Академический Документы

Профессиональный Документы

Культура Документы

R 1 Any PDF

Загружено:

DunkMeИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

R 1 Any PDF

Загружено:

DunkMeАвторское право:

Доступные форматы

Form R-1

Virginia Department of Taxation

Business Registration Form

Go to www.tax.virginia.gov/iReg to register or update your business information online.

Reason for Submitting this Form:

New Business Registration. Complete applicable lines in Sections I, II, IX and all applicable tax types.

Add an Additional Tax Type to Existing Account. Complete applicable lines in Sections I, II, IX and applicable tax types.

Add a New Business Location to Existing Account. Complete applicable lines in Sections I, II, IX and applicable tax types.

Update Contact or Responsible Officer Information. Complete applicable lines in Sections I, II and IX.

Section I - Business Profile Information

1

Business Name. Enter full legal name of business. Sole Proprietors - enter owners name (first, middle initial, last).

Federal Employer Identification Number (FEIN). This number is required to register. To obtain a FEIN, contact the IRS.

2a If Sole Proprietor, enter Social Security Number (SSN) of Owner.

3

Entity Type. Check One. See instructions.

Sole Proprietor (or single

member limited liability

company taxed as an

individual)

Estate/Trust

Corporation

C Corporation

Non-Profit Corporation

Limited Liability Company

electing to file as a

corporation

Pass-Through Entity

S Corporation

General Partnership

Limited Partnership

Limited Liability

Partnership

Limited Liability Company

electing to file as a passthrough entity

Other Entity

Government Entity

Non-Profit

Organization

Cooperative

Credit Union

Bank

Savings and Loan

Public Service

Corporation

Trading As Name (or Doing Business As Name). This is the name known by the public.

Primary Business Activity. Describe:

Check if you will be selling any tobacco products.

Federal Government

Virginia State Government

Local Government

Other State Government (not

Virginia)

Other Government

Check if you intend to operate a retail food establishment, food manufacturing operation, or food warehouse that sells food

products or dietary supplements. Exception: If you intend to operate solely as a restaurant, do not check this box. See

instructions.

6

Primary Business Address. Enter the physical address of your business.

Street Address

Primary Mailing Address. Enter a mailing address if different from your Primary Business Address.

Street Address or P.O. Box

City, State, ZIP

City, State, ZIP

Primary Contact Information. Use this section to designate an individual authorized to discuss tax matters on behalf of this

business. The named contact is permitted to resolve specific tax issues and discuss transactions with the Department. See

instructions.

Name

Title

Contact Phone Number

(

R-1 1501220 (Rev. 03/15)

Page 2

FEIN ______________________________________________

Section II - Responsible Party

Responsible Party / Corporations and Pass-Through Entities Only - Identify corporate, partnership or limited liability officers

responsible for tax obligations. See instructions. Providing this information assists Department representatives in verifying authorized

contacts and resolving tax matters.

a) Name of Responsible Party

c) Relationship Title

b) SSN

d) Relationship Date

e) Home Phone Number (Including Area Code)

f) Residence Address

g) City, State, ZIP

a) Name of Responsible Party

b) SSN

c) Relationship Title

d) Relationship Date

f) Residence Address

e) Home Phone Number (Including Area Code)

g) City, State, ZIP

Section III - Annual Tax

A Corporation Income Tax

1

Date you became liable for Corporation Income tax (MM/DD/YY).

Date and state of incorporation

Tax Year. Must be same as your Federal taxable year. Check one.

State

Date (MM/DD/YY)

Calendar Year (1/1 12/31) or Fiscal Year - Beginning month ______________ and Ending month ______________

or

52-53 Taxable year - Beginning month _______________ and Ending month _ ______________

Mailing Address. (If different from the Mailing Address on page 1)

Street Address or P.O. Box.

City, State, ZIP

Subsidiary or Affiliate. Complete the following only if this business is a subsidiary or affiliated with another business and the

parent is filing a combined or consolidated return.

Combined return. Check if business is a subsidiary or affiliate and parent files combined return.

Consolidated return. Check if business is a subsidiary or affiliate and parent files consolidated return.

Parent Companys Business Name

Parent Companys FEIN

Contact Information. If different from Primary Contact on page 1, enter contact information for person designated for this tax.

