1%, 54.7%, 54.0%

and 53.6% respectively. The effect will be a rise in demand for low-cost essentials. However,

with the range of growth rates a relatively narrow one, the social class distribution will not

significantly change: in 2030, social class E will represent 38.8% of the population aged 15+

and social class D, 25.6% both up by just 0.1 percentage point versus the 2014 figures;

Young consumers will continue to dominate social class E, albeit on slightly reduced shares,

owing to population ageing. The 15-19 age band will comprise 23.4% of social class E in

2030, followed by the 20-24 age bracket on 14.0%. This underlines the potential of low-cost

business models built on a young consumer profile.

Chart 5

Source:

Age Composition of Social Classes ABCDE: 2014

Euromonitor International from national statistics

HOUSEHOLD INCOME DISTRIBUTION

Large Income Gap Yawns Wider

Annual disposable income per household was fairly stagnant between 2009 and 2014:

In 2014, Kenyan annual disposable income per household totalled KES304,358 (US$3,462),

having risen by just 0.4% in real terms over the 2009-2014 period (or an average annual real

increase of 0.1%). Only Kuwait and Iran posted worse performances in the Middle East and

African during the interval. Once again, modest annual growth of less than 1.0% in real terms

in four years out of five were pegged back by a real annual slump of 1.6% in 2013;

The previously lacklustre growth pace will perk up considerably through to 2030, thanks in

part to government strategies, such as Kenya Vision 2030, which involves improvements in

education, health, and housing, in order for Kenya to attain middle-income status by 2030.

Euromonitor International

Passport

INCOME AND EXPENDITURE: KENYA

Between 2015 and 2030, per household annual disposable income is forecast to climb by

74.7% in real terms, or an average annual real hike of 3.8%.

Kenyas steep socioeconomic disparities are set to persist through to 2030:

The most affluent 10.0% of households (decile 10) were in receipt of 44.9% of overall annual

disposable income in 2014, compared to 1.5% going to the poorest 10.0% (decile 1);

Kenya has one of the highest rates of inequality among major world nations, a trait it shares

with several African peer countries. Stark urban-rural disparities; limited employment

opportunities; corruption and nepotism; and elites that seek to cling onto their advantages

have all fuelled the countrys socioeconomic iniquities. The income gap widened further

throughout the review period: decile 1s share of overall annual disposable income stood at

1.6% in 2009, and decile 10s portion at 44.0%;

Investment in support for the agriculture industry; higher health and education spending,

including to fund free primary and secondary education; affordable housing; and a beefing up

of social security for the vulnerable have been among the measures taken to support the

livings of the worst off adopted by the Kenyan government, with the elimination of poverty a

target of Kenya Vision 2030. However, adverse weather conditions; Islamic terrorism and

ethnic tension; and the efforts of Kenyas elites to preserve their privileges thwart attempts to

narrow the income gap. Decile 10s share of overall annual disposable income will increase

from 45.0% to 45.9% between 2015 and 2030, while decile 1s portion will hold steady at

1.5%.

Chart 6

Source:

Note:

Average Household Annual Disposable Income by Decile: 2014 and 2030

Euromonitor International from national statistics

Data for 2030 are forecasts. Data are in constant US$.

Socioeconomic inequalities keep the mean and median household incomes some distance

apart:

Kenyas 2014 mean household income came to US$3,462, the lowest figure both in the

Middle East and Africa and out of 85 major countries. That years median income, which

stood at US$1,977 far short of the mean, as a consequence of the wide income gap

serves as a more useful illustration of realities on the ground. With close to 70.0% of homes in

Euromonitor International

Passport

INCOME AND EXPENDITURE: KENYA

receipt of less than the 2014 mean income, low-cost basics should fare well on the Kenyan

consumer marketplace. Over the 2015-2030 period, median income per household is

projected to jump by 71.5% in real terms;

Chart 7

Source:

Household Income Distribution: 2014

Euromonitor International from national statistics

In 2014, 2.8 million homes, or 26.9% of the overall number of households nationwide, formed

the Kenyan middle class defined as households on between 75.0% and 125% of median

income. The proportion is relatively low, owing to the wide income gap, which shifts

households away from the median sum. In absolute terms, the cohort grew over the 20092014 period, from a base of 2.4 million homes in 2009. However, this was attributable to

strong gains in the total number of households. Proportionally, the group dropped back

slightly from 27.1% of the overall households in 2009, owing to worsening inequality;

Through to 2030, in absolute terms, Kenyas middle class will continue to be buoyed by the

rising number of homes overall, despite falling back proportionally. In 2030, the cohort will

number 4.2 million households, or 26.6% of the nationwide total.

