Академический Документы

Профессиональный Документы

Культура Документы

AngelBrokingResearch GlaxoSmithKlinePharma 3QFY2016RU 180216

Загружено:

HitechSoft HitsoftИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

AngelBrokingResearch GlaxoSmithKlinePharma 3QFY2016RU 180216

Загружено:

HitechSoft HitsoftАвторское право:

Доступные форматы

3QFY2016 Result Update | Pharmaceutical

February 18, 2016

GlaxoSmithKline Pharma

NEUTRAL

Performance Highlights

CMP

Target Price

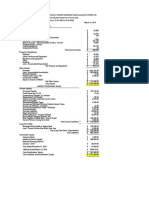

Y/E Mar (` cr)

Net Sales

2QFY2016

% chg (qoq)

3QFY2015

% chg (yoy)

729

692

5.3

646

12.8

Investment Period

33

40

(15.6)

17

94.3

Gross profit

387

390

(0.9)

360

7.6

Operating profit

103

121

(14.9)

110

(6.6)

Market Cap (` cr)

27,061

82

101

(18.9)

55

50.1

Net Debt (` cr)

(1,631)

Source: Company, Angel Research

Pharmaceutical

Sector

Beta

For 3QFY2016, GlaxoSmithKline Pharmaceuticals (GSK Pharma) posted a

disappointing operating performance. For the quarter, the company posted sales

of `729cr (V/s `730cr expected), a growth of 12.8% yoy. On the operating front,

the company posted a gross margin of 53.1% V/s 55.6% in the corresponding

period of the previous year. The OPM came in at 14.1% V/s 17.0% during the

corresponding period of previous year, mainly owing to lower gross margin on a

yoy basis. Adj. net profit came in at `82cr V/s `55cr in 3QFY2015, a yoy growth

of 50.1%. We remain Neutral on the stock.

0.37

52 Week High / Low

3,825/2,965

Avg. Daily Volume

2,435

10

Face Value (`)

23,382

BSE Sensex

Nifty

7,108

Reuters Code

GLAX.BO

GLXO@IN

Bloomberg Code

Results below our expectations: For 3QFY2016, the company posted a

disappointing operating performance. For the quarter, the company posted sales

of `729cr (V/s `730cr expected), a growth of 12.8% yoy. On the operating front,

the company posted a gross margin of 53.1% V/s 55.6% in the corresponding

period of the previous year. The OPM came in at 14.1% V/s 17.0% during the

corresponding period of previous year, mainly owing to lower gross margin on a

yoy basis. This lead the Adj. net profit came in at `82cr V/s `55cr in 3QFY2015,

a yoy growth of 50.1%.

Shareholding Pattern (%)

Outlook and valuation: Company has a strong balance sheet with cash of

~`2,000cr, which could be used for future acquisitions or higher dividend

payouts. On the operational front, we expect the companys net sales to post a

CAGR of 9.8% to `3,158cr and EPS to register a mere CAGR of 6.6% to `68.3

over FY201517E. We remain Neutral on the stock.

Key financials (Consolidated)

75.0

MF / Banks / Indian Fls

10.3

FII / NRIs / OCBs

Abs. (%)

3yr

Sensex

(9.6) (19.7)

20.1

Glaxo

2.6

52.5

2,500

464

509

504

579

2,000

% chg

(29.4)

9.8

(1.1)

14.9

1,500

EPS (`)

54.8

60.1

59.5

68.3

EBITDA (%)

19.9

17.8

20.0

22.1

P/E (x)

58.3

53.1

53.7

46.7

RoE (%)

23.2

26.7

28.5

34.3

RoCE (%)

22.4

26.7

26.8

33.7

P/BV (x)

13.6

14.8

15.8

16.3

9.9

7.7

8.8

8.1

49.7

43.2

44.1

36.6

EV/EBITDA (x)

Source: Company, Angel Research; Note: CMP as of February 17, 2016, * 15 months numbers

Please refer to important disclosures at the end of this report

Jan-16

10.0

Jul-15

(12.3)

Oct-15

28.9

Jan-15

(3.2)

Apr-15

3,000

Jan-14

3,158

Apr-14

2,870

Jul-13

3,272

Oct-13

2,538

Jan-13

3,500

Apr-13

FY2017E

EV/Sales (x)

(1.5)

4,000

FY2016E

Net profit

3m

3-year price chart

FY2015*

% chg

12.2

1yr

CY2013

Net sales

2.5

Indian Public / Others

Oct-12

Y/E Mar (` cr)

Promoters

Jul-14

Adj. PAT

Stock Info

Oct-14

Other income

3QFY2016

`3,195

-

Source: Company, Angel Research

Sarabjit Kour Nangra

+91 22 39357800 Ext: 6806

sarabjit@angelbroking.com

Glaxo | 3QFY2016 Result Update

Exhibit 1: 3QFY2016 Standalone performance

Y/E March (` cr)

Net Sales

3QFY2016

2QFY2016

% chg (qoq)

3QFY2015

% chg (yoy)

9MFY2016

9MFY2015

% chg

729

692

5.3

646

12.8

2,042

1,994

2.4

Other income

33

40

(15.6)

