Академический Документы

Профессиональный Документы

Культура Документы

Magni-Tech Industries Berhad

Загружено:

khai_tajolОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Magni-Tech Industries Berhad

Загружено:

khai_tajolАвторское право:

Доступные форматы

Magni-Tech Industries Berhad

( Incorporated in Malaysia ; Company No. 422585-V )

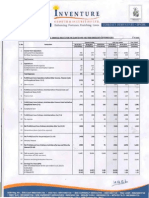

Condensed Consolidated Income Statement

Unaudited Interim Financial Report For The Third Quarter Ended 31 January 2016

3rd Quarter

Revenue

Operating Expenses

Year to Date - 9 Months

31-1-2016

31-1-2015

31-1-2016

31-1-2015

RM'000

RM'000

RM'000

RM'000

268,921

200,376

660,081

539,652

(235,690)

(180,425)

(592,509)

(497,909)

Other Operating Income

264

2,710

11,601

2,435

Profit from Operations

33,495

22,661

79,173

44,178

777

541

4,484

3,535

(121)

(112)

Investment Related Income

Finance Costs

(349)

(352)

Profit before Taxation

34,151

23,090

83,308

47,361

Taxation

(8,085)

(5,597)

(20,038)

(11,781)

Net Profit after Taxation

26,066

17,493

63,270

35,580

26,066

17,492

63,270

35,578

Profit attributable to:

Owners of the Company

Non-controlling interests

Basic earnings per share (Sen)

26,066

17,493

63,270

35,580

16.02

10.75

38.88

21.86

The Condensed Consolidated Statement of Financial Position should be read in conjunction with the audited financial statements

for the year ended 30 April 2015 and the accompanying explanatory notes attached to the interim financial statements.

Magni-Tech Industries Berhad

( Incorporated in Malaysia ; Company No. 422585-V )

Unaudited Condensed Consolidated Statement of Financial Position as at 31 January 2016

Unaudited

@ 31-01-2016

Audited

@ 30-04-2015

ASSETS

RM'000

RM'000

Non-current Assets

Property, Plant and Equipment

Investment Properties

Quoted Shares

Unquoted Shares

Other Investments

55,688

105

1,052

17,820

43,600

118,265

58,111

110

1,096

17,820

44,218

121,355

71,474

141,827

140

81,764

4,359

64,051

82,722

19

66,088

2,951

299,564

215,831

417,829

337,186

162,732

149,438

108,488

164,276

Non-controlling Interests

312,170

32

272,764

32

Total Equity

312,202

272,796

6,592

6,547

86,962

12,073

99,035

52,446

5,397

57,843

Total Liabilities

105,627

64,390

TOTAL EQUITY AND LIABILITIES

417,829

337,186

1.92

1.68

Current Assets

Inventories

Receivables

Current Tax Assets

Deposits with Licensed Banks

Cash and Bank Balances

TOTAL ASSETS

EQUITY AND LIABILITIES

Equity attributable to Owners of the Company

Share Capital

Reserves

(Par value per share RM1)

Non-current Liability

Deferred Taxation

Current Liabilities

Payables

Current Tax Liabilities

Net Assets per share (RM)

Footnote (i)

Footnotes :

(i)

The computation for Net Assets per share is based on 162,731,842 issued shares, after the Bonus Issue which was

completed on 12 November 2015 (Note 17).

The Condensed Consolidated Statement of Financial Position should be read in conjunction with the audited financial statements

for the year ended 30 April 2015 and the accompanying explanatory notes attached to the interim financial statements.

Magni-Tech Industries Berhad

( Incorporated in Malaysia ; Company No. 422585-V )

Condensed Consolidated Statement of Comprehensive Income

Unaudited Interim Financial Report For The Third Quarter Ended 31 January 2016

3rd Quarter

Net Profit

Year to Date - 9 Months

31-1-2016

31-1-2015

31-1-2016

31-1-2015

RM'000

RM'000

RM'000

RM'000

26,066

17,493

63,270

35,580

Other Comprehensive Income

Gain/(Loss) on changes in fair value of available-for-sale

financial assets

Total Comprehensive Income

(269)

(427)

26,071

17,224

63,273

35,153

26,071

17,223

63,273

35,151

Total Comprehensive Income attributable to :

Owners of the Company

Non-controlling interests

26,071

1

17,224

63,273

2

35,153

The Condensed Consolidated Statement of Financial Position should be read in conjunction with the audited financial statements

for the year ended 30 April 2015 and the accompanying explanatory notes attached to the interim financial statements.

