Академический Документы

Профессиональный Документы

Культура Документы

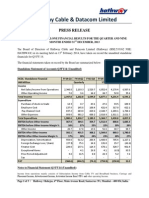

YOU - Income Statements (Aggregated) : INR in Million FY13 FY14 H1FY14 H1FY15 H2FY14 H2FY15 FY15 Revenue

Загружено:

Anonymous hPo9UwИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

YOU - Income Statements (Aggregated) : INR in Million FY13 FY14 H1FY14 H1FY15 H2FY14 H2FY15 FY15 Revenue

Загружено:

Anonymous hPo9UwАвторское право:

Доступные форматы

Draft

YOU - Income statements (aggregated)

INR in million

Revenue

Broadband business

Lease of fibre

EBS

Total revenue (A)

Direct costs

Bandwidth cost

Cost of distribution/collection

EBS business COGS

Direct costs (B)

Gross margin C = (A-B)

Employee costs

Network operations & maint

SG&A

Overheads

EBITDA before GPON cost

GPON cost

EBITDA after GPON cost

Advances written off

Interest expense

Exchange loss on foreign currency loan

Other non operating income (net)

PBDAT

Depreciation and amortisation

PBT

FY13

FY14

794.0

21.7^

82.9

898.7

(99.4)

(27.3)

(82.0)

(208.7)

690.0

(289.8)

(63.3)

(270.9)

(623.9)

66.0

(5.5)

60.6

(1,294.9)

(49.9)

(17.3)

50.0

(1,251.5)

(238.9)

(1,490.4)

H1FY14

H1FY15

953.0

9.1

28.5

990.5

463.4

5.0

15.7

484.1

530.0

4.3

11.2

545.5

(119.4)

(25.0)

(22.1)

(166.6)

823.9

(310.3)

(66.0)

(255.7)

(632.0)

191.9

(17.1)

174.8

(133.1)

(50.8)

(30.4)

31.4

(8.1)

(197.0)

(205.1)

(60.2)

(10.7)

(13.6)

(84.5)

399.6

(162.8)

(32.0)

(117.5)

(312.3)

87.3

(5.7)

81.6

(24.1)

(45.3)

0.1

12.3

(107.7)

(95.4)

(65.5)

(12.6)

(9.0)

(87.1)

458.4

(186.2)

(35.1)

(124.3)

(345.6)

112.7

(11.6)

101.1

(18.0)

(8.0)

6.6

81.7

(102.0)

(20.3)

H2FY14

H2FY15

FY15

1,101.9

7.0

20.0

1,128.9

(131.7)

(25.9)

(14.2)

(171.7)

957.1

(376.3)

(52.7)

(240.4)

(669.4)

287.8

(22.1)

265.6

(105.2)

(27.4)

14.7

(1.3)

146.5#

(198.8)

(52.2)

KPIs

Gross margin %#

EBITDA % before GPON cost

EBITDA % after GPON cost

Average revenue per subscribers (INR) p.a.

EBITDA per subscriber after GPON cost (INR) p.a.

Source: Management information and PwC analysis

Na: Not available

84.0%

7.3%

6.7%

6,923

528

84.8%

19.4%

17.7%

7,611

1,396

# broadband business

*annualised

84.7%

18.0%

16.9%

7,561

1,332

85.3%

20.7%

18.5%

7,703

1,470

85.7%

25.5%

23.5%

EBS-Enterprise Business Solution

^ For the purpose of our analyses we have excluded lease revenue of INR 12.3 million in FY13 received from SCOD18 (group company).

Datapack Project Speed

Page 1 of 14

RIS

Strictly Private Confidential

Draft

Datapack Project Speed

Page 2 of 14

RIS

Strictly Private Confidential

Draft

% change

FY14 v.

FY13

H1FY15 v.

