Академический Документы

Профессиональный Документы

Культура Документы

2008 Financial Crisis

Загружено:

prabhat_j19Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

2008 Financial Crisis

Загружено:

prabhat_j19Авторское право:

Доступные форматы

The American Sub-prime crisis

1. Trigger- central bank reduced lending rates and bond yields to 1% in 2004 as

part of its plan for reviving the economy after the dot com bust and 9/11

2. This in turn led banks to borrow more money and lend out more

3. Simultaneously, this also led to investors (American and foreign) to favor

other investments than American treasury bonds due to their low return rate.

4. The excess liquidity with the banks translated into greater lending, thus

providing easy access of liquidity for big purchases such as houses, cars, etc.

5. At the same time, the investors mentioned above recognized the housing

sector as the sector they wanted to invest in due to its characteristic of

continuous appreciation and thus sure-shot returns. It appeared to be a lowrisk and high-return investment.

6. Therefore, to provide a profitable investment instrument to investors, banks

began clubbing thousands of mortgages into instruments called Mortgage

backed securities and selling them to investors (these securities also

received AAA rating from credit-rating agencies such as Moodys and S&P).

The win-win logic being:

a. In case the borrower repaid the debt, the bank would make a profit

through the interest

b. In case the borrower defaulted, the bank would get the collateral (the

house) and then sell it off to someone else and make a profit

7. While this was going on, housing prices kept rising steadily in the US. As the

safe loans (i.e. loans to customers with good credit ratings) dried-up, banks

started handing out loans to risky customers (people with bad credit history

or unsteady jobs), or sub-prime lending to meet the demand of investors for

more such securities. Therefore, millions of people in the US bought houses

they could ill-afford or not afford at all, and bought them only because at that

point they thought they could repay the EMIs at the low interest. CDOs

(Collateralized Debt Obligations) were an ever riskier form of securities and

consisted primarily of such sub-prime mortgages.

8. However, soon after, such sub-prime customers started defaulting on their

payments. The banks now found themselves with an excessive inventory of

houses with no buyers in sight. As this situation arrived, housing prices

crashed, and buyers who were repaying their EMIs also realized that they

were paying the banks much more than what their house was now worth

e.g. I was paying $300,000 for a house that now cost only $90,000! Therefore

these customers too stopped their repayments. This in turn aggravated the

existing crisis and led to the precipitation of the sub-prime crisis of 2008.

Вам также может понравиться

- 2008 Financial CrisisДокумент1 страница2008 Financial Crisisprabhat_j19Оценок пока нет

- 2008 Financial CrisisДокумент1 страница2008 Financial Crisisprabhat_j19Оценок пока нет

- 2008 Financial CrisisДокумент1 страница2008 Financial Crisisprabhat_j19Оценок пока нет

- Gen YДокумент12 страницGen Yprabhat_j19Оценок пока нет

- Gen YДокумент13 страницGen Yprabhat_j19Оценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- SyllabusДокумент5 страницSyllabusBalbeer SinghОценок пока нет

- 1 OM-IntroductionДокумент35 страниц1 OM-IntroductionA11Shridhar SuryawanshiОценок пока нет

- Cosst Accounting SourceДокумент134 страницыCosst Accounting SourceIsabel FlonascaОценок пока нет

- List of Process For BBP Preparation (PP, SD, MM and FI)Документ22 страницыList of Process For BBP Preparation (PP, SD, MM and FI)Debi GhoshОценок пока нет

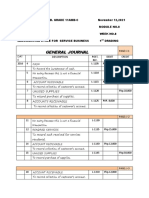

- Accounting Cycle for a Service BusinessДокумент5 страницAccounting Cycle for a Service BusinessKristel Mae PayotОценок пока нет

- Chapter-1-Regulatory FrameworkДокумент6 страницChapter-1-Regulatory FrameworkYean Soramy100% (1)

- Distribution in Rural Market.Документ4 страницыDistribution in Rural Market.Mitesh Kadakia100% (1)

- fileCHAPTER 1 Test QuestionsДокумент5 страницfileCHAPTER 1 Test QuestionsEsmeraldaОценок пока нет

- Engineering Economics (Model Paper)Документ4 страницыEngineering Economics (Model Paper)nitishgalaxyОценок пока нет

- Depriciation AccountingДокумент42 страницыDepriciation Accountingezek1elОценок пока нет

- Bản Sao Của DOWNYДокумент50 страницBản Sao Của DOWNYDuy AnhОценок пока нет

- MBA Case StudiesДокумент123 страницыMBA Case StudiesMariell Joy Cariño-TanОценок пока нет

- Reading 3 - Through What Channels Can You Get Teas Onto The European MarketДокумент9 страницReading 3 - Through What Channels Can You Get Teas Onto The European MarketTrần Lê Uyên ThiОценок пока нет

- TYBAF Project TopicsДокумент2 страницыTYBAF Project Topicsseema mundaleОценок пока нет

- 01 Conceptual Framework (Student)Документ23 страницы01 Conceptual Framework (Student)Christina DulayОценок пока нет

- Solutions To Chapter 2Документ9 страницSolutions To Chapter 2Alma Delos SantosОценок пока нет

- 1-The Nature and Importance of EntrepreneurshipДокумент10 страниц1-The Nature and Importance of EntrepreneurshipMuhammad AtharОценок пока нет

- Dawlance 1Документ11 страницDawlance 1SparksОценок пока нет

- Inventory Functions & ImportanceДокумент1 страницаInventory Functions & ImportanceRiad HossainОценок пока нет

- VOC To CTQ Conversion SampleДокумент5 страницVOC To CTQ Conversion SampleshivaprasadmvitОценок пока нет

- Key Point Slides - Ch9Документ10 страницKey Point Slides - Ch927Winanda Setyaning KridantikaОценок пока нет

- Class Guide - Sales Funnel Fundamentals PDFДокумент15 страницClass Guide - Sales Funnel Fundamentals PDFJayson Tabuen ChanchicoОценок пока нет

- Profile - Power Root MalaysiaДокумент2 страницыProfile - Power Root MalaysiaMuhamad SyafiqОценок пока нет

- Company Profil KAP Hendrawinata Eddy Sidharta & TanzilДокумент12 страницCompany Profil KAP Hendrawinata Eddy Sidharta & TanzilHusni YasinОценок пока нет

- Ingvysya 1Документ235 страницIngvysya 1Prathyusha KoguruОценок пока нет

- Ch08 PricingДокумент69 страницCh08 PricingDaniel KangОценок пока нет

- Overview of Ifrs Convergence Process in IndonesiaДокумент14 страницOverview of Ifrs Convergence Process in IndonesiaAngga PramadaОценок пока нет

- InfoQSample KanbanFromThe Inside Chapt4Документ41 страницаInfoQSample KanbanFromThe Inside Chapt4chansk4003Оценок пока нет

- Acctg201 Support Cost Department AllocationДокумент3 страницыAcctg201 Support Cost Department AllocationEab RondinaОценок пока нет

- REFERENCESДокумент2 страницыREFERENCESjessrylmae belza100% (1)