Академический Документы

Профессиональный Документы

Культура Документы

Asignment Fixed

Загружено:

Daood AbdullahАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Asignment Fixed

Загружено:

Daood AbdullahАвторское право:

Доступные форматы

Bond Sector of Pakistan

ASIGNMENT # 1

Bond Sector of Pakistan

Fixed Income and Derivative Analysis

Name :

Daood Abdullah

Fozia Asghar

Farah Islam

14209003

13109002

13119001

Submitted To:

Sir Faisal Munir

School of Accounting and Finance

Gujranwala

Table of Content

1

Assignment 1

Bond Sector of Pakistan

1. Introduction of Bond Market............................................................................ 3

1.1 Background....................................................................................................... 3

1.2 History of Bond Sector....................................................................................... 3

1.3 Significance of Bond Market for Pakistan...........................................................4

2. Bond market in Pakistan................................................................................... 5

2.1 Current status and Overview.............................................................................5

2.2 Government Bond Market.................................................................................6

2.2.1 T-Bills........................................................................................................... 6

2.2.2 Federal Investment Bonds...........................................................................6

2.3 Corporate Bond Market............................................................................................. 7

2.4 Sukuk Market:........................................................................................................ 8

2.5 Commercial Paper:................................................................................................... 8

3. External Bond Market................................................................................................. 9

3.1 Dollar Dominated and Eurobonds................................................................................. 9

2

Assignment 1

Bond Sector of Pakistan

1. Introduction of Bond Market

The bond market also known as the debt, credit, or fixed income market is a

financial market where participants buy and sell debt securities usually in the

form of bonds.

1.1 Background

Bond markets play an important role in mobilization of capital. The

investments are very necessary for economic development of a country. A

good market will help promote economic growth and reduce the risk of

financial crises. 1

The bond market is composed of Pakistan investment bonds, corporate

bonds, Sukuks and commercial paper. Overall this market is 5% of GDP at the

moment which is very small as compared to other economies.2

1.2 History of Bond Sector

In Pakistan, the development of bond market was commenced in late 1990s

after the liberalization reforms; however, Pakistan's bond market has

established at a slow speed as compared to other states. Pakistan bond

market is at its initial phase and has a very slow pace of development, just

1% of GDP, as compared to other countries. Like other developing markets,

most of the debt financing is done through bank borrowings. According to

State Bank of Pakistan (SBP) and Securities and Exchange Commission of

Pakistan (SECP) the domestic bonds outstanding were 30 percent of the GDP,

equivalent to PKR 5.8 trillion as of June 2012. This consists mainly of

government bonds, as the corporate market is yet to develop. Government

bond market gained momentum after the introduction of Pakistan

Investment Bonds (PlBs) in 2000, which helped to rationalize the auction of

Government Securities and to develop secondary market for the Government

instruments. SBP introduced selective Primary Dealer System (PD) in 2000.

In 2001 KlBOR/KIBlD rates were introduced to provide inter-bank call money

arch. Outstanding T-bills are roughly PKR 2.4 trillion as of June 2012 out of

1 Developing Bond Markets in APEC - Toward Greater Public-Private Sector Regional

Partnership

2 bond market development in Pakistan by Muhammad Arif 2007

3

Assignment 1

Bond Sector of Pakistan

which banks hold 75 percent worth of short term paper. Outstanding PIB

amount is PKR 974 billion, out of which 52 percent of holding are with banks.3

1.3 Significance of Bond Market for Pakistan

Bond market is of great significance to a country that faces large budget

deficits, like Pakistan. Generally a well-developed bond market is important

for these reasons:

Increasing the competitiveness and efficiency of the financial system, which

here is dominated by large banks. At micro economic level development of

securities market helps change the financial system from bank-oriented

system to multi layered system where capital markets can complement bank

financing. Enhancing the stability of the financial system by creating

alternatives to banks that will reduce the power of banks simply it provides a

resort for domestic funding and budget deficits other than by central bank

Bond market helps in the implementation of monetary policy, including

achievement of monetary targets or may be inflation objectives. The

development of bond market can force the financial intermediaries to

develop other products like Repo, Structured finance and Derivatives. Cost of

debt servicing can be reduced through funding of Government Budget

deficits on market-oriented funds.4

Further development of local bond market provides:

Diversification of financial sector into equity, debt and bank financing

Effective allocation of capital competition in financial sector

Supports infrastructure development, privatization, securitization, and

the rise of new institutional investors requiring long term assets to

match long term liabilities

Reduces the currency, interest rate and funding exposures risks

Allows more efficient allocation of savings by reducing banks role that

also reduces the element of political interference

3 Nazir (2010) .Future and Prospects of Bond Market Development in Pakistan: A

Review

4 Arif (2007).Bond market development in Pakistan

4

Assignment 1

Bond Sector of Pakistan

Allows borrowers to use capital that is tailored to their assets and

operations

Provides retail and institutional investors with several high quality and

liquid domestic saving vehicles.

2. Bond market in Pakistan

2.1 Current status and Overview

With the partition of subcontinent, the stock market and SBP starts to

perform its operations. At that time financial system of Pakistan was very

weak. Then with the passage of time private sector starts to develop that in

1970s acquired by government. This trend increases in period of 1970-1990s

when private sector was almost shrunk and government took control.

Then post 1990s time period consists of financial liberalization reforms that

were initiated to reduce the Government deficit.

At that time with the privatization reforms, Government started to issue fixed

income securities to pool funds form public for reduction of government

deficit. Government borrowed on tap instruments having predetermined

rates. Captive Finding was provided by SBP that was restricted later on by

increasing the statuary liquidity requirements and cash reserve

requirements. So as whole fixed income market for government securities

was not properly developed that could provide benchmark yield for corporate

securities.

The first long term bond issued in 1992 thus giving an opportunity to

corporation to issue a bond by taking that long term yield curve as a bond.

Hence a series started in 1995 when the first term Finance Certificate was

sold in market then later on in 2000 and Pakistan Investment bonds are sold

by Government. But due to the limited supply of government s securities a

representative long-term yield curve had not formed which constrained the

development of corporate bond market.5

Liberalization of the financial system and the switch from credit planning to a

market based monetary policy has created a secondary market for

government bonds in Pakistan. Trading in treasury bills and in short-term

federal bonds provides the basis for open market operations of the state

bank.

5 Nazir (2010) .Future and Prospects of Bond Market Development in Pakistan: A

Review

5

Assignment 1

Bond Sector of Pakistan

In 1991, the government with the consultation of World Bank, started

issuance of two types of securitiesone of short-term maturity and the other

of long-term maturity on the basis of auction through the intermediation of

primary dealers, i.e. treasury Bills (short-term) and federal investment bonds

(long-term).

Market Treasury Bills (MTB) is short term debt issued by the government to

raise funds for less than 1 year at a risk free rate. These securities can be

sold in the secondary market. In addition to it, government of Pakistan had

launched Pakistan Investment bonds in 2000 for long-term financing. These

bonds are issued for the tenor of 3, 5, 10, 15 and 20 years of maturity. There

also exists secondary market for these securities. Government has started

national saving schemes for retail investors. Another one is term finance

certificate. TFC are issued by corporation for a specified time period at both

fixed and floating interest rates by both financial and non-financial

institutions. Returns in these securities are changed with the maturity and

credit risk of the issuer.

2.2 Government Bond Market

2.2.1 T-Bills

The bills are issued at a discount. The investors are required to quote the

price at which they are willing to buy t-bills of Rs.100 face value. Individuals,

institutions and corporate bodies including banks/DFIs are eligible to

purchase the bills. The principal and profit accrued thereon is guaranteed by

the government. Principal and profit is payable on maturity. T-bills can be

traded freely and are transferable by endorsement and delivery.Tax is

deducted at source under the Income Tax Ordinance 1979.

2.2.2 Federal Investment Bonds

Bonds are of three different maturity periods viz. three years, five years and

ten years. Short-term FIBs have also been issued. Individuals, institutions

and corporate bodies including banks, irrespective of their residential status

can purchase bonds. There is no quantitative limit on purchases. Bonds are

redeemable at par on completion of their respective maturity period. In case

cash is require before the maturity date of the bond, the investor may

approach his banker et his bonds converted into cash at the market price. In

the manner, the government bonds can be traded freely in the secondary

market before their maturity date. Each bank is required to display daily sale

and purchase prices of bonds at their main branches in major cities.

