Академический Документы

Профессиональный Документы

Культура Документы

33.expo 2015 Women in SME Business

Загружено:

Raymond Krishnil Kumar0 оценок0% нашли этот документ полезным (0 голосов)

27 просмотров2 страницыWomen

Оригинальное название

33.Expo 2015 Women in SME Business

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документWomen

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

27 просмотров2 страницы33.expo 2015 Women in SME Business

Загружено:

Raymond Krishnil KumarWomen

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

Talk Tax Women in Small and Medium Business (SMEs)

TIMES: Do SMEs have to register with FRCA?

CEO: Yes, small and medium entrepreneurs (SME) or small business operators are required to

register with FRCA. To register they are required to complete the relevant sections namely income tax registration form, value added tax (VAT) supplementary registration application

form, (if SME wishes to register for VAT), certificate of business registration, and attach some

form of identification and details. For example, voter registration card, copy of driver's license.

FT: Will SMEs have to pay income tax?

CEO: SMEs with a gross turnover of less than $500,000 will not be subject to income tax and

this includes:

(a) any form of agriculture;

(b) fishing;

(c) livestock rearing;

(d) bee keeping;

(e) community and social project which involves traditional production of handicraft;

(f) tourism project which involves sea-cruise operation, river-tour operation and ecotourism; and

(g) Supportive project, established and operated at a site in Fiji with facilities of a

permanent nature for the public presentation, especially to overseas visitors to Fiji,

of matter of interest to tourist that relate to Fiji, including in particular and without

derogating from the generality of the foregoing, matters relating toi. the flora, fauna and the other natural characteristics of Fiji; and

ii. the history ,traditions, cultures and ways of life of its people;

FT: How about small canteens and those other that youve specified above?

Other than those listed above, canteen and kiosk operators, hawkers etc. whose net profit (i.e.

sales less expenses) exceeds $16,000 in a year will be subject to Income Tax.

FT: Do FRCA charge SMEs for registering at FRCA

CEO: There is no fee charged or levied by FRCA for income tax or other tax registration.

FT: Can SMEs register for VAT?

CEO: Under the VAT Decree, any person whose annual gross income exceeds $100,000, is

obligated to register for VAT purpose and must abide by the VAT Decree. However, most SMEs

don't exceed the annual gross income of $100,000 and hence are not required to register for

VAT but can voluntarily register for VAT. Where SMEs voluntarily register for VAT they will be

required to maintain proper books of records, are able to lodge VAT returns and are able to pay

VAT on time. Once registered for VAT an SME will be required to charge VAT on all their sales,

maintain a proper Tax Invoice, claim VAT on business related purchases and expenses, lodge

VAT return and pay VAT on the stipulated times and maintain a proper records in English for

seven years.

FT: What assistance can FRCA offer SMEs?

CEO: We can offer advice, mentoring, training and support - free of charge. We note that some

small entrepreneurs dont come to FRCA for fear of being taxed which is wrong. In fact we are

here to assist SMEs to grow.

For SMEs that have registered for VAT and whose annual gross turnover is less than $300,000,

they can opt to lodge VAT returns on quarterly or annually from the monthly basis. For SMEs

that have registered in error, we will assist by deregistering them from VAT. For those that

want to de-register as they fall below the annual gross income of $100,000, they can do so, but

will need to apply in writing.

Вам также может понравиться

- Business Taxation 1Документ81 страницаBusiness Taxation 1Prince Isaiah Jacob100% (1)

- SARS Small Business Tax GuideДокумент8 страницSARS Small Business Tax GuideAndile NtuliОценок пока нет

- 3.2 Business Profit TaxДокумент49 страниц3.2 Business Profit TaxBizu AtnafuОценок пока нет

- Tax GuideДокумент8 страницTax GuideGooglyОценок пока нет

- VAT Guide Explains Tax Rules for BusinessesДокумент25 страницVAT Guide Explains Tax Rules for BusinessesJerome DanielОценок пока нет

- Implication of VAT On Individuals: Value Added Tax (VAT)Документ4 страницыImplication of VAT On Individuals: Value Added Tax (VAT)Jabir U V KaladiОценок пока нет

- It 48Документ40 страницIt 48Robert Daysor BancifraОценок пока нет

- Newsletter Online VAT Registration Portal v2 PDFДокумент3 страницыNewsletter Online VAT Registration Portal v2 PDFNils VanhasselОценок пока нет

- Transfer and Business Taxation: Module WritersДокумент129 страницTransfer and Business Taxation: Module WritersPaulita GomezОценок пока нет

- VAT in UAEДокумент20 страницVAT in UAELaxmidhara NayakОценок пока нет

- Corporate TaxesДокумент6 страницCorporate TaxesfranОценок пока нет

- Income Taxation - 5Документ34 страницыIncome Taxation - 5Maria Maganda MalditaОценок пока нет

