Академический Документы

Профессиональный Документы

Культура Документы

Midterm

Загружено:

Sumanth MuvvalaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Midterm

Загружено:

Sumanth MuvvalaАвторское право:

Доступные форматы

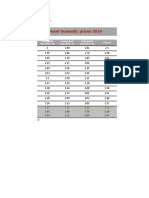

The table below shows the key data pertaining to Marine Tower Renovation Project.

If renovated, new equity shall change for case (a) and case (b). Calculation of cash flows if not

renovated and renovated with two different new loan structures is explained below:

The cash flows from each case are generated by (i) building the loan repayment structure, (ii)

taxable income and tax expenses, (iii) cash flows from operations and (iv) after tax cash flow

from sale of property

(i) Loan repayment structure: Loan calculator is built (provided in the spreadsheet) to estimate the

loan repayment structure. Excel formulas PMT and PPMT are used in estimating the total

monthly payment and the principal amount. The difference provides the interest payment.

After estimating the interest and principal payments for the whole period, annual interest and

principal payments are calculated.

Following is the data used in estimating the monthly payment and principal payment are

number of periods = 20*12 = 240. In developing the loan repayment structure for without

renovation, total loan amount = 600,000 and monthly interest rate = 10%/12 = 0.83%

While developing the loan repayment structure for renovation, under case (a), total loan =

600,000 + (200,000*75%) = 750,000 and monthly interest rate = 11%/12 = 0.92%. Under

case (b), total loan = (820,000+200,000)*75% = 765,000 and monthly interest rate = 11%/12

= 0.92%.

Based on these numbers, the loan repayment structure for all three scenarios is developed.

(ii) Taxable income: Taxable income for the projected period is calculated as Taxable income = Net

operating income interest depreciation.

Net operating income for the projected period for without renovation scenario is estimated

based on annual growth rate of 2% and for initial year it is 90,000 and for the projected case

scenario, based on annual growth rate of 3% and for the initial year it is 90,000*(1+20%) =

108,000. Interest is considered from the loan repayment structure. Depreciation for the case

without renovation = 600,000/39 = 15,385 and for renovation case = (600,000+200,000)/39 =

20,513. Tax expenses in all the three cases are calculated as 28% of taxable income.

(iii)

After tax cash flows from operations: After tax cash flows from operations is calculated as

net operating income debt service tax expenses. Debt service is the total of interest and

principal payments for every year. All the required amounts are obtained from the steps (i)

and (ii) for all the three cases.

(iv) After tax cash flow from sale of property: This is calculated as Sale price sale costs

outstanding loan tax expenses. Sale price for the case without renovation is 905,346 and for

the case with renovation using 10% capitalization rate and net operating income for Year-8 =

125,202. Sale cost in all the cases is 6% of sale price. Outstanding loan at the end of year 7 is

obtained from loan repayment structure. Tax expenses are calculated as 28% of capital gains.

Capital gains are calculated as Sale price sale costs adjusted book value. Adjusted book

value is obtained by deducting accumulated depreciation from the gross book value (800,000

for case without renovation and 1,000,000 for case with renovation).

The outstanding loan for renovation is 750,000 for case (a) and 765,000 for case (b). As such, the

interest expenses and accordingly, total after tax cash flows are different. The table below shows

the incremental cash flows.

Question (a)

Thus, incremental return (ATIRRe) is 22.5%

Question (b)

Thus, incremental return (ATIRRe) is 38.3%

The cash outflow in year-2 represents the additional equity investment.

Question (c)

The return for case (b) is higher (38.3% vs. 22.5%) due to the additional financing. This is

obtained by positive leverage. Thus, more leverage and additional financing indicates additional

financing risk.

Question (d)

I would Richard Rambo to renovate if his opportunity cost of funds is less than 22.5%.

Furthermore, if he feels that the additional return justifies the additional financing risk and the

total risk is in his threshold, he should go with case (b) of financing for renovation.