H1FY14

20%

(58%)

(66%)

10%

14%

(14%)

(29%)

13%

20%

(8%)

(73%)

(20%)

19%

7%

4%

(6%)

1%

191%

213%

189%

2%

76%

(99%)

(18%)

(86%)

9%

18%

(34%)

3%

15%

14%

10%

6%

11%

29%

104%

24%

(25%)

(82%)

564%

(5%)

(79%)

Datapack Project Speed

Page 3 of 14

RIS

Strictly Private Confidential

Draft

Datapack Project Speed

Page 4 of 14

RIS

Strictly Private Confidential

Draft

Monthly income statements

INR in million

Revenue

Usage

Unlimited

Rentals

Installation

G'pon

Sale of EBS/HW

VOIP

Corporate

SME

Others

Total revenue

###

###

###

#

###

#

#

##

###

#

#

###

Cost of goods sold

Bandwidth

Cost of Distribution & Collection

Revenue share (G'pon)

VOIP Termination Cost

EBS (Cyber Roam &SI) Direct Cost

Total COGS

#

#

#

##

#

###

Contribution

Contribution % total

Contribution

Contribution % BB

###

###

###

###

Network operations and maintainance

#

Gross profit

###

Operating costs

Other

Staff costs

Office

Other opex

Provision for doubtful debt

###

#

#

#

Common operating cost

Staff costs

Datapack Project Speed

Page 5 of 14

Monthly

Strictly Private Confidential

Draft

Marketing

Office

Other opex

Call centre cost

Total operating cost

#

#

#

#

###

EBITDA (before cost of acqusition)###

Cost of acqusition

Acquisition FOS cost

Other cost of acquisition

Marketing

Total cost of acqusition

#

#

#

###

EBITDA (after cost of acqusition) ###

Non-operating expenses

#

Forex gain/(loss)

#

Interest Income

#

Interest Expense

#

EBITDA after non-operating & NII ###

Depreciation

Amortisation

EBIT

###

#

###

Source: Management information and PwC analysis

Note: FY13 expenses are before provision for doubtful debts of INR 16.4 million

Datapack Project Speed

Page 6 of 14

Monthly

Strictly Private Confidential

Draft

Monthly income statements

INR in million

Revenue

Usage

Unlimited

Rentals

Installation

G'pon

Sale of EBS/HW

VOIP

Corporate

SME

Others

Total revenue

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

H1FY15

20.0

38.0

0.0

9.4

2.8

17.4

0.1

0.7

88.2

20.2

39.7

0.0

11.8

1.0

17.6

0.1

0.6

91.1

19.5

38.8

0.0

12.8

1.4

17.5

0.5

0.6

91.1

20.2

40.4

0.0

13.9

1.4

18.4

0.3

0.6

95.2

19.6

39.7

0.0

13.8

2.6

18.8

0.3

0.6

95.3

19.4

40.3

0.0

11.2

2.1

18.2

0.3

0.6

92.1

118.9

236.8

0.1

72.9

11.2

107.8

1.6

3.7

553.0

Cost of goods sold

Bandwidth

Cost of Distribution & Collection

Revenue share (G'pon)

VOIP Termination Cost

EBS (Cyber Roam &SI) Direct Cost

Total COGS

10.0

2.3

1.5

2.1

15.9

10.0

2.2

1.7

0.7

14.6

10.4

2.2

1.7

1.1

15.3

10.7

2.2

1.9

1.1

15.8

10.8

2.2

2.0

2.0

17.0

11.1

2.2

2.0

1.6

16.9

62.9

13.4

10.7

8.6

95.6

Contribution

Contribution % total

Contribution

Contribution % BB

72.3

82%

71.7

84%

76.4

84%

76.2

85%

75.7

83%

75.4

84%

79.4

83%

79.1

84%

78.3

82%

77.7

84%

75.2

82%

74.8

83%

457.4

83%

454.8

84%

5.6

5.7

4.9

4.7

4.6

4.6

30.1

Gross profit

66.7

70.8

70.8

74.7

73.7

70.6

427.3

Operating costs

Other

Staff costs

Office

Other opex

Provision for doubtful debt

18.9

8.9

0.0

0.4

20.0

9.7

0.3

0.5

20.1

9.8

(0.1)

