Академический Документы

Профессиональный Документы

Культура Документы

Financial Results For December 31, 2015 (Result)

Загружено:

Shyam SunderИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Results For December 31, 2015 (Result)

Загружено:

Shyam SunderАвторское право:

Доступные форматы

Krebs Biochemicals & Industries Limited

8-2-57718, PlotNo.34,3rd Floor, Maas Heights, Road N0.8, Banjara Hills, Hyderabad-S00034

CIN : 12411()TG1991PLCO1351

l-2tn February,2016

To,

The Manager,

Listing Department,

National Stock Exchange of India Limited,

Exchange Plaza, Bandra Kurla Complex,

Bandra (E), Mumbai- 400051.

The Manager,

Department of Corporate Relations,

BSE Limited,

Towers, Dalal Street,

Fort, Mumbai- 400001

PJ

Dear Sir/Madam,

Sub: Submission of Unaudited Financial Results for the quarter ended

3l't December,2OL5

Ref: Reg.33 of SEBt (Listing Obligations and Disclosure Requirements) Regulations ,20L5

We refer to the above captioned subject, we herewith submit you the unaudited financial results

and the Limited Review Report of the Statutory Auditors for the quarter and 9 months ended 31't

December, 2015, which was taken on record at the Board Meeting held on 12th February, 201.5.

Kindly take the same into your records.

Thanking You,

Yours Faithfully,

I- -pi;

Tel : 0091-(0) 40-66037777 Fax : 0091-(0) 40-66037755

E-mail : krebs@krebsbiochem.com, marketing@krebsbiochem.com URL : www.krebsbiochem.com

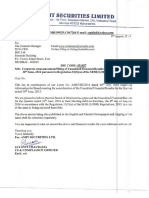

KREBS BIOCHEMICALS & INDUSTRIES LIMITED

CIN: L24ll0TGl991PLC0l35ll

Resd. Office: Plot No:38. 8-2-5778. Maas Heiebts. Road No:2. Baniara Hills. Hyderabad -500034

STAND ALONE FINANCIAL RDSULTS F'OR

.HE

OUARTER AND NINE MONTHS ENDED 3IST DECEMBER 2015

(Rs. In lacs

Previous Year

Ended

(6 Months)

Nine Months Etrded

Quarter Ended

Particulan

2.2015

fIInrD.lite.l)

PART - I

[ncome from Ooerations

a) Net Sales / Income from ODerations (Net ofExcise Dutv)

b) Other ODeratins Income

Total Income from oDerations (net)

tr

o

7

8

fArdiferl)

31.12.2015

31.12.2014

(l

{Ardifed)

31.03.201s

/A

2l

40.27

34

40.27

34.21

(8 48)

166 84

18.85

(241 64)

74.48

Cost of Material Consmed

Changes in invmtories offinished goods,

Emolovee bmefi ts exoense

L DeDreciation md Amortisation exoense

Other Mmufacnrrhs Exoenses

Other Exoenses

fotal Exoenses

lrofit / (Loss) from Operations before other income, finance costs and

)xceDtional items (1 - 2)

120.8

95.54

exceptional Items (3 + 4)

Finmce Costs

Protit / (Loss) from Ordinary Activities after Finance Costs but

before exceotional items (5 + 6)

(23

64

(227.e8)

109 08

6't 94

368.44

95.54

23.r1

(227.38'

185 67

187 I

90 76

213 82

677-38

(677.38)

286 62

248

82;70

160 3

60 0'1

369.sr

5'1

4'1.03

222 54

389.71

139.80

t.181.92

24 88

134'70

G7.80

(329,24)

(3ss.s0)

(139.801

(1,09r.s9)

67.80

63.89

l8r

(139.80)

(r,027.70)

69.61

Cther Income

Prolit / (Loss) from ordinary activitie before finance costs &

1'.75

99

2.38

60 76

(326.86)

(294.74)

356 66

20 90

407

0.25

25 17

(347.76)

(298.8r)

(r40.0s)

(r,0s2.87)

tt2

(676.26)

104

402 85

(1,079.r1)

68.5?