Вам также может понравиться

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОценок пока нет

- C05 Revenue Recognition - Percentage Completion AccountingДокумент16 страницC05 Revenue Recognition - Percentage Completion AccountingBrooke CarterОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionОценок пока нет

- q3 3Документ7 страницq3 3JimmyChaoОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionОценок пока нет

- Finance Analysis of Capital BankДокумент10 страницFinance Analysis of Capital BankAnita GaoОценок пока нет

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)От EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Оценок пока нет

- MCQ Accounts With AnswersДокумент70 страницMCQ Accounts With AnswersPrashant Nayyar100% (1)

- Multiples Choice Questions With AnswersДокумент60 страницMultiples Choice Questions With AnswersVaibhav Rusia100% (2)

- FR - MID - TERM - TEST - 2020 CPA Financial ReportingДокумент13 страницFR - MID - TERM - TEST - 2020 CPA Financial ReportingH M Yasir MuyidОценок пока нет

- Fin Reporting Cashflow1 Feb4 GMSISUCCESSДокумент12 страницFin Reporting Cashflow1 Feb4 GMSISUCCESSChetan BasraОценок пока нет

- FosmpqkwoqkcfnjДокумент6 страницFosmpqkwoqkcfnjmartyna.chmielОценок пока нет

- In Case of Doubts in Answers, Whatsapp 9730768982: Cost & Management Accounting - December 2019Документ16 страницIn Case of Doubts in Answers, Whatsapp 9730768982: Cost & Management Accounting - December 2019Ashutosh shahОценок пока нет

- C Recognizes Profit On A Piecemeal BasisДокумент7 страницC Recognizes Profit On A Piecemeal BasisWawan Sulaiman AlkarimiОценок пока нет

- Taxation MalawiДокумент15 страницTaxation MalawiCean Mhango100% (1)

- POA 2008 ZA + ZB CommentariesДокумент28 страницPOA 2008 ZA + ZB CommentariesEmily TanОценок пока нет

- Curve CCC!C CC"#$%C& CCC C''C (CC) CCC:) c11111111111111111cc2 cc11111111111111111111111c "$$3c4cc56"7cccccc CCCCCCCCCCДокумент7 страницCurve CCC!C CC"#$%C& CCC C''C (CC) CCC:) c11111111111111111cc2 cc11111111111111111111111c "$$3c4cc56"7cccccc CCCCCCCCCC037boyОценок пока нет

- Week 4 IndividualДокумент8 страницWeek 4 IndividualNatasha BoldonОценок пока нет

- Cash Flow Estimation & Risk AnalysisДокумент6 страницCash Flow Estimation & Risk AnalysisShreenivasan K AnanthanОценок пока нет

- NSE Financial Modeling Exam Questions and Solution - 2Документ55 страницNSE Financial Modeling Exam Questions and Solution - 2rahulnationalite83% (6)

- 19696ipcc Acc Vol2 Chapter14Документ41 страница19696ipcc Acc Vol2 Chapter14Shivam TripathiОценок пока нет

- PracticeQuestions-Qbank-Part I-FM-IIДокумент7 страницPracticeQuestions-Qbank-Part I-FM-IISonakshi BhatiaОценок пока нет

- Managing FinanceДокумент34 страницыManaging FinanceShaji Viswanathan. Mcom, MBA (U.K)Оценок пока нет

- Tutorial 2 - Principles of Capital BudgetingДокумент3 страницыTutorial 2 - Principles of Capital Budgetingbrahim.safa2018Оценок пока нет

- 123doc Questions and Answers For Financial Accounting 1Документ16 страниц123doc Questions and Answers For Financial Accounting 1Minh PhươngОценок пока нет

- Financial Reporting and Statement Analysis ºa Stategy perspective¿ÎºóÌâ а Chapter2Документ14 страницFinancial Reporting and Statement Analysis ºa Stategy perspective¿ÎºóÌâ а Chapter2Udit AgrawalОценок пока нет

- CF 17Документ18 страницCF 17Aditi OholОценок пока нет

- Financial Management (MBOF 912 D) 1Документ5 страницFinancial Management (MBOF 912 D) 1Siva KumarОценок пока нет

- Finals Answer KeyДокумент13 страницFinals Answer Keymarx marolinaОценок пока нет

- FND - Pilot Question & AnswerДокумент118 страницFND - Pilot Question & AnswerSunday OluwoleОценок пока нет

- QuesДокумент5 страницQuesMonika KauraОценок пока нет

- Ques On Capital BudgetingДокумент5 страницQues On Capital BudgetingMonika KauraОценок пока нет

- M 14 Final Financial Reporting Guideline AnswersДокумент16 страницM 14 Final Financial Reporting Guideline Answersmj192Оценок пока нет

- Financial Accounting and Auditing X - Costing (SEM VI)Документ24 страницыFinancial Accounting and Auditing X - Costing (SEM VI)721DEEPIKA SOYAОценок пока нет