CONSUMER EXPENDITURE BY CATEGORY

Improving Living Standards To Boost fun Discretionary Categories

Population growth was the main driver of rising consumer spending between 2009 and 2014:

Overall consumer expenditure in Kenya stood at KES3.4 trillion (US$38.2 billion) in 2014,

following a hike of 17.4% in real terms over the 2009-2014 period (or an average real upswing

of 3.3% per year). This was largely ascribable to a concomitant 14.4% expansion of the total

Kenyan population during the interval. Consumer credit and government efforts, such as the

Kenya Economic Stimulus Program (ESP), introduced in the 2009/2010 budget speech, were

also factors. Robustly rising incomes on the back of government initiatives to spur the

Euromonitor International

Passport

INCOME AND EXPENDITURE: KENYA

economy and reduce poverty will see consumer expenditure surge by 151% in real terms (or

an average real hike of 6.3% per year) over the 2015-2030 period;

In 2014, non-discretionary spending that is, money given over to food, non-alcoholic

beverages and housing accounted for 53.8% of Kenyas overall consumer expenditure.

While this proportion does not diverge significantly from the 52.0% figure for the Middle East

and Africa that year, the split does: food and non-alcoholic beverages absorbed 46.9% of total

budgets in Kenya (versus 31.8% across the region) and housing just 6.9% (against 20.2%) in

2014. This reflects both the widespread poverty in Kenya that directs a large slice of

expenditure towards sustenance; the prevalence of low-cost rural and slum housing; and the

inclusion in the regional figure of wealthier Middle Eastern states with very different

economies. The slice of total outgoings devoted to non-discretionary spending will drop back

to 51.5% in 2030, tamped down by higher incomes.

Rising living standards are driving outlay on the fun-based discretionary categories of hotels

and catering and leisure and recreation:

Hotels and catering recorded the biggest spike over the period of 2009-2014, up by 40.1% in

real terms. It was led by strong catering spending, as Kenyas restaurant sector boomed (in

2014, fast food giant McDonalds signalled its intention to enter the market) on the back of the

urban middle class. Second came leisure and recreation, which rose by a real 36.6% during

the timeframe. Package holidays was the best performing subcategory, as the government

and private operators invested in promoting domestic tourism, while more generally new

options for entertainment and enjoyment proliferated on Kenyas developing consumer

market. Marking a hike of 22.3% in real terms between 2009 and 2014, food and nonalcoholic beverages came third, against a backdrop of food price inflation (costs are subject to

Kenyas sometimes unfavourable climatic conditions);

Through to 2030, hotels and catering and leisure and recreation will continue to soar, fuelled

by briskly improving incomes and living standards. Communications will be the third most

dynamic category, as penetration rises on Kenyas mobile market, with the launch of 4G

services (a technology that provides very fast mobile broadband) after 2015 poised to

invigorate the sector further.

Chart 8

Real Growth Indices of Fastest Growing Consumer Spending Categories:

2015-2030

Euromonitor International

Passport

INCOME AND EXPENDITURE: KENYA

Source:

Note:

Euromonitor International from national statistics/UN/OECD

Data are forecasts.

Three categories suffered real declines between 2009 and 2014. Clothing and footwear

slumped by 6.7% in real terms, as prices were tamped down by pressure from foreign

competition. Alcoholic beverages and tobacco posted a real 2.8% drop over the 2009-2014

period, subdued by the weak tobacco subcategory, which had to contend with anti-smoking

campaigns and competition from counterfeit cigarettes. Third came housing, down by 1.7% in

real terms during the timeframe, on a weak rental market;

The period through to 2030 will see the same three categories continue to struggle for similar

reasons: variously, tepid tobacco spending, tough competition in the garment industry and

trailing rents. However, with even the most lacklustre category alcoholic beverages and

tobacco marking a real hike of 85.7% between 2015 and 2030, and all other categories set

to more than double in real terms over the timeframe, these weaker performances still offer

marketers plenty of opportunities.