17

94.3

119

143

(16.6)

Total Income

762

731

4.2

663

14.9

2,162

2,137

1.2

Gross profit

387

390

(0.9)

360

7.6

1,119

1,038

7.8

Gross margin

53.1

56.4

54.8

52.1

Operating profit

103

121

327

364

Operating margin (%)

55.6

(14.9)

110

(6.6)

14.1

17.4

16.0

18.3

Interest

Depreciation & Amortisation

46.5

33.5

18

15

22.4

PBT & Exceptional Items

128

155

(17.2)

121

5.8

428

492

(13.1)

Less : Exceptional Items

(3)

(8)

(21)

(14)

Profit before tax

17.0

(10.2)

125

147

(15.0)

100

24.3

415

492

(15.8)

Provision for taxation

45

51

(11.7)

55

(18.5)

145

169

(14.0)

Reported PAT

80

96

(16.8)

45

76.4

269

324

(16.8)

(18.9)

55

50.1

278

324

(14.1)

32.8

38.2

Adj. Net profit

82

101

EPS (`)

9.7

11.9

6.5

Source: Company, Angel Research, Note- Full year numbers are consolidated numbers

Exhibit 2: 3QFY2016 Actual vs Angel estimates

(` cr)

Net sales

Other income

Operating profit

Actual

Estimates

Variation (%)

729

730

(0.2)

33

44

(23.3)

103

131

(21.7)

Tax

45

67

(32.3)

Adj. net profit

82

103

(20.2)

Source: Company, Angel Research

Revenue grew by 12.8%

For 3QFY2016, the company posted a disappointing operating performance.

Sales came in at `729cr (V/s `730cr expected), a growth of 12.8% yoy.

February 18, 2016

Glaxo | 3QFY2016 Result Update

Exhibit 3: Sales trend

800

40.0

35.0

729

30.0

692

25.0

646

622

613

20.0

600

(%)

(` cr)

700

15.0

10.0

5.0

500

0.0

(5.0)

(10.0)

400

4QFY2015

5QFY2015

Sales

1QFY2016

2QFY2016

Growth (YoY)

3QFY2016

Source: Company, Angel Research, Note- Financial year changed to March from Dec in 2015

OPM comes in lower at 14.1%

On the operating front, the gross margins for the quarter came in at 53.1% V/s

55.6% in 3QFY2015. The OPM came in at 14.1% V/s 17.0% in 3QFY2015,

mainly owing to lower GPM on a yoy basis. This is against our expectation of

18.1%.

Exhibit 4: OPM trend

25.0

19.4

20.0

(%)

17.0

16.7

17.4

15.0

14.1

10.0

4QFY2015

5QFY2015

1QFY2016

2QFY2016

3QFY2016

Source: Company, Angel Research, Note- Financial year changed to March from Dec in 2015

Net profit lower than estimated

The reported net profit came in at `80cr V/s `45cr in 3QFY2015. However the

Adj. net profit came in at `82cr V/s `55cr in 3QFY2015, a yoy growth of 50.1%.

February 18, 2016

Glaxo | 3QFY2016 Result Update

Exhibit 5: Adjusted net profit trend

150

107

95

(` cr)

100

101

82

55

50

0

4QFY2015

5QFY2015

1QFY2016

2QFY2016

3QFY2016

Source: Company, Angel Research, Note- Financial year changed to March from Dec in 2015

February 18, 2016

Glaxo | 3QFY2016 Result Update

Recommendation rationale

Renewed focus on the Indian market; CY2013 & FY2015 muted on back of DPCO

2013: GSK Pharma is among the top ten players in the Indian pharmaceutical

market, having a market share of ~3.7%. Unlike other MNCs, the company has

been amongst the few which have taken initiatives to grow their businesses in the

Indian market with consistent launch of new products.

Over the last six years, the company has strategically decided to expand its

presence in the Specialty segment. Specialty segments contribution to sales has

reached 23% (as of 2013). The segment grew by 9.0% yoy in CY2013. Another

segment which is strong for the company is the area of vaccine, where GSK

Vaccines has become the leading company in the private market for vaccines in

India. The recently introduced vaccine for pneumococcal conjugate disease,

Synflorix, has become the biggest brand in the vaccine portfolio of the company in

the second year of its launch. The efforts of the company in raising awareness

about vaccines and preventable diseases continue with increasing fervor. Also, in

FY2015, GlaxoSmithKline Plc (GSK), London, UK, entered into three interconditional agreements with Novartis AG (Novartis), Basel, Switzerland. In one

such agreement GSK agreed to acquire Novartiss Vaccines business (excluding

influenza vaccine) and manufacturing capabilities and facilities from Novartis, and

in the second agreement, GSK agreed to sell the rights of its Marketed Oncology

Portfolio, related R&D activities and AKT Inhibitors currently in development

to Novartis. Globally, these transactions with Novartis were completed on

March 2nd, 2015.

