Академический Документы

Профессиональный Документы

Культура Документы

List of Indian As Convergence With Ifrs

Загружено:

Nikhil KasatОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

List of Indian As Convergence With Ifrs

Загружено:

Nikhil KasatАвторское право:

Доступные форматы

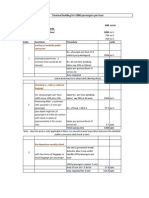

IND AS (NACAS) (MCA NOTIFICATION)

No. Notifications

G.S.R 111(E) dated 16 Feb 2015

1 Indian Accounting Standard (Ind AS)

2 Indian Accounting Standard (Ind AS)

3 Indian Accounting Standard (Ind AS)

4 Indian Accounting Standard (Ind AS)

5 Indian Accounting Standard (Ind AS)

6 Indian Accounting Standard (Ind AS)

7 Indian Accounting Standard (Ind AS)

8 Indian Accounting Standard (Ind AS)

9 Indian Accounting Standard (Ind AS)

10 Indian Accounting Standard (Ind AS)

11 Indian Accounting Standard (Ind AS)

12 Indian Accounting Standard (Ind AS)

13 Indian Accounting Standard (Ind AS)

14 Indian Accounting Standard (Ind AS)

15 Indian Accounting Standard (Ind AS)

16 Indian Accounting Standard (Ind AS)

17 Indian Accounting Standard (Ind AS)

18 Indian Accounting Standard (Ind AS)

19 Indian Accounting Standard (Ind AS)

20 Indian Accounting Standard (Ind AS)

21 Indian Accounting Standard (Ind AS)

22 Indian Accounting Standard (Ind AS)

23 Indian Accounting Standard (Ind AS)

24 Indian Accounting Standard (Ind AS)

Indian

25

26 Indian

27 Indian

28 Indian

29 Indian

30 Indian

31 Indian

32 Indian

33 Indian

34 Indian

35 Indian

36 Indian

37 Indian

38 Indian

39 Indian

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

1

2

7

8

10

12

16

17

19

Description

The Companies (Indian Accounting Standards) Rules, 2015.

First-time Adoption of Indian Accounting Standards

Share-based Payment

Business Combinations

Insurance Contracts

Non-current Assets Held for Sale and Discontinued Operations

Exploration for and Evaluation of Mineral Resources

Financial Instruments: Disclosures

Operating Segments

Financial Instruments

Consolidated Financial Statements

Joint Arrangements

Disclosure of Interests in Other Entities

Fair Value Measurement

Regulatory Deferral Accounts

Revenue from Contracts with Customers

Presentation of Financial Statements

Inventories

Statement of Cash Flows

Accounting Policies, Changes in Accounting Estimates and Errors

Events after the Reporting Period

Income Taxes

Property, Plant and Equipment

Leases

Employee Benefits

Accounting Standard (Ind AS) 20

Accounting for Government Grants and Disclosure of Government Assistance

Accounting

Accounting

Accounting

Accounting

Accounting

Accounting

Accounting

Accounting

Accounting

Accounting

Accounting

Accounting

Accounting

Accounting

The Effects of Changes in Foreign Exchange Rates

Borrowing Costs

Related Party Disclosures

Separate Financial Statements

Investments in Associates and Joint Ventures

Financial Reporting in Hyperinflationary Economies

Financial Instruments: Presentation

Earnings per Share

Interim Financial Reporting

Impairment of Assets

Provisions, Contingent Liabilities and Contingent Assets

Intangible Assets

Investment Property

Agriculture

Reference:

Standard

Standard

Standard

Standard

Standard

Standard

Standard

Standard

Standard

Standard

Standard

Standard

Standard

Standard

(Ind

(Ind

(Ind

(Ind

(Ind

(Ind

(Ind

(Ind

(Ind

(Ind

(Ind

(Ind

(Ind

(Ind

AS)

AS)

AS)

AS)

AS)

AS)

AS)

AS)

AS)

AS)

AS)

AS)

AS)

AS)