Name

Title

Contact Phone Number

Page 3

FEIN ______________________________________________

Pass-Through Entity

1

Date you became liable for reporting Pass-Through Entity Income (MM/DD/YY).

Date and state of formation

Tax Year. Must be same as your Federal taxable year. Check one.

Calendar Year (1/1 12/31) or Fiscal Year - Beginning month _________ and Ending month __________

or

52-53 Taxable year - Beginning month _________ and Ending month __________

Mailing Address (If different from the Mailing Address on page 1)

Street Address or P.O. Box

State

Date (MM/DD/YY)

City, State, ZIP

Contact Information. If different from Primary Contact on page 1, enter contact information for this tax.

Name

Title

Contact Phone Number

C Insurance Premiums License Tax

1

Date you became liable for Insurance Premiums License Tax (MM/DD/YY).

Insurance Company. If you are an insurance company pending licensure by the Virginia State Corporation Commission

Bureau of Insurance, complete the Insurance Company Section below. Insurance companies must also complete and attach

the Declaration of Estimated Insurance Premiums License Tax, Form R-1A. Form R-1A is available to download or print on

our website, www.tax.virginia.gov.

Company Type and Company Sub-Type are provided to you by the Bureau of Insurance.

License Number

Company Type

Company Sub-Type

Surplus Lines Broker and Surplus Lines Agency. If a Surplus Lines Broker or Agency, enter producer number below.

Producer Number

Mailing Address (If different from the Mailing Address on page 1)

Street Address or P.O. Box

City, State, ZIP

Contact Information. If different from Primary Contact on page 1, enter contact information for this tax.

Name

Title

Contact Phone Number

Page 4

FEIN ______________________________________________

Section IV - Employer Withholding Tax

1

Date you had employees and began paying wages (MM/DD/YY).

Filing Frequency. Will be determined by the Dept. of Taxation and reviewed periodically. Indicate below the amount of Virginia

Income Tax you expect to withhold each quarter.

Quarterly Filer - Less Than $300 Virginia Withholding Per Quarter

Pension Plan Only

Monthly Filer - Between $300 and $3,000 Virginia Withholding Per Quarter

Household Employer - Annual Filer

Semi-Weekly Filer - $3,000 or Greater Virginia Withholding Per Quarter

JAN

FEB MAR APR MAY JUN

Seasonal Business. If open only part of the year,

check months business is active.

Mailing Address (If different from the Mailing Address on page 1)

Street Address or P.O. Box

JUL AUG

SEP

OCT NOV DEC

City, State, ZIP

Contact Information. If different from Primary Contact on page 1, enter contact information for this tax.

Name

Title

Contact Phone Number

Section V - Retail Sales and Use Tax

A In-State Dealers. If your business location is in Virginia, use this area to register for Retail Sales and Use Tax.

1

Date You Became Liable. Anticipated date of first retail sale (MM/DD/YY).

Filing Options. Virginia retail sales businesses with multiple locations, indicate how you will submit your return(s).

a. File one combined return for all business locations in the same locality.

b. File one consolidated return for all business locations.

c. File a separate return for each business location.

3

4

5

Seasonal Business. If open only part of the year,

check months business is active.

JAN

FEB MAR APR MAY JUN

JUL AUG

SEP

OCT NOV DEC

Specialty Dealer. Check this box if you sell at flea markets, craft shows, etc. at various locations in Virginia.

Business Locations. Complete this section to add a new business location in Virginia whether you are registering for the first

time or adding a location to your existing account. If adding multiple locations, attach a separate sheet using the same format

or use the business location schedule located at the end of this document.

a) Add This Location to This Virginia Account Number

b) Date Location Opened

c) Trade Name of Business

d) Business Locality FIPS Code (Lookup at www.tax.virginia.gov)

e) Business Physical Street Address - (No P.O. Boxes.)

City, State and ZIP

f) Mailing Address ( If different from above)

City, State and ZIP

Contact Information. If different from Primary Contact on page 1, enter contact information for this tax.