Magni-Tech Industries Berhad

(Incorporated in Malaysia ; Company No. 422585-V)

Condensed Consolidated Statement of Changes in Equity

Unaudited Interim Financial Report For The Third Quarter Ended 31 January 2016

| - - - - - - - Attributable to Owners of the Company - - - - - - - |

Non-distributable

Distributable

Share

Capital

Share

Premium

AFS (^)

Reserves

Retained

Profits

Total

Reserves

Total

Interests

Total

Equity

RM'000

RM'000

RM'000

RM'000

RM'000

RM'000

RM'000

RM'000

272,764

Non-controlling

Financial period ended 31 January 2016

Balance as at 1 May 2015

Bonus Issue

Total Comprehensive Income

for the financial period

108,488

3,766

160,510

164,276

54,244

(3,766)

(50,478)

(54,244)

162,732

32

-

272,796

-

63,270

63,273

63,273

63,273

173,302

173,305

336,037

32

336,069

Transaction with Owners

Dividends in respect of year

ended 30 April 2015

(10,849)

(10,849)

(10,849)

(10,849)

Dividends in respect of year

ending 30 April 2016

(13,018)

(13,018)

(13,018)

(13,018)

149,435

149,438

312,170

32

312,202

Balance as at 31 January 2016

162,732

108,488

3,766

220

122,410

126,396

234,884

32

234,916

(427)

35,578

35,151

35,151

35,153

(207) 157,988

161,547

270,035

34

270,069

(^) Available-for-sale

Financial period ended 31 January 2015

Balance as at 1 May 2014

Total Comprehensive Income

for the financial period

108,488

3,766

Transaction with Owners

Dividends in respect of year

ended 30 April 2014

Balance as at 31 January 2015

108,488

3,766

(8,679)

(207) 149,309

(8,679)

152,868

(8,679)

261,356

34

The Condensed Consolidated Statement of Financial Position should be read in conjunction with the audited financial statements for the year ended

30 April 2015 and the accompanying explanatory notes attached to the interim financial statements.

(8,679)

261,390

Magni-Tech Industries Berhad

(Incorporated in Malaysia ; Company No. 422585-V)

Condensed Consolidated Statement of Cash Flows

Unaudited Interim Financial Report For The Third Quarter Ended 31 January 2016

(Unaudited)

9 months to

31-1-2016

RM'000

(Unaudited)

9 months to

31-1-2015

RM'000

Cash flows from operating activities

Profit before tax

Adjustments for :

Depreciation

Dividend income

Gain on disposal of other investment

Interest income

(Gain)/Loss on disposal of property, plant and equipment

Property, plant and equipment written off

83,308

47,361

4,217

(3,325)

(144)

(1,015)

(178)

898

4,332

(2,141)

(297)

(1,097)

144

306

Operating profit before working capital changes

83,761

48,608

(Increase)/decreased in inventories

(7,423)

3,980

(59,104)

(8,214)

Increase in payables

34,516

2,114

Cash generated from operations

51,750

46,488

(13,440)

(9,925)

38,310

36,563

3,325

1,015

178

32,130

(2,686)

(31,321)

2,141

1,097

760

14,304

(2,289)

(40,151)

2,641

(24,138)

(23,867)

(8,679)

Net increase in cash and cash equivalents

17,084

3,746

Cash and cash equivalents at beginning

69,039

70,987

Cash and cash equivalents at end

86,123

74,733

4,359

3,674

81,764

86,123

71,059

74,733

Increase in receivables

Net Income tax paid

Net cash from operating activities

Cash flows from investing activities

Net dividend received

Interest received

Proceeds from disposal of property, plant and equipment

Proceeds from disposal of other investments

Purchase of property, plant and equipment

Purchase of other investments

Net cash from / (used in) investing activities

Cash flows from financing activities

Dividends paid

Cash & Cash Equivalents comprise the following :-

Cash and bank balances

Deposits with licensed banks

The Condensed Consolidated Statement of Financial Position should be read in conjunction with the audited financial statements

for the year ended 30 April 2015 and the accompanying explanatory notes attached to the interim financial statements.

