Академический Документы

Профессиональный Документы

Культура Документы

New Microsoft Office Word Document

Загружено:

Kanishk YadavОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

New Microsoft Office Word Document

Загружено:

Kanishk YadavАвторское право:

Доступные форматы

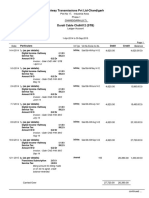

The third party sources (Income Tax department) have provided the data about gross

receipts of some parties including M/s Kinerk Direct Marketing Solutions Pvt. Ltd., C

134, Phase VIII, Industrial Focal Point, S. A. S. Nagar, Mohali in which the said party has

shown to have received an amount of Rs. 6,05,12,233/- during the Financial year 2012

13 but has shown to have deposited NIL service tax.

Acting on the above information, the some information / data / documents viz. Bank

statements, Balance Sheets, Income Tax returns and Form 26 AS (TDS) for the period

2012 13 were called from the party which the party submitted vide their letters dated

02.11.2015. The party vide their ST 3 returns also availed exemption on account of

providing Information Technology services to overseas customers. To verify the facts,

certain additional documents viz. Invoices issued, FIRCs and Softex Forms were called for.

The party submitted copies of invoices, FIRCs and Softex forms vide their letter dated

01.12.2015.

Analysis and Observations:

1

2

3

Third Party Source: The source document has shown that the gross receipts of the

party is Rs. 6,05,12,233/- during the financial year 2012 13.

Form 26 AS (TDS): Examining the Form 26 AS, it is noticed that the gross receipts

of the party during the financial year 2012 13 is Rs. 17,460/-.

Balance Sheets: Examining the balance sheets, it is noticed that the gross receipts of

the party during the financial year 2012 13 is Rs. 6,05,12,233/- on account of sale of

services.

Bank Statements: Examining the bank statements of Axis Bank, Account No. 9120 200

4140 1088, submitted by the party it is noticed that the gross receipts of the party

during the financial year 2012 13 is Rs. 6,07,42,336/-.

It is observed that the party has exported services in terms of Rule 6A of Service Tax

Rules, 1994 (as amended) and have received an amount of Rs. 6,05,12,233/- from the

non-taxable territory on account of export of services. The same is also revealed by the

copies of invoices issued, softex froms & FIRCs submitted by the party. In support of the

differences in Bank Account and Balance sheets, the party submitted Bank Ledger

account which shows the total credits of Rs. 6,12,28,983/- during the financial year 2012

13. Scrutiny of the Bank Ledger reveals that party has received a total amount Rs.

6,12,28,983/-. The differential amount pertains to the refund amount of input services

received from the department on account of export of services, which is not liable to

service tax. The export of services has been exempted from the purview of Service Tax in

terms of the provision of Notification 41/2012 C. E. / N. T.

Conclusions:

In view of the above mentioned facts, it appears that the party has exported services in

terms of Rule 6A of Service Tax Rules, 1994 (as amended) which is exempted from the

purview of Service Tax in terms of the provision of Notification 41/2012 C. E. / N. T. Also,

threshold exemption of rupees ten lakh as application vide the provisions of Finance Act,

1994 read with Notification No. 33/2012 dated 20.06.2012 was available for the party

and the party has availed the same. Thus the service tax on the amount shown to have

received in the data received from the third party source (Income Tax department) does

not appear to be leviable.

Hence, no service tax liability is detected.

Вам также может понравиться

- Form 16Документ2 страницыForm 16SIVA100% (1)

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedДокумент7 страницSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavОценок пока нет

- Food Corporation of India - 41202411354277Документ9 страницFood Corporation of India - 41202411354277abhimanyu7004Оценок пока нет

- Professional Training ReportДокумент10 страницProfessional Training Reportjaya sreeОценок пока нет

- Office of The Commissioner, Central Excise & Service Tax, 38, M.G. Marg, Civil Lines, Allahabad-211001Документ4 страницыOffice of The Commissioner, Central Excise & Service Tax, 38, M.G. Marg, Civil Lines, Allahabad-211001jitendraktОценок пока нет

