Академический Документы

Профессиональный Документы

Культура Документы

Transfertaxform Apv9t Form (072010)

Загружено:

Karma Pema DorjeАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

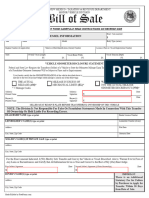

Transfertaxform Apv9t Form (072010)

Загружено:

Karma Pema DorjeАвторское право:

Доступные форматы

DO NOT WRITE OR STAPLE

IN THIS SPACE

Transfer/Tax Form

Motor Vehicle Act

Commercial Transport Act

Consumption Tax Rebate and Transition Act

Excise Tax Act

Motor Vehicle (All Terrain) Act

Motor Dealer Act

Insurance Corporation

of British Columbia

This form must be fully completed and presented to an Autoplan Broker with identification within ten days of the sale

VEHICLE DESCRIPTION

REGISTRATION NO.

FUEL

COLOUR

YEAR

MAKE

MODEL

BODY STYLE

SEE

REVERSE

VEHICLE IDENTIFICATION NO. (VIN)

SEATING

CAPACITY

NET WEIGHT (kg)

GROSS WEIGHT (kg)

DISP (CC)

VEHICLE STATUS

FLOOD

A - ALTERED

D - NON-REPR

R - REBUILT

S - SALVAGE

Complete this line only if the vehicle was constructed new by a primary manufacturer

and a secondary manufacturer and has 2 vehicle identification numbers (e.g. motor homes,

school buses). (see reverse)

YEAR

FRAME / BODY

MAKE

No

VEHICLE HAS CURRENT/

CONDITIONAL AIRCARE PASS

No

Yes

Yes

FRAME / BODY

VEHICLE IDENTIFICATION NO. (VIN)

FRAME / BODY

SELLER INFORMATION AND VEHICLE DECLARATION

PREVIOUS VEHICLE DAMAGE SUSTAINED IN ANY ONE INCIDENT

VEHICLE PREVIOUSLY

REGISTERED OUTSIDE BC New vehicle where

No

Used vehicle damage over $2,000

damage exceeded 20%

No

Yes

Yes

of purchase price

PREVIOUS VEHICLE HISTORY

HAS VEHICLE EVER BEEN USED FOR ANY OF THE FOLLOWING:

Emergency

None of

Lease

Taxi

Rental

or Police

these

SELLERS BC DRIVER'S

LIC. NO.

NAME (SURNAME followed by given names (no initials) or registered company name(s))

ODOMETER READING

ODOMETER

REPLACED/BROKEN

No

Yes

SELLERS BC DRIVER'S

LIC. NO.

km

mi

DATE OF SALE (ddmmyyyy)

I/we the seller(s) certify that we are the registered owner(s) of the described vehicle

and that I/we are entitled to sell it, and that the information above is true.

RESIDENTIAL ADDRESS OF SELLER

SIGNATURE OF SELLER(S) (Print name and title if other than an individual.)

PROVINCE

POSTAL CODE

SIGNATURE OF SELLER(S) (Print name and title if other than an individual.)

PURCHASER INFORMATION AND TAX DECLARATION

- Stated purchase price below market value?

- Stated trade-in value more than market value?

- Exemption from tax being claimed?

No

No

No

Tax Calculation

Yes

Yes

Yes

OTHER THAN DEALERS

DEALERS/VENDORS ONLY

Comments: _______________________________________________________________________________________________________

PURCHASE PRICE

HST REG. NO.

LESS TRADE (if applicable)

YEAR

MAKE

MODEL

VIN NO.

.

.

.

.

.

LESS TRADE (if applicable)

$

If the Autoplan Broker determines the purchase price is below current market value or that a trade-in vehicle

is more than current market value, or if an exemption is being claimed, the purchaser may be required to

provide supporting documentation to the Autoplan Broker. The purchaser should retain all documents

supporting the tax payable or claimed exemption for tax audit purposes.

A signed Vehicle Registration (APV250) must accompany this document (for licensed dealers an

NET PURCHASE PRICE

CTB

AUTHORIZING STAMP

(WHERE REQUIRED)

(ALL COPIES)

SST/TDP PAYABLE (if applicable)

HST (BC) PAYABLE (if applicable)

APV250 or APV9 is acceptable)

DEALER REG. NO. OR ICBC APP. NO.

