Академический Документы

Профессиональный Документы

Культура Документы

Greece MacroView June 28 2016

Загружено:

TatianaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Greece MacroView June 28 2016

Загружено:

TatianaАвторское право:

Доступные форматы

NATIONAL BANK OF GREECE | Greece: Macro View | July 2014

GREECE

NATIONAL BANK

Macro View

June 2016

OF GREECE

Tourism has increased strongly since 2011, showing notable resilience

to the macroeconomic headwinds. The share of travel revenue in GDP,

THE TOURISM SECTOR which is utilized as a simple measure of the direct contribution of

PROVIDES MUCH STRONGER- international tourism to the economy, increased cumulatively by 2.1 pps

THAN-INITIALLY-ESTIMATED to 7.6% of GDP in 2015 from 5.5% in 2011, with a direct support to GDP

growth of 0.4% per year in 2011-2015.

SUPPORT TO THE ECONOMY

NBG Research believes the direct impact of the tourism sector on GDP

growth in recent years is significantly larger, as travel data based on

surveys are becoming increasingly less reliable due to the use of more

sophisticated payment methods. NBG Research constructs a supply side

measure of non-resident tourism services, which indicates that the

Macroeconomic Indicators

value added of the sector increased by 3.5 pps of GDP between 2011

& Fiscal Outlook, pages 13-20

and 2015, 1.4 pps of GDP (and 62%) higher than the increase from the

survey data, despite the fact that NBG’s measure of tourism services

(comprising only accommodation and food) is significantly narrower

than that of travel revenue, and moreover, nets out operating costs.

Indeed, value added per tourist increased by 57% during this period.

The increase in value added reflects higher output as well as lower

production costs (intermediate expenditure). Specifically, output

related to non-residents is estimated to increase by €5.9 bn in 2011-

2015 (plus 74% cumulatively), and reflects, inter alia, the improving

capacity of the domestic accommodation and food services sector to

offer higher quality services as reflected in upgrades of the

accommodation infrastructure, which is mainly related to investment

initiated prior to the beginning of the crisis. Moreover, production costs

declined considerably (-12.8% between 2011 and 2015), despite the

significantly higher output, due to ongoing business restructuring --

mainly in the accommodation sector -- and falling input costs.

Direct contribution of international tourism to GDP

growth: demand vs supply-side perspectives

2,0 forec.

1,5 pps

1,0

0,5

0,0

-0,5

-1,0

Paul Mylonas, PhD

2016-23f

2010

2011

2012

2013

2014

2015

(+30210) 334 1521

e-mail: pmylonas@nbg.gr

Value added - accommodation and food services

Travel revenue (balance of payments)

Sources: National Accounts, balance of payments data and NBG estimates

NBG Economic Analysis Department

86 Eolou Str., 102 32 Athens, Greece

https://www.nbg.gr/en/the-group/press-office/e-spot/reports

Greece

Macro View

June 2016

Profitability in the tourism sector has also increased notably in recent

years, making the sector attractive for investment. Specifically, the

share of labor compensation declined due to a significant wage

adjustment in this sector by 24% since 2011 -- 2x times more than the

economy average wage reduction of 12%. As a result, gross operational

profits corresponded to about 40% of each euro of value added

generated in the sector in 2015 -- 20% higher than the average of Spain

and Portugal.

Based on World Travel & Tourism Council (WTTC) long-term projections

of the increase in tourism demand until 2023, it is estimated that about

€5.5 bn of new investments (3.1% of 2015 GDP) in new hotel capacity

and equipment will be needed in the years 2017-2023 to bring the

projected occupancy in line with its 15-year average (83% in Q3). Note

that without new investments, the occupancy rate would increase to

95% by 2018.

As a result of the higher demand -- and the increased capacity -- the

combined contribution to GDP growth from new investment and value

added generation is estimated at 1.3% per year in 2017-23, more than

double the average of the previous decade.

Greece: Economic & Market Analysis | June 2016| p. 2

NATIONAL BANK OF GREECE | Greece: Macro View

THE TOURISM SECTOR PROVIDES MUCH STRONGER-

THAN-INITIALLY-ESTIMATED SUPPORT TO THE

ECONOMY

Nikos S. Magginas, PhD

Head of Greece Macro Analysis Tourism has increased strongly since 2011, showing notable

(+30210) 334 1516

e-mail: nimagi@nbg.gr resilience to the macroeconomic headwinds and high uncertainty

Effrosyni Alevizopoulou, PhD arising from the negotiations with creditors on a series of economic

(+30210) 334 1620

e-mail:ALEVIZOPOULOU.E@nbg.gr programmes and the implementation of new fiscal measures

Aikaterini Gouveli, MSc equivalent to about 10% of GDP during the past four years. Indeed, in

(+30210) 334 2359

e-mail: gouveli.aikaterini@nbg.gr the period 2011-2015, the cumulative growth in tourist arrivals

reached 44%, compared with cumulative growth of 17.4% for the

Tourism activity increased strongly average of Spain, Portugal, Italy and Turkey. Both revenue and

in recent years… arrivals climbed to historical highs in each of the past six years,

_______________________________________________

reaching €14.1 bn and 23.6 mn visitors, respectively, in 2015 from

International tourist arrivals €10.5 bn and 16.4 mn in 2011. The share of travel revenue in GDP,

200 200 which is often utilized as a simple measure of the direct contribution

index

175 2000=100, 175 of international tourism to the economy, increased cumulatively by

2015 UNWTO estimates

for IT,SP,FR,PT 2.1 pps to 7.6% of GDP in 2015 from 5.5% in 2011, while its share in

150 150

total exports value reached 26.6% in 2015 from 20% in 2011. These

125 125

trends imply a direct contribution of international tourism to GDP

100 100 growth of +0.4 pps per annum in 2011-2015.

75 75 NBG Research believes the direct impact of the tourism sector on GDP

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

growth in recent years is significantly larger than the above numbers

Italy France

Portugal Spain

suggest. Indeed, the results of the border survey, on the basis of

Greece which travel data are compiled, are increasingly underestimating

actual revenue and spending of non-residents as traveling through

…with Greece over-performing multiple countries gains ground rapidly, along with the increasing role

against the main competitors… of remote payments and online bookings, as well as credit card use

_______________________________________________

by foreigners in Greece, all of which distort the traveler’s perception

of the final spending on tourism services.

International tourism revenue as

percentage of GDP Our approach analyzes the sector from the supply-side

10 10

9

%

*IMF forecast, 9 decomposition of the GDP accounts. The analysis focuses on business

8 NBG estimates 8

7 7

activity in the accommodation and food services sector, which is

6 6

5 5

closely related to tourism demand by residents and non-residents

4 4 and accounts for the bulk of tourism-related output. This output

3 3

2 2 comprises the provision of accommodation services to visitors and

1 1

0 0 other travelers (residents and non-residents) by hotels, and other

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016*

accommodation facilities/entities, as well as catering services in

Greece Portugal

Spain Italy hotels, restaurants, bars, cafeterias and other similar activities. Even

Turkey

this proxy, which is by construction a more narrow definition of

Sources: Eurostat & BoG, balance of payments data

tourism services, as it does not include all spending but just the main

categories, appears to result in higher estimates of the size of the

Sources: BoG, IMF, Eurostat, NBG estimates

tourism sector than that derived from border estimates.

GREECE | NBG Macro View |June 2016| p. 3

NATIONAL BANK OF GREECE | Greece: Macro View

…in terms of tourism revenue and The numbers attached by the media to the size of the tourism sector

arrivals

are usually much larger, as they include the indirect impact of tourism

Tourism receipts and arrivals

25 20

services (i.e., second round effects). Indeed, the full impact (direct

y-o-y change

20 15 and indirect) of tourism is traditionally derived by applying a

15 10 Keynesian multiplier to the direct impact -- related to resident and

10 5

non-resident demand -- which, in the case of Greece, results in a

5 0

0 -5 10.2% share of GDP (based on the demand side estimates of the

-5 -10 direct effect). Moreover, sectoral studies analyzing the role of

-10 -15

tourism in the economy estimate an even higher average share of

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

tourism (resident and non-resident) in Greek GDP of more than 15%

Source: Bank of Greece

of GDP, and in some cases 20% by including in the tourism sector

Non-resident arrivals (left axis)

Tourism receipts (gross, right axis)

perimeter several activities with indirect or partial connection with

tourism (such as transportation, related business services and other

The performance is even more auxiliary activities), as well as investment made by tourism business,

impressive from a supply-side

perspective: Total sectoral output while they do not usually adjust for the drag related to the import

increased by 2.2% of GDP in 2011- content of tourism. The broader definitions are hard to measure, as

2015…

_______________________________________________ they are often arbitrarily set. As such, their use is limited in analysing

developments in the sector (e.g. competitiveness), especially over

Output of accommodation & food short time periods. As a result, NBG Research’s analysis focuses on

services sector developments in the narrower definition, ignoring the wider impact

14

13 euro bn 13 on the economy.

12

11 11 Higher output reflects rising international demand for services of

10

9 9 increasing quality

8

7

Source: Eurostat Sectoral National

7 Overall output of the accommodation and food services sector

6 Accounts and NBG estimates based on

5 Greek household budget survey data for 5 increased (in constant prices), according to national accounts data

4 residents

3 3

from the production side of GDP, by c. €3.6 bn (2.2% of GDP, constant

2009

2010

2011

2012

2013

2014

2015e

prices) between 2011 and 2015 to 11.6% of GDP in 2015. This growth

Non-residents Residents

reflects the fact that increasing external demand more than

Accommodation and services sector -

compensated for the shrinkage of domestic demand.