- Shashank Kantheti Hyd 12 13Документ5 страницShashank Kantheti Hyd 12 13kshashankОценок пока нет

- Form 16Документ22 страницыForm 16Ajay Chowdary Ajay ChowdaryОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- E-Filing PresentationДокумент48 страницE-Filing PresentationAnkit Mehta R67% (3)

- Ahrpv0731f 2013-14Документ2 страницыAhrpv0731f 2013-14Shiva KumarОценок пока нет

- Form 24QДокумент10 страницForm 24QNIKHILОценок пока нет

- Paper 16Документ71 страницаPaper 16pkaul1Оценок пока нет

- IAS 7, Statement of Cash Flows - A Closer Look: ArticleДокумент10 страницIAS 7, Statement of Cash Flows - A Closer Look: ArticlevcdsvcdsvsdfОценок пока нет

- All About GST Annual ReturnsДокумент9 страницAll About GST Annual ReturnsinfoОценок пока нет

- Standalone Financial Results, Form B For March 31, 2016 (Result)Документ7 страницStandalone Financial Results, Form B For March 31, 2016 (Result)Shyam SunderОценок пока нет

- BIR - Invoicing RequirementsДокумент17 страницBIR - Invoicing RequirementsCkey ArОценок пока нет

- Tax. 23Документ18 страницTax. 23RahulОценок пока нет

- TDS Grossing Up Agreement To Gross Up Available - Sergi TransformersДокумент6 страницTDS Grossing Up Agreement To Gross Up Available - Sergi TransformersGOKUL BALAJIОценок пока нет

- EA 2000 Desk Review & ReconciliationДокумент43 страницыEA 2000 Desk Review & ReconciliationSushant SaxenaОценок пока нет

- SIGTAS & New IRC Forms - AmДокумент24 страницыSIGTAS & New IRC Forms - AmAnnahMaso100% (2)

- Guidelines and Instruction For BIR Form No. 1702-RT (JUNE 2013)Документ9 страницGuidelines and Instruction For BIR Form No. 1702-RT (JUNE 2013)Reynold Briones Azusano ButeresОценок пока нет

- Cash Flow Statements Exercises and AnswersДокумент39 страницCash Flow Statements Exercises and Answersszn189% (9)

- C2012 Guidebook 2Документ144 страницыC2012 Guidebook 2Selva Bavani SelwaduraiОценок пока нет

- Manac-1: Group Assignment BM 2013-15 Section AДокумент12 страницManac-1: Group Assignment BM 2013-15 Section AKaran ChhabraОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- TDS at A Glance 2013-14 BookДокумент34 страницыTDS at A Glance 2013-14 Bookajad babuОценок пока нет

- Taxation System in IndiaДокумент46 страницTaxation System in IndiaNiket Dattani100% (1)

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Inome Tax April 15Документ2 страницыInome Tax April 15brainОценок пока нет

- Assignment Taxation 2Документ13 страницAssignment Taxation 2afiq hisyamОценок пока нет

- Example Revenue PDFДокумент9 страницExample Revenue PDFgilbert.belciugОценок пока нет

- Checklist For Income Tax Returns FilingДокумент4 страницыChecklist For Income Tax Returns FilingSabin YadavОценок пока нет

- "H & R Block India Pvt. LTD.": A Project Report OnДокумент98 страниц"H & R Block India Pvt. LTD.": A Project Report OnraviОценок пока нет

- Ranjan Sir Lecture - Details - UnlockedДокумент77 страницRanjan Sir Lecture - Details - UnlockedTumpakuri67% (6)

- 2012 Building Intl Bridges (03!28!2013)Документ17 страниц2012 Building Intl Bridges (03!28!2013)Jk McCreaОценок пока нет

- Interest Charge On DISC-Related Deferred Tax Liability: Sign HereДокумент2 страницыInterest Charge On DISC-Related Deferred Tax Liability: Sign HereInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Оценок пока нет

- REVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherДокумент15 страницREVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherGoogleОценок пока нет

- Tds TcsДокумент20 страницTds TcsnaysarОценок пока нет

- Reference Guide South African Revenue Service Payment Rules: Effective Date 09.11.2010Документ8 страницReference Guide South African Revenue Service Payment Rules: Effective Date 09.11.2010biccard7338Оценок пока нет

