Академический Документы

Профессиональный Документы

Культура Документы

Chocolate Industry cp1

Загружено:

rajulramiАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Chocolate Industry cp1

Загружено:

rajulramiАвторское право:

Доступные форматы

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

A

Project Report

On

Chocolate Industry

Submitted in Partial Fulfillment of award of MBA Degree

Project Guide(s):Prof. Krupa Mehta

Submitted by:

Leuva Jignasha S. (40)

Parmar Khushbu M. (56)

Rohit Payal M. (81)

S. K. PATEL INSTITUTE OF MANAGEMENT & COMPUTER STUDIES

Gandhinagar, India

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

CERTIFICATE

This is to certify that Miss. Leuva Jignasha, Miss.Rohit Payal, Miss Parmar Khushbu

are the students of MBA 3rd SEMESTER of S. K. Patel Institute of Management and

Computer Studies, have completed their comprehensive project titled CHOCOLATE

INDUSTRY in the year 2015, in partial fulfillment of curriculum requirements for the

award of MBA degree under Kadi Sarva Vishwa Vidhyalaya University.

Dr.Bhavin Pandya

Director

Prof. Krupa Mehta

Faculty Guide

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

DECLARATION

we, here by, declare that the comprehensive project report titled, Brief study of the

chocolate industry with special focus on the Cadbury india is original to the best of our

knowledge and has not been published elsewhere. This is for the purpose of partial

fulfillment of Kadi Sarva Vishwa Vidhyalaya University requirements for the award of the

title of Master of Business Administration, only.

Student Names

Signature

Leuva Jignasha S. (40)

Parmar Khushbu M. (56)

Rohit Payal M. (81)

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

CHAPTER : 1

INTRODUCTION ABOUT THE INDUSTRY

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

From its origin in South America to the tables of Europe and America, chocolate has a long history.

As European countries colonize

d different areas of the world, they established cocoa plantations to ensure a constant supply of

chocolate.

Cocoa trees only grow in tropical climates and they require a labor-intensive process to harvest.

Consequently, plantation owners turned to the slave trade as a means of supplying cheap labor.

As the popularity of chocolate soared, new production processes developed. These innovations

helped turn chocolate into an inexpensive luxury people of all social classes could enjoy.

Today cocoa is still grown in many of the same regions as generations ago, and it is consumed by

people throughout the world.

ORIGINS

The ancient Maya are believed to be the first people to make chocolate, over 2,000 years ago. Cocoa

trees, native to Central and South America, provided the beans used to make a bitter, spicy chocolate

drink.

In the fourteenth century the Aztecs dominated Central Mexico and they developed a sophisticated

trade network of cocoa until the Spanish conquered the region in 1521. Conquistador Hernn Corts

is often credited with introducing cocoa to Spain in 1528, but no one truly knows when and how

cocoa traveled to Europe.

COCOA TRADE

Spain could not keep chocolate a secret for very long, and the rest of Europe quickly fell in love with

the drink. By the seventeenth century, as Britain, France, and the Netherlands colonized countries

around the world, they established cacao plantations in tropical locations such as Ceylon (Sri Lanka),

Venezuela, and the West Indies, respectively. These equatorial areas were critical to developing cacao

5

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

production because cacao trees thrive in tropical regions, which provide continual moisture and a

temperate climate.

Once a trade network was established to keep Europe well-supplied in chocolate, European landowners in the Caribbean looked to Africa for their workforce. For over two hundred years cacao

plantations relied on enslaved Africans for labor. Cocoa was one of many products in the triangular

trade network between Europe, West Africa, and the Caribbean.

CHOCOLATE CONSUMPTION

Originally chocolate was exclusively consumed as a drink. Because Europeans did not like the bitter

taste, they added sugar and cinnamon. Gradually chocolate was mixed with milk instead of water to

produce a much lighter and smoother drink, and in 1657 the first known chocolate house opened in

London. Like taverns, and later coffee houses, chocolate houses were comfortable places for

socializing.

Until the mid-eighteenth century chocolate was an expensive drink, a luxury reserved for the wealthy.

The main reason for the high cost was that cocoa was ground by hand. The use of powered

machinery began, not in Europe, but in the American colonies, after New England began trading

cacao from the West Indies in the 1750s.

The earliest known machine-powered chocolate producers were Obadiah Brown of Providence,

Rhode Island, in 1752 and John Hannon of Milton, Massachusetts, in 1765. Water-powered mills

were able to mass-produce chocolate at a much faster pace and in greater quantities. This early

industrialization dramatically reduced the cost of the final product and chocolate became affordable

to the general public.

The world continues to consume great quantities of chocolate. Statistics calculated in 2002 average

the worlds yearly chocolate intake at approximately 1.2 pounds per person. The average European

consumes just over four pounds per year. The Americas come in second at 2.6 pounds per person,

with Africa at a third of a pound, then Asia and the Pacific islands at just under a quarter pound per

year.

TODAY'S CACAO PRODUCING REGIONS

Today cocoa is grown in the Ivory Coast, Ghana, and Indonesia, with Nigeria and Brazil rounding

out the top five countries. Many of the cacao regions established centuries ago still grow the beans

today, along with dozens of new regions located along the equator. The Netherlands, the United

States, Ivory Coast, Brazil, and Germany are the top five importers of cacao beans.

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

CHAPTER :2

RESEARCH METHODOLOGY

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

OBJECTIVES OF THE STUDY OF PRODUCT MARKET ANALYSIS

To Study of chocolate industry

To do five forces model

Pestel Analysis

OT Analysis

RESEARCH DESIGN

Descriptive research design:

Descriptive research is a study designed to depict the participants in an accurate way. More simply

put, descriptive research is all about describing people who take part in the study.

DATA COLLECTION & SOURCES.

1. SECONDARY DATA

2. INTERNET, BOOK

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

CHAPTER :3

INDUSTRY STUDY

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

Chocolate industry

Produced from the seed of the tropical Theorem cacao tree, cocoa has been cultivated for at least

three millennia. This food originated in Mexico, Central and Northern South America and dates back

to around 1100 BC when the Aztecs made it into a beverage known as Nahunta or "bitter water" in

English.

The chocolate-making process remained unchanged for hundreds of years. It wasn't until the

Industrial Revolution, when mechanical mills were used to squeeze out cocoa butter which created

durable chocolate, which many changes occurred.

Even though cocoa beans were discovered in the Americas, about two-thirds of the world's cocoa is

produced in West Africa. In 2011, 32 percent of all chocolate sales were generated from Western

Europe. According to Euro monitor, the United Kingdom had the highest chocolate consumption per

person than any other country.

On average, every U.K. citizen consumed about eleven kilograms (24.25 lbs) of chocolate in 2011,

with the United States coming in at fifteenth position at 4.6 kilograms.

Milk chocolate also appears to be favored throughout the United States compared to any other

chocolate type. In 2012, just over 50 percent of consumers preferred to eat this type of chocolate.

Chocolate is a global industry that will continue to grow steadily and is prevalent on five out of the

seven continents.

Global scenario of industry

The global chocolate industry has been in a moderate growth trajectory since the last five years. This

growth is largely fueled by the increased global demand for premium chocolate.

The major developing countries such as China and India are expected to offer great opportunities to

the global chocolate industry; thanks to the use of chocolate as a functional fo

10

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

Organic and fair trade chocolate is a rapidly growing segment of the industry. With consumers

developing more awareness regarding environment-friendly products, this segment is expected to rise

rapidly in the next five years.

