Академический Документы

Профессиональный Документы

Культура Документы

EC212 Course Outline 2015

Загружено:

Nibhrat LohiaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

EC212 Course Outline 2015

Загружено:

Nibhrat LohiaАвторское право:

Доступные форматы

EC212 Introduction to Econometrics

Outline and Reading List 2015

Lecturer:

Dr Christopher Dougherty

Course Objective:

The objective of this course is to provide the basic knowledge of

econometrics that is essential equipment for any serious economist or social

scientist, to a level where the participant would be competent to continue with

the study of the subject in a graduate programme. While the course is

ambitious in terms of its coverage of technical topics, equal importance is

attached to the development of an intuitive understanding of the material that

will allow these skills to be utilised effectively and creatively, and to give

participants the foundation for understanding specialized applications through

self-study with confidence when needed.

Prerequisites:

An introductory statistics course and at least one semester of multivariate

calculus, passed with respectable grades.

Course Text:

The course text will be the fourth edition of C. Dougherty, Introduction to

Econometrics, Oxford University Press, 2011

Content:

The first part of the course introduces the statistical tool known as regression

analysis applied to cross-sectional data. It begins with the use and properties

of the classical linear regression model and then discusses how various

technical problems should be handled. Initially ordinary least squares is the

standard technique, but eventually the focus shifts to instrumental variables

estimation. The second part of the course discusses the application of the

regression model to time series data. The course concludes with an optional,

non-examinable, section on some relatively advanced topics.

Although the course does not make use of matrix algebra, it is technically

rigorous, giving emphasis to the analysis of the finite sample and asymptotic

properties of least squares and instrumental variables estimators under

different assumptions concerning the data generation process and to the

accompanying implications for statistical inference. Participants are expected

to be able to provide proofs of the unbiasedness or biasedness, and

consistency or inconsistency of least squares and instrumental variables

estimators in simple models where appropriate. Examples of applications in

economics are used throughout.

In addition to the formal theory sessions, participants take part in daily

workshops using Stata to fit educational attainment and wage equation

models with cross-sectional data and EViews to fit demand functions with

time series data.

Presentation:

Computer video graphics will be used to present the analysis.

Topics:

1. Simple Regression Analysis

It will be shown how a hypothetical linear relationship may be quantified using appropriate data. The

principle of least squares analysis will be explained and expressions for coefficients derived.

2. Properties of Regression Coefficients and Hypothesis Testing

Conditions for the unbiasedness of the regression coefficients and factors governing their variance

will be discussed, together with hypothesis testing and the construction of confidence intervals in the

context of the regression model.

3. Multiple Regression Analysis

Least squares regression analysis is generalized to cover the case where there are several or many

explanatory variables in the regression model, rather than just one. The problem of multicollinearity

and the use of restrictions will also be discussed.

4. Transformation of Variables

Many economic processes are best modelled by nonlinear relationships: demand functions and

production functions, for example. Linear regression analysis will be extended to cover nonlinear

models.

5. Dummy Variables

It frequently happens that some of the factors which should be taken account of in a regression model

are qualitative in nature and therefore not measurable in quantitative terms. It will be explained how

such factors can be handled with dummy variables.

6. Specification of Regression Variables

This preliminary discussion of specification issues covers: the consequences of including in the

regression a variable which should not be there; the consequences of leaving out a variable that

should be included; what happens if there is difficulty finding data on a variable and use a proxy for it

instead; and methods for testing whether a restriction is valid.

7. Heteroscedasticity

The course now turns to a common problem encountered in regression analysis, discussing its

detection and consequences, and means to alleviate it.

8. Stochastic Regressors and Measurement Errors

Two further complications of the regression model are discussed, and the Instrumental Variable

approach to the fitting of a regression model is introduced. The use of the Durbin-Wu-Hausman

specification test is described.

9. Simultaneous Equations Estimation

The next topic is the estimation of relationships that jointly form a simultaneous equations model (for

example, a simple macroeconomic model). It will be shown that Ordinary Least Squares is in general

not a suitable regression technique and that Instrumental Variables should be used instead.

10. Modelling Dynamic Processes

Many economic processes require time to work themselves out and accordingly there is a need to

introduce a time dimension into econometric modelling. The autoregressive distributed lag (ADL)

model, an important method of modelling dynamics, is discussed and the asymptotic and finitesample properties of estimators are investigated. The course concludes with a treatment of two

special issues that arise in regressions using time series data. One relates to the use of simulation.