6

Assignment 1

Bond Sector of Pakistan

WAPDA, NDFC, BEL, PICIC, and some other firms have also issued nongovernment corporate bonds and certificates. Trading is very limited.

Investment banks which were expected to play a major market-making role

have not succeeded in doing so. Term Finance Certificate (TFCs) has been

issued by financial and manufacturing companies from time to time. 62 TFCs

instruments have been issued on the KSE during 1996-2003 (21 of these

were issued in 2002-2003).

The secondary market is shallow and largely confined to the public debt

sector. The range of financial assets available is limited. The growth of the

secondary market has been restricted by the expansion of the national

saving schemes (NSS), which are very popular with the public. Rates of

return in the secondary market are generally lower than those offered by the

national saving schemes although rates on these schemes have been

drastically reduced during 2000-2002. The growth of the secondary market is

limited by the interventions of the government in the auctioning process to

hold down interest rates. Such intervention has been reduced since 1997,

when the autonomy of the state bank was recognized through the

amendment of the State Bank of Pakistan Act 1962.

About Rs.5 billion worth of TFCs were issued during 1995-2000. There was

major upsurge in 2002 but the secondary market in TFCs is very

undeveloped. Pakistan Investment Bond issues are significantly larger

(exceeding Rs.100 billion in 2001-2002 for example). A secondary market

has not developed in PIBs and PIBs are not regarded as a capital market

instrument. The public is not informed of what the government does with the

money raised through Pakistan Investment Bond issues.6

Main features of government bond market in Pakistan are as under:

Bonds are issued in 3, 5, 10, 15, 20, and 30 years tenors.

Bonds are issued through auction system in which only Primary Dealers

(PDs) can participate.

Issued at Par.

Coupon payments are made semiannually.

Bonds are issued in the form of un-certificated bonds and are maintained in

6 SA Meenai (2004) .Money and banking in Pakistan, fifth edition, oxford university press

7

Assignment 1

Bond Sector of Pakistan

SGLA maintained by the SBP.

Bonds are SLR eligible securities and individuals, institutions and corporate

bodies including banks can purchase, irrespective of their residential

status.

Bonds are tradable in secondary market.

2.3 Corporate Bond Market

Foundations of the corporate bond market were laid in 1995 with the first issue of Term

Finance Certificates. Since then issuance of listed TFCs has totaled approximately PKR

80 billions.

Amongst those were de-regulation of the banking sector, lower interest rates, availability of

benchmarks for both fixed and floating rate debt, active inter-bank trading markets in

government securities, coming of age for mutual funds, etc.

Corporate bond market in Pakistan is smaller in comparison to many equivalent rated economies

(less than 1% of GDP) although the situation is improving. The reduction in interest rate

volatility during 2005 brought life back into issuers. Issuers appear less perturbed by higher rates

than by volatility. Hence, 2005 and 2006 remained good years in terms of the number of issues

and volume of issuance.

Main features of the corporate bond market in Pakistan are as under:

1. The corporate bond in Pakistan is in form of Term Finance Certificate (TFC).

2. TFCs are based on legislation enacted in 1984, which authorize issuance of redeemable capital

securities. As a debt instrument TFC is slightly different from the corporate bond because it was

specifically designed to comply with Sariah law. The key difference is that the TFC substitutes

the words expected profit rates for interest rate.

3. TFC issuers include both NBFIs as well as public and private firms.

4. The coupon rates on the TFCs display a wide variety with different fixed coupons as well as

floating coupons linked to various interest rates including the discount rates, PIB rates and the

KIBOR.

2.4 Sukuk Market:

Sovereign Sukuk market does not exist in Pakistan, though GOP has floated a Sukuk in the

international market in 2005 that fetched US$ 600 million at 6 months Libor+220bps. The

concept used in this issue was Ijarah (Leasing). SBP in this regard has proposed a product for the

domestic market based on Ijarah concept. Moreover, to fulfil the needs of short-term instrument

8

Assignment 1

Bond Sector of Pakistan

having T-Bill features, a hybrid product (Combination of Ijarah and Murhabah concepts) has

been proposed to the GOP.

