Академический Документы

Профессиональный Документы

Культура Документы

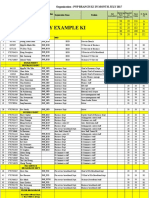

CignaTTK ProHealth Vs Apollo Optima Restore

Загружено:

maakabhawan26Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CignaTTK ProHealth Vs Apollo Optima Restore

Загружено:

maakabhawan26Авторское право:

Доступные форматы

FOR INTERNAL USE ONLY.

TO BE US

Product Name

Features

Entry Age (Adult)

Apollo Munich Optima Restore

Entry age - 18 years

Maximum entry age - 65 years

Lifetime

Renewal Age

Age of Dependent Child (Min & Max Child from 91 days to 5 years can be

covered if both parents are covered

Entry Age) for Floater

Dependent Parents Covered

Sum Insured Options

Tenure ( Years)

Policy type - (Individual / Floater)

Plan payout basis

Premium Band

Medical Test Requirement

Coverage

Hospitalisation

Pre Hospitalization

Post Hospitalisation

Day care Treatment

Domiciliary hospitalization

Ambulance Charges

Yes

3Lac, 5Lac, 10Lac, 15Lac

1 & 2 Years

Individual / Family Floater

Reimbursement of actual expenses

Age Band Wise

Based on Age and Sum Insured

Covered upto Full SI

60 days

180 days

Covered

Covered

2000 per hospitalisation in case of

emergency

Hospital Cash Allowance

Critical Illness

Not available

Not available

E Opinion

Not available

Recovery Grant/Convalescence

Organ Donor

Not available

Covered upto Full SI

Out Patient Expenses General

Out-patient dental treatment

Out Patients Pharmacy

Not available

Not available

Not available

Maternity

Pre - Existing Illness

Restoration

Worldwide Emergency Cover

Features

Claim Processing

Cumulative Bonus (No Claim)

Not available

After 3 years of waiting (36 months)

Restore available to re-instate the Basic

Sum Insured to 100% once in policy year

for all future claims once basic SI &

cumulative bonus SI is exhausted.

Restored SI to be

utilised in the same policy year.

Not available

TPA

50% of Basic SI on each renewal,

maximum upto 100% of Basic SI. If a

Claim is made CB is reduced by 50%

Long Term Discount on premium

Health Check up

Not available

Not available

Co-pay / Deductible/Sublimits

Not available

Renewal Special Features

No Special Renewal Feature

USE ONLY. TO BE USED FOR TRAINING PURPOSE. NOT TO BE CIRCULATED TO CUSTOMERS.

ProHealth Protect

ProHealth Plus

Min Entry Age: 18 Years

Lifetime

Max Entry Age: No limit

Lifetime

Min Entry Age: 91 days

Yes

Rs. 2.5 Lac/3.5 Lac/ 4.5 Lac

Yes

Rs. 4.5 Lac/5.5 Lac/7.5 Lac/10 Lac

1 year/2 year

Individual & Family Floater

Reimbursement of actual

expenses / Benefit payout for

Critical Illness

1 year/2 year

Individual & Family Floater

Reimbursement of actual expenses

/ Benefit payout for Critical Illness

Age and Zone Wise

Medicals required for insured

aged 46 years & above

Age and Zone Wise

SI 4.5 Lac/ 5.5 Lac/ 7.5 Lac Medicals required for insured aged

46 years & above

SI 10 Lac - Medicals

required for insured aged 41 years

and above

In-patient hospitalization

expenses as per actual.

Room rent (shared room) as

per actual

In-patient hospitalization expenses

as per actual.

Room

rent (single private room) as per

actual

60 days

90 days

171 listed procedures

Covered upto full Sum Insured

60 days

180 days

171 listed procedures

Covered upto full Sum Insured

Upto Rs.2000/- per

hospitalization event

Upto Rs.3000/- per hospitalization

event

Not available

Lump sum payment of full Sum

Insured if opted

Not available

Lump sum payment of full Sum

Insured if opted

Expert opinion available once

during policy year for each

insured

Expert opinion available once

during policy year for each insured

Not available

Covered upto full Sum Insured

Not available

Covered upto full Sum Insured

Rs.500/- available to redeem

against OPD expenses

Rs.2000/- available to redeem

against OPD expenses

Max Age: 23 years

Not available

Covered upto 15,000 for normal

delivery and 25,000 for CSection per event after a waiting

period of 48 months

New Born baby

cover also available Vaccination

expenses is covered over & above

Maternity SI

Pre-existing disease covered

after 48 months

Pre-existing disease covered after

36 months

When the basic SI & earned cumulative bonus is insufficient due to claims paid or accepted as pa

the same will be restored to 100% of basic SI. This does not require the Basic SI + CB to be exha

completely.

