Академический Документы

Профессиональный Документы

Культура Документы

Abl System

Загружено:

Fahad Khan LangahАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Abl System

Загружено:

Fahad Khan LangahАвторское право:

Доступные форматы

System Analysis and Design

Muhammad Faisal Amin

Muhammad Mohsin

Adil Hassan

02

17

09

Management Information System,

Mam Amna Lodhi,

10th Feb, 2016

Table of Contents

List of Table

List of Figures

1 | Page

System Analysis and Design

1.0

Introduction

1.1

Background of the Study

1.2

Statement of Objective

1.2.1 General Problem

1.2.2 Specific Problem

1.2.3 General Objective

1.2.4 Specific Objective

1.3 Significance of the Study

1.4 Scope and Limitation

2.0 Methodology of the Study

3.0 Data Gathering Procedure and output

4.0 The Existing System

4.1 Company Background

Allied Bank Limited was the first bank, established in Pakistan. Before independence, in 1942

it started out in Lahore, the name of bank was Australasia Bank; in 1974 it was renamed to Allied

Bank of Pakistan Limited and later on Allied Bank Limited in 2005. In August 2004, the Banks

ownership was transferred to an Ibrahim Leasing Limited and Ibrahim Group because of capital

reconstruction.

Today, with its existence of over 60 years, the Bank has built itself a foundation with a strong

equity, assets and deposit base. It offers universal banking services, while placing major

emphasis on retail banking. The Bank also has the largest network of over 800 online branches in

Pakistan and offers various technology based products and services to its diverse clientele.

Vision

To become a dynamic and efficient bank providing integrated solutions in order to be the first

choice bank for the customers.

Mission

To provide value added services to our customers

To provide high tech innovative solutions to meet customers' requirements

To create sustainable value through growth, efficiency and diversity for all stakeholders

To provide a challenging work environment and reward dedicated team members

according to their abilities and performance

To play a proactive role in contributing towards the society

Core Values

Integrity

Excellence in Service

High Performance

Innovation and Growth

2 | Page

System Analysis and Design

Company History:

Under the Chairmanship of Khawaja Bashir Bux bank was esblished in December 1942 as the

Australasia Bank at Lahore with a paid-up share capital of Paki Rs.0.12 million, and his business

associates, including Abdul Rahman Malik who was amongst the original Board of Directors, the

bank had attracted deposits, equivalent to PKR 0.431 million in its first eighteen months of

business assets then amounted to PKR 0.572 million. Today Allied Bank's paid up Capital &

Reserves amount to Rs. 10.5 billion, deposit exceeded Rs. 143 billion and total assets equal Rs.

170 billion.

Reason for selecting Allied Bank:

Reason of selecting Allied Bank is that, it is one of the leading bank in Pakistan with

international standards and which keeps on innovating and secondly because we have a reference

in this organization which help us in extracting the required information in this project more

easily and without much difficulty.

Personal

Banking Services

4.2 Description of the System

Almost one year ago Allied Bank replaces UNI BANKING to TEMENOSE (T24). T24 is the

latest information system which is now a day mandatory from State Bank of Pakistan for every

new bank.

With the help of new information technology Allied Bank Limited records the daily transactions,

and that took place from all over the Pakistan into a centralized database in real time and now

there is no batch processing is taking place in Allied Bank all over the Pakistan. Every bank

branch is an online branch and is directly connected to the centralized server to keep the data up

to date to avoid any problems. Now information system of Allied Bank makes thousands of

transactions per day. And this information system makes whole process more quick, reliable and

simple. And employees can easily connect with other branches; customer service gets improved,

online banking emerged and lot of other benefits.

Now a day Allied Direct Internet Banking is an innovative online banking service. Allied Direct

Internet Banking offers you good policy to manage and control your banking and finances (when

you want to, where you want to. Now its Simple & Convenient, Secure and Faster. So, just get

clicking.)