Sectoral output decomposition

d(2015-

To compare production trends related to external demand with the

2011 2015

2011) balance of payments data on non-residents’ spending in the economy

euro bn

Residents 9,9 7,6 -2,2 (travel revenue data), we subtract residents’ spending in this sector

Non residents 7,9 13,8 5,9 derived from the Greek household budget survey from the total. The

Total 17,9 21,5 3,6

two sources are comparable – and thus one can be subtracted from

0

% GDP the other – since the household survey is directly used for compiling

Residents 5,2% 4,1% -1,1% the national accounts. Residents’ spending, based on the household

Non residents 4,2% 7,5% 3,3%

survey, declined significantly in recent years (-23% cumulatively, or

Total 9,4% 11,6% 2,2%

Memo item: €2.2 bn in 2012-2015 from €9.9 bn in 2012). Accordingly, the implied

BoP travel revenue (bn) 10,5 14,1 3,6

increase in output related to non-resident demand is estimated to be

BoP travel revenue (% GDP) 5,5% 7,6% 2,1%

€5.9 bn (+74% cumulatively) in 2011-2015 (from €7.9 bn in 2011 to

Sources: BoG, Eurostat, NBG estimates €13.8 bn in 2015), and accounts for 64% of sector output in 2015 from

45% in 2011. The respective increase in gross travel revenue data in

GREECE | NBG Macro View |June 2016| p. 4

NATIONAL BANK OF GREECE | Greece: Macro View

…driven by rapidly increasing the balance of payments was 37% lower (+€3.7 bn in 2012-2015).

demand by non-residents

_______________________________________________ This is a notable difference since (as mentioned above) the

Output of accommodation & food accommodation and food services sector corresponds to a narrower

services definition of tourism activity compared with travel revenue, which

25 Source: Eurostat

euro bn

National Accounts includes spending on a broader range of goods and services, such as

20 transportation, communications, retail trade as well as

15 accommodation and food services.

10 The increase in output reflects, inter alia, the improving capacity of

the domestic accommodation and food services sector to handle

5

increasing demand by non-residents for higher quality services. This

0

improvement reflects, inter alia:

2011

2012

2013

2014

2015e

Residents Non-residents

• An upgrade of capacity reflected in the steadily rising gross fixed

capital formation in this sector during the previous decade, that

Strong investment initiated prior to peaked in 2008 at 0.7% of GDP from 0.3% in 2001 -- a cumulative

the beginning of the crisis…

_______________________________________________ increase in gross investment of €7.1 bn (constant prices)

Number of bedrooms & total between 2000 and 2008. This investment led the total capital

tourism investment stock of the accommodation and food services sector to €28.5bn

4 25

%GDP thousand

bedrooms in 2013 (at current replacement costs, adjusted for depreciation)

20

3 from €26 bn in 2006. About 60% of this cumulative increase

15

reflected construction activity and the remainder investment in

10

2

equipment. Moreover, the share of equipment in total capital

5

stock reached a historical high of 22% (or €6.2 bn) in 2013 from

1 0

16%, on average, in 2005-2008, indicating an upgrade of the

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Investment in tourism sector (national accounts, productive capacity, as this share is typically positively

%GDP, left axis)

Number of hotel bedrooms, annual change ( 2y

correlated with the provision of more differentiated services. It

m.a., right axis) should be noted that a significant part of these investments in

new capacity, especially in the hotel segment, were initiated

…led to an increase in the level of

capital, along with a significant prior to the beginning of the crisis, and have been only

qualitative upgrade of the completed in recent years, as the average time of completion for

accommodation infrastructure…

_______________________________________________ construction projects is estimated at about 3-4 years. The

Greece: Quality decomposition of additional capacity, in conjunction with the closing of smaller

hotel capacity

uncompetitive units, resulted in an increase in the average size

800 Thousand

700 bedrooms of Greek hotels to 41.6 rooms in 2015 from 40.9 in 2011 and 39.0

600 in 2000 (Source: Hellenic Chamber of Hotels).

500

400 • However, aside from the absolute level of capital and aggregate

300

200

capacity additions, the quality of capital stock is also an

100 important determinant of sectoral output. In this respect, a

0

significant qualitative upgrade of the accommodation

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

infrastructure also occurred in recent years, with the proportion

Source: Hellenic Chamber of Hotels

of rooms in 4 and 5-star hotels rising to 40.6% of the total room

1 star 2 star 3 star 4 star 5 star

Sources: Eurostat, HCH, NBG estimates capacity in 2015 compared with 38% in 2010 and 31% in 2000.

This qualitative upgrade reflected not only new units, but also

GREECE | NBG Macro View |June 2016| p. 5

NATIONAL BANK OF GREECE | Greece: Macro View

…reflected in the increasing share of upgrades from lower categories supported by renovation and

4 and 5-star hotels in total hotel

capacity… services upgrades. In this respect, an increasing share of the

_______________________________________________

Greek accommodation sector succeeded in providing services of

Greece: Quality decomposition of a higher quality and increasing differentiation including e.g.,

hotel capacity (per cent of total) sports, health, recreation, transportation, communications,

cultural and agro tourism services, along with the more

100

90

80

conventional accommodation facilities. Moreover, higher

70

60

quality hotel categories experienced the largest increase in

50 occupancy rates during the period 2011-15 (from 80% in

40

30 Q3:2011 to 85% in 2015 for 4 and 5-star hotels compared with

20

10

0

78% for hotels of 3-stars or less), underlining the role of these

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

units in the provision of more competitive and value-generating

Source: Hellenic Chamber of Hotels services.

5 star 4 star 3 star 2 star 1 star

The notable improvement in the competitiveness of the Greek

accommodation sector is exemplified by the overperformance

…which strengthened the

international competitive position of of Greek hotels against their competitors (EU 25 countries) as

the Greek accommodation sector regards the customer satisfaction rating in 2014-2015. Indeed,

_______________________________________________

according to the General Satisfaction Index (GRI: Global Review

Quality decomposition of hotel Index, ReviewPro, SETE), Greek hotels also attained higher rates

capacity - percent of total

than their competitors regarding special sub-indicators of the

100

related survey, such as value for money, service, room quality,

80

food, beverages and cleaning services. The highest rate of

60

satisfaction (88%, on average in 2015) and the strongest

40

20

improvement in 2014-15 was recorded among customers of 5-

0

star hotels followed by 4-star hotels.

Greece Greece Italy Spain Portugal

2008 2014 Labor market trends also accompanied the solid rebound in

Source: Hellenic Chamber of Hotels & National sectoral activity, as 68% of new employment positions in 2013-

authorities

5 star 4 star 3 star 2 star 1 star

2015 have been created in the accommodation and food

services sector, with the average annual growth in employment

Greek hotels: customer in this sector reaching 6.7% in the same period compared with

satisfaction rating (GRI, index) an average decline in economy-wide employment of 0.7% y-o-y.

90 index These developments also surpass employment creation in this

89 100= maximum

88 sector in other euro area countries.

87

86 • There has been a significant increase in arrivals from high

85

84 income markets and/or markets with a higher propensity to

83

82

spend, such as Russia and, more recently, the US and UK, with

Sources: ReviewPro,

81

SETE Intelligence revenue per arrival from these markets exceeding the respective

80

average for travelers from the euro area by 12%, 71% and 15%,

Jan-14

Jan-15

Jan-16

Jul-14

Jul-15

Apr-14

Oct-14

Apr-15

Oct-15

Apr-16

respectively, in 2015. These markets, along with the euro area

.

5 star 4 star 3 star countries, jointly account for 51% of arrivals and 70% of travel

Sources: Eurostat, HCH, ReviewPro/SETE, NBG estimates revenue in 2015. Higher quality foreign visitors are typically

characterized by a high propensity to spend on a broader range

GREECE | NBG Macro View |June 2016| p. 6

NATIONAL BANK OF GREECE | Greece: Macro View

of facilities and auxiliary services (e.g. transportation,

Travel & tourism competitiveness index

(1 low - 7 high, 2015) communications) and goods (e.g. food and beverages), as well

Source: World

Business

environment

Economic Forum as on services with a high degree of differentiation and/or

Cultural resources 7 Safety & security

& business travel 6

5

quality (e.g. restaurants, sports, health care, recreation and

Natural resources Health & hygiene

4

3 culture).

Tourist service 2 Human resources

infrastructure 1 & labour market

Ground & port

0

• Data on the value of transactions made in Greece using debit and

ICT readiness

infrastructure

Air transport Prioritization of

credit cards issued abroad provide some additional indirect

infrastructure Travel & Tourism

Environmental International evidence on the ongoing rebalancing of Greek tourism. The

sustainability Openness

Price

competitiveness average annual growth of the value of these transactions, which

Spain Portugal Eurozone Greece are considered to be closely related to foreigners’ spending on

tourism services, increased by an unprecedented 22% y-o-y in

The accommodation and food

services sector has been the main each of the years 2013 and 2014 (i.e. prior to the imposition of

driver of employment creation capital controls). This increase outpaced, by a large margin, the

_______________________________________________

rise in international tourism revenue (+13.3% per annum, in the

Employment by sector of same period) and the respective growth in cashless payments by

economic activity

110 non-residents in other euro area countries (e.g. an estimated

100 average cumulative growth of 13% in Cyprus, Portugal and

90 Spain). The above trends are also suggestive of the increasing

80 value of services provided by the official tourism sector. It could

70

index

also be seen as an indication of a potential underestimation of

60 2008=100

non-residents’ spending in recent years, as approximated by the

50

border survey used in the compilation of travel revenue data.