0.5

22.7

10.6

0.1

0.4

24.8

10.6

0.1

0.5

25.1

10.6

0.1

0.3

131.6

60.2

0.6

2.6

Common operating cost

Staff costs

3.6

3.5

4.2

4.1

4.1

23.2

Network operations and maintainance

Datapack Project Speed

3.7

Page 7 of 14

Monthly

Strictly Private Confidential

Draft

Marketing

Office

Other opex

Call centre cost

Total operating cost

1.3

2.1

1.1

2.6

38.8

1.3

2.0

0.9

2.6

40.7

0.1

1.9

1.1

2.6

39.7

0.1

1.1

0.8

2.6

42.8

0.1

1.1

0.8

2.6

44.8

0.1

1.1

0.8

2.6

44.9

3.1

9.2

5.5

15.7

251.6

EBITDA (before cost of acqusition)

27.9

30.1

31.1

31.9

28.9

25.8

175.6

6.3

0.8

1.9

9.0

6.1

1.3

1.8

9.2

EBITDA (after cost of acqusition)

18.9

20.9

22.3

22.0

20.9

Non-operating expenses

Forex gain/(loss)

Interest Income

Interest Expense

EBITDA after non-operating & NII

0.0

(1.3)

0.7

3.4

14.9

0.0

7.5

1.3

3.2

26.4

3.8

(5.6)

1.2

2.5

11.5

0.0

(0.7)

1.1

2.8

19.6

0.9

(1.5)

1.2

2.7

17.1

1.6

(6.3)

1.2

2.5

8.8

6.4

(8.0)

6.6

17.2

98.2

Depreciation

Amortisation

EBIT

16.8

0.3

(2.3)

16.3

0.3

9.8

16.1

0.3

(4.9)

17.2

0.3

2.1

19.0

0.3

(2.2)

14.8

0.3

(6.3)

100.2

1.8

(3.8)

Cost of acqusition

Acquisition FOS cost

Other cost of acquisition

Marketing

Total cost of acqusition

##

7.0

1.9

(0.2)

8.7

8.2

1.9

(0.2)

9.9

6.3

1.9

(0.2)

8.0

6.0

1.9

(0.2)

7.7

18.0

39.9

9.6

2.9

52.5

123.2

Source: Management information and PwC analysis

Note: FY13 expenses are before provision for doubtful debts of INR 16.4 million

Datapack Project Speed

Page 8 of 14

Monthly

Strictly Private Confidential

Overheads and SG&A costs per subscriber per annum

INR in million

Manpower cost

Outsourced contract cost

Employee costs

Rent expenses

Power & electricity charges

Repairs and maintenance

Network shifting charges

License fees - TRAI and others

Hire charges network equipment

Network operations & mait

SG&A costs

Overheads total

Less: one-time service-tax exp*

Less: one-time repair & main*

Adjusted overheads

FY13

156.9

132.9

289.8

29.2

13.8

12.0

3.9

3.2

1.2

63.3

270.9

623.9

623.9

FY14

H1FY15

153.2

66.0

157.1

120.2

310.3

186.2

33.6

18.4

14.5

7.8

12.0

5.2

2.4

1.8

2.6

1.5

0.9

0.5

66.0

35.1

255.7

124.3

632.0

345.6

(7.9)

(4.4)

(4.0)

620.1

341.2

FY15

166.7

209.9

376.6

29.7

15.7

3.2

0.4

25.1

0.9

75.1

240.4

692.1

(4.4)

687.7

Source: Management information and PwC analysis

* for details refer QOE page 28

No. of subscribers

114,687

125,208

137,608

154,916

H1FY15

FY15

SG&A costs per subscriber per annum

INR in million

Office and admin expenses

Rent

Electricity expenses (office)

