Академический Документы

Профессиональный Документы

Культура Документы

Best Firm Daily Analysis: Friday, March 18, 2016

Загружено:

ανατολή και πετύχετεОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Best Firm Daily Analysis: Friday, March 18, 2016

Загружено:

ανατολή και πετύχετεАвторское право:

Доступные форматы

http://quotes.wsj.com/PH/XPHS/atn/historical-prices/download?

mod_view=page&num_rows=180&range_days=180&sta

http://quotes.wsj.com/PH/XPHS/web/historical-prices/download?mod_view=page&

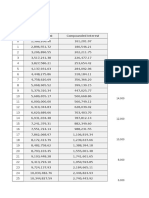

BEST FIRM DAILY ANALYSIS

Friday, March 18, 2016

2GO

Close

7.36

ABS

58.6

72924

AC

737

412958

AEV

63.4

AGF

SYMBOL

10 day SMA Vol Analysis

182200

CMF

50 SMA

Bearish

Bullish

Bullish

Bullish

Bearish BIG

Bearish

Bullish

1529171

Bullish BIG

Bullish

Bullish

2.85

245200

Bearish BIG Bearish

Bullish

AGI

15.88

8291210

Bearish

ALI

36.6

11623800

RSI

STS

69.77

84.09

7.35

7.46

Bearish

78.30

92.93

58.42

58.68

Bullish

62.00

65.22

735.88

753.45

77.11

97.74

61.54

63.60

Bullish

45.34

11.29

2.84

2.98

Bullish

Bearish

66.39

80.73

15.87

16.02

Bullish

Bullish

Bullish

72.77

95.45

35.55

36.81

ANI

4.67

1289600

Bearish BIG Bearish

Bearish

Bearish

41.20

11.19

4.55

4.79

AP

43.3

2363600

Bearish BIG

Bearish

Bullish

Bullish

51.73

30.77

43.09

44.35

APC

0.54

1279000

Bullish BIG #DIV/0!

Bullish

Bullish

60.42

73.33

0.53

0.55

AR

0.005

112800000

#DIV/0!

Bullish

ARA

1.61

431000

Bullish

Bullish

ATN

0.29

2300000

#DIV/0!

Bullish

BDO

104

3017425

Bearish

Bullish

BHI

0.065

2300000

Bullish

Bullish

BLOOM

5.3

11594320

Bullish BIG Bearish

Bullish

BSC

0.238

424000

Bearish BIG #DIV/0!

CAL

3.38

765900

Bullish BIG

CEI

0.128

7626000

CNPF

19

1360020

Bullish BIG

COAL

0.48

COSCO

Bullish BIG

Bullish BIG

HH,HL,LL

FibSupport FibResistance

65.98 100.00 0.00428

Bullish

63.11 100.00

1.55

1.61

92.17 100.00

0.29

0.29

60.83

70.51

103.57

105.10

70.64

78.95

0.06

0.07

Bullish

74.76

82.73

5.28

5.47

Bullish

Bullish

57.15

33.33

0.23

0.24

Bullish

Bullish

Bullish

65.99

82.05

3.24

3.44

#DIV/0!

Bullish

61.39

62.50

0.128

0.128

Bullish

Bullish

Bearish

87.06

97.47

18.35

19.07

2229000

Bearish BIG #DIV/0!

Bullish

Bearish

65.10

50.00

0.47

0.50

7.2

2347930

Bearish BIG Bearish

Bullish

Bearish

45.18

0.00

7.19

7.41

CPG

0.55

6198800

Bullish

Bullish

42.30

40.00

0.55

0.56

CROWN

2.39

1477500

Bullish

Bullish

65.60

64.71

2.37

2.40

CYBR

0.5

14167600

#DIV/0!

