Академический Документы

Профессиональный Документы

Культура Документы

About The Book: Dushyant Tyagi Holds An M.Phil Degree From Department of Economics, Ccs University, Meerut and PHD

Загружено:

Dushyant TyagiИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

About The Book: Dushyant Tyagi Holds An M.Phil Degree From Department of Economics, Ccs University, Meerut and PHD

Загружено:

Dushyant TyagiАвторское право:

Доступные форматы

About the book

An arrangement of efficient credit provision is a sine qua non for income generation in the enterprises of

capitalist system. Various measures were initiated for improving outreach and ensuring credit to rural areas.

Formal credit markets in India have on the whole failed to provide credit to the rural areas. For instance, formal

credit markets needs numerical literacy and often have little understanding of petty business and social

obligations in rural areas. Further the formal credit agencies find themselves incapable to entertain credit

requirement of a sizeable rural people. One of the major problems facing formal rural credit is the poor

performance of the recovery mechanism. Subsequent Narasimham Committee Report included phasing out of

concessional rates, lowering the directed credit towards rural sector, instituting special tribunals for recovery of

the dues, etc. This results in joint liability Self Help Groups (SHGs), a socio-economic and legal innovation

because it incentivize to repay loans in the rural areas. In such cases, then, micro-financing services offer the

best solution to the aforementioned problem. It is encouraging to note that micro-financing is being recognized

as a powerful tool in alleviating poverty and promoting growth and development at the grassroots level. It can

influence structural cause of rural poverty by guarantees a rise in real output, a more equitable income

distribution and increase welfare levels for the poor majority of rural people. Leading writers saw micro-credit

as a panacea for income generation in rural microenterprises. It also records the impact on income generation, of

various social factors such as quality of leadership, education, cast, gender and dependency. This book uses

mainly primary data for discussing results and other necessary socio-economic interventions for generating

income to remove poverty from rural areas. The evaluation carried out from various perspectives led to

conclusive evidence showing that duration of SHGs membership and the kinds of SHGs were predominant in

income generation in rural microenterprises. For reaching potential income, a rural micro-entrepreneur also need

access to one or more of the following: transport, communications, power, water, storage facilities, a legal

system for enforcing contracts and settling disputes, etc. Apart from infrastructure, rural micro entrepreneurs

require information about market trends and skills to run their micro enterprises.

Dushyant Tyagi holds an M.Phil degree from Department of Economics, CCS University, Meerut and PhD

from Giri Insititute of Development Studies, Lucknow attached to CSJM Univeristy Kanpur. He has contributed

a number of research articles. Presently, he is serving as Assistant Professor ant Zakir Husain Delhi College

(Evening), University of Delhi.

Sharad Ranjan is at present Associate Professor of Economics at Zakir Husain Delhi College (Evening),

University of Delhi. He holds an M.Phil degree in Applied Economics from Centre for Development Studies,

Trivandrum and PhD from Centre for Economic Studies and Planning, JNU, New Delhi. He has over twenty

years of teaching experience. He has also contributed numerous articles to various leading journals of high

repute that includes Economic and Political Weekly, Productivity and Social Scientist.

Вам также может понравиться

- John Deere 6405 and 6605 Tractor Repair Technical ManualДокумент16 страницJohn Deere 6405 and 6605 Tractor Repair Technical ManualJefferson Carvajal67% (6)

- Capacity Management in Service FirmsДокумент10 страницCapacity Management in Service FirmsJussie BatistilОценок пока нет

- PHD DissertationДокумент14 страницPHD DissertationShito Ryu100% (1)

- Access to Finance: Microfinance Innovations in the People's Republic of ChinaОт EverandAccess to Finance: Microfinance Innovations in the People's Republic of ChinaОценок пока нет

- MicrofinanceДокумент58 страницMicrofinanceSamuel Davis100% (1)

- Microfinance and Its Impact On IndiaДокумент60 страницMicrofinance and Its Impact On Indiabagal07100% (1)

- Self Help GroupsДокумент12 страницSelf Help GroupsunknownОценок пока нет

- Challenges of Micro FinanceДокумент9 страницChallenges of Micro FinancebharathОценок пока нет

