Академический Документы

Профессиональный Документы

Культура Документы

Paid Preparer's Earned Income Credit Checklist

Загружено:

anon_294216815Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Paid Preparer's Earned Income Credit Checklist

Загружено:

anon_294216815Авторское право:

Доступные форматы

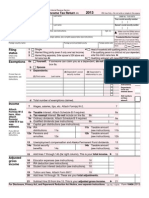

Form

8867

Paid Preparer's Earned Income Credit Checklist

Department of the Treasury

Internal Revenue Service

OMB No. 1545-1629

2015

To be completed by preparer and filed with Form 1040, 1040A, or 1040EZ.

Information

about Form 8867 and its separate instructions is at www.irs.gov/form8867.

Attachment

Sequence No. 177

Taxpayer's social security number

Taxpayer name(s) shown on return

For the definitions of Qualifying Child and Earned Income, see Pub. 596.

Part I

All Taxpayers

Enter preparer's name and PTIN

Is the taxpayers filing status married filing separately? .

If

Yes

No

Yes

No

you checked No on line 3, stop; the taxpayer cannot take the EIC. Otherwise, continue.

Is the taxpayer (or the taxpayer's spouse if filing jointly) filing Form 2555 or 2555-EZ (relating to the

exclusion of foreign earned income)? . . . . . . . . . . . . . . . . . . . . .

If

5a

No

If you checked Yes on line 2, stop; the taxpayer cannot take the EIC. Otherwise, continue.

Does the taxpayer (and the taxpayers spouse if filing jointly) have a social security number (SSN)

that allows him or her to work and is valid for EIC purposes? See the instructions before

answering . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

you checked Yes on line 4, stop; the taxpayer cannot take the EIC. Otherwise, continue.

Was the taxpayer (or the taxpayer's spouse) a nonresident alien for any part of 2015?

If

Yes

No

Yes

No

Yes

No

Yes

No

you checked Yes on line 5a, go to line 5b. Otherwise, skip line 5b and go to line 6.

b Is the taxpayers filing status married filing jointly?

you checked Yes on line 5a and No on line 5b, stop; the taxpayer cannot take the EIC.

Otherwise, continue.

If

Is the taxpayers investment income more than $3,400? See the instructions before answering.

If

you checked Yes on line 6, stop; the taxpayer cannot take the EIC. Otherwise, continue.

Could the taxpayer be a qualifying child of another person for 2015? If the taxpayer's filing status is

married filing jointly, check No. Otherwise, see instructions before answering . . . . . . .

you checked Yes on line 7, stop; the taxpayer cannot take the EIC. Otherwise, go to Part II

or Part III, whichever applies.

If

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 26142H

Form

8867 (2015)

Page 2

Form 8867 (2015)

Part II

Taxpayers With a Child

Caution: If there is more than one child, complete lines 8 through 14 for

one child before going to the next column.

8

9

Childs name . . . . . . . . . . . . . . . . . . . . .

Is the child the taxpayers son, daughter, stepchild, foster child, brother, sister,

stepbrother, stepsister, half brother, half sister, or a descendant of any of them?

10

Was the child unmarried at the end of 2015?

If the child was married at the end of 2015, see the instructions before

answering

. . . . . . . . . . . . . . . . . . . . .

Did the child live with the taxpayer in the United States for over half of 2015?

See the instructions before answering . . . . . . . . . . . .

11

12

Child 1

Child 2

Child 3

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Was the child (at the end of 2015)

Under age 19 and younger than the taxpayer (or the taxpayers spouse,

if the taxpayer files jointly),

Under age 24, a student (defined in the instructions), and younger than

the taxpayer (or the taxpayers spouse, if the taxpayer files jointly), or

Any age and permanently and totally disabled? . . . . . . . .

If you checked Yes on lines 9, 10, 11, and 12, the child is the

taxpayers qualifying child; go to line 13a. If you checked No on line 9,

10, 11, or 12, the child is not the taxpayers qualifying child; see the

instructions for line 12.