Chart 9

Real Growth Indices of Slowest Growing Consumer Spending Categories:

2015-2030

Euromonitor International

Passport

INCOME AND EXPENDITURE: KENYA

Source:

Note:

Euromonitor International from national statistics/UN/OECD

Data are forecasts.

CONSUMER EXPENDITURE BY REGION

Nairobi Well Ahead of the Pack

The capital region Nairobi is the countrys predominant consumer hub, owing to its sizeable

population and superior purchasing power:

Nairobi posted the highest total consumer spending in 2014, at US$15.1 billion. Home to

around 3.5 million people, the Kenyan capital is the countrys most populous city by some way

and a major metropolitan force in both East Africa and the entire continent;

In 2030, consumer outlay in Nairobi is projected to surge to US$76.3 billion, buoyed by rapid

gains in headcount Nairobi is one of the fastest growing cities in Africa, as migrants from

poorer countries in the continent seek better employment opportunities and region-leading

rises in earnings.

Chart 10

Total Consumer Expenditure by Region: 2014

Euromonitor International

Passport

10

INCOME AND EXPENDITURE: KENYA

Source:

Euromonitor International from national statistics/UN/OECD

Homes in Nairobi posted over 2.5 times the level of consumer outlay as those in Coast, the

second highest-spending region, in 2014:

At a per household level, Nairobi was also the scene of the biggest consumer expenditure by

some way, posting US$12,192 in 2014 (with the second placed Coast region registering

US$4,826). This embodies Kenyas high urban-rural inequality. Kenyas financial and

business epicentre, Nairobi is home to the national stock market; the regional headquarters of

various major international and African corporations; and a significant manufacturing base.

Consequently it hosts a disproportionate share of relatively wealthy professionals;

At US$801, 2014s smallest per household consumer expenditure came in the North Eastern

region. A tribal province, it shares a border and links with volatile Somalia, and has been the

scene of various attacks by terrorist group Al-Shabaab since 2011, including the massacre at

Garissa University in 2015. The region is also partly arid, limiting agricultural development and

leaving many residents reliant on raising livestock.

Chart 11

Chart11 Per Household Consumer Expenditure by Region: 2014

Euromonitor International

Passport

11

INCOME AND EXPENDITURE: KENYA

Source:

Euromonitor International from national statistics/UN/OECD

CONSUMER EXPENDITURE BY INCOME LEVEL

Rich Outspend Poor Tenfold

2015 will bring further upticks in per household consumer expenditure across Kenyan society:

Decile 10s consumer outlay was 10.3 times the level of decile 1s expenditure in 2014, in the

context of an annual disposable income that was 29.2 times as great that year. Leisure and

recreation displayed the greatest gulf in the outgoings of the rich and poor: the richest 10.0%

of society allocated 42.7 times as much to this category as the poorest 10.0% in 2014. Next

came transport and clothing and footwear (on which decile 10s 2014 outlay was 37.1 and

32.3 times as high as decile 1s spending respectively);

All deciles recorded a strong growth in consumer expenditure between 2009 and 2014. The

hikes varied little proportionally, with the wealthier posting only fractionally greater upswings.

Over the 2009-2014 timeframe, decile 1 upped its per household outgoings by 28.2% (in US$

terms), versus a 30.9% increase (in US$ terms) in per household expenditure from decile 9,

and a 33.0% jump (in US$ terms) from decile 10 during the interval. Accelerating economic

expansion, buoyed by strong growth in consumer credit and infrastructure spending, will result

in year-on-year rises in per household consumer expenditure in US$ terms from all deciles in

2015.

Through to 2030, the capacity for discretionary spending will increase across all rungs of

Kenyan society:

In 2014, low-income households (decile 1) apportioned 69.1% of their total budgets to nondiscretionary purchases. For middle-income homes (decile 5), that years figure came to

59.1% and for high-income households (decile 10) it stood at 44.9%. These large numbers

underline the truncated capacity for discretionary outlay, even from the wealthy;

Rising outlay on food and non-alcoholic beverages pushed up the share of overall spending

devoted to essential purchases throughout the 2009-2014 period for poor and middle-class

homes, while richer homes were able to reduced their non-discretionary outlay proportionally

Euromonitor International

Passport

12

INCOME AND EXPENDITURE: KENYA

over the timeframe. In 2009, non-discretionary outgoings made up 67.1%, 57.9% and 45.3%

of deciles 1, 5 and 10s respective total consumer expenditure;

Essential spending will reduce as a share of overall budgets for Kenyan households of all

means through to 2030. The share of overall outgoings given over to non-discretionary

purchases will drop back from 69.0% to 68.6% for decile 1; from 58.8% to 57.4% for decile 5;

and from 44.6% to 41.7% for decile 10, over the 2009-2014 interval.

