Академический Документы

Профессиональный Документы

Культура Документы

BUS 401 Week 2 Quiz

Загружено:

assignmentclick110 оценок0% нашли этот документ полезным (0 голосов)

28 просмотров4 страницыbus 401,uop bus 401,uop bus 401complete course,uop bus 401 entire course,uop bus 401 week 1,uop bus 401 week 2,uop bus 401 week 3,uop bus 401 week 4,uop bus 401 week 5,uop bus 401 tutorials,bus 401 assignments,bus 401 help

Авторское право

© © All Rights Reserved

Доступные форматы

DOC, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документbus 401,uop bus 401,uop bus 401complete course,uop bus 401 entire course,uop bus 401 week 1,uop bus 401 week 2,uop bus 401 week 3,uop bus 401 week 4,uop bus 401 week 5,uop bus 401 tutorials,bus 401 assignments,bus 401 help

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

28 просмотров4 страницыBUS 401 Week 2 Quiz

Загружено:

assignmentclick11bus 401,uop bus 401,uop bus 401complete course,uop bus 401 entire course,uop bus 401 week 1,uop bus 401 week 2,uop bus 401 week 3,uop bus 401 week 4,uop bus 401 week 5,uop bus 401 tutorials,bus 401 assignments,bus 401 help

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 4

BUS 401 Week 2 Quiz

Check this A+ tutorial guideline at

http://www.assignmentclick.com/

BUS-401-NEW/BUS-401-Week-2Quiz

1.) The longer we have to wait for a future amount to be

received

the lower its present value will be.

the higher its present value will be.

Time does not affect present value, so it doesnt matter

how long we have to wait.

Beyond 10 years the value doesnt change anymore

because 10 years might as well be 20 years.

2.) Compounding means that:

dollar interest the first year is multiplied by the number

of years to get total interest.

the same dollar amount of interest is paid each period.

interest is paid on interest earned in earlier periods.

the rate of interest grows over time.

3.) An ordinary annuity has its first payment ______, but an

annuity due has its first payment _________.

at the beginning of the period; at the beginning of the

period.

at the beginning of the period; at the end of the period.

at the end of the period; at the end of the period.

at the end of the period; at the beginning of the period.

4.) The great majority of stock trades occur:

in the secondary markets.

in the primary market.

as IPOs (initial public offerings).

directly between the company and investors.

5.) Shareholders gains come in the form of:

only dividends.

only capital gains.

dividends and capital gains.

interest payments.

6.) Interest rates are given as annual rates. If semiannual

(twice a year) compounding is being used, then you would

make the following adjustments:

Double the rate and double the number of years.

Double the rate and halve the number of years.

Halve the rate and halve the number of years.

Halve the rate and double the number of years.

7.) Which of the following is true of the structure of a

zero-coupon bond?

an annuity of interest payments and a single principal

payment at maturity

no interim interest payments but a variable payment at

maturity, depending on interest rates

an annuity of payments comprised of both interest and

principal

no interim interest payments and a single payment at

maturity

8.) If we make the assumption that a companys dividends

grow at some constant rate, then we can value the stock

as:

a growing perpetuity.

a growing annuity.

a perpetuity.

an annuity.

9.) Which of the following is NOT true of preferred stock?

Preferred stock generally pays a fixed dividend.

Preferred stock is a perpetuity.

Dividends on preferred stock are tax deductible.

Preferred stock dividends have a higher priority than

common stock dividends.

10.) Zeta Corporation just paid a $2.00 dividend. Analysts

believe that Zeta Corporations dividend will grow by 20%

next year, and then settle into a constant growth regime

at 5% per year into the future. If investors assign a

required rate of return of 12% to Zetas stock, what

should the stock sell for today?

