Академический Документы

Профессиональный Документы

Культура Документы

FI Cut Over Activities: A: Master Data Upload

Загружено:

Anil Vishaka0 оценок0% нашли этот документ полезным (0 голосов)

15 просмотров3 страницыperiod end processes

Оригинальное название

prnit2

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документperiod end processes

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

15 просмотров3 страницыFI Cut Over Activities: A: Master Data Upload

Загружено:

Anil Vishakaperiod end processes

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

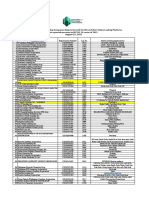

FI Cut over activities

A: master data upload

1. G/L Master Upload thru BDC or LSMW (FS00 & FS01)

2. Vendor Master Upload thru BDC or LSMW (Will be Taken Care by MM)

3. Customer Master Upload thru BDC or LSMW (Will be Taken Care by SD)

4. Asset Master Upload (AS90)

5. Cost Element Master Upload

6. Cost Center Master Upload

7. Profit Center Master Upload

b. Transaction data upload

1. G/L Balances (F-02)

2. Vendor Balances (F-43)

3. Customer Balances (F-22)

4. Customer Advances (F-29)

5. Vendor Advances (F-48) - Before uploading Vendor Balances you have to take care of TDS Information.

6. Asset value uploads (AS91).

FI period end activities

1. Recurring Documents.

a) Create Recurring documents

b) Create Batch Input for Posting Recurring Documents

c) Run the Batch Input Session

2. Posting Accruals or Provisions entries at month end

3. Managing the GR/IR Account-Run the GR/Ir Automatic Clearing

4. Foreign Currency Open Item Revaluation-Revaluate Open Items in AR.AP

5. Maintain Exchange Rates

6. Run Balance Sheets Run Financial Statement Version

7. Reclassify Payables and Receivables if necessary

8. Run the Depreciation Calculation

9. Fiscal Year Change of Asset Accounting if it is year end

10. Run the Bank Reconciliation

11. Interest calculation

11. Open Next Accounting Period

12.Settlement of I/O to AUC

Asset period end activities

1. Check Last Closed Fiscal Year in FI and FI-AA

2. Check Customizing Using Report RACHECK0

3. Check Incomplete Assets

4. Check Indexes

5. Recalculate Depreciation

6. Execute Depreciation Posting Run

7. Execute Periodic Posting Program

8. Reconcile General Ledger and Subsidiary Ledger

9.Execute Fiscal Year Change Program

controlling Cut over activities

1. Upload Cost center plan

2. Execute the allocation cycles within cost center accounting

3. Update planned activity

4. Calculate Activity prices

5. Execute product costing run.

Other Pre-Go live activities

1. Ensure all the customizing request is in the production system

2. Ensure all the number ranges for all the modules have been maintained in the production system

3. Ensure that Operating concern has been generated

4. Ensure all material masters (all material types) have been loaded

5. Upload Open purchase orders

6. Stock upload

7. Wip calculation for the existing and unprocessed orders.

7. Mark and Release the cost estimates.

CONTROLLING PERIOD END CLOSING ACTIVITIES

1. Repost CO Documents that was incorrectly posted

2. Run Distribution or Assessment Cycles

3. Cost center split

4. Actual activity price calculation

5. Revaluation of activities

6. actual overhead allocation

7. Co product settlement(only in production order)

8. wip cut off period

9. wip calculation

10.variance calculation

11.production/sales order settlement

12.copa internal assessment cycle run.

