Академический Документы

Профессиональный Документы

Культура Документы

5 Comprehensive Examination: Case No-1

Загружено:

Sajid AliИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

5 Comprehensive Examination: Case No-1

Загружено:

Sajid AliАвторское право:

Доступные форматы

Sr. No.

001

INSTITUTE OF COST AND MANAGEMENT ACCOUNTANTS OF PAKISTAN

5th Comprehensive Examination

Sunday, the 10th August, 2008

Time Allowed 2 Hours

Maximum Marks 60

(i) Attempt both the cases 1 and 2, that carry 30 marks each.

(ii) Answers must be neat, relevant and brief.

(iii) In marking the question paper, the examiners take into account the clarity of

exposition, logic of arguments, effective presentation, language and use of clear

diagram or chart where appropriate.

(iv) Read the instructions printed on the top cover of answer script CAREFULLY before

attempting the paper.

(v) Use of non-programmable scientific calculators of any model is allowed.

(vi) DO NOT write your Name, Reg. No. or Roll No. anywhere inside the answer script.

(vii) Question No. 1 Multiple Choice Question printed separately, is an integral part of

this question paper.

CASE NO- 1

Marks

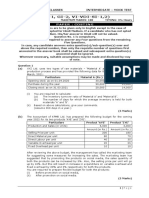

The management of Al-Rumah Hotel Ltd., has prepared the budget, which shows the

following room occupancy:

Average %

January March

April June

July September

October December

45

60

90

55

Revenue for the year is estimated to be Rs.24,000,000 and arises from three profit

centres;

Accommodation

45 %

Restaurant

35 %

Bar

Total

20 %

100 %

The accommodation revenue is earned from several different categories of guest

each of which pays a different rate per room.

PTO

Page 1 of 3

The three profit centres have the following percentage gross margins:

Revenue

Wages

Cost of sales

Direct costs

Accommodation

%

100

20

10

30

70

Restaurant

%

100

30

40

10

80

20

Marks

Bar

%

100

15

50

5

70

30

Fixed costs for the year are estimated to be Rs.4,520,000.

Capital employed is Rs.56,000,000.

As a means of improving the Return of Capital Employed (ROCE) two suggestions

have been made;

(i)

to offer special two-night holidays at a reduced price of Rs.200 per night. It is

expected that those accepting the offer would spend an amount equal to 40% of

the accommodation charge in the restaurant, and 20% in the bar. The gross

margin percentages for the three profit centers would remain same as indicated

above.

(ii)

to increase prices, management is confident that there will be no drop in volume

of sales if restaurant prices are increased by 18% and bar prices by 10%.

Accommodation prices would also need to be increased.

Required:

(a) Calculate the budgeted return on capital employed before tax; and

10

(b) Calculate;

(i) how many two-night holidays would need to be sold each week in the four

quarters to improve the return on capital employed by a further 4% above

the percentage calculated in (a) above.

10

(ii)

By what percentage the prices of accommodation would need to be

increased to achieve the desired ROCE shown in (b) (i) above.

Page 2 of 3

10

CASE NO- 2

Marks

(a) The Sportswear Ltd., is considering a new location. If it constructs a sports outlet and

manufactures 100 cricket helmets the cost will be Rs.200,000 and the project is likely to

produce net cash flows of Rs.34,000 per year for 15 years, after which the leasehold on the

land expires and there will be no residual value. The companys required return is 18 percent.

If the location proves favorable, Sportswear Ltd., will be able to expand by another 100

helmets at the end of 4 years. The cost per helmet would be Rs.400. With the new helmets,

incremental net cash flows of Rs.34,000 per year for years 5 through 15 would be expected.

The company believes there is a 50 50 chance that the location will prove to be a favorable

one.

Required:

05

(i) Is the initial project acceptable?

(ii) What is the value of the option? The worth of the project with the option? Is it

15

acceptable?