13a

Do you or the taxpayer know of another person who could check Yes

on lines 9, 10, 11, and 12 for the child? (If the only other person is the

taxpayer's spouse, see the instructions before answering.) . . . . .

If you checked No on line 13a, go to line 14. Otherwise, go to

line 13b.

b Enter the childs relationship to the other person(s) . . . . . . . .

c Under the tiebreaker rules, is the child treated as the taxpayers qualifying

child? See the instructions before answering . . . . . . . . . .

Yes

No

Yes

No

Dont know

Yes

No

Dont know

Yes

No

Dont know

Yes

Yes

Yes

No

Yes

No

If you checked Yes on line 13c, go to line 14. If you checked No, the

taxpayer cannot take the EIC based on this child and cannot take the EIC for

taxpayers who do not have a qualifying child. If there is more than one child,

see the Note at the bottom of this page. If you checked Dont know,

explain to the taxpayer that, under the tiebreaker rules, the taxpayers EIC

and other tax benefits may be disallowed. Then, if the taxpayer wants to take

the EIC based on this child, complete lines 14 and 15. If not, and there are no

other qualifying children, the taxpayer cannot take the EIC, including the EIC

for taxpayers without a qualifying child; do not complete Part III. If there is

more than one child, see the Note at the bottom of this page.

14

Does the qualifying child have an SSN that allows him or her to work and is

valid for EIC purposes? See the instructions before answering . . . .

If you checked No on line 14, the taxpayer cannot take the EIC

based on this child and cannot take the EIC available to taxpayers

without a qualifying child. If there is more than one child, see the Note at

the bottom of this page. If you checked Yes on line 14, continue.

Are the taxpayers earned income and adjusted gross income each less

than the limit that applies to the taxpayer for 2015? See instructions . .

No

No

15

If you checked No on line 15, stop; the taxpayer cannot take the

EIC. If you checked Yes on line 15, the taxpayer can take the EIC.

Complete Schedule EIC and attach it to the taxpayers return. If there

are two or three qualifying children with valid SSNs, list them on

Schedule EIC in the same order as they are listed here. If the taxpayers

EIC was reduced or disallowed for a year after 1996, see Pub. 596 to see

if Form 8862 must be filed. Go to line 20.

Note: If there is more than one child, complete lines 8 through 14 for the

other child(ren) (but for no more than three qualifying children).

Form 8867 (2015)

Page 3

Form 8867 (2015)

Part III

16

Taxpayers Without a Qualifying Child

Was the taxpayers main home, and the main home of the taxpayers spouse if filing jointly, in the

United States for more than half the year? (Military personnel on extended active duty outside the

United States are considered to be living in the United States during that duty period.) See the

instructions before answering.

17

Was the taxpayer, or the taxpayers spouse if filing jointly, at least age 25 but under age 65 at the

end of 2015? See the instructions before answering . . . . . . . . . . . . . . . .

19

Yes

No

Yes

No

Yes

No

Yes

No

you checked No on line 17, stop; the taxpayer cannot take the EIC. Otherwise, continue.

Is the taxpayer eligible to be claimed as a dependent on anyone elses federal income tax return for

2015? If the taxpayer's filing status is married filing jointly, check No . . . . . . . . . .

No

If you checked No on line 16, stop; the taxpayer cannot take the EIC. Otherwise, continue.

If

18

Yes

If you checked Yes on line 18, stop; the taxpayer cannot take the EIC. Otherwise, continue.

Are the taxpayers earned income and adjusted gross income each less than the limit that

applies to the taxpayer for 2015? See instructions . . . . . . . . . . . . . . . .

If you checked No on line 19, stop; the taxpayer cannot take the EIC. If you checked Yes

on line 19, the taxpayer can take the EIC. If the taxpayers EIC was reduced or disallowed for a

year after 1996, see Pub. 596 to find out if Form 8862 must be filed. Go to line 20.

Part IV

20

21

22

23

24

Due Diligence Requirements

Did you complete Form 8867 based on current information provided by the taxpayer or reasonably

obtained by you? . . . . . . . . . . . . . . . . . . . . . . . . . . .