Exceptional Itmes:

a) Debit balances witten

off

(692.16

b) Waiver of Princioal of Bmk Loms & Others

3,625 17

(126.93

c) Deplerion in Value of Inventory

d) Amounts Written Back

9

0

1l

19.56

e) Profit on Sale of Food Division's Imovable Assets

f) Excess Provision ofErlier Period Written Back

Profit / (Loss) from Ordinarv activitis befor tax (7 + 8)

fax Exoeose

Net

Profit

Extra Ordinary Items

\et Profit / (Loss) for the Deriod

l5

t6

t7

l8

u07.671

(l40.05)

(1.031.02'

(11 + 12)

(784.01

84.t2

(39

99',,

(328.20)

(407.67)

(140.0s)

(1,03r.021

44.13

(784.01)

(328.20)

u07.67)

(140.0st

(1,03r.02)

44.13

(784.01r

(328.20)

(407.67)

(r40.0s)

(r,03r.02)

44.r3

(784.01)

1241 4:.

9s1.43

t306 43

95t.43

951.43

ihare of Profrt / (Loss) ofAssociates

Vlinority Interest

Net Profit / (Loss) afaer Taxes, minority Interest

[Loss) ofAssociates (f3 + f,|+

)

ffl

&

Share of ProfiU

Pajd-up Equity Share CaDital (Face Value Rs. I 0/- each

Reserve Excluding Revaluation Reserves as

1306 43

pu Balmce

Sheet ofprevious

b) Diluted

(2,637.91)

89 66

15 55

(328.20)

Accountins Year

Eaming Per Sbare (before extsaordinarry Items) (ofRs.10/- each) (not

re (D

Annualised)

) Rasic

19 (ii)

(126.93

t8 07

59 12

/ (Loss) from ordinary activitis after Tax (9 + 10)

I4

rdifed\

5.85

work-in-orop:ress md stock -in-tade

31.t2.2014

Exnenses

a

b

30.09.2015

(llna

3arning Per Share (after extaordinarry ltems)

(ofRs

10/-

NA

NA

NA

(1,407 e2)

NA

(2.5 I )

(3.28\

47

(3.28)

47

(7.89)

(7 89)

0.46

0.46

(8 24

(2 51

4',1

(7 8e)

046

(8.24

(7 8e)

046

(8 24

(8 24

each) (not

a) Basic

(2 5r

3.28)

@) Diluted

(2.5 1)

(3.28)

The above results have been reviewed by the Audit

NA

Comittee

(1

(r.47)

at its meeting held on 12th February, 2016 and approved by the Board of Directors of the Compmy at its meeting held

on l2th February, 2016.

fhe Above results are subjtrted to limited review by Compmy's Statutory Auditors.

Ihe Company is operating in

Figures have been regrouped, reananged wherever necessary

Ihe company has afloted 6.50 lacs equity shres md 6.80 lacs convertible wffimts on 03.10.2015 md the same was approved by shareholders on

'lace : Hyderabad

tafe

02 2016

one segment only hence no segment results have been disclosed

\I A

ltl 03.2015J4/i^te

J--

){'l

\---d)

-^hr.il \

./?- lufanaeinsD \ H\\ro'

Вам также может понравиться

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryОт EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Metalworking Machinery Wholesale Revenues World Summary: Market Values & Financials by CountryОт EverandMetalworking Machinery Wholesale Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Financial Results For December 31, 2015 (Result)Документ3 страницыFinancial Results For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Документ7 страницStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results For Dec 31, 2015 (Result)Документ4 страницыFinancial Results For Dec 31, 2015 (Result)Shyam SunderОценок пока нет

- Rain Calcining Limited: Audited Financial Results For The Quarter Ended June 30, 2004Документ1 страницаRain Calcining Limited: Audited Financial Results For The Quarter Ended June 30, 2004nitin2khОценок пока нет

