Академический Документы

Профессиональный Документы

Культура Документы

Dec5028 Tutorial 2-Question

Загружено:

Jian Zhi TehИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Dec5028 Tutorial 2-Question

Загружено:

Jian Zhi TehАвторское право:

Доступные форматы

DEC5028 MACROECONOMICS TRI2 2015/16

TUTORIAL 2 NATIONAL INCOME ACCOUNTING

SECTION A: MULTIPLE CHOICES QUESTION

1.

Gross Domestic Product is equal to the market value of all the final goods and services

____________ in a given period of time.

A)

B)

C)

D.

consumed within a country

produced within a country

produced by the citizens of a country

produced and consume within a country

2.

Double counting (counting the same thing twice) in GDP accounting is avoided by not

including

A)

B)

C)

D)

net exports.

intermediate good

illegal activities

depreciation

3.

Which of the following is an example of a final good or service?

A)

B)

C)

D)

wheat a bakery purchases to make bread.

coffee beans Starbucks purchases to make coffee.

lumber purchased by a construction company to used in building houses.

a computer purchased by Federal Express to track shipments.

4.

The expenditure approach measures GDP by adding

A)

compensation of employees, rental income, corporate profits, net interest, and

proprietors income.

compensation of employees, rental income, corporate profits, net interest, proprietors

income, subsidies paid by the government, indirect taxes paid, and depreciation.

compensation of employees, rental income, corporate profits, net interest, proprietors

income, indirect taxes paid, and depreciation and subtracting subsidies paid by the

government.

consumption expenditure, gross private domestic investment, net exports of goods and

services, and government expenditure on goods and services.

B)

C)

D)

1|Page

DEC5028 MACROECONOMICS TRI2 2015/16

5.

If Nike, an American corporation, produces sneakers in Thailand this would

A)

B)

C)

D)

count as part of U.S. GDP since it is a U.S. corporation.

count for both Thailands GDP and U.S. GDP.

add to Thailands GDP but not to U.S. GDP.

add to neither U.S. GDP nor Thailands GDP.

6.

In calculating GDP, governmental transfer payments, such as social security or

unemployment compensation, are:

A)

B)

C)

D)

not counted.

counted as investment spending.

counted as government spending.

counted as consumption spending.

7.

In national income accounting, government purchases include:

A)

B)

C)

D)

purchases by Federal, state, and local governments.

purchases by the Federal government only.

government transfer payments.

purchases of goods for consumption, but not public capital goods.

8.

Which of the following is NOT counted in the GNP of the United States?

A)

B)

C)

The wage of a U.S. citizen who works in a foreign country for a foreign firm.

The interest earned by a U.S. bank on loans to a business firm located in Brazil.

The profit earned by a restaurant located in the United States but owned by a Mexican

company.

The value of services that are produced by state and local governments in the United

States.

D)

9.

Profits earned in the United States by foreign-owned companies are included in

A)

B)

C)

D)

the U.S. GDP but not GNP.

neither the U.S. GDP nor GNP.

the U.S. GNP but not GDP.

both the U.S. GDP and GNP.

2|Page

DEC5028 MACROECONOMICS TRI2 2015/16

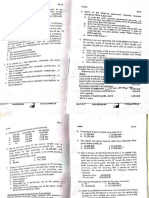

Table 1

10.

Refer to Table 1, Personal consumption expenditures in billions of dollars are

A)

B)

C)

D)

900.

1,100.

1,400.

1,600.

11.

Refer to Table 1. The value for gross private domestic investment in billions of dollars is

A)

B)

C)

D)

740.

810.

850.

890.

12.

Refer to Table 1. The value for net exports in billions of dollars is

A)

B)

C)

D)

-200.

-150.

50.

250.

13)

Refer to Table 1. The value for gross domestic product in billions of dollars is

A)

B)

C)

D)

2,900.

3,140.

3,440.

3,650.

3|Page

DEC5028 MACROECONOMICS TRI2 2015/16

14)

Refer to Table 1. The value of government spending in billions of dollars is

A)

B)

C)

D)

200.

600.

800.