In many situations, mathematical analysis allows only the asymptotic properties of estimators to be

established It will be shown how simulation can be used to investigate their finite-sample properties

as well.

11. Autocorrelation

Autocorrelation of the disturbance term gives rise to a further set of issues that are often important in

time series regressions. The most common tests for autocorrelationthe BreuschGodfrey test, the

DurbinWatson test, and the Durbin h testare presented and methods of rectifying the problem are

discussed. The treatment leads to a more general discussion of model specification.

12. Panel data regressions

The final mainstream topic of the course is the application of regression analysis to panel

(longitudinal) data sets where one has repeated observations on the same set of agents (for example,

individuals, households, or enterprises). It will be shown how some important econometric problems

may be overcome through the use of fixed effects or random effects models. (This set of topics,

being relatively technical, will not be included in the syllabus for the final examination.)

Optional Topics

The last teaching day will be used to give an outline of some advanced topics that are not part of the

syllabus for the examinations: binary choice models (logit and probit), maximum likelihood estimation,

and an introduction to regression models with nonstationary time series.

Computer Exercises

Participants will be given homework assignments every day and some of these will involve the use of

the computing facilities at LSE. The course will use the Stata and EViews regression applications. No

prior knowledge of these applications is required. Assistance with the practical work will be provided.

Вам также может понравиться

- B11Документ20 страницB11smilesprn100% (1)

- E 122 - 09e1Документ5 страницE 122 - 09e1ruben carcamoОценок пока нет

- Assignment 4 Simple Linear RegressionДокумент3 страницыAssignment 4 Simple Linear Regressionalka aswar100% (1)

- Measures of DispersionДокумент18 страницMeasures of DispersionJawedIqbalforex100% (6)

- Basic Course in Biomedical Research Last Minute Revision Notes V2Документ72 страницыBasic Course in Biomedical Research Last Minute Revision Notes V2Dr Prasad JaybhayeОценок пока нет

- Introduction C359 v12011Документ18 страницIntroduction C359 v12011Chumba MusekeОценок пока нет

- Spearman Rho NewcorrelationДокумент22 страницыSpearman Rho NewcorrelationZamaniОценок пока нет

- An Optimization PrimerДокумент149 страницAn Optimization PrimerCmpt Cmpt50% (2)

- TAMU 06 Statistical Quality ControlДокумент39 страницTAMU 06 Statistical Quality ControlVicky MalhotraОценок пока нет

- Measures of DispersionДокумент25 страницMeasures of Dispersionroland100% (1)

- Simulation NotesДокумент138 страницSimulation Notesramakant_sawant2001Оценок пока нет

- Numerical RenaissanceДокумент767 страницNumerical RenaissancepabsramsОценок пока нет

- Introduction To Modeling and SimulationДокумент7 страницIntroduction To Modeling and SimulationAbiodun Gbenga100% (2)

- Assessment of Learning 1 ExamДокумент53 страницыAssessment of Learning 1 ExamGlydelyne Dumaguing75% (4)

- Econometric AnalysisДокумент60 страницEconometric AnalysisAmador PensadorОценок пока нет

- Modeling, Analysis, and Control of Dynamic Systems PDFДокумент10 страницModeling, Analysis, and Control of Dynamic Systems PDFTaha Al-abed0% (6)

- DP by Bellman Functional EquationДокумент296 страницDP by Bellman Functional Equation.cadeau01Оценок пока нет

- BOOKFE Kalot14Документ217 страницBOOKFE Kalot14AhmedОценок пока нет

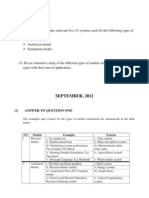

- SEPTEMBER, 2012: QuestionsДокумент6 страницSEPTEMBER, 2012: QuestionsHusseini MuhammedОценок пока нет

- Structural Macroeconometrics: David N. Dejong Chetan DaveДокумент12 страницStructural Macroeconometrics: David N. Dejong Chetan DaveagilerbОценок пока нет

- Econtrics RESOURCEДокумент65 страницEcontrics RESOURCEramboriОценок пока нет

- Why Do Mathematical Modeling?Документ9 страницWhy Do Mathematical Modeling?mnbОценок пока нет

- Dynamic Econ ProgrammeДокумент2 страницыDynamic Econ Programmesimao_sabrosa7794Оценок пока нет

- Applied Regression Analysis (Juran) SP2016Документ3 страницыApplied Regression Analysis (Juran) SP2016darwin12Оценок пока нет

