Академический Документы

Профессиональный Документы

Культура Документы

Tax Treaty - ASEAN

Загружено:

Timothy Jevon LieanderАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Tax Treaty - ASEAN

Загружено:

Timothy Jevon LieanderАвторское право:

Доступные форматы

Timothy Jevon Lieander

14/361200/EK/19720

Meeting 12: Tax Treaty ASEAN

For the Faculty of Economics and Business, Universitas Gadjah Mada

References: KPMG International 2013 ASEAN Tax Guide, KPMG Asia Pacific Tax Center Guide

Introduction

The need of the knowledge and further understanding regarding to the ASEAN Tax

matter including the Tax Treaty among the ASEAN countries is derived from the fact that in

the year of 2007, 10 ASEAN member countries made an agreement of the creation of the

ASEAN Economic Community (AEC) and ASEAN Free Trade Area (AFTA). This new economic

corporation will make it necessary for the ASEAN member countries to negotiate and make

a deal that comforts both of them including the tax matter in form of the agreement that is

called as the Tax Treaty. For this case it is called as the Tax Treaty ASEAN.

Summary

KPMG has made several key characteristic that identifies the AEC:

A competitive economic region

A region of equitable economic development

A region fully integrated into the global economy

AEC is a corporation that consist of 10 ASEAN member countries, the total population of

those 10 member countries is forecasted to reach 700 million people by 2020. Although, the

community has become effective since the December 2015, many believe that during the

first several years of its creation; the fully integrated economic community of south-east

Asia will not exist. However, it is predicted that the AEC will presents new opportunity for

ASEAN member states to create a competitive regional environment and it holds the

potential to transform ASEAN into the worlds next economic powerhouse. The one that is

needed in business among the ASEAN countries is the harmonization.

Based on the agreement in the AEC 2015 blueprint, there are several amendments of

tax policies:

The recognition of intellectual property as a major determinant of local value and

external competitiveness (item 44)

A call to harmonize the policy and legal infrastructure for e-commerce (item 59)

An objective to realize a more comprehensive investment agreement which

would increase investor confidence in ASEAN (item 26) and provide enhanced

protection to all investors and investment (item 27).

The Implication can come from the difference of Corporate Tax among ASEAN

countries, the different tax regulation has made the countries issue an alternative of the

same tax treatment that can help in eliminating the incentive of tax payers to shift from

high-tax jurisdiction to low-tax jurisdiction. Harmonization is heralded as a model for

regional integration but typically is that it limits member states sovereignty by restricting

the ability to decide their own tax rates as matter of national policy.

The problem may also arise from the difference of the Indirect Tax such as the

VAT/GST and Customs among the ASEAN member countries. The AEC will currently open up

a market of over 600 million people in countries where the average GDP growth is 5.4%.

This is believed to push consumer expenditure to a predicted 1.5 trillion by 2020. Along with

the increasing prevalence of middle-class segment the demand of goods and service will

increase the tax among ASEAN countries.

The requirement for freedom of trade among the ASEAN countries, it is expected

that by the implementation of AEC, the ASEAN-6 that includes Singapore, Thailand,

Philippines, Brunei, Indonesia and Malaysia and also the CMLV (Cambodia, Laos, Myanmar,

and Vietnam will set out the Common Effective Preferential Tariffs for ASEAN Free Trade

Area (CEPT AFTA) agreement.

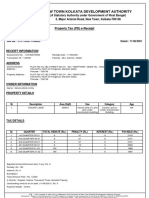

Here is the Double Tax Treaty Coverage that has existed among ASEAN countries,

Вам также может понравиться

- Permanent Establishment and Transfer PricingДокумент27 страницPermanent Establishment and Transfer PricingTimothy Jevon LieanderОценок пока нет

- Indonesian Values and Ideology - Searching of Indonesian CharatersДокумент1 страницаIndonesian Values and Ideology - Searching of Indonesian CharatersTimothy Jevon LieanderОценок пока нет

- Paper of Bussiness NegotitaionДокумент2 страницыPaper of Bussiness NegotitaionTimothy Jevon LieanderОценок пока нет

- Introduction To Law - Power PointДокумент16 страницIntroduction To Law - Power PointTimothy Jevon LieanderОценок пока нет

- Presentation 1 - Building A Strategic Internal Audit FunctionДокумент24 страницыPresentation 1 - Building A Strategic Internal Audit FunctionTimothy Jevon LieanderОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Advance To PayДокумент1 страницаAdvance To PayMayank RathodОценок пока нет

- On WCTДокумент28 страницOn WCTumaambekar123Оценок пока нет

- FINA1109 Lecture 6 2019 HandoutДокумент48 страницFINA1109 Lecture 6 2019 HandoutDylan AdrianОценок пока нет

