Академический Документы

Профессиональный Документы

Культура Документы

Bull2016 2

Загружено:

jspectorИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Bull2016 2

Загружено:

jspectorАвторское право:

Доступные форматы

NYSTRS.

org

New York State Teachers Retirement System

Administrative Bulletin

To: Chief School Administrators

College and University Presidents

District Contacts

Employer Secure Area Contacts

Issue No. 2016-2

February 2016

Estimated Employer Contribution Rate

For the 2016-17 Payroll

History of the Employer

Contribution Rate (ECR)

In an effort to assist you with 2016-17 budget preparations, we

recommend you use an estimated employer contribution rate (ECR)

of 11.72% for 2016-17 payroll. This projected rate is consistent with

Administrative Bulletin 2015-9, issued in November 2015, in which we

estimated a rate of between 11.50% and 12.00%.

Salary Year

ECR

1980-81

1981-82

1982-83

1983-84

1984-85

23.49%

23.49%

23.49%

22.90%

22.80%

Although the funds associated with this ECR will not be collected

until fall 2017, we send this alert well in advance to assist with your

planning. The Retirement Board will adopt the 2016-17 ECR at its July

meeting and an Administrative Bulletin formalizing this rate will be

issued soon thereafter.

1985-86

1986-87

1987-88

1988-89

1989-90

21.40%

18.80%

16.83%

14.79%

6.87%

As previously noted (see Administrative Bulletin 2015-6), the ECR

applicable to your 2015-16 payroll will be 13.26%. These funds will

be collected in the fall of 2016 and correspond to NYSTRS member

salaries for the 2015-16 school year.

1990-91

1991-92

1992-93

1993-94

1994-95

6.84%

6.64%

8.00%

8.41%

7.24%

1995-96

1996-97

1997-98

1998-99

1999-00

6.37%

3.57%

1.25%

1.42%

1.43%

2000-01

2001-02

2002-03

2003-04

2004-05

0.43%

0.36%

0.36%

2.52%

5.63%

2005-06

2006-07

2007-08

2008-09

2009-10

7.97%

8.60%

8.73%

7.63%

6.19%

2010-11

2011-12

2012-13

2013-14

2014-15

8.62%

11.11%

11.84%

16.25%

17.53%

2015-16

13.26%

The decrease in the 2016-17 ECR is primarily due to favorable

investment returns over the past several years through June 30, 2015.

This does not mean rates will continue to decrease in the future.

ECRs are dependent upon many variables, such as future investment

performance and member demographic experience.

For those employers who have elected to participate in the Stable

Contribution Option (SCO), the SCO rate that will apply to fiscal year

2016-17 NYSTRS member salaries will remain at 14.13% (14.0% base

rate as per statute plus the 0.13% group life insurance rate).

The ECR and the SCO rate are adopted each July, but the

contributions associated with these particular rates are not collected

for another 14-16 months. Except for those employers required to pay

directly, payments are deducted annually from State Aid apportioned in

September, October and November.

If you have any additional questions, please call John Cardillo,

Manager of Public Information, at (518) 447-4743.

Administrative Bulletins dating from 2005 to the present are available on our website at

NYSTRS.org. Select Employers and visit the Administrative Bulletins page.

10 Corporate Woods Drive

Albany, NY 12211-2395

(800) 356-3128

Вам также может понравиться

- Alert: Developments in Preparation, Compilation, and Review Engagements, 2017/18От EverandAlert: Developments in Preparation, Compilation, and Review Engagements, 2017/18Оценок пока нет

- Bull2014 2Документ1 страницаBull2014 2jspectorОценок пока нет

- Bull2016 6Документ1 страницаBull2016 6jspectorОценок пока нет

- Estimated Employer Contribution Rate For The 2013-14 PayrollДокумент1 страницаEstimated Employer Contribution Rate For The 2013-14 PayrollRick KarlinОценок пока нет

- Bull2013 1Документ1 страницаBull2013 1jspectorОценок пока нет

- Bull2013 8Документ1 страницаBull2013 8jspectorОценок пока нет

- Bull2014 9 PDFДокумент1 страницаBull2014 9 PDFjspectorОценок пока нет

- Bull2012 8Документ1 страницаBull2012 8jspectorОценок пока нет

- Employer Contributions To Be Collected During The 2015-16 School YearДокумент1 страницаEmployer Contributions To Be Collected During The 2015-16 School YearjspectorОценок пока нет