2008

2009

2010

2011

2012

2013

2014

2015

Agriculture, forestry and fishing Production costs declined significantly as ongoing business

Manufacturing

Wholesale and retail trade restructuring -- mainly in the accommodation sector -- supported

Transportation and storage

Accommodation and food service activities productive efficiency

There has been a significant Another notable trend that characterized the accommodation and

increase in arrivals from high income

food services sector in recent years relates to the significant

markets and/or markets with a higher

propensity to spend reduction in production costs (recorded in national accounts as

_______________________________________________

“intermediate expenditure”). Total intermediate expenditure in the

Tourism receipts by country of

accommodation and food services sector is estimated to have

origin declined by 20.8% or €1.8 bn (in constant prices) between 2011 and

2,5 2,5

bn eur 2015 to 3.7% of GDP from 4.6% in 2011. Impressively, enterprises in

2,0 2,0 this sector managed to handle increasing demand, provide higher

1,5 1,5

quality services and, at the same time, reduce spending on

production inputs. In fact, the ratio of total intermediate expenditure

1,0 1,0

per euro of sectoral output declined to a multi-year low of c. 32 cents

0,5 0,5 in 2015 from 50 cents in 2009 (euro in constant prices). Assuming

0,0 0,0

identical input costs for providing services to residents and non-

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

residents, the estimated decline in the intermediate expenditure for

producing the higher output demanded by non-residents was -12.8%

UK USA Russia

Sources: WEF, Eurostat, HCH, BoG

between 2011 and 2015 (-€0.5 bn).

GREECE | NBG Macro View |June 2016| p. 7

NATIONAL BANK OF GREECE | Greece: Macro View

This reduction in production costs reflects a change in the structure

The increase in the value of of inputs and improving efficiency in their use, which is mainly due to

transactions made in Greece using the increasing role in sectoral activity of larger and more efficient

debit and credit cards issued abroad

outpaces the growth in travel

business entities -- especially in the accommodation sector – and, just

revenue by a considerable margin as importantly, an increasing use of cheaper (often domestically-

_______________________________________________

produced) inputs.

Transactions with cards issued The role of larger and more efficient business units in business activity

abroad & travel revenue

(non-residents) expanded significantly in recent years – especially in the

25 y-o-y 25 accommodation sector – and is estimated to have contributed to

higher productive efficiency and lower production costs. Indeed, the

15 15

share of intermediate expenditure for the production of each unit of

5 5

output is about 15% lower for larger firms (with more than 50

-5 -5

*Sources: ECB & BoG

employees) compared with smaller firms (Eurostat SBS data for the

-15 -15 Greek accommodation sector). This rebalancing has evidently played

2008

2009

2010

2011

2012

2013

2014

2015e

a significant role in supporting productive efficiency as reflected in

Tourism revenue, gross (Source: BoG, balance of

payments) the increase of the contribution of larger firms in total value added

Value of transactions at domestic POS terminals

with cards issued abroad generation of this sector to 42% (of the total) in 2013 from 31% in

2010 (Eurostat SBS and national accounts data) and an even higher

share in 2015 (estimated as no data available).

The cost reduction in the accommodation and food services sector

has also been supported by the broad-based disinflation of the 2013-

2015 period. The significant decline in the cost of a number of mostly

The significant reduction in

production costs also supported labor intensive services -- as reflected in the path of relevant producer

value added generation prices and wages -- permitted a further rationalization and

_______________________________________________

streamlining of the sector’s cost structure. Indeed, prices of

Intermediate expenditure in

engineering, technical testing and architectural services declined by

accommodation & food services 15.0%, cumulatively, in 2011-15, cleaning services by 5.5%,

euro bn accounting, bookkeeping, tax and auditing services by 3.0%, with

10 10

price discrepancies among services providers also increasing

8 8

significantly as suggested by the dispersion in the answers of the

6 6

relevant survey participants (EL.STAT, and Eurostat).

4 4

This streamlining, according to market sources, also included

2 Source: Eurostat Sectoral National Accounts and 2

NBG estimates based on Greek household budget outsourcing of non-core activities in conjunction with a shift towards

survey data for residents

0 0

to cheaper and/or more efficient suppliers (e.g. maintenance,

2009

2010

2011

2012

2013

2014

2015e

security, personnel hiring).

Non-residents Residents

Total Value added up by almost 60% since 2011 to c. 8% of GDP in 2015

The measure of the economic contribution of a sector in GDP is gross

value added. Recall that value added corresponds to the difference

between the value of sectoral output and the corresponding

Sources: ECB, Eurostat, BoG, NBG estimates

intermediate expenditure.

GREECE | NBG Macro View |June 2016| p. 8

NATIONAL BANK OF GREECE | Greece: Macro View

Value added increased by c. 60% As discussed above, trends in both components of the value added

since 2011…

_______________________________________________ have been supportive of new value added creation. Indeed, total

value added generated by the accommodation and food services

Accommodation and food

services: value added as per cent sector increased by 59% (+€5.4 bn) in the period 2011-2015,

of the total value added reflecting a cumulative increase in total output of 20% (+€3.6 bn) and

generated in the economy

10 10 a decline in total intermediate expenditure of -21% (-€1.8 bn) . The

%

8 8 increase in value added related to the provision of services to non-

6 6 residents is estimated to have been +160% (+€6.4 bn), reflecting an

4 4 estimated sharp increase in output (+€5.9 bn) and an estimated

2 2 decline in intermediate expenditure for producing this output (of €0.5

0 0 bn). The impact on average GDP growth in 2011-15 from the above

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

developments is estimated at 0.8% per year, as regards the

Greece Spain

contribution of the total sectoral value added in GDP, which increases

France Italy

Cyprus Portugal to 1% per annum for the value added related to international tourism.

The respective direct contribution to GDP growth of non-residents’

… reflecting the solid growth in non-

residents demand spending, as measured by BoP-travel revenue trends, is only 0.4% per

_______________________________________________

year in this period.

Gross value added generated in The increase in value added to the economy as a whole is even

accommodation & food services

greater, as the cost reduction has been accompanied by import

15 15

13

euro bn

13 substitution – which does not, by itself, increase the value added of

11 11

the specific sector, ceteris paribus, but does increase the value added

9 9

7 7 of the economy (e.g. the value added of a sector producing the input

5 5

3 3

increases).

1 1

-1 -1 To shed some light on the role of import substitution in this sector we

2009

2010

2011

2012

2013

2014

2015e

extract the change in the composition of inputs in the sector between

Non-residents Residents

Total imported and domestically-produced ones. We use as a reference

Source: Eurostat Sectoral National Accounts and point the year 2010, when the latest national accounts data on the

NBG estimates based on Greek household budget

survey data for residents structure of inputs used by this sector are available (including their

decomposition in domestic and imported ones). According to this

Drivers of total value added

creation in the accommodation & data, the annual value of imported goods used by the

food services sector accommodation and food services sector amounted to €3.0 bn in

(residents & non-residents, 2y m.a.)

2 2 2010. Subsequently, monthly data on imports of the same categories

bn eur

Χιλιάδες

of goods are used to estimate spending on these inputs in the years

1 1

2011-2015. To this end, we use additional information from the

0 0

seasonal patterns of import spending with a view to identifying the

-1

Source: Eurostat

-1 part of import demand related to international tourism. Specifically,

National Accounts we assume that the residents’ average monthly spending on these

-2 -2

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

import categories corresponds to the average monthly spending in

Contribution of intermediate expenditure the months January-April and October-December (months with little

Contribution of sectoral output

VA in constant prices tourism). Therefore, the import demand related to international

Sources: Eurostat, NBG estimates

tourism in each year corresponds to the difference between the total

import value in these categories for the months May-September and

GREECE | NBG Macro View |June 2016| p. 9

NATIONAL BANK OF GREECE | Greece: Macro View

the estimated import spending of residents for this period. In this

setting, the decline in intermediate expenditure on imports of non-

residents between 2011 and 2015 is estimated at €0.5 bn -- or nearly

⅓ of the total decline in intermediate expenditure in this period.

Breakdown of value added generation in the

accommodation and food services sector Complementary evidence from recent trends in manufacturing

2011 2015 d(15/11) 2011 2015 d(15/11) production of the food and beverage sector – provided that food and

euro bn % GDP beverages account for almost 50% of total imports of the

Total

accommodation and food services sector -- are supportive of the

Output 17,9 21,5 3,6 9,4% 11,6% 2,2% previous analysis of import substitution. Indeed, domestic production

Interm. Expendit. 8,7 6,9 -1,8 4,6% 3,7% -0,8% of food and beverages, net of exports, increased by almost €0.55 bn

Value added 9,2 14,6 5,4 4,8% 7,9% 3,1% between Q4:2011 and Q4:2015. In sum, import substitution is

estimated to have provided an additional 0.3% cumulatively in

Residents

economy-wide value added and GDP in this period.