Information System:

The MIS used at Allied bank Limited is Oracle Database 10g. Oracle Data base 10g has

completely transformed the outlook and operations of ABL. It has transformed the structure such

that now ABL's IS does not consist of fragmented machineries working individually to attain

3 | Page

System Analysis and Design

goals but they now function as a fused collection of servers, storage devices, and systems to meet

the changing processing needs of ABL. This resulted in dramatic cost reduction, overall

efficiency and enhancement in the quality of customer service. It has also reduced hardware costs

by efficient networking and amalgamating of functions performed by various servers and

systems. Cost reduction also took place because Oracle 10g eliminated the need for the

purchases and upgrading of management softwares and tools and third party interventions as it

was a complete management solution in itself.

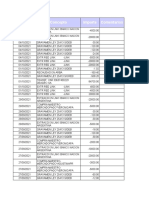

Through TPS all routine information are collected in Allied Bank. All details of TPSs HUBs go

into Management Information System. This information is then summarized in the form of

reports for the manager so that they can check whether the firm is working properly or not. If

there are some flaws then they take control measures to fix those flaws. In one branch all daily

transactions are recorded and all reports are prepared on daily basis. TEMINOS generate daily

information report at the end of the day.

Organizational transaction processing system in T24:

TPS is a type of information system. It collects, store, modify, and save the transactions of

organization. One transaction is an event that generates and modifies data that is eventually

stored in information system. TPS monitors transaction programs. Basic purpose of TPS program

is that must be left in a consistent state. TPS that Allied Bank is using is effective, that systems

process is fast and rapidly, to ensure the smooth flow of data and the progression of processes.

Payroll Transaction Process System:

TPS in Allied Bank is for to get information and record of the employee payroll and calculate

his/her annual earning. It get information about the employee from the employees department

and also from general ledger and send it to payroll TPS. From where it links that information

with the previous record and prepare a report which is forwarded to management. Management

takes notice of the record of the employees efficiency to work and may declare bonus or

incentive or demote him/her. This report is checked and approved by the branch manager after

which check is issued to the employee. And at the time of salary or any incentive or benefits,

when that check is cashed, the record is update in the general ledger as well as the master payroll

4 | Page

System Analysis and Design

(HUB).

New Customer Identification:

Allied bank is using TEMENOS banking system which is connected to NADRA. Banks

information system automatically verifies customers ID number, address, income, and city

name. Which helps the management to identify whether he/she is using his original ID card or

not. Whenever new customer come for open an account customer fill and form named KYC,

abbreviation of KNOW YOUR CUSTOMER. Operational manager enter all date of that form

into system which contains actual worth and expectations of deposit and after that manger enter

his/her comment which he/she knows personally about that customer. Customer due diligence

named report related to that customer goes to Head office and State bank also have access to that

customer, through which State Bank knows the credit history of that customer.

5 | Page

System Analysis and Design

Employees Record:

All employees having their personal login IDs which allotted at the time of employment and

they are supposed to login when they enter the bank and logout on leaving. Their accounts are

also connected with the HUB which continuously makes record of their hours spent in the bank.

Moreover, the bank has their own setup which makes records of all the transactions made by an

employee. All these help management to monitor the working efficiency of an employee.

Through this information system management also have record of, how many customers served

by whom employee. And they also have information through this system that how many

customers convinced to open an account by whom.

Real time Banking:

When a customer withdraws a sum of money from his or her account the transactions are

processed and the account balance updated as soon as possible, allowing both the bank and

customer to keep track of funds. When a customer goes to bank for withdraw or deposit the cash

through cheque or cash then there are certain steps. We will just describe withdraw transaction.

First step on the time of withdraw through cheque is, first cashier made entry of that cheque into

information system (put cheque number, name of a/c holder) and then cheque is scanned into

FLATBED PRINTER. And after that information system configure instrument number, amount

in words & digits, and signature etc. If entered and scanned information will be same then

system will proceed to next step. If transaction is of less than Rs.25, 000 then it needs the

verification of just one person. And if cheque is of more than Rs.25, 000 then it needs the

supervision of two supervisors. In case of more than twenty five thousand rupees transaction,

system of Allied Bank generates one supervision code. One person made transaction and

second supervises. And after configuration transaction is done. TEMENOS system of Allied

Bank shows option of debit and credit at the time of transaction. And when transaction is made

then the new transaction is send to Lane. Date and time of transaction automatically entered

6 | Page

System Analysis and Design

whenever transaction made. The Lane enters the HUB where the specified file is accessed.