Covered upto full Sum Insured

Covered upto full Sum Insured

TPA

5 % increase in Sum Insured

maximum upto 50 %.

No reduction in SI in case of a

claim

TPA

10 % increase in Sum Insured maximum upto 50 %.

reduction in SI in case of a claim

7.5% for a 2 years policy term

Available once in a block of 3

Available at each renewal, to all

years for all Insured persons

insured persons who have

who have completed 18 years of completed 18 years of Age.

age.

Co-pay: Options to choose

between 10% and 20%

copayment for each and every

claim

Sum Insured - Deductible

options

2.5 Lac - Not Availble

3.5 Lac - 1 Lac

4.5 Lac - 1 Lac/ 2 lac

Mandatory

Co-pay of 20% for insured aged

65 years & above.

Co-pay: Options to choose between

10% and 20% copayment for each

and every claim

Sum Insured - Deductible options

4.5 Lac - 1 Lac/ 2 Lac

5.5 Lac - 2 Lac/ 3 Lac

7.5 Lac - 2 Lac/ 3 Lac

10 Lac - 3 Lac

Mandatory Copay of 20% for insured aged 65

years & above.

Reward Points to be earned for each year of premium paid and accumulated for 2 years. Rewards

completing Our Online Wellness Programs. These earned Reward Points can be used to get a disc

Premium OR they can be redeemed for equivalent value of Health Maintenance vouchers.

RCULATED TO CUSTOMERS.

18 Years

ProHealth Preferred

ProHealth Premier

Max Entry Age: No limit

Lifetime

e: 91 days

Max Age: 23 years

Lifetime

Yes

Rs. 15 Lac/30 Lac/ 50 Lac

Yes

Rs. 100 Lac

1 year/2 year

Individual & Family Floater

Reimbursement of actual

expenses / Benefit payout for

Critical Illness

1 year/2 year

Individual & Family Floater

Reimbursement of actual

expenses / Benefit payout for

Critical Illness

Age and Zone Wise

Medicals for all age group

Age and Zone Wise

Medicals for all age group

In-patient hospitalization expenses In-patient hospitalization

as per actual.

Room

expenses as per actual.

rent (single private room) as per

Room rent (single private room)

actual

as per actual

60 days

180 days

171 listed procedures

Covered upto full Sum Insured

60 days

180 days

171 listed procedures

Covered upto full Sum Insured

Actual expenses paid per

hospitalization event

Actual expenses paid per

hospitalization event

Not available

Lump sum payment of full Sum

Insured if opted

Not available

Not available

Expert opinion available once

Expert opinion available once

during policy year for each insured during policy year for each

insured

Not available

Covered upto full Sum Insured

Not available

Covered upto full Sum Insured

Covered upto 1% of Sum Insured subject to maximum of 15000 per

policy year

Covered upto 50,000 for normal

delivery and 100,000 for CSection per event after a waiting

Period of 48 months

New Born baby cover

also available Vaccination

expenses is covered over & above

Maternity SI

Covered upto 50,000 for

normal delivery and 100,000

for C-Section per event after a

waiting Period of 48 months

New Born baby cover also

available

Vaccination expenses is covered

over & above Maternity SI

Pre-existing disease covered after 24 months

due to claims paid or accepted as payable,

require the Basic SI + CB to be exhausted

Covered upto a maximum of Rs.10

Lac

TPA

red maximum upto 50 %.

a claim

No

for a 2 years policy term

Available at each renewal, to all

insured persons who have

completed 18 years of Age.

Not available

Covered upto a maximum of

Rs.10 Lac

TPA

Not available

Available at each renewal, to all

insured persons who have

completed 18 years of Age.

Co-pay/Deductible - Not available

Co-pay/Deductible - Not available

Mandatory Co-pay of 20% for

insured aged 65 years & above.

Mandatory Co-pay of 20% for

insured aged 65 years & above.

nd accumulated for 2 years. Rewards can also be earned for enrolling and

ward Points can be used to get a discount in premium from the 3rd Annual

Health Maintenance vouchers.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Rajiv KhannaДокумент4 страницыRajiv Khannamaakabhawan26Оценок пока нет

- R S TRADING CO (Bajaj Fire Policy)Документ10 страницR S TRADING CO (Bajaj Fire Policy)maakabhawan26Оценок пока нет

- Best Buy: Let's Uncomplicate. Let's UncomplicateДокумент1 страницаBest Buy: Let's Uncomplicate. Let's Uncomplicatemaakabhawan26Оценок пока нет