- Micro Finance: Opportunities AheadДокумент3 страницыMicro Finance: Opportunities AheadProf S P GargОценок пока нет

- Financial Inclusion-Its Changing Nature in Indian Banking Sector.Документ15 страницFinancial Inclusion-Its Changing Nature in Indian Banking Sector.Madhumita DasguptaОценок пока нет

- Sakshi Pote Tybbi ProjectДокумент93 страницыSakshi Pote Tybbi ProjectAkshataОценок пока нет

- Role of Microfinance Institutions in Rural Development B.V.S.S. Subba Rao AbstractДокумент13 страницRole of Microfinance Institutions in Rural Development B.V.S.S. Subba Rao AbstractIndu GuptaОценок пока нет

- Micro-Finance in The India: The Changing Face of Micro-Credit SchemesДокумент11 страницMicro-Finance in The India: The Changing Face of Micro-Credit SchemesMahesh ChavanОценок пока нет

- Poverty Alleviation Through Micro Finance in India: Empirical EvidencesДокумент8 страницPoverty Alleviation Through Micro Finance in India: Empirical EvidencesRia MakkarОценок пока нет

- Chapter - 2 Literature ReviewДокумент6 страницChapter - 2 Literature ReviewAamir KhanОценок пока нет

- Eco-Geo Assignment IДокумент11 страницEco-Geo Assignment INal ChowdhuryОценок пока нет

- Research Paper Suhail Khakil 2010Документ13 страницResearch Paper Suhail Khakil 2010Khaki AudilОценок пока нет

- Thesis On Microfinance in IndiaДокумент5 страницThesis On Microfinance in IndiaOnlinePaperWritersUK100% (2)

- Introduction To The ProjectДокумент4 страницыIntroduction To The ProjectnainaОценок пока нет

- 6 MT Done PDFДокумент4 страницы6 MT Done PDFSam GregoryОценок пока нет

- Financial Inclusion and The Growth of Micro and Small BusinessesДокумент5 страницFinancial Inclusion and The Growth of Micro and Small BusinessesManagement Journal for Advanced ResearchОценок пока нет

- Role of Microfinance Institution in Financial InclusionДокумент15 страницRole of Microfinance Institution in Financial Inclusionswati_agarwal67Оценок пока нет

- Edited MicrofinanceДокумент59 страницEdited Microfinancedarthvader005Оценок пока нет

- RamakantДокумент41 страницаRamakantArchitОценок пока нет

- Need For MF Gap DD and SSДокумент2 страницыNeed For MF Gap DD and SSalviarpitaОценок пока нет

- CapstoneДокумент29 страницCapstonelajjo1230% (1)

- MICROFINANCEДокумент62 страницыMICROFINANCEHarshal SonalОценок пока нет

- Microfinance Capstone Mijjin OommenДокумент4 страницыMicrofinance Capstone Mijjin OommenmijjinОценок пока нет

- A Study On Recent Trends and Problems in Using Micro Finance Services in India-2Документ11 страницA Study On Recent Trends and Problems in Using Micro Finance Services in India-2prjpublicationsОценок пока нет

- A Research Proposal Submitted To The SCHДокумент6 страницA Research Proposal Submitted To The SCHYours SopheaОценок пока нет

- Impact of Microfinance On Poverty Reduction in Southern Punjab PakistanДокумент16 страницImpact of Microfinance On Poverty Reduction in Southern Punjab Pakistanindex PubОценок пока нет

- Research Paper On Microfinance in India PDFДокумент8 страницResearch Paper On Microfinance in India PDFegya6qzc100% (1)

- Microfinance and Women EmpowermentДокумент6 страницMicrofinance and Women EmpowermentRasel Talukder100% (1)

- Microfinance ResearchДокумент17 страницMicrofinance ResearchKausik KskОценок пока нет

- A Study On Role and Effects of Microfinance Banks in Rural Areas in India 1Документ63 страницыA Study On Role and Effects of Microfinance Banks in Rural Areas in India 1Rohit KumarОценок пока нет