1,000.

15.

Which of the following is subtracted from national income to get to personal income?

A)

B)

C)

D)

retained earnings

personal interest income

depreciation

personal Taxes

16.

If personal income is $925 billion and personal income taxes are $70 billion, the value of

disposable personal income is

A)

B)

C)

D)

$835 billion.

$855 billion.

$890 billion.

$995 billion.

17.

Nominal GDP measures the value of all goods and services

A)

B)

C)

D)

in constant dollars.

in current dollars.

in fixed dollars.

without inflation.

18.

Gross domestic product measured in terms of the prices of a fixed, or base, year is

A)

B)

C)

D)

current GDP.

base GDP.

real GDP.

nominal GDP.

4|Page

DEC5028 MACROECONOMICS TRI2 2015/16

19.

The GDP deflator is the

A)

B)

C)

D)

difference between real GDP and nominal GDP multiplied by 100.

difference between nominal GDP and real GDP multiplied by 100.

ratio of nominal GDP to real GDP multiplied by 100.

ratio of real GDP to nominal GDP multiplied by 100.

20.

If real GDP in a particular year is $80 billion and nominal GDP is $240 billion, the GDP

price index for that year is:

A)

B)

C)

D)

100.

200.

240.

300.

Use the following table for a hypothetical single-product economy.

21.

Refer to the above data. Nominal GDP in year 3 is:

A)

B)

C)

D)

$100.

$450.

$225.

$150.

22.

Refer to the above data. Real GDP in year 3 is:

A)

B)

C)

D)

$100.

$450.

$225.

$150.

5|Page

DEC5028 MACROECONOMICS TRI2 2015/16

SECTION B: STRUCTURED QUESTION

QUESTION 1

1. Below table show a list of domestic output and national income figures for a Year 2008.

Items

Wages

Interest

Personal Consumption

Export

Government Purchase

Income earned from the rest of the world

Indirect Business Taxes

Inventory Investment

Income earned by the rest of the world

Residential Investment

Corporate Taxes

Personal Income Taxes

Import

Statistical Adjustment

Retained Earnings

Rents

Corporate Profit

Depreciation

RM (million)

500

34

1,200

380

247

150

36

80

200

80

180

60

238

10

248

15

68

220

a) Using the above data, determine Gross Domestic Product using the expenditure method.

b) Determine National Income

c) With the answer that you obtained from b), now determine Personal Income by making the

required adjustments.

d) Make necessary adjustments of Personal Income from part b) in deriving Disposable Income.

6|Page

DEC5028 MACROECONOMICS TRI2 2015/16

QUESTION 2

Table 2 show a list of domestic output and national income figures for a Year 2011.

Items

Wages and salaries

Personal Consumption

Export

Government Purchase

Income earned from the rest of the world

Indirect Business Taxes

Interest receive on loans

Inventory Investment

Income earned by the rest of the world

Interest paid on borrowings

Residential Investment

Corporate Taxes

Proprietors income

Pension Payment

Import

Retained Earnings

Rents

Corporate Profit

Capital Consumption

RM (billion)

650

1,250

150

140

150

36

64

100

200

30

100

100

45

60

580

248

15

68

220

Table 2

a) Using the above data, compute:

i) National Income for year 2011.

ii) GDP by making three (3) adjustments from total of National Income.

iii) Gross National Product(GNP) by making two adjustments from total GDP.

iv) Personal Income

7|Page

DEC5028 MACROECONOMICS TRI2 2015/16

Question 3

(i)

A country produces only watch and MP4, in year 2012, price for watch was RM88 each,

and quantities produced were 10 pcs. Price for MP4 was RM 200 and quantities produced

were 5 units. On second year, the country produced 20 watches at RM 99 each and 8

units MP4 at RM 188 each.

Watch

MP4

Qty

10

5

2012

Price

RM 88

RM 200

Qty

20

8

2013

Price

RM 99

RM 188

a) Calculate Nominal GDP on year 2012

b) Calculate Nominal GDP on year 2013

c) Calculate Real GDP on year 2012 ( base year 2012)

d) Calculate GDP Deflator 2013

Question 4

List and discuss various types of goods and services omitted from measured GDP.