Name

Title

Contact Phone Number

Page 5

FEIN ______________________________________________

Out-of-State Dealers. Use this area to register for Retail Sales and Use Tax. Every dealer outside Virginia doing business

in Virginia as a dealer is required to register and to collect and pay the tax on all taxable tangible personal property sold or

delivered for storage, use or consumption in Virginia.

1

Date You Became Liable. Date of first sale or use in Virginia (MM/DD/YY)

Seasonal Business. If open only part of the year,

check months business is active.

Mailing Address. If different from the Mailing Address on page 1

JAN

FEB MAR APR MAY JUN

Street Address or P.O. Box

JUL AUG

SEP

OCT NOV DEC

City, State, ZIP

Contact Information. If different from Primary Contact on page 1, enter contact information for this tax.

Name

Title

Contact Phone Number

C Vending Machine Sales Tax

1

Existing Accounts. Enter Virginia Account Number.

Date You Became Liable. Anticipated date of first retail sale (MM/DD/YY).

City or County. Enter the City or County of each location you will operate vending machines (see instructions).

Location 1

Location 2

Location 3

Location 4

Location 6

Mailing Address (If different from the Mailing Address on page 1)

Street Address or P.O. Box

Location 5

City, State, ZIP

Contact Information. If different from Primary Contact on page 1, enter contact information for this tax.

Name

Title

Contact Phone Number

Other Sales and Use Tax. Use this area to register for Sales Type Specific and Use Taxes.

1

Indicate Tax Type(s) & date you became liable. This is the date of the first sale of a particular product or service, or the

purchase date of the item for use tax purposes.

Tax Type

Tax Type

Date You Became Liable

Consumer Use Tax

Date _________________

Watercraft Tax

Date _________________

Digital Media Fee

Date _________________

Tire Recycling Fee

Date _________________

Number of Aircraft Owned

Previous Year:

Virginia Commercial Fleet

Aircraft License Number:

JAN

FEB MAR APR MAY JUN

Seasonal Business. If open only part of the year,

check months business is active.

Mailing Address (If different from the Mailing Address on page 1)

Street Address or P.O. Box

Date You Became Liable

Aircraft Tax

Date _ ____________________

_____________________

_____________________

JUL AUG

SEP

OCT NOV DEC

City, State, ZIP

Contact Information. If different from Primary Contact on page 1, enter contact information for this tax.

Name

Title

Contact Phone Number

Page 6

FEIN ______________________________________________

Section VI - Communications Tax

A communications service is any electronic transmission of voice, data, audio, video or other information by or through any

electronic, radio, satellite, cable, optical, microwave or other medium or method regardless of the protocol used for the transmission

or conveyance. Communications services subject to the tax include: landline telephone services (including Voice Over Internet

Protocol); wireless telephone services; cable television; satellite television; satellite radio.

1

Date You Became Liable. Date communications services were provided or anticipated date (MM/DD/YY).

Mailing Address (If different from the Mailing Address on page 1)

Street Address or P.O. Box

City, State, ZIP

Contact Information. If different from Primary Contact on page 1, enter contact information for this tax.

Name

Title

Contact Phone Number

Section VII - Litter Tax

A litter tax is imposed on every business in the state who, on January 1 of the taxable year, was engaged in business as a

manufacturer, wholesaler, distributor, or retailer of certain enumerated products. If you are not in business on January 1, you are not

liable for Virginia Litter Tax until the succeeding year. The products that subject the business to litter tax are: food for human or pet

consumption, groceries, cigarettes and tobacco products, soft drinks and carbonated waters, beer and other malt beverages, wine,

newspapers and magazines, paper products and household paper, glass containers, metal containers, plastic or fiber containers

made of synthetic material, cleaning agents and toiletries, non-drug drugstore sundry products, distilled spirits, and motor vehicle

parts. This tax does not apply to individual consumers.

1

Existing Accounts. Enter Virginia Account Number.

Date You Became Liable. Date you became liable for Litter Tax (MM/DD/YY).

Number of business locations subject to litter tax

Mailing Address (If different from the Mailing Address on page 1)

Street Address or P.O. Box

City, State, ZIP

Contact Information. If different from Primary Contact on page 1, enter contact information for this tax.