HST REG NO.

1 0 7 8 6 4 73 8 RT 0 0 8 1

NAME (SURNAME followed by given names (no initials) or registered company name(s))

PURCHASERS BC DRIVER'S

LIC. NO.

PURCHASERS BC DRIVER'S

LIC. NO.

RESIDENTIAL ADDRESS OF PURCHASER

I/we the purchaser(s) being 18 Years of age or older or having obtained parents

consent apply to the Insurance Corporation of British Columbia for vehicle

registration or transfer of registered ownership of the vehicle described above and

by my/our signature(s), I/we declare that the information included above is true.

SIGNATURE OF PURCHASER(S) (Print name and title if other than an individual.)

PROVINCE

POSTAL CODE

SIGNATURE OF PURCHASER(S) (Print name and title if other than an individual.)

Consent of parent or legal guardian for applicant under 18 years of age

I,

PRINT NAME OF PARENT OR LEGAL GUARDIAN

PRINT ADDRESS IN FULL

SIGNATURE OF PARENT OR LEGAL GUARDIAN

consent to the registration and licencing in the name of the applicant(s), of the vehicle described hereon.

WARNING TO PURCHASER AND SELLER

This form is not valid if the information shown is inconsistent, changed or altered. Any false information regarding the purchase price and trade-in

(if applicable) or tax payable may result in fines and penalties.

AUTOPLAN AGENT TO COMPLETE

For all new registrations, and rebuilt or altered vehicles Check applicable boxes

Proof of ownership

Canadian Import

Canadian vehicle - previous jurisdiction _______________________________________

Vehicle purchased from GST/HST registrant?

Yes

NVIS/Certificate of Origin

IPRE confirmed

Vehicle Registration

Windshield

BC Vehicle Inspection Report(s)

Certificate of Title

Body location

Vehicle Import Form Form 1

Bill of Sale

No

Foreign Import

P - may not be sold or disposed of in Canada at any time without authorization from

Canada Border Services Agency

T - may not be sold on or before ______________________________________________

No. of plates 0

surrendered

None visible

Salvage Invoice

1

Broker Enquiry confirmed ownership

N - not subject to a disposal restriction

TYPE OF IDENTIFICATION

IDENTIFICATION NUMBER

TYPE OF IDENTIFICATION

I have viewed the purchasers identification or confirmed legal entity

and verified the Autoplan Agent to complete information.

Physical Damage

(except BC dealer with NVIS)

VIN sighted and confirmed

NAME OF AGENT (PRINT)

IDENTIFICATION NUMBER

NOT VALID UNLESS STAMPED BY

AUTHORIZED ISSUING OFFICE

LEGAL ENTITY NUMBER (other than individual)

SIGNATURE OF AGENT

SEE REVERSE FOR INSTRUCTIONS

APV9T (072010)

Vehicle Registration

COMPLETION OF TRANSFER/TAX FORM (APV9T)

-

The purchaser is advised to check for liens and encumbrances with the Personal Property Registry, Victoria, BC before finalizing the sale.

The seller completes the Seller section of the form including information from the Vehicle Registration, and signs the Sellers Certification.

The purchaser completes and signs the Purchaser section.

The seller retains the Seller copy of the form with the Seller and Purchaser sections completed.

The purchaser must present the remaining copies of the Transfer/Tax Form (APV9T) and the Vehicle Registration (APV250

only, signed by the registered owner) to an Autoplan Broker for registration within 10 days of sale.

Signatures - where the seller or purchaser is a registered company, the signatures required are of signing officer(s) with official title(s) with the company.

Note: Business names not registered with the Corporate Registry, Victoria, BC, may not be used.

TAX OWING:

Vehicles Purchased prior to July 1, 2010

Social Service Tax (SST) is owing. For vehicles purchased July 1, 2010 or later, follow the instructions below under Vehicles purchased in BC

and Vehicles Purchased Outside BC, as applicable.

Vehicles Purchased in BC

1. Dealer and Vendor Sales: HST will be collected by the dealer or vendor. The dealers or vendors HST registrant number is required.