The global chocolate market is highly consumer driven and companies need to focus on their

development and marketing strategies towards capturing a larger consumer base, and acquiring new

markets.

Cocoa is the main raw material for chocolate production and has no other substitute. Moreover, it can

only be grown within 10 degrees (latitudes) of the equator. Due to this constraint, global production

of cocoa is highly concentrated in West African countries such as Ghana, Cote d'Ivoire, Cameroon,

and Nigeria.

Vanilla is the most preferred flavor in the chocolate industry. A number of other important flavors

such as mint, coffee, strawberry, and orange are being increasingly used these days as the consumer

is more open to experimenting; however, the traditional chocolate flavor is still the most sought-after.

Almost 90% of the total vanilla used as a flavor is synthetic.

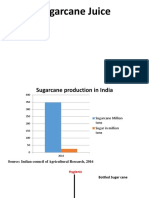

The major demand for sugar is fueled by the manufacturing and food preparation sectors, including

the beverages market. Developing economies such as India, China, and Indonesia are expected to

account for more than 3.2 million tons (72%) of the overall sugar consumption by 2015.

These are the same countries expected to witness high CAGR in the global chocolate market. The

growth in the overall sugar market is attributed to India, a result of the expansion in the sugarcane

area, and generally favorable weather.

The report analyzes global chocolate market by product, sales category, geography and raw

materials; forecasting revenues and analyzing trends in each of the following submarkets:

By product types:

Dark chocolate

Milk chocolate

White chocolate

By sales category:

Everyday chocolate

Premium chocolate

Seasonal chocolate

By geography:

North America

11

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

Europe

Asia

ROW (Rest of the World)

characteristics of global industry

Who are the main manufacturers of chocolate in the world?

Candy Industry publishes an annual list of the top 100 global confectionery companies.

ranking them by net sales.

The table below is an extract from this list, giving the top ten global confectionery companies that

manufacture some form of chocolate, by net confectionery sales value in 2014:

Company

Net Sales 2014 (US$ millions)

Mars Inc (USA)

18,480

Mondelz International (USA)

14,350

Ferrero Group (Luxembourg / Italy)

10,911

Nestl SA (Switzerland)

10,466

Meiji Co Ltd (Japan)

9,818*

Hershey Foods Corp (USA)

7,485

SChocoladenfabriken Lindt & Sprngli AG (Switzerland)

4,022

Arcor (Argentina)

3,500*

Ezaki Glico Co Ltd (Japan)

3,049*

August Storck KG (Germany)

2,272

Fair Trade cocoa and chocolate

Fair Trade is a trading partnership, based on dialogue, transparency and respect, that seeks greater

equity in international trade. It contributes to sustainable development by offering better trading

conditions to, and securing their rights of, disadvantaged producers and workers - especially in the

South (FINE, 2001).

12

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

Fair Trade certified producer organizations must comply with a number of requirements, related to

social, economic and environmental developments. In addition, labour conditions in these

organizations must follow certain standards.

The essential characteristic of Fair Trade cocoa is that producer organizations receive a higher price

for their cocoa beans. The Fair Trade price represents the necessary condition for the producer

organizations to have the financial ability to fulfil the above requirements, and to cover the

certification fees.

It is calculated on the basis of world market prices, plus fair trade premiums. The Fair Trade

premium for standard quality cocoa is US$ 150 per tonne. The minimum price for Fair Trade

standard quality cocoa, including the premium, is US$ 1,750 per tonne. Other benefits for certified

producer organizations are better "capacity building" and "market access".

Presently, cocoa sold with the Fair Trade label still captures a very low share of the cocoa market

(0.5%).

Organic cocoa and chocolate

The organic cocoa market represents a very small share of the total cocoa market, estimated at less

than 0.5% of total production. ICCO estimates production of certified organic cocoa at 15,500

tonnes, sourced from the following countries: Madagascar, Tanzania, Uganda, Belize, Bolivia, Brazil,

Costa Rica, Dominican Republic, El Salvador, Mexico, Nicaragua, Panama, Peru, Venezuela, Fiji,

India, Sri Lanka and Vanuatu.

However, the demand for organic cocoa products is growing at a very strong pace, as consumers are

increasingly concerned about the safety of their food supply along with other environmental issues.

According to Euro monitor International, global organic chocolate sales were estimated to have

increased from a value of US$ 171 million in 2002 to US$ 304 million in 2005.

Certified organic cocoa producers must comply with all requirements associated with the legislation

of importing countries on production of organic products. The benefit for cocoa farmers is that

organic cocoa commands a higher price than conventional cocoa, usually ranging from US$ 100 to

US$ 300 per tonne. However, originating countries with smaller volumes can fetch much higher

premiums. This premium should cover both the cost of fulfilling organic cocoa production

requirements and certification fees paid to certification bodies.

PEST Analysis of Industry in world Market

PEST Analysis

Market trends of confectioneries are highly determined by the elements of the external environment.

Companies operating in the different sectors have little or no influence on these factors. The only

solution is to adapt to the current situation and try to find the best ways to operate in it, and gain the

most favorable positions. In the case of a new product it is especially important to be clear with the

political, economic, social and technological factors affecting the targeted market. These factors are

examined within a PEST analysis.

13

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

Political factors

The foreign and domestic politics, monetary processes have significant effects on the performance of

Hungarian companies. A long-term correction and restructuring program has been introduced by the

government in 2007 to meet the requirements of the EU Convergence Program and to create a stable

economic environment in Hungary.

It contains the introduction of new taxes, energy price and tax increases, and the reform of medical

and educational system as well. As it was expected it caused a significant setback in the economic

performance of the country in the first period. The high tax regime and the unstable business

environment have resulted in a remarkable fall of foreign and domestic investments and

reinvestments of profits.

Besides that, due to the high uncertainty level, peoples faith in the government has been shaken.

Thus, parallel to the growing economic problems an inner political crisis is about to evolve, which

can hinder the future success of the reform and development plans. In 2004 Hungary entered the

European Union and new principles were introduced, which has to be followed by the companies

operating in the confectionary industry.

Strict rules were implemented in the new member states regarding the food safety, like the ISO 9002

and HACCP (Hazard Analysis Critical Control Point) preventative food safety. These require meeting

the basic quality, safety and environmental requirements of the EU.The primary goal of these new

regulations is to protect the consumers and the market from low quality, unhealthy and harmful

product.

Economic factors

As a consequence of the long-term correction program introduced last year, the short-term

macroeconomic situation became quite problematic. Last year data show that among the 10 member

states entered into the EU in 2004, Hungary is one of the worst performing countries The country has

the lowest GDP growth within the European Union with 1.3%,the unemployment rate is around 8%,

prices increase faster than wages, and the consumer price index is higher then it was forecasted in the

previous year. These factors all contribute to the fall of purchasing power of households.

Service sector and those sectors which sales are directed to the domestic market suffer most from the

correction program, since they are limited by the declining domestic demand. The earlier flourishing

construction sector, which established significant capacities over the last few years, also has huge

losses. Furthermore, foreign direct investments show decreasing trend and investment willingness

shads significantly dropped. The success area of the Hungarian economy is manufacturing ,recording

a growth rate of 8% in 2007 (Kopint-Trki).

