Академический Документы

Профессиональный Документы

Культура Документы

Stablisation Policy

Загружено:

BappiSwargiary0 оценок0% нашли этот документ полезным (0 голосов)

21 просмотров5 страницStabilization Policy and India

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документStabilization Policy and India

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

21 просмотров5 страницStablisation Policy

Загружено:

BappiSwargiaryStabilization Policy and India

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 5

Keynes Stabilization policy

Economic stability is fundamental for the economic development of a country.

Governments can use fiscal policy as a counter-cyclical tool, because changes in

government outlays and taxes affect aggregate demand and aggregate

supply. According to Keynes, market economies had a tendency to fall into

depression when consumer and business spending declined. Instead of waiting

for self-correcting market mechanisms to work, Keynes advocated deliberate

deficit spending by the government to stimulate aggregate demand. Therefore,

the role of fiscal policy is to remove the inflationary or deflationary gap from the

economy. The government can apply three main fiscal tools, i.e., taxation,

government spending, and transfer payments:

1. Expansionary Fiscal Policy / During Deflation: During deflation the

government has three choices:

(a)

Increase government spending, i.e., government purchases multiplier

(b) Decrease taxes, i.e., tax multiplier

(c)

Increase transfer payments

(a) Increase government spending: An increase in government spending

for public goods and services:

(i)

(ii)

(iii)

(iv)

(v)

initiates a multiplier effect which results in a cumulative

increase in total spending that is greater than the initial change in

government spending

is always undertaken

government services.

when

the

public

wants

more

should always be accompanied by an equal increase in taxes,

so that the budget remains in balance, i.e., balanced budget

multiplier.

is an effective policy tool when the economy is in Stagflation.

is impossible if the budget is already in deficit and the

economy is in Depression.

In the above diagram, the economy is operating at equilibrium point E 1, which is

less than the full employment level of E 2, or in other words, the economy is

facing deflationary gap. At point E1, the aggregate demand curve AD 1 intersects

the aggregate supply curve AS. When government spending is increased, the

aggregate demand increases from AD1 to AD2. Now the new aggregate demand

curve AD2 intersects the aggregate supply curve AS at a new point of

equilibrium, i.e., E2. At this new equilibrium point E 2, the national output is

higher than before and the economy is operating under full employment level.

(b) Decrease taxes: Generally speaking, the tax multiplier for a decrease in

taxes is weaker than the government spending multiplier, because:

(i)

paying taxes is voluntary.

(ii)

the underground economy avoids paying taxes through tax

loopholes.

(iii)

income taxes can be passed on to somebody else.

(iv)

part of a tax cut will be saved.

(v)

politically, it's not as easy to cut taxes as it is to cut

government spending.

In the above diagram, the economy is operating at equilibrium point E 1, which is

less than the full employment level of E 2, or in other words, the economy is

facing deflationary gap. At point E1, the aggregate demand curve AD 1 intersects

the aggregate supply curve AS. When government decreases taxes to give a

boost in consumption and investment expenditure, the aggregate demand

increases from AD1 to AD2. Now the new aggregate demand curve AD 2 intersects

the aggregate supply curve AS at a new point of equilibrium, i.e., E 2. At this new

equilibrium point E2, the national output is higher than before and the economy

is operating under full employment level.

(c) Increase transfer payments: During deflation, when transfer payments

(pensions, unemployment compensation, allowances, etc.) are increased, the

multiplier effect is of minor magnitude. However, it can help in:

(i)

removing deflationary gap from the economy,

(ii)

increasing purchasing power of the people, and

(iii)

bringing full employment level in the economy (to some extent)

2. Contractionary Fiscal Policy / During Inflation: During inflation the

government has three choices:

(a) Decrease government spending, i.e., government purchasing multiplier

(b) Increase taxes, i.e., tax multiplier

(c)

Decrease transfer payments

(a) Decrease government spending: During inflation, a decrease in

government spending:

(i)

will cause a decrease in aggregate demand more than the change in

government spending through multiplier effect

(ii)

is always undertaken when there is a severe inflationary gap in the

economy

(iii)

is an effective fiscal measure when the economy is in hyper inflation

(iv)

a decrease in government spending should always be followed by an

decrease in taxes, so that the budget remains in balance, i.e., balanced

budget multiplier

In the above diagram, the economy is operating at the equilibrium point E 1,

which is higher than the full-employment level of EO, or in other words, the

economy is facing an inflationary gap. At point E1, the aggregate demand curve

AD1 intersects the aggregate supply curve AS. When the government reduces its

spending, the aggregate demand curve shifts from AD 1 to ADO. Now the new

aggregate demand curve ADO intersects the aggregate supply curve AS at a new

point of equilibrium, i.e., EO. At this new equilibrium point EO, the national output

is less than before and the economy is operating under full employment level.