On the other hand, its other key segments like mass markets and mass specialty,

which contribute 60% of its sales, de-grew by 12% in CY2013. This was as a result

of a number of products of the company having come under the DPCO 2013

ruling, resulting in reduction in prices of its drugs, which impacted its sales in

CY2013. Along with this, the supply constraints, mainly from local supplies during

FY2015, have been impacting its performance. However, going forward, with

companys own facilities coming on stream in FY2017, we expect the volatility in

sales to end. Overall, for FY2015-17E, we expect the domestic formulation

business of the company to grow at a CAGR of 8.0%.

Significant capex plans ahead indicate revival in growth: Global pharmaceutical

major GSK announced an `864cr investment in India to set up a medicine

manufacturing unit. The new facility will substantially increase GSKs

manufacturing base. The drug maker is proactively building capacity in the country

as it delivers its portfolio of products in areas such as gastroenterology and antiinflammatory medicines. When complete, the factory will make pharmaceutical

products for the Indian market at a rate of up to 8bn tablets and 1bn capsules a

year. The facility, expected to be operational by 2017, will include a warehouse,

site infrastructure, and utilities to support the manufacturing and packing of

medicines. It showcases GSK's latest commitment to its manufacturing network in

India where the company has invested `1,017cr over the last decade. The

development is positive and comes after a long lull in terms of investments.

February 18, 2016

Glaxo | 3QFY2016 Result Update

Outlook and valuation:

GSK Pharma has a strong balance sheet with cash of ~`2,000cr, which could be

used for future acquisitions or higher dividend payouts. The companys parent had

announced to increase stake in it through a voluntary open offer, after which the

parent company holds 75.0% stake in its Indian subsidiary. The buy-back of shares

is a strong indicator from the Management towards the performance of its listed

Indian entity, especially as it comes after the recent `864cr investment plan

announced by the company to further its growth prospects in the Indian

pharmaceuticals market. The said investments are expected to fructify by 2017.

On the operational front, we expect the companys net sales to post a CAGR of

9.8% to `3,158cr and EPS to register a CAGR of 6.6% to `68.3 over

FY201517E. At current levels, the stock is trading at 53.7x and 46.7x its FY2016E

and FY2017E earnings, respectively. We remain Neutral on the stock.

Exhibit 6: Key assumptions

FY2016E

FY2017E

9.6

10.0

Growth in employee expenses (%)

10.0

10.0

Operating margin (%)

20.0

22.1

Capex (` cr)

200

200

Sales growth (%)

Source: Company, Angel Research

Exhibit 7: One-year forward PE

4,500

4,000

3,500

(`)

3,000

2,500

2,000

1,500

1,000

Oct-09

Jan-10

Apr-10

Jul-10

Oct-10

Jan-11

Apr-11

Jul-11

Oct-11

Jan-12

Apr-12

Jul-12

Oct-12

Jan-13

Apr-13

Jul-13

Oct-13

Jan-14

Apr-14

Jul-14

Oct-14

Jan-15

Apr-15

Jul-15

Oct-15

Jan-16

500

Price

18x

30x

42x

54x

Source: Company, Angel Research

February 18, 2016

Glaxo | 3QFY2016 Result Update

Exhibit 8: Recommendation summary

Company

Reco

CMP

(`)

Tgt. price Upside

(`)

FY2017E

% PE (x)

FY15-17E

EV/Sales (x)

EV/EBITDA (x)

CAGR in EPS (%)

FY2017E

RoCE (%) RoE (%)

Alembic Pharma

Neutral

609

21.2

2.9

15.0

38.2

31.3

31.2

Aurobindo Pharma

Buy

663

856

29.1

15.5

2.5

11.0

15.6

23.5

30.2

Cadila Healthcare

Accumulate

314

352

12.1

17.8

2.7

12.2

24.6

25.2

29.0

Cipla

Neutral

520

636

22.3

18.0

2.4

12.8

21.4

17.1

16.8

Dr Reddy's

Neutral

2,961

3,933

32.8

16.6

2.5

10.7

17.2

19.1

20.4

Dishman Pharma

Neutral

313

15.7

1.7

7.8

15.9

9.4

11.0

GSK Pharma*

Neutral

3,195

46.7

8.1

36.6

6.6

33.7

34.3

Indoco Remedies

Neutral

260

19.1

2.1

11.4

23.0

19.7

19.7

Ipca labs

Buy

599

900

50.3

21.4

2.2

11.7

17.9

11.8

14.0

Lupin

Neutral

1,731

25.3

4.4

16.1

13.1

29.6

24.7

Sanofi India*

Neutral

4,176

27.6

3.6

17.1

33.1

27.9

25.5

Sun Pharma

Accumulate

855

950

11.2

31.8

5.6

18.3

8.4

15.8

16.6

Source: Company, Angel Research; Note: * December year ending;

February 18, 2016

Glaxo | 3QFY2016 Result Update

Company Background

GlaxoSmithKline Pharmaceuticals is the sixth largest pharmaceutical player in the

Indian market with a market share of ~3.7%. The companys product portfolio

includes both, prescription medicines and vaccines. GSK Pharma sells prescription

medicines across therapeutic areas such as anti-infectives, dermatology,

gynaecology, diabetes, oncology, cardiovascular diseases and respiratory

diseases. A large portion of the companys revenue comes from the acute

therapeutic portfolio. However, the company is now scouting for opportunities in

high-growth therapeutic areas such as CVS, CNS, diabetes and oncology. Further,

with a strong parentage, the company plans to increase its product portfolio

through patented launches and vaccines. To fructify the same, the company plans

to enhance its manufacturing assets with its parent company investing `864cr in it;

the capacity expansion is expected to fructify in 2017.