Chart 12

Source:

Note:

Spending Patterns of Deciles 1, 5 and 10: 2014

Euromonitor International from national statistical offices/OECD

A:

Food and non-alcoholic beverages; B:

Alcoholic beverages and tobacco; C:

Clothing and footwear; D:

Housing; E:

Household goods and services; F:

Health goods and medical services; G:

Transport; H:

Communications; I:

Leisure and recreation; J:

Education; K:

Hotels and catering; L:

Miscellaneous goods and services. The figure in brackets refers to the average disposable

income of households in each decile.

Decile 10 was the source of over two fifths of total leisure and recreation expenditure in 2014:

In 2014, Kenyas most discretionary category meaning, the one where the biggest share of

total category expenditure comes from decile 10 was leisure and recreation (40.2% of 2014

expenditure, on which came from decile 10). While affluent consumers (typically urban

dwellers) have plenty of opportunities to spend their ample spare cash on entertaining

themselves (from malls to concerts), their poorer counterparts (often rural dwellers) can spare

little for this purpose and have few outlets for such expenditure;

2014s second most discretionary category was transport (where decile 10 was responsible

for 38.7% of total category outgoings) and clothing and footwear (37.3 %). This further

underscores the stark differences in lifestyles between the most and least affluent homes:

while rich consumers travel often (including abroad); may own more than one high-end

vehicle (SUVs, motorbikes and boats); and shop in designer stores to burnish their image,

their poorest compatriots travel around mostly on foot and dress frugally;

2014s least discretionary spending categories namely, those where the expenditure of

deciles 1, 5 and 10 varies the least were alcoholic beverages and tobacco and food and

non-alcoholic beverages. The consumable nature of these products gives rise to a natural lid

on intake, while in the case of the former, richer consumers also tend to be more health

Euromonitor International

Passport

13

INCOME AND EXPENDITURE: KENYA

conscious. Third came communications: while price pressure has kept tariffs low, enabling

access for the least well off consumers, once richer ones are fully connected through several

devices, there are few ways to spend more money.

Chart 13

Source:

Category Expenditure by Each Decile as a Proportion of Total Category

Spending: 2014

Euromonitor International from national statistical offices/OECD

DEFINITIONS

Deciles

Deciles are calculated by ranking all of the households in a country by disposable income

level, from the lowest earning to the highest earning. The ranking is then split into 10 equal

sized groups of households. Decile 1 refers to the lowest earning 10.0%, through to Decile 10,

which refers to the highest earning 10.0% of households.

Discretionary Spending

Discretionary spending is the expenditure by consumers or households on all consumerspending categories other than the essentials of food and non-alcoholic beverages and housing.

Disposable Income

This is gross income minus social security contributions and income taxes.

Euromonitor International

Passport

14

INCOME AND EXPENDITURE: KENYA

Gross Income

Annual gross income refers to income before taxes and social security contributions from all

sources including earnings from employment, investments, benefits and other sources such as

remittances.

Mean Income

The mean income also referred to as the average income is the total or aggregate income

divided by the number of households.

Median Income

The median income is the amount which divides the household income distribution into two

equal groups, half having disposable income above that amount and half having income below

that amount.

Middle Class

The middle class is defined as the number of households with between 75.0% and 125% of

median income.

Non-discretionary Spending

Non-discretionary spending is the expenditure by consumers or households on the two

essential categories of food and non-alcoholic beverages and housing.

Social Class A

Social Class A presents data referring to the number of individuals with a gross income over

200% of an average gross income of all individuals aged 15+.

Social Class B

Social Class B presents data referring to the number of individuals with a gross income

between 150% and 200% of an average gross income of all individuals aged 15+.

Social Class C

Social Class C presents data referring to the number of individuals with a gross income

between 100% and 150% of an average gross income of all individuals aged 15+.