2. Private Sales: Tax on Designated Property (TDP) is payable on the net purchase price.

Vehicles Purchased Outside BC

1. Purchased in Canada, HST Paid: no tax is owing. The dealers or vendors HST registrant number is required.

2. Purchased in Canada, GST Paid: the provincial portion of HST (HST(BC)) is owing. Proof of payment of GST is required.

3. Private Sales in Canada: Tax on Designated Property (TDP) is payable on the net purchase price.

4. Purchased Outside Canada: the provincial portion of HST (HST(BC)) is owing. Proof of payment of GST is required.

The purchaser must provide supporting documentation if claiming an exemption, and may be asked to provide documentation if the purchase price

is lower than current market value, or if the trade-in value is more than the current market value.

NEW VEHICLE REGISTRATIONS - TWO VINs ON NEW VEHICLE INFORMATION STATEMENT (NVIS)

The year, make and vehicle identification numbers recorded on the NVIS will be entered on the Transfer/Tax Form as follows:

School Bus - Year and Make: Always record year and make of secondary manufacturer on the first line of the Transfer/Tax document.

Record the year and make of the primary manufacturer on the third line of the Transfer/Tax document, circling the word Frame.

VIN: Record the secondary manufacturers VIN on the second line of the Transfer/Tax document only if the VIN is 17 digits long, otherwise record

the primary manufacturers VIN. Record the alternate VIN on the third line of the Transfer/Tax document and circle Frame or Body.

Motor Home Class A: Follow Year and Make and VIN instructions as for school bus.

Motor Home Class C: Year and Make: Record year, make and VIN of primary manufacturer on the first line of the Transfer/Tax document.

Record year and make of the secondary manufacturer on the third line of the Transfer/Tax document, circling the word Body.

SUBSTITUTE VEHICLE:

An owner of a BC licensed and insured vehicle may transfer the number plates to a newly purchased BC vehicle and operate the vehicle for a

maximum period of ten days from the date the vehicle has been purchased if:

1. the newly purchased vehicle is of the same type (eg. passenger vehicle replaced by passenger vehicle) and corresponding number plates are compatible;

2. the newly purchased vehicle is a BC registered vehicle or is a new vehicle purchased from a BC registered dealer;

3. title or interest in the original vehicle has been transferred;

4. during the ten day period and before the agent has validated the necessary forms, the operator shall carry and produce to a Peace Officer upon request,

a. Purchasers copies of completed and signed Transfer/Tax Form (APV9T)

b. Purchasers Owners Certificate of Insurance and Vehicle Licence valid for the transferred original vehicle

c. Previous Owners Certificate of Registration for the new vehicle, or a signed and dated Bill of Sale if brand new vehicle purchased

from a BC Registered Dealer

5. the plates are not compatible or the title to or the interest in the original vehicle has not been transferred, the necessary forms must be completed

by an agent and new plates issued before the new vehicle can be operated on a highway and until that form is completed and new plates

issued, no insurance is in force on the new vehicle.

To have the newly purchased vehicle registered in the name of the holder of the licence, the application for transfer of registered ownership must

be presented to an agent within ten days of purchase, along with the documents mentioned in paragraph 4.

VEHICLES BROUGHT INTO BRITISH COLUMBIA FROM ANOTHER JURISDICTION:

Passenger vehicles, including small pickup trucks, motorcycles and trailers used for personal/pleasure use, must be registered by the owner within

30 days of entering the province. Cars, motor homes, vans and small trucks with a net weight of 3,500 kgs or less that have been previously registered,

titled or licensed in another jurisdiction must pass a certified safety inspection before they can be registered and licenced in BC.

Commercial vehicles (except for commercial trailers) used for commercial purposes must be registered immediately. Commercial trailers that are

licensed in compliance with their home jurisdiction may be operated on a BC highway.

All vehicles imported by the owner into BC must be taken to an Autoplan Broker by the owner, where the ownership, description of the vehicle,

body style, vehicle identification number and odometer reading will be verified. Tax is payable unless the owner qualifies under the settlers effects

exemption contained in the Consumption Tax Rebate and Transition Regulations.

Present Vehicle Registration, Certificate of Title and plates - must be surrendered. Owner(s) of a vehicle from another country must also produce

a Vehicle Import Form - Form 1 and surrender it at the time of registration.