February 18, 2016

Glaxo | 3QFY2016 Result Update

Profit & loss statement

Y/E March (` cr)

Gross sales

Less: Excise duty

Net sales

Other operating income

CY2011 CY2012 CY2013 FY2015 FY2016E FY2017E

2,433

2,692

2,589

3,328

2,929

3,222

55

71

51

56

59

64

2,378

2,621

2,538

3,272

2,870

3,158

29

24

32

2,379

2,651

2,563

3,305

2,876

3,165

10.3

11.4

(3.3)

28.9

(13.0)

10.0

Total expenditure

1,635

1,862

2,034

2,690

2,297

2,461

Net raw materials

919

1,104

1,164

1,510

1,263

1,389

Other Mfg costs

122

94

89

115

99

107

Personnel

279

296

362

493

432

476

Other

314

369

420

572

502

489

Total operating income

% chg

EBITDA

743

759

504

582

574

696

% chg

(2.0)

2.1

(33.6)

15.5

(1.4)

21.3

(% of Net Sales)

31.2

29.0

19.9

17.8

20.0

22.1

20

18

20

25

47

61

723

741

484

557

527

636

Depreciation& amortisation

EBIT

% chg

(2.5)

2.6

(34.7)

15.0

(5.3)

20.6

(% of Net Sales)

30.4

28.3

19.1

17.0

18.4

20.1

Interest & other charges

Other income

182

175

177

200

200

200

905

945

685

789

733

843

(% of PBT)

Share in profit of Associates

Recurring PBT

% chg

3.9

4.4

(27.5)

15.1

(7.0)

14.9

Extraordinary expense/(Inc.)

301

101

(26)

33

PBT (reported)

605

844

711

756

733

843

Tax

176

318

230

279

229

264

(% of PBT)

29.1

37.7

32.3

36.9

31.3

31.3

PAT (reported)

429

526

482

477

504

579

Add: Share of earnings of asso.

Less: Minority interest (MI)

Prior period items

Exceptional items

429

526

482

477

504

579

ADJ. PAT

587

657

464

509

504

579

% chg

1.6

12.0

(29.4)

9.8

(1.1)

14.9

24.7

25.1

18.3

15.6

17.5

18.3

Basic EPS (`)

69

78

55

60

59

68

Fully diluted EPS (`)

69

78

55

60

59

68

% chg

1.6

12.0

(29.4)

9.8

(1.1)

14.9

(% of Net Sales)

February 18, 2016

PAT after MI (reported)

Glaxo | 3QFY2016 Result Update

Balance Sheet

Y/E March (` cr)

CY2011

CY2012

CY2013E FY2015

FY2016E

FY2017E

SOURCES OF FUNDS

Equity share capital

85

85

85

85

85

85

Preference Capital

Reserves& surplus

1,851

1,922

1,905

1,744

1,624

1,578

Shareholders funds

1,936

2,007

1,990

1,829

1,708

1,663

Minority Interest

Total loans

Other long-term liabilities

225

236

242

273

273

273

Long-term provisions

Deferred tax liability

(62)

(87)

(92)

(83)

(83)

(83)

2,108

2,165

2,148

2,026

1,909

1,864

Gross block

274

274

323

467

667

867

Less: Acc. depreciation

217

227

247

272

319

379

Net block

57

47

76

195

348

487

Capital work-in-progress

16

44

44

44

44

44

Goodwill

42

42

42

Total liabilities

APPLICATION OF FUNDS

Other non-current assets

36

17

14

Long-term loans and adv.

157

195

238

307

270

297

Investments

112

55

10

Current assets

2,548

2,602

2,614

2,587

2,596

2,520

Cash

2,014

2,067

2,042

1,911

1,735

1,573

85

134

238

122

287

316

448

401

335

554

574

632

Loans & advances

Other

Current liabilities

Net current assets

Mis. Exp. not written off

Total Assets

February 18, 2016

860

836

889

1,107

1,349

1,484

1,688

1,765

1,725

1,480

1,247

1,036

2,108

2,165

2,148

2,026

1,909

1,864

10

Glaxo | 3QFY2016 Result Update

Cash flow statement

Y/E March (` cr)

Profit before tax and exceptional

Depreciation

605

844

711

756

733

843

20

18

20

25

47

61

(205)

(25)

15

114

58

49

Direct taxes paid

188

318

230

279

229

264

Cash Flow from Operations

232

519

517

616

608

688

39

(28)

(49)

(144)

(200)

(200)

(Inc.)/Dec. in investments

(6)

(57)

(45)

(10)

Cash Flow from Investing

34

(85)

(93)

(154)

(200)