- Teacher PensionДокумент1 страницаTeacher PensionRick KarlinОценок пока нет

- Assabet Budgets-How Much Does It Cost To Run? Marlborough Council, 1-23-12 AgendaДокумент67 страницAssabet Budgets-How Much Does It Cost To Run? Marlborough Council, 1-23-12 AgendaourmarlboroughОценок пока нет

- Latest Income Tax Slabs and Rates For FY 2013-14 and AS 2014-15Документ6 страницLatest Income Tax Slabs and Rates For FY 2013-14 and AS 2014-15Michaelben MichaelbenОценок пока нет

- Guideline On ITДокумент19 страницGuideline On ITmikekikОценок пока нет

- 2016 SLRP Valuation ReportДокумент44 страницы2016 SLRP Valuation Reportthe kingfishОценок пока нет

- CPF contribution rate changes for older workers explainedДокумент5 страницCPF contribution rate changes for older workers explainedannleeyhОценок пока нет

- Federal Salary Council Recommendations: Nov. 2014Документ23 страницыFederal Salary Council Recommendations: Nov. 2014FedSmith Inc.Оценок пока нет

- Fiscal Policy InstituteДокумент3 страницыFiscal Policy InstituteRick KarlinОценок пока нет

- March 2013 TestimonyДокумент8 страницMarch 2013 TestimonyCeleste KatzОценок пока нет

- InstructionsДокумент8 страницInstructionssathyanarayana medaОценок пока нет

- NYSCRF Actuary ReportДокумент15 страницNYSCRF Actuary ReportJimmyVielkindОценок пока нет

- How To Calculate Ur Income TaxДокумент3 страницыHow To Calculate Ur Income TaxrazeemshipОценок пока нет

- Oakland Minimum Wage Law 6-Month ReportДокумент122 страницыOakland Minimum Wage Law 6-Month ReportdarwinbondgrahamОценок пока нет

- Avast CodesДокумент4 страницыAvast CodesS Comm. 2013Оценок пока нет

- Higher Pension - SimulatorДокумент8 страницHigher Pension - SimulatorShashikant ChaudhariОценок пока нет

- United Medical Center FY2017 BudgetДокумент83 страницыUnited Medical Center FY2017 BudgettinareedreporterОценок пока нет

- Summer 2013Документ8 страницSummer 2013lesley_chisholm_1Оценок пока нет

- Examples Turnover ReportingДокумент3 страницыExamples Turnover ReportingnavatoОценок пока нет

- NHS Pay Deal Aug 2018Документ6 страницNHS Pay Deal Aug 2018LindaОценок пока нет

- 2016 Taylor S&P ReportДокумент7 страниц2016 Taylor S&P ReportDavid HerndonОценок пока нет

- San Dieguito Water District PensionДокумент104 страницыSan Dieguito Water District PensionEncinitasProjectОценок пока нет

- Withholding Taxes: BIR Form 1601CДокумент4 страницыWithholding Taxes: BIR Form 1601CJoana Marie ManaloОценок пока нет

- MEABF Plan Design Scenarios - September 6, 2016Документ8 страницMEABF Plan Design Scenarios - September 6, 2016The Daily LineОценок пока нет

- Mar 2016 State Employment ReleaseДокумент8 страницMar 2016 State Employment ReleaseCarolinaMercuryОценок пока нет

- TDS Calculation Sheet in Excel and Slabs For FY 2017-18 and AY 2018-19Документ5 страницTDS Calculation Sheet in Excel and Slabs For FY 2017-18 and AY 2018-19Nishit MarvaniaОценок пока нет

- Accenture LetterДокумент1 страницаAccenture LettersdrfОценок пока нет

- AccentureДокумент1 страницаAccenturesdrfОценок пока нет

- Letter From AccentureДокумент1 страницаLetter From AccenturesdrfОценок пока нет

- Accenture Offer Letter DetailsДокумент1 страницаAccenture Offer Letter DetailssdrfОценок пока нет

- PD Survey JuneДокумент3 страницыPD Survey JuneZerohedgeОценок пока нет

- Mobile Mayor Sam Jones Proposed Budget For 2012Документ25 страницMobile Mayor Sam Jones Proposed Budget For 2012jamieburch75Оценок пока нет

- Shakopee Quarterly Financial Update Q1-2016Документ6 страницShakopee Quarterly Financial Update Q1-2016Brad TabkeОценок пока нет

- District IELRB Response 9 16 14Документ125 страницDistrict IELRB Response 9 16 14morgansearlesОценок пока нет

- PEF Contract SummaryДокумент10 страницPEF Contract SummaryJimmyVielkindОценок пока нет

- 3134 - 2017 Budget Memo 12.06.16Документ8 страниц3134 - 2017 Budget Memo 12.06.16Brad TabkeОценок пока нет