(b) Birds & Birds Co., has launched an expansion program that, in 6 years, should result

in the saturation of the coastal area marketing region of Sindh. As a result, the

company is predicting a growth in earnings of 12 percent for 3 years, 6 percent for

years 4 through 6, then constant earnings for the foreseeable future. The company

expects to increase its dividend per share, now Rs.24, in keeping with this growth

pattern. Currently, the market price of the stock is Rs.300 per share.

Required:

Estimate the companys cost of equity capital.

THE END

Page 3 of 3

10

Вам также может понравиться

- Secondary Mathematics Teacher Guide 2016Документ149 страницSecondary Mathematics Teacher Guide 2016Felicia Shan Sugata100% (3)

- Chapter 14 SolutionsДокумент10 страницChapter 14 SolutionsAmanda Ng100% (1)

- Jackpot Description v.2Документ4 страницыJackpot Description v.2Sergio PeñuelaОценок пока нет

- Year 10 Maths PlaneДокумент62 страницыYear 10 Maths Planehal wangОценок пока нет

- Chapter 8 Solutions GitmanДокумент22 страницыChapter 8 Solutions GitmanCat Valentine100% (3)

- List of Important Formula For MathsДокумент20 страницList of Important Formula For MathsQazi Kamal50% (2)

- Turfgrass Fertilization BasicsДокумент3 страницыTurfgrass Fertilization BasicsKirk's Lawn CareОценок пока нет

- Chapter 11 SolutionsДокумент22 страницыChapter 11 SolutionsChander Santos Monteiro100% (3)

- Semi-Detailed LP in MathematicsДокумент4 страницыSemi-Detailed LP in MathematicsMaebelle AbalosОценок пока нет

- Chapter 12 SolutionsДокумент13 страницChapter 12 SolutionsCindy Lee75% (4)

- Chapter 16Документ11 страницChapter 16Aarti J50% (2)

- ICT ILLUSTRATION 8 MODULE 3 Lesson 2Документ16 страницICT ILLUSTRATION 8 MODULE 3 Lesson 2JENIFER PATAGOC100% (1)

- Capital Budgeting Exercise1Документ14 страницCapital Budgeting Exercise1rohini jha0% (1)

- Economic Insights from Input–Output Tables for Asia and the PacificОт EverandEconomic Insights from Input–Output Tables for Asia and the PacificОценок пока нет

- Chapter 7 SolutionsДокумент9 страницChapter 7 SolutionsMuhammad Naeem100% (3)

- Financial Management-Capital Budgeting:: Answer The Following QuestionsДокумент2 страницыFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaОценок пока нет

- Chapter 9 SolutionsДокумент11 страницChapter 9 Solutionssaddam hussain80% (5)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Документ12 страниц3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali50% (2)

- Percentage, Rate, and BaseДокумент4 страницыPercentage, Rate, and BaseAbner BodegasОценок пока нет

- DBP v. Bonita PerezДокумент3 страницыDBP v. Bonita PerezRaphael Emmanuel GarciaОценок пока нет

- Maths IGCSEДокумент42 страницыMaths IGCSEPhelix_Young_640433% (3)

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportОт EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportОценок пока нет

- 820003Документ2 страницы820003komalbhadani77Оценок пока нет

- CA Inter FM SM Q MTP 2 May 2024 Castudynotes ComДокумент12 страницCA Inter FM SM Q MTP 2 May 2024 Castudynotes ComsaurabhОценок пока нет

- Ex.C.BudgetДокумент3 страницыEx.C.BudgetGeethika NayanaprabhaОценок пока нет

- MTP 19 53 Questions 1713430127Документ12 страницMTP 19 53 Questions 1713430127Murugesh MuruОценок пока нет

- Gujarat Technological University: InstructionsДокумент3 страницыGujarat Technological University: Instructionssiddharth devnaniОценок пока нет

- Strategic Financial Management PaperДокумент6 страницStrategic Financial Management Papersanaskhh508Оценок пока нет