FUEL

TYPE

CODES

Code

A

B

D

E

Fuel Type

Alcohol

Butane

Diesel

Electric

Code

F

G

H

L

Fuel Type

Diesel - Butane

Gasoline

Gasoline - Alcohol

Gasoline - Electric

Code

N

P

R

S

Fuel Type

Natural Gas

Propane

Diesel - Natural Gas

Propane - Natural Gas

Code

T

U

W

Y

Z

Fuel Type

Diesel - Propane

Gasoline - Natural Gas

Gasoline - Propane

Hydrogen

Multi-Fuel

PRIVACY NOTICE:

The personal information on this form is collected: (a) by ICBC for the purpose of considering the application by seller and purchaser of the initial vehicle registration or transfer of

vehicle ownership and is authorized by the Motor Vehicle Act, the regulations thereunder and other related legislation; (b) by ICBC for the purpose of administering the Excise Tax Act

and the regulations thereunder, and (c) by the Ministry of Finance (Ministry) for the purpose of administering the Consumption Tax Rebate and Transition Act and the regulations

thereunder. Each of ICBC and the Ministry may use and disclose this information in accordance with the provisions of Part 3 of the Freedom of Information and Protection of Privacy

Act. Questions about the collection of this information can be directed to: (a) for ICBC, to the Manager, Information and Privacy, by phone 604-661-2800 or to this address: ICBC,

PO Box 5050 Station Terminal, Vancouver BC V6B 4T4; for the Ministry, to the Information and Privacy Analyst, at, Ministry of Finance, by phone in Victoria at (250) 953-3671, or

in Vancouver at (604) 660-2421, elsewhere in BC at 1-800-663-7867 and ask to be re-directed, or to this address: PO BOX 9432, Stn Prov Govt, Victoria, BC V8W 9N6.

Вам также может понравиться

- AA0A0A00000000000000: Temporary Vehicle Registration ReceiptДокумент1 страницаAA0A0A00000000000000: Temporary Vehicle Registration ReceiptDestiny BadeauxОценок пока нет

- 7D Manual 0718 0Документ61 страница7D Manual 0718 0AngieОценок пока нет

- Thai Driving License Exam Test Questions & AnswersДокумент90 страницThai Driving License Exam Test Questions & Answers叶芊Оценок пока нет

- SGS Inspection ReportДокумент2 страницыSGS Inspection Reportcyanez123100% (1)

- AirwayBill ManualДокумент1 страницаAirwayBill ManualDani VerdenОценок пока нет

- Dock ReceiptДокумент2 страницыDock ReceiptKarriem WakkiluddinОценок пока нет

- Certificate of Conformity For Commodities and Products To Be Exported To The Kingdom of Saudi ArabiaДокумент1 страницаCertificate of Conformity For Commodities and Products To Be Exported To The Kingdom of Saudi Arabiaaal_shurafaОценок пока нет

- 2015 EPA Certificate of Conformity - Totyota CorollaДокумент1 страница2015 EPA Certificate of Conformity - Totyota Corollajoynern7Оценок пока нет

- Vendor Registration Form - FKF1J.v2Документ2 страницыVendor Registration Form - FKF1J.v2Ryzen AnimationОценок пока нет

- Cargo Arrival NoticeДокумент2 страницыCargo Arrival NoticeSanjay RathodОценок пока нет

- Thumbs up Trucking llc E-book: Step by step e-book on how to start a trucking companyОт EverandThumbs up Trucking llc E-book: Step by step e-book on how to start a trucking companyОценок пока нет

- Mantras & Mudras Puxianmalaysia Page 2Документ27 страницMantras & Mudras Puxianmalaysia Page 2Karma Pema DorjeОценок пока нет

- 130 U 3Документ2 страницы130 U 3Juan Escobar JuncalОценок пока нет

- Van Tax FormДокумент2 страницыVan Tax FormtoptafОценок пока нет

- Vsa17a PDFДокумент2 страницыVsa17a PDFxerxeschuaОценок пока нет

- Vehicle History Report SampleДокумент2 страницыVehicle History Report SampleRohit DuranjayОценок пока нет