Bullish

Bearish

65.80

65.52

0.49

0.52

DAVIN

6.02

12063570

Bearish BIG Bearish

Bullish

Bullish

70.79

78.40

5.98

6.68

DD

38.95

4210430

Bearish BIG Bearish

Bullish

Bearish

91.42

94.08

38.23

39.57

DIZ

7.88

93130

Bearish BIG Bearish

Bullish

Bearish

63.55

68.00

7.80

7.99

DMC

13.56

5796010

Bullish BIG

Bullish

Bullish

Bullish

73.90

85.14

13.51

13.72

DMPL

11.7

217510

Bearish

Bullish

Bearish

55.78

25.00

11.59

11.78

DNL

5646030

Bearish

Bullish

Bearish

55.48

56.52

8.98

9.36

EDC

5.96

17358310

Bearish BIG Bearish

Bullish

Bearish

50.91

37.18

5.95

6.15

EEI

7.12

489410

Bullish

Bullish

Bullish

57.11

50.00

7.10

7.18

EMP

7.52

4605810

Bearish BIG Bearish

Bearish

Bearish

50.96

37.27

7.50

7.80

FGEN

20.85

4479130

Bullish BIG Bearish

Bullish

46.91

51.79

20.82

21.35

FLI

1.78

22597900

Bearish

Bullish

77.78

87.10

1.75

1.81

FNI

0.84

73597700

Bullish

Bullish

67.29

76.19

0.83

0.85

FOOD

0.75

107100

#DIV/0!

Bullish

60.77

80.00

0.74

0.75

Bearish BIG

Bearish

0.005049

Bullish

FPI

0.229

154000

#DIV/0!

Bullish

48.75 100.00

0.23

0.23

GEO

0.295

2429000

Bearish

Bullish

48.49

42.86

0.29476

0.298577

GERI

1.04

7463800

Bullish

Bullish

63.89

63.64

1.01

1.05

GLO

2190

173241

Bullish

Bullish

74.86

98.11

2169.48

2198.52

GMA7

6.92

231220

Bearish

Bullish

63.10

88.10

6.87

6.96

GSMI

11.12

2700

#DIV/0!

Bearish

33.13

0.00

11.12

11.12

H2O

3.31

9600

Bearish BIG #DIV/0!

Bullish

Bullish

54.81

67.80

3.30

3.45

HOLCM

13.9

29730

Bullish BIG #DIV/0!

Bullish

Bullish

48.75

68.18

13.83

13.90

HOUSE

494750

Bullish BIG

Bullish

Bullish

Bullish

89.12

99.01

7.78

8.02

IDC

3.4

2095200

Bullish BIG Bearish

Bullish

Bullish

76.13

83.19

3.38

3.54

IMI

5.61

393000

Bearish

Bullish

56.57

52.50

5.57

5.62

ION

2.65

4515700

Bullish

Bullish

62.81

49.18

2.61

2.67

IS

0.27

113424000

Bearish

Bullish

73.60

65.52

0.26927

0.28073

ISM

1.37

3579500

Bullish BIG Bearish

Bullish

70.65

72.41

1.35

1.40

LC

0.29

68092000

Bearish

Bullish

41.10

22.22

0.28976

0.293577

LIB

3.7

1139700

Bearish

Bearish

Bearish

41.30

40.00

3.67

3.74

LPZ

6.36

5918470

Bullish

Bullish

Bullish

72.06

92.80

6.21

6.43

LTG

15.8

3173590

Bullish BIG Bearish

Bullish

Bullish

41.08

46.67

15.72

15.98

MAC

2.75

71400

#DIV/0!

Bullish

Bullish

72.20

95.24

2.65

2.76

MACAY

37.4

1210

#DIV/0!

Bearish

30.99

81.36

37.40

37.40

MARC

2.12

949500

Bullish

Bullish

Bullish

60.17

44.44

2.11

2.21

MAXS

20.6

1128630

Bullish

Bullish

Bullish

81.84

85.44

19.60

21.20

MB

0.54

58800

Bearish BIG #DIV/0!