Magni-Tech Industries Berhad

(Incorporated in Malaysia ; Company No. 422585-V)

Notes To The Quarterly Financial Report

Unaudited Interim Financial Report For The Third Quarter Ended 31 January 2016

1)

Basis of Preparation

Adoption of new MFRSs, Amendments/Improvements to MFRSs and IC Interpretation

The condensed consolidated interim financial report is unaudited and has been prepared in accordance with Malaysian

Accounting Standards Board ("MFRS") 134 - Interim Financial Reporting Standards in Malaysia and International Accounting

Standards ("IAS") 34 - Interim Financial Reporting and paragraph 9.22 of the Main Market Listing Requirements of Bursa

Malaysia Securities Berhad.

The interim financial statements should be read in conjunction with the audited financial statements of the Group for the year

ended 30 April 2015. These explanatory notes attached to the interim financial statements provide an explanation of events

and transactions that are significant to an understanding of the changes in the financial position and performance of the Group

since the financial year ended 30 April 2015.

The Group has not early adopted the standards and interpretations that have been issued but not yet effective for the financial

year.

The application of the new/revised standards and interpretations is not expected to have any significant impact on the financial

statements upon their initial adoption.

2)

Audit Report of Preceding Annual Financial Statements

The auditors report of the Companys most recent annual financial statements for the financial year ended 30 April 2015 was

not subject to any qualification.

3)

Seasonal or Cyclical Factors

The operations of the Group were not materially affected by seasonal or cyclical factors.

4)

Unusual Items

There were no unusual items affecting the assets, liabilities, equity, net income or cash flows of the Group for the 9 months

ended 31 January 2016 ("financial period").

5)

Material Changes in Estimates

There were no material changes in the estimates of amounts reported in the second quarter ended 31 January 2016 ("current

quarter").

6)

Change in Composition of the Group

There were no changes in the composition of the Group during the financial period.

7)

Debts and Equity Securities

There were no issuances, cancellations, repurchases, resale and repayments of debt and equity securities during the financial

period.

8)

Dividend Paid

During the financial period, the Company paid the following dividends :

(i) The single tier final dividend of 3 Sen per share and single tier special dividend of 7 Sen per share for the financial

year ended 30 April 2015 had been paid on 20 November 2015.

(ii) Single tier interim dividend of 5 Sen per share and single tier special dividend of 3 Sen per share in respect of the

financial year ending 30 April 2016 had been paid on 26 January 2016.

9)

Revaluation of Property, Plant and Equipment

There was no revaluation of property, plant and equipment during the financial period.

10) Subsequent Events

There were no material subsequent events for the financial period, up to the date of this announcement.

11) Segment Information

The segmental analysis of the Group's operations for the financial period is as follows :

External

Inter

-segment

Revenue

RM'000

RM'000

Packaging

Garment Manufacturing

Elimination - Inter-segment Revenue

90,365

58

569,716

Total Revenue

660,081

(58)

-

Financial period

to 31-1-2016

RM'000

90,423

569,716

(58)

660,081

Magni-Tech Industries Berhad

(Incorporated in Malaysia ; Company No. 422585-V)

Notes To The Quarterly Financial Report

Unaudited Interim Financial Report For The Third Quarter Ended 31 January 2016

Financial period

to 31-1-2016

11) Segment Information (Cont'd)

Results

RM'000

Packaging

Garment manufacturing

4,303

75,056

79,359

(186)

79,173

Unallocated corporate expenses

Profit from operations

Investment Related Income :

Dividend income

Interest income

Gain on disposal of other investment

3,325

1,015

144

4,484

(349)

83,308

(20,038)

63,270

Finance costs

Profit before taxation

Taxation

Net Profit after Taxation

12) Analysis of Performance

The Group is primarily engaged in the manufacturing of garments for export and a wide range of flexible plastic packaging,

corrugated packaging products and offset printing packaging products. The garment segment accounted for about 86.3% of

Group's revenue for the financial period.