Output 9,9 7,7 -2,3 5,2% 4,1% -1,1%

Interm. Expendit. 4,8 3,5 -1,3 2,5% 1,9% -0,6% Profitability is increasing as the share of labor compensation in

Value added 5,1 4,2 -1,0 2,7% 2,2% -0,4% value added declines

Non-Residents

The increase in value added has been accompanied by a decline in

Output 7,9 13,8 5,9 4,2% 7,5% 3,3% labor costs in the sector, which started in 2010 and gained traction in

Interm. Expendit. 3,9 3,4 -0,5 2,1% 1,8% -0,2% 2011-2013. Overall, economy-wide wages declined by 21% in 2009-

Value added 4,0 10,4 6,4 2,1% 5,6% 3,5% 2015, and by an estimated 12% in 2011-2015. The decline has been

combined with a sharp increase in flexible employment forms, which

account for about 50% of new job openings in the economy. This

rebalancing is even more intense in the accommodation and food

services sector, which has been traditionally characterized by

The sharp adjustment in labor relatively high flexibility as regards compensation and employment

costs… schemes. In this vein, it is notable that total spending on labor

_______________________________________________

compensation in the accommodation and food services sector

Compensation of employees, declined by 16.5% since 2011 (and by almost 33% compared with

index, accommodation and food 2009) to below 20% of the sectoral value added in 2015 from 32% in

services 2003=100

180

2011, while employment increased by about 9% cumulatively. This

index

160 2003=100 development suggests that the adjustment in the wage bill in this

140

sector was significantly larger than the economy’s average during the

period 2011-2015, despite the increase in employment (described

120

above). Indeed, labor cost index data (LCI) suggest that the average

100

level of wages and salaries in the accommodation and food sector

80

declined by an estimated 24% since 2011.

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

Greece Spain Consequently, gross operating surplus and mixed income -- which

France Italy

Portugal closely track business (gross) profitability trends – increased, to an

estimated, 70% of sectoral value added in 2015 from 58% in 2011.

Please note that the high share reflects a significant percentage of

Sources: Eurostat, NBG estimates self-employed and family run businesses in this sector (i.e., mixed

income). In this respect, we combine Eurostat data on the

decomposition of gross operating surplus and mixed income (at

GREECE | NBG Macro View |June 2016| p. 10

NATIONAL BANK OF GREECE | Greece: Macro View

… was 2x times more than the factor costs) available until 2013 with LFS data on sectoral

economy average wage reduction…

_______________________________________________ employment trends by type of employment, to estimate separately

Greece: Labor cost index - the trends of gross operating surplus and mixed income until 2015.

wages & salaries

Clearly gross operating surplus — which tracks operational

Source: Eurostat

100

index

100 profitability of corporates – emerges as the exclusive driver of the

2009=100

90 90 increase in non-labor income provided that the number of self-

80 80 employed and business owners in the sector declined by 7%

70 70

cumulatively since 2011 in contrast to wage earners who increased

by almost 20% (s.a. data) in this period. In this respect, gross

60 60

operational profits correspond to about 40% of each euro of value

50 50

added generated in the sector in 2015 – 20% higher than the average

2009

2012

2013

2014

of Spain and Portugal. The above trends clearly reveal the

Total business economy

Accommodation & food services sector

attractiveness of this sector from an investment perspective. Data

from the business sector are also suggestive of a steady improvement

…and gave a decisive push to the

of the sectoral EBITDA since 2012 (EBIDTA of tourism business

operational profitability of the sector

_______________________________________________ increased by 23.7% in the period 2012-2014, ICAP data).

Gross operating surplus & mixed Investment in tourism is profitable and key to unlocking Greece’s

income as per cent of sectoral sizeable exporting potential

value added (accommodation &

food services) Large investments in the previous decade and the reduction in

80%

Sources: Eurostat & NBG residents’ tourism activity permitted Greek tourism to keep up with

70% estimates using LFS data

60%

increasing external demand without reaching capacity limits.

50% However, data on hotel occupancy rates in the core months of the

40%

tourism season (Q3) show a steady increase in recent years. Under

30%

20% the baseline scenario of a gradual recovery in domestic demand

10%

(corresponding to a moderate recovery in private sector disposable

0%

income of 1% in 2017 and 1.8% in 2018) and assuming growth in

2009

2010

2011

2012

2013

2014e

2015e

Mixed income Gross operating surplus

external demand to be similar to the average WTTC estimates for the

Mediterranean region (c. +3.0% per annum in 2017-2023), capacity

Investment in tourism is profitable constraints in the accommodation sector are expected to become

and key to unlocking Greece’s

sizeable exporting potential

binding in 2018. Specifically, hotel occupancy is estimated to rise to a

_______________________________________________ 10 year high of 86% in Q3:2017 (with occupancy rates in 4 and 5-star

Tourist accommodation

occupancy rate during Q3

hotels approaching 90%) and to 88% and 95%, respectively, in

(seasonal peak) Q3:2018. These figures suggest that the Greek accommodation sector

100

% will be unable to handle demand at a regional level during the peak

90

season in the near future. In this respect, the timely initiation of

80 investment in new capacity is a necessary condition for expanding

further the contribution of this sector and overcoming capacity

70 NBG

estimates constraints.

60

We estimate that about €3.5 bn of new investments (2.0% of 2015

Q3:2004

Q3:2005

Q3:2006

Q3:2007

Q3:2008

Q3:2009

Q3:2010

Q3:2011

Q3:2012

Q3:2013

Q3:2014

Q3:2015

Q3:2016

Q3:2017

Q3:2018

Q3:2019

Q3:2020

Q3:2021

Q3:2022

Q3:2023

GDP) in new hotel capacity will be needed in the years 2017-2023

Greece with sufficient investment (adjusting for capital depreciation) to bring the projected occupancy

Greece with weak investment

rate beyond 2019, in line with its 15-year average of 83% (in Q3,

Sources: Eurostat, NBG estimates

GREECE | NBG Macro View |June 2016| p. 11

NATIONAL BANK OF GREECE | Greece: Macro View

which is analogous to the average of Spain and Portugal) and

successfully respond to the ongoing shift of demand to higher quality

hotels. If we include spending on equipment, the effective increase in

The combined contribution to GDP

growth from new investment and

sectoral investment in this period is estimated to reach €5.5 bn (3.1%

value added generation is estimated of 2015 GDP), assuming a share of investment in equipment in total

at 1.35% per year in 2017-2023

_______________________________________________

sectoral investment similar to the average in 2000-2008. Thus, the

direct support to annual GDP growth from this investment is

estimated at 0.3% per year in 2017-2023.

Direct contribution of

international tourism to GDP By benchmarking the 2011-2015 production trends -- and assuming

growth: demand vs supply-side

perspectives that intermediate expenditure remains stable as a per cent of sectoral

2,0 pps forec. output in the following years (i.e. no additional contribution in value

1,5

added creation from declining input costs), we estimate that the

1,0

0,5 average annual growth in value added could reach 9.0% y-o-y in 2017-

0,0 2023 (vs 13.2% in 2011-2015), which corresponds to a direct boost to

-0,5

-1,0 annual GDP growth of 0.8% in this period. The recovery of resident

2010

2011

2012

2013

2014

2015

2016-23f

demand for tourism services (+3% per annual in 2017-2023) is

Value added - accommodation and food services

expected to contribute another 0.2 pps to annual GDP growth.

Travel revenue (balance of payments) Overall, the combined support to annual average GDP growth in

Sources: National Accounts, balance of payments 2017-2023 from new investment and the supply of higher value

data and NBG estimates

added services to residents and non-residents is estimated at 1.3%

per year, more than double the average of the previous decade.

GREECE | NBG Macro View |June 2016| p. 12

Appendix

Da

GREECE

Macro View - Economic Outlook | June 2016

Mild recession continues in Q1:2016 – positive confidence and

liquidity effects from the recent completion of the 1st review of

the new Programme are expected to counteract the impact of

increasing fiscal drag, paving the way for a pick-up in economic

activity in H2:2016

Latest indicators suggest

GREECE | NBG Macro View | June 2016

NATIONAL BANK OF GREECE | Greece: Macro View |June 2016

Greece: Tracking the economy’s cyclical position

Aug-13

Aug-14

Aug-15

May-13

Nov-13

May-14

Nov-14

May-15

Nov-15

May-16

Feb-13

Mar-13

Apr-13

Dec-13

Apr-14

Dec-14

Dec-15

Jun-13

Sep-13

Feb-14

Mar-14

Jan-14

Jun-14

Sep-14

Feb-15

Mar-15

Apr-15

Jan-15

Jun-15

Sep-15

Feb-16

Mar-16

Apr-16

Jan-16

Oct-13

Juλ-14

Oct-14

Oct-15

Jul-13

Jul-15

PMI (index level) 43 42,1 45 45,3 45,4 47 48,7 47,5 47,3 49,2 49,6 51,2 51,3 49,7 51,1 51 49,4 48,7 50,1 48,4 48,8 49,1 49,4 48,3 48,4 48,9 46,5 48 46,9 30,2 39,1 43,3 47,3 48,1 50,2 50 48,4 49 49,7 48,4

Industrial confidence (index level) -12,5 -11,6 -11,1 -6,7 -8,8 -10,6 -10,7 -5,3 -9,9 -11 -10,6 -11,2 -7,1 -4,1 -8,9 -4,9 1,3 1,5 0,3 -5,4 -0,6 1,3 -3 -7,9 -9,2 -10,2 -15 -13 -14,1 -26,4 -30,2 -23,3 -19,6 -16,6 -13,6 -10,1 -10,2 -7,8 -7,8 -11,6

Manufacturing production (yoy) 0,1 1,9 2,9 -2,1 5,7 -4,7 -4,3 -2,6 -4,9 -4,2 0,2 -0,5 3,1 -0,8 -1,5 2,4 -2,0 5,5 0,5 -0,8 4,7 7,0 4,1 3,3 5,1 8,9 3,8 -2,9 -3,5 -7,0 3,5 2,2 -1,5 1,5 4,4 4,6 -2,5 -3,6 2,8