(200)

(Inc)/Dec in working capital

(Inc.)/Dec.in fixed assets

Issue of equity

Inc./(Dec.) in loans

Dividend paid (Incl. Tax)

Others

(1)

(444)

(491)

(495)

(624)

(624)

(624)

191

110

47

32

41

(26)

(254)

(381)

(448)

(593)

(584)

(650)

11

52

(25)

(131)

(176)

(162)

Opening cash balances

2,003

2,014

2,067

2,042

1,911

1,735

Closing cash balances

2,014

2,067

2,042

1,911

1,735

1,573

Cash Flow from Financing

Inc./(Dec.) in cash

February 18, 2016

CY2011 CY2012 CY2013 FY2015 FY2016E FY2017E

11

Glaxo | 3QFY2016 Result Update

Key ratio

Y/E March

CY2011 CY2012 CY2013 FY2015

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

46.1

41.2

58.3

53.1

53.7

46.7

P/CEPS

60.3

49.8

54.0

53.9

49.2

42.3

P/BV

14.0

13.5

13.6

14.8

15.8

16.3

Dividend yield (%)

1.4

1.6

1.6

1.6

1.6

1.6

EV/Sales

10.5

9.5

9.9

7.7

8.8

8.1

EV/EBITDA

33.7

32.9

49.7

43.2

44.1

36.6

EV / Total Assets

11.9

11.5

11.6

12.4

13.3

13.7

EPS (Basic)

69.3

77.6

54.8

60.1

59.5

68.3

EPS (fully diluted)

69.3

77.6

54.8

60.1

59.5

68.3

Cash EPS

53.0

64.2

59.2

59.3

65.0

75.5

DPS

45.0

50.0

50.0

50.0

50.0

51.0

228.5

236.9

234.9

215.9

201.7

196.3

36.1

34.7

22.4

26.7

26.8

33.7

Per Share Data (`)

Book Value

Returns (%)

RoCE (Pre-tax)

Angel ROIC (Pre-tax)

30.2

33.3

23.2

26.7

28.5

34.3

Asset Turnover (Gross Block)

8.0

9.7

8.6

8.4

5.1

4.1

Inventory / Sales (days)

47

43

48

40

43

38

Receivables (days)

10

14

15

11

13

12

Payables (days)

69

58

54

55

68

74

WC cycle (ex-cash) (days)

80

74

79

69

98

104

Net debt to equity

(1.0)

(1.0)

(1.0)

(1.0)

(1.0)

(0.9)

Net debt to EBITDA

(2.7)

(2.7)

(4.0)

(3.3)

(3.0)

(2.2)

RoE

Turnover ratios (x)

Solvency ratios (x)

Interest Coverage (EBIT / Int.)

February 18, 2016

12

Glaxo | 3QFY2016 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as Angel) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Glaxo Pharma

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

over 12 months investment period):

February 18, 2016

Buy (> 15%)

Accumulate (5% to 15%)

Reduce (-5% to -15%)

Neutral (-5 to 5%)

Sell (< -15)

13

Вам также может понравиться

- Medical & Diagnostic Laboratory Lines World Summary: Market Values & Financials by CountryОт EverandMedical & Diagnostic Laboratory Lines World Summary: Market Values & Financials by CountryОценок пока нет

- DR Reddys Laboratories Limited 4 QuarterUpdateДокумент11 страницDR Reddys Laboratories Limited 4 QuarterUpdateparry0843Оценок пока нет

- AngelBrokingResearch CadilaHealthcare 3QFY0216RU 240216Документ11 страницAngelBrokingResearch CadilaHealthcare 3QFY0216RU 240216HitechSoft HitsoftОценок пока нет

- Indoco Remedies 4Q FY 2013Документ11 страницIndoco Remedies 4Q FY 2013Angel BrokingОценок пока нет

- Cadila 4Q FY 2013Документ12 страницCadila 4Q FY 2013Angel BrokingОценок пока нет

- Indoco Remedies, 30th January 2013Документ11 страницIndoco Remedies, 30th January 2013Angel BrokingОценок пока нет

- Indoco Remedies: Performance HighlightsДокумент11 страницIndoco Remedies: Performance HighlightsAngel BrokingОценок пока нет

- Ipca, 1st February 2013Документ11 страницIpca, 1st February 2013Angel BrokingОценок пока нет

- Cadila, 1Q FY 2014Документ12 страницCadila, 1Q FY 2014Angel BrokingОценок пока нет

- GSK, 20th February, 2013Документ11 страницGSK, 20th February, 2013Angel BrokingОценок пока нет

- Ipca Labs: Performance HighlightsДокумент11 страницIpca Labs: Performance HighlightsAngel BrokingОценок пока нет

- Alembic Pharma, 1Q FY 2014Документ10 страницAlembic Pharma, 1Q FY 2014Angel BrokingОценок пока нет

- Dishman 2QFY2013RUДокумент10 страницDishman 2QFY2013RUAngel BrokingОценок пока нет

- Aurobindo, 12th February 2013Документ11 страницAurobindo, 12th February 2013Angel BrokingОценок пока нет