- Introduction To TdsДокумент28 страницIntroduction To TdsGavendra BhartiОценок пока нет

- Income Tax Refund PDFДокумент3 страницыIncome Tax Refund PDFArunDaniel100% (1)

- Form 16: Wipro LimitedДокумент5 страницForm 16: Wipro Limiteddeepak9976Оценок пока нет

- GauriДокумент12 страницGauriRahul MittalОценок пока нет

- Guidelines 1702-EX June 2013Документ4 страницыGuidelines 1702-EX June 2013Julio Gabriel AseronОценок пока нет

- Guide 04: Tax Overview For Businesses, Investors & IndividualsДокумент8 страницGuide 04: Tax Overview For Businesses, Investors & IndividualsAbdul NafiОценок пока нет

- Organizations of The Net Revenue PoolДокумент23 страницыOrganizations of The Net Revenue PoolahmedchughtaiОценок пока нет

- Chapter 4-Statement of Cash FlowsДокумент3 страницыChapter 4-Statement of Cash FlowsDan GalvezОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ7 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Topic 5 CFДокумент18 страницTopic 5 CFAmalMdIsaОценок пока нет

- 14374752Документ2 страницы14374752Anshul MehtaОценок пока нет

- How To File Indian Income Tax Updated ReturnДокумент6 страницHow To File Indian Income Tax Updated ReturnpragativistaarОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ7 страницFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Form 16 For AY 2015-16 CAknowledge - inДокумент16 страницForm 16 For AY 2015-16 CAknowledge - inKiranОценок пока нет

- 1/28/2012 ©Taxmann/Dr. Vinod K. Singhania 1Документ167 страниц1/28/2012 ©Taxmann/Dr. Vinod K. Singhania 1Manoj KumarОценок пока нет

- MEMORANDUM D17-1-5: in BriefДокумент39 страницMEMORANDUM D17-1-5: in Briefbiharris22Оценок пока нет

- Direct Tax and Compliance Farheen 202200535 WordsДокумент11 страницDirect Tax and Compliance Farheen 202200535 Wordsnaazfarheen7777Оценок пока нет

- 1652426740-447 & 8168 HCL Comnet Systems & Services LTDДокумент7 страниц1652426740-447 & 8168 HCL Comnet Systems & Services LTDArulnidhi Ramanathan SeshanОценок пока нет

- Know About Changes Introduced in The New ITR-6 Released For Assessment Year 2024-25Документ5 страницKnow About Changes Introduced in The New ITR-6 Released For Assessment Year 2024-25Suman AgarwalОценок пока нет

- TRN FI102 Account Receivable v1.5Документ92 страницыTRN FI102 Account Receivable v1.5Shyam JaganathОценок пока нет

- Friends Cable Network 24539 COMMДокумент3 страницыFriends Cable Network 24539 COMMKanishk YadavОценок пока нет

- Friends Cable Jaswinder-24539Документ8 страницFriends Cable Jaswinder-24539Kanishk YadavОценок пока нет

- Durali Cable Durali SA C 0019 09Документ4 страницыDurali Cable Durali SA C 0019 09Kanishk YadavОценок пока нет

- Friends Cable (Tony)Документ6 страницFriends Cable (Tony)Kanishk YadavОценок пока нет

- Durali Cable Chdh012 (STB)Документ2 страницыDurali Cable Chdh012 (STB)Kanishk YadavОценок пока нет

- M/S J D Residency Gross Taxable Amt. Claimed As Abatement Non-Taxable ServiceДокумент3 страницыM/S J D Residency Gross Taxable Amt. Claimed As Abatement Non-Taxable ServiceKanishk YadavОценок пока нет

- The Commissioner, Central Excise Commissionerate, Chandigarh - IIДокумент3 страницыThe Commissioner, Central Excise Commissionerate, Chandigarh - IIKanishk YadavОценок пока нет

- XII Physics Chapter 1 - Electric Charges Fields Saju HssliveДокумент16 страницXII Physics Chapter 1 - Electric Charges Fields Saju HssliveKanishk Yadav100% (1)