Industrial production (yoy) -2,8 -0,4 1,0 -4,4 2,3 -7,2 -5,5 -3,2 -6,1 -6,6 -1,4 -2,8 0,5 -3,9 -3,2 0,3 -5,2 0,1 -4,7 -4,3 0,0 3,3 -2,7 0,1 1,8 5,4 0,5 -4,3 -4,4 -2,5 4,1 2,6 -2,1 2,0 6,2 5,7 1,4 -2,0 5,8

Services confidence (index level) -22,5 -22,4 -22,7 -13,1 -2,5 -4,6 -7 -9,7 -7,1 -8,1 -4,9 2,5 4,5 4,9 6 6,5 18,4 19,7 22,3 14,8 15,8 21,6 15,3 9 4,4 -0,3 -4,4 -10,1 -9,4 -27,6 -42,8 -15,1 -14,3 -15,4 -16,6 -5,3 -23,1 -17,3 -13 -11,4

Consumer confidence (index level) -71,4 -71,2 -71,8 -63,4 -66,5 -70,9 -76,6 -72,2 -66,2 -66,7 -63,3 -64,5 -65,2 -59,7 -52,6 -50,5 -47,7 -48 -54 -56 -50,9 -49,9 -53,9 -49,3 -30,6 -31 -40,5 -43,6 -46,8 -52,9 -64,8 -64,2 -59,6 -64,1 -61,1 -63,9 -66,8 -71,9 -73,7 -71,9

Retail confidence (index level) -33,1 -25,9 -26,7 -15,2 -19,1 -21 -21,3 -22,5 -22,8 -18,1 -15 -11,6 -8,4 -10 -9,7 -7,4 2,5 4,8 6,6 -2,5 5,0 10,3 4,7 -1,0 -3,9 -4,1 -0,6 0,2 -3,5 -25,9 -31,0 -20,0 -15,3 -12,8 -5,3 -3,4 3,2 3,0 5,6 5,1

Retail trade volume (yoy) -14 -6 -14 -2 -8 -14 -8 -5 -1 3 -6 -3,0 -2,9 -3,4 5,0 -6,1 1,7 1,5 3,2 0,0 2,1 -1,3 -1,4 0,6 -1,7 1,0 -1,8 4,1 -0,4 -7,2 -2,1 -3,3 -2,4 -4,4 0,2 -1,7 -6,8 -1,6

Construction Permits (yoy) -45 -56 -16 -51 -15 -4 -30 -37 9 89 -44 -41 -5 4 -8 10 53 -24 -5,3 7,2 -2,8 -36,4 13,1 12,2 36,6 35,6 -3,5 6,1 -15,1 -25,2 -28,5 -13,1 -38,2 -4,5 67,3 -5,2 8,3 -34,8

House prices (yoy, quarterly series) -12 -12 -12 -12 -12 -10 -10 -10 -10 -10 -10 -9 -9 -9 -8 -8 -8 -7 -7 -7 -6 -6 -6 -4 -4 -4 -5 -5 -5 -6 -6 -6 -5 -5 -5 -5 -5 -5

Construction confidence (index level) -47 -46 -39 -35 -34 -32 -30 -18 -37 -33 -39 -23 -23 -14 -20 -20 -19 -20 -21 -33 -21,2 -34,2 -16,6 -29,8 -31,9 -40,0 -41,9 -44,5 -48,0 -62,5 -67,5 -52,8 -49,4 -47,0 -49,1 -37,9 -37,5 -35,9 -45,9 -39,0

Employment (y-o-y) -7,3 -6,9 -6,0 -5,5 -4,6 -4,3 -3,5 -2,9 -3,1 -2,8 -2,7 -1,2 -0,9 -0,2 -0,5 0,2 1,1 1,7 1,0 1,3 1,3 1,6 1,6 0,9 1,2 0,7 2,1 2,2 1,9 1,9 2,4 2,2 2,7 2,6 3,0 2,2 2,3 2,5

Interest rate on new private sector loans (CPI deflated) 5,7 6,0 6,3 6,0 5,9 6,2 6,8 6,7 7,6 8,4 6,8 7,1 6,5 6,8 7,2 7,4 6,3 6,1 5,6 6,0 7,0 6,4 7,6 7,9 7,1 7,1 7,0 7,1 6,9 7,0 6,3 6,5 6,0 5,7 5,3 5,7 5,4 6,2 6,1

Credit to private sector (y-o-y) -8,9 -6,8 -6,8 -7,4 -6,8 -5,1 -4,8 -4,7 -4,8 -4,7 -4,3 -3,5 -3,7 -5,5 -4,9 -4,4 -4,0 -3,9 -3,7 -3,7 -3,2 -3,0 -2,7 -1,6 -1,5 -1,2 -1,6 -2,8 -2,9 -3,3 -3,7 -3,6 -3,6 -3,7 -3,6 -5,0 -4,8 -5,1 -4,6 -3,2

Private sector deposits (y-o-y) -2,3 -2,3 -3,9 1,6 4,9 2,4 2,5 1,7 0,5 0,4 -1,5 -2,4 -3,9 -3,0 -1,5 -2,1 0,3 0,7 1,4 2,2 2,6 2,1 -1,7 -7,2 -11,2 -12,9 -16,3 -18,6 -25,4 -26,3 -26,6 -26,3 -26,5 -28,3 -25,3 -20,3 -16,6 -15,7 -12,5 -10,0

Interest rate on new time deposits (households, CPI deflated) 4,4 4,6 4,8 4,5 4,3 4,2 4,6 4,2 5,0 5,7 4,5 4,3 3,9 4,2 4,1 4,5 3,5 3,0 2,4 2,9 3,6 3,1 4,4 4,6 4,0 4,0 3,9 4,0 4,0 3,5 2,7 2,9 2,0 1,7 1,2 1,7 1,4 2,4 2,1

Economic sentiment index (EU Commision, NBG weights, Greece) 64 64 63 73 73 69 64 67 72 72 75 78 78 83 87 89 96 96 92 88 92 95 90 91 105 103 93 89 87 76 62 71 75 71 73 75 67 65 65 67

Economic sentiment index (EU Commision, Euro area) 90 90 88 89 92 93 96 97 98 99 100,7 101,4 101,2 102,7 102,2 103 102,3 102 101 100 100,7 100,6 100,7 101,5 102,2 103,9 103,8 103,8 103,4 103,9 104 105,5 106 106 106,6 105 104 103 104 104,7

Exports (other (excl.oil&shipping) y-o-y 6m mov.avg 13,3 19,7 26,2 29,0 30,4 33,3 29,3 30,5 25,2 25,5 20,4 13,4 10,9 5,9 0,4 -1,6 -2,2 -0,6 -0,7 0,1 2,6 1,9 3,9 3,9 5,5 7,9 9,6 9,7 10,2 9,4 7,8 5,0 2,2 1,3 -0,6 -1,9 -1,0 -0,6 -0,1

Imports (other (excl.oil&shipping) y-o-y 6m mov.avg -3 8 17 22 31 36 32 35 33 37 37 27 24 16 10 6 2 4 3 5 6 7 8 8 9 10 10 9 8 2 -1 -5 -6 -8 -10 -6 -4 -3 -2

NBG Composite Index of cyclical conditions ► ► ► ► -24,4 -21,9 -17,8 -17,1 -9,31 -16,9 -13,7 -7,01 -12,1 -9 -3,97 -0,8 -1,2 -0,2 0,5 1,3 2,2 2,4 3,5 3,9 4,5 0,2 -2,8 -6,5 -1,5 -2,5 -4,8 -9,5 -14,8 -18,9 -25,3 -26,5 -28,0 -30,0 -32,0 -34,2 -36,5 -36,3

Color map scale 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27

Rapid contraction Moderate contraction Slow contraction Stabilization Slow expansion Moderate expansion Rapid expansion

Sources: NBG, BoG, ELSTAT, EU Commission, IOBE

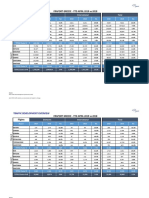

Greece: Growth Outlook

2014 2015 2016f 2014 2015 2016f

Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2f Q3f Q4f

GDP (rea l , % y-o-y, s .a.) 0,7 -0,3 -0,8 1,3 0,9 0,4 0,9 -1,7 -0,9 -1,4 -1,5 -0,7 0,6

GDP (rea l , % q-o-q, s .a. ) … … … 1,4 -0,8 0,1 0,3 -1,3 0,1 -0,5 0,2 -0,4 1,3

Domestic Demand (y-o-y) 1,0 -1,4 -0,7 0,6 2,7 2,1 -0,6 -4,8 -2,2 -2,1 -1,5 0,2 0,7

Final Consumption (y-o-y) 0,0 0,1 -1,1 -0,4 -0,8 0,3 1,2 -0,7 -0,2 -1,3 -1,7 -0,9 -0,6

Private Consumption (y-o-y) 0,7 0,2 -1,1 0,7 0,9 0,7 1,7 -0,4 -1,0 -1,3 -1,8 -0,9 -0,3

Fixed Capital Formation (y-o-y) -2,7 0,9 4,4 2,8 3,4 10,2 0,2 -11,7 5,3 -2,7 0,3 10,2 10,0

Residential construction -52,2 -23,3 -8,0 -44,2 -52,3 -30,7 -8,1 -34,0 -16,5 -17,3 -9,8 -5,9 -3,1

Total GFCF excluding residential 8,8 3,3 5,3 12,3 14,1 15,6 1,0 -9,4 7,1 -1,6 1,2 11,4 10,8

Inventories * (contri bution to GDP) 1,3 -1,6 -0,2 0,6 3,1 0,7 -1,7 -2,9 -2,7 -0,7 0,0 0,0 0,0