- Renewal Advice: OfferДокумент2 страницыRenewal Advice: Offermaakabhawan26Оценок пока нет

- Acctstmt DДокумент4 страницыAcctstmt Dmaakabhawan26Оценок пока нет

- Account Statement: Non-TransferableДокумент2 страницыAccount Statement: Non-Transferablemaakabhawan26Оценок пока нет

- Acctstmt BДокумент5 страницAcctstmt Bmaakabhawan26Оценок пока нет

- Subject: Household Insurance Policy No:2003262613000333: Home AssistanceДокумент2 страницыSubject: Household Insurance Policy No:2003262613000333: Home Assistancemaakabhawan26Оценок пока нет

- Policy Pack For 30196307201502Документ42 страницыPolicy Pack For 30196307201502maakabhawan26Оценок пока нет

- Subject: Household Insurance Policy No:2003262613000179: Home AssistanceДокумент2 страницыSubject: Household Insurance Policy No:2003262613000179: Home Assistancemaakabhawan26Оценок пока нет

- Subject: Household Insurance Policy No:2003262613000292: Home AssistanceДокумент2 страницыSubject: Household Insurance Policy No:2003262613000292: Home Assistancemaakabhawan26Оценок пока нет

- Every DETAIL Matters To Your HEALTH.: Policy ContractДокумент38 страницEvery DETAIL Matters To Your HEALTH.: Policy Contractmaakabhawan26Оценок пока нет

- Account Statement: Folio No.: 8859269 / 96Документ3 страницыAccount Statement: Folio No.: 8859269 / 96maakabhawan26Оценок пока нет

- Tata Mutual Fund: Transaction StatementДокумент5 страницTata Mutual Fund: Transaction Statementmaakabhawan26Оценок пока нет

- Third Party Declaration v1 1Документ1 страницаThird Party Declaration v1 1maakabhawan26Оценок пока нет

- Tata Mutual Fund: Transaction StatementДокумент5 страницTata Mutual Fund: Transaction Statementmaakabhawan26Оценок пока нет

- Acctstmt HДокумент3 страницыAcctstmt Hmaakabhawan26Оценок пока нет

- CignaTTK ProHealth Vs Max Bupa HeartBeatДокумент9 страницCignaTTK ProHealth Vs Max Bupa HeartBeatmaakabhawan26Оценок пока нет

- CignaTTK ProHealth Vs Religare CareДокумент9 страницCignaTTK ProHealth Vs Religare Caremaakabhawan26Оценок пока нет

- CignaTTK ProHealth Vs Star ComprehensiveДокумент9 страницCignaTTK ProHealth Vs Star Comprehensivemaakabhawan26Оценок пока нет

- Third Party Declaration For Partnership FirmДокумент1 страницаThird Party Declaration For Partnership Firmmaakabhawan26Оценок пока нет

- CignaTTK ProHealth Vs ICICI Lombard CHIДокумент9 страницCignaTTK ProHealth Vs ICICI Lombard CHImaakabhawan26Оценок пока нет

- Form I-A Application For Appointment To Act As An Insurance Agent (With A Life Insurer OR General Insurer OR Health Insurer)Документ3 страницыForm I-A Application For Appointment To Act As An Insurance Agent (With A Life Insurer OR General Insurer OR Health Insurer)maakabhawan260% (2)

- Online Exam TipsДокумент1 страницаOnline Exam Tipsmaakabhawan26Оценок пока нет

- InductionДокумент36 страницInductionmaakabhawan26Оценок пока нет

- Illustration of BenefitsДокумент2 страницыIllustration of Benefitsmaakabhawan26Оценок пока нет

- Portability Consent Form - V1.1Документ1 страницаPortability Consent Form - V1.1maakabhawan26Оценок пока нет

- IC 34 Question Bank - Answer PaperДокумент40 страницIC 34 Question Bank - Answer Papermaakabhawan2667% (9)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Spare Part PhilosophyДокумент27 страницSpare Part Philosophyavaisharma50% (2)

- First - Second and Third Class Levers in The Body - Movement Analysis in Sport - Eduqas - Gcse Physical Education Revision - Eduqas - BBC BitesizeДокумент2 страницыFirst - Second and Third Class Levers in The Body - Movement Analysis in Sport - Eduqas - Gcse Physical Education Revision - Eduqas - BBC BitesizeyoyoyoОценок пока нет

- Enrile v. SalazarДокумент26 страницEnrile v. SalazarMaria Aerial AbawagОценок пока нет

- Additional Article Information: Keywords: Adenoid Cystic Carcinoma, Cribriform Pattern, Parotid GlandДокумент7 страницAdditional Article Information: Keywords: Adenoid Cystic Carcinoma, Cribriform Pattern, Parotid GlandRizal TabootiОценок пока нет