- Women Needed Opportunity, Not Charity - They Want Chance, Not Bleeding Hearts" - Prof. Mohammed YunnsДокумент28 страницWomen Needed Opportunity, Not Charity - They Want Chance, Not Bleeding Hearts" - Prof. Mohammed YunnsAf UsmanОценок пока нет

- Project Proposal - ASH1610013MДокумент5 страницProject Proposal - ASH1610013MSalma AkterОценок пока нет

- Micro Finance and Small Enterprises Development: Client Perspective Study of Baluchistan, PakistanДокумент14 страницMicro Finance and Small Enterprises Development: Client Perspective Study of Baluchistan, PakistanYousaf KhanОценок пока нет

- A Study On Role and Effects of Microfinance Banks in Rural Areas in India 2Документ55 страницA Study On Role and Effects of Microfinance Banks in Rural Areas in India 2Rohit KumarОценок пока нет

- Microfinance A Tool For Poverty Alleviation, A Case Study of District RajouriДокумент4 страницыMicrofinance A Tool For Poverty Alleviation, A Case Study of District Rajourifaiqul hazmiОценок пока нет

- Rekha & Saravanan ArticleДокумент5 страницRekha & Saravanan ArticleMurugan SaravananОценок пока нет

- Contribution of Ngo in BangladeshДокумент19 страницContribution of Ngo in Bangladeshamit-badhan100% (1)

- Ijmrd: A Study On Recent Trends and Problems in Using Micro Finance Services in IndiaДокумент11 страницIjmrd: A Study On Recent Trends and Problems in Using Micro Finance Services in IndiaRogil Jacob DanielОценок пока нет

- The Scenario of Retail Industry in India: Its Growth, Challenges and OpportunitiesДокумент11 страницThe Scenario of Retail Industry in India: Its Growth, Challenges and OpportunitiesSajja VamsidharОценок пока нет

- Impact of Micro Finance On Living Standard With Reference To Microfinance Holders in Kurunegala DistrictДокумент8 страницImpact of Micro Finance On Living Standard With Reference To Microfinance Holders in Kurunegala DistrictInternational Journal of Business Marketing and ManagementОценок пока нет

- Impact of Micro Finance On Living Standard With Reference To Microfinance Holders in Kurunegala DistrictДокумент9 страницImpact of Micro Finance On Living Standard With Reference To Microfinance Holders in Kurunegala DistrictShah WazirОценок пока нет

- GANASEVA0MODEL Enabling Rural BankingДокумент20 страницGANASEVA0MODEL Enabling Rural BankingAnjali AryaОценок пока нет

- Project Draft - 10927873Документ2 страницыProject Draft - 10927873moneyeeshОценок пока нет

- Capital Structure, Financial Performance, and Sustainability of Micro-Finance Institutions (Mfis) in BangladeshДокумент18 страницCapital Structure, Financial Performance, and Sustainability of Micro-Finance Institutions (Mfis) in BangladeshlalalandОценок пока нет

- Anshu Bansal GuptaДокумент32 страницыAnshu Bansal Guptasahu_krishna1995Оценок пока нет

- An Empirical Study On The Role of MUDRA Yojana in Financing Micro EnterprisesДокумент11 страницAn Empirical Study On The Role of MUDRA Yojana in Financing Micro EnterprisesRahul V MohareОценок пока нет

- Syllabus:Development Processes and The Development Industry-The Role ofДокумент8 страницSyllabus:Development Processes and The Development Industry-The Role ofShiva JiОценок пока нет

- Role of SelfДокумент16 страницRole of SelfSellanAnithaОценок пока нет

- Diganta Kumar Das PDFДокумент17 страницDiganta Kumar Das PDFHitesh ParwaniОценок пока нет

- Ifs Cia - 3: Made By: Karan Sethi 1620518Документ10 страницIfs Cia - 3: Made By: Karan Sethi 1620518Karan SethiОценок пока нет

- Ap 18Документ5 страницAp 18Anitha PeyyalaОценок пока нет

- AugsburgSchmidt FOSS-MFI GlobelicsДокумент20 страницAugsburgSchmidt FOSS-MFI GlobelicsnajathslОценок пока нет