Net exports (contri bution to GDP) -0,3 1,1 -0,1 0,7 -1,9 -1,8 1,5 3,2 1,4 0,8 0,0 -0,9 -0,2

Exports (y-o-y) 7,4 -3,8 -3,1 9,1 10,3 3,7 1,5 -10,5 -9,3 -11,7 -7,2 3,2 4,2

Imports (y-o-y) 7,8 -6,9 -2,8 6,0 16,2 9,3 -3,3 -19,8 -12,5 -12,8 -6,9 6,9 4,5

GDP deflator (% y-o-y) -2,3 -0,6 0,3 -0,8 -0,7 -0,4 -0,6 -0,9 -0,4 -0,1 -0,5 0,7 1,1

*also including

Source: EL.STAT.other

andstatistical discrepancies

NBG Research Estimates / Source: ELSTAT, NBG estimates

GREECE | NBG Macro View |June 2016| p. 14

NATIONAL BANK OF GREECE | Greece: Macro View |June 2016

GDP declined by 1.4% y-o-y in Q1:2016, dragged down by

... which has been accompanied by frontloaded new fiscal

weaker domestic demand, against a backdrop of lengthy

measures to be implemented during 2016-2018 under the

negotiations for completing the 1st Review of the economic

medium-term fiscal strategy

support programme …

Composition of output growth by Primary balance & fiscal

expenditure component measures (as % of GDP)

7 3,5

4 % GDP

1

-2 2,0

-5

contributions in

-8

pps

-11 0,5

-14

2011:Q3

2012:Q1

2012:Q3

2013:Q1

2013:Q3

2014:Q1

2014:Q3

2015:Q1

2015:Q3

2016:Q1

2015

2016*

2017*

2018*

-1,0

Change in primary balance (%GDP)

Consumption Net Exports

Fiscal measures (% GDP)

Investment Inventories Primary balance (% of GDP)

Growth * Program targets

The fiscal drag in H2:2016 is estimated at -1.5% y-o-y, … net programme funding inflows to the economy of €4.3

however, the recessionary impact is expected to be bn (2.5% of GDP) until end-2016, mainly for clearing

mitigated by supportive confidence, liquidity (ECB’s government arrears, and c. €3.0bn (1.7% of GDP) of

decision on waiver) and base effects in conjunction with… additional structural funds in H2:2016

GDP growth: y-o-y and q-o-q Official funding inflows to the

6 forecasts

Greek economy: Government

3

y-o-y 2 arrears clearance and EU funds

0 0 4,0 % of GDP

-3 3,0

-2

2,0

-6

-4 1,0

-9 0,0

-12 -6 -1,0

2012:Q2

2009:Q2

2010:Q1

2010:Q4

2011:Q3

2013:Q1

2013:Q4

2014:Q3

2015:Q2

2016:Q1

2016:Q4

-2,0

H2:2015 H2:2016 2017-2018

Clearance of government arrears (neg. sign

GDP (q-o-q s.a., right axis) stands for new arrears accumulation)

GDP growth (s.a.,y-o-y, left axis) EU funds

Uncertainty about new fiscal measures and restrictive Lower demand and the weakening of GBP against the euro

liquidity conditions weighed on consumer sentiment following the Brexit referendum, are estimated to result in

despite the continuing improvement in the labor market an annual decline of Greece’s exports of goods and tourism

and the supportive impact of energy-driven deflation services to the UK of about 0.15% of GDP in 2016

Energy prices, headline inflation Greece's external linkages with the

& employment growth UK

2 % GDP, current prices

y-o-y y-o-y 50 1,5

6

40

3 30 1,5 1,3

0 20

1,1

-3 10 1

0 0,9

-6

-10 0,5

-9 -20 0,7

-12 -30

0 0,5

May-10

May-16

May-11

May-12

May-13

May-14

May-15

Nov-10

Nov-11

Nov-12

Nov-13

Nov-14

Nov-15

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016 June

CPI inflation (left axis)

Goods exports to the UK, left axis

Employment growth (left axis)

Gross tourism revenue - UK travelers, left axis

Energy Prices (right axis) EUR/GBP exch. Rate, right axis

GREECE | NBG Macro View |June 2016| p. 15

NATIONAL BANK OF GREECE | Greece: Macro View |June 2016

Manufacturing production rebounded strongly in April Capacity utilization recovered to a 15-month high in April,

(+5.7%, y-o-y, s.a.) reflecting increasing production in suggesting that new investment will be forthcoming,

export-oriented sectors (food, tobacco, chemicals, metals especially in specific sub-sectors (e.g. food, beverages,

and non-metallic mineral products) tobacco)

Key sectoral contributions in PMI & Capacity utilization

11

industrial production growth 72

4 y-o-y 10

in pps 6

3 8 70

2 6 1

4 68

1

2 -4

0 66

0

-1 -9 64

-2

-2 -4 -14 62

-3 -6

-4 -8 -19 60

Feb-16

Feb-14

Feb-15

Dec-15

Dec-13

Dec-14

Oct-13

Apr-15

Jun-15

Apr-14

Jun-14

Aug-14

Oct-14

Aug-15

Oct-15

Apr-16

-24 58

May-13

May-16

May-12

May-14

May-15

Feb-16

Feb-12

Feb-13

Feb-14

Feb-15

Nov-11

Nov-12

Nov-13

Nov-14

Nov-15

Aug-11

Aug-12

Aug-13

Aug-14

Aug-15

Non-metallic minerals (in pps, left axis)

Food (in pps, left axis)

Beverages (in pps, left axis) PMI, deviat. from 50 (left axis)

Basic metals (in pps, left axis)

Chemicals (in pps, left axis) Capacity utilization (right axis)

Forward-looking indicators point to an expansion of Construction shows signs of recovery, supported by a timely

business activity in Q2:2016 -- driven by export/tourism- implementation of the public investment programme

oriented sectors (increase in PIP disbursements of 14.7% y-o-y in 5M:2016)

Public investment program (PIP)

Business, services and consumer

disbursements and construction

confidence indicators

30 -25 confidence

%

20 -10

-35

10 130

-45

0 -30 80

-10 -55 30

-20 -50 -20

-65

-30 -70

-75

-40 -70 -120

May-16

Jan-13

Sep-14

Feb-15

Jul-15

Dec-15

Nov-13

Apr-14

Aug-12

Jun-13

-50 -85

May-15

May-13

Feb-14

May-14

May-16

Feb-13

Feb-15

Feb-16

Nov-12

Aug-13

Nov-13

Aug-14

Nov-14

Aug-15

Nov-15

Construction Confidence (left axis)

Industrial confidence (left axis)

Services confidence (left axis) PIP Disbursements (y-o-y change, 3m moving

Consumer confidence (right axis) average, right axis)

Downside pressures on house prices eased in Q1:2016,

Improving sentiment, in conjunction with the prospective (-5.0% y-o-y vs -5.3% in Q4:2015), as did the fall in

normalization of liquidity conditions, following the commercial real estate prices (-1.5% in H2:2015). Tax and

completion of the 1st programme review, bode well for an liquidity factors and the still high supply overhang maintain

investment recovery, but also entail the main downside risk pressures on this market, with the cumulative fall in house

prices reaching -41.6% since the beginning of the crisis

Gross fixed capital formation and House & commercial prices

industrial confidence

% 5 y-o-y 10

26 6 5

18 0

10 -4 0

2 -5

-6 -14 -5

-14 -10

-22 -24 -10

-30

-38 -34 -15 -15

Q4:2004

Q1:2006

Q2:2007

Q3:2008

Q4:2009

Q1:2011

Q2:2012

Q3:2013

Q4:2014

Q1:2016

-20 -20

H2:2008

H1:2009

H2:2009

H1:2010

H2:2010

H1:2011

H2:2011

H1:2012

H2:2012

H1:2013

H2:2013

H1:2014

H2:2014

H1:2015

H2:2015

Q1:2016

Real fixed investment (y-o-y growth, left axis)

House prices (total, y-o-y)

Industrial Confidence (right axis) Office prices (Athens, y-o-y)

Retail prices (Athens, y-o-y)

GREECE | NBG Macro View |June 2016| p. 16

NATIONAL BANK OF GREECE | Greece: Macro View |June 2016

The improved flexibility of the labor market and the near

The unemployment rate declined to a 3-year low of 24.1%

completion of business restructuring in key sectors -- such

in March 2016, notably in a period where seasonal support

as accommodation, food services, retail-wholesale trade

from tourism is absent, whereas employment increased by

and manufacturing -- underlie healthy employment growth

2.3% y-o-y s.a. in 3M:2016

of 2.3% y-o-y in Q1:2016 -- driven by wage earners

Employment trends per Employment growth &

employment category unemployment rate %

9 28

4 y-o-y

2 6 24

0 3 20

-2 0 16

-4 -3 12

-6 contribution in annual -6 8

change in

-8 employment in pps -9 4

-10 -12 0

2010:Q1

2010:Q4

2015:Q2

2007:Q1

2007:Q4

2008:Q3

2009:Q2

2011:Q3

2012:Q2

2013:Q1

2013:Q4

2014:Q3

2016:Q1

Q3:2009

Q1:2010

Q3:2010

Q1:2011

Q3:2011

Q1:2012

Q3:2012

Q1:2013

Q3:2013

Q1:2014

Q3:2014

Q1:2015

Q3:2015

Q1:2016

Wage earners Self employed Employment growth (left axis)

Wage earners (left axis)

Businessmen Family employees Unemployment rate (right axis)