Immense growth in Islamic banking industry during the last four years has necessitated for

emergence of Sukuk (Shariah complaint instrument) market in Pakistan. However till this day

only three issuances have come into the market and that too from the corporate side. GOP Sukuk

has yet to be issued that is being awaited as it would in-fact provide yield curve for future Sukuk

issuances.

2.5 Commercial Paper:

Commercial Paper (CPs) is an unsecured tradable instrument used by highly rated corporate

entities to raise short term working capital. It is usually sold to cash rich financial institutions

which have an appetite for short term MM instrument. CPs are discount instrument like T-Bill

and are issued in the form of promissory note. They can even be traded in the secondary market;

however secondary CP market is not yet developed in Pakistan.

SBP and SECP issued guidelines for their issuance. The tenor of commercial papers is 3, 6 and 9

months. The Corporates can issue CPs on attaining criteria i.e. equity of the corporate is not less

than Rs 100 million, minimum credit rating for short term CP should be A- and for long tenor A,

it should have clean credit information Bureau (CIB) report and as per the latest ended balance

sheet report the company maintains a minimum current ratio of 1:1 and a debit equity ratio of

60:40. CP market is at very nascent stage in Pakistan. Packages Ltd was the first company to

raise working capital through CP.

3. External Bond Market

On external sector GOP floated three of its Sovereign Bonds including one Sukuk to make its

presence on the radar of international debt market. The significant achievement on this front is

successful auction of 30 years bonds at competitive price. This has paved the way for Corporate

sector in Pakistan to access international debt market. Pakistan floated its bond for the first time

in 1994 and then in 1997 to the amount of USD 610 million (US$ 150 million on 22-12-94 at

11.5%, US$ 160 million on 26-2-97 at 6% & US$ 300 million on 30-5-97 at 6 Month Libor+395

bps) however in 1998 on detonation of atomic bomb Pakistan was left with no position to repay

them on their maturity. So they were restructured at high premium i.e. 10% interest rate with

final repayment in December 2005.

Pakistan reverted back to the international capital market in 2004 with better credit rating

emanating from its improved macroeconomic indicators. Currently its Sovereign rating by

Standards and Poors is B+ (Foreign currency) and B for short term and BB for long term

9

Assignment 1

Bond Sector of Pakistan

(Local Currency). This process seems likely to continue to keep Pakistans presence in the

international Capital Market for developing its domestic bond market as well.

3.1 Dollar Dominated and Eurobonds

Pakistan Earlier, in March 2014, has raised $2 billion by floating five and ten year dollardenominated bonds at interest rates ranging between 7.25% and 8.25%. In the second attempt,

the government issued five-year $1 billion Ijara-Sukuk bonds at 6.75%.

On April 08, 2014 placed USD 1,000.0m in bonds with a 8.25% coupon, maturing in 2024. The

bond was priced at 100% to yield 8.25%. Bank of America Merrill Lynch, Barclays Capital,

Citigroup, Deutsche Bank arranged the deal.

Pakistan on November 26, 2014 placed USD 1,000.0m in bonds with a 6.75% coupon, maturing

in 2019. The bond was priced at 100% to yield 6.75%. Bookrunner: Citigroup, Deutsche Bank,

Dubai Islamic Bank, Standard Chartered Bank arranged the deal.

Pakistan in last week of September 2015 has issued a new 10-year bond of $500 million in the

international Euro bond market at a coupon rate of 8.25 per cent.

Pakistan initially wanted to raise $500 million through Eurobonds, but the offering of over 7.2

per cent return attracted unexpectedly very high amount of investment of up to $5 billion. The

government has reportedly raised $2bn.

Experts in the financial sector, bankers and analysts noted with enthusiasm that Pakistan quickly

made inroads to the international financial market and got the response much bigger than their

expectations.

According to available information, the government has raised $1bn in five-year bonds at a fixed

rate of 7.25pc 558 basis points (bps) above benchmark five-year US Treasury and $1bn in

10-year bonds at a fixed rate of 8.25pc 556bps above benchmark 10-year US Treasury.

Experts see multiple positive impact of Eurobond launching, particularly while the government

is struggling to improve the countrys image tarnished by the terrorism and poor law and order

situation.

Bankers said the issuance of Eurobonds would help improve balance of payments and, more

importantly, the image of Pakistan. They said the bond issue would go a long way in restoring

investor confidence.