Security charges

Travelling expenses

Communication expenses

Other office expenses

Credit card and bank charges

Service tax - expense

Cafetaria

Repairs and maintenance

House keeping expenses

Insurance

Hire charges

Recruitment expenses

Other opex

Legal and professional fees

Audit fees

Others

Office and admin expenses

Advertisement

Sales promotion

Advt & mktg

Call centre cost

Provision for doubt debtors

Dealer commission -activation

Sale promotion - target incentives

Other cost of acquisition

SG&A Total

Less: one-time service-tax exp$

FY13

32.1

19.2

13.1

11.0

8.2

10.9

5.1

6.6

4.6

3.8

5.1

2.3

2.5

15.3

2.2

0.8

142.8

46.3

13.8

60.2

29.7

22.5

4.9

10.7

15.6

270.9

-

FY14

33.7

18.6

15.7

8.2

7.5

10.6

8.5

7.9

7.4

8.9

4.2

5.1

2.5

*

20.9

2.2

1.5

163.3

27.1

13.3

40.4

29.2

5.5

6.2

11.0

17.3

255.7

(7.9)

17.5

10.4

8.9

5.9

5.6

5.5

4.7

4.4

3.9

3.0

2.7

2.0

1.1

*

6.0

1.6

0.6

84.1

9.6

4.9

14.5

15.8

2.7

2.6

4.5

7.2

124.3

(4.4)

39.7

19.8

18.6

11.8

9.2

6.0

9.8

4.4

9.0

6.7

4.9

4.2

4.6

1.5

17.8

2.9

171.2

8.4

5.6

14.0

36.9

4.6

5.0

8.7

13.7

240.41

(4.4)

2.7

Less: one-time repair & main$

Adjusted SG&A

270.9

(4.0)

243.8

119.9

236.0

Source: Management information and PwC analysis

* Regoruped as part of employee costs

(240.4)

0.0

Cost per subscriber

FY13

FY14

H1FY15

1,368

1,224

960

1,159

1,255

1,747

2,527

2,478

2,707

254

268

267

120

116

113

105

96

75

34

19

26

28

21

22

10

7

7

552

527

511

2,362

2,042

1,806

5,440

5,047

5,024

(63)

(64)

(32)

5,440

4,952

4,960

^annualised H1FY15 over FY14

FY15

2,152

2,710

4,862

383.1862

203.2506

41.92134

5.642012

324.6068

11.03496

970

3,104

8,936

(57)

0

8,879

Cost per subscriber

FY13

280

168

115

96

71

95

45

58

40

33

45

20

22

133

19

7

1,245

404

121

524

259

196

42

94

136

2,362

-

FY14

H1FY15

269

149

125

65

60

85

67

63

59

71

33

41

20

167

17

12

1,304

217

106

323

233

44

50

88

138

2,042

(63)

254

150

130

86

81

80

69

65

57

44

40

30

16

% change in cost

FY14

H1FY15^

(2%)

(14%)

18%

53%

7%

20%

15%

9%

5%

8%

0%

(14%)

(39%)

48%

(18%)

18%

(22%)

13%

4%

6%

(6%)

(3%)

1%

9%

% change in cost

FY15

FY14

H1FY15^

513

256.1534

240.5156

152.0574

119

77

127

57

117

87

63

54

60

5%

(3%)

19%

(26%)

(8%)

(3%)

65%

12%

94%

11%

(1%)

11%

-

4%

11%

14%

45%

49%

3%

12%

13%

6%

(32%)

31%

(19%)

(15%)

-

88

230

24

37

9

1,222

2,210

140

108

71

73

211 181.1275

230 477.0231

39 59.38702

38

64.0496

66 112.5532

104

177

1,806

3,104

(64)

(57)

36%

1%

96%

14%

(41%)

(4%)

(33%)

(2%)

(76%)

28%

3%

11%

(6%)

#DIV/0!