Automated Teller Machine Card (ATM Card):

Through ATM card customer can withdraw of cash easily. At the time of apply he/she give bio

data, income summary, company name, NIC. That data (NIC no. and bio data) send to system

TEMINOS which directly linked to NADRA. If information correct then it is forward to

customer

service

center

and

the

issue

of

credit

card.

Management Information System after TPS:

Through TPS all routine information are collected in Allied Bank. All details of TPSs HUBs go

into Management Information System. This information is then summarized in the form of

reports for the manager so that they can check whether the firm is working properly or not. If

there are some flaws then they take control measures to fix those flaws. In one branch all daily

transactions are recorded and all reports are prepared on daily basis. TEMINOS generate daily

information report at the end of the day.

7 | Page

System Analysis and Design

Diagram

8 | Page

of

TPS

and

MIS

System Analysis and Design

T24 Information System in Allied Bank:

New management information system, of Allied bank is TEMINOS (T24). In banking language

it is called T24. This information system is recommended by State Bank Pakistan, it is easy to

use and operate. Trainings of Allied Bank are also held on computers. ABL has one training

institute in Lahore.

The bank provides on the job training facilities to employees through job rotation to in different

department as per requirement training more emphasis is in practical.

Benefits of TEMINOS Information System:

User friendly: It is easy to use. This Information System run on windows operating system and

graphics of this system also works like windows. As compare to UNI Banking System, UNI

banking has just black graphics and contains on command system.

Web page: Through registered ID, employee of the bank work online that is easily accessible for

manager, immediate boss and head office.

Security: Data of bank is secure in this information system.

Easy to install: This information system is easy to install as compare to UNI Banking system.

Bank install this IS through web. And if there is any problem in system then it can resolve

through web.

Centralized: This information is centralized so transactions are recorded on daily basis. And

head office has record of each branch.

4.3 Problem Areas

To function effectively as an interacting, interrelated, and interdependent fee Database

Administrator tool for management and staff, MIS must be "useable." The five elements of a

useable MIS system are: timeliness, accuracy, consistency, completeness, and relevance. The

usefulness of MIS is hindered whenever one or more of these elements are compromised.

The IS at Allied Bank, although effective to a great extent, has certain weaknesses as we found

out:

9 | Page

System Analysis and Design

From a branch centered approach, the bank has moved to a centralized system. Transactions at

the branches, previously used to be stored and processed at the branches only. It was only at the

day end, that all data and information was relayed to the head office. Now, however, this practice

has changed. Branches only facilitate interactions with customers, whereas the information is

directly send to the head office and is processed there in real time. The problem with this is the

time lag that results subsequently. Data flow from the point of transaction to the head office,

back to the point of transaction is a longer and hence a slower process.

Also the security procedures inbuilt in the new software, Temenos, make processing slower. In

the new IS, cash transactions taking place go from a Temenos account head to a buffer account

and then to the customer's account. Previously, the cash transactions were directly debited/

credited to the customer account. Buffer accounts created, although increase the overall security;

make the processing of data slower.

Too much reliance on information systems also means that in the scenario when server crashes

down, or gets hanged, banking transactions will be completely disrupted.

One of the major concerns of organizations using information technology to carry out their

business processes is how to secure the data against internal and external threats. With modern

advancements, mitigating information security threats has become an ongoing battle. Viruses,

worms, hacker attacks, spam, phishing, and instant messaging attacks are just some of the

problems. Data bank faces risk of security breaches not only at the hands of customers and

outsiders, but also from the employees working within the organization. Therefore it is highly

crucial to build security parameters to detect whatsoever threats there might be and also to ensure

data safety.

Future Plan

Allied bank is planning to replace the current Core Business Solution 'Uni Bank' with 'Temenos'.

This transformation is in its phase I. The software is being tested in one branch near the Head

Office in Lahore. This testing phase will end on June 30th.

Training of employees is being conducted and further more sessions are in the pipeline

Allied bank plans to introduce Temenos in 107 branches out of the whole network of 800 braches

within six months.

Implementation in further branches is still unplanned.

Allied Bank has opened its branch in Kashmir and plans to extend its network and reach in the

remote areas of the country.

