Академический Документы

Профессиональный Документы

Культура Документы

Sss Peso Fund Program

Загружено:

Armand MinozaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Sss Peso Fund Program

Загружено:

Armand MinozaАвторское право:

Доступные форматы

Are withdrawals from the SSS P.E.S.O.

Fund allowed?

No withdrawals are allowed from the

retirement/total disability account.

Withdrawals from the fund shall be allowed

only from the Medical (25%) and General

Purpose (10%) Accounts.

Withdrawals within the 5-year retention

period shall be charged with

corresponding penalty and service fees.

When can a member receive benefits

from the SSS P.E.S.O. Fund?

The member will receive benefits

upon filing a retirement, total

disability or death claim under the

regular SSS program.

Retirement or total disability

benefits, which consist of the

members contributions and

earnings from the SSS P.E.S.O. Fund,

may opt to receive this in monthly

pension, lump sum or a combination

of both.

Death benefits shall be paid in lump

sum to the members beneficiaries.

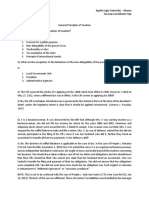

(For illustration purpose only)

Comparison of Fund Growth:

SSS. P.E.S.O. Fund vs Savings Deposit Account

Total Deposits from age

40 to 60 = Php 2.0M

Php

2.5M

Php

1.9M

Php

1.2M

Php

639.0k

Php

101.1k

Age 40

45

SSS P.E.S.O. Fund

50

55

59

Savings Deposit Account

The table shows that an SSS P.E.S.O. Fund

member who contributes P100,000 per year

starting at age 40 will have contributed a total

of P2.0M by the time he reaches age 60.

Assuming that the fund growth rates are at

3.75%, 1.85% and 1.85% per annum (may be

higher or lower) for Retirement Account,

Medical Account and General Purpose

Account, respectively, the member would earn

P500,000 in 20 years, giving him a total of

P2.5M upon retirement.

However, if the member placed his P2.0M in a

bank with an average savings interest rate of

0.45% per annum (net of tax), his deposit

would earn P100,000 in 20 years, giving him a

total of P2.1M upon retirement.

For more information email:

member_relations@sss.gov.ph or call 920-6446 to 55

or visit: www.sss.gov.ph

Published by the Corporate Communications Department

September 2014

SSS P.E.S.O. Fund

for Members

a.

Below 55 years of age;

b. Have paid contributions in the

regular SSS program for at least six

(6) consecutive months within the

What is the SSS P.E.S.O. Fund?

12-month period immediately prior

The SSS P.E.S.O. Fund (Personal Equity and

Savings Option) is a voluntary provident fund

offered exclusively to SSS members in

addition to the regular SSS program.

Through this program, members who have

the capacity to contribute more are given the

opportunity to save more in order to receive

additional benefits in the future.

to the month of enrollment;

c.

SE, VM and OFW members should

be paying the maximum amount of

contributions under the regular SSS

program;

d. Have not filed any final claim under

the regular SSS program.

How can an SSS member join the SSS

Why is the SSS P.E.S.O. Fund a good

investment?

The program provides an option for SSS

members to save their excess earnings and

build a secure future through:

P.E.S.O. Fund?

Interested and qualified SSS members can

enroll in the program

over-the-counter at any

SSS branch. Enrollment

Tax-free earnings and benefits;

via My.SSS will be

Contributions placed in sovereign

guaranteed investments; and

announced later.

Guaranteed earnings.

Who can join in the SSS P.E.S.O. Fund?

The program is open to all employees, selfemployed (SE), voluntary (VM) and OFW

members who have met the following

qualifications:

When can a member contribute to the

SSS P.E.S.O. Fund?

Contributions to the P.E.S.O. Fund may be

made anytime, whenever the member has

excess funds.

SE, VM and OFW members, must have

regular SSS contributions based on the

maximum Monthly Salary Credit (MSC) on the

month of payment before they can contribute

to the P.E.S.O. Fund.

Each member shall be allowed a maximum

contribution of P100,000 per annum and a

minimum of P1,000 per contribution.

How is the SSS P.E.S.O. Fund allocated?

The contributions and earnings of a member

shall be allocated to three (3) types of

accounts:

Account Type

with guaranteed

earnings based on

5-year T-Bond rates

Medical

with guaranteed

earnings based on

364-day T-Bill rates

25%

Membership begins with the payment of the

first contribution to the P.E.S.O. Fund.