Bullish

Bearish

43.18

42.86

0.54

0.54

MBT

87.5

3395296

Bullish

Bullish

Bullish

74.72 100.00

86.03

87.60

MCP

2.83

36895900

Bullish

Bullish

Bullish

75.67

84.16

2.78

2.89

MED

0.56

2924400

Bearish

Bullish

57.68

9.09

0.56

0.57

MEG

4.05

36260900

Bullish BIG Bearish

Bullish

Bullish

69.65

76.71

4.04

4.16

MER

315

262388

Bearish BIG

Bearish

Bearish

Bearish

41.37

0.00

314.56

321.44

MPI

31777060

Bullish BIG

Bearish

Bullish

53.16

66.67

5.99

6.02

MRC

0.092

7844000

#DIV/0!

Bullish

Bearish

49.10

35.00

0.09047

0.093528

MWC

26.5

900580

Bearish

Bullish

Bullish

48.29

46.15

26.39

26.61

NIKL

5.63

6854450

Bullish

Bullish

Bullish

63.70

57.80

5.57

5.69

NOW

0.86

17914800

Bearish

Bullish

Bullish

59.35

62.96

0.85

0.89

OM

0.54

11900

Bullish BIG

#DIV/0!

Bullish

48.70

20.00

0.54

0.54

OPM

0.01

23200000

Bullish BIG

#DIV/0!

Bullish

Bullish

52.72

50.00

0.00995

0.010715

ORE

1.28

134300

Bullish BIG

#DIV/0!

Bullish

Bullish

57.90

66.67

1.26

1.32

OV

0.012

117180000

#DIV/0!

Bullish

53.03

50.00

0.01

0.01

PA

0.033

103710000

Bearish

Bullish

Bearish

55.55

42.86

0.03

0.03

PCOR

10.3

9888020

Bearish

Bullish

Bullish

65.26

85.45

10.21

10.35

PF

169

37018

#DIV/0!

Bullish

Bullish

72.53

97.05

167.55

169.46

PGOLD

37.65

3822970

Bearish

Bullish

Bullish

70.41

96.67

37.57

37.76

PHA

0.455

769000

#DIV/0!

Bullish

69.78

63.64

0.45

0.46

Bullish BIG

Bullish BIG

Bullish BIG

Bullish BIG

Bullish BIG

Bullish

Bearish

Bullish

PHES

0.229

772000

#DIV/0!

Bearish

Bearish

48.67

42.11

0.22

0.23

PIP

3.82

467600

Bullish

Bullish

Bullish

79.65

89.74

3.74

3.88

PLC

0.96

43049200

Bullish

Bullish

65.75

75.00

0.94

0.96

PNX

4.33

582400

#DIV/0!

Bullish

Bearish

81.82

96.92

4.19

4.35

POPI

2.01

968800

Bearish

Bullish

Bearish

34.04

66.67

1.97

2.03

PPC

2.7

436800

Bullish

Bullish

Bearish

51.02

18.87

2.69

2.72

PSPC

1.72

581700

Bullish BIG

Bullish

Bullish

Bullish

60.56

70.37

1.67

1.75

PX

5980320.6

Bullish BIG

Bearish

Bullish

Bullish

67.33

79.37

5.99

6.18

PXP

2.5

5754400

Bullish BIG

Bullish

Bullish

Bullish

77.85 100.00

2.13

2.53

REG

2.75

5100

Bullish BIG

#DIV/0!

Bullish

Bearish

52.51 100.00

2.74

2.75

RFM

4.09

3617800

Bullish

Bullish

Bearish

65.96

64.10

4.04

4.11

RLC

29.2

3213550

Bearish BIG Bearish

Bullish

Bullish

66.05

76.60

29.15

29.99

RLT

0.445

58000

#DIV/0!

Bullish

86.46

90.00

0.45

0.45

ROCK

1.48

470500

Bearish

Bullish

47.79

53.85

1.48

1.49

ROX

5.04

77220

#DIV/0!