4.4

10 | P a g e

Data Specification

4.4.1 Entity Relationship Diagram

System Analysis and Design

5.0

System Implementation Plan

5.1

Resource Requirements

5.1.1 Hardware Requirements

Desktop PC's Specs: Intel Pentium 4 2.5ghz, 512MB RAM, 80 GB hard-disk

Laptop PC's Specifications: Intel Dual Core2 2Ghz, 2gb RAM, 160GB Hard-disk

IBM P5 Mainframe Server

Specifications:

Four 1.65GHz 64-bit POWER5 processors

L2 cache: 1.9MB (2-way); 3.8MB (4-way)

L3 cache: 36MB (2-way); 72MB (4-way)

32GB of 266MHz DDR1 memory

11 | P a g e

System Analysis and Design

Two 10/100/1000 Ethernet ports

Optional 2 Gigabit Fibre Channel, 10 Gigabit Ethernet and 4x InfiniBand adapters

Two USB, two HMC and two system ports

5.1.2 Software Requirements

The department's computers were found to be using the following system software.

Operating System: Windows XP for Desk-top PC's

Windows Vista for the Laptops. Windows NT server for mainframe server.

5.1.3 Human Resources Requirements

In this era of cut-throat competition and diminishing profit margins Banks are becoming more

lean, service oriented and efficient. As mentioned before Banks in order to keep this trend of

efficiency going upward are adopting new information systems and updating the existing ones

however one barrier to this are the employees, there is already a shortage of computer literate

people in Pakistan and for this reason when new software's or In our case a new CORE

BANKNG SOLUTION is introduced it requires rigorous training session to train the employees

so that they are able to use the software.

The effectiveness of core banking systems is directly related to the skills and knowledge of those

operating them; therefore training is an essential investment and not an expense. The training

session have been divided into three stages

When we talk of the end user it's the employees themselves here, they use the information

available and make different queries accordingly as mentioned before currently the Core

Banking Solution (CBS) namely Unibank is being change to Temenos and this requires that the

support and operations staff be trained to use this CBS. For this reason different training sessions

have been organized by the Bank and the Temenos technical team itself.

Apart from this Temenos, to support the contracted BANKS, also provides the following courses

to their employees:

Open Training Courses

Bespoke Training courses

End User Training (EUT)

Training consultancy for design and development of EUT courses

E-Learning and Computer Based Training (CBT)

The "Train the Trainer" approach

12 | P a g e

System Analysis and Design

The benefits of attending these training programs include dedicated premises and training

equipment, and the added advantage of minimizing interruptions for the duration of training

courses.

13 | P a g e

Вам также может понравиться

- University of Central Punjab: "Quality in Education"Документ21 страницаUniversity of Central Punjab: "Quality in Education"Fahad Khan LangahОценок пока нет

- JJ ProfectДокумент2 страницыJJ ProfectFahad Khan LangahОценок пока нет

- Simple Resume Vol1Документ1 страницаSimple Resume Vol1Fahad Khan LangahОценок пока нет

- Russia United States: Air Force Combat AircraftДокумент15 страницRussia United States: Air Force Combat AircraftFahad Khan LangahОценок пока нет

- Muhammad Mohsin: Career ObjectiveДокумент1 страницаMuhammad Mohsin: Career ObjectiveFahad Khan LangahОценок пока нет

- Sir Jam Javed MCQДокумент15 страницSir Jam Javed MCQFahad Khan LangahОценок пока нет

- Management Information System of Allied BankДокумент29 страницManagement Information System of Allied BankFahad Khan LangahОценок пока нет

- ABL Annual Report 2014 PDFДокумент256 страницABL Annual Report 2014 PDFFahad Khan LangahОценок пока нет

- 2006 Chapter 07 AssignmentДокумент6 страниц2006 Chapter 07 AssignmentFahad Khan LangahОценок пока нет

- Ieee-Paper Format 1Документ3 страницыIeee-Paper Format 1Fahad Khan LangahОценок пока нет

- Abl System Analysis and DesignДокумент18 страницAbl System Analysis and DesignFahad Khan LangahОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Digital Lending For SMEsДокумент5 страницDigital Lending For SMEsSatwika PutraОценок пока нет