- Template - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKДокумент9 страницTemplate - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKajaykrsinghpintuОценок пока нет

- Economics: Issues: Interest Rates and The Mankiw RuleДокумент4 страницыEconomics: Issues: Interest Rates and The Mankiw RuleBelinda WinkelmanОценок пока нет

- Complete Financial Plan - FinalДокумент16 страницComplete Financial Plan - FinalMustufa HusainОценок пока нет

- Quickstart 2013-14Документ29 страницQuickstart 2013-14Nick ReismanОценок пока нет

- Offer Letter From AccentureДокумент1 страницаOffer Letter From AccenturesdrfОценок пока нет

- DO 56, S. 2016 - Guidelines On The Grant of Performance-Based Bonus For The Department of Education Employees and Officials For Fiscal Year 2015Документ48 страницDO 56, S. 2016 - Guidelines On The Grant of Performance-Based Bonus For The Department of Education Employees and Officials For Fiscal Year 2015Deped Tambayan100% (6)

- To: From: CC: Date: ReДокумент11 страницTo: From: CC: Date: ReBrad TabkeОценок пока нет

- Financial Forecasting in The Budget Preparation ProcessДокумент7 страницFinancial Forecasting in The Budget Preparation Processnmsusarla888Оценок пока нет

- Standard and Poor Bond Rating 2014 - Tewksbury, MAДокумент6 страницStandard and Poor Bond Rating 2014 - Tewksbury, MALizMThughesОценок пока нет

- Education Trust Fund SpreadsheetДокумент17 страницEducation Trust Fund SpreadsheetMike CasonОценок пока нет

- 640 Budget PaperДокумент5 страниц640 Budget Paperpy007Оценок пока нет

- Features of Employees Deposit Linked Insurance SchemeДокумент4 страницыFeatures of Employees Deposit Linked Insurance SchemeVikrant DeshmukhОценок пока нет

- PAYROLLДокумент17 страницPAYROLLsaptaksamadder4Оценок пока нет

- CalPERS Pension & Health Benefits Committee Agenda Item 4Документ7 страницCalPERS Pension & Health Benefits Committee Agenda Item 4jon_ortizОценок пока нет

- Income Tax Slabs & Rates For Assessment Year 2013-14Документ37 страницIncome Tax Slabs & Rates For Assessment Year 2013-14Jigar RavalОценок пока нет

- 640-Budget PaperДокумент5 страниц640-Budget Paperpy007Оценок пока нет

- IG LetterДокумент3 страницыIG Letterjspector100% (1)

- Class of 2022Документ1 страницаClass of 2022jspectorОценок пока нет

- Cornell ComplaintДокумент41 страницаCornell Complaintjspector100% (1)

- Joseph Ruggiero Employment AgreementДокумент6 страницJoseph Ruggiero Employment AgreementjspectorОценок пока нет

- Siena Poll March 27, 2017Документ7 страницSiena Poll March 27, 2017jspectorОценок пока нет

- Inflation AllowablegrowthfactorsДокумент1 страницаInflation AllowablegrowthfactorsjspectorОценок пока нет

- State Health CoverageДокумент26 страницState Health CoveragejspectorОценок пока нет

- Pennies For Charity 2018Документ12 страницPennies For Charity 2018ZacharyEJWilliamsОценок пока нет

- Federal Budget Fiscal Year 2017 Web VersionДокумент36 страницFederal Budget Fiscal Year 2017 Web VersionjspectorОценок пока нет

- Abo 2017 Annual ReportДокумент65 страницAbo 2017 Annual ReportrkarlinОценок пока нет

- 2017 08 18 Constitution OrderДокумент27 страниц2017 08 18 Constitution OrderjspectorОценок пока нет

- Hiffa Settlement Agreement ExecutedДокумент5 страницHiffa Settlement Agreement ExecutedNick Reisman0% (1)

- Film Tax Credit - Quarterly Report, Calendar Year 2017 2nd Quarter PDFДокумент8 страницFilm Tax Credit - Quarterly Report, Calendar Year 2017 2nd Quarter PDFjspectorОценок пока нет

- NYSCrimeReport2016 PrelimДокумент14 страницNYSCrimeReport2016 PrelimjspectorОценок пока нет

- SNY0517 Crosstabs 052417Документ4 страницыSNY0517 Crosstabs 052417Nick ReismanОценок пока нет

- Teacher Shortage Report 05232017 PDFДокумент16 страницTeacher Shortage Report 05232017 PDFjspectorОценок пока нет