21

23

24

27

28

29

32

33

34

36

37

38

40

41

http://www.mca.gov.in/MinistryV2/Stand.html

IFRS (IASB)

IFRS 1

IFRS 2

IFRS 3

IFRS 4

IFRS 5

IFRS 6

IFRS 7

IFRS 8

IFRS 9

IFRS 10

IFRS 11

IFRS 12

IFRS 13

IFRS 14

IFRS 15

IAS 1

IAS 2

IAS 7

IAS 8

IAS 10

IAS 12

IAS 16

IAS 17

IAS 19

First-time Adoption of International Financial Reporting Standards

Share-based Payment

Business Combinations

Insurance Contracts

Non-current Assets Held for Sale and Discontinued Operations

Exploration for and Evaluation of Mineral Assets

Financial Instruments: Disclosures

Operating Segments

Financial Instruments

Consolidated Financial Statements

Joint Arrangements

Disclosure of Interests in Other Entities

Fair Value Measurement

Regulatory Deferral Accounts

Revenue from Contracts with Customers

Presentation of Financial Statements

Inventories

Statement of Cash Flows

Accounting Policies, Changes in Accounting Estimates and Errors

Events After the Reporting Period

Income Taxes

Property, Plant and Equipment

Leases

Employee Benefits (2011)

2008*

2004

2008*

2004

2004

2004

2005

2006

2014*

2011

2011

2011

2011

2014

2014

2007*

2005*

1992

2003

2003

1996*

2003*

2003*

2011*

IAS

IAS

IAS

IAS

IAS

IAS

IAS

IAS

IAS

IAS

IAS

IAS

IAS

IAS

IAS

Accounting for Government Grants and Disclosure of Government Assistance

The Effects of Changes in Foreign Exchange Rates

Borrowing Costs

Related Party Disclosures

Separate Financial Statements (2011)

Investments in Associates and Joint Ventures (2011)

Financial Reporting in Hyperinflationary Economies

Financial Instruments: Presentation

Earnings Per Share

Interim Financial Reporting

Impairment of Assets

Provisions, Contingent Liabilities and Contingent Assets

Intangible Assets

Investment Property

Agriculture

1983

2003*

2007*

2009*

2011

2011

1989

2003*

2003*

1998

2004*

1998

2004*

2003*

2001

20

21

23

24

27

28

29

32

33

34

36

37

38

40

41

Note:

* Standards withdrawn or Superseded

IAS 3

Consolidated Financial Statements (Superseded in 1989 by IAS 27 and IAS 28)

IAS 4

Depreciation Accounting (Withdrawn in 1999)

IND AS are numbered in line with IFRS numbering. All the IND AS which are based on IAS have same numbers only difference is that

IND AS which are based on IFRS start with serias of 100 and so on.

IAS 5

Information to Be Disclosed in Financial Statements (Superseded by IAS 1 effective 1

July 1998)

IAS 6

Accounting Responses to Changing Prices (Superseded by IAS 15, which was withdrawn

December 2003)

IAS 9

IAS 11

Accounting for Research and Development Activities (Superseded by IAS 38 effective 1

July 1999)

Construction Contracts (Will be superseded by IFRS 15 as of 1 January 2017)

IAS

IAS

IAS

IAS

IAS

IAS

IAS

IAS

IAS

13

14

15

18

19

22

25

26

27

Presentation of Current Assets and Current Liabilities (Superseded by IAS 1 effective 1

July 1998)

Segment Reporting (Superseded by IFRS 8 effective 1 January 2009)

Information Reflecting the Effects of Changing Prices (Withdrawn December 2003)

Revenue (Will be superseded by IFRS 15 as of 1 January 2017)

Employee Benefits (1998) (Superseded by IAS 19 (2011) effective 1 January 2013)

Business Combinations (Superseded by IFRS 3 effective 31 March 2004)

Accounting for Investments (Superseded by IAS 39 and IAS 40 effective 2001)

Accounting and Reporting by Retirement Benefit Plans

Separate Financial Statements (2011)