- Standalone Financial Results For March 31, 2016 (Result)Документ6 страницStandalone Financial Results For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ8 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Документ7 страницStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- V-Guard Industries LTD 150513 RSTДокумент4 страницыV-Guard Industries LTD 150513 RSTSwamiОценок пока нет

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Документ8 страницAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderОценок пока нет

- TTR RRL: LimitedДокумент5 страницTTR RRL: LimitedShyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Документ6 страницStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Документ15 страницStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ5 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ5 страницFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Документ4 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Документ6 страницStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ5 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ7 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Statement of Assets & Liabilites As On March 31, 2016 (Result)Документ6 страницStatement of Assets & Liabilites As On March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Документ5 страницStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Документ3 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Документ6 страницStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results For December 31, 2015 (Result)Документ2 страницыFinancial Results For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Документ5 страницStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ6 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Updates On Financial Result For Dec 31, 2015 (Company Update)Документ4 страницыUpdates On Financial Result For Dec 31, 2015 (Company Update)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Документ7 страницStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Corrected Financial Results For The Period Ended March 31, 2016 & June 30, 2016 (Result)Документ4 страницыCorrected Financial Results For The Period Ended March 31, 2016 & June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For June 30, 2016 (Result)Документ1 страницаStandalone Financial Results For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ8 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Audited Result 2010 11Документ2 страницыAudited Result 2010 11Priya SharmaОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Документ4 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderОценок пока нет

- HINDUNILVR: Hindustan Unilever LimitedДокумент1 страницаHINDUNILVR: Hindustan Unilever LimitedShyam SunderОценок пока нет

- Financial Results For Dec 31, 2013 (Result)Документ4 страницыFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Mutual Fund Holdings in DHFLДокумент7 страницMutual Fund Holdings in DHFLShyam SunderОценок пока нет

- JUSTDIAL Mutual Fund HoldingsДокумент2 страницыJUSTDIAL Mutual Fund HoldingsShyam SunderОценок пока нет

- Financial Results For September 30, 2013 (Result)Документ2 страницыFinancial Results For September 30, 2013 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedДокумент2 страницыSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderОценок пока нет

- Order of Hon'ble Supreme Court in The Matter of The SaharasДокумент6 страницOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderОценок пока нет

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Документ1 страницаPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Settlement Order in Respect of R.R. Corporate Securities LimitedДокумент2 страницыSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderОценок пока нет

- Financial Results For June 30, 2013 (Audited) (Result)Документ2 страницыFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderОценок пока нет

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliДокумент5 страницExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderОценок пока нет

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Документ5 страницStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results For June 30, 2014 (Audited) (Result)Документ3 страницыFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For March 31, 2016 (Result)Документ11 страницStandalone Financial Results For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results For Mar 31, 2014 (Result)Документ2 страницыFinancial Results For Mar 31, 2014 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For September 30, 2016 (Result)Документ3 страницыStandalone Financial Results For September 30, 2016 (Result)Shyam SunderОценок пока нет

- PDF Processed With Cutepdf Evaluation EditionДокумент3 страницыPDF Processed With Cutepdf Evaluation EditionShyam SunderОценок пока нет

- Standalone Financial Results For June 30, 2016 (Result)Документ2 страницыStandalone Financial Results For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Investor Presentation For December 31, 2016 (Company Update)Документ27 страницInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderОценок пока нет

- Transcript of The Investors / Analysts Con Call (Company Update)Документ15 страницTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Methodology and Specifications Guide: Platts-ICE Forward Curve - Electricity (North America)Документ5 страницMethodology and Specifications Guide: Platts-ICE Forward Curve - Electricity (North America)BubblyDeliciousОценок пока нет

- As 26 Intangible AssetsДокумент26 страницAs 26 Intangible Assetsapi-3705877Оценок пока нет

- Capital Structure of Ranbaxy PharmaДокумент40 страницCapital Structure of Ranbaxy PharmaNooral Alfa100% (1)

- Manager Profile BalestraДокумент5 страницManager Profile BalestrakunalwarwickОценок пока нет