The EU accession had important effects on the confectionery market. First, the export-import trade

accelerated and many cheap and low quality products flooded the Hungarian market. Then

multinational companies arrived with modern equipments, lower production costs, therefore cheaper

products, and they became extremely important players.

14

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

New, earlier unknown companies and products were introduced, and the supply of chocolate grew

rapidly. They pushed out the old traditional Hungarian companies, or bought them and continued the

production of domestic brands along with their own well-known international products. Therefore,

the confectionary market is characterized by high level of concentration.

Just a few examples: Nestl bought the traditional Szerencsi chocolate factory in 1991; Kraft Foods

had a subsidiary in Hungary, but from 2004 production has been shifted to the neighboring countries,

where conditions are better; while Sweet Point - the largest Hungarian-owned confectionery

company -will be liquidated in 2008 (www.hunbisco.hu). The competition is still quite fierce; there

are many players on the market from the small specialty Hungarian firms, tothe big multinationals.

The only chance for smaller domestic companies to survive and be successful is in the innovation

and the continuous development of product.

Social Factors

According to the data of the Hungarian Central Statistical Office (KSH) the population of Hungary

has been decreasing in the last few decades. The number of children is less endless, while the society

is getting older, thus all though there are more companies offering wide variety of products the

number of potential consumers decreases every year.

Smaller households with one or maximum two children are quite typical in Hungary. Parents in small

families give everything to their children including many food and sweet products as well Companies

try to take advantage of this situation and they always come out with new and innovative products

which can attract children and stimulate their parents to buy them. Gfk Researcher Company

regularly analyzes the role of children within the households.

According to their 2007 data, this role is increasing considerably, since shopping often become a

family program, or children usually go with their mother to the shops. They are attracted by products

in colored packages, sweets packed with toys, and they are especially interested in those products

that they can recognize from advertisements. Besides that, a new young generation has grown up

since the change of regime in the 1990s.

They are now about 20-25 years old, often live alone, work in a good position and spend large part of

their income on themselves. They can afford to follow the newest trends, and they reactquickly to the

changing and fast developing environment. It is very important for the confectionery market, since

this and the following similar generations will constitute the largest part of consumers in the future.

Due to the changed consumer needs quick spread of hyper- and supermarkets can be observed in

Hungary. Consumers try to reduce the duration of shopping, and buy everything in one place at lower

prices. Hypermarkets, like Tesco, Auchan or Metro turn out in force not just in Budapest, but all

over the country in the bigger towns. The number of small grocery stores is continuously decreasing:

last year data shows a decrease from 21959 to 21340.

Contrarily, the number of hyper markets has increased from 109 to123 in 2007, which is a

considerable increase regarding the size of the country. The share of hypermarkets from the total

retail market of food products is about 30%; while this ratio is 18.3% in the case of supermarkets.

One-third of chocolate products are also bought in these large facilities. (AC Nielsen)

15

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

Technological factors

On the Hungarian market the consumers are becoming more health conscious, and spend more on

quality food, just like in the Western European area. Only those companies can survive who are able

to follow the trends and satisfy perfectly the consumer needs.

Companies on the confectionery market need to continuously come out with innovations, and to

provide more special and unique products than before; it is true for producers and traders as well.

FEDA has to choose carefully from the many producers, and to keep good relationship with them.

For an importer company it is necessary to make sure of the quality of the products that they buy

from foreign producers..

Chocolates as sensitive and perishable goods - need to be stored in a warehouse which keeps the

products in the same temperature during the winter and the summer periods as well. And finally,

customers should be informed thoroughly about the products characteristics, origins and quality

List of corporate & countries suppliers / customers.

Chocolate is a product of the cacao bean, which grows primarily in the tropical climates of Western

Africa, Asia, and Latin America.[1] The cacao bean is more commonly referred to as cocoa, so that is

the term that will be used throughout this article. Western African countries, mostly Ghana and the

Ivory Coast, supply more than 70% of the worlds cocoa. The cocoa they grow and harvest is sold to

a majority of chocolate companies, including the largest in the world.

In recent years, a handful of organizations and journalists have exposed the widespread use of child

labor, and in some cases slavery, on cocoa farms in Western Africa. Since then, the industry has

become increasingly secretive, making it difficult for reporters to not only access farms where human

rights violations still occur, but to then disseminate this information to the public. In 2004, the Ivorian

First Ladys entourage allegedly kidnapped and killed a journalist reporting on government

corruption in its profitable cocoa industry In 2010, Ivorian government authorities detained three

newspaper journalists after they published an article exposing government corruption in the cocoa

sector.

The farms of Western Africa supply cocoa to international giants such as Hersheys, Mars, and Nestl

revealing the industrys direct connection to the worst forms of child labor, human trafficking, and

slavery.

16

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

The Worst Forms of Child Labor

In Western Africa, cocoa is a commodity crop grown primarily for export; 60% of the Ivory Coast

export revenue comes from its cocoa. As the chocolate industry has grown over the years, so has the

demand for cheap cocoa. On average, cocoa farmers earn less than $2 per day, an income below the

poverty line. As a result, they often resort to the use of child labor to keep their prices competitive.

The children of Western Africa are surrounded by intense poverty, and most begin working at a

young age to help support their families. Some children end up on the cocoa farms because they need

work and traffickers tell them that the job pays well.

Other children are sold to traffickers or farm owners by their own relatives, who are unaware of the

dangerous work environment and the lack of any provisions for an education. Often, traffickers

abduct the young children from small villages in neighboring African countries, such as Burkina Faso

and Mali, two of the poorest countries in the world. Once they have been taken to the cocoa farms,

the children may not see their families for years, if ever.

Most of the children laboring on cocoa farms are between the ages of 12 and 16, but reporters have

found children as young as 5. In addition, 40% of these children are girls, and some stay for a few

months, while others end up working on the cocoa farms through adulthood.

A childs workday typically begins at six in the morning and ends in the evening. Some of the

children use chainsaws to clear the forests. Other children climb the cocoa trees to cut bean pods

using a machete. These large, heavy, dangerous knives are the standard tools for children on the

cocoa farms, which violates international labor laws and a UN convention on eliminating the worst

forms of child labor. Once they cut the bean pods from the trees, the children pack the pods into

sacks that weigh more than 100 pounds when full and drag them through the forest [17] Aly Diabate, a

former cocoa slave, said, Some of the bags were taller than me. It took two people to put the bag on

my head. And when you didnt hurry, you were beaten.

In addition to the hazards of using machetes, children are also exposed to agricultural chemicals on

cocoa farms in Western Africa. Tropical regions such as Ghana and the Ivory Coast consistently deal

with prolific insect populations and choose to spray the pods with large amounts of industrial

chemicals. In Ghana, children as young as 10 spray the pods with these toxins without wearing

protective clothing.

17

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

To date, relatively little progress has been made to reduce or eliminate child labor and slavery in the

cocoa industry of Western Africa. At the very least, the industry has agreed to work to eliminate what

the ILO calls the worst forms of child labor. These are defined as practices likely to harm the

health, safety, or morals of children and include the use of hazardous tools and any work that

interferes with schooling.[26] Approximately1.8 million children in the Ivory Coast and Ghana may

be exposed to the worst forms of child labor on cocoa farms.

Slavery

Recently, investigators have discovered children trafficked into Western African cocoa farms and

coerced to work without pay. Abby Mills, campaigns director of the International Labor Rights

Forum, adds, Every research study ever conducted in [Western Africa] shows that there is human

trafficking going on, particularly in the Ivory Coast. While the term slavery has a variety of

historical contexts, slavery in the cocoa industry involves the same core human rights violations as

other forms of slavery throughout the world.