- Vidya.v. Kumar ProjectДокумент54 страницыVidya.v. Kumar Projectwolverdragon100% (1)

- The Role of Micro Finance in SHGДокумент12 страницThe Role of Micro Finance in SHGijgarph100% (1)

- Analysis of The Effects of Microfinance PDFДокумент13 страницAnalysis of The Effects of Microfinance PDFxulphikarОценок пока нет

- Gender Tool Kit: Micro, Small, and Medium-Sized Enterprise Finance and DevelopmentОт EverandGender Tool Kit: Micro, Small, and Medium-Sized Enterprise Finance and DevelopmentОценок пока нет

- Sustainability and Poverty Outreach in Microfinance: the Sri Lankan Experience: To Resolve Dilemmas of Microfinance Practitioners and Policy MakersОт EverandSustainability and Poverty Outreach in Microfinance: the Sri Lankan Experience: To Resolve Dilemmas of Microfinance Practitioners and Policy MakersОценок пока нет

- Monthly Current Affairs GK Digest August 2021Документ80 страницMonthly Current Affairs GK Digest August 2021Vinay SangwanОценок пока нет

- About The Book: Dushyant Tyagi Holds An M.Phil Degree From Department of Economics, Ccs University, Meerut and PHDДокумент1 страницаAbout The Book: Dushyant Tyagi Holds An M.Phil Degree From Department of Economics, Ccs University, Meerut and PHDDushyant TyagiОценок пока нет

- Economic School of ThoughtДокумент199 страницEconomic School of ThoughtMinakshi Barman100% (1)

- PD31 2021 Principles of Macroeconomics IДокумент3 страницыPD31 2021 Principles of Macroeconomics IDushyant TyagiОценок пока нет

- BA (Prog.) 2020 SEM. VI IV II (CBCS)Документ16 страницBA (Prog.) 2020 SEM. VI IV II (CBCS)Dushyant TyagiОценок пока нет

- 1 2Документ2 страницы1 2Dushyant TyagiОценок пока нет

- RingДокумент1 страницаRingDushyant TyagiОценок пока нет

- Book 1Документ2 страницыBook 1Dushyant TyagiОценок пока нет

- RingДокумент1 страницаRingDushyant TyagiОценок пока нет

- SpringДокумент1 страницаSpringDushyant TyagiОценок пока нет

- ProbabilityДокумент2 страницыProbabilityDushyant TyagiОценок пока нет

- SpringДокумент1 страницаSpringDushyant TyagiОценок пока нет

- Letter ZhpgeДокумент2 страницыLetter ZhpgeDushyant TyagiОценок пока нет

- AERAMembership FormДокумент1 страницаAERAMembership FormDushyant TyagiОценок пока нет

- DC-1 Marks StatementДокумент4 страницыDC-1 Marks StatementDushyant TyagiОценок пока нет

- DC-1 Marks StatementДокумент4 страницыDC-1 Marks StatementDushyant TyagiОценок пока нет

- AERAMembership FormДокумент1 страницаAERAMembership FormDushyant TyagiОценок пока нет

- Book 1Документ1 страницаBook 1Dushyant TyagiОценок пока нет

- DERAMembership FormДокумент1 страницаDERAMembership FormDushyant TyagiОценок пока нет

- References Bhaduri,: Myint, H. 'The Classicaltheoryof InternationaltradeandtheunderdevelopedДокумент2 страницыReferences Bhaduri,: Myint, H. 'The Classicaltheoryof InternationaltradeandtheunderdevelopedDushyant TyagiОценок пока нет

- AERAMembership FormДокумент1 страницаAERAMembership FormDushyant TyagiОценок пока нет

- Devore Ch3Документ4 страницыDevore Ch3Dushyant TyagiОценок пока нет

- Book 1Документ1 страницаBook 1Dushyant TyagiОценок пока нет

- ProbabilityДокумент2 страницыProbabilityDushyant TyagiОценок пока нет

- Book 1Документ1 страницаBook 1Dushyant TyagiОценок пока нет

- Devore Ch3Документ4 страницыDevore Ch3Dushyant TyagiОценок пока нет

- Gaban by PremchandДокумент1 страницаGaban by PremchandDushyant TyagiОценок пока нет