IAS 27

Consolidated and Separate Financial Statements (Superseded by IFRS 10, IFRS 12 and

IAS 27 (2011) effective 1 January 2013)

IAS 28

Investments in Associates (Superseded by IAS 28 (2011) and IFRS 12 effective 1 January

2013)

IAS 30

Disclosures in the Financial Statements of Banks and Similar Financial Institutions

(Superseded by IFRS 7 effective 1 January 2007)

1990

IAS 31

IAS 35

Interests In Joint Ventures (Superseded by IFRS 11 and IFRS 12 effective 1 January 2013)

Discontinuing Operations (Superseded by IFRS 5 effective 1 January 2005)

2003

1998

IAS 39

Financial Instruments: Recognition and Measurement (Superseded by IFRS 9 effective 1

January 2018 where IFRS 9 is applied)

2003*

1976

1976

1993

1997

2003

1993

1998

1998*

1987

2011

2003

2003

Вам также может понравиться

- Income Declaration Scheme Rules, 2016: Form 1Документ9 страницIncome Declaration Scheme Rules, 2016: Form 1Nikhil KasatОценок пока нет

- Some Confusing & Debatable CSR Issues: Learning Series Vol.-I Issue - 2 2015-16Документ21 страницаSome Confusing & Debatable CSR Issues: Learning Series Vol.-I Issue - 2 2015-16Nikhil KasatОценок пока нет

- CA Result AnalysisДокумент1 страницаCA Result AnalysisNikhil KasatОценок пока нет

- Types of Stamps and Some Concepts of Stamp DutyДокумент5 страницTypes of Stamps and Some Concepts of Stamp DutyNikhil Kasat100% (3)

- ApplicabiliTY of ProvisionsДокумент3 страницыApplicabiliTY of ProvisionsNikhil KasatОценок пока нет

- Hedging With Financial DerivativesДокумент30 страницHedging With Financial DerivativesNikhil KasatОценок пока нет

- Black Money BillДокумент30 страницBlack Money BillNikhil KasatОценок пока нет

- CA Final Writing Professional Ethics AnswersДокумент2 страницыCA Final Writing Professional Ethics AnswersNikhil KasatОценок пока нет

- Fees Calculation For Increase in Authorised Share Capital Form SH 7, Only For GujaratДокумент10 страницFees Calculation For Increase in Authorised Share Capital Form SH 7, Only For GujaratNikhil KasatОценок пока нет

- Defamation Under Common LawДокумент6 страницDefamation Under Common LawNikhil KasatОценок пока нет

- Privileges To Small CompaniesДокумент2 страницыPrivileges To Small CompaniesNikhil KasatОценок пока нет

- Agricultural Income: Agricultural Income: - As Per Sec 10 (1) Agricultural Income Earned by TheДокумент9 страницAgricultural Income: Agricultural Income: - As Per Sec 10 (1) Agricultural Income Earned by TheNikhil KasatОценок пока нет

- Curriculum VitaeДокумент13 страницCurriculum VitaeNikhil KasatОценок пока нет

- Cusoms Valuation MaterialДокумент8 страницCusoms Valuation MaterialNikhil KasatОценок пока нет

- August Month CompliancesДокумент1 страницаAugust Month CompliancesNikhil KasatОценок пока нет

- SN Vertical Due Dates Particular Consequence of Non ComplianceДокумент1 страницаSN Vertical Due Dates Particular Consequence of Non ComplianceNikhil KasatОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Price Negotiator E-CommerceДокумент17 страницPrice Negotiator E-Commerce20261A3232 LAKKIREDDY RUTHWIK REDDYОценок пока нет

- Microwave Oven: Instructions & Cooking GuideДокумент38 страницMicrowave Oven: Instructions & Cooking GuidethomaselandОценок пока нет

- Bus Terminal Building AreasДокумент3 страницыBus Terminal Building AreasRohit Kashyap100% (1)