Lower energy prices kept headline inflation in negative

In Q1:2016, the current account improved (-1.3% of GDP) as

territory in 5M:2016 (-1% y-o-y). However, the period of

the lower oil deficit (-0.3% of GDP y-o-y) and higher primary

deflation is expected to end in H2:2016 on the back of new

income balance (+0.6% of GDP y-o-y) offset the negative

increases in indirect taxes and higher energy prices. Core

impact from the sharp drop in export revenue from non-

inflation increased by 0.3% y-o-y in May reflecting, inter

tourism services (-40.9% y-o-y) due to capital controls and

alia, the inflationary impact of the VAT rate hike on July

low shipping freight prices (-22.2% y-o-y)

20th 2015 (an estimated +1.0% y-o-y in 5M:2015)

Headline & core inflation

Balance of Payments (as % GDP) 3 3

2015 2016 2 2

%, y-o-y

Q1 Q2 Q3 Q4 Q1 1 1

Current Account -1,8 -0,4 3,2 -1,0 -1,3 0 0

Non-oil Trade Balance -2,1 -2,1 -1,2 -2,0 -2,0 -1 -1

Non-oil Exports 2,5 2,7 2,5 2,6 2,5 -2 -2

Non-oil Imports 4,7 4,8 3,7 4,5 4,5 -3 May-16 -3

Mar-12

Jan-13

Sep-14

Feb-15

Jul-15

Dec-15

Nov-13

Apr-14

Aug-12

Jun-13

Oil Balance -0,7 -0,6 -0,6 -0,5 -0,3

Services Balance 0,7 2,7 5,1 1,0 0,4

Primary Income Balance 0,3 -0,3 -0,1 0,4 0,6 Contribution of fuel in CPI (in percentage points,

left axis)

Secondary Income Balance 0,0 -0,2 -0,1 0,0 0,1 CPI inflation (y-o-y change, right axis)

Capital account 0,3 0,1 0,0 0,8 0,4

Source: Bank of Greece Core inflation (y-o-y change, right axis)

Corporate credit declined by 0.6% y-o-y in April 2016 compared

Credit to the private sector declined by 1.9% y-o-y in April

with -1.2% y-o-y in December 2015, with a further contraction

(-2.0% in December 2015), with loans to households

in lending to shipping and industry sectors outweighing the

contracting by 2.9% y-o-y (-3.1% in December) increase in loans to construction (+1.2% y-o-y)

Bank lending to private sector Bank credit to export-oriented

sectors

y-o-y change 9% y-o-y

9%

32 32 6% 6%

3% 3%

22 22

0% 0%

12 12 -3% -3%

2 2 -6% -6%

-9% -9%

-8 -8

Q2:2006

Q1:2007

Q4:2007

Q3:2008

Q2:2009

Q1:2010

Q4:2010

Q3:2011

Q2:2012

Q1:2013

Q4:2013

Q3:2014

Q2:2015

Q1:2016

-12% -12%

Jan-14

Jul-13

Jul-14

Jan-15

Jul-15

Jan-16

Oct-13

Oct-15

Apr-14

Oct-14

Apr-15

Apr-16

Housing loans Industry Tourism

Credit to private sector

Loans to enterprises Agriculture Construction

GREECE | NBG Macro View |June 2016| p. 17

NATIONAL BANK OF GREECE | Greece: Macro View |June 2016

The Greek banking system’s total financing from the

Private sector deposits are stabilizing, and the shift from

Eurosystem decreased further, by €11.8bn in 5M:2016 and

time to core deposits has ceased in 4M:2016. Deposits are

by €30.9bn cumulatively since June 2015, with the ELA

expected to pick up in the following months, supported by

dependence declining by €4.1bn between December 2015

tourism activity and net inflows of programme funding

and May 2016

Private sector deposits Greek banks' borrowing from the

3 capital 180

Eurosystem 40

controls

160

140 30

-2

120

100

monthly flows 20

-7 80

in bn

60

40 10

-12 20

May-16

Mar-15

May-15

Jan-16

Mar-16

Sep-15

Jul-15

Nov-15

0 0

May-10

May-11

May-12

May-13

May-14

May-15

May-16

Nov-09

Nov-10

Nov-11

Nov-12

Nov-13

Nov-14

Nov-15

Non-EA residents

Non-financial corporations ELA (left axis)

Households ECB (left axis)

Private sector deposits Eurosystem funding (% of total assets, right axis)

The Greek sovereign yield curve shows clear signs of … and the reinstatement of the ECB’s waiver on Greek

normalization following the successful completion of the 1st assets, albeit the result of the Brexit referendum led to a

review of the 3rd financial support programme in June… small widening of periphery bond spreads over bund

Greek Sovereign Yield Curve* 10y government bond spreads

70 over bund

60 PSI&2nd

Agreement

35 for further 35

50 MoU relief &

30 buyback 30

40

25 25

Agreement on a

30 new financing

20 programme 20

20

15 15

10

10 10

0

5 5

6m 3y 5y 10y 15y

0 0

September 15th, 2014

Apr-15

Nov-15

Mar-11

May-12

Feb-14

Sep-14

Dec-12

Jul-13

Oct-11

Jun-16

July 8th, 2015

June 16th, 2016

*Bloomberg and NBG Research interpolation/curve

fitting Greece Spain Portugal

A strong overperformance in State budget implementation The phasing-in of new fiscal measures in H2:2016 in

continues (primary surplus of 1.3% of GDP vs target of conjunction with the disbursement of programme funding

primary deficit of 0.5% of GDP for 5M 2016), reflecting will permit a further normalization in state budget

credible spending restraint (primary spending 1.2% of GDP implementation in the following months – normalization in

lower than 5M target) and improving tax revenue trends spending – and a shrinkage of government arrears (up

(+0.2% of GDP above the 5M target or +6.1% y-o-y) €0.8bn in 4M:2016) by more than €4bn by end 2016

Greece - State Budget Primary General government budget

balance trends (modified-cash basis)

3 3

5 bn euro 5

2 2

1 1

0 -1

-1 3 3

-2

-2 % GDP -3

-3

-4 2 2

-4

-5 -5

-6 -6

-7 -7 0 0

-8 *excluding SMP& ANFA revenue -8

-9 -9

-2 -2

-10 -10

Dec-14

Feb-15

Dec-15

Feb-16

Oct-14

Apr-15

Oct-15

Apr-16

Jun-14

Aug-14

Jun-15

Aug-15

Jan

Mar

May

Feb

Jul

Sep

Dec

Oct

Apr

Jun

Aug

Nov

2012 2011 2010 State budget primary balance

2009 2013* 2014*

Rest of Gen.Government balance

2015* 2016*

GREECE | NBG Macro View |June 2016| p. 18

NATIONAL BANK OF GREECE | Greece: Macro View |June 2016

Greece: Dates to Watch

June

2 7 16/17 22 24 28-29

ECB €280mn Eurogroup ECB Governing

Moody's credit European

Governing IMF meeting/ECOFIN Council: non-

rating review for Council

Council repayment finance ministers’ monetary policy

Greece meeting

meeting due meeting meeting

July

6 11 13 20 21 22

ECB Governing

€430mn IMF €2.3bn ECB Governing S&P credit

Council: non- Eurogroup

repayment ECB/Eurosystem Council: monetary rating review

monetary meeting

due repayment due policy meeting for Greece

policy meeting

August

3 12

ECB Governing Council: non-monetary policy EL.STAT. release: Quarterly National Accounts

meeting (Q2:2016)

September

2 7 8 9 19 21

ECB Governing

Fitch’s credit

€283mn IMF ECB Governing Eurogroup €137mn IMF Council: non-

rating review

repayment due Council meeting meeting repayment due monetary policy

for Greece

meeting

October

5 7-9 10 14 20 20-21

ECB Governing Council:

ECB Governing IMF/World Moody's monetary policy

Council: non- Bank Eurogroup credit rating meeting/ EL.STAT. European

monetary annual meeting review for release: General Council meeting

policy meeting meetings Greece government deficit and

debt 2015

GREECE | NBG Macro View |June 2016| p. 19

NATIONAL BANK OF GREECE | Greece: Macro View |June 2016

Greek Economy: Selected Indicators

2014 2015 2016 2016f

year year

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Most recent

aver. aver.

Real sector (y-o-y period average, constant prices)

GDP 0,4 0,2 1,3 0,9 0,7 0,4 0,9 -1,7 -0,9 -0,3 -1,4 Q1:16 -1,4 -0,8

Domestic demand -1,1 1,7 0,6 2,7 1,0 2,1 -0,6 -4,8 -2,2 -1,4 -2,1 Q1:16 -2,1 -0,7

Final Consumption 0,9 0,2 -0,4 -0,8 0,0 0,3 1,2 -0,7 -0,2 0,1 -1,3 Q1:16 -1,3 -1,1

Gross fixed capital formation -8,9 -7,6 2,8 3,4 -2,7 10,2 0,2 -11,7 5,3 0,9 -2,7 Q1:16 -2,7 4,4

Exports of goods and services 5,3 4,7 9,1 10,3 7,4 3,7 1,5 -10,5 -9,3 -3,8 -11,7 Q1:16 -11,7 -3,1

Imports of goods and services -0,2 9,7 6,0 16,2 7,8 9,3 -3,3 -19,8 -12,5 -6,9 -12,8 Q1:16 -12,8 -2,8

Coincident and leading indicators (period average)

Retail sales volume (y-o-y) -3,1 0,1 1,6 -0,3 -0,4 0,0 0,6 -4,2 -2,1 -1,5 -3,4 Mar -1,6 …

Retail confidence (15-yr. average: -1,5) -10,0 -4,9 3,0 6,7 -1,3 -3,0 -1,3 -25,6 -11,1 -10,3 0,9 May 5,1 …