Did you complete the EIC worksheet found in the Form 1040, 1040A, or 1040EZ instructions (or your

own worksheet that provides the same information as the 1040, 1040A, or 1040EZ worksheet)? . .

If any qualifying child was not the taxpayer's son or daughter, do you know or did you ask why the

parents were not claiming the child? . . . . . . . . . . . . . . . . . . . . .

Yes

No

Yes

No

Does not apply

If the answer to question 13a is Yes (indicating that the child lived for more than half the year with

someone else who could claim the child for the EIC), did you explain the tiebreaker rules and

possible consequences of another person claiming your client's qualifying child? . . . . . .

Did you ask this taxpayer any additional questions that are necessary to meet your knowledge

requirement? See the instructions before answering . . . . . . . . . . . . . . . .

Yes

No

Does not apply

Yes

No

Does not apply

To comply with the EIC knowledge requirement, you must not know or have reason to know

that any information you used to determine the taxpayer's eligibility for, and the amount of,

the EIC is incorrect. You may not ignore the implications of information furnished to you or

known by you, and you must make reasonable inquiries if the information furnished to you

appears to be incorrect, inconsistent, or incomplete. At the time you make these inquiries,

you must document in your files the inquiries you made and the taxpayer's responses.

25

Did you document (a) the taxpayer's answer to question 22 (if applicable), (b) whether you explained

the tiebreaker rules to the taxpayer and any additional information you got from the taxpayer as a

result, and (c) any additional questions you asked and the taxpayer's answers? . . . . . . .

Yes

No

Does not apply

You have complied with all the due diligence requirements if you:

1. Completed the actions described on lines 20 and 21 and checked Yes on those lines,

2. Completed the actions described on lines 22, 23, 24, and 25 (if they apply) and checked Yes (or

Does not apply) on those lines,

3. Submit Form 8867 in the manner required, and

4. Keep all five of the following records for 3 years from the latest of the dates specified in the

instructions under Document Retention:

a. Form 8867,

b. The EIC worksheet(s) or your own worksheet(s),

c. Copies of any taxpayer documents you relied on to determine eligibility for or amount of EIC,

d. A record of how, when, and from whom the information used to prepare the form and

worksheet(s) was obtained, and

e. A record of any additional questions you asked and your client's answers.

You have not complied with all the due diligence requirements if you checked No on line 20, 21, 22,

23, 24, or 25. You may have to pay a $505 penalty for each failure to comply.

Form 8867 (2015)

Page 4

Form 8867 (2015)

Part V

26

Documents Provided to You

Identify below any document that the taxpayer provided to you and that you relied on to determine the taxpayer's EIC

eligibility. Check all that apply. Keep a copy of any documents you relied on. See the instructions before answering. If there

is no qualifying child, check box a. If there is no disabled child, check box o.

Residency of Qualifying Child(ren)

No qualifying child

School records or statement

Landlord or property management statement

Health care provider statement

Medical records

Child care provider records

Placement agency statement

Social service records or statement

o

p

q

r

No disabled child

Doctor statement

Other health care provider statement

Social services agency or program statement

i

j

k

l

Place of worship statement

Indian tribal official statement

Employer statement

Other (specify)

a

b

c

d

e

f

g

h

m Did not rely on any documents, but made notes in file

n Did not rely on any documents

Disability of Qualifying Child(ren)

27

s Other (specify)

t Did not rely on any documents, but made notes in file

u Did not rely on any documents

If a Schedule C is included with this return, identify below the information that the taxpayer provided to you and that you relied

on to prepare the Schedule C. Check all that apply. Keep a copy of any documents you relied on. See the instructions

before answering. If there is no Schedule C, check box a.