Name

Title

Contact Phone Number

Page 7

FEIN ______________________________________________

Section VIII - Commodity and Excise Taxes

1

Tax Type - See instructions. Indicate tax type and the date you became liable. (MM/DD/YY).

Corn Assessment

Date ______________

Forest Products Tax

Date ______________

Small Grains Assessment Date ______________

Cotton Assessment

Date ______________

Peanut Excise Tax

Date ______________

Soft Drink Excise Tax

Date ______________

Egg Excise Tax

Date ______________

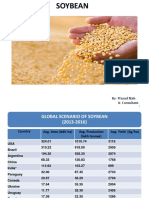

Soybean Assessment

Date_______________

Sheep Assessment

Date_______________

Mailing Address (If different from the Mailing Address on page 1)

Street Address or P.O. Box

City, State, ZIP

Contact Information. If different from Primary Contact on page 1, enter contact information for this tax.

Name

Title

Contact Phone Number

Section IX - Signature

Important - Read Before Signing

This registration form must be signed by an officer of the corporation, limited liability company or unincorporated association, who

is authorized to sign on behalf of the organization. The proprietor must sign for a sole proprietorship.

Under penalty of law, I believe the information on the application to be true and correct.

Signature

Print Name

Title

Date

Daytime Phone Number

For assistance with this form, or for information about taxes not listed in this form, please call (804) 367-8037.

Fax the completed form to (804) 367-2603 or mail it to:

Virginia Department of Taxation

Registration Unit

P.O. Box 1114

Richmond, VA 23218-1114

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Net Zero Energy Buildings PDFДокумент195 страницNet Zero Energy Buildings PDFAnamaria StranzОценок пока нет

- Healthpro Vs MedbuyДокумент3 страницыHealthpro Vs MedbuyTim RosenbergОценок пока нет

- Sponsorship Prospectus - FINALДокумент20 страницSponsorship Prospectus - FINALAndrea SchermerhornОценок пока нет

- RMC 46-99Документ7 страницRMC 46-99mnyng100% (1)

- Belt and Road InitiativeДокумент17 страницBelt and Road Initiativetahi69100% (2)

- Hi Shield PДокумент2 страницыHi Shield PDunkMeОценок пока нет

- HI 1060 Specialty Fiber PDFДокумент2 страницыHI 1060 Specialty Fiber PDFDunkMeОценок пока нет

- Hi 8586pdiДокумент9 страницHi 8586pdiDunkMeОценок пока нет

- Extraordinary Encounters PDFДокумент307 страницExtraordinary Encounters PDFDunkMe100% (2)

- CD Hybridoma Medium UGДокумент2 страницыCD Hybridoma Medium UGDunkMeОценок пока нет

- Stm/U: Direct Current Electronic Drivers Alimentatori Elettronici in Corrente ContinuaДокумент1 страницаStm/U: Direct Current Electronic Drivers Alimentatori Elettronici in Corrente ContinuaDunkMeОценок пока нет

- Televic Confidea DD CD WiFiДокумент3 страницыTelevic Confidea DD CD WiFiDunkMeОценок пока нет

- X 1 Fast-Acting Ceramic Tube Fuses: ABC SeriesДокумент2 страницыX 1 Fast-Acting Ceramic Tube Fuses: ABC SeriesDunkMeОценок пока нет

- Cambridge Pre U Guide For Higher Education Admissions Staff in The UkДокумент4 страницыCambridge Pre U Guide For Higher Education Admissions Staff in The UkDunkMeОценок пока нет

- Product Overview: Features: Applications: Also AvailableДокумент2 страницыProduct Overview: Features: Applications: Also AvailableDunkMeОценок пока нет

- PM - 15-4344 U and T Visa Law Enforcement Resource Guide 11Документ33 страницыPM - 15-4344 U and T Visa Law Enforcement Resource Guide 11DunkMeОценок пока нет

- Part 1. Victim Information: Form I-918 Supplement B, U Nonimmigrant Status CertificationДокумент3 страницыPart 1. Victim Information: Form I-918 Supplement B, U Nonimmigrant Status CertificationDunkMeОценок пока нет

- 1171 A 22016 PoliticsДокумент10 страниц1171 A 22016 PoliticsDunkMeОценок пока нет