- Cost and Management AccountingДокумент6 страницCost and Management AccountingAli HaiderОценок пока нет

- Gujarat Technological UniversityДокумент2 страницыGujarat Technological UniversityIsha KhannaОценок пока нет

- Sample Qn.Документ3 страницыSample Qn.meОценок пока нет

- Questions For Group 1: S.B.Khatri-FM-AIMДокумент6 страницQuestions For Group 1: S.B.Khatri-FM-AIMAbhishek singhОценок пока нет

- Questions For Group 1: S.B.Khatri-FM-AIMДокумент6 страницQuestions For Group 1: S.B.Khatri-FM-AIMAbhishek singhОценок пока нет

- Instructions To CandidatesДокумент3 страницыInstructions To CandidatesSchoTestОценок пока нет

- Case StudiesДокумент47 страницCase StudiesVIVEK KUMARОценок пока нет

- ECON F315 - FIN F315 - Compre QP PDFДокумент3 страницыECON F315 - FIN F315 - Compre QP PDFPrabhjeet Kalsi100% (1)

- Corporate Finance I mA6Q2VgQxb PDFДокумент4 страницыCorporate Finance I mA6Q2VgQxb PDFvikas4433Оценок пока нет

- Corporate Finance I763 UmyMzqnN1hДокумент2 страницыCorporate Finance I763 UmyMzqnN1hABHINAV AGRAWALОценок пока нет

- CS Final - Financial Tresurs and Forex Management - June 2004Документ4 страницыCS Final - Financial Tresurs and Forex Management - June 2004Rushikesh DeshmukhОценок пока нет

- Investment Appraisal TAE TESTДокумент2 страницыInvestment Appraisal TAE TESTJames MartinОценок пока нет

- SFMДокумент29 страницSFMShrinivas PrabhuneОценок пока нет

- Costing FM Mock Test May 2019Документ20 страницCosting FM Mock Test May 2019Roshinisai VuppalaОценок пока нет

- 54543bos43717ipcc p3q PDFДокумент6 страниц54543bos43717ipcc p3q PDFPuneet VyasОценок пока нет

- Caf-01 Far-I (Mah SS)Документ4 страницыCaf-01 Far-I (Mah SS)Abdullah SaberОценок пока нет

- Investment Decisions Problems 2Документ5 страницInvestment Decisions Problems 2MussaОценок пока нет

- UntitledДокумент5 страницUntitledbetty KemОценок пока нет

- Gujarat Technological UniversityДокумент3 страницыGujarat Technological UniversityAmul PatelОценок пока нет

- Capital Budgeting Cash Flow ExercisesДокумент1 страницаCapital Budgeting Cash Flow ExercisesAAM260% (1)

- Section A - QuestionsДокумент27 страницSection A - Questionsnek_akhtar87250% (1)

- 16 Af 601 Sma - 3Документ4 страницы16 Af 601 Sma - 3umargee123Оценок пока нет

- Exercises (Capital Budgeting)Документ2 страницыExercises (Capital Budgeting)bdiitОценок пока нет

- Time Value of Money SumsДокумент13 страницTime Value of Money SumsrahulОценок пока нет

- SFM - 1Документ3 страницыSFM - 1ketulОценок пока нет

- SFM Old MTP Dec 21Документ6 страницSFM Old MTP Dec 21Kanchana SubbaramОценок пока нет

- 05 s601 SFM PDFДокумент4 страницы05 s601 SFM PDFMuhammad Zahid FaridОценок пока нет

- Cost Management Accounting Full Test 1 Nov 2023 Test Paper 1689158389Документ17 страницCost Management Accounting Full Test 1 Nov 2023 Test Paper 1689158389ahanaghosal2022Оценок пока нет

- Final Examination (Final Exam Weightage:25%) Principle of Finance (Finn 100)Документ3 страницыFinal Examination (Final Exam Weightage:25%) Principle of Finance (Finn 100)Taimoor ShahidОценок пока нет

