Академический Документы

Профессиональный Документы

Культура Документы

Commercial Real Estate Finance Consultant in Los Angeles Orange County CA Steven Randall

Загружено:

StevenRandallАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Commercial Real Estate Finance Consultant in Los Angeles Orange County CA Steven Randall

Загружено:

StevenRandallАвторское право:

Доступные форматы

Steven J.

Randall

Irvine, CA 92602

H (714) 505-4534

C (714) 640-4656

SteveRandall@cox.net

EXPERIENCE

Commercial Real Estate Finance Consulting, President, 2016-Present

My twenty five plus years of broad experience in commercial real estate finance uniquely

qualifies me to supplement existing resources and provide rapid and significant

contributions to non-routine and complex real estate finance issues. My perspective is

one of identifying risk, how its properly priced and the means to mitigate risk.

Examples of Potential Client Situations Include:

Outside portfolio review for regulatory or audit compliance.

Independent portfolio analysis and valuation.

Additional resources for acquisition/disposition due diligence.

Special Projects/Complex asset resolution.

Examples of Relevant Skills Include:

Market and competitive property analysis across multiple markets and property types.

Cash flow analysis and projections using Excel/Argus.

Knowledge of debt and equity markets for potential asset recapitalization.

Risk Analysis/Sensitivity Analysis.

Clear and concise report writing and board/investment committee presentation

John Hancock Real Estate Finance, Irvine, CA, Senior Investment Officer, 2011-2015.

Senior team member for regional origination office of a national Life Insurance Co.

Responsible for sourcing, underwriting, securing committee approval and closing

commercial real estate loans of $10-100 million.

Consistently exceed regional goals. Responsible for in-house loan servicing.

Federal Deposit Insurance Corporation (FDIC), Irvine, CA, Receivership Resolution

Specialist/Asset Management (CG-14), 2009 2011.

Senior asset manager responsible for overseeing the resolution of the most complex nonperforming real estate and commercial credits managed by WCTSO.

Compile, research and draft detailed case write-ups prior to presentation to credit

committee.

Voting member of credit committee.

Participate in over 15 bank closings in the role of subject matter expert for

government insured loans.

MMA Realty Capital/ MONY Life Insurance Company, Irvine, CA, Regional VicePresident & Senior Director of Investments, 1997-2008.

Western regional production head for a NYSE Real Estate Company. Investments include

all major commercial and residential property types.

EDUCATION

Debt investment programs include permanent portfolio loans, construction and

bridge loans.

Equity type investment programs include mezzanine loans and participating debt/JV

structures.

Primary servicer for all debt and equity investments including borrower/partner

interface, investment modification approvals, enforcing remedies, and post

foreclosure asset management and disposition.

University of California, Los Angeles, MA 1981 (Emphasis in Real Estate Finance and

Development GPA: 3.5).

Вам также может понравиться

- Hire Purchase For Bcom and Nepal CAДокумент14 страницHire Purchase For Bcom and Nepal CANandani BurnwalОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- ILAEAnnual Report2015Документ80 страницILAEAnnual Report2015LunaFiaОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Rapport Startup 2023 PDFДокумент23 страницыRapport Startup 2023 PDFsalma hilaliОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- UCC 1 Security AgreementДокумент1 страницаUCC 1 Security Agreementtlh78great100% (7)

- Strengths, Weaknesses, Opportunities, Threats The SWOT Analysis - KWHSДокумент1 страницаStrengths, Weaknesses, Opportunities, Threats The SWOT Analysis - KWHSAyushi AggarwalОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Technical Analysis of MahindraДокумент3 страницыTechnical Analysis of MahindraRipunjoy SonowalОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Periodic MethodДокумент14 страницPeriodic MethodRACHEL DAMALERIOОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Bala Raksha Bhavan Rent Not File DT 07.02.2020Документ2 страницыBala Raksha Bhavan Rent Not File DT 07.02.2020District Child Protection Officer VikarabadОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Business-Today 200920 PDFДокумент94 страницыBusiness-Today 200920 PDFPriyabrataTaraiОценок пока нет

- Mabcredit BrochureДокумент15 страницMabcredit BrochurealfredogoncalvesjrОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Cross Country Comparison of Efficiency in Investment BankingДокумент26 страницCross Country Comparison of Efficiency in Investment Bankingnehanazare15Оценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Ratio Analysis of Shree Cement and Ambuja Cement Project Report 2Документ7 страницRatio Analysis of Shree Cement and Ambuja Cement Project Report 2Dale 08Оценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Free Credit Score and Report - Free Monthly Credit CheckДокумент3 страницыFree Credit Score and Report - Free Monthly Credit CheckSagar Chandra KhatuaОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Two Alternative Binomial Option Pricing Model Approaches To Derive Black-Scholes Option Pricing ModelДокумент27 страницTwo Alternative Binomial Option Pricing Model Approaches To Derive Black-Scholes Option Pricing ModelHyzcinth BorjaОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Digital BankingДокумент5 страницDigital BankingAmit SinghОценок пока нет

- Topic2 Part1Документ16 страницTopic2 Part1Abdul MoezОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Golden Rules of AccountingДокумент5 страницGolden Rules of AccountingVinay ChintamaneniОценок пока нет

- 24.4 SebiДокумент30 страниц24.4 SebijashuramuОценок пока нет

- Compare Savings Accounts & ISAs NationwideДокумент1 страницаCompare Savings Accounts & ISAs NationwideVivienneОценок пока нет

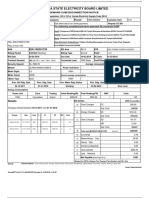

- KsebBill 1165411013809Документ1 страницаKsebBill 1165411013809Jio CpyОценок пока нет

- Amalgmation, Absorbtion, External ReconstructionДокумент12 страницAmalgmation, Absorbtion, External Reconstructionpijiyo78Оценок пока нет

- By Bakampa Brian Baryaguma : Real Property, 5 Ed, Stevens & Sons LTD, p.913)Документ11 страницBy Bakampa Brian Baryaguma : Real Property, 5 Ed, Stevens & Sons LTD, p.913)Real TrekstarОценок пока нет

- 2 Full 5-4a 5-4bДокумент82 страницы2 Full 5-4a 5-4banurag sonkarОценок пока нет

- T24 System Build Credit V1.0Документ30 страницT24 System Build Credit V1.0Quoc Dat Tran50% (2)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- FPT Software Company Financial Statement and Management Report 1Документ39 страницFPT Software Company Financial Statement and Management Report 1Huy Nguyễn NgọcОценок пока нет

- Company ProfileДокумент15 страницCompany ProfileAslam HossainОценок пока нет

- High Light - Chapter 26Документ64 страницыHigh Light - Chapter 26Samira AlhashimiОценок пока нет

- Funds Flow AnalysisДокумент105 страницFunds Flow AnalysisAmjad Khan100% (2)

- Ch17 - Analysis of Bonds W Embedded Options.AДокумент25 страницCh17 - Analysis of Bonds W Embedded Options.Akerenkang100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Management Accounting Module - VДокумент11 страницManagement Accounting Module - Vdivya kalyaniОценок пока нет