- Acknowledgement & Assumption of Risk and Release of LiabilityДокумент2 страницыAcknowledgement & Assumption of Risk and Release of LiabilityDunkMeОценок пока нет

- Request For Permanent Premise Approval InstructionsДокумент3 страницыRequest For Permanent Premise Approval InstructionsDunkMeОценок пока нет

- 2017 Metrobank - Mtap Deped Math Challenge Elimination Round Grade 2 Time Allotment: 60 MinДокумент2 страницы2017 Metrobank - Mtap Deped Math Challenge Elimination Round Grade 2 Time Allotment: 60 MinElla David100% (1)

- India of My Dreams: India of My Dream Is, Naturally, The Same Ancient Land, Full of Peace, Prosperity, Wealth andДокумент2 страницыIndia of My Dreams: India of My Dream Is, Naturally, The Same Ancient Land, Full of Peace, Prosperity, Wealth andDITSAОценок пока нет

- Scheme For CBCS Curriculum For B. A Pass CourseДокумент18 страницScheme For CBCS Curriculum For B. A Pass CourseSumanОценок пока нет

- Asiawide Franchise Consultant (AFC)Документ8 страницAsiawide Franchise Consultant (AFC)strawberryktОценок пока нет

- Ahmed BashaДокумент1 страницаAhmed BashaYASHОценок пока нет

- Stock-Trak Project 2013Документ4 страницыStock-Trak Project 2013viettuan91Оценок пока нет

- Posting Journal - 1-5 - 1-5Документ5 страницPosting Journal - 1-5 - 1-5Shagi FastОценок пока нет

- Pune HNIДокумент9 страницPune HNIAvik Sarkar0% (1)

- Bill CertificateДокумент3 страницыBill CertificateRohith ReddyОценок пока нет

- Revenue Procedure 2014-11Документ10 страницRevenue Procedure 2014-11Leonard E Sienko JrОценок пока нет

- Guide To Accounting For Income Taxes NewДокумент620 страницGuide To Accounting For Income Taxes NewRahul Modi100% (1)

- Contract Costing 07Документ16 страницContract Costing 07Kamal BhanushaliОценок пока нет

- Levacic, Rebmann - Macroeconomics. An I... o Keynesian-Neoclassical ControversiesДокумент14 страницLevacic, Rebmann - Macroeconomics. An I... o Keynesian-Neoclassical ControversiesAlvaro MedinaОценок пока нет

- Flex Parts BookДокумент16 страницFlex Parts BookrodolfoОценок пока нет

- Soybean Scenario - LaturДокумент18 страницSoybean Scenario - LaturPrasad NaleОценок пока нет

- HQ01 - General Principles of TaxationДокумент14 страницHQ01 - General Principles of TaxationJimmyChao100% (1)

- Correlations in Forex Pairs SHEET by - YouthFXRisingДокумент2 страницыCorrelations in Forex Pairs SHEET by - YouthFXRisingprathamgamer147Оценок пока нет

- Ifland Engineers, Inc.-Civil Engineers - RedactedДокумент18 страницIfland Engineers, Inc.-Civil Engineers - RedactedL. A. PatersonОценок пока нет

- Pandit Automotive Pvt. Ltd.Документ6 страницPandit Automotive Pvt. Ltd.JudicialОценок пока нет

- Calander of Events 18 3 2020-21Документ67 страницCalander of Events 18 3 2020-21Ekta Tractor Agency KhetasaraiОценок пока нет

- BS 6206-1981 PDFДокумент24 страницыBS 6206-1981 PDFwepverro100% (2)

- Trade Confirmation: Pt. Danareksa SekuritasДокумент1 страницаTrade Confirmation: Pt. Danareksa SekuritashendricОценок пока нет

- Delivering The Goods: Victorian Freight PlanДокумент56 страницDelivering The Goods: Victorian Freight PlanVictor BowmanОценок пока нет

- Patent Trolling in IndiaДокумент3 страницыPatent Trolling in IndiaM VridhiОценок пока нет

- Microsoft Word - CHAPTER - 05 - DEPOSITS - IN - BANKSДокумент8 страницMicrosoft Word - CHAPTER - 05 - DEPOSITS - IN - BANKSDuy Trần TấnОценок пока нет