(b) Increase taxes: If the economy is operating at a level above full

employment level, the government can remove this inflationary gap through

excessive taxation. The removal of inflationary gap will depend on the multiplier

effect of increase in tax or tax multiplier. These fiscal measures will bring the

following changes in the economy:

(i)

(ii)

decrease in aggregate demand

decrease in consumption and investment expenditures, and

(iii) finally a decrease in national output cutting the extra inflationary

pressure in the economy

In the above diagram, the economy is operating at the equilibrium point E 1,

which is higher than the full-employment level of EO, or in other words, the

economy is facing an inflationary gap. At point E1, the aggregate demand curve

AD1 intersects the aggregate supply curve AS. When the government increases

taxes, the aggregate demand curve shifts from AD 1 to ADO. Now the new

aggregate demand curve ADO intersects the aggregate supply curve AS at a new

point of equilibrium, i.e., EO. At this new equilibrium point EO, the national output

is less than before and the economy is operating under full employment level.

(c) Decrease transfer payments: Decrease in transfer payments can

improve the inflationary situation in the economy, but decreases in pensions,

unemployment compensations, allowances, can be very controversial and

socially apathetic. However, a decrease in transfer payments can remove the

inflationary gap from the economy.

Вам также может понравиться

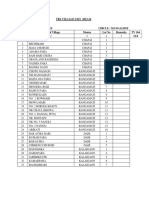

- TRS VILLAGE LIST 2023statementunna2358628765Документ10 страницTRS VILLAGE LIST 2023statementunna2358628765BappiSwargiaryОценок пока нет

- (IRFCA) Indian Railways FAQ - Signs, Hand Signals & Whistle CodesДокумент15 страниц(IRFCA) Indian Railways FAQ - Signs, Hand Signals & Whistle CodesBappiSwargiaryОценок пока нет

- TRSStatementunna 2358628765Документ1 страницаTRSStatementunna 2358628765BappiSwargiaryОценок пока нет

- CTET Form SampleДокумент1 страницаCTET Form SampleBappiSwargiaryОценок пока нет

- Relevance of GandhiДокумент2 страницыRelevance of GandhiBappiSwargiaryОценок пока нет

- External Sector1Документ29 страницExternal Sector1BappiSwargiaryОценок пока нет

- Metabolic Profiling of Cytokine Induced Keratinocytes Using NMR SpectrosДокумент46 страницMetabolic Profiling of Cytokine Induced Keratinocytes Using NMR SpectrosBappiSwargiaryОценок пока нет

- All India Radio GauhatiДокумент2 страницыAll India Radio GauhatiBappiSwargiaryОценок пока нет

- Appendix I Certificate For S.C. /S.T. Candidates OnlyДокумент1 страницаAppendix I Certificate For S.C. /S.T. Candidates OnlyBappiSwargiaryОценок пока нет

- SeptДокумент56 страницSeptBappiSwargiaryОценок пока нет

- Human Development in IndiaДокумент261 страницаHuman Development in IndiaAnkit SaxenaОценок пока нет

- Youth DatabaseДокумент255 страницYouth DatabaseBappiSwargiaryОценок пока нет

- Tour DiaryДокумент3 страницыTour DiaryBappiSwargiaryОценок пока нет

- Ashutosh Internal 2Документ4 страницыAshutosh Internal 2BappiSwargiaryОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Department of Education On Academic DishonestyДокумент3 страницыThe Department of Education On Academic DishonestyNathaniel VenusОценок пока нет

- List of Departed Soul For Daily PrayerДокумент12 страницList of Departed Soul For Daily PrayermoreОценок пока нет

- 10.4324 9781003172246 PreviewpdfДокумент76 страниц10.4324 9781003172246 Previewpdfnenelindelwa274Оценок пока нет

- International Introduction To Securities and Investment Ed6 PDFДокумент204 страницыInternational Introduction To Securities and Investment Ed6 PDFdds50% (2)

- Spica 3.2 PDFДокумент55 страницSpica 3.2 PDFKavi k83% (6)