Cases often involve acts of physical violence, such as being whipped for working slowly or trying to

escape. Reporters have also documented cases where children and adults were locked in at night to

prevent them from escaping. Former cocoa slave Aly Diabate told reporters, The beatings were a

part of my life. I had seen others who tried to escape. When they tried, they were severely beaten.

Drissa, a recently freed slave who had never even tasted chocolate, experienced similar

circumstances. When asked what he would tell people who eat chocolate made from slave labor, he

replied that they enjoyed something that he suffered to make, adding, When people eat chocolate,

they are eating my flesh.

Is Slave-free Chocolate Possible?

Despite their role in contributing to child labor, slavery, and human trafficking, the chocolate

industry has not taken significant steps to remedy the problem. Within their $60-billion industry,

chocolate companies have the power to end the use of child labor and slave labor by paying cocoa

farmers a living wage for their product.

The chocolate industry is also being called upon to develop and financially support programs to

rescue and rehabilitate children who have been sold to cocoa farms. To date, the industry has done

little to remove child labor, let alone aid survivors of child labor.

18

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

Hersheys, the largest chocolate manufacturer in North America, has not thoroughly addressed

accusations of child labor in its supply chain and refuses to release any information about where it

sources its cocoa.[31] This lack of transparency is characteristic of the chocolate industry, which has

the resources to address and eliminate child labor but consistently fails to take action.

Are the Labels on Chocolate Meaningful?

Aside from large-scale production in Western Africa, a significant amount of cocoa is also grown in

Latin America. This is where the majority of organic cocoa originates. At this time, neither slavery

nor child labor have been documented on these cocoa farms. While it remains possible that some

Latin American farms may employ these practices, it is not widely documented as it is in Western

Africa.

The truth is that consumers today have no sure way of knowing if the chocolate they are buying

involved the use of slavery or child labor. There are many different labels on chocolate bars today,

such as various fair trade certifications and the Rainforest Alliance Certification; however, no single

label can guarantee that the chocolate was made without the use of exploitive labor. In 2009, the

founders of the fair trade certification process had to suspend several of their Western African

suppliers due to evidence that they were using child labor.

Chocolate companies, however, continue to certify their products to tell consumers that they source

their cocoa ethically. But in 2011, a Danish journalist investigated farms in Western Africa where

major chocolate companies buy cocoa. He filmed illegal child labor on these farms, including those

certified by UTZ and Rainforest Alliance. Despite the industrys claims, child labor still plagues

cocoa farms in Western Africa.

Multiple government and NGO programs have been developed, attempting to address the root causes

of the worst forms of child labor and slavery in West Africa. However, the success of these efforts

will depend greatly on the genuine support or lack thereof from the chocolate industry over the

coming years.

19

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

Recommendations

Consumers play an essential role in diminishing the food industrys injustices. Child slavery on cocoa

farms is a difficult issue to fully address because the most serious abuses take place across the world;

however, that does not mean our responsibility is reduced, since chocolate is a luxury and not a

necessity like fruits and vegetables. Taking all of this into consideration and looking at the research

that is available at this time, F.E.P. has created a list with vegan chocolates that we do and do not

recommend based on the sourcing of the cocoa. Other than a few exceptions (which are explained),

we encourage people not to purchase chocolate that is sourced from Western Africa. The list is

available on our website along with free downloadable apps for the iPhone and Android.

Global Trends In production, consumption, product development & marketing.

Coffee is a truly global commodity and a major foreign exchange earner in many developing

countries. The global coffee chain has changed dramatically as a result of deregulation, new

consumption patterns, and evolving corporate strategies. From a balanced contest between producing

and consuming countries within the politics of international coffee agreements, power relations

shifted to the advantage of transnational corporations.

A relatively stable institutional environment where proportions of generated income were fairly

distributed between producing and consuming countries turned into one that is more informal,

unstable, and unequal. Through the lenses of global commodity chain analysis, this paper examines

how these transformations affect developing countries and what policy instruments are available to

address the emerging imbalances.

Keywords

coffee;

commodity chains;

development;

globalization;

regulation

20

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

21

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

CHAPTER : 4

STUDY OF INDIAN MARKET :

22

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

The stock market is witnessing heightened activities and is increasingly gaining importance. In the

current context of globalization and the subsequent integration of the global markets this paper

captures the trends, similarities and patterns in the activities and movements of the Indian Stock

Market in comparison to U.S Stock Market. New York Stock Exchange (NYSE) and Bombay stock

exchange (BSE) has been used in the study as a part of study. The time period used is from 20122013 to test the correlation between the Indian Stock Exchanges and U.S. Stock Exchanges.

Introduction

Stock markets refer to a market place where investors can buy and sell stocks. The price at which

each buying and selling transaction takes is determined by the market forces (i.e. demand and supply

for a particular stock). Let us take an example for a better understanding of how market forces

determine stock prices. ABC Co. Ltd. enjoys high investor confidence and there is an anticipation of

an upward movement in its stock price.

More and more people would want to buy this stock (i.e. high demand) and very few people will

want to sell this stock at current market price (i.e. less supply). Therefore, buyers will have to bid a

higher price for this stock to match the ask price from the seller which will increase the stock price of

ABC Co. Ltd. On the contrary, if there are more sellers than buyers (i.e. high supply and low

demand) for the stock of ABC Co. Ltd. in the market, its price will fall down.

STOCK MARKET OF INDIA

In earlier times, buyers and sellers used to assemble at stock exchanges to make a transaction but

now with the dawn of IT, most of the operations are done electronically and the stock markets have

become almost paperless. Now investorsdont have to gather at the Exchanges, and can trade freely

from their home or office over the phone or through Internet.

The Indian stock exchanges hold a place of prominence not only in Asia but also at the global stage.

The Bombay Stock Exchange (BSE) is one of the oldest exchanges across the world, while the

National Stock Exchange (NSE) is among the best in terms of sophistication and advancement of

technology. The Indian stock market scene really picked up after the opening up of the economy in

the early nineties. The whole of nineties were used to experiment and fine tune an efficient and

effective system. The corporate

23

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

History of Industry in India

History

The Indian Chocolate Industry has come a long way since

long years. Ever since 1947 the Cadbury is in India,

Cadbury chocolates have ruled the hearts of Indians with

their fabulous taste. Indian Chocolate Industry?s Cadbury

Company today employs nearly 2000 people across India.

The company is one of the oldest and strongest players in

the Indian confectionary industry with an estimated 68%

value share and 62% volume share of the total chocolate

market. It has exhibited continuously strong revenue

growth of 34% and net profit growth of 24% throughout

the 1990?s. The brand of Cadbury is known for its

exceptional capabilities in product innovation, distribution

and marketing. With brands like Dairy Milk, Gems, 5 Star,

Bournvita, Perk, Celebrations, Bytes, Chocki, Delite and

Temptations, there is a Cadbury offering to suit all

occasions and moods.