Social Class D

Social Class D presents data referring to the number of individuals with a gross income

between 50.0% and 100% of an average gross income of all individuals aged 15+.

Social Class E

Social Class E presents data referring to the number of individuals with a gross income less

than 50.0% of an average gross income of all individuals aged 15+.

Euromonitor International

Passport

15

Вам также может понравиться

- 8 5x11color 125inchsquaresДокумент1 страница8 5x11color 125inchsquarescrampingpaulОценок пока нет

- France National Football Team - WikipediaДокумент17 страницFrance National Football Team - WikipediacrampingpaulОценок пока нет

- Princess Tina - WikipediaДокумент1 страницаPrincess Tina - WikipediacrampingpaulОценок пока нет

- List of Sony α Cameras - WikipediaДокумент7 страницList of Sony α Cameras - WikipediacrampingpaulОценок пока нет

- 2018 FIFA World Cup - WikipediaДокумент27 страниц2018 FIFA World Cup - WikipediacrampingpaulОценок пока нет

- Set50 100 H1 2018Документ2 страницыSet50 100 H1 2018crampingpaulОценок пока нет

- Tarquinia Tarquini - WikipediaДокумент2 страницыTarquinia Tarquini - WikipediacrampingpaulОценок пока нет

- Modified Internal Rate of Return - WikipediaДокумент3 страницыModified Internal Rate of Return - WikipediacrampingpaulОценок пока нет

- TDS UniversalFoldableKeyboardДокумент1 страницаTDS UniversalFoldableKeyboardcrampingpaulОценок пока нет

- INTERPOL Member Country Statutory Contributions 2015Документ5 страницINTERPOL Member Country Statutory Contributions 2015crampingpaulОценок пока нет

- EmiliaДокумент27 страницEmiliacrampingpaul100% (1)

- Woraphon Ch03 Financial StatementДокумент69 страницWoraphon Ch03 Financial StatementcrampingpaulОценок пока нет

- Sales (Pivot Table)Документ4 страницыSales (Pivot Table)crampingpaulОценок пока нет

- 2015 CFA Level 1 QuickSheetДокумент6 страниц2015 CFA Level 1 QuickSheetGauri PuranikОценок пока нет

- Ace The Case 2nd Ed PDFДокумент162 страницыAce The Case 2nd Ed PDFkaushalmightyОценок пока нет

- CF Cover Letters and ResumesДокумент45 страницCF Cover Letters and ResumesMridul Hakeem100% (1)

- BE 04 Lecture Schedule Semester2 2015 Updated 4 February 2016Документ1 страницаBE 04 Lecture Schedule Semester2 2015 Updated 4 February 2016crampingpaulОценок пока нет

- Gpa (Advanced Filtering)Документ2 страницыGpa (Advanced Filtering)crampingpaulОценок пока нет

- East North Central FT WorkersДокумент372 страницыEast North Central FT WorkerscrampingpaulОценок пока нет

- book24x7書單2008 111Документ916 страницbook24x7書單2008 111crampingpaulОценок пока нет

- Gyanesh Sinha - Case Interview Guide PDFДокумент35 страницGyanesh Sinha - Case Interview Guide PDFcrampingpaulОценок пока нет

- Case Interview TrainingДокумент33 страницыCase Interview TrainingsyedainahmadОценок пока нет

- 2012-03 Case Framworks and Bonus Cases PDFДокумент57 страниц2012-03 Case Framworks and Bonus Cases PDFcrampingpaulОценок пока нет

- Zip Code ListДокумент1 страницаZip Code ListcrampingpaulОценок пока нет

- Advanced Excel ChartingДокумент19 страницAdvanced Excel ChartingcrampingpaulОценок пока нет

- Case Interview Guide PDFДокумент13 страницCase Interview Guide PDFGrand OverallОценок пока нет

- Adyen Payments in China 2014Документ6 страницAdyen Payments in China 2014crampingpaulОценок пока нет

- Class I Economy and The EnvironmentДокумент17 страницClass I Economy and The EnvironmentcrampingpaulОценок пока нет

- Spring ConversionДокумент3 страницыSpring ConversioncrampingpaulОценок пока нет

- Extent of Food Losses and WasteДокумент6 страницExtent of Food Losses and WastecrampingpaulОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Botswana Livestock Crop ReportДокумент47 страницBotswana Livestock Crop ReportOpzasets100% (1)