10

Assignment 1

Вам также может понравиться

- FM11 CH 20 ShowДокумент26 страницFM11 CH 20 ShowDaood AbdullahОценок пока нет

- FM11 CH 15 ShowДокумент45 страницFM11 CH 15 ShowDaood AbdullahОценок пока нет

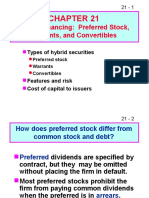

- FM11 CH 21 ShowДокумент47 страницFM11 CH 21 ShowDaood AbdullahОценок пока нет

- FM11 CH 23 ShowДокумент27 страницFM11 CH 23 ShowDaood AbdullahОценок пока нет

- The WordДокумент4 страницыThe WordDaood AbdullahОценок пока нет

- Human Resource Manager Amtech Systems LTD IslamabadДокумент2 страницыHuman Resource Manager Amtech Systems LTD IslamabadDaood AbdullahОценок пока нет

- 13 CF3 SM Ch13Документ13 страниц13 CF3 SM Ch13Daood AbdullahОценок пока нет

- SemiДокумент62 страницыSemiDaood AbdullahОценок пока нет

- Working Capital PolicyДокумент44 страницыWorking Capital PolicySteve BremsethОценок пока нет

- FM11 CH 20 ShowДокумент26 страницFM11 CH 20 ShowDaood AbdullahОценок пока нет

- Capital Structure and Leverage: Multiple Choice: ConceptualДокумент56 страницCapital Structure and Leverage: Multiple Choice: ConceptualEngr Fizza AkbarОценок пока нет

- NationalДокумент9 страницNationalDaood AbdullahОценок пока нет

- InstructionДокумент1 страницаInstructionDaood AbdullahОценок пока нет

- Dustvac's Pre-Merger WACC and Value to MagicleanДокумент2 страницыDustvac's Pre-Merger WACC and Value to MagicleanDaood AbdullahОценок пока нет

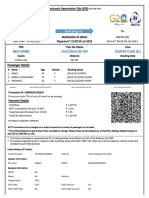

- Salary Slip (30673168 February, 2016)Документ1 страницаSalary Slip (30673168 February, 2016)Daood AbdullahОценок пока нет

- Course Outline Corporate Finance Fall 2015Документ8 страницCourse Outline Corporate Finance Fall 2015Daood AbdullahОценок пока нет

- Coldstores England 2Документ54 страницыColdstores England 2Daood AbdullahОценок пока нет

- Quiz 5Документ1 страницаQuiz 5Daood AbdullahОценок пока нет

- Corporate Finance Quiz Liquidity Ratios ROAДокумент2 страницыCorporate Finance Quiz Liquidity Ratios ROADaood AbdullahОценок пока нет

- Management Acct Decision Making Course OuitlineДокумент5 страницManagement Acct Decision Making Course OuitlineDaood AbdullahОценок пока нет

- FM11 CH 25 Test BankДокумент21 страницаFM11 CH 25 Test BankDaood AbdullahОценок пока нет

- Asignment # 1: Management Accounting Decision MakingДокумент6 страницAsignment # 1: Management Accounting Decision MakingDaood AbdullahОценок пока нет

- List of MoUsДокумент6 страницList of MoUsDaood AbdullahОценок пока нет

- GIFT University Magazine TidingsДокумент4 страницыGIFT University Magazine TidingsDaood AbdullahОценок пока нет

- Im 18Документ24 страницыIm 18Daood AbdullahОценок пока нет

- 18Документ4 страницы18Aditya Wisnu P100% (1)

- Fixed Income and Derivative AnalysisДокумент5 страницFixed Income and Derivative AnalysisDaood AbdullahОценок пока нет

- MANAGEMENT ACCOUNTING DECISION MAKINGДокумент1 страницаMANAGEMENT ACCOUNTING DECISION MAKINGDaood AbdullahОценок пока нет

- Development of Bond Market in PAKISTANДокумент10 страницDevelopment of Bond Market in PAKISTANwajji1234580% (5)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Resume SureshДокумент2 страницыResume SureshSiva BandiОценок пока нет

- EuroSports Global Limited - Offer Document Dated 7 January 2014Документ314 страницEuroSports Global Limited - Offer Document Dated 7 January 2014Invest StockОценок пока нет