- Capital BudgetingДокумент47 страницCapital BudgetingShaheer AliОценок пока нет

- Practice Exam #2Документ12 страницPractice Exam #2Mat MorashОценок пока нет

- Intermediate Financial Accounting I: Current Liabilities and ContingenciesДокумент37 страницIntermediate Financial Accounting I: Current Liabilities and Contingenciesrain06021992Оценок пока нет

- Draft Solutions Diploma in IFRS For SMEs Final Exam JD21Документ84 страницыDraft Solutions Diploma in IFRS For SMEs Final Exam JD21Vuthy DaraОценок пока нет

- Present ValueДокумент8 страницPresent ValueFarrukhsgОценок пока нет

- S A Ipcc Nov 2011 - GR IДокумент97 страницS A Ipcc Nov 2011 - GR ISaibhumi100% (1)

- Accf 2204Документ7 страницAccf 2204Avi StrikyОценок пока нет

- The Appraisal of Capital Projects: C. G. LewinДокумент28 страницThe Appraisal of Capital Projects: C. G. LewinBhuvana ArasuОценок пока нет

- Chapter 13 Appendix CДокумент30 страницChapter 13 Appendix Cfoxstupidfox100% (1)

- Regression Analysis MethodДокумент6 страницRegression Analysis MethodMiccah Jade CastilloОценок пока нет

- Final Review Questions SolutionsДокумент5 страницFinal Review Questions SolutionsNuray Aliyeva100% (1)

- Question of Capital BudgetingДокумент7 страницQuestion of Capital Budgeting29_ramesh170100% (2)

- Cash Flow AnalysisДокумент12 страницCash Flow AnalysisHassan SaeedОценок пока нет

- Intermediate Accounting Solutions Chapter 3Документ27 страницIntermediate Accounting Solutions Chapter 3jharris1063% (8)

- Caluclation of VoidДокумент8 страницCaluclation of VoidفتىالصحراءفتىالصحراءОценок пока нет

- Notes On Capital BudgetingДокумент3 страницыNotes On Capital BudgetingCheshta Suri100% (1)

- BSMAN3009 Accounting For Managers 20 June 2014 Exam PaperДокумент8 страницBSMAN3009 Accounting For Managers 20 June 2014 Exam Paper纪泽勇0% (1)

- Capital BudgettingДокумент9 страницCapital BudgettingRussel BarquinОценок пока нет

- Accounting Assignment PDFДокумент18 страницAccounting Assignment PDFMohammed SafwatОценок пока нет

- Gls University Faculty of Commerce Sub: Advanced Corporate Account - 2 Objective Questions (17-18) Unit:-Accounts of Banking CompaniesДокумент11 страницGls University Faculty of Commerce Sub: Advanced Corporate Account - 2 Objective Questions (17-18) Unit:-Accounts of Banking Companiessumathi psgcas0% (1)

- MBA-I Sem - II Subject: Financial Management (202) : Assignment Submission: 5 Nov 2016Документ3 страницыMBA-I Sem - II Subject: Financial Management (202) : Assignment Submission: 5 Nov 2016ISLAMICLECTURESОценок пока нет

- The Figures in The Margin On The Right Side Indicate Full MarksДокумент16 страницThe Figures in The Margin On The Right Side Indicate Full MarksJatin GalaОценок пока нет

- Capital BudgetingДокумент2 страницыCapital BudgetingEdmon ManalotoОценок пока нет

- Jun 2003 SolutionsДокумент10 страницJun 2003 SolutionsJosh LebetkinОценок пока нет

- Feasibility Assignment 1&2 AnswersДокумент12 страницFeasibility Assignment 1&2 AnswersSouliman MuhammadОценок пока нет

- FAB Assignment 2020-2021 - UpdatedДокумент7 страницFAB Assignment 2020-2021 - UpdatedMuhammad Hamza AminОценок пока нет

- Chidrenplan - 21-3-2022 3.7.36Документ5 страницChidrenplan - 21-3-2022 3.7.36Sumanth MuvvalaОценок пока нет

- HouseДокумент6 страницHouseSumanth MuvvalaОценок пока нет

- IoT Value Chain Sensors To Software Website4 xfKk3MLДокумент24 страницыIoT Value Chain Sensors To Software Website4 xfKk3MLSumanth MuvvalaОценок пока нет

- Rera RepresentationДокумент8 страницRera RepresentationSumanth MuvvalaОценок пока нет

- Zurich FundsДокумент34 страницыZurich FundsSumanth MuvvalaОценок пока нет

- NAC Pitch Book - Jan 2022Документ16 страницNAC Pitch Book - Jan 2022Sumanth MuvvalaОценок пока нет