- BMV 4625Документ2 страницыBMV 4625Frank WagnerОценок пока нет

- Vendor Master FormДокумент2 страницыVendor Master Formsundarji sundararajuluОценок пока нет

- Vendor Declaration FormДокумент2 страницыVendor Declaration FormMuazzamAliОценок пока нет

- I Want Seats Online 122818Документ2 страницыI Want Seats Online 122818Lorence Dominic NarciseОценок пока нет

- Packing List: This Packing List Must Be Completed in EnglishДокумент2 страницыPacking List: This Packing List Must Be Completed in EnglishJames FernandoОценок пока нет

- Inf1125 Req For Your Own DL Card or Vehicle Reg Info RecordДокумент1 страницаInf1125 Req For Your Own DL Card or Vehicle Reg Info RecordSteve SmithОценок пока нет

- Insurance Claim FormДокумент4 страницыInsurance Claim Formmaheshcs4327Оценок пока нет

- Vehicle Damage StructureДокумент1 страницаVehicle Damage StructurecreatorusОценок пока нет

- Shipping Order FormДокумент1 страницаShipping Order Formmy booksОценок пока нет

- TirCarnet TemplateДокумент13 страницTirCarnet TemplategavgabiОценок пока нет

- Motor Claim FormДокумент3 страницыMotor Claim FormYCMOUОценок пока нет

- DOF-RO Form 91Документ6 страницDOF-RO Form 91Bobby Olavides SebastianОценок пока нет

- Commercial InvoiceДокумент4 страницыCommercial InvoiceHimanshu KushwahaОценок пока нет

- Purchase Order: Kiara's WorksДокумент1 страницаPurchase Order: Kiara's WorksKiara CooperОценок пока нет

- Dell Quotation INDДокумент5 страницDell Quotation INDManisha AgrawalОценок пока нет

- InsuranceДокумент3 страницыInsuranceMohammed Abdul Mutalib Qureshi100% (1)

- Bike PolicyДокумент2 страницыBike PolicyAdhwareshBharadwaj100% (2)

- Commercial InvoiceДокумент3 страницыCommercial InvoiceLJ RavenОценок пока нет

- TS30T4398 LabourДокумент2 страницыTS30T4398 Labourphani kumarОценок пока нет

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Документ1 страницаTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Mayank PanwarОценок пока нет

- Luovutuskirja Ajoneuvon Vesikulkuneuvon Omistusoikeuden Siirrosta B124eДокумент2 страницыLuovutuskirja Ajoneuvon Vesikulkuneuvon Omistusoikeuden Siirrosta B124eAirsoftОценок пока нет

- Warehouse Receipt Label 4 X 6Документ8 страницWarehouse Receipt Label 4 X 6Megan DeeОценок пока нет

- Fleet Agreement 2018-05-11Документ20 страницFleet Agreement 2018-05-11David PattyОценок пока нет

- Khrisna Anggun Yuliana (136220021) : Item Description Qty Unit Price Disc % Tax AmountДокумент1 страницаKhrisna Anggun Yuliana (136220021) : Item Description Qty Unit Price Disc % Tax AmountK-AnggunYulianaОценок пока нет

- IRDA Reimbursement Claim Form - InsuredДокумент2 страницыIRDA Reimbursement Claim Form - InsuredSoham BanerjeeОценок пока нет

- Purchase Order For Nitrile Gloves T&CsДокумент4 страницыPurchase Order For Nitrile Gloves T&CsAadityaa PawarОценок пока нет

- Export DocumentsДокумент28 страницExport DocumentsAmit PatelОценок пока нет

- Payment Receipt PALASHДокумент1 страницаPayment Receipt PALASHarpitОценок пока нет

- Hafale ClearnaceДокумент3 страницыHafale Clearnacemumtaz_khanОценок пока нет

- CAC CertificateДокумент15 страницCAC CertificateAjeh SylvanusОценок пока нет

- Comercial InvoiceДокумент1 страницаComercial Invoicepatel vimalОценок пока нет

- PDFДокумент3 страницыPDFPrashant KumarОценок пока нет

- Online Invoice Memo GST04-06-2019C7920147 PDFДокумент1 страницаOnline Invoice Memo GST04-06-2019C7920147 PDFsainath salesОценок пока нет