- Myanmar Tax StructureДокумент20 страницMyanmar Tax StructureYe PhoneОценок пока нет

- Admas University: Learning GuideДокумент19 страницAdmas University: Learning Guidebirhanu sintayehuОценок пока нет

- Register Call Center PhilippinesДокумент4 страницыRegister Call Center PhilippinesGraze IsidroОценок пока нет

- Assessment 1 - Written or Oral QuestionsДокумент7 страницAssessment 1 - Written or Oral Questionswilson garzonОценок пока нет

- GG 25112008Документ6 страницGG 25112008goldzergОценок пока нет

- Summary of Thailand-Tax-Guide and LawsДокумент34 страницыSummary of Thailand-Tax-Guide and LawsPranav BhatОценок пока нет

- VAT on agriculture: Key rules for farmersДокумент2 страницыVAT on agriculture: Key rules for farmersAljeanОценок пока нет

- Preferential TaxationДокумент9 страницPreferential TaxationMОценок пока нет

- Week 16 and 17 Tax Incentives and BMBEДокумент28 страницWeek 16 and 17 Tax Incentives and BMBEwatanabe200412Оценок пока нет

- Income Taxation For Individual and CorpДокумент19 страницIncome Taxation For Individual and CorpJohn Rey Bantay RodriguezОценок пока нет

- Establishing A Business in CambodiaДокумент2 страницыEstablishing A Business in CambodiaSovan Meas100% (1)

- M1PLR Introduction To Business TaxesДокумент2 страницыM1PLR Introduction To Business TaxesClaricel JoyОценок пока нет

- A Guide To Procedures and Processes at The Ministry of Commerce & IndustryДокумент21 страницаA Guide To Procedures and Processes at The Ministry of Commerce & IndustryMOCIdocsОценок пока нет

- Business Taxation Midterm Quiz 1 2 PhineeeДокумент4 страницыBusiness Taxation Midterm Quiz 1 2 PhineeeKaxy PHОценок пока нет

- Benefits of Registering as a Barangay Micro Business Enterprise (BMBEДокумент16 страницBenefits of Registering as a Barangay Micro Business Enterprise (BMBEGerson CastroОценок пока нет

- Botswana Tax Lecture Slides, SydneyДокумент84 страницыBotswana Tax Lecture Slides, SydneysmedupeОценок пока нет

- An Easy Guide To Taxation For Startup EntrepreneursДокумент16 страницAn Easy Guide To Taxation For Startup EntrepreneursChristine P. ToledoОценок пока нет

- Percentage TaxДокумент4 страницыPercentage TaxPATRICK JAMES BALOGBOG ROSARIOОценок пока нет

- Tax Planning Guide: Key Sections to Reduce Your Tax BurdenДокумент14 страницTax Planning Guide: Key Sections to Reduce Your Tax BurdenRohitОценок пока нет

- Gambia Tax Guide 2016 17Документ11 страницGambia Tax Guide 2016 17joebeqОценок пока нет

- Singapore Tax Guide: Rates, System and Regulations in 40 CharactersДокумент22 страницыSingapore Tax Guide: Rates, System and Regulations in 40 CharactersDio PatraОценок пока нет

- Topic-1 Taxation of Business IncomeДокумент23 страницыTopic-1 Taxation of Business IncomeMohamedОценок пока нет

- Tax InfoДокумент2 страницыTax InfoDionechordОценок пока нет

- Tax On MIEsДокумент18 страницTax On MIEsEuniceBrillanteОценок пока нет

- From An Employee To A SelfДокумент3 страницыFrom An Employee To A SelfChristine BobisОценок пока нет

- INCOME AND BUSINESS TAXATION FinalsДокумент21 страницаINCOME AND BUSINESS TAXATION FinalsAbegail BlancoОценок пока нет

- Starting A Business: Checklist For New BusinessesДокумент3 страницыStarting A Business: Checklist For New BusinessesSuganya DeviОценок пока нет

- Setting Up New Business in EthiopiaДокумент5 страницSetting Up New Business in EthiopiaMesfin DerbewОценок пока нет

- Tax System SriLankaДокумент44 страницыTax System SriLankamandarak7146Оценок пока нет

- 5 Features of Economic Zones Under PEZA in The Philippines - Tax and Accounting Center, IncДокумент7 страниц5 Features of Economic Zones Under PEZA in The Philippines - Tax and Accounting Center, IncMartin MartelОценок пока нет

- 6.1 Tax AssignmentДокумент3 страницы6.1 Tax AssignmentHazel Malveda GamillaОценок пока нет

- CHAPTER 5 TO 6Документ13 страницCHAPTER 5 TO 6Anore, Anton NikolaiОценок пока нет