Today, the company reaches millions of loyal customers through a distribution network of 5.5 lakhs

outlets across the country and this number is increasing everyday. In 1946 the Cadbury?s

manufacturing operations started in Mumbai, which was subsequently transferred to Thane. In 1964,

Induri Farm at Talegaon, near Pune was set up with a view to promote modern methods as well as

improve milk yield. In 1981-82, a new chocolate manufacturing unit was set up in the same location

in Talegaon. The company, way back in 1964, pioneered cocoa farming in India to reduce

dependence on imported cocoa beans. The parent company provided cocoa seeds and clonal

materials free of cost for the first 8 years of operations. Cocoa farming is done in Karnataka, Kerala

and Tamil Nadu. In 1977, the company also took steps to promote higher production of milk by

setting up a subsidiary Induri Farms Ltd., near Pune.

In 1989, the company set up a new plant at Malanpur, MP, to derive benefits available to the

backward area. In 1995, Cadbury expanded Malanpur plant in a major way. The Malanpur plant has

modernized facilities for Gems, Eclairs, and Perk etc. Cadbury operates as the third party operations

at Phalton, Warana and Nashik in Maharashtra. These factories churn out close to 8,000 tonnes of

chocolate annually. In response to rising demand in the chocolate industry and reduce dependency

on imports, Indian cocoa producers have planned to increase domestic cocoa production by 60% in

the next four years. The Indian market is thought to be worth some 15bn rupee (?0.25bn) and has

been hailed as offering great potential for Western chocolate manufacturers as the market is still in its

early stages.

24

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

Chocolate consumption is gaining popularity in India due to increasing prosperity coupled with a

shift in food habits, pushing up the country's cocoa imports. Firms across the country have

announced plans to step-up domestic production from 10,000 tonnes to 16,000 tonnes, according to

Reuters. To secure good quality raw material in the long term, private players like Cadbury India are

encouraging cocoa cultivation, the news agency said. Cocoa requirement is growing around 15%

annually and will reach about 30,000 tonnes in the next 5 years.

Brief Introduction

Indian Chocolate Industry as today is dominated by two

companies, both multinationals. The market leader is Cadbury

with a lion's share of 70%. The company's brands like Five Star,

Gems, Eclairs, Perk, Dairy Milk are leaders in their segments.

Untill early 90's, Cadbury had a market share of over 80 %, but

its party was spoiled when Nestle appeared on the scene. The

other one has introduced its international brands in the country

(Kit Kat, Lions), and now commands approximately 15% market

share. The two companies operating in the segment are Gujarat

Co-operative Milk Marketing Federation (GCMMF) and Central

Arecanut and Cocoa Manufactures and Processors Co-operation

(CAMPCO). Competition in the segment will soonly get keener

as overseas chocolate giants Hershey's and Mars consolidate to

grab a bite of the Indian chocolate pie.

The UK based confectionery giant, Cadbury is a dominant player in the Indian chocolate market and

the company expects the energy glucose variant of its popular Perk brand to be singularly responsible

for adding five per cent annually to the size of the company?s market share.

Market capitalization

The Indian candy market is currently valued at

around $664 million, with about 70% share ($

461 million) in sugar confectionery and the

remaining 30% ($ 203 million) in chocolate

confectionery. Indian Chocolate Industry is

estimated at US$ 400 million and growing at 18%

per annum. Cadbury has over 70 % share in this

market, and recorded a turnover of over US$ 37m

in 2008.

25

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

Size of the industry

The size of the market for chocolates in India was estimated at 30,000 tonnes in 2008. Bars of

moulded chocolates like amul, milk chocolate, dairy milk, truffle, nestle premium, and nestle milky

bar comprise the largest segment, accounting for 37% of the total market in terms of volume. The

chocolate market in India has a production volume of 30,800 tonnes. The chocolate segment is

characterized by high volumes, huge expenses on advertising, low margins, and price sensitivity.The

count segment is the next biggest segment, accounting for 30% of the total chocolate market. The

count segment has been growing at a faster pace during the last three years driven by growth in perk

and kitkat volumes. Wafer chocolates such as kit kat and perk also belong to this segment. Panned

chocolates accounts for 10% of the total market. The chocolate market today is primarily dominated

by Cadbury and Nestle, together accounting for 90% of the market.

Major Players

Cadburys India Limited

Nestle India

Gujarat Co-operative Milk Marketing Federation

Cocoa Manufactures and Processors Co-operative (CAMPCO)

Bars Count Lines Wafer Panned Premium

Cadbury?s Dairy Milk & Variants

5-Star, Milk

Amul Milk Chocolate

Treat Perk Gems,

Tiffins Temptation & Celebrations

Nestle Milky Bar & Bar One.

Latest developments

Chocolate-lovers may soon find their chocolate dearer if the problems plaguing the industry

continue. Raw material costs have risen by more than 20 % in the last few years. Although retail

prices have not increased, a rise in input costs will force the manufacturers to consider a price hike.

The Bigger players in the country such as Cadbury, which leads the Rs 2,500 crore chocolate markets

in India with a share of 72%, will find it easier to absorb the surge in input costs as it has products at

various price points in the market, said industry experts. Cadbury may also opt for a price hike, albeit

marginal, if the current trend continues. Indian Chocolate Industry's Margin range between 10 and

20%, depending on the price point at which the product is placed. The input costs in India are under

check owing to the 24% decline in the prices of sugar.

The World?s Leading manufacturer of high quality cocoa and chocolate products Barry Callebaut,

has announced the opening of its first, state-of the art, Chocolate Academy in Mumbai, India in July

2007.

26

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

According to the analysis of the international market intelligence provider Euromonitor, the relatively

small Indian chocolate market with volumes of about 55,000 metric tonnes of chocolate and

compound per year is expected to grow on average per year by around 17.8% between 2008 and

2012.

Ferrero the Italian confectionery giant of $8 billion has planned up for a new production facility in

Maharashtra with an investment of over $125 million to whip up some of its popular brands that

include Rocher and Kinder.

Indian Scenario of Industry

Chocolates are not just meant for kids but for everyone. If you look at the consumption scenario in

India only, then you will get to know that from adolescents to young people to middle-aged people all

are consumers of chocolates And there have been studies proving this fact. This is the reason the

chocolate industry is day-by-day growing in India. Chocolates now grace the most auspicious

occasions in India, be it festivals like Diwali, a wedding, an engagement or birthday ceremonies.

Most of the chocolate brands in India produce chocolates in different sizes, shapes and designs that

are priced accordingly. Most popular chocolates like Diary Milk and Five Star can be bought for just

Rs. 5.

In India, chocolates are tardily but steadily replacing traditional Indian sweets, or we can say

Mithai. Owing to ascending social cognisance, on festivities and functions, people choose to gift

well-wrapped chocolates over traditional sweets. Capitalising this situation, top chocolate brands in

India are currently concentrating more on the packaging and introducing well-packaged designer

chocolates for specific occasions. Apart from that, increasing health consciousness among the urban

masses is also tempting them towards dark chocolates rather than calorie-stuffed sweets. Ad

campaigns like Meethe Pe Kuch Meetha Ho Jaye and Shubh Arambh are also luring consumers

towards making chocolates a part of their everyday life.