- Crash Report 85853814 - Marco Island Police DepartmentДокумент4 страницыCrash Report 85853814 - Marco Island Police DepartmentOmar Rodriguez OrtizОценок пока нет

- DHL Comm InvДокумент4 страницыDHL Comm InvPra ChiОценок пока нет

- Cubework AgreementДокумент11 страницCubework AgreementHudson GibbsОценок пока нет

- SalesPackingSlip ReportДокумент1 страницаSalesPackingSlip Reportfattaninaveed786100% (1)

- AllnexДокумент1 страницаAllnexArif Tawil PrionoОценок пока нет

- Rate Confirmation New - PDF Kris 1Документ2 страницыRate Confirmation New - PDF Kris 1cris KamariОценок пока нет

- Warehouse Tentative Agreement With AwsДокумент2 страницыWarehouse Tentative Agreement With Awsgrandsupreme.myОценок пока нет

- Bill of Lading Guidance NotesДокумент3 страницыBill of Lading Guidance NotesBajjaliОценок пока нет

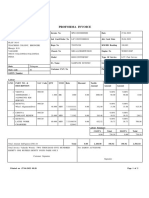

- Proforma InvoiceДокумент1 страницаProforma InvoiceSameer VyavahareОценок пока нет

- Verification Code (For Office Use Only) 5301039772 17053 /Dfgp2I6Dkov 17082017015924PmДокумент1 страницаVerification Code (For Office Use Only) 5301039772 17053 /Dfgp2I6Dkov 17082017015924PmAnonymous cclKewWGVОценок пока нет

- U.S. Customs Form: CBP Form 19 - ProtestДокумент3 страницыU.S. Customs Form: CBP Form 19 - ProtestCustoms FormsОценок пока нет

- S M Asloob.Документ2 страницыS M Asloob.saikripa1210% (1)

- 711 申請書Документ2 страницы711 申請書Stefanie SusantiОценок пока нет

- Reg 343Документ2 страницыReg 343aloknsinghОценок пока нет

- VTR 130 UifДокумент2 страницыVTR 130 UifZeeshan MasoodОценок пока нет

- Builders Foundation Handbook 62Документ1 страницаBuilders Foundation Handbook 62Karma Pema DorjeОценок пока нет

- Typical RoomДокумент1 страницаTypical RoomKarma Pema DorjeОценок пока нет

- Site Plan W Chief Arch BackgroundДокумент1 страницаSite Plan W Chief Arch BackgroundKarma Pema DorjeОценок пока нет

- Table1 PDFДокумент17 страницTable1 PDFKarma Pema DorjeОценок пока нет

- Crossref Table Cbcch34 Cebc p10 2016Документ9 страницCrossref Table Cbcch34 Cebc p10 2016Karma Pema DorjeОценок пока нет

- LOMANCO (Installation Manual) OR4 Omniridge Ridge VentДокумент2 страницыLOMANCO (Installation Manual) OR4 Omniridge Ridge VentKarma Pema DorjeОценок пока нет

- Crossref Table Cbcch34 Cebc p10 2016Документ9 страницCrossref Table Cbcch34 Cebc p10 2016Karma Pema DorjeОценок пока нет

- GMH 02 NoRestrictionДокумент5 страницGMH 02 NoRestrictionKarma Pema DorjeОценок пока нет

- Section 13 Using Standards Data and Information: AndbookДокумент5 страницSection 13 Using Standards Data and Information: AndbookKarma Pema DorjeОценок пока нет

- List of Interactive Equations: Dimensions and Areas of CirclesДокумент4 страницыList of Interactive Equations: Dimensions and Areas of CirclesKarma Pema DorjeОценок пока нет

- GMH 09 NoRestrictionДокумент20 страницGMH 09 NoRestrictionKarma Pema DorjeОценок пока нет

- K435 PDFДокумент16 страницK435 PDFKarma Pema DorjeОценок пока нет

- GMH 10 NoRestrictionДокумент10 страницGMH 10 NoRestrictionKarma Pema DorjeОценок пока нет

- GMH 14 NoRestrictionДокумент9 страницGMH 14 NoRestrictionKarma Pema DorjeОценок пока нет