8|Page

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Tutorial 6Документ4 страницыTutorial 6Jian Zhi TehОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- International Business Chapter 12Документ34 страницыInternational Business Chapter 12Joey Zahary Ginting100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- IB TipsДокумент10 страницIB TipsJian Zhi TehОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- DCS 5148 Introduction To Information SystemДокумент15 страницDCS 5148 Introduction To Information SystemJian Zhi TehОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- TestBank IBДокумент29 страницTestBank IBJoey Zahary GintingОценок пока нет

- Tutorial 5Документ5 страницTutorial 5Jian Zhi TehОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- IB Final Exam NotesДокумент22 страницыIB Final Exam NotesJian Zhi TehОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Topic 1Документ1 страницаTopic 1Jian Zhi TehОценок пока нет

- MB 2.2.5, 2.2.6Документ5 страницMB 2.2.5, 2.2.6Jian Zhi TehОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- 2.0 Value Creation System: ProductsДокумент8 страниц2.0 Value Creation System: ProductsJian Zhi TehОценок пока нет

- Organization StructureДокумент1 страницаOrganization StructureJian Zhi TehОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Case Study - RevisionДокумент1 страницаCase Study - RevisionJian Zhi TehОценок пока нет

- IB TipsДокумент10 страницIB TipsJian Zhi TehОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Survey FormДокумент3 страницыSurvey FormJian Zhi TehОценок пока нет

- CH 1 - Organizations and Organizational EffectivenessДокумент28 страницCH 1 - Organizations and Organizational Effectivenessliedo_88Оценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- DOT5018 - Lecture Plan MMLSДокумент3 страницыDOT5018 - Lecture Plan MMLSJian Zhi TehОценок пока нет

- Human Resources Chapter 1 Test BankДокумент27 страницHuman Resources Chapter 1 Test BankRayz86% (7)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Dhr5018 Human Resource Management - Group Project GuidelinesДокумент3 страницыDhr5018 Human Resource Management - Group Project GuidelinesJian Zhi TehОценок пока нет

- OT Chapter 1Документ21 страницаOT Chapter 1Jian Zhi TehОценок пока нет

- Wal MartДокумент20 страницWal MartJian Zhi TehОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Teaching Plan: B. Subject InformationДокумент5 страницTeaching Plan: B. Subject InformationJian Zhi TehОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- DHR5018 - Teaching Plan For MMLSДокумент3 страницыDHR5018 - Teaching Plan For MMLSJian Zhi TehОценок пока нет

- Stakeholders, Managers, and EthicsДокумент39 страницStakeholders, Managers, and EthicsJian Zhi TehОценок пока нет

- Dhr5018 Human Resource Management - Group Project GuidelinesДокумент3 страницыDhr5018 Human Resource Management - Group Project GuidelinesJian Zhi TehОценок пока нет

- Tutorial 7Документ5 страницTutorial 7Jian Zhi TehОценок пока нет

- Tutorial 2Документ5 страницTutorial 2Jian Zhi Teh0% (1)

- Tutorial 8Документ4 страницыTutorial 8Jian Zhi TehОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Dec5028 Tutorial 1-QuestionДокумент6 страницDec5028 Tutorial 1-QuestionJian Zhi TehОценок пока нет

- Answers To Concepts in Review Chapter1Документ8 страницAnswers To Concepts in Review Chapter1Jian Zhi TehОценок пока нет

- Scott CH 3Документ16 страницScott CH 3RATNIDAОценок пока нет

- Hp Ux系统启动的日志rcДокумент19 страницHp Ux系统启动的日志rcMq SfsОценок пока нет

- Painter Gary Woo - Oct 19 Talk by Yolanda Garfias WooДокумент2 страницыPainter Gary Woo - Oct 19 Talk by Yolanda Garfias WooChinese Historical Society of America MuseumОценок пока нет

- 4-String Cigar Box Guitar Chord Book (Brent Robitaille) (Z-Library)Документ172 страницы4-String Cigar Box Guitar Chord Book (Brent Robitaille) (Z-Library)gregory berlemontОценок пока нет