The key factors that affect the performance of garment business include mainly the labour costs, other operating costs, and

demand for the garments and the ability of management to cope with change.

For the packaging segment, the key factors that affect its performance include mainly raw material costs, such as Kraft liner,

test liner, medium papers, paper boards, polyethylene resins and etc.), operating costs, demand for the packaging products

and the abilility of management to cope with change.

Current Quarter vs Preceding Year Corresponding Quarter

Revenue for the current quarter increased by 34.2% as compared to the preceding year corresponding quarter.

Revenue for the current quarter for garment business increased by 40.6% mainly due to the favourable effects of USD against

Ringgit and higher sales orders. However, revenue for packaging business dropped slightly by 0.6%.

Profit before taxation (PBT) for the current quarter increased by 47.9% mainly due to higher garment revenue but was offset by

lower operating income arising from lower currency exchange gain.

Financial Period vs Preceding Year Corresponding Period

Revenue for the financial period increased by 22.3% as compared to the preceding year corresponding period.

Revenue for the financial period for garment business increased by 27.1% mainly due to the favourable effects of USD against

Ringgit and higher sale orders. However, revenue for packaging business dropped slightly by 1.0%.

PBT for the financial period increased by 75.9% mainly attributed to higher garment revenue, higher other operating income

arising from favourable currency exchange rate and positive results from on-going productivity improvement and cost control

measures.

13) Material Variance of Results vs Preceding Quarter

Revenue for the current quarter increased by 36.3% as compared to the preceding quarter.

Revenue for the current quarter for garment and packaging segments increased by 42.2% and 3.2% mainly due to higher

sales orders received.

PBT for the current quarter increased by 19.1% mainly due to higher revenue but was offset by lower other operating income

arising from lower currency exchange gain.

14) Future Prospects

The manufacturing and sales of garment will still be the Group's major revenue contributor. The Group maintains a cautiously

positive outlook for the remaining quarter of the current financial year amid the global economic uncertainty. Both the garment

and packaging businesses are expected to remain profitable for the remaining quarter of the current financial year.

15) Taxation

The tax charge for the current quarter or financial period is made up as follows :

Provision for current tax

Provision for deferred tax

Over provision of prior year's current tax

Current quarter Financial period

to 31-1-2016

to 31-1-2016

RM'000

RM'000

8,227

(126)

(16)

20,022

44

(28)

8,085

20,038

There is no significant variance in the effective tax rate for the current quarter and financial period as compared to the statutory

rate.

Magni-Tech Industries Berhad

(Incorporated in Malaysia ; Company No. 422585-V)

Notes To The Quarterly Financial Report

Unaudited Interim Financial Report For The Third Quarter Ended 31 January 2016

16) Profit Forecast or Profit Guarantee

There was no profit forecast made in any public document.

17) Corporate Proposals

As announced earlier, the 54,243,942 Bonus Shares were issued, listed and quoted on the Main Market of Bursa Securities on

12 November 2015, marking completion of the Bonus Issue.

There were no corporate proposals announced but not completed as at the date of this announcement.

18) Group Borrowings and Debts Securities

The Group has no borrowings and debt securities as at the end of the financial period.

19) Material Litigation

There were no material litigations during the financial period.

20) Contingent Liabilities and Assets

There were no contingent assets or contingent liabilities since the end of the last annual reporting period.

21) Capital Commitments

As at 31 January 2016, the Group had a capital commitment of approximately RM2.278 million in respect of the acquistion of

commercial properties.

22) Dividend

Dividends for the current financial year ending 30 April 2016 are as follows:

(a) (i) first single tier interim dividend of 5 sen per share and single tier special dividend of 3 Sen per share totalling RM13.019 million

(2015 : nil) which were approved by the Directors on 22 December 2015 and paid on 26 January 2016;

(b) (ii) the Directors has on even date approved the second single tier interim dividend of 3 Sen per share (2015 : single tier interim

dividend of 3.33 Sen per share - adjusted due to bonus issue) and single tier special dividend of 2 Sen (2015 : Nil) totalling

RM8.137 million). The entitlement and payment dates will be separately announced today.