- Finance ManagmentДокумент5 страницFinance ManagmentAnand KumarОценок пока нет

- Set: A: Instructions For CandidatesДокумент10 страницSet: A: Instructions For CandidatessaurabhОценок пока нет

- Institute of Management Technology: Centre For Distance LearningДокумент2 страницыInstitute of Management Technology: Centre For Distance Learningabhimani5472Оценок пока нет

- Costing English Question-01.09.2022Документ5 страницCosting English Question-01.09.2022Planet ZoomОценок пока нет

- Cash Flow Probability Cash Flow Probability Proj A Proj B Proj A Year Project A Project B Expected Value Discount Rate PV (Encf)Документ10 страницCash Flow Probability Cash Flow Probability Proj A Proj B Proj A Year Project A Project B Expected Value Discount Rate PV (Encf)hardik100Оценок пока нет

- FM Revision Q BankДокумент10 страницFM Revision Q BankOmkar VaigankarОценок пока нет

- Financial Management 201Документ4 страницыFinancial Management 201Avijit DindaОценок пока нет

- Finance RTP Cap-II June 2016Документ37 страницFinance RTP Cap-II June 2016Artha sarokarОценок пока нет

- Project Appraisal - Stages FlowchartДокумент6 страницProject Appraisal - Stages FlowchartAshokОценок пока нет

- Final Examination::I: I... " .,+3 Anh, Surendra Mode School of Comrerap+,/'/ - :, I + ,.... 9 DДокумент8 страницFinal Examination::I: I... " .,+3 Anh, Surendra Mode School of Comrerap+,/'/ - :, I + ,.... 9 DSREYA JAGARLAPUDIОценок пока нет

- SMA Notes (Imp. Problems)Документ26 страницSMA Notes (Imp. Problems)Naresh GuduruОценок пока нет

- Project Financial Appraisal - NumericalsДокумент5 страницProject Financial Appraisal - NumericalsAbhishek KarekarОценок пока нет

- Paper - 2: Strategic Financial Management Questions Project Planning and Capital BudgetingДокумент33 страницыPaper - 2: Strategic Financial Management Questions Project Planning and Capital BudgetingShyam virsinghОценок пока нет

- Indian Institute of TechnologyДокумент8 страницIndian Institute of TechnologySohini RoyОценок пока нет

- Project Risk Analysis Assignment Xi 2011Документ3 страницыProject Risk Analysis Assignment Xi 2011Piyush SikariaОценок пока нет

- Financial ManagementДокумент3 страницыFinancial ManagementMRRYNIMAVATОценок пока нет

- MBA 2nd-4th Sem Internal TestДокумент3 страницыMBA 2nd-4th Sem Internal TestNritya khoundОценок пока нет

- Budgeting Q and AДокумент26 страницBudgeting Q and AAnonymous WoG0AmvPb100% (2)

- Finance Cap 2Документ19 страницFinance Cap 2Dj babuОценок пока нет

- Mock Test - 4-2Документ16 страницMock Test - 4-2Deepsikha maitiОценок пока нет

- Fall 2008 Past PaperДокумент4 страницыFall 2008 Past PaperKhizra AliОценок пока нет

- Chapter 15Документ6 страницChapter 15Rayhan Atunu100% (1)

- Chapter 13 Solutions MKДокумент26 страницChapter 13 Solutions MKCindy Kirana17% (6)

- Chpater 4 SolutionsДокумент13 страницChpater 4 SolutionsAhmed Rawy100% (1)

- Chapter 1 SolutionsДокумент3 страницыChapter 1 SolutionsChadwick PohОценок пока нет

- Chapter 10 SolutionsДокумент21 страницаChapter 10 SolutionsFranco Ambunan Regino75% (8)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Документ14 страниц3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (2)

- Chapter 2 SolutionsДокумент5 страницChapter 2 SolutionskendozxОценок пока нет

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Документ11 страниц3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliОценок пока нет