- Model Order Reduction ThesisДокумент4 страницыModel Order Reduction Thesisvaleriemejiabakersfield100% (2)

- WQU - Econometrics - Compiled Content - Module5 PDFДокумент46 страницWQU - Econometrics - Compiled Content - Module5 PDFvikrantОценок пока нет

- Annu Maria-Introduction To Modelling and SimulationДокумент7 страницAnnu Maria-Introduction To Modelling and SimulationMiguel Dominguez de García0% (1)

- Mas291 Chap1Документ6 страницMas291 Chap1hahoang33322Оценок пока нет

- Admm Distr StatsДокумент125 страницAdmm Distr StatsMairton BarrosОценок пока нет

- Econometrics For Dummies by Roberto PedaДокумент6 страницEconometrics For Dummies by Roberto Pedamatias ColasoОценок пока нет

- Course OutlineДокумент3 страницыCourse OutlineAman GargОценок пока нет

- Chapter 1Документ24 страницыChapter 1hahoang33322Оценок пока нет

- An Overview of Heuristic Solution Methods: Journal of The Operational Research Society May 2004Документ50 страницAn Overview of Heuristic Solution Methods: Journal of The Operational Research Society May 2004Yaswitha SadhuОценок пока нет

- CHAPTER 1 TheoremДокумент20 страницCHAPTER 1 Theoremhahoang33322Оценок пока нет

- FM Assignment 1Документ4 страницыFM Assignment 1Narender SinghОценок пока нет

- Mathematical Modeling in Chemical EngineeringДокумент25 страницMathematical Modeling in Chemical Engineerings9n9Оценок пока нет

- ACT 7105 - EconometricsДокумент2 страницыACT 7105 - Econometricsr.h.anik1596Оценок пока нет

- Physical ModelДокумент22 страницыPhysical ModelyubrajОценок пока нет

- Eco No Metrics Course OutlineДокумент2 страницыEco No Metrics Course Outlinebhagavath012Оценок пока нет

- DuiltyДокумент16 страницDuiltynahid hasanОценок пока нет

- Interval. For Example, A Decision On Whether To Make or Buy A Product Is Static in Nature (See The Web ChapterДокумент6 страницInterval. For Example, A Decision On Whether To Make or Buy A Product Is Static in Nature (See The Web ChapterShubham MishraОценок пока нет

- Quantitative Analysis Lecture - 1-Introduction: Associate Professor, Anwar Mahmoud Mohamed, PHD, Mba, PMPДокумент41 страницаQuantitative Analysis Lecture - 1-Introduction: Associate Professor, Anwar Mahmoud Mohamed, PHD, Mba, PMPEngMohamedReyadHelesyОценок пока нет

- Important Questions of AORДокумент26 страницImportant Questions of AORDhaliwal Kaur100% (1)

- QMS 064-DAS-ContentДокумент3 страницыQMS 064-DAS-ContentSalum AhmedОценок пока нет

- GEM-304 Course DescriptionДокумент1 страницаGEM-304 Course DescriptionYisrael AshkenazimОценок пока нет

- Thesis On Multilevel ModelingДокумент6 страницThesis On Multilevel Modelingsashajoneskansascity100% (2)

- Nguyen ATДокумент30 страницNguyen ATAhmed HassanОценок пока нет

- Thesis On Simulation ModelДокумент7 страницThesis On Simulation ModelSabrina Ball100% (1)

- Cluster Analysis & Factor AnalysisДокумент39 страницCluster Analysis & Factor AnalysisselamitspОценок пока нет

- Module OutlineДокумент4 страницыModule OutlineHamza RedzuanОценок пока нет

- BSC Mathematics Major With Finance Minor at Leeds University - Course DescriptionДокумент6 страницBSC Mathematics Major With Finance Minor at Leeds University - Course DescriptionVytautas KazlauskasОценок пока нет

- Role of Statistics: in Mathematical ModellingДокумент7 страницRole of Statistics: in Mathematical ModellingKumar ShantanuОценок пока нет

- Implementing A Class of Structural Change Tests: An Econometric Computing ApproachДокумент22 страницыImplementing A Class of Structural Change Tests: An Econometric Computing ApproachemiОценок пока нет

- What Is Operations Research?: Optimization Tools 1.1Документ6 страницWhat Is Operations Research?: Optimization Tools 1.1mehmetozerОценок пока нет