Documents or Other Information

No Schedule C

Business license

Forms 1099

Records of gross receipts provided by taxpayer

Taxpayer summary of income

Records of expenses provided by taxpayer

Taxpayer summary of expenses

h Bank statements

i Reconstruction of income and expenses

j Other (specify)

a

b

c

d

e

f

g

k Did not rely on any documents, but made notes in file

l Did not rely on any documents

Form 8867 (2015)

Вам также может понравиться

- IRS Publication Form 8867Документ4 страницыIRS Publication Form 8867Francis Wolfgang UrbanОценок пока нет

- Taxes Are FunДокумент2 страницыTaxes Are Funlfoirirjrkjbghghg999Оценок пока нет

- Form 1040NR-EZ Tax Return for Nonresident AliensДокумент2 страницыForm 1040NR-EZ Tax Return for Nonresident AliensElena Alexandra CărăvanОценок пока нет

- 2011 Irs Tax Form 1040 A Individual Income Tax ReturnДокумент3 страницы2011 Irs Tax Form 1040 A Individual Income Tax ReturnscribddownloadedОценок пока нет

- Mikeandjennykelly@Gmail - Com 2011Документ6 страницMikeandjennykelly@Gmail - Com 2011Melanie RoseОценок пока нет

- Information To Claim Certain Credits After DisallowanceДокумент4 страницыInformation To Claim Certain Credits After DisallowanceJane DoeОценок пока нет

- Check tax-free interest eligibility formДокумент1 страницаCheck tax-free interest eligibility formjonyelyОценок пока нет

- F1040ez PDFДокумент2 страницыF1040ez PDFjc75aОценок пока нет

- 2011 Federal 1040Документ2 страницы2011 Federal 1040Swati SarangОценок пока нет

- U.S. Individual Income Tax ReturnДокумент2 страницыU.S. Individual Income Tax ReturnadrianaОценок пока нет

- Form 1040Документ3 страницыForm 1040Peng JinОценок пока нет

- f1040 Draft 2015Документ3 страницыf1040 Draft 2015Anonymous IpryXQAKZОценок пока нет

- U.S. Individual Income Tax ReturnДокумент2 страницыU.S. Individual Income Tax Returnapi-173610472Оценок пока нет

- Income Tax Return For Single and Joint Filers With No DependentsДокумент2 страницыIncome Tax Return For Single and Joint Filers With No DependentsmarahmaneОценок пока нет

- Child Benefits FormДокумент9 страницChild Benefits FormIoan-Daniel HustiuОценок пока нет

- 1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsДокумент2 страницы1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No Dependentspixel986Оценок пока нет

- CH2 CH3 Combined For Web EnglishДокумент9 страницCH2 CH3 Combined For Web EnglishIoana AndreeaОценок пока нет

- Form 1040A Tax Credit DetailsДокумент3 страницыForm 1040A Tax Credit DetailsYosbanyОценок пока нет

- Form 8862Документ2 страницыForm 8862Francis Wolfgang UrbanОценок пока нет

- F1040ez 2008Документ2 страницыF1040ez 2008jonathandeauxОценок пока нет

- U.S. Individual Income Tax Return: John Public 0 0 0 0 0 0 0 0 0 Jane Public 0 0 0 0 0 0 0 0 1Документ2 страницыU.S. Individual Income Tax Return: John Public 0 0 0 0 0 0 0 0 0 Jane Public 0 0 0 0 0 0 0 0 1Renee Leon100% (1)

- AlaAL ZAALIG2011Документ5 страницAlaAL ZAALIG2011Ala AlzaaligОценок пока нет

- Monica L Lindo Tax FormДокумент2 страницыMonica L Lindo Tax Formapi-299234513Оценок пока нет

- Glacier Tax User GuideДокумент5 страницGlacier Tax User Guideinter4ever77Оценок пока нет

- Form 9465 (Installment Agreement Request)Документ2 страницыForm 9465 (Installment Agreement Request)Benne JamesОценок пока нет

- Arizona Child Safety Benefits Screening ToolДокумент3 страницыArizona Child Safety Benefits Screening ToolMichelle Morgan100% (1)

- Value Added Tax (VAT) Number Registration / ApplicationДокумент4 страницыValue Added Tax (VAT) Number Registration / ApplicationLedger Domains LLCОценок пока нет