Bullish

Bullish

63.52

86.05

4.94

5.05

RRHI

71.8

2672563

Bullish

Bullish

Bearish

73.76

95.51

70.93

72.00

RWM

3.69

5562100

Bearish BIG Bearish

Bearish

Bearish

41.76

2.22

3.68

3.79

SBS

6.15

1806800

Bearish

Bullish

Bearish

61.73

51.80

6.05

6.23

SCC

135

494046

Bearish

Bullish

Bearish

68.26

74.32

134.85

137.15

SECB

161

1148805

Bullish

Bullish

Bullish

87.66

98.52

160.20

161.27

SEVN

105

111865

#DIV/0!

Bullish

74.44 100.00

101.42

105.24

SFI

0.16

7464000

Bullish

Bullish

57.99

62.50

0.16

0.16

SGI

1.09

979300

#DIV/0!

Bullish

51.79

40.91

1.09

1.10

SLI

0.84

2726600

Bullish

Bullish

64.68

77.78

0.83

0.85

SM

990

279712

Bullish

Bullish

73.94

95.52

968.18

996.83

SMC

77.5

595708

Bearish

Bullish

64.67

74.63

77.48

77.82

SMPH

21.45

15210620

Bullish BIG Bearish

Bullish

54.88

61.54

21.40

21.63

SOC

0.77

113300

Bearish BIG #DIV/0!

Bullish

48.48

36.36

0.77

0.78

SPH

2.44

138300

#DIV/0!

Bearish

54.02

28.57

2.42

2.48

SPM

2.2

12200

#DIV/0!

Bearish

29.99

47.37

2.20

2.20

SRDC

0.8

#DIV/0!

Bearish

100.00 #####

0.80

0.80

SSI

3.44

6916700

Bearish

Bullish

48.25

48.00

3.42

3.51

STI

0.53

4245400

Bullish

Bullish

61.40

57.14

0.52

0.54

STR

5.62

3610

#DIV/0!

Bullish

44.37

57.41

5.62

5.62

SUN

1.01

1821300

Bearish

Bullish

Bullish

56.38

56.25

1.01

1.02

TA

2.75

10802800

Bearish

Bullish

Bullish

78.08

85.71

2.73

2.77

TECH

17.8

360930

Bearish BIG

Bearish

Bearish

Bearish

39.34

0.00

17.77

18.20

TEL

1978

298624.5

Bullish BIG

Bullish

Bearish

Bullish

40.68

87.83

1948.06

2009.94

TFHI

155

99050

Bearish

Bullish

Bearish

56.04

39.81

154.76

158.58

TUGS

1.25

350200

#DIV/0!

Bullish

55.06

40.00

1.25

1.27

UNI

0.31

3988000

Bearish BIG #DIV/0!

Bullish

Bearish

57.24

28.57

0.30927

0.32073

VITA

0.77

15351200

Bearish

Bullish

Bearish

62.71

45.16

0.75

0.80

Bearish BIG

Bullish BIG

Bearish BIG

Bullish BIG

Bullish BIG

Bullish

Bullish

Bearish

VLL

4.69

7267300

Bearish

Bullish

62.41

78.38

4.66

4.75

VMC

4.6

1063200

#DIV/0!

Bearish

44.95

20.83

4.60

4.60

VUL

1.15

143500

#DIV/0!

Bullish

Bearish

57.84

23.08

1.15

1.15

WEB

22.05

299880

Bullish

Bearish

Bullish

26.31

56.82

21.87

22.06

WIN

0.195

1144000

#DIV/0!

Bearish

Bearish

44.89

11.54

0.19

0.20

17.1

3685010

Bearish

Bullish

69.23

66.67

16.96

17.32

YEHEY

4.78

41600

#DIV/0!

Bullish

47.45

61.36

4.78

4.81

ZHI

#DIV/0!

#DIV/0!

#DIV/0!

100.00 #####

Bearish BIG

Bearish BIG

#DIV/0!

Bullish

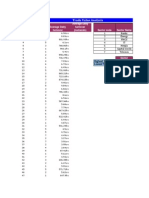

LEGEND

10 DAY VOL SMA

An analysis of 10 day