65%

Retirement/

Total Disability

When does membership in the SSS

P.E.S.O. Fund start?

% Allocation

General Purpose

(education, housing,

livelihood,

unemployment)

10%

with guaranteed

earnings based on

364-day T-Bill rates

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Process Safety Management PresentationДокумент37 страницProcess Safety Management Presentationtatarey79100% (2)

- Aspect North Brightwater Property ReportДокумент62 страницыAspect North Brightwater Property ReportMick MillanОценок пока нет

- Payroll Accounting: - SecondaryДокумент7 страницPayroll Accounting: - SecondaryAkshatha PrabhuОценок пока нет

- DOA EmailДокумент2 страницыDOA EmailWIS Digital News StaffОценок пока нет

- Syllabus Nccer Welding IДокумент6 страницSyllabus Nccer Welding Iapi-293312231100% (1)

- Candidate Interview Application FormДокумент1 страницаCandidate Interview Application FormAlok TiwariОценок пока нет

- Cover Letter Examples MalaysiaДокумент7 страницCover Letter Examples Malaysiamhzkehajd100% (2)

- The Gender Division of Labour. GLOPPДокумент1 страницаThe Gender Division of Labour. GLOPPMayank ShuklaОценок пока нет

- Skippers United Pacific, Inc. vs. Lagne DigestДокумент4 страницыSkippers United Pacific, Inc. vs. Lagne DigestEmir MendozaОценок пока нет

- Visa QuestionsДокумент6 страницVisa QuestionsAmruta MotkaОценок пока нет

- Construction Industry KPI Report FINAL PDFДокумент78 страницConstruction Industry KPI Report FINAL PDFAbdulrahmanОценок пока нет

- Texas Workforce Commission Submit An Appeal - Appeal ConfirmationДокумент2 страницыTexas Workforce Commission Submit An Appeal - Appeal ConfirmationamirОценок пока нет

- CLU vs. Exec. Secretary, 194 SCRA 317 (1991)Документ1 страницаCLU vs. Exec. Secretary, 194 SCRA 317 (1991)Reginald Dwight FloridoОценок пока нет

- Chapter 4 Internal ... Competitive StregthДокумент24 страницыChapter 4 Internal ... Competitive StregthchelintiОценок пока нет

- Big Bazaar AttritionДокумент101 страницаBig Bazaar AttritionGeetha Viswanathan100% (1)

- Labor Law ReviewerДокумент87 страницLabor Law Reviewergod-win100% (7)

- 08 - Chapter 2 PDFДокумент88 страниц08 - Chapter 2 PDFSaurav Choudhary100% (1)

- Skills Development Levy (SDL)Документ2 страницыSkills Development Levy (SDL)Jody KingОценок пока нет

- Classical Human Relations ApproachДокумент5 страницClassical Human Relations ApproachDeogratias LaurentОценок пока нет

- VACANCY NOTICE - Cybercrime Officer (INT02658)Документ4 страницыVACANCY NOTICE - Cybercrime Officer (INT02658)Nick HaldenОценок пока нет

- Tax Law LMT Aquila Legis FraternityДокумент17 страницTax Law LMT Aquila Legis FraternityWilbert ChongОценок пока нет

- Hubbard College of Admin of FL, EPOCH Business Analysis QuesДокумент3 страницыHubbard College of Admin of FL, EPOCH Business Analysis QuesFlibberdygibber100% (1)

- Free CV Templates IrelandДокумент6 страницFree CV Templates Irelande764xmjg100% (1)

- Leadership Skills For NursesДокумент34 страницыLeadership Skills For NursesjonaОценок пока нет

- Institute of Business Management: HRM-410 - Managing Human CapitalДокумент12 страницInstitute of Business Management: HRM-410 - Managing Human CapitalSmart JhnzbОценок пока нет

- QHSE ManualsДокумент20 страницQHSE Manualswasiull100% (1)

- Organisational Change - A Critical ReviewДокумент5 страницOrganisational Change - A Critical ReviewAnu PatilОценок пока нет

- Singapore Employment Act - 2013Документ18 страницSingapore Employment Act - 2013Ei HninОценок пока нет

- Yeow Teck Chai and Ooi Chooi Im - The Development of Free Industrial ZonesThe Malaysian ExperienceДокумент24 страницыYeow Teck Chai and Ooi Chooi Im - The Development of Free Industrial ZonesThe Malaysian ExperienceEileen ChuОценок пока нет