- Maceda Vs ERBДокумент13 страницMaceda Vs ERBMargrein M. GreganaОценок пока нет

- Mark Scheme (Results) October 2019Документ21 страницаMark Scheme (Results) October 2019유리Оценок пока нет

- Course Curriculum of MBA in Oil and Gas ManagementДокумент31 страницаCourse Curriculum of MBA in Oil and Gas Managementantopaul2Оценок пока нет

- Example Withholding TaxДокумент2 страницыExample Withholding TaxRaudhatun Nisa'Оценок пока нет

- Chief Engineer IBIS-Indus Telemetry - HP CLJ 255dw Printer - Q171123 - NomanДокумент3 страницыChief Engineer IBIS-Indus Telemetry - HP CLJ 255dw Printer - Q171123 - NomanMumtaz Ali QaziОценок пока нет

- Exempt From TaxДокумент32 страницыExempt From TaxErik KaufmanОценок пока нет

- Economic Feasibility Study On Sitting of Soap Plant in The South Eastern NigeriaДокумент11 страницEconomic Feasibility Study On Sitting of Soap Plant in The South Eastern NigeriaMarienОценок пока нет

- C04-Fundamentals of Business Economics: Sample Exam PaperДокумент17 страницC04-Fundamentals of Business Economics: Sample Exam Paperhkanuradha100% (1)

- Union Direct Tax Performance Report 28 2016Документ111 страницUnion Direct Tax Performance Report 28 2016silvernitrate1953Оценок пока нет

- Civil Engineering ManualДокумент185 страницCivil Engineering ManualtipsypigОценок пока нет

- List of PI Questions For Bcom StudentsДокумент2 страницыList of PI Questions For Bcom StudentsAdyasha SahuОценок пока нет

- Unit 6 - Capital Structure and LeverageДокумент12 страницUnit 6 - Capital Structure and LeverageGizaw BelayОценок пока нет

- Taxation - Paper 11Документ8 страницTaxation - Paper 11Innocent Won Aber100% (1)

- Book Swconfig Policy ManagementДокумент306 страницBook Swconfig Policy ManagementAditya GourОценок пока нет

- Ugyen-ODL-Quantitative Techniques in Management - AssignmentA-Question 1Документ6 страницUgyen-ODL-Quantitative Techniques in Management - AssignmentA-Question 1Ugyen LingpaОценок пока нет

- PSPCL Diary Pbi and EnglishДокумент339 страницPSPCL Diary Pbi and EnglishAartiОценок пока нет

- City of Fort St. John - Pandemic Effect On The Operating Budget, March 2020Документ4 страницыCity of Fort St. John - Pandemic Effect On The Operating Budget, March 2020AlaskaHighwayNewsОценок пока нет

- Taxation: GlossaryДокумент8 страницTaxation: GlossarySara PattersonОценок пока нет

- Sh. Satya Dev Sharma, Jaipur Vs Assessee On 23 January, 2014Документ15 страницSh. Satya Dev Sharma, Jaipur Vs Assessee On 23 January, 2014sunОценок пока нет

- TallyДокумент38 страницTallyDhananjay RokadeОценок пока нет

- New Town Kolkata Development Authority: Property Tax (PD) E-ReceiptДокумент2 страницыNew Town Kolkata Development Authority: Property Tax (PD) E-ReceiptSSK DEVELOPERSОценок пока нет

- Sample Document Retention and Destruction PolicyДокумент3 страницыSample Document Retention and Destruction PolicyElyss SantiagoОценок пока нет

- Management Accountant - December 2011 PDFДокумент121 страницаManagement Accountant - December 2011 PDFSubir ChakrabartyОценок пока нет

- DARSHAN P Project Report On TAX PAYERS PERSEPTION TOWARDS E - FILING SYSTEM OF INCOME TAX" (IN CASE STUDY OF BELLARI CITY)Документ73 страницыDARSHAN P Project Report On TAX PAYERS PERSEPTION TOWARDS E - FILING SYSTEM OF INCOME TAX" (IN CASE STUDY OF BELLARI CITY)DARSHAN PОценок пока нет

- MTQ2 Deductions From Gross IncomeДокумент4 страницыMTQ2 Deductions From Gross IncomeEISEN BELWIGANОценок пока нет

- Chapter 12: Assessment of Various Entities: Section - A: Statutory UpdateДокумент49 страницChapter 12: Assessment of Various Entities: Section - A: Statutory UpdateAmol TambeОценок пока нет

- PA2 X ESP HW9 G1 Revanza TrivianДокумент9 страницPA2 X ESP HW9 G1 Revanza TrivianRevan KonglomeratОценок пока нет