Вам также может понравиться

- Sales Revenue ($250 X 6 Mos.) ......................................................................................................... $1,500Документ4 страницыSales Revenue ($250 X 6 Mos.) ......................................................................................................... $1,500Iman naufalОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Consolidated Balance Sheet: Godrej Industries LimitedДокумент6 страницConsolidated Balance Sheet: Godrej Industries LimitedAjjay AmulОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Chapter 7-The Revenue/Receivables/Cash Cycle: Multiple ChoiceДокумент33 страницыChapter 7-The Revenue/Receivables/Cash Cycle: Multiple Choicemisssunshine112Оценок пока нет

- Dictionar EconomicДокумент62 страницыDictionar EconomicMorgaine le FayОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- LLL 14 PDF FreeДокумент34 страницыLLL 14 PDF FreeLayОценок пока нет

- Re050 Ifrs16Документ141 страницаRe050 Ifrs16Milica PavlovicОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Deutsche Finan ExcelДокумент6 страницDeutsche Finan ExcelAnonymous VVSLkDOAC1Оценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Sensitivity Analysis in Excel TemplateДокумент8 страницSensitivity Analysis in Excel TemplateMohd Yousuf MasoodОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Chapter I - INTERNAL Auditing: By: Dennis F. GabrielДокумент27 страницChapter I - INTERNAL Auditing: By: Dennis F. GabrielJasmine LeonardoОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Advanced Corporate Accounting On13april2016 PDFДокумент198 страницAdvanced Corporate Accounting On13april2016 PDFDidier NkonoОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- 06P Earnings Per Share Book Value Per ShareДокумент19 страниц06P Earnings Per Share Book Value Per SharejulsОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Marijuana Business Plan ExampleДокумент29 страницMarijuana Business Plan Examplejackson jimОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- E-Business Section 04Документ21 страницаE-Business Section 04Salma AbobakrОценок пока нет

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-2Документ4 страницыUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-2Pramod VasudevОценок пока нет

- CH 07Документ24 страницыCH 07Muhammad AmirulОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Financial Accounting For Managers Author: Sanjay Dhamija Financial Accounting For Managers Author: Sanjay DhamijaДокумент42 страницыFinancial Accounting For Managers Author: Sanjay Dhamija Financial Accounting For Managers Author: Sanjay DhamijaShivam Thakur0% (1)

- Chapter 1 An Introduction To Accounting: Fundamental Financial Accounting Concepts, 10e (Edmonds)Документ53 страницыChapter 1 An Introduction To Accounting: Fundamental Financial Accounting Concepts, 10e (Edmonds)brockОценок пока нет

- RAR Overview OriginalДокумент32 страницыRAR Overview OriginalnagalakshmiОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Accounts RTP CA Foundation May 2020Документ31 страницаAccounts RTP CA Foundation May 2020YashОценок пока нет

- Working File - SIMДокумент7 страницWorking File - SIMmaica G.Оценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Chartered Accountancy Professional Ii (CAP-II) : Education Department The Institute of Chartered Accountants of NepalДокумент192 страницыChartered Accountancy Professional Ii (CAP-II) : Education Department The Institute of Chartered Accountants of NepalPrashant Sagar GautamОценок пока нет

- Unit .2 The Accounting CycleДокумент29 страницUnit .2 The Accounting CycleYonasОценок пока нет

- List of Financing and Lending Companies Registered With The SEC and Their Online Lending Platforms As Reported Pursuant To SEC MC 19, Series of 2019Документ2 страницыList of Financing and Lending Companies Registered With The SEC and Their Online Lending Platforms As Reported Pursuant To SEC MC 19, Series of 2019Clark Adrian De Asis. Distor0% (1)

- ACCT601 - Prelim Examination PDFДокумент10 страницACCT601 - Prelim Examination PDFSweet EmmeОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Tally Question PaperДокумент2 страницыTally Question PaperRAAGHAV GUPTAОценок пока нет

- CH 19-Notes 1025242961Документ7 страницCH 19-Notes 1025242961ayten.ayman.elerakyОценок пока нет

- 1 Cash and Cash Equivalents 3Документ14 страниц1 Cash and Cash Equivalents 3Abegail AdoraОценок пока нет

- (041621) Nike, Inc. - Cost of CapitalДокумент8 страниц(041621) Nike, Inc. - Cost of CapitalPutri Alya RamadhaniОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Partnership Formation - SolutionsДокумент5 страницPartnership Formation - SolutionsMohammadОценок пока нет

- ExamView Pro - DEBT FINANCING - TST PDFДокумент15 страницExamView Pro - DEBT FINANCING - TST PDFShannon ElizaldeОценок пока нет