- Basic Certification - Study Guide (For Tax Season 2017)Документ6 страницBasic Certification - Study Guide (For Tax Season 2017)Center for Economic ProgressОценок пока нет

- Tax Guide for Non-Residents and Deemed ResidentsДокумент75 страницTax Guide for Non-Residents and Deemed ResidentsAlejandro VelizОценок пока нет

- The Q Word: Balance DueДокумент5 страницThe Q Word: Balance DueCenter for Economic ProgressОценок пока нет

- Tax File Number DeclarationДокумент7 страницTax File Number DeclarationJessie YuОценок пока нет

- F 1040Документ2 страницыF 1040Sue BosleyОценок пока нет

- Form 1040nrez 2010Документ2 страницыForm 1040nrez 2010David A. VestОценок пока нет

- QC 16161Документ12 страницQC 16161john englishОценок пока нет

- General Income Tax and Benefit Guide 2015: How To Fill in and File Your 2015 Tax ReturnДокумент79 страницGeneral Income Tax and Benefit Guide 2015: How To Fill in and File Your 2015 Tax ReturnEmad MerganОценок пока нет

- F 1040 NRДокумент5 страницF 1040 NRsrao_919525Оценок пока нет

- Fernando Vazquez567935467Документ21 страницаFernando Vazquez567935467Richivee100% (2)

- Tax return for 2013 tax yearДокумент16 страницTax return for 2013 tax yearmwf1806Оценок пока нет

- AskTheTaxWhiz: Top questions on tax amnestyДокумент8 страницAskTheTaxWhiz: Top questions on tax amnestyLucky MalihanОценок пока нет

- Submitting Your U.S. Tax Documents: Print, Sign, MailДокумент5 страницSubmitting Your U.S. Tax Documents: Print, Sign, MailGia Han100% (1)

- 2011 1040NR-EZ Form - SampleДокумент2 страницы2011 1040NR-EZ Form - Samplefrankvanhaste100% (1)

- Student FInance FormДокумент18 страницStudent FInance Formnightmare999111Оценок пока нет

- Ir 330Документ4 страницыIr 330b_wooОценок пока нет

- 1040 Tax Form SummaryДокумент2 страницы1040 Tax Form SummaryKevin RowanОценок пока нет

- Science Technician (Part-Time)Документ15 страницScience Technician (Part-Time)Christ's SchoolОценок пока нет

- Teacher of GeographyДокумент16 страницTeacher of GeographyChrist's SchoolОценок пока нет

- Income-Driven Repayment Plan Request How To Complete YourДокумент13 страницIncome-Driven Repayment Plan Request How To Complete YourAnonymous 6jR6DuОценок пока нет

- Science TechnicianДокумент15 страницScience TechnicianChrist's SchoolОценок пока нет

- 1040 Form Filing Status and DependentsДокумент2 страницы1040 Form Filing Status and DependentsAU Sharma0% (1)

- Status FormДокумент3 страницыStatus FormAbdul Latief FaqihОценок пока нет

- Solution Manual For Fundamentals of Taxation 2015 8Th Edition by Cruz Isbn 0077862309 9780077862305 Full Chapter PDFДокумент36 страницSolution Manual For Fundamentals of Taxation 2015 8Th Edition by Cruz Isbn 0077862309 9780077862305 Full Chapter PDFpete.salazar966100% (11)

- Teacher of MathematicsДокумент16 страницTeacher of MathematicsChrist's SchoolОценок пока нет

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryОт EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryОценок пока нет

- Innocent Spouse Relief: How You May Not Have To Pay Your Taxes!От EverandInnocent Spouse Relief: How You May Not Have To Pay Your Taxes!Оценок пока нет

- Business ResearchДокумент8 страницBusiness ResearchDhrumil GadariaОценок пока нет

- What Is A RecessionДокумент3 страницыWhat Is A Recessionsamina123Оценок пока нет

- PSPCL Industrial Tariff Subsidy MemoДокумент2 страницыPSPCL Industrial Tariff Subsidy Memoqwertyui123321Оценок пока нет