- Financial Model - Checklist - IRLДокумент1 страницаFinancial Model - Checklist - IRLSumanth MuvvalaОценок пока нет

- EMEA Map (I) : Text in Here Text in Here Text in HereДокумент4 страницыEMEA Map (I) : Text in Here Text in Here Text in HereSumanth MuvvalaОценок пока нет

- BetasДокумент11 страницBetasFelipe Rincon TorresОценок пока нет

- Gmat Handbook 2019 05 02Документ42 страницыGmat Handbook 2019 05 02duc anhОценок пока нет

- Buy or Rent A House Calculations - Ankur WarikooДокумент6 страницBuy or Rent A House Calculations - Ankur WarikooVivek GuptaОценок пока нет

- Dubai AttractionsДокумент1 страницаDubai AttractionsSumanth MuvvalaОценок пока нет

- ReadmeДокумент1 страницаReadmeSumanth MuvvalaОценок пока нет

- DomesticPrices Gasoline2019Документ2 страницыDomesticPrices Gasoline2019Sumanth MuvvalaОценок пока нет

- Affordable Housing Drive Hits A HurdleДокумент3 страницыAffordable Housing Drive Hits A HurdleSumanth MuvvalaОценок пока нет

- Business FinanceДокумент199 страницBusiness FinanceSumanth Muvvala100% (8)

- Steps For Converting Private Joint Stock Company To Public Joint Stock Company Pre-IPO Steps Before Hiring ProtivitiДокумент2 страницыSteps For Converting Private Joint Stock Company To Public Joint Stock Company Pre-IPO Steps Before Hiring ProtivitiSumanth MuvvalaОценок пока нет

- CH 1 - 4450Документ20 страницCH 1 - 4450Sumanth MuvvalaОценок пока нет

- Capital BudgetingДокумент41 страницаCapital BudgetingSudipta BanerjeeОценок пока нет

- Contents RevisedДокумент92 страницыContents RevisedAnoopKumarMangarajОценок пока нет

- Travel OrderДокумент2 страницыTravel OrderStephen EstalОценок пока нет

- RISO RZ User GuideДокумент112 страницRISO RZ User GuideJojo AritallaОценок пока нет

- 20131022-Additive Manufacturing & Allied Technologies, PuneДокумент56 страниц20131022-Additive Manufacturing & Allied Technologies, Puneprakush_prakushОценок пока нет

- Article On Role of Cyberspace in Geopolitics-PegasusДокумент5 страницArticle On Role of Cyberspace in Geopolitics-PegasusIJRASETPublicationsОценок пока нет

- (Guide) Supercharger V6 For Everyone, Make Your Phone Faster - Xda-DevelopersДокумент7 страниц(Guide) Supercharger V6 For Everyone, Make Your Phone Faster - Xda-Developersmantubabu6374Оценок пока нет

- 033 - Flight Planning Monitoring - QuestionsДокумент126 страниц033 - Flight Planning Monitoring - QuestionsEASA ATPL Question Bank100% (4)

- CHAPTER I KyleДокумент13 страницCHAPTER I KyleCresiel Pontijon100% (1)

- Check Out The Buyers Guide On FacebookДокумент28 страницCheck Out The Buyers Guide On FacebookCoolerAdsОценок пока нет

- MBF100 Subject OutlineДокумент2 страницыMBF100 Subject OutlineMARUTI JEWELSОценок пока нет

- Bylaws of A Texas CorporationДокумент34 страницыBylaws of A Texas CorporationDiego AntoliniОценок пока нет

- Faithful Love: Guitar SoloДокумент3 страницыFaithful Love: Guitar SoloCarol Goldburg33% (3)

- Comparativa Microplex F40 Printronix P8220 enДокумент1 страницаComparativa Microplex F40 Printronix P8220 enangel ricaОценок пока нет

- English Literature Coursework Aqa GcseДокумент6 страницEnglish Literature Coursework Aqa Gcsef5d17e05100% (2)

- Revised Study Material - Economics ChandigarhДокумент159 страницRevised Study Material - Economics ChandigarhvishaljalanОценок пока нет

- Toeic VocabularyДокумент10 страницToeic VocabularyBrian Niblo80% (5)

- Antonov 225 - The Largest - Airliner in The WorldДокумент63 страницыAntonov 225 - The Largest - Airliner in The WorldFridayFunStuffОценок пока нет