- PAL v. Edu, GR No. L-41383, 15 August 1988Документ1 страницаPAL v. Edu, GR No. L-41383, 15 August 1988Christopher Jan DotimasОценок пока нет

- Jacksonjambalaya: Mississippi Medical Cannabis Act (DRAFT) SummaryДокумент12 страницJacksonjambalaya: Mississippi Medical Cannabis Act (DRAFT) Summarythe kingfishОценок пока нет

- The Final Traffic and Road Safety Registration Plates Regulations, 11.04.2023 FinalДокумент48 страницThe Final Traffic and Road Safety Registration Plates Regulations, 11.04.2023 FinalWasswa Kasim SsensaloОценок пока нет

- 2011 Kaufvertrag Engl 33250Документ4 страницы2011 Kaufvertrag Engl 33250nanalexandru.14.02.2004Оценок пока нет

- Admin, GSS, HR Accomplishment ReportДокумент12 страницAdmin, GSS, HR Accomplishment Reportkrismae fatima de castroОценок пока нет

- Checklist - LTO - Transferring Ownership of Private Motor Vehicles and MotorcyclesДокумент2 страницыChecklist - LTO - Transferring Ownership of Private Motor Vehicles and MotorcyclesLRMОценок пока нет

- New York State Inspector General's Office ReportДокумент29 страницNew York State Inspector General's Office ReportStef DygaОценок пока нет

- Authorization Letter To Vehicle RegistrationДокумент2 страницыAuthorization Letter To Vehicle Registrationcoinsph.loadОценок пока нет

- VAHAN 4.0 (Citizen Services) Onlineapp01 135 8000Документ1 страницаVAHAN 4.0 (Citizen Services) Onlineapp01 135 8000shaikrehaan8688Оценок пока нет

- Form 25Документ2 страницыForm 25Prathamesh KhairnarОценок пока нет

- GGGGДокумент115 страницGGGGparaktisado1Оценок пока нет

- VSA 14 Application For Registration PDFДокумент2 страницыVSA 14 Application For Registration PDFRoman JanjuliaОценок пока нет

- Special Tools BulletinДокумент5 страницSpecial Tools BulletinoscarОценок пока нет

- Vikash Kumar Singh Disclaimer WB 38 Choice NoДокумент1 страницаVikash Kumar Singh Disclaimer WB 38 Choice NoAnwAr AzZyОценок пока нет

- Register A Used Car in DubaiДокумент5 страницRegister A Used Car in DubaiifyjoslynОценок пока нет

- NY mv21-mcДокумент54 страницыNY mv21-mcAres RomanОценок пока нет

- Form 31Документ2 страницыForm 31riyu4393Оценок пока нет

- VAHAN 4.0 (Citizen Services) Onlineapp01 135 8000Документ1 страницаVAHAN 4.0 (Citizen Services) Onlineapp01 135 8000jack sonОценок пока нет

- Customer Unavailable - Declaration of ResidencyДокумент1 страницаCustomer Unavailable - Declaration of ResidencyTesa GalvezОценок пока нет

- Erezo v. Jepte PDFДокумент6 страницErezo v. Jepte PDFd-fbuser-49417072Оценок пока нет

- New Mexico Bill of Sale Form For Motor Vehicle Trailer or BoatДокумент2 страницыNew Mexico Bill of Sale Form For Motor Vehicle Trailer or BoatMocks CetОценок пока нет

- Form 31Документ2 страницыForm 31Jimit ShahОценок пока нет

- Dealer ManualДокумент85 страницDealer ManualLakelands CyclesОценок пока нет

- Executive Order 1011Документ26 страницExecutive Order 1011Dominic jarinОценок пока нет

- Note:-The Motor Vehicle Above Described Is Not Subject To An Agreement of Hire Purchase, Lease or HypothecationДокумент2 страницыNote:-The Motor Vehicle Above Described Is Not Subject To An Agreement of Hire Purchase, Lease or HypothecationDIPAK RAYCHURAОценок пока нет

- DMV-VD119-Vehicle Reg Tax Title AppДокумент3 страницыDMV-VD119-Vehicle Reg Tax Title Appmary7805Оценок пока нет

- Application No./RECEIPT No: Receipt DateДокумент1 страницаApplication No./RECEIPT No: Receipt Dategagan ninaweОценок пока нет