(42%)

50%

(23%)

3%

(29%)

(26%)

(28%)

8%

(3%)

(15%)

(18%)

(17%)

(3%)

11%

2,362

(32)

1,947

1,743

^annualised H1FY15 over FY14

$ for details refer QOE page 28

3,047

#DIV/0!

(100%)

Office and admin costs

% change in cost

INR in million

FY13

Office and admin expenses

Rent

32.1

Electricity expenses (office)

19.2

Security charges

13.1

Travelling expenses

11.0

Communication expenses

8.2

Other office expenses

10.9

Credit card and bank charges

5.1

Service tax - expense

Cafetaria

6.6

Repairs and maintenance

4.6

House keeping expenses

3.8

Insurance

5.1

Hire charges

2.3

Recruitment expenses

2.5

Other opex

Legal and professional fees

15.3

Audit fees

2.2

Others

0.8

Office and admin expenses

142.8

Less: one-time service-tax exp$

Less: one-time repair & main$

Adjusted Office and admin exp 142.8

FY14

33.7

18.6

15.7

8.2

7.5

10.6

8.5

7.9

7.4

8.9

4.2

5.1

2.5

*

20.9

2.2

1.5

163.3

(7.9)

(4.0)

151.4

H1FY15

17.5

10.4

8.9

5.9

5.6

5.5

4.7

4.4

3.9

3.0

2.7

2.0

1.1

*

6.0

1.6

0.6

84.1

(4.4)

79.7

FY15

38.6

19.8

18.6

11.8

9.2

6.0

9.8

4.4

9.0

6.7

4.9

4.2

4.6

1.5

17.8

2.9

170.0

(4.4)

165.6

Source: Management information and PwC analysis^annualised H1FY15 over FY14

* Regoruped as part of employee costs

FY14

5%

(3%)

19%

(26%)

(8%)

(3%)

65%

H1FY15^

12%

94%

11%

(1%)

11%

4%

11%

14%

45%

49%

3%

12%

13%

6%

(32%)

31%

(19%)

(15%)

36%

1%

96%

14%

(42%)

50%

(23%)

3%

6%

5%

Вам также может понравиться

- Wireless Telecommunications Carrier Revenues World Summary: Market Values & Financials by CountryОт EverandWireless Telecommunications Carrier Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Cellular & Wireless Telecommunication Revenues World Summary: Market Values & Financials by CountryОт EverandCellular & Wireless Telecommunication Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- GP MIS ReportДокумент16 страницGP MIS ReportFarah MarjanОценок пока нет

- Tata Communications LTD: Key Financial IndicatorsДокумент4 страницыTata Communications LTD: Key Financial IndicatorsDeepak AswalОценок пока нет

- Bharti Airtel Result UpdatedДокумент13 страницBharti Airtel Result UpdatedAngel BrokingОценок пока нет

- Airthread WorksheetДокумент21 страницаAirthread Worksheetabhikothari3085% (13)

- Bharti Airtel (BHATE) : Roll-Out Benefits of 4G To Be Visible SoonДокумент12 страницBharti Airtel (BHATE) : Roll-Out Benefits of 4G To Be Visible Soonarun_algoОценок пока нет

- Airthread SolutionДокумент30 страницAirthread SolutionSrikanth VasantadaОценок пока нет

- Tata MotorsДокумент5 страницTata Motorsinsurana73Оценок пока нет

- RMN - 0228 - THCOM (Achieving The Impossible)Документ4 страницыRMN - 0228 - THCOM (Achieving The Impossible)bodaiОценок пока нет

- Hathway Press Release BSДокумент3 страницыHathway Press Release BSAmol JadhaoОценок пока нет

- AirThread CalcДокумент15 страницAirThread CalcSwati VermaОценок пока нет

- Alibaba FCFEДокумент60 страницAlibaba FCFEAhmad Faiz SyauqiОценок пока нет

- HSBC Telecom Report May 2012Документ11 страницHSBC Telecom Report May 2012Senem Deniz SağıroğluОценок пока нет