- Eco-13 EngДокумент32 страницыEco-13 EngAkshada RОценок пока нет

- One World One CurrencyДокумент3 страницыOne World One CurrencyHarish NatrajОценок пока нет

- Retirement Nestegg Calculator: You May Need A Nestegg of $3,287,327 To Retire at Age 67Документ4 страницыRetirement Nestegg Calculator: You May Need A Nestegg of $3,287,327 To Retire at Age 67fishtaco96Оценок пока нет

- ECON 201 12/9/2003 Prof. Gordon: Final ExamДокумент23 страницыECON 201 12/9/2003 Prof. Gordon: Final ExamManicks VelanОценок пока нет

- TANF Extension Reduces FundingДокумент2 страницыTANF Extension Reduces FundingPatricia DillonОценок пока нет

- Strategy - Tejasvi RanaДокумент6 страницStrategy - Tejasvi RanaB AspirantОценок пока нет

- Ito Na Talaga Totoo Pramis Teksman Mamatay Man-2Документ11 страницIto Na Talaga Totoo Pramis Teksman Mamatay Man-2ReveRieОценок пока нет

- U.S. Customs Form: CBP Form 3229 - Certificate of OriginДокумент2 страницыU.S. Customs Form: CBP Form 3229 - Certificate of OriginCustoms FormsОценок пока нет

- Inflation Vs Interest RatesДокумент12 страницInflation Vs Interest RatesanshuldceОценок пока нет

- Chapter 10 Question 1 and 2Документ7 страницChapter 10 Question 1 and 2Francien BaileyОценок пока нет

- Fisher and Wicksell On The Quantity Theory: Thomas M. HumphreyДокумент20 страницFisher and Wicksell On The Quantity Theory: Thomas M. HumphreyLovelesh AgarwalОценок пока нет

- Fiscal Policy and Deficit FinancingДокумент4 страницыFiscal Policy and Deficit FinancingAnkit JainОценок пока нет

- Rogerian Argument OutlineДокумент4 страницыRogerian Argument Outlineapi-318248566Оценок пока нет

- Lesson 1 Simple InterestДокумент2 страницыLesson 1 Simple InterestKarla BangFerОценок пока нет

- Chapter 20 - The Exchange Rate System and The Balance of Payments (Part 2)Документ8 страницChapter 20 - The Exchange Rate System and The Balance of Payments (Part 2)ohyeajcrocksОценок пока нет

- Free Trade ZoneДокумент3 страницыFree Trade ZonemanoramanОценок пока нет

- International Monetary Fund: Articles of Agreement, and Began Operations On March 1, 1947. (Note: There Are 184 MemberДокумент6 страницInternational Monetary Fund: Articles of Agreement, and Began Operations On March 1, 1947. (Note: There Are 184 MemberSohaib AshfaqОценок пока нет

- ACC 4020 - SU - W3 - A2 - Moore - DДокумент6 страницACC 4020 - SU - W3 - A2 - Moore - DRosalia Anabell Lacuesta100% (1)

- Government Intervention and Trade ProtectionismДокумент30 страницGovernment Intervention and Trade ProtectionismDennisRonaldi100% (1)

- Define Public Policy (5marks)Документ1 страницаDefine Public Policy (5marks)Syafika Masrom-4FОценок пока нет

- State Co-Operative Bank LatestДокумент29 страницState Co-Operative Bank LatestAhana SenОценок пока нет

- Protest Letter SampleДокумент3 страницыProtest Letter Samplesarah.gleason100% (1)

- Korean Labor LawДокумент13 страницKorean Labor LawAnnabaNadyaОценок пока нет

- Globalization and Its DiscontentsДокумент6 страницGlobalization and Its DiscontentsNazish SohailОценок пока нет

- 7.stpi & SezДокумент3 страницы7.stpi & SezmercatuzОценок пока нет

- GSTR-3 Monthly Return FilingДокумент12 страницGSTR-3 Monthly Return FilingVikram PuriОценок пока нет

- TAX 2 SyllabusДокумент5 страницTAX 2 SyllabusSarah Jeane CardonaОценок пока нет