- Bowerman Regression CHPT 1Документ18 страницBowerman Regression CHPT 1CharleneKronstedt100% (1)

- First Order SchedulingДокумент45 страницFirst Order SchedulingChris VerveridisОценок пока нет

- Quantitative Analysis Indidual AssignmentДокумент8 страницQuantitative Analysis Indidual AssignmentwelduОценок пока нет

- IND202 - Operations Research-Lecture-01Документ35 страницIND202 - Operations Research-Lecture-01Mohamed OmarОценок пока нет

- Model Predictive Control PHD ThesisДокумент7 страницModel Predictive Control PHD ThesisWendy Belieu100% (2)

- Aspects of Multivariate AnalysisДокумент4 страницыAspects of Multivariate AnalysisMarcos SilvaОценок пока нет

- MBA Semester II Assignment 2 - : MB0048 - Operations Research - 4 Credits MB0048Документ12 страницMBA Semester II Assignment 2 - : MB0048 - Operations Research - 4 Credits MB0048Anshul MittalОценок пока нет

- Probability Merged 3Документ602 страницыProbability Merged 3bommraОценок пока нет

- MS926 Class Outline 22 - 23Документ6 страницMS926 Class Outline 22 - 23DaveОценок пока нет

- Operations Research April 2023 ExaminationДокумент12 страницOperations Research April 2023 ExaminationAssignment HuntОценок пока нет

- Focardi SergioДокумент125 страницFocardi SergioPrasad HegdeОценок пока нет

- Wuensch StatsДокумент807 страницWuensch StatsPabitra A. Chatterjee100% (1)

- Copulas and Machine Learning PDFДокумент104 страницыCopulas and Machine Learning PDFkarim kaifОценок пока нет

- Reading 3 - Probability ConceptsДокумент47 страницReading 3 - Probability ConceptsAllen AravindanОценок пока нет

- T F DistributionДокумент9 страницT F Distributionkuchipudi durga pravallikaОценок пока нет

- What Do You Mean by The Additive Property of The TДокумент2 страницыWhat Do You Mean by The Additive Property of The TPAWAN KUMAR0% (1)

- Statistics For Business and Economics 12th Edition Anderson Solutions Manual 1Документ36 страницStatistics For Business and Economics 12th Edition Anderson Solutions Manual 1jillnguyenoestdiacfq100% (26)

- Quiz A ResultДокумент4 страницыQuiz A ResultmanmeetОценок пока нет

- Measures of Central Tendancy Theory Spring 2014Документ18 страницMeasures of Central Tendancy Theory Spring 2014Nick254Оценок пока нет

- Harvard Ec 1123 Econometrics Problem Set 4 - Tarun Preet SinghДокумент4 страницыHarvard Ec 1123 Econometrics Problem Set 4 - Tarun Preet Singhtarun singh100% (2)

- Pengaruh Personal Selling Terhadap Keputusan Berkunjung Di Jendela AlamДокумент8 страницPengaruh Personal Selling Terhadap Keputusan Berkunjung Di Jendela AlamzainabОценок пока нет

- Linear Regression WRK CH 1Документ3 страницыLinear Regression WRK CH 1Katie DuncanОценок пока нет

- Sample Size A Rough Guide: Ronán ConroyДокумент30 страницSample Size A Rough Guide: Ronán ConroyNaheedОценок пока нет

- Measures of Correlation ModuleДокумент24 страницыMeasures of Correlation ModuleMeynard MagsinoОценок пока нет

- Assumptions of Linear Regression: No or Little MulticollinearityДокумент14 страницAssumptions of Linear Regression: No or Little MulticollinearityAmjad IqbalОценок пока нет

- Problem SetДокумент6 страницProblem SetKunal KumarОценок пока нет

- 6 DDCBF 707 Ada 64327770Документ2 страницы6 DDCBF 707 Ada 64327770api-465329396Оценок пока нет

- Sustainability 11 00868Документ24 страницыSustainability 11 00868Melyn BustamanteОценок пока нет

- Toleranslar IngilizceДокумент1 страницаToleranslar IngilizceAngela BirleaОценок пока нет

- Model GeneralizationДокумент117 страницModel GeneralizationEhab EmamОценок пока нет

- Unit II: Basic Data Analytic MethodsДокумент38 страницUnit II: Basic Data Analytic MethodsvaibhavbdxОценок пока нет

- NLTK CLCДокумент6 страницNLTK CLCK60 Lương Đức VinhОценок пока нет