- Q2FY11 Reliance Communications Result UpdateДокумент4 страницыQ2FY11 Reliance Communications Result UpdateVinit BolinjkarОценок пока нет

- Revenue: INR in Million FY Dec - 15 Avg. Profit Per SubscriberДокумент2 страницыRevenue: INR in Million FY Dec - 15 Avg. Profit Per SubscriberAnonymous hPo9UwОценок пока нет

- JK Tyres & Industries LTD: Lower Sales Hinder Performance, Maintain BUYДокумент4 страницыJK Tyres & Industries LTD: Lower Sales Hinder Performance, Maintain BUYDeepa GuptaОценок пока нет

- Magma Fin Report Inv PresДокумент38 страницMagma Fin Report Inv PresDemetrius PaisОценок пока нет

- Cost MGMT Assigneemnt Pmu Week3Документ11 страницCost MGMT Assigneemnt Pmu Week3pranjal92pandeyОценок пока нет

- Q1 FY2013 InvestorsДокумент28 страницQ1 FY2013 InvestorsRajesh NaiduОценок пока нет

- SUN TV Network: Performance HighlightsДокумент11 страницSUN TV Network: Performance HighlightsAngel BrokingОценок пока нет

- Reliance Communication, 1Q FY 2014Документ10 страницReliance Communication, 1Q FY 2014Angel BrokingОценок пока нет

- Alibaba IPO Financial Model WallstreetMojoДокумент52 страницыAlibaba IPO Financial Model WallstreetMojoJulian HutabaratОценок пока нет

- GR I Crew XV 2018 TcsДокумент79 страницGR I Crew XV 2018 TcsMUKESH KUMARОценок пока нет

- Tulip Telecom LTD: Results In-Line, Retain BUYДокумент5 страницTulip Telecom LTD: Results In-Line, Retain BUYadatta785031Оценок пока нет

- Alibaba IPO Financial ModelДокумент54 страницыAlibaba IPO Financial ModelPRIYANKA KОценок пока нет

- The - Model - Class WorkДокумент16 страницThe - Model - Class WorkZoha KhaliqОценок пока нет

- Starhub LTD: Announcement of Audited Results For The Full Year Ended 31 December 2014Документ33 страницыStarhub LTD: Announcement of Audited Results For The Full Year Ended 31 December 2014Cương TiếnОценок пока нет

- First Resources: Singapore Company FocusДокумент7 страницFirst Resources: Singapore Company FocusphuawlОценок пока нет

- Deliverable #1 - Fiat Chrysler and VolkswagenДокумент4 страницыDeliverable #1 - Fiat Chrysler and VolkswagenSavitaОценок пока нет

- Net Phone ProjectДокумент4 страницыNet Phone ProjectUyên TrầnОценок пока нет

- Mercury AthleticДокумент13 страницMercury Athleticarnabpramanik100% (1)

- Sun TV, 1Q Fy 2014Документ11 страницSun TV, 1Q Fy 2014Angel BrokingОценок пока нет

- China Telecom: Smartphones For All Segments and SeasonsДокумент4 страницыChina Telecom: Smartphones For All Segments and SeasonsNate Joshua TanОценок пока нет

- Project 2Документ26 страницProject 2api-325954956Оценок пока нет

- Solution - Eicher Motors LTDДокумент28 страницSolution - Eicher Motors LTDvasudevОценок пока нет

- Alibaba IPO: Prepared by - Dheeraj Vaidya, CFA, FRMДокумент53 страницыAlibaba IPO: Prepared by - Dheeraj Vaidya, CFA, FRMHaysam TayyabОценок пока нет

- Bakrie Telecom: Entering The Maturity PhaseДокумент6 страницBakrie Telecom: Entering The Maturity PhasetswijayaОценок пока нет

- Qualcomm, Inc. - Aakaash SreereddyДокумент18 страницQualcomm, Inc. - Aakaash Sreereddyaakaash3369Оценок пока нет