- Cipla: Performance HighlightsДокумент11 страницCipla: Performance HighlightsAngel BrokingОценок пока нет

- Aurobindo 4Q FY 2013Документ10 страницAurobindo 4Q FY 2013Angel BrokingОценок пока нет

- Abbott India, 2Q CY 2013Документ12 страницAbbott India, 2Q CY 2013Angel BrokingОценок пока нет

- Cipla 4Q FY 2013Документ11 страницCipla 4Q FY 2013Angel BrokingОценок пока нет

- GSK Consumer 1Q CY 2013Документ10 страницGSK Consumer 1Q CY 2013Angel BrokingОценок пока нет

- Aurobindo, 1Q FY 2014Документ11 страницAurobindo, 1Q FY 2014Angel BrokingОценок пока нет

- Cadila Healthcare, 12th February 2013Документ12 страницCadila Healthcare, 12th February 2013Angel BrokingОценок пока нет

- Cipla: Performance HighlightsДокумент11 страницCipla: Performance HighlightsAngel BrokingОценок пока нет

- Dishman 4Q FY 2013Документ10 страницDishman 4Q FY 2013Angel BrokingОценок пока нет

- Aurobindo Pharma: Performance HighlightsДокумент11 страницAurobindo Pharma: Performance HighlightsAngel BrokingОценок пока нет

- Set For Strong Growth: FMCG Q2FY14 Result Preview 08 Oct 2013Документ5 страницSet For Strong Growth: FMCG Q2FY14 Result Preview 08 Oct 2013Abhishek SinghОценок пока нет

- Cipla LTD: Key Financial IndicatorsДокумент4 страницыCipla LTD: Key Financial IndicatorsMelwyn MathewОценок пока нет

- Unichem Fullerton April 13Документ8 страницUnichem Fullerton April 13vicky168Оценок пока нет

- Ranbaxy, 2Q CY 2013Документ11 страницRanbaxy, 2Q CY 2013Angel BrokingОценок пока нет

- Indoco Remedies Result UpdatedДокумент11 страницIndoco Remedies Result UpdatedAngel BrokingОценок пока нет

- Marico: Performance HighlightsДокумент12 страницMarico: Performance HighlightsAngel BrokingОценок пока нет

- Glaxosmithkline Pharma: Performance HighlightsДокумент11 страницGlaxosmithkline Pharma: Performance HighlightsAngel BrokingОценок пока нет

- Godrej Consumer Products: Performance HighlightsДокумент11 страницGodrej Consumer Products: Performance HighlightsajujkОценок пока нет

- Sintex Analysis Report From Motilal 28 Jan 2015Документ12 страницSintex Analysis Report From Motilal 28 Jan 2015MLastTryОценок пока нет

- DB Corp 4Q FY 2013Документ11 страницDB Corp 4Q FY 2013Angel BrokingОценок пока нет

- DB Corp.: Performance HighlightsДокумент11 страницDB Corp.: Performance HighlightsAngel BrokingОценок пока нет

- Glaxo Smithkline PharmaДокумент11 страницGlaxo Smithkline PharmaAngel BrokingОценок пока нет

- Cipla: Performance HighlightsДокумент11 страницCipla: Performance HighlightsAngel BrokingОценок пока нет

- Interim Financial Results: For The Six Months Ended 31 December 2006Документ2 страницыInterim Financial Results: For The Six Months Ended 31 December 2006LungisaniОценок пока нет

- GSK Consumer, 2Q CY 2013Документ10 страницGSK Consumer, 2Q CY 2013Angel BrokingОценок пока нет

- Target: Rs.185. Alembic Pharmaceuticals LTDДокумент8 страницTarget: Rs.185. Alembic Pharmaceuticals LTDnikunjОценок пока нет

- BXPHARMA - Equity Note - Updated 04-11-13 PDFДокумент2 страницыBXPHARMA - Equity Note - Updated 04-11-13 PDFRajuRahmotulAlamОценок пока нет

- Relaxo Footwears: Promising FutureДокумент13 страницRelaxo Footwears: Promising FutureIrfan ShaikhОценок пока нет

- Lupin: Performance HighlightsДокумент12 страницLupin: Performance HighlightsHitechSoft HitsoftОценок пока нет

- q3 2020 Results AnnouncementДокумент65 страницq3 2020 Results AnnouncementmarceloОценок пока нет

- 2013-14 SPIL - Annual ReportДокумент144 страницы2013-14 SPIL - Annual ReportAnshumanSharmaОценок пока нет

- IDirect GSKConsumer ICДокумент26 страницIDirect GSKConsumer ICChaitanya JagarlapudiОценок пока нет

- Cadila Healthcare: Performance HighlightsДокумент12 страницCadila Healthcare: Performance HighlightsAngel BrokingОценок пока нет

- Alembic Pharma: Performance HighlightsДокумент10 страницAlembic Pharma: Performance HighlightsTirthajit SinhaОценок пока нет

- Project Report - GSK and Novartis AcquisitionДокумент13 страницProject Report - GSK and Novartis Acquisitionabhisht89Оценок пока нет