- Guide To Global BusinessДокумент32 страницыGuide To Global BusinessKeshav SewrajОценок пока нет

- Bangladesh Income Tax RatesДокумент5 страницBangladesh Income Tax RatesaadonОценок пока нет

- Tax Planning and ManagementДокумент23 страницыTax Planning and ManagementMinisha Gupta100% (19)

- Paper 12 TAX Practice Admin Ethics Questions August 2020Документ3 страницыPaper 12 TAX Practice Admin Ethics Questions August 2020Justice ArkohОценок пока нет

- Effect of Tax Incentives On The Growth of Smes in Rwanda: A Case Study of Smes in Nyarugenge DistrictДокумент9 страницEffect of Tax Incentives On The Growth of Smes in Rwanda: A Case Study of Smes in Nyarugenge DistrictMusondaОценок пока нет

- Legal and Tax Aspects of Business OrganizationsДокумент4 страницыLegal and Tax Aspects of Business OrganizationsMaureenОценок пока нет

- Local Restriction Support Grant (LRSG) Closed Addendum FormДокумент2 страницыLocal Restriction Support Grant (LRSG) Closed Addendum FormJohn OyewoleОценок пока нет

- Index For Income TaxДокумент20 страницIndex For Income TaxSandyОценок пока нет

- Vat ReviewДокумент4 страницыVat ReviewVensen FuentesОценок пока нет

- KH Tax Guide To Taxation in Cambodia 2020Документ30 страницKH Tax Guide To Taxation in Cambodia 2020Lee XingОценок пока нет

- Tax Planning - Intro NotesДокумент7 страницTax Planning - Intro NotesBest How To StudioОценок пока нет

- Requirements and Fees - Dti Bir Fda SecДокумент25 страницRequirements and Fees - Dti Bir Fda SecHiraeth WeltschmerzОценок пока нет

- Legal Documents You Need To Run A Business in Philippines SEC Registration DTI Registration Mayor's Business PermitДокумент2 страницыLegal Documents You Need To Run A Business in Philippines SEC Registration DTI Registration Mayor's Business PermitblessingОценок пока нет

- Live, work, retire, buy property and do business in Mauritius: Make Mauritius your second homeОт EverandLive, work, retire, buy property and do business in Mauritius: Make Mauritius your second homeОценок пока нет

- Group Ind Case Study - MRP IIДокумент25 страницGroup Ind Case Study - MRP IIRaymond Krishnil Kumar100% (1)

- Chapter 9Документ61 страницаChapter 9Raymond Krishnil KumarОценок пока нет

- Chapter 5Документ57 страницChapter 5Raymond Krishnil KumarОценок пока нет

- The Mobile Economy: Pacific Islands 2015Документ54 страницыThe Mobile Economy: Pacific Islands 2015Raymond Krishnil KumarОценок пока нет

- PersonalityДокумент28 страницPersonalityRaymond Krishnil KumarОценок пока нет

- Chapt01 LectureДокумент35 страницChapt01 LectureVinay ThakurОценок пока нет

- Case ERP in Airlines IndustryДокумент9 страницCase ERP in Airlines IndustryRaymond Krishnil KumarОценок пока нет

- 2 Change ManagementДокумент14 страниц2 Change ManagementRaymond Krishnil KumarОценок пока нет

- Powerpoint Themes Light SlidesДокумент25 страницPowerpoint Themes Light Slidestania__starОценок пока нет

- Eq 1 PDFДокумент34 страницыEq 1 PDFRaymond Krishnil KumarОценок пока нет

- AbstractДокумент1 страницаAbstractRaymond Krishnil KumarОценок пока нет

- Managing An AgeДокумент2 страницыManaging An AgeRaymond Krishnil KumarОценок пока нет

- Annual Calendar Blank 2014 Landscape BackupДокумент1 страницаAnnual Calendar Blank 2014 Landscape BackupRaymond Krishnil KumarОценок пока нет

- Robb Ob 8e TB CH01Документ38 страницRobb Ob 8e TB CH01Raymond Krishnil KumarОценок пока нет

- Mba435 2016 Seminar and Case Studies DiscussionsДокумент11 страницMba435 2016 Seminar and Case Studies DiscussionsRaymond Krishnil KumarОценок пока нет

- MDPДокумент1 страницаMDPRaymond Krishnil KumarОценок пока нет

- Robb Ob 8e TB CH01Документ38 страницRobb Ob 8e TB CH01Raymond Krishnil KumarОценок пока нет

- Kotler09 TifДокумент31 страницаKotler09 TifRaymond Krishnil Kumar100% (1)

- Withdrawal Application Education FormДокумент4 страницыWithdrawal Application Education FormRaymond Krishnil Kumar100% (3)