- Reliance Communication: Performance HighlightsДокумент10 страницReliance Communication: Performance HighlightsAngel BrokingОценок пока нет

- Bosch 1qcy2014ru 290414Документ12 страницBosch 1qcy2014ru 290414Tirthajit SinhaОценок пока нет

- Bajaj Electricals: Pinch From E&P To End SoonДокумент14 страницBajaj Electricals: Pinch From E&P To End SoonYash BhayaniОценок пока нет

- Air Thread Excel FileДокумент7 страницAir Thread Excel FileAlex Wilson0% (1)

- DMX Technologies: OverweightДокумент4 страницыDMX Technologies: Overweightstoreroom_02Оценок пока нет

- IRB Infrastructure: Performance HighlightsДокумент14 страницIRB Infrastructure: Performance HighlightsAngel BrokingОценок пока нет

- CJ - Credit SuiseДокумент24 страницыCJ - Credit Suisebackup tringuyenОценок пока нет

- Tesla Company AnalysisДокумент83 страницыTesla Company AnalysisStevenTsaiОценок пока нет

- Airthread Connections NidaДокумент15 страницAirthread Connections NidaNidaParveen100% (1)

- 5 EstadosДокумент15 страниц5 EstadosHenryRuizОценок пока нет

- Herc - 2014 15.91 92Документ2 страницыHerc - 2014 15.91 92ACОценок пока нет

- Operating Profit Analysis: Tata Consultancy Services (TCS)Документ43 страницыOperating Profit Analysis: Tata Consultancy Services (TCS)manju_chandelОценок пока нет

- Ho Bee - Kim EngДокумент8 страницHo Bee - Kim EngTheng RogerОценок пока нет

- Prime Focus - Q4FY12 - Result Update - Centrum 09062012Документ4 страницыPrime Focus - Q4FY12 - Result Update - Centrum 09062012Varsha BangОценок пока нет

- Macrs Depreciation: New Smart Phone Calculation AnalysisДокумент4 страницыMacrs Depreciation: New Smart Phone Calculation AnalysisErro Jaya RosadyОценок пока нет

- Bharti Airtel: Performance HighlightsДокумент13 страницBharti Airtel: Performance HighlightsAngel BrokingОценок пока нет

- FSM With DCFДокумент31 страницаFSM With DCFjustinbui85Оценок пока нет

- Container Corp of India: Valuations Appear To Have Bottomed Out Upgrade To BuyДокумент4 страницыContainer Corp of India: Valuations Appear To Have Bottomed Out Upgrade To BuyDoshi VaibhavОценок пока нет

- Wired Telecommunications Carrier Lines World Summary: Market Values & Financials by CountryОт EverandWired Telecommunications Carrier Lines World Summary: Market Values & Financials by CountryОценок пока нет

- Telecommunications Reseller Revenues World Summary: Market Values & Financials by CountryОт EverandTelecommunications Reseller Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Building Inspection Service Revenues World Summary: Market Values & Financials by CountryОт EverandBuilding Inspection Service Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Valuing SynergiesДокумент4 страницыValuing SynergiesAnonymous hPo9UwОценок пока нет

- Revenue: INR in Million FY Dec - 15 Avg. Profit Per SubscriberДокумент2 страницыRevenue: INR in Million FY Dec - 15 Avg. Profit Per SubscriberAnonymous hPo9UwОценок пока нет

- Purchase December WorkingДокумент466 страницPurchase December WorkingAnonymous hPo9UwОценок пока нет

- CapexДокумент3 страницыCapexAnonymous hPo9UwОценок пока нет

- Inter GraphДокумент46 страницInter GraphRakesh Kolasani NaiduОценок пока нет

- Tutorial 3 MFRS8 Q PDFДокумент3 страницыTutorial 3 MFRS8 Q PDFKelvin LeongОценок пока нет