Car registrations (y-o-y) 21,3 36,0 31,5 30,9 30,1 19,2 33,2 -2,2 2,1 13,8 -0,3 Apr 25,5 …

Consumer confidence (15-yr. average: -43,4) -61,3 -50,3 -52,7 -51,6 -54,0 -37,0 -43,6 -60,6 -61,6 -50,7 -67,5 May -71,9 …

Industrial production (y-o-y) -2,1 -2,8 -2,9 0,1 -1,9 2,5 -2,8 1,2 2,0 0,7 -0,7 Apr 2,8 …

Manufacturing production (y-o-y) 0,6 -0,4 1,8 5,3 1,8 5,9 -1,0 -0,8 1,4 1,3 1,4 Apr 5,8 …

Capacity Utilization (15-yr. average: 72,8) 66,3 68,5 69,0 68,8 68,2 67,1 67,0 62,0 65,2 65,3 65,9 Apr 68,6 …

Industrial confidence (15-yr. average: -6,1) -7,5 -4,2 -1,2 -0,8 -3,4 -9,1 -14,0 -26,6 -16,6 -16,6 -9,4 May -11,6 …

PMI Manufacturing (base=50) 50,7 50,5 49,1 49,1 49,9 48,5 47,1 37,5 48,5 45,4 49,1 Apr 49,7 …

Construction permits (y-o-y) -17,0 17,4 -11,2 -12,3 -5,7 29,2 -5,6 -22,4 5,9 -0,3 -11,9 Mar -34,8 …

Construction confidence (15-yr. average: -21,9) -20,0 -19,8 -24,5 -24,0 -22,1 -33,9 -44,8 -60,9 -48,5 -47,0 -37,1 May -39,0 …

PIP Disbursements (y-o-y) 91,7 11,7 29,3 -24,2 -0,9 -40,9 -57,6 -21,0 43,9 -2,8 7,0 Apr 21,6 …

Stock of finished goods (15-yr. average: 12,2) 6,7 3,2 4,4 6,4 5,2 13,0 15,0 17,4 15,3 15,2 12,5 May 9,9 …

External sector (period average)

Current account balance (% of GDP) -1,1 -1,0 2,1 -2,2 -2,1 -1,8 -0,4 3,2 -1,0 -0,1 -1,3 Q1:16 -1,3 0,5

Current account balance (EUR mn) -1985 -1739 3777 -3821 -3767 -3214 -669 5559 -1773 -98 -2255 Q1:16 -2255 …

Services balance, net (EUR mn) 1625 4462 9628 2558 18273 1297 4757 9062 1816 16932 730 Q1:16 730 …

Primary Income Balance, net (EUR mn) 1416 -475 -186 -182 574 557 -494 -104 780 739 1045 Q1:16 1045 …

Merchandise exports-- non-oil (y-o-y cum.) -3,0 -1,3 0,2 1,9 1,9 10,0 5,2 -2,2 -4,3 -9,5 -1,1 Q1:16 -1,1 …

Merchandise imports-- non-oil (y-o-y cum.) 2,7 8,9 7,8 7,9 7,9 4,6 -7,1 -19,6 -8,7 -18,2 -3,3 Q1:16 -3,3 …

Gross tourism revenue (y-o-y) 17,3 8,6 11,5 4,4 10,2 9,4 9,5 5,2 -3,9 5,5 -0,1 Q1:16 -0,1 …

International tourist arrivals (y-o-y) 16,0 15,5 25,8 27,7 23,0 45,6 15,0 2,6 -2,1 7,1 -6,2 Q1:16 -6,2 …

Employment

Unemployment rate 27,0 26,9 26,2 26,0 26,5 25,8 25,1 24,8 24,4 25,0 24,3 Mar 24,1 24,1

Employment growth (y-o-y) -0,8 0,2 1,3 1,5 0,6 0,9 2,1 2,1 2,7 2,0 2,3 Mar 2,5 1,9

Prices (y-o-y period average)

Headline inflation -1,3 -1,5 -0,6 -1,8 -1,3 -2,4 -2,1 -1,8 -0,6 -1,7 -0,9 May -0,9 0,0

Core inflation -1,0 -1,2 -0,1 -0,7 -0,8 -0,7 -0,9 -0,5 0,3 -0,5 0,2 May 0,3 0,8

Producer prices excl.energy -0,7 -0,7 -0,6 -0,1 -0,5 -0,1 0,2 0,2 -0,2 0,0 -0,6 Mar -0,7 …

Fiscal policy

Gov. deficit/GDP (excl banking system support&SMP/ANFA revenue) … … … … -3,7 … … … … -3,1 … … … -2,7

Government debt/GDP … … … … 180,1 … … … … 176,9 … … … 182,0

Revenues--Ordinary budget (cum. % change) 4,7 3,9 1,0 -3,5 -3,5 -1,8 -5,7 -6,7 -0,8 -0,8 4,4 May 2,5 …

Expenditure--Ordinary budget (cum. % change) -7,3 -8,2 -7,0 -6,4 -6,4 -2,2 -6,7 -5,3 0,2 0,2 -2,3 May -0,8 …

Monetary sector (y-o-y, end of period)

Total deposits -3,4 1,0 0,3 -2,0 -2,0 -14,4 -26,8 -27,1 -24,9 -24,9 -15,0 May -9,2 …

Loans to private sector (incl. sec. & bond loans) -4,1 -3,5 -3,5 -3,1 -3,1 -2,5 -1,7 -1,5 -2,0 -2,0 -2,1 May -2,0 …

Mortgage loans (including securitized loans) -3,4 -3,2 -3,1 -3,0 -3,0 -3,3 -3,4 -3,5 -3,5 -3,5 -3,4 May -3,3 …

Consumer credit (including securitized loans) -3,4 -2,7 -2,5 -2,8 -2,8 -2,5 -2,3 -2,8 -2,3 -2,3 -1,7 May -1,4 …

Interest rates (period average)

10-year government bond yield 7,5 6,2 6,0 8,0 6,9 10,0 11,6 10,8 7,9 10,1 9,5 May 7,7 …

Spread between 10 year and bunds (bps) 586 473 493 719 568 967 1112 1011 730 955 919 May 754 …

Exchange rates (period average)

USD/euro 1,37 1,37 1,33 1,25 1,33 1,13 1,11 1,11 1,10 1,11 1,10 May 1,13 …

Sources: BoG, NSSG, MoF, ASE,NBG,Bloomberg

GREECE | NBG Macro View |June 2016| p. 20

NATIONAL BANK OF GREECE | Greece: Macro View |June 2016

GREECE

Macro View

June 2016

NA TI ON A L B AN K

OF GR E E C E

This Bulletin can be viewed at: https://www.nbg.gr/en/the-group/press-office/e-spot/reports

Editor: P. Mylonas, Deputy CEO, Head of Research, e-mail: pmylonas@nbg.gr Tel: (+30210) 3341521, FAX: (+30210) 3341702.

Main contributors to this issue (in alphabetical order): E. Alevizopoulou, A. Gouveli, N. Magginas, G. Murphy, P. Nikolitsa.

This analysis is provided solely for the information of professional investors who are expected to make their own investment

decisions without undue reliance on its contents. Under no circumstances is it to be used or considered as an offer to sell, or a

solicitation of any offer to buy. Any data provided in this bulletin has been obtained from sources believed to be reliable.

Because of the possibility of error on the part of such sources, National Bank of Greece does not guarantee the accuracy,

timeliness or usefulness of any information. The National Bank of Greece and its affiliate companies accept no liability for any

direct or consequential loss arising from any use of this report.

Note: The Bulletin analysis is based on data up to June 22, 2016, unless otherwise indicated

GREECE | NBG Macro View |June 2016| p. 21

Вам также может понравиться

- UNWTO Barometer 2022 - 04 July ExcerptДокумент6 страницUNWTO Barometer 2022 - 04 July ExcerptTatianaОценок пока нет

- 06 2022 EuropeanДокумент1 страница06 2022 EuropeanTatianaОценок пока нет

- 05 2022 AthensДокумент1 страница05 2022 AthensTatianaОценок пока нет

- Increasing The Value of Tax Free Shopping For EU Destination EconomiesДокумент5 страницIncreasing The Value of Tax Free Shopping For EU Destination EconomiesTatianaОценок пока нет

- HAMA Spring 2021 Outlook SurveyДокумент16 страницHAMA Spring 2021 Outlook SurveyTatianaОценок пока нет

- Overall Performance of The Attica Hotel IndustryДокумент1 страницаOverall Performance of The Attica Hotel IndustryTatianaОценок пока нет

- Premium Comfort FactsheetДокумент2 страницыPremium Comfort FactsheetTatianaОценок пока нет

- Increasing The Value of Tax Free Shopping For EU Destination EconomiesДокумент5 страницIncreasing The Value of Tax Free Shopping For EU Destination EconomiesTatianaОценок пока нет

- Thomas Cook Greece PresentationДокумент12 страницThomas Cook Greece PresentationTatianaОценок пока нет

- COVID-19 Destination Protocol 18-04-2022Документ7 страницCOVID-19 Destination Protocol 18-04-2022TatianaОценок пока нет

- Παρουσίαση American AirlinesДокумент9 страницΠαρουσίαση American AirlinesTatianaОценок пока нет

- 2021 Black Representation in Hospitality Industry Leadership FinalДокумент20 страниц2021 Black Representation in Hospitality Industry Leadership FinalTatianaОценок пока нет

- European Benchmark: Year To Date July 2020Документ1 страницаEuropean Benchmark: Year To Date July 2020TatianaОценок пока нет