- ProbabilityДокумент2 страницыProbabilityDushyant TyagiОценок пока нет

- Gaban by PremchandДокумент1 страницаGaban by PremchandDushyant TyagiОценок пока нет

- Porter 5 Force FinalДокумент35 страницPorter 5 Force FinalAbinash BiswalОценок пока нет

- Ceramic Tiles - Official Gazette 27 (10234)Документ16 страницCeramic Tiles - Official Gazette 27 (10234)NajeebОценок пока нет

- Human Resources-WPS Office PDFДокумент14 страницHuman Resources-WPS Office PDFArun KarthikОценок пока нет

- GM OEM Financials Dgi9ja-2Документ1 страницаGM OEM Financials Dgi9ja-2Dananjaya GokhaleОценок пока нет

- The Affluent SocietyДокумент189 страницThe Affluent SocietyOtter1zОценок пока нет

- Aayat Niryat FormsДокумент175 страницAayat Niryat FormsSenthil MuruganОценок пока нет

- Project ProposalДокумент7 страницProject Proposalrehmaniaaa100% (3)

- EcoTourism Unit 8Документ20 страницEcoTourism Unit 8Mark Angelo PanisОценок пока нет

- Pipistrel Alpha Trainer e Learning 2020Документ185 страницPipistrel Alpha Trainer e Learning 2020Kostas RossidisОценок пока нет

- CRN 7075614092Документ3 страницыCRN 7075614092Prasad BoniОценок пока нет

- Chapter 1 - GST - Introduction Overview and AdministrationДокумент62 страницыChapter 1 - GST - Introduction Overview and AdministrationAkhil SagarОценок пока нет

- 115 - Yam v. CA DigestДокумент2 страницы115 - Yam v. CA DigestStephieIgnacioОценок пока нет

- Panay Electric vs. NLRCДокумент1 страницаPanay Electric vs. NLRCsamme1010Оценок пока нет

- Interpretation Nadeem SirДокумент2 страницыInterpretation Nadeem SirDENZYL D'COUTHOОценок пока нет

- L 1Документ5 страницL 1Elizabeth Espinosa ManilagОценок пока нет

- Financial ServicesДокумент42 страницыFinancial ServicesGururaj Av100% (1)

- Certification of Residency - Form A - AccomplishedДокумент2 страницыCertification of Residency - Form A - AccomplishedjonbertОценок пока нет

- YUL YYZ: TICKET - ConfirmedДокумент3 страницыYUL YYZ: TICKET - ConfirmedRamuОценок пока нет

- HKKJR LJDKJ: Central Public Works DepartmentДокумент40 страницHKKJR LJDKJ: Central Public Works DepartmentGautam DuttaОценок пока нет

- Proposal Project AyamДокумент14 страницProposal Project AyamIrvan PamungkasОценок пока нет

- Dettol ProjectДокумент25 страницDettol ProjectSujeet KumarОценок пока нет

- Yong Le: Beijing Huaxia Yongleadhesive Tape Co., LTDДокумент9 страницYong Le: Beijing Huaxia Yongleadhesive Tape Co., LTDColors Little ParkОценок пока нет

- A Study On Impact of Foregin Stock Markets On Indian Stock MarketДокумент20 страницA Study On Impact of Foregin Stock Markets On Indian Stock MarketRaj KumarОценок пока нет

- Forecasts - The TestДокумент3 страницыForecasts - The TestPatrykОценок пока нет

- Jason White Resume 2019 v2Документ1 страницаJason White Resume 2019 v2api-355115412Оценок пока нет

- List of Cases by Justice PBДокумент37 страницList of Cases by Justice PBAirah MacabandingОценок пока нет

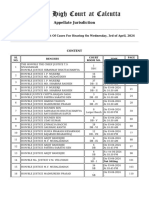

- Notice 11120 02 Apr 2024Документ669 страницNotice 11120 02 Apr 2024bhattacharya.devangana2Оценок пока нет

- Globalisation and The Emerging Trends of NationalismДокумент23 страницыGlobalisation and The Emerging Trends of NationalismSwayam SambhabОценок пока нет