- SMPP-IF-SPEC v3 3Документ49 страницSMPP-IF-SPEC v3 3Keosboy SignupОценок пока нет

- Cel Mai Bun Curs de LinuxДокумент147 страницCel Mai Bun Curs de LinuxNicușor VatrăОценок пока нет

- Dtxnewss 7Документ180 страницDtxnewss 7Raymond Krishnil KumarОценок пока нет

- Destination 2 (12A)Документ3 страницыDestination 2 (12A)oldhastonian100% (1)

- CG Assignment 1Документ13 страницCG Assignment 1arslan0989Оценок пока нет

- City Government of Quezon City v. ErictaДокумент2 страницыCity Government of Quezon City v. ErictaNoreenesse SantosОценок пока нет

- Filed Court Document Motion For ReconsiderationДокумент14 страницFiled Court Document Motion For Reconsiderationleenav-1Оценок пока нет

- Income Tax Law and PracticesДокумент26 страницIncome Tax Law and Practicesremruata rascalralteОценок пока нет

- Maternity Benefit ActДокумент9 страницMaternity Benefit Acthimanshu kumarОценок пока нет

- Primary Details: Pending (Cav)Документ2 страницыPrimary Details: Pending (Cav)Ilayaraja BeharaОценок пока нет

- United States Court of Appeals Tenth CircuitДокумент10 страницUnited States Court of Appeals Tenth CircuitScribd Government DocsОценок пока нет

- Hernandez Vs CAДокумент2 страницыHernandez Vs CAabby100% (1)

- Financial disclosure rules and exceptionsДокумент2 страницыFinancial disclosure rules and exceptionsHaikal AdninОценок пока нет

- Hire Purchase LAW MBAДокумент5 страницHire Purchase LAW MBAainonlelaОценок пока нет

- 08 - Chapter 3 PDFДокумент128 страниц08 - Chapter 3 PDFAnonymous VXnKfXZ2PОценок пока нет

- Sexual Harassment Laws in the WorkplaceДокумент17 страницSexual Harassment Laws in the Workplacetina g morfiОценок пока нет

- Osa 2015 Exceptions ReportДокумент46 страницOsa 2015 Exceptions ReportRuss LatinoОценок пока нет

- Vat On Sale of Services AND Use or Lease of PropertyДокумент67 страницVat On Sale of Services AND Use or Lease of PropertyZvioule Ma FuentesОценок пока нет

- People v. SumayoДокумент7 страницPeople v. SumayoJohn Kayle BorjaОценок пока нет

- Federalism in AsiaДокумент353 страницыFederalism in AsiaVanyaОценок пока нет

- Alicia, Zamboanga SibugayДокумент2 страницыAlicia, Zamboanga SibugaySunStar Philippine NewsОценок пока нет

- Application Form For New Students Bursary SchemeДокумент8 страницApplication Form For New Students Bursary SchemeLahiru WijethungaОценок пока нет

- LAN 1003 Malaysian Studies Kuiz 2 July AnswerДокумент10 страницLAN 1003 Malaysian Studies Kuiz 2 July AnswerWilliam AnthonyОценок пока нет

- IND2601Документ3 страницыIND2601milandaОценок пока нет

- CBSE Class 12 Political Science Revision Notes Chapter-2 The End of BipolarityДокумент4 страницыCBSE Class 12 Political Science Revision Notes Chapter-2 The End of BipolaritygouravОценок пока нет

- PARTY SYMBOLS (Revised) PDFДокумент40 страницPARTY SYMBOLS (Revised) PDFelinzolaОценок пока нет

- VOL. 354, MARCH 14, 2001 339 People vs. Go: - First DivisionДокумент15 страницVOL. 354, MARCH 14, 2001 339 People vs. Go: - First DivisionMichelle Joy ItableОценок пока нет

- Swarberg v. Menu Foods Holding Inc Et Al - Document No. 32Документ1 страницаSwarberg v. Menu Foods Holding Inc Et Al - Document No. 32Justia.comОценок пока нет

- Separate Legal Personality of CorporationsДокумент55 страницSeparate Legal Personality of CorporationsJanineОценок пока нет

- CWS Position Paper Violence Against Women PDFДокумент3 страницыCWS Position Paper Violence Against Women PDFJill BuntagОценок пока нет

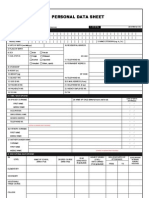

- CSC Form 212 (Revised 2005)Документ4 страницыCSC Form 212 (Revised 2005)johnmark21493% (40)

- Yap V GragedaДокумент2 страницыYap V GragedaPatricia BautistaОценок пока нет

- Ordinance 0380Документ3 страницыOrdinance 0380JessielleОценок пока нет