- 3-7 2005 Dec Q PDFДокумент12 страниц3-7 2005 Dec Q PDFSajid AliОценок пока нет

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Документ12 страниц3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (3)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Документ11 страниц3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (2)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Документ11 страниц3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (1)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Документ12 страниц3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali67% (3)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Документ12 страниц3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliОценок пока нет

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Документ12 страниц3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliОценок пока нет

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Документ10 страниц3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali0% (1)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Документ13 страниц3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliОценок пока нет

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Документ11 страниц3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (1)

- AccA P4/3.7 - 2002 - Dec - QДокумент12 страницAccA P4/3.7 - 2002 - Dec - Qroker_m3Оценок пока нет

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Документ15 страниц3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliОценок пока нет

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Документ12 страниц3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (1)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Документ14 страниц3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (1)

- 8th Math Percentage Test PapersДокумент3 страницы8th Math Percentage Test PapersManoj KumarОценок пока нет

- The Options Handbook: A Publication of Schaeffer's Investment Research, IncДокумент61 страницаThe Options Handbook: A Publication of Schaeffer's Investment Research, IncchavezczОценок пока нет

- LDC 25 1st ShiftДокумент48 страницLDC 25 1st ShiftGopi StyzzОценок пока нет

- TLE7 AFA AGRICROP - Q1 - M3 - v2Документ37 страницTLE7 AFA AGRICROP - Q1 - M3 - v2Alan Banluta100% (1)

- Student's Understanding of Algebraic Notation PDFДокумент19 страницStudent's Understanding of Algebraic Notation PDFSebastian GelvesОценок пока нет

- Simple Interest PDF For Bank Exams IBPS SBI PO Clerk RRBДокумент26 страницSimple Interest PDF For Bank Exams IBPS SBI PO Clerk RRBSrini VasuluОценок пока нет

- Solved SSC MTS 21 September 2017 Shift 3 Paper With SolutionsДокумент39 страницSolved SSC MTS 21 September 2017 Shift 3 Paper With SolutionsGopal PrasadОценок пока нет

- TEST1 Percentages 05062016Документ5 страницTEST1 Percentages 05062016Sahil KalaОценок пока нет

- BSAIS 1st Year BusMath PrelimДокумент19 страницBSAIS 1st Year BusMath PrelimJ QuisidoОценок пока нет

- LIC AAO Set 1 PDFДокумент26 страницLIC AAO Set 1 PDFAnkit RawatОценок пока нет

- Applications of The Geometric MeanДокумент5 страницApplications of The Geometric Meanrida74100% (1)

- Fractions Percentages Assessment AnswersДокумент2 страницыFractions Percentages Assessment AnswerssanduedОценок пока нет

- Exercise 6 CДокумент1 страницаExercise 6 Csubhi_dugarОценок пока нет

- Update Faculty Based Bank Written Math-2019 by Yousuf AliДокумент23 страницыUpdate Faculty Based Bank Written Math-2019 by Yousuf AliAlex MoonОценок пока нет

- DCPD Profit and LossДокумент29 страницDCPD Profit and LossHimanshuОценок пока нет

- Bộ Bài Mẫu Writing Task 1 - IELTS DefeatingДокумент37 страницBộ Bài Mẫu Writing Task 1 - IELTS DefeatingĐoàn TâmОценок пока нет

- Normal Distribution Worksheet 2 - ANSДокумент2 страницыNormal Distribution Worksheet 2 - ANSRavi Nookala0% (1)

- English Part 71 PDF PDFДокумент14 страницEnglish Part 71 PDF PDFAsthaОценок пока нет

- 7th English Maths 2 PDFДокумент156 страниц7th English Maths 2 PDFBasavarajBusnurОценок пока нет

- General - Mathematics XI XIIДокумент58 страницGeneral - Mathematics XI XIIjavierОценок пока нет