Total dividends approved to date for the current financial year amount to 13 Sen per share (2015 : 3.33 Sen single tier interim

dividend per share - adjusted due to bonus issue). Based on the no. of ordinary shares in issue on even date, the total dividends

paid and payable for the financial year ending 30 April 2016 are RM21.155 million, representing 33.4% of the Group's attributable

profits for the financial period.

23) Earnings Per Share (EPS)

The basic EPS has been calculated by dividing the Groups profit attribuitable to owners of the Company during the period by the

number of ordinary shares in issue of 162,731,842 as at 31 January 2016 :

Current quarter

to 31-1-2016

Profit attributable to Owners of the Company

(RM'000)

Quarter to

31-1-2015

Financial period Financial period

to 31-1-2016

31-1-2015

26,066

17,492

63,270

35,578

No. of ordinary shares (Note 17)

('000)

162,732

162,732

162,732

162,732

Basic EPS

(Sen)

16.02

10.75

38.88

21.86

There is no diluted EPS as the Company does not have any convertible financial instruments as at the end of the financial period.

24) Profit Before Tax

Profit before tax is arrived at after charging/(crediting) the following items :-

Interest income

Dividend income

Interest expenses

Depreciation and amortisation

Net unrealised (gain)/loss on foreign exchange

Net realised (gain)/loss on foreign exchange

Impairment loss on quoted investments

Gain on disposal of other investment

Fair value gain reclassified from equity upon disposal of available-for-sale investments

Gain / (Loss) on disposal of property, plant and equipment

Provision for and write off of Inventories / receivables

Plant and equipment written off

(Gain) / loss on derivatives / Exceptional items

Current quarter

to 31-1-2016

Quarter to Financial period Financial period

31-1-2015

to 31-1-2016

to 31-1-2015

RM'000

RM'000

RM'000

RM'000

(313)

(458)

1,390

(1,274)

1,146

(6)

-

(234)

(174)

1,469

950

(3,598)

(133)

23

-

(1,015)

(3,325)

4,217

3,811

(14,845)

(144)

(178)

898

-

(1,097)

(2,141)

4,332

819

(3,146)

(297)

144

306

-

Magni-Tech Industries Berhad

(Incorporated in Malaysia ; Company No. 422585-V)

Notes To The Quarterly Financial Report

Unaudited Interim Financial Report For The Third Quarter Ended 31 January 2016

25) Realised and Unrealised Profits

The breakdown of retained profits of the Group as at end of the financial period, into realised and unrealised profits are as follows:

As at 31-1-2016 As at 30-04-2015

Total retained earnings of the Company and its subsidiaries :

RM'000

- realised

189,116

- unrealised

(10,403)

178,713

Less : Consolidated adjustments

By Order of the Board

Tan Sri Dato' Seri Tan Kok Ping

Chairman

18 March 2016

c.c. Securities Commission

RM'000

197,143

(7,355)

189,788

(29,278)

(29,278)

149,435

160,510

Вам также может понравиться

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosОт EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Документ8 страницStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Документ9 страницStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosОт EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosОценок пока нет

- Signed LGE FY16 Q1 English Report Separate PDFДокумент62 страницыSigned LGE FY16 Q1 English Report Separate PDFvinodОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ8 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Документ5 страницStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Документ9 страницStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- TTR RRL: LimitedДокумент5 страницTTR RRL: LimitedShyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Form B, Auditors Report For March 31, 2016 (Result)Документ8 страницStandalone & Consolidated Financial Results, Form B, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ5 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Drb-Hicom Berhad: Interim Financial Report For The Financial Period Ended 30 September 2015Документ22 страницыDrb-Hicom Berhad: Interim Financial Report For The Financial Period Ended 30 September 2015cybermen35Оценок пока нет

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Документ3 страницыFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ5 страницFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For September 30, 2016 (Result)Документ23 страницыStandalone Financial Results For September 30, 2016 (Result)Shyam SunderОценок пока нет