- Alembic Pharma: Performance HighlightsДокумент11 страницAlembic Pharma: Performance HighlightsAngel BrokingОценок пока нет

- GSK Consumer: Performance HighlightsДокумент9 страницGSK Consumer: Performance HighlightsAngel BrokingОценок пока нет

- Dishman, 12th February, 2013Документ10 страницDishman, 12th February, 2013Angel BrokingОценок пока нет

- Sun Pharma, 12th February, 2013Документ11 страницSun Pharma, 12th February, 2013Angel BrokingОценок пока нет

- GCPL, 4th February, 2013Документ11 страницGCPL, 4th February, 2013Angel BrokingОценок пока нет

- IDirect JubilantLife CoUpdate Sep16Документ4 страницыIDirect JubilantLife CoUpdate Sep16umaganОценок пока нет

- Marico: Performance HighlightsДокумент12 страницMarico: Performance HighlightsAngel BrokingОценок пока нет

- Hitachi Home & Life Solutions: Performance HighlightsДокумент13 страницHitachi Home & Life Solutions: Performance HighlightsAngel BrokingОценок пока нет

- Rallis India: Performance HighlightsДокумент10 страницRallis India: Performance HighlightsHitechSoft HitsoftОценок пока нет

- Cravatex: Strategic Partnerships To Be Key DriverДокумент14 страницCravatex: Strategic Partnerships To Be Key DriverAngel BrokingОценок пока нет

- Dabur India 4Q FY 2013Документ11 страницDabur India 4Q FY 2013Angel BrokingОценок пока нет

- Company Analysis and Financial Due Diligence: August 2013Документ50 страницCompany Analysis and Financial Due Diligence: August 2013HitechSoft HitsoftОценок пока нет

- JindalWorldwide 5315430316Документ101 страницаJindalWorldwide 5315430316HitechSoft HitsoftОценок пока нет

- Intense 5323260316Документ118 страницIntense 5323260316HitechSoft HitsoftОценок пока нет

- Jnac 31mar16Документ4 страницыJnac 31mar16HitechSoft HitsoftОценок пока нет

- MediaRelease ExtendedWorkOrder MIPДокумент3 страницыMediaRelease ExtendedWorkOrder MIPHitechSoft HitsoftОценок пока нет

- CholaFin AR 20182019Документ234 страницыCholaFin AR 20182019HitechSoft HitsoftОценок пока нет

- Sree Rayalseema Alkalies 16 5077530316Документ75 страницSree Rayalseema Alkalies 16 5077530316HitechSoft HitsoftОценок пока нет

- HPCotton 5028730316Документ72 страницыHPCotton 5028730316HitechSoft HitsoftОценок пока нет

- Gloster 5385950315Документ121 страницаGloster 5385950315HitechSoft HitsoftОценок пока нет

- Sankhya 5329720316Документ77 страницSankhya 5329720316HitechSoft HitsoftОценок пока нет

- Intense 5323260316Документ118 страницIntense 5323260316HitechSoft HitsoftОценок пока нет

- Gloster 5385950316Документ130 страницGloster 5385950316HitechSoft HitsoftОценок пока нет

- Gloster 5385950314Документ105 страницGloster 5385950314HitechSoft HitsoftОценок пока нет

- IndTraDeco Annual Report 1516Документ49 страницIndTraDeco Annual Report 1516HitechSoft HitsoftОценок пока нет

- Bajaj Auto 3Q FY2016Документ12 страницBajaj Auto 3Q FY2016HitechSoft HitsoftОценок пока нет

- IndoAMines Annual Reort 2015-2016 India CorporateДокумент120 страницIndoAMines Annual Reort 2015-2016 India CorporateHitechSoft HitsoftОценок пока нет

- AngelBrokingResearch NTPC OFSNote 230216Документ11 страницAngelBrokingResearch NTPC OFSNote 230216HitechSoft HitsoftОценок пока нет

- Lupin: Performance HighlightsДокумент12 страницLupin: Performance HighlightsHitechSoft HitsoftОценок пока нет

- Panama Petroleum India Corporate Annual Report 2013Документ71 страницаPanama Petroleum India Corporate Annual Report 2013HitechSoft HitsoftОценок пока нет

- State Bank of India 3Q FY2016 Review IndiaДокумент10 страницState Bank of India 3Q FY2016 Review IndiaHitechSoft HitsoftОценок пока нет

- AngelBrokingResearch Cipla 3QFY2016RU 240216Документ11 страницAngelBrokingResearch Cipla 3QFY2016RU 240216HitechSoft HitsoftОценок пока нет

- Redmi1s Flash Screens 1s Brick CellДокумент1 страницаRedmi1s Flash Screens 1s Brick CellHitechSoft HitsoftОценок пока нет

- BulletProofInvesting TakeawaysДокумент3 страницыBulletProofInvesting TakeawaysHitechSoft HitsoftОценок пока нет

- Panama Petroleum 2012 Annual Report India CorporateДокумент45 страницPanama Petroleum 2012 Annual Report India CorporateHitechSoft HitsoftОценок пока нет