- I. True or FalseДокумент5 страницI. True or FalseDianne S. GarciaОценок пока нет

- Doosan Generator WarrantyДокумент2 страницыDoosan Generator WarrantyFrank HigueraОценок пока нет

- Magnitude of Magnetic Field Inside Hydrogen Atom ModelДокумент6 страницMagnitude of Magnetic Field Inside Hydrogen Atom ModelChristopher ThaiОценок пока нет

- STAMPF V TRIGG - OpinionДокумент32 страницыSTAMPF V TRIGG - Opinionml07751Оценок пока нет

- Ristvet 2014 Ritual Performance and Politics in The Ancient Near East Final DraftДокумент434 страницыRistvet 2014 Ritual Performance and Politics in The Ancient Near East Final Draftflanders_ned_Оценок пока нет

- Lea2 Comparative Models in Policing Syllabus Ok Converted 1Документ6 страницLea2 Comparative Models in Policing Syllabus Ok Converted 1Red Buttrerfly RC100% (2)

- 14312/BHUJ BE EXP Sleeper Class (SL)Документ2 страницы14312/BHUJ BE EXP Sleeper Class (SL)AnnuОценок пока нет

- JOIN OUR BATCH FOR AMUEEE PREPARATIONДокумент16 страницJOIN OUR BATCH FOR AMUEEE PREPARATIONDRAG-E-SPORT100% (1)

- Land Management CommitteeДокумент14 страницLand Management CommitteeDisha Ahluwalia50% (4)

- Pdic 2Документ6 страницPdic 2jeams vidalОценок пока нет

- MBA Internship Report FINALДокумент82 страницыMBA Internship Report FINALPratyaksha AgnihotriОценок пока нет

- Marking Guide for Contract Administration ExamДокумент7 страницMarking Guide for Contract Administration Examრაქსშ საჰაОценок пока нет

- TVM - Time Value of Money ProblemsДокумент1 страницаTVM - Time Value of Money ProblemsperiОценок пока нет

- Factsheet Nifty High Beta50 PDFДокумент2 страницыFactsheet Nifty High Beta50 PDFRajeshОценок пока нет

- Baystate V Bentley (Gorton, Software, Copyright, Data Structures)Документ17 страницBaystate V Bentley (Gorton, Software, Copyright, Data Structures)gesmerОценок пока нет

- Class 32 Infill Exemption CriteriaДокумент3 страницыClass 32 Infill Exemption CriteriaDaniel JimenezОценок пока нет

- Oxford Research Encyclopedia of Latin American History: CloseДокумент21 страницаOxford Research Encyclopedia of Latin American History: CloseemiroheОценок пока нет

- 2016 Gcrsport enДокумент398 страниц2016 Gcrsport enDeewas PokhОценок пока нет

- DENR V DENR Region 12 EmployeesДокумент2 страницыDENR V DENR Region 12 EmployeesKara RichardsonОценок пока нет

- SAP Business One and The Prolification of TechnologyДокумент23 страницыSAP Business One and The Prolification of TechnologyDeepak NandikantiОценок пока нет

- Model articles of association for limited companies - GOV.UKДокумент7 страницModel articles of association for limited companies - GOV.UK45pfzfsx7bОценок пока нет

- 3 - Supplemental Counter-AffidavitДокумент3 страницы3 - Supplemental Counter-AffidavitGUILLERMO R. DE LEON100% (1)

- Certification Manual: Servomex OxydetectДокумент32 страницыCertification Manual: Servomex OxydetectfamelotОценок пока нет

- BIZ ADMIN INDUSTRIAL TRAINING REPORTДокумент14 страницBIZ ADMIN INDUSTRIAL TRAINING REPORTghostbirdОценок пока нет

- Question 3-FSДокумент1 страницаQuestion 3-FSRax-Nguajandja KapuireОценок пока нет

- UPCAT Application Form GuideДокумент2 страницыUPCAT Application Form GuideJM TSR0% (1)

- Tar Ge T 100: JS AccountancyДокумент33 страницыTar Ge T 100: JS Accountancyvishal joshiОценок пока нет

- Paper On Society1 Modernity PDFДокумент13 страницPaper On Society1 Modernity PDFferiha goharОценок пока нет