List of India's leading and popular chocolate brands:

Cadbury is a British multinational chocolate major. It is handled by Mondelez India. Cadbury was

established in Birmingham, U.K. by John Cadbury in 1824. Cadbury entered India in 1948 and

started its operations by importing chocolates. Today, Cadbury is the most loved and most widely

sold in India. According to Euromonitor International, Cadbury accounted for 55.5% of the total

chocolate sales in India during 2014. Dairy Milk is the flagship brand of Cadbury. Here are some of

the most famous Cadbury variants:

Dairy Milk

5 Star

27

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

Gems

Perk

Silk

Bournville

Celebrations

Founded in 1866, Nestle is a multinational beverage and consumer food items company based in

Switzerland. Henry Nestle founded the company in Vevey, Switzerland. Nestle came to India in the

late 1950s. Nestle was the second best-selling chocolate brand in India in 2014 with 17% share of the

total sales volume. Kit Kat, a bar of crisp wafer fingers covered with chocolate layer, is Nestle's

flagship variant in India. Some of the widely consumed Nestle brands are as follows:

Extra Smooth

Kit Kat Senses

Kit Kat Dark Senses

Alpino

Kit Kat

Bar-One

Munch

Ferrero India

Ferrero is an Italian food and beverage company founded in 1946 by Michele Ferrero. The company

started its business in India in 2004 and has gained a considerable ground in the Indian chocolate

industry within a decade. It is famous for its unique taste defined by its main ingredients creamy

filling, a crunchy wafer and a hazelnut centre. Ferrero India was the third biggest chocolate brand in

India as it held 5% market share in 2014. Ferrero Rocher is the flagship variant of Ferrero India. Here

are some of the Ferrero variants:

Ferrero Rocher

Nutella

28

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

Kinder

Raffaello

Mon Cheri

Amul

Amul is India's indigenous dairy cooperative primarily dealing in dairy products. It is also one of the

biggest players involved in chocolate manufacturing industry of India. Amul is owned by Gujarat Cooperative Milk Marketing Federation Ltd. (GCMMF) and was founded in 1946 by Dr. Verghese

Kurien. The credit of making India the largest producer of milk and dairy products by bringing about

the 'White Revolution' goes to Amul. Milk chocolate is Amul's most trusted brand amongst Indians.

Accounting for 1.1% of India's overall chocolate sales volume in 2014, Amul stands fourth. Some of

its variants are as follows:

Milk Chocolate

Dark Chocolate

Fruit & Nut Chocolate

Tropical Orange Chocolate

Almond Bar

Mars India International

Mars was established in 1911 by Franc C. Mars in Washington, U.S.A. The first recognised brand of

Mars was Milky Way that was launched in 1920s. Mars has been popular in India as well. Very

recently, Mars has started its manufacturing in India. Snickers and Galaxy are the most popular

chocolates in India that are made by Mars. The company was the fifth biggest seller of chocolates in

India in 2014 as it got 1.1% share of the total sales. Some of its products are as follows:

Snickers

Galaxy

Mars

Milky Way

Skittles

29

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

M&M's

Twix

Campco

Campco (Central Arecanut and Cocoa Marketing and Processing Cooperative Ltd.) is an Indian

cooperative that was founded in 1973 in Mangalore, Karnataka. Areca nut is the main ingredient of

the Campco chocolate products, which is mainly cultivated in Indian states of Kerala, Karnataka and

Assam. Campco processes, procures, markets and sells areca nut and cocoa. Some of its products are

as follows:

Bar

Krust

Fun Tan

Melto

Snack Bar

Treat

Turbo

Dairy Cream

ChocOn India

ChocOn started making chocolates in 1998, but it was founded in 1994 and started off with

manufacturing bottled mineral water. The company's operations were stretched to a whole new

manufacturing segment of sweet and the first brand was Milk N Nut, which was launched in 1998.

Since then, a series of exciting tasty chocolate brands have been launched. Some of ChocOns

products are as follows:

Chocolaty Bar

Milcreme Choco Bar

ChocOn Coconut

30

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

Parle

World's best-selling biscuit Parle-G is the flagship product of Parle, an Indian manufacturer of

consumer goods, confectioneries and beverages. Parle was founded in 1929 by Vile Parle's Chauhan

family. The company is the biggest biscuit manufacturer in India. It deals in confectionery items as

well. Parle products are a rare combination of fine taste, nutrition and quality. Chocolate variants of

Parle are as follows:

Kismi Bar

Kismi Toffee

2-in-1 Eclairs

2-in-1

Fruit Drops

Lotus

The Lotus chocolate company was founded in 1992 and is the maker of some of India's finest and

most exquisite chocolates, cocoa derivatives and cocoa products. Lotus supplies cocoa and chocolate

products to local bakeries as well as multinational chocolate manufacturers.

Chuckles

Milky Punch

Eclairs

Kajoos

Candyman

31

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

Candyman is owned by Indian conglomerate ITC founded in 1910 and based in Kolkata, West

Bengal. ITC launched its confectionery brands in 2002. Within a little more than a decade of its

existence, Candyman has launched a wide range of confectionery variants that have ruled over Indian

masses. Candyman is admired by the people of India for the innovative and unique taste it provides

through various products.

Choco Double Eclairs

Eclairs

Creme Lacto

Toffichoo

Cofitino

Growth and Evolution of Industry in India

Chocolate, the world's most illustrious food item has become a vital part of daily appetite among

Indians. Be it a birthday, job promotion, salary increment, examination success or religious and

traditional fiesta, every Indian is ready to nibble his / her share of chocolate to rejoice.

Today, the Indian confectionery industry is one of the fastest growing in the world with an estimated

market size of over Rs 2,000 crore per annum accounting for an annual growth of 18-20 per cent.

The global chocolate market is estimated to be around $85 billion. The Indian confectionery industry

is further categorized into sub-sectors such as sugar- based confectionery, chocolatebasedconfectionery and gums.

The Beginning Chocolate has a long history of almost 3,400 years. At the beginning, it was consumed

as beverage by the Central American people including Mayan and Aztecs. Ancient Mayans and

Aztecs linked chocolate with their gods and goddesses of fertility and so they called it Food of the

Gods. Dr J S Pai, executive director, Protein Foods and Nutrition Development Association of India

(PFNDAI), said, "Early chocolate products were beverages rather than solid sweets.

Even fermented alcoholic drinks prepared from it were consumed. After the Spanish conquest of

Aztecs, chocolate was brought to Europe and the rich started drinking chocolate beverage." After its

inception as a beverage drink, the chocolate-making process remained unchanged for hundreds of

years.

Cocoa drink

Later, when the Industrial Revolution arrived, many changes occurred that brought the hard, sweet

candy to life. "Famous British physician Hans Sloane in Jamaica came across a drink made of cocoa

enjoyed by locals. He made it more palatable by mixing it with milk, thus making the first milk

chocolate beverage. This recipe was eventually acquired by Cadbury Brothers who then started to

manufacture in the 19th century.

32

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

The Industrial Revolution enabled separation of cocoa butter and cocoa powder, so various different

products including the most popular chocolate candy were made from the various ingredients. As

cocoa plantation was possible in other parts of the world besides Central and South American places,

especially in Africa, and large manufacturing units started producing chocolate-based products, these

were then affordable by common people too," Dr Pai, noted in one of his article titled Chocolate Food of the God.

According to confectionery experts, one of the primary demand drivers for chocolate and other

sweets globally is consumer taste, and patrons continue to love chocolate. Matt Sena, research

analyst and trader, said in a published paper, "Long a beloved treat in the Western world, a recent

study in Great Britain showed that 91% of females and 87% of males consume chocolate products.

The taste for chocolate is now expanding into highly populated nations with a growing middle-class,

such as India and China. Rising disposable incomes and changing tastes will continue to drive

growth in the industry overseas, just as improving domestic economic conditions increase sales at

home."