- Panama Petroleum India Corporate Annual Report 2013Документ71 страницаPanama Petroleum India Corporate Annual Report 2013HitechSoft HitsoftОценок пока нет

- Panamapanama Petroleum 2011 Annual Report India CorporateДокумент49 страницPanamapanama Petroleum 2011 Annual Report India CorporateHitechSoft HitsoftОценок пока нет

- Panama Petro Ar 2010Документ40 страницPanama Petro Ar 2010Inder KalraОценок пока нет

- Panama Petroleum India Corporate Annual Report 2013Документ71 страницаPanama Petroleum India Corporate Annual Report 2013HitechSoft HitsoftОценок пока нет

- Database Management System and SQL CommandsДокумент3 страницыDatabase Management System and SQL Commandsdev guptaОценок пока нет

- MDC PT ChartДокумент2 страницыMDC PT ChartKailas NimbalkarОценок пока нет

- Pharaoh TextДокумент143 страницыPharaoh Textanon_31362848Оценок пока нет

- CNS Manual Vol III Version 2.0Документ54 страницыCNS Manual Vol III Version 2.0rono9796Оценок пока нет

- WVU's Response Letter To Campbell Regarding HugginsДокумент4 страницыWVU's Response Letter To Campbell Regarding HugginsJosh JarnaginОценок пока нет

- Reflection Paper 1Документ5 страницReflection Paper 1Juliean Torres AkiatanОценок пока нет

- Incoterms 2010 PresentationДокумент47 страницIncoterms 2010 PresentationBiswajit DuttaОценок пока нет

- Pyro ShieldДокумент6 страницPyro Shieldmunim87Оценок пока нет

- Computerized AccountingДокумент14 страницComputerized Accountinglayyah2013Оценок пока нет

- Oops in PythonДокумент64 страницыOops in PythonSyed SalmanОценок пока нет

- For Exam ReviewerДокумент5 страницFor Exam ReviewerGelyn Cruz67% (3)

- Verma Toys Leona Bebe PDFДокумент28 страницVerma Toys Leona Bebe PDFSILVIA ROMERO100% (3)

- RFM How To Automatically Segment Customers Using Purchase Data and A Few Lines of PythonДокумент8 страницRFM How To Automatically Segment Customers Using Purchase Data and A Few Lines of PythonSteven MoietОценок пока нет

- Gogte Institute of Technology: Karnatak Law Society'SДокумент33 страницыGogte Institute of Technology: Karnatak Law Society'SjagaenatorОценок пока нет

- Installation Manual EnUS 2691840011Документ4 страницыInstallation Manual EnUS 2691840011Patts MarcОценок пока нет

- Mentorship ICT at A GlanceДокумент5 страницMentorship ICT at A GlanceTeachers Without Borders0% (1)

- Lps - Config Doc of Fm-BcsДокумент37 страницLps - Config Doc of Fm-Bcsraj01072007Оценок пока нет

- Questionnaire: ON Measures For Employee Welfare in HCL InfosystemsДокумент3 страницыQuestionnaire: ON Measures For Employee Welfare in HCL Infosystemsseelam manoj sai kumarОценок пока нет

- 1 075 Syn4e PDFДокумент2 страницы1 075 Syn4e PDFSalvador FayssalОценок пока нет

- Certification DSWD Educational AssistanceДокумент3 страницыCertification DSWD Educational AssistancePatoc Stand Alone Senior High School (Region VIII - Leyte)Оценок пока нет

- Electric Arc Furnace STEEL MAKINGДокумент28 страницElectric Arc Furnace STEEL MAKINGAMMASI A SHARAN100% (3)

- 1.6 Program AdministrationДокумент56 страниц1.6 Program Administration'JeoffreyLaycoОценок пока нет

- DevelopmentPermission Handbook T&CPДокумент43 страницыDevelopmentPermission Handbook T&CPShanmukha KattaОценок пока нет

- La Bugal-b'Laan Tribal Association Et - Al Vs Ramos Et - AlДокумент6 страницLa Bugal-b'Laan Tribal Association Et - Al Vs Ramos Et - AlMarlouis U. PlanasОценок пока нет

- ProAim InstructionsДокумент1 страницаProAim Instructionsfeli24arias06Оценок пока нет

- Supply Chain Risk Management: Resilience and Business ContinuityДокумент27 страницSupply Chain Risk Management: Resilience and Business ContinuityHope VillonОценок пока нет

- How Can You Achieve Safety and Profitability ?Документ32 страницыHow Can You Achieve Safety and Profitability ?Mohamed OmarОценок пока нет

- Charlemagne Command ListДокумент69 страницCharlemagne Command ListBoardkingZeroОценок пока нет

- European Steel and Alloy Grades: 16Mncr5 (1.7131)Документ3 страницыEuropean Steel and Alloy Grades: 16Mncr5 (1.7131)farshid KarpasandОценок пока нет

- S SSB29 - Alternator Cables PM: WARNING: This Equipment Contains Hazardous VoltagesДокумент3 страницыS SSB29 - Alternator Cables PM: WARNING: This Equipment Contains Hazardous VoltagesMohan PreethОценок пока нет