- 5Документ56 страниц5Willy AndersonОценок пока нет

- Banco Filipino vs. NavarroДокумент11 страницBanco Filipino vs. NavarroBert AlcazarenОценок пока нет

- B6005 Lecture 11 Trade Credit and Shortem Loan HandoutДокумент32 страницыB6005 Lecture 11 Trade Credit and Shortem Loan HandoutTeddy HandayaОценок пока нет

- Week 9 Implied TrustДокумент56 страницWeek 9 Implied TrustMikaela TriaОценок пока нет

- MF QuestionnaireДокумент5 страницMF QuestionnaireVINEETA KAPOORОценок пока нет

- PNK Pinnacle Entertainment GLPI Investor Deck 2016Документ35 страницPNK Pinnacle Entertainment GLPI Investor Deck 2016Ala BasterОценок пока нет

- Matrix XXXДокумент114 страницMatrix XXXIcyy Dela PeñaОценок пока нет

- Dupont Corporation: Sale of Performance Coatings Student Preparation GuideДокумент1 страницаDupont Corporation: Sale of Performance Coatings Student Preparation GuideTrade OnОценок пока нет

- Form A Application FormДокумент6 страницForm A Application FormBoinzb TОценок пока нет

- Abdul Azeem: Topicwise Icap Past Paper Analysis - Cfap 4 (Bfd/Mac)Документ6 страницAbdul Azeem: Topicwise Icap Past Paper Analysis - Cfap 4 (Bfd/Mac)sheralihrz0% (1)

- Cash Flow of Southwest AirlinesДокумент4 страницыCash Flow of Southwest AirlinessumitОценок пока нет

- Accounting AnswersДокумент5 страницAccounting AnswersallhomeworktutorsОценок пока нет

- Nevada Unclaimed Property Reporting ManualДокумент22 страницыNevada Unclaimed Property Reporting ManualJay SingletonОценок пока нет

- Application Form For MsmesДокумент8 страницApplication Form For MsmesNitin PaliwalОценок пока нет

- Cambridge Associates LLC U.S. Venture Capital Index and Selected Benchmark Statistics March 31, 2009Документ11 страницCambridge Associates LLC U.S. Venture Capital Index and Selected Benchmark Statistics March 31, 2009Dan Primack100% (1)

- Purchase of Land - Legal Checklists - Property BytesДокумент12 страницPurchase of Land - Legal Checklists - Property BytesSivashankar DhanarajОценок пока нет

- MFSI-Unit IДокумент35 страницMFSI-Unit ISanthiya LakshmiОценок пока нет

- COST OF CAPITAL KEY TERMSДокумент33 страницыCOST OF CAPITAL KEY TERMSMark Levi CorpuzОценок пока нет

- 2023citizen's Charter (2nd Edition) For Extension OfficesДокумент1 203 страницы2023citizen's Charter (2nd Edition) For Extension OfficesJason YinОценок пока нет

- Literature Review of Gold ETF Performance and CharacteristicsДокумент8 страницLiterature Review of Gold ETF Performance and CharacteristicsAshi GargОценок пока нет

- Dilip Kumar Das: Curriculum VitaeДокумент3 страницыDilip Kumar Das: Curriculum VitaedilipkumardasОценок пока нет

- Dallas Business Journal 2014Документ48 страницDallas Business Journal 2014sarah123Оценок пока нет

- 4 Bond Valuation - PPT PDFДокумент79 страниц4 Bond Valuation - PPT PDFJocel LactaoОценок пока нет

- GN Case Digests FinalДокумент259 страницGN Case Digests FinalSharmane PastranaОценок пока нет

- Section 5 Registration PDFДокумент2 страницыSection 5 Registration PDFAnonymous YBBpXPb7VОценок пока нет

- Using ADX to identify trend breakouts and scalping opportunities in futures marketsДокумент7 страницUsing ADX to identify trend breakouts and scalping opportunities in futures marketsMilind Bidve100% (6)