- Ec2 QP 510012Документ11 страницEc2 QP 510012microdotcdmОценок пока нет

- MTBFДокумент3 страницыMTBFNahidul IslamОценок пока нет

- The Ideal CityДокумент2 страницыThe Ideal CityrmrantunezОценок пока нет

- Faq English BskyДокумент2 страницыFaq English BskyHytech Pvt. Ltd.Оценок пока нет

- Total ProjectДокумент77 страницTotal Projectamitsonawane67% (3)

- Graduate Cover Lettertemplate by Reed - Co.ukДокумент1 страницаGraduate Cover Lettertemplate by Reed - Co.ukRazu Ahmed RazuОценок пока нет

- JeanneMWrenn CandidateSurveyДокумент8 страницJeanneMWrenn CandidateSurveyInjustice WatchОценок пока нет

- SHG in IndiaДокумент162 страницыSHG in Indiaapi-3729564Оценок пока нет

- Financial Literacy RRLДокумент5 страницFinancial Literacy RRLCarl Angelo MontinolaОценок пока нет

- Development Issues Africa PDFДокумент15 страницDevelopment Issues Africa PDFallama420Оценок пока нет

- Issues and Concerns of School Dropouts in IndiaДокумент6 страницIssues and Concerns of School Dropouts in IndiaarcherselevatorsОценок пока нет

- The Economics of Microfinance: Beatriz Armendáriz Jonathan MorduchДокумент24 страницыThe Economics of Microfinance: Beatriz Armendáriz Jonathan MorduchUmmeSolaimОценок пока нет

- The Philippines A Century HenceДокумент5 страницThe Philippines A Century HencezhayyyОценок пока нет

- Recommendation R195 - Human Resources Development Recommendation, 2004 (No. 195)Документ7 страницRecommendation R195 - Human Resources Development Recommendation, 2004 (No. 195)Elmir ƏzimovОценок пока нет

- Problems of Indian Tribes and Measures From Government of IndiaДокумент17 страницProblems of Indian Tribes and Measures From Government of Indiajeyakar.mz8442Оценок пока нет

- 1.format - Man-An Study of Microfinance Schemes and Its Awareness in PDFДокумент9 страниц1.format - Man-An Study of Microfinance Schemes and Its Awareness in PDFImpact JournalsОценок пока нет

- Application FormДокумент2 страницыApplication Formtotalgaming947071Оценок пока нет

- Adunea DinkuДокумент110 страницAdunea Dinkuabraha gebru100% (3)

- Dr. Veena JhaДокумент4 страницыDr. Veena JhaINTERNATIONAL JOURNAL FOR EDUCATIONAL RESEARCH STUDIESОценок пока нет

- Use The Following To Answer Questions 5-7:: Figure: Strawberries and SubmarinesДокумент16 страницUse The Following To Answer Questions 5-7:: Figure: Strawberries and SubmarinesMahmoud FariedОценок пока нет

- De - Blois - L - Lo Cascio - E - 2007 - The Impact of The Roman ArmyДокумент612 страницDe - Blois - L - Lo Cascio - E - 2007 - The Impact of The Roman ArmyJose CostaОценок пока нет

- Example of Fieldwork ReportДокумент17 страницExample of Fieldwork ReportKiestiko Sri Saptasari67% (3)

- The Economic System in IslamДокумент3 страницыThe Economic System in IslamYaldaramОценок пока нет

- CDP Devendranagar EnglishДокумент125 страницCDP Devendranagar EnglishCity Development Plan Madhya PradeshОценок пока нет

- Christopher GardnerДокумент3 страницыChristopher GardnerPrashant KanaujiaОценок пока нет

- Michigan Corrected Mediciaid Final Departmental Review For Crawley LawsuitДокумент259 страницMichigan Corrected Mediciaid Final Departmental Review For Crawley LawsuitBeverly TranОценок пока нет

- SmepolicyeДокумент66 страницSmepolicyeJahangir MiltonОценок пока нет

- The Role of The Dumai City Government in The Use of Reducing PovertyДокумент12 страницThe Role of The Dumai City Government in The Use of Reducing PovertyInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Bangladesh: Secondary Education Sector Development ProgramДокумент22 страницыBangladesh: Secondary Education Sector Development ProgramADBGADОценок пока нет