- Office of The General Manager (Com-Rev) : Assam Power Distribution Company LTDДокумент5 страницOffice of The General Manager (Com-Rev) : Assam Power Distribution Company LTDishansri7776873Оценок пока нет

- Questions and Answers About Direct PLUS Loans For Graduate and Professional StudentsДокумент2 страницыQuestions and Answers About Direct PLUS Loans For Graduate and Professional Studentsistuff28Оценок пока нет

- Impact of Internet Banking System and Technology On Indian BanksДокумент6 страницImpact of Internet Banking System and Technology On Indian BanksBhanu BasnalОценок пока нет

- Research Report The Contribution of Micro Finance Banks in The Empowerment of Small-Scale BusinessДокумент59 страницResearch Report The Contribution of Micro Finance Banks in The Empowerment of Small-Scale BusinessAvik BarmanОценок пока нет

- 123-Online Shopping System - SynopsisДокумент6 страниц123-Online Shopping System - SynopsismcaprojectsОценок пока нет

- Banking Law Notes 11Документ4 страницыBanking Law Notes 11Afiqah IsmailОценок пока нет

- Movimientos HistoricosДокумент22 страницыMovimientos HistoricosVerónica RodОценок пока нет

- Sale of Scrap in SD ModuleДокумент20 страницSale of Scrap in SD ModuleSrinath VasamОценок пока нет

- AXIS BANK-Wealth ManagementДокумент155 страницAXIS BANK-Wealth Managementakanungo91% (11)

- Sample StatementДокумент1 страницаSample StatementMurali TОценок пока нет

- 017517-Proforma Invoices FY 2019-20 PDFДокумент1 страница017517-Proforma Invoices FY 2019-20 PDFMEDICAL SUPERINTENDENTОценок пока нет

- Tender Datasheet PDFДокумент4 страницыTender Datasheet PDFJayachandranОценок пока нет

- Union County Real Estate Tax Debt ListДокумент92 страницыUnion County Real Estate Tax Debt ListDelinquencyReport.com100% (1)

- Preweek Handouts in Business Law May 2014 BatchДокумент8 страницPreweek Handouts in Business Law May 2014 BatchPhilip CastroОценок пока нет

- Bank Reconciliation: Prepared By: Rezel A. Funtila R, LPTДокумент19 страницBank Reconciliation: Prepared By: Rezel A. Funtila R, LPTRezel FuntilarОценок пока нет

- The Last Days of Lehman BrothersДокумент19 страницThe Last Days of Lehman BrothersSalman Mohammed ShirasОценок пока нет

- Entrepreneurship ManagementДокумент33 страницыEntrepreneurship ManagementhinalviraОценок пока нет

- Mba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Документ9 страницMba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Sammy Datastat GathuruОценок пока нет

- LIDL Connect SIM Installation SilverCrest Tablet PDFДокумент5 страницLIDL Connect SIM Installation SilverCrest Tablet PDFoskudicaОценок пока нет

- Bet You Thought (Federal Reserve) PDFДокумент21 страницаBet You Thought (Federal Reserve) PDFtdon777100% (6)

- Kalpana Bisen Paper On Dress CodeДокумент19 страницKalpana Bisen Paper On Dress CodeKalpana BisenОценок пока нет

- KYC Master Directions 2016 - Presentations For RefДокумент15 страницKYC Master Directions 2016 - Presentations For RefAnagha LokhandeОценок пока нет

- Dissertation On Retail and Commercial BankingДокумент4 страницыDissertation On Retail and Commercial BankingCustomPaperWritingServiceUK100% (1)

- Case Presentation Strategic TransformationДокумент10 страницCase Presentation Strategic TransformationTarun GuptaОценок пока нет

- The Money Paid To Jamii BusinessДокумент2 страницыThe Money Paid To Jamii Businessnetspheretechnologies254Оценок пока нет

- Audit of Cash and Cash EquivalentsДокумент2 страницыAudit of Cash and Cash EquivalentsWawex Davis100% (1)

- Proforma 1EДокумент3 страницыProforma 1EEric HernandezОценок пока нет

- Universak BankingДокумент33 страницыUniversak BankingprashantgoruleОценок пока нет

- Auto Loan CalculatorДокумент13 страницAuto Loan CalculatorLinkon PeterОценок пока нет