- Student's T DistributionДокумент6 страницStudent's T DistributionNur AliaОценок пока нет

- GlobalДокумент24 страницыGloballaleye_olumideОценок пока нет

- UN Layout Key For Trade DocumentsДокумент92 страницыUN Layout Key For Trade DocumentsСтоян ТитевОценок пока нет

- Pinto pm5 Tif 02Документ24 страницыPinto pm5 Tif 02Salem BawazirОценок пока нет

- Fish Siomai RecipeДокумент12 страницFish Siomai RecipeRhyz Mareschal DongonОценок пока нет

- Updated PDPДокумент540 страницUpdated PDPnikulaaaasОценок пока нет

- Queen - Hammer To Fall ChordsДокумент3 страницыQueen - Hammer To Fall ChordsDavideContiОценок пока нет

- Problem Solving Questions: Solutions (Including Comments)Документ25 страницProblem Solving Questions: Solutions (Including Comments)Narendrn KanaesonОценок пока нет

- Strategi Meningkatkan Kapasitas Penangkar Benih Padi Sawah (Oriza Sativa L) Dengan Optimalisasi Peran Kelompok TaniДокумент24 страницыStrategi Meningkatkan Kapasitas Penangkar Benih Padi Sawah (Oriza Sativa L) Dengan Optimalisasi Peran Kelompok TaniHilmyTafantoОценок пока нет

- Business Maths Chapter 5Документ9 страницBusiness Maths Chapter 5鄭仲抗Оценок пока нет

- Fix LHA Whole PagesДокумент81 страницаFix LHA Whole PagesvuonghhОценок пока нет

- Man of The House Faq: About MothДокумент2 страницыMan of The House Faq: About MothPrapya BarmanОценок пока нет

- Topics For Oral PresentationДокумент6 страницTopics For Oral PresentationMohd HyqalОценок пока нет

- Transportation Engineering Unit I Part I CTLPДокумент60 страницTransportation Engineering Unit I Part I CTLPMadhu Ane NenuОценок пока нет

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingОт EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingРейтинг: 4.5 из 5 звезд4.5/5 (17)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNОт Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNРейтинг: 4.5 из 5 звезд4.5/5 (3)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursОт EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursРейтинг: 4.5 из 5 звезд4.5/5 (8)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 4.5 из 5 звезд4.5/5 (14)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisОт EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisРейтинг: 5 из 5 звезд5/5 (6)

- Finance Basics (HBR 20-Minute Manager Series)От EverandFinance Basics (HBR 20-Minute Manager Series)Рейтинг: 4.5 из 5 звезд4.5/5 (32)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОт Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОценок пока нет

- Financial Risk Management: A Simple IntroductionОт EverandFinancial Risk Management: A Simple IntroductionРейтинг: 4.5 из 5 звезд4.5/5 (7)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successОт EverandReady, Set, Growth hack:: A beginners guide to growth hacking successРейтинг: 4.5 из 5 звезд4.5/5 (93)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialРейтинг: 4.5 из 5 звезд4.5/5 (32)

- Value: The Four Cornerstones of Corporate FinanceОт EverandValue: The Four Cornerstones of Corporate FinanceРейтинг: 4.5 из 5 звезд4.5/5 (18)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursОт EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursРейтинг: 4.5 из 5 звезд4.5/5 (34)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetОт EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetРейтинг: 5 из 5 звезд5/5 (2)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamОт EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamОценок пока нет

- How to Measure Anything: Finding the Value of Intangibles in BusinessОт EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessРейтинг: 3.5 из 5 звезд3.5/5 (4)

- Joy of Agility: How to Solve Problems and Succeed SoonerОт EverandJoy of Agility: How to Solve Problems and Succeed SoonerРейтинг: 4 из 5 звезд4/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistОт EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistРейтинг: 4.5 из 5 звезд4.5/5 (73)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsОт EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsРейтинг: 5 из 5 звезд5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanОт EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanРейтинг: 4.5 из 5 звезд4.5/5 (79)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistОт EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistРейтинг: 4 из 5 звезд4/5 (32)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОценок пока нет

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityОт EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityРейтинг: 4.5 из 5 звезд4.5/5 (4)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)От EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Рейтинг: 4.5 из 5 звезд4.5/5 (4)

- The Synergy Solution: How Companies Win the Mergers and Acquisitions GameОт EverandThe Synergy Solution: How Companies Win the Mergers and Acquisitions GameОценок пока нет