- Tieng Anh Thuong Mai 1Документ18 страницTieng Anh Thuong Mai 1nminhvan072Оценок пока нет

- 05 CEE2219 TM2 MidExam - 2018-19 - SolnДокумент8 страниц05 CEE2219 TM2 MidExam - 2018-19 - SolnCyrus ChartehОценок пока нет

- Palma vs. Fortich PDFДокумент3 страницыPalma vs. Fortich PDFKristine VillanuevaОценок пока нет

- The Cornerstones of TestingДокумент7 страницThe Cornerstones of TestingOmar Khalid Shohag100% (3)

- Power Electronics For RenewablesДокумент22 страницыPower Electronics For RenewablesShiv Prakash M.Tech., Electrical Engineering, IIT(BHU)Оценок пока нет

- PRTC Tax Final Preboard May 2018Документ13 страницPRTC Tax Final Preboard May 2018BonDocEldRicОценок пока нет

- Chapter 4Документ20 страницChapter 4Alyssa Grace CamposОценок пока нет

- I. Lesson Plan Overview and DescriptionДокумент5 страницI. Lesson Plan Overview and Descriptionapi-283247632Оценок пока нет

- KULT Divinity Lost - Scenario - An Echo From The Past (28-29)Документ2 страницыKULT Divinity Lost - Scenario - An Echo From The Past (28-29)Charly SpartanОценок пока нет

- Veer Singh RaghuvanshiДокумент725 страницVeer Singh RaghuvanshiDesi RocksОценок пока нет

- MANILA HOTEL CORP. vs. NLRCДокумент5 страницMANILA HOTEL CORP. vs. NLRCHilary MostajoОценок пока нет

- Iris Sofía Tobar Quilachamín - Classwork - 16-09-2022Документ4 страницыIris Sofía Tobar Quilachamín - Classwork - 16-09-2022IRIS SOFIA TOBAR QUILACHAMINОценок пока нет

- Soal Passive VoiceДокумент1 страницаSoal Passive VoiceRonny RalinОценок пока нет

- NASA: 45607main NNBE Interim Report1 12-20-02Документ91 страницаNASA: 45607main NNBE Interim Report1 12-20-02NASAdocumentsОценок пока нет

- Interpretive Dance RubricДокумент1 страницаInterpretive Dance RubricWarren Sumile67% (3)

- MBA Negotiable Instruments Act 1881 F2Документ72 страницыMBA Negotiable Instruments Act 1881 F2khmahbub100% (1)

- Econ 281 Chapter02Документ86 страницEcon 281 Chapter02Elon MuskОценок пока нет

- Elevex ENДокумент4 страницыElevex ENMirko Mejias SotoОценок пока нет

- Lembar Soal I. Read The Text Carefully and Choose The Best Answer Between A, B, C, D or E!Документ5 страницLembar Soal I. Read The Text Carefully and Choose The Best Answer Between A, B, C, D or E!nyunyunОценок пока нет

- Education-and-Life-in-Europe - Life and Works of RizalДокумент3 страницыEducation-and-Life-in-Europe - Life and Works of Rizal202202345Оценок пока нет

- Unity School of ChristianityДокумент3 страницыUnity School of ChristianityServant Of TruthОценок пока нет

- Business Law Term PaperДокумент19 страницBusiness Law Term PaperDavid Adeabah OsafoОценок пока нет

- EPM Key Design Decisions - Design PhaseДокумент7 страницEPM Key Design Decisions - Design PhaseVishwanath GОценок пока нет

- The List of Official United States National SymbolsДокумент3 страницыThe List of Official United States National SymbolsВікторія АтаманюкОценок пока нет

- Labor Law Review Midterm Exercise 2ndsem 2017-2018Документ17 страницLabor Law Review Midterm Exercise 2ndsem 2017-2018MaeJoyLoyolaBorlagdatanОценок пока нет

- Business Communication EnglishДокумент191 страницаBusiness Communication EnglishkamaleshvaranОценок пока нет