- The Time Machine Was First Published in 1984 As A Story Under The Name The Time Traveller in The National ObserverДокумент1 страницаThe Time Machine Was First Published in 1984 As A Story Under The Name The Time Traveller in The National ObservermarceОценок пока нет

- UFO Yukon Spring 2010Документ8 страницUFO Yukon Spring 2010Joy SimsОценок пока нет

- Introducing The Thinkcentre M70A. A Desktop You DefineДокумент3 страницыIntroducing The Thinkcentre M70A. A Desktop You DefineSiti RohayatiОценок пока нет

- How To Add Attachment Using JAVA MappingДокумент4 страницыHow To Add Attachment Using JAVA MappingmvrooyenОценок пока нет

- Data Network Unit 6 - UCДокумент15 страницData Network Unit 6 - UCANISHA DONDEОценок пока нет

- Academic Socialization and Its Effects On Academic SuccessДокумент2 страницыAcademic Socialization and Its Effects On Academic SuccessJustin LargoОценок пока нет

- Operations Management Interim ProjectДокумент4 страницыOperations Management Interim ProjectABAYANKAR SRIRAM (RA1931201020042)Оценок пока нет

- Reaction Paper FinalДокумент5 страницReaction Paper FinalJelo RoxasОценок пока нет

- Week - 2 Lab - 1 - Part I Lab Aim: Basic Programming Concepts, Python InstallationДокумент13 страницWeek - 2 Lab - 1 - Part I Lab Aim: Basic Programming Concepts, Python InstallationSahil Shah100% (1)

- PNP Ki in July-2017 AdminДокумент21 страницаPNP Ki in July-2017 AdminSina NeouОценок пока нет

- Animal Health ChecklistДокумент4 страницыAnimal Health ChecklistcapsfastОценок пока нет

- Galman V PamaranДокумент7 страницGalman V PamaranChow Momville EstimoОценок пока нет

- Bioinformatics Computing II: MotivationДокумент7 страницBioinformatics Computing II: MotivationTasmia SaleemОценок пока нет

- C. Robert Mesle (Auth.) - John Hick's Theodicy - A Process Humanist Critique-Palgrave Macmillan UK (1991)Документ168 страницC. Robert Mesle (Auth.) - John Hick's Theodicy - A Process Humanist Critique-Palgrave Macmillan UK (1991)Nelson100% (3)

- John Wren-Lewis - NDEДокумент7 страницJohn Wren-Lewis - NDEpointandspaceОценок пока нет

- Lect2 - 1151 - Grillage AnalysisДокумент31 страницаLect2 - 1151 - Grillage AnalysisCheong100% (1)

- Paul Wade - The Ultimate Isometrics Manual - Building Maximum Strength and Conditioning With Static Training-Dragon Door Publications (2020) - 120-146Документ27 страницPaul Wade - The Ultimate Isometrics Manual - Building Maximum Strength and Conditioning With Static Training-Dragon Door Publications (2020) - 120-146usman azharОценок пока нет

- Bgrim 1q2022Документ56 страницBgrim 1q2022Dianne SabadoОценок пока нет

- Flow of FoodДокумент2 страницыFlow of FoodGenevaОценок пока нет

- Arbans Complete Conservatory Method For Trumpet Arbans Complete ConservatoryДокумент33 страницыArbans Complete Conservatory Method For Trumpet Arbans Complete ConservatoryRicardo SoldadoОценок пока нет

- Aero Ebook - Choosing The Design of Your Aircraft - Chris Heintz PDFДокумент6 страницAero Ebook - Choosing The Design of Your Aircraft - Chris Heintz PDFGana tp100% (1)

- Verniers Micrometers and Measurement Uncertainty and Digital2Документ30 страницVerniers Micrometers and Measurement Uncertainty and Digital2Raymond ScottОценок пока нет

- Operating Instructions: HTL-PHP Air Torque PumpДокумент38 страницOperating Instructions: HTL-PHP Air Torque PumpvankarpОценок пока нет

- Calculus For The Life Sciences 2nd Edition Greenwell Solutions ManualДокумент26 страницCalculus For The Life Sciences 2nd Edition Greenwell Solutions ManualSharonPerezozqy100% (56)

- STS Module 11Документ64 страницыSTS Module 11Desiree GalletoОценок пока нет

- Muscles of The Dog 2: 2012 Martin Cake, Murdoch UniversityДокумент11 страницMuscles of The Dog 2: 2012 Martin Cake, Murdoch UniversityPiereОценок пока нет