$30.00

$32.14

$34.29

$36.00

For more classes visit

http://www.assignmentclick.c

om

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Multiple Choice Questio10Документ21 страницаMultiple Choice Questio10Achiket Anand DesaiОценок пока нет

- Example Paper CF Exam 2Документ6 страницExample Paper CF Exam 2Ashton Kyle ClarkeОценок пока нет

- IT Chem F5 SPM Model Paper (E)Документ10 страницIT Chem F5 SPM Model Paper (E)Norzawati NoordinОценок пока нет

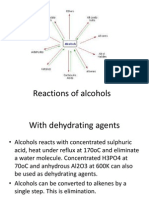

- Reactions of AlcoholsДокумент10 страницReactions of AlcoholsNeen NaazОценок пока нет

- Jawaban Soal Problem Brigham MankeuДокумент4 страницыJawaban Soal Problem Brigham MankeuArttikaОценок пока нет

- FINANCE 6301 Individual Assignment #1 PJM Due February 29, 2016Документ3 страницыFINANCE 6301 Individual Assignment #1 PJM Due February 29, 2016Sijo VMОценок пока нет

- Project On Parallel EconomyДокумент22 страницыProject On Parallel EconomySarthak Mathur50% (2)

- Bomb Calorimeter ReportДокумент18 страницBomb Calorimeter ReportRami Chaoul0% (1)

- Classification of HydrocarbonsДокумент9 страницClassification of Hydrocarbonsdave_1128Оценок пока нет

- Classification Tests For HydrocarbonsДокумент4 страницыClassification Tests For HydrocarbonsGracelyn GatusОценок пока нет

- Bab 1 Kimia PolimerДокумент77 страницBab 1 Kimia PolimeryunitaОценок пока нет

- IandF CT1 201709 ExamДокумент6 страницIandF CT1 201709 ExamViorel AdirvaОценок пока нет

- LBYCH32 - Formal Laboratory Report 1 - Experiment 2Документ9 страницLBYCH32 - Formal Laboratory Report 1 - Experiment 2Charmaine MaghirangОценок пока нет

- Bond AnalysisДокумент4 страницыBond AnalysisLinda Zhou100% (2)

- Fixed Income Trading Strategies 2007Документ106 страницFixed Income Trading Strategies 2007Ben Boudraf100% (1)

- Learning ObjectiveДокумент13 страницLearning Objectivevineet singhОценок пока нет

- Experiment 7 - Heterogenous Equilibria FWR PDFДокумент6 страницExperiment 7 - Heterogenous Equilibria FWR PDFkm3197100% (1)

- Valuation of Non SLR Securities QДокумент15 страницValuation of Non SLR Securities QjayaОценок пока нет

- Dyeing of Polyamide FibresДокумент53 страницыDyeing of Polyamide FibresParul PrajapatiОценок пока нет

- Submission 2Документ2 страницыSubmission 2lxОценок пока нет

- Ex 1 PPДокумент8 страницEx 1 PPUday Prakash SahuОценок пока нет

- Dfe 4 B 043 Bcca 419825Документ11 страницDfe 4 B 043 Bcca 419825Sarvesh DubeyОценок пока нет

- Towards Recycling of Textile FibersДокумент75 страницTowards Recycling of Textile FibersMusa EltayebОценок пока нет

- Idx Statistic 2014Документ151 страницаIdx Statistic 2014accounting nusaindahОценок пока нет

- Coordination Chemistry TestДокумент3 страницыCoordination Chemistry TestSabitra Rudra100% (1)

- Promissory Note ExamplesДокумент17 страницPromissory Note ExamplesGellie Vale T. Managbanag100% (1)

- NSE Equity Research Module 1 PDFДокумент143 страницыNSE Equity Research Module 1 PDFBaneОценок пока нет

- 07 Chem 105 LComputation ResultsДокумент10 страниц07 Chem 105 LComputation ResultsBandiyah Sri AprilliaОценок пока нет

- Gold Bond Form PDFДокумент5 страницGold Bond Form PDFrakesh kumar100% (1)

- Financial Market Problems and FormulasДокумент3 страницыFinancial Market Problems and FormulasNufayl KatoОценок пока нет