- Docu69346 Unity Hybrid and Unity All Flash Configuring Converged Network Adaptor PortsДокумент11 страницDocu69346 Unity Hybrid and Unity All Flash Configuring Converged Network Adaptor PortsAmir Majzoub GhadiriОценок пока нет

- 13 Reasons Why Discussion GuideДокумент115 страниц13 Reasons Why Discussion GuideEC Pisano RiggioОценок пока нет

- Wp406 DSP Design ProductivityДокумент14 страницWp406 DSP Design ProductivityStar LiОценок пока нет

- Exploration of MoonДокумент8 страницExploration of MoonAryan KhannaОценок пока нет

- A Catechism of Anarchy (Cover)Документ2 страницыA Catechism of Anarchy (Cover)Charles W. JohnsonОценок пока нет

- 3 - Accounting For Loans and ImpairmentДокумент1 страница3 - Accounting For Loans and ImpairmentReese AyessaОценок пока нет

- Fig. 6.14 Circular WaveguideДокумент16 страницFig. 6.14 Circular WaveguideThiagu RajivОценок пока нет

- Strategi Penatalaksanaan Stomatitis Aftosa RekurenДокумент11 страницStrategi Penatalaksanaan Stomatitis Aftosa RekurenPRADNJA SURYA PARAMITHAОценок пока нет

- Q. 15 Insurance Regulatory and Development AuthorityДокумент2 страницыQ. 15 Insurance Regulatory and Development AuthorityMAHENDRA SHIVAJI DHENAKОценок пока нет

- Mobile DevGuide 13 - Gulde For Mobile DeveloperДокумент258 страницMobile DevGuide 13 - Gulde For Mobile DevelopersmaliscribdОценок пока нет

- Finals Lesson Ii Technology As A WAY of Revealing: Submitted By: Teejay M. AndrdaДокумент8 страницFinals Lesson Ii Technology As A WAY of Revealing: Submitted By: Teejay M. AndrdaTeejay AndradaОценок пока нет

- Knock Knock GamesДокумент1 страницаKnock Knock GamesArsyta AnandaОценок пока нет

- Bill Vaskis ObitДокумент1 страницаBill Vaskis ObitSarah TorribioОценок пока нет

- MVP Teacher 12Документ6 страницMVP Teacher 12Ivan ChuОценок пока нет

- Rock Classification Gizmo WorksheetДокумент4 страницыRock Classification Gizmo WorksheetDiamond실비Оценок пока нет

- Mindfulness of Breathing and The Four Elements MeditationДокумент98 страницMindfulness of Breathing and The Four Elements Meditationulrich_ehrenbergerОценок пока нет

- Using Open-Ended Tools in Facilitating Mathematics and Science LearningДокумент59 страницUsing Open-Ended Tools in Facilitating Mathematics and Science LearningDomina Jayne PagapulaanОценок пока нет

- Group6 Business-Proposal Delivery AppДокумент15 страницGroup6 Business-Proposal Delivery AppNathaniel Karl Enin PulidoОценок пока нет

- Tinniuts Today March 1990 Vol 15, No 1Документ19 страницTinniuts Today March 1990 Vol 15, No 1American Tinnitus AssociationОценок пока нет

- 7999 Cswdo Day CareДокумент3 страницы7999 Cswdo Day CareCharles D. FloresОценок пока нет

- Beacon Explorer B Press KitДокумент36 страницBeacon Explorer B Press KitBob AndrepontОценок пока нет

- StratificationДокумент91 страницаStratificationAshish NairОценок пока нет

- AIPT 2021 GuidelineДокумент4 страницыAIPT 2021 GuidelineThsavi WijayasingheОценок пока нет

- Final Research Report - LP and AfДокумент147 страницFinal Research Report - LP and Afapi-636943816Оценок пока нет

- Programming Essentials in PythonДокумент23 страницыProgramming Essentials in PythonNabeel AmjadОценок пока нет

- Analytical ReasoningДокумент7 страницAnalytical ReasoningKashif NadeemОценок пока нет

- Vodafone Idea MergerДокумент20 страницVodafone Idea MergerCyvita Veigas100% (1)