After LPG - Liberalisation, Privatisation and Globalisation, India has witnessed tremendous growth

in F&B sector, particularly, in the confectionery segment. Many foreign players like Nestle and

Cadbury forayed into the Indian market to tap 100+ million customers. Growth drivers

Hussain Shaikh, proprietor, Heena Sales Corporation, suppliers of candies & premium chocolates in

Pune, said, "The growth we achieved in last years of 21st century is remarkable.

Today, the key growth drivers of chocolate industry in India are tradition of gifting sweets, shifting in

consumer preference from traditional mithai to chocolates, rising income levels and attractive pricing

which is suitable for every pocket.

The urban India and tier I, II cities have woken up to the fad of chocolate being considered as a gift

proposition. While even till few years back sweets were the only option in delicacy gifting, overt

media exposure and smart marketing techniques have positioned chocolates as an alternative."As per

research study done by Technopak Advisors, the two giants Cadbury with 70 per cent and Nestle

around 25 per cent have been instrumental in building up the chocolate market in India with huge

investments in product development, advertising and brand building. Here, the chocolate industry has

plethora of opportunities.

33

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

CHAPTER:5

PRODUCT PROFILE

34

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

Brands

Varieties

Wilbur chocolate with a bold American flavor

profile

Swiss-style Peters chocolate

Veliche Belgian chocolate

Milk

Dark

White

With a full line of chocolates including milk, dark and white, Wilbur

offers the right chocolate coatings to meet your needs. Using the

highest-quality cocoa beans to produce our chocolate coatings, we

roast beans and manufacture chocolate liquor in a way that ensures

quality throughout the entire chocolate-making process.

Product

Cashmere milk chocolate

Description

Our most popular milk chocolate with a well-balanced flavor

profile.

Sable milk chocolate

The same flavor profile of Cashmere in a thin viscosity.

Cupid milk chocolate

A medium viscosity chocolate coating with vanilla and whole

milk flavor. Ideal for hand dipping or enrobing.

Windsor milk chocolate

A silky smooth milk chocolate with a slightly caramelized note

made with vanilla.

H732 milk chocolate

An economical chocolate coating with a pleasant milk flavor

made with vanilla.

Bronze Medal semisweet chocolate Our most popular semisweet with a strong chocolate impact and

added milk fat to inhibit bloom. Made with vanilla.

Warwick semisweet chocolate

A dark, sweet, non-alkalized chocolate with a hint of bitterness.

A rich, fudgy semisweet chocolate with a hint of bitterness, that

Westbrook semisweet chocolate

is made with vanilla. Great for complementing a sweet center.

Our darkest semisweet chocolate with strong Dutched

Velvet semisweet chocolate

characteristics and added milk fat to inhibit bloom.

Platinum white chocolate

Premium white chocolate made with vanilla.

M540 milk chocolate drop

Robust chocolate impact made with vanilla.

B558 semisweet drop

Well-rounded, rich flavor for upscale cookies. Made with vanilla.

T110 classic semisweet drop

Nice dark flavor for economical applications. Made with vanilla.

R377 durable semisweet drop

Intense flavor with dextrose makes this drop excellent for

challenging baking applications.

T157 semisweet drop

A smooth and creamy release of fruit and cacao in drop form.

35

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

R900 semisweet drop

T559 semisweet drop

S192 semisweet drop

W742 semisweet drop

P1383 glazed semisweet drop

S843 white chocolate drop

Y252 white chocolate drop

A sweet economical drop with high impact chocolate notes.

Made with dextrose for a quick-setting chocolate chip cookie

application.

Robust chocolate drop with a hint of sweetness.

Blended liquor piece with a well-rounded chocolate flavor

profile and a hint of vanillin.

A mild semisweet chocolate drop with strong sweetness and

vanillin impact.

Highly polished panned drop with a robust roasted chocolate

flavor. Coated in a barrier that inhibits bloom and helps to

improve gloss stability.

A premium white cocoa butter drop offering a white chocolate

impact. Made with vanilla.

A white chocolate drop containing low sweetness with a milky,

cocoa butter flavor.

M540 milk chocolate chunk

Premium milk chocolate in a rectangular chunk.

(rectangular)

M540 milk chocolate chunk (square) Premium milk chocolate in a thin, square chunk.

T157 semisweet chunk

Premium chocolate flake with a smooth and creamy release of

fruit and cacao.

S390 semisweet chunk

Smooth semisweet chocolate in a thin chunk.

S836 semisweet chunk

Thick square chunk with a well-balanced flavor profile. Made

with vanilla.

T559 semisweet chunk

Robust chocolate chunk with a hint of sweetness.

V995 Brandywine bittersweet

Traditional Brandywine chocolate in chunk form.

chunk

S842 white chocolate chunk

Sweet and creamy white cocoa butter chunk.

S843 white cocoa butter chunk

Premium white cocoa butter chunk offering a strong white

chocolate impact.

S843 white cocoa butter drop

A premium white cocoa butter drop offering a white chocolate

impact your customers are expecting. Made with vanilla.

Peters milk chocolates have always exhibited the distinct flavor

characteristics of the original Swiss inventors, Daniel Peter and Henri

Nestl. Peters semisweet chocolates are formulated with special

flavor beans to provide the unique flavors not found in other

36

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

chocolates.

Product

Ultra milk chocolate

Description

Our lightest colored milk chocolate with a very distinct flavor

resulting from uniquely flavored beans.

Crema milk chocolate

A typical Swiss-styled milk chocolate with a medium strength

chocolate flavor, popularly used with peanut flavored centers.

Broc milk chocolate

Our most popular milk chocolate, this original Swiss formula

has a predominant milk flavor and is less sweet.

Madison milk chocolate

A fine flavor balance of milk chocolate makes this product a

natural for chocolate covered pretzels.

Maridel milk chocolate

Containing 33% cocoa solids and a subtle infusion of vanilla,

its balanced flavor profile makes this one of our most versatile

milk chocolates.

Glenmere milk chocolate

A sweet and somewhat darker milk chocolate designed for

enrobing; it especially complements nut confections.

Chatham milk chocolate

This product has the most intense chocolate flavor of all our

milk chocolate.

Vallen milk chocolate

Our original Swiss formula with a predominant milk flavor and

a subtle infusion of vanilla, perfect for enrobed confections.

Superfine milk chocolate

Newport semisweet chocolate

Viking semisweet chocolate

A golden colored milk chocolate with spicy overtones.

Specially roasted beans provide a strong chocolate flavor.

A full roast chocolate, used when a mild semisweet flavor is

desired. Preferred by bakers.

A robust, semisweet chocolate with fudgy and fruity flavor

notes. Made with vanilla.

A full dark roast chocolate with fruity and smoky overtones. An

excellent match with cordial cherries.

Lenoir semisweet chocolate

Monogram semisweet chocolate

37

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

Burgundy semisweet chocolate

Our most popular semisweet chocolate. Has a reddish cast and

a fruity, winey flavor note.

Cambra bittersweet chocolate

A bittersweet chocolate with 72% cocoa solids blended with

European-style low roast liquor and aged to produce a mellow,

balanced flavor. Made with vanilla.

Gibraltar bittersweet chocolate

A true bittersweet chocolate with 60% cocoa solids especially

adapted to blend with sweet centers. Excellent for chocolate

covered mints. Packed 5 blocks per case - net weight 50 lbs.

Peter's Original white chocolate A rich cream color and cocoa butter-based, whole milk coating.

It has delicate chocolate aroma and flavor.