- Moody's Methodology For Asset Management FirmsДокумент20 страницMoody's Methodology For Asset Management FirmsSteve KravitzОценок пока нет

- Chuck Akre Value Investing Conference TalkДокумент21 страницаChuck Akre Value Investing Conference TalkMarc F. DemshockОценок пока нет

- AirThread Valuation SheetДокумент11 страницAirThread Valuation SheetAngsuman BhanjdeoОценок пока нет

- Financial Management - Financial Statements Analysis NotesДокумент24 страницыFinancial Management - Financial Statements Analysis Noteskamdica100% (3)

- Chapter 4 Sample BankДокумент18 страницChapter 4 Sample BankWillyNoBrainsОценок пока нет

- Ar 0910Документ174 страницыAr 0910nishantjims223290Оценок пока нет

- AirThread G015Документ6 страницAirThread G015sahildharhakim83% (6)

- 15WO030580 2014 Annual Report WebДокумент106 страниц15WO030580 2014 Annual Report WebDyah FirgianiОценок пока нет

- Supply Chain Management Practices in India (A Case Study of Tata Steel) Pre Submission PH.D - ThesisДокумент31 страницаSupply Chain Management Practices in India (A Case Study of Tata Steel) Pre Submission PH.D - Thesismanoj rakesh100% (10)

- Uber Technologies, Inc.: United States Securities and Exchange Commission Form S 1 Registration StatementДокумент420 страницUber Technologies, Inc.: United States Securities and Exchange Commission Form S 1 Registration StatementZerohedgeОценок пока нет

- 109 04 Simple LBO ModelДокумент7 страниц109 04 Simple LBO Modelheedi0Оценок пока нет

- 2004 05mainДокумент175 страниц2004 05mainSweta J MathОценок пока нет

- TRAI Annual Report English 16052016 2Документ228 страницTRAI Annual Report English 16052016 2Rajeev KumarОценок пока нет

- Worldwide Paper DCFДокумент16 страницWorldwide Paper DCFLaila SchaferОценок пока нет

- Financial Analysis, Planning and Forecasting Theory and ApplicationДокумент102 страницыFinancial Analysis, Planning and Forecasting Theory and ApplicationJose MartinezОценок пока нет

- 2019 PDFДокумент283 страницы2019 PDFAmitОценок пока нет

- Ahel Annual Report 2018 PDFДокумент364 страницыAhel Annual Report 2018 PDFEdricОценок пока нет

- Touchstone Outlook EdisonДокумент12 страницTouchstone Outlook Edisonnishant bhushanОценок пока нет

- Shareholder Value Analysis FrameworkДокумент9 страницShareholder Value Analysis Frameworkashish.the7353Оценок пока нет

- 109 12 Quick IRR Calculation SlidesДокумент14 страниц109 12 Quick IRR Calculation SlidesfmexiaОценок пока нет

- UPL Limited BSE 512070 Financials RatiosДокумент5 страницUPL Limited BSE 512070 Financials RatiosRehan TyagiОценок пока нет

- Ten Tips For Leading Companies Out of CrisisДокумент6 страницTen Tips For Leading Companies Out of CrisisPatriciaFutboleraОценок пока нет

- Granules India Research Reports Investors PresentationДокумент51 страницаGranules India Research Reports Investors Presentationvasu.nadapanaОценок пока нет

- About BalcoДокумент52 страницыAbout BalcoNirved VaishnawОценок пока нет

- Airtel Case Study PDFДокумент14 страницAirtel Case Study PDFMohit RanaОценок пока нет

- Free Cash Flow ValuationДокумент14 страницFree Cash Flow ValuationabcОценок пока нет

- Case: AUTOZONE, INC.Документ17 страницCase: AUTOZONE, INC.rzannat94100% (2)

- Group 13 Harsh Electricals COGS Exercise and BEPДокумент12 страницGroup 13 Harsh Electricals COGS Exercise and BEPShoaib100% (3)