- SP Setia Annual Report 2005Документ13 страницSP Setia Annual Report 2005Xavier YeohОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ23 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Документ5 страницStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- EMSCFIN-FARДокумент37 страницEMSCFIN-FARPuwanachandran KaniegahОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ7 страницStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ5 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Документ9 страницStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Oldtown QRДокумент26 страницOldtown QRfieya91Оценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Документ11 страницStandalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results For Dec 31, 2015 (Standalone) (Result)Документ4 страницыFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ6 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Announces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Документ7 страницAnnounces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For March 31, 2015 (Result)Документ3 страницыStandalone Financial Results For March 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Документ5 страницStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Документ11 страницFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Pakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)Документ8 страницPakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)mohammadtalhaОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Weida 2011's 4th QTR Return - 31032011Документ23 страницыWeida 2011's 4th QTR Return - 31032011Kai Sheng RooraОценок пока нет

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ11 страницStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Interim Financial Result For 3rd Quarter Ended 31.01.2013Документ23 страницыInterim Financial Result For 3rd Quarter Ended 31.01.2013nickong53Оценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ6 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Документ5 страницAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Документ5 страницStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Content Notes Unit 1: See Revision SheetДокумент3 страницыContent Notes Unit 1: See Revision Sheetkhai_tajolОценок пока нет

- Economics Unit 4: CompetitivenessДокумент1 страницаEconomics Unit 4: Competitivenesskhai_tajolОценок пока нет

- (Farmers) (Hairdressers) (Few Firms Control Market) (One Firm Controls Market)Документ2 страницы(Farmers) (Hairdressers) (Few Firms Control Market) (One Firm Controls Market)khai_tajolОценок пока нет

- Collusion!!: Overt Collusion Tacit CollusionДокумент1 страницаCollusion!!: Overt Collusion Tacit Collusionkhai_tajolОценок пока нет

- 1 Electronvolt Is Defined As An Amount of Kinetic Energy Gained by An Electron When It Is Accelerated Across A Potential Difference of 1 VoltДокумент1 страница1 Electronvolt Is Defined As An Amount of Kinetic Energy Gained by An Electron When It Is Accelerated Across A Potential Difference of 1 Voltkhai_tajolОценок пока нет

- Case Study - ACI and Marico BDДокумент9 страницCase Study - ACI and Marico BDsadekjakeОценок пока нет

- VI. 80% Owned-Subsidiary: Cost Model - Full Goodwill Approach Downstream and Upstream of Property, Unrealized Gain and Realized Gain On SaleДокумент3 страницыVI. 80% Owned-Subsidiary: Cost Model - Full Goodwill Approach Downstream and Upstream of Property, Unrealized Gain and Realized Gain On SaleMa'arifa HussainОценок пока нет

- BUSCOM ActivityДокумент14 страницBUSCOM ActivityLerma MarianoОценок пока нет

- Analysis Using T-AccountsДокумент10 страницAnalysis Using T-AccountsChris Aruh BorsalinaОценок пока нет

- Capital and Revenue ExpendituresДокумент30 страницCapital and Revenue ExpendituresBir MallaОценок пока нет

- Wiley Chapter 1. Financial Accounting. IFRS EditionДокумент67 страницWiley Chapter 1. Financial Accounting. IFRS Editionshuguftarashid100% (2)

- Test Financial AcountingДокумент12 страницTest Financial Acountingtouria100% (1)

- Financial Statements of Not-for-Profit Organisations: Meaning of Key Terms Used in The ChapterДокумент202 страницыFinancial Statements of Not-for-Profit Organisations: Meaning of Key Terms Used in The ChapterVISHNUKUMAR S VОценок пока нет

- f7 Mock QuestionДокумент20 страницf7 Mock Questionnoor ul anumОценок пока нет

- QuizДокумент5 страницQuizmiss independent100% (1)

- Quali - ReviewДокумент32 страницыQuali - ReviewLA M AEОценок пока нет

- Kelompok 2 - Segment Reporting-1Документ8 страницKelompok 2 - Segment Reporting-1Khansa AuliaОценок пока нет

- Pre-Quali Examination - Level III - Cluster C, PDF FSUU AccountingДокумент13 страницPre-Quali Examination - Level III - Cluster C, PDF FSUU AccountingRobert CastilloОценок пока нет