Gourmet chocolate chips

A smooth, creamy chip with spicy overtones and a strong

semisweet chocolate flavor.

Flavored with vanilla and non-alkalized liquor, the Veliche brand is

chocolate in the Belgian tradition -- rich in character and complex in

flavor, yet remarkably workable in form.

Product

Chocolat Blanc 29%

White Chocolate

Chocolat Lait 40%

Milk Chocolate

Chocolat Noir

58% Bittersweet

Chocolate

Chocolat Noir 64%

Bittersweet Chocolate

Description

A clean, balanced milk flavor with a buttery mouth-feel, inviting aroma and

a subtle suggestion of vanilla.

Balanced and smooth milk character with harmonious undertones of

caramel, honey and butterscotch.

Dusky and intense cocoa flavor with bittersweet, lightly fudgy aftertaste.

Made with Tahitian vanilla.

Complex and dimensional bittersweet with mellow notes of roasted coffee

and tobacco, and a lingering chocolate richness that melts into the palate.

Made with Tahitian vanilla.

Chocolat Noir 72%

Subtle depths of flavor with surprisingly delicate bittersweet roasted notes

Bittersweet Chocolate that form gradually and dissipate slowly. Made with Tahitian vanilla.

38

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

CHAPTER :-6

Demand determination of the Industry

39

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

DETERMINANTS OF DEMAND AND SUPPLY OF CADBURY

Determinants of Demand

Income

Population and Age Group

Brand Image

Consumer Preference and Taste

Expected Future Price

Competition

Price of Complementary Goods

Cooling Weather and Recession

Determinants of Supply

number of supplier

expected price

price of input costs

Factors that Affect The Demand of Cadbury

Income of the consumer will also affect the demand of goods. For example, if the income of the

consumer increase, they have more money to spend, therefore they will buy more goods. At that

moment, the demand curve for the goods will shift to the right. However, not demand for the goods

will increase only, demand for normal good will increased.

There is a real life instance for this theory. When our salary increases, we will have extra money to

spend, so before increase of salary, we may only purchase 1 or 2 chocolate bars. However, after

increase of salary, maybe we will buy dozens of chocolate bars. This made us to purchase more of the

goods sold. Therefore the demand of the product will increased due to the raise of income. So, there

is a positive relationship between income and the product demand.

The determinant that affects the demand of Cadbury is population and age group. The product is

known for the children, adults and also for the old people so the age group are not much affected the

demand of the product. In this case, demand remains constant. If by increasing in the population,

there will be more buyers than there must be more of the market demand. Thus, the demand of the

Cadbury products will increase and the demand curve shifts leftward to rightward.

40

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

The brand image also determines the demand of the product as its brand of Cadbury plays an

important role in the demand of the Cadbury. This product has built such a brand image that it has

attracted the mind of the consumers so they will not like to go for any other product.

The demand of Cadbury product also depends on consumers preference and taste. If people

enjoy eating and develop a preference for the sweet and classic tasting Cadbury Chocolate, they

will want more of it. If consumer do not prefer by its sweetness tasting, they will want less of it

or change to other brand. Income changes and lower priced substitutions could affect their taste

and a cheaper priced alternative could become a new preference.

Expected price is also included. If consumer expects that the price of a certain commodity will

rise in future, the demand will increase as the product is under the current lower price before the

price rise. Inversely, consumers may believe that a price of a good will be reduced in future; they

will delay on purchasing the product until the price reduces to the lower rate. Many consumers

may purchase Cadbury products if they know that the price is going to be increasing in the near

future. On the other hand, consumers may wait to buy the products if they know the prices are

going to drop in the near future.

Competition is also other factors that affect the demand of Cadbury products. In this market,

consumers can find a lot variety of different brands of chocolate that are available such as Nestle

Kit-Kat, Ferrero Roche, Hershey ,Mars and so on. All chocolates are sold according to the market

price including Cadbury. So it is a tough competition for all confectionery companies. In order to

increase the demand for Cadbury products, the price of the competitors have to be increase. In

vice versa, if the price of the competitors decrease, the demand of Cadbury products not much

affected by it as it is considered as consumers brand loyal but the sales volume is not much as

the previous. In the results, the profits will not that high as before the changes of price of

competitors.

Furthermore, price of complementary goods is also another determinant. If the price of

complementary goods increases then there will be no change in the demand as Cadbury has

referred to normal goods. It becomes every people daily needs. But there is another consideration

that the demand will be affected if the price of complementary goods increases highly. For

example, in 2009 a shortage of cocoa was reported in UK. The cost of cocoa has increased

drastically to 2,055 a ton, the highest since 1985. The sale revenues dropped drastically as many

41

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

consumers may be unwilling to buy the product. They would rather to purchase sweet or candy

rather than buy chocolate.

Other factors for affect the change in demand could be related to the cooling weather and to the

recession. Cooler weather encourages the increase in sales of chocolate and the recession could

mean that people are staying at home rather than going out to eat. In 2009, Cadbury have that a

stay-at-home culture that have helped increase Cadburys UK sales by 12% in the first half year

(BBC News, 2009). Thus, the weather affects the demand curve shift from left to right as demand

increases.

Factors that Affect The Supply of Cadbury

The price of related goods will affect the supply that will shift the supply curve. For example, in

2009, UK had faced inflation in the price of cocoa that brought a huge impact to all confectionery

companies including Cadbury. (mail online, 2009).The increases in the price of the related good

(cocoa) will affect less supply on the confectionery products although the price of the product

remains constant. This shifts the supply curve to the left.

Besides, the number of suppliers also will affect supply. For example, as Cadbury expands their

business to more than 70 countries, there are a lot of supplies for Cadbury product. An increase in

number of suppliers shifts the supply curve rightward. The greater the number of suppliers in the

market, the greater the supply of Cadbury products in the market. There will be more Cadbury

products to go around for the consumers.

Expected price of the good also determines the supply of Cadbury products. Producers may delay the

production of Cadbury in the current period if they expect the price of the products to rise. They will

be more willing to sell the products at a higher price rather than selling and producing at the lower

price. The higher price will increase their net revenue.

price

42

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

Items in search results

Cadbury Glow 16 Luxurious Praline Wrapped in Delicious Chocolate 160 gms

Excellent Gift for DIWALI CHRISTMAS & NEW YEAR

Rs. 425.00

Buy It Now

+Rs. 70.00 shipping

Cadbury Caramel Nibbles Chocolate Imported From Uk

Free Shipping Bluedart / Fed Ex Same Day Shipping

Rs. 699.00

Buy It Now

Free shipping

4 watching

43

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

Cadbury Fingers Creamy White Chocolate Biscuits (Imported Chocolates)

Made in UK & fast shipping

Rs. 499.00

Buy It Now

Free shipping

Send Online Cadbury Celebrations 126 gms On Birthday as Chocolate Gift

Rs. 349.00

Buy It Now

Free shipping

Cadbury Twirl Bites Chocolate Imported From Uk Limited Edition

Free Shipping Bluedart / Fed Ex Same Day Shipping

Rs. 599.00

Buy It Now

Free shipping

3 watching

44

KADI SARVA VISHWAVIDYALAYA 2014 -2016

S. K. PATEL Institute of Management & Computer Studies Gandhinagar.

Cadbury Dairy Milk Bubbly Milk Chocolate Imported (Limited Quantity Available

Very Rare To Fine In India // Fast Shipping