- Oag Sed Letter Ice 2-27-17Документ3 страницыOag Sed Letter Ice 2-27-17BethanyОценок пока нет

- Opiods 2017-04-20-By Numbers Brief No8Документ17 страницOpiods 2017-04-20-By Numbers Brief No8rkarlinОценок пока нет

- Activity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017Документ4 страницыActivity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017jspectorОценок пока нет

- Schneiderman Voter Fraud Letter 022217Документ2 страницыSchneiderman Voter Fraud Letter 022217Matthew HamiltonОценок пока нет

- 2017 School Bfast Report Online Version 3-7-17 0Документ29 страниц2017 School Bfast Report Online Version 3-7-17 0jspectorОценок пока нет

- Youth Cigarette and E-Cigs UseДокумент1 страницаYouth Cigarette and E-Cigs UsejspectorОценок пока нет

- 16 273 Amicus Brief of SF NYC and 29 Other JurisdictionsДокумент55 страниц16 273 Amicus Brief of SF NYC and 29 Other JurisdictionsjspectorОценок пока нет

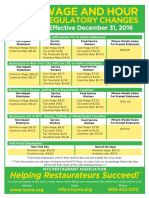

- Wage and Hour Regulatory Changes 2016Документ2 страницыWage and Hour Regulatory Changes 2016jspectorОценок пока нет

- p12 Budget Testimony 2-14-17Документ31 страницаp12 Budget Testimony 2-14-17jspectorОценок пока нет

- Darweesh Cities AmicusДокумент32 страницыDarweesh Cities AmicusjspectorОценок пока нет

- Review of Executive Budget 2017Документ102 страницыReview of Executive Budget 2017Nick ReismanОценок пока нет

- Voting Report CardДокумент1 страницаVoting Report CardjspectorОценок пока нет

- 2016 Local Sales Tax CollectionsДокумент4 страницы2016 Local Sales Tax CollectionsjspectorОценок пока нет

- Pub Auth Num 2017Документ54 страницыPub Auth Num 2017jspectorОценок пока нет

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesОт EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesРейтинг: 4.5 из 5 звезд4.5/5 (30)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОт EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОценок пока нет

- Rich Nurse Poor Nurses The Critical Stuff Nursing School Forgot To Teach YouОт EverandRich Nurse Poor Nurses The Critical Stuff Nursing School Forgot To Teach YouОценок пока нет

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessОт EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessРейтинг: 4.5 из 5 звезд4.5/5 (4)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsОт EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsОценок пока нет

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantОт EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantРейтинг: 4 из 5 звезд4/5 (104)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.От EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Рейтинг: 5 из 5 звезд5/5 (75)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouОт EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouРейтинг: 5 из 5 звезд5/5 (5)

- How To Budget And Manage Your Money In 7 Simple StepsОт EverandHow To Budget And Manage Your Money In 7 Simple StepsРейтинг: 5 из 5 звезд5/5 (4)

- More Money Now: A Millennial's Guide to Financial Freedom and SecurityОт EverandMore Money Now: A Millennial's Guide to Financial Freedom and SecurityОценок пока нет

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyОт EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyРейтинг: 5 из 5 звезд5/5 (1)

- Lean but Agile: Rethink Workforce Planning and Gain a True Competitive EdgeОт EverandLean but Agile: Rethink Workforce Planning and Gain a True Competitive EdgeОценок пока нет

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationОт EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationРейтинг: 4.5 из 5 звезд4.5/5 (18)

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonОт EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonРейтинг: 5 из 5 звезд5/5 (9)

- Finance for Nonfinancial Managers, Second Edition (Briefcase Books Series)От EverandFinance for Nonfinancial Managers, Second Edition (Briefcase Books Series)Рейтинг: 3.5 из 5 звезд3.5/5 (6)

- Budgeting: The Ultimate Guide for Getting Your Finances TogetherОт EverandBudgeting: The Ultimate Guide for Getting Your Finances TogetherРейтинг: 5 из 5 звезд5/5 (14)

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayОт EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayРейтинг: 3.5 из 5 звезд3.5/5 (2)

- 2,001 Innovative Ways to Save Your Company Thousands by Reducing Costs: A Complete Guide to Creative Cost Cutting And Boosting ProfitsОт Everand2,001 Innovative Ways to Save Your Company Thousands by Reducing Costs: A Complete Guide to Creative Cost Cutting And Boosting ProfitsОценок пока нет

- Saving Money: Simple tips that will help you save more money every day, and have more money every week!От EverandSaving Money: Simple tips that will help you save more money every day, and have more money every week!Оценок пока нет