- 2016 GMC Individuals Round 1 ResultsДокумент2 страницы2016 GMC Individuals Round 1 Resultsjmjr30Оценок пока нет

- The Mystical Number 13Документ4 страницыThe Mystical Number 13Camilo MachadoОценок пока нет

- Core Values Behavioral Statements Quarter 1 2 3 4Документ1 страницаCore Values Behavioral Statements Quarter 1 2 3 4Michael Fernandez ArevaloОценок пока нет

- Organization and ManagementДокумент65 страницOrganization and ManagementIvan Kirby EncarnacionОценок пока нет

- The Future of Freedom: Illiberal Democracy at Home and AbroadДокумент2 страницыThe Future of Freedom: Illiberal Democracy at Home and AbroadRidho Shidqi MujahidiОценок пока нет

- TRB - HSK NC IiiДокумент7 страницTRB - HSK NC IiiBlessy AlinaОценок пока нет

- Fillomena, Harrold T.: ObjectiveДокумент3 страницыFillomena, Harrold T.: ObjectiveHarrold FillomenaОценок пока нет

- Contract of Lease - Torres My FarmДокумент2 страницыContract of Lease - Torres My FarmAngeles Sabandal SalinasОценок пока нет

- Restrictive Covenants - AfsaДокумент10 страницRestrictive Covenants - AfsaFrank A. Cusumano, Jr.Оценок пока нет

- Coursework Assignment: Graduate Job ImpactДокумент13 страницCoursework Assignment: Graduate Job ImpactmirwaisОценок пока нет

- MAKAUT CIVIL Syllabus SEM 8Документ9 страницMAKAUT CIVIL Syllabus SEM 8u9830120786Оценок пока нет

- eLTE5.0 DBS3900 Product Description (3GPP)Документ37 страницeLTE5.0 DBS3900 Product Description (3GPP)Wisut MorthaiОценок пока нет

- Dwnload Full Essentials of Testing and Assessment A Practical Guide For Counselors Social Workers and Psychologists 3rd Edition Neukrug Test Bank PDFДокумент36 страницDwnload Full Essentials of Testing and Assessment A Practical Guide For Counselors Social Workers and Psychologists 3rd Edition Neukrug Test Bank PDFbiolysis.roomthyzp2y100% (9)

- Cuthites: Cuthites in Jewish LiteratureДокумент2 страницыCuthites: Cuthites in Jewish LiteratureErdincОценок пока нет

- Business Enterprise Simulation Quarter 3 - Module 2 - Lesson 1: Analyzing The MarketДокумент13 страницBusiness Enterprise Simulation Quarter 3 - Module 2 - Lesson 1: Analyzing The MarketJtm GarciaОценок пока нет

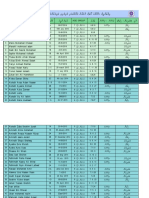

- Open Quruan 2023 ListДокумент6 страницOpen Quruan 2023 ListMohamed LaamirОценок пока нет

- RwservletДокумент2 страницыRwservletsallyОценок пока нет

- Lean Supply Chains: Chapter FourteenДокумент29 страницLean Supply Chains: Chapter FourteenKshitij SharmaОценок пока нет

- The Lure of The Exotic Gauguin in New York CollectionsДокумент258 страницThe Lure of The Exotic Gauguin in New York CollectionsFábia Pereira100% (1)

- .. Anadolu Teknik, Teknik Lise Ve Endüstri Meslek LisesiДокумент3 страницы.. Anadolu Teknik, Teknik Lise Ve Endüstri Meslek LisesiLisleОценок пока нет

- José Mourinho - Defensive Organization PDFДокумент3 страницыJosé Mourinho - Defensive Organization PDFIvo Leite100% (1)

- 6 Chase Nat'l Bank of New York V BattatДокумент2 страницы6 Chase Nat'l Bank of New York V BattatrОценок пока нет

- Dda 2020Документ32 страницыDda 2020GetGuidanceОценок пока нет

- Turtle Walk WaiverДокумент1 страницаTurtle Walk Waiverrebecca mott0% (1)

- PTE GURU - Will Provide You Template For Following SST, SWT, RETELL, DI and ESSAY and at The End Some Good Knowledge of Scoring SystemДокумент6 страницPTE GURU - Will Provide You Template For Following SST, SWT, RETELL, DI and ESSAY and at The End Some Good Knowledge of Scoring Systemrohit singh100% (1)