- Tutorial 2 Q Part 1 - Accounting Cycle For Trade and ServicesДокумент8 страницTutorial 2 Q Part 1 - Accounting Cycle For Trade and ServicesNezelle WongОценок пока нет

- 2018A QE Part 3 Partnerships PracticeДокумент11 страниц2018A QE Part 3 Partnerships PracticeNicole Andrea TuazonОценок пока нет

- 2 Topsim WS2012 13 InitialsituationДокумент8 страниц2 Topsim WS2012 13 InitialsituationMaliha KhanОценок пока нет

- Detailed Lesson Plan - Fabm 1 (Second)Документ12 страницDetailed Lesson Plan - Fabm 1 (Second)Maria Benna Mendiola100% (5)

- CH 8Документ20 страницCH 8Firas HamadОценок пока нет

- Problem 1Документ13 страницProblem 1Ghaill CruzОценок пока нет

- Standard Balance Sheet - YUNITA WIDHY ASTUTIДокумент1 страницаStandard Balance Sheet - YUNITA WIDHY ASTUTIDian Novia PurwandariОценок пока нет

- Hsslive Xii Acc 3 Admission of A Partner KeyДокумент8 страницHsslive Xii Acc 3 Admission of A Partner KeyShinu ShinadОценок пока нет

- Group Assignment - Questions - RevisedДокумент6 страницGroup Assignment - Questions - Revised31231023949Оценок пока нет

- Final Account BBAДокумент37 страницFinal Account BBAgrivand100% (1)

- Statutory Merger Problem 1Документ2 страницыStatutory Merger Problem 1Meleen TadenaОценок пока нет

- Problem 4-4 Dindorf CompanyДокумент5 страницProblem 4-4 Dindorf Companymelati50% (4)

- Pas 1 - Presentation of Financial StatementsДокумент30 страницPas 1 - Presentation of Financial StatementsLee Anne Gallema Camarao100% (3)

- QB 11,12,14,15Документ59 страницQB 11,12,14,15Giang Thái HươngОценок пока нет

- CH 03 Review and Discussion Problems SolutionsДокумент23 страницыCH 03 Review and Discussion Problems SolutionsArman Beirami57% (7)

- Problems On Depreciation AccountingДокумент3 страницыProblems On Depreciation Accountingmaheshbendigeri5945Оценок пока нет

- Sol. Man. - Chapter 11 - She (Part 2) - 2021Документ26 страницSol. Man. - Chapter 11 - She (Part 2) - 2021Crystal Rose TenerifeОценок пока нет

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideОт Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideРейтинг: 2.5 из 5 звезд2.5/5 (2)

- A Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersОт EverandA Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersРейтинг: 4.5 из 5 звезд4.5/5 (11)

- The Layman's Guide GDPR Compliance for Small Medium BusinessОт EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessРейтинг: 5 из 5 звезд5/5 (1)

- Building a World-Class Compliance Program: Best Practices and Strategies for SuccessОт EverandBuilding a World-Class Compliance Program: Best Practices and Strategies for SuccessОценок пока нет

- Financial Shenanigans, Fourth Edition: How to Detect Accounting Gimmicks & Fraud in Financial ReportsОт EverandFinancial Shenanigans, Fourth Edition: How to Detect Accounting Gimmicks & Fraud in Financial ReportsРейтинг: 4 из 5 звезд4/5 (26)

- Frequently Asked Questions in International Standards on AuditingОт EverandFrequently Asked Questions in International Standards on AuditingРейтинг: 1 из 5 звезд1/5 (1)

- Mastering Internal Audit Fundamentals A Step-by-Step ApproachОт EverandMastering Internal Audit Fundamentals A Step-by-Step ApproachРейтинг: 4 из 5 звезд4/5 (1)

- A Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowОт EverandA Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowОценок пока нет

- Bribery and Corruption Casebook: The View from Under the TableОт EverandBribery and Corruption Casebook: The View from Under the TableОценок пока нет

- Guide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyОт EverandGuide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyОценок пока нет

- Business Process Mapping: Improving Customer SatisfactionОт EverandBusiness Process Mapping: Improving Customer SatisfactionРейтинг: 5 из 5 звезд5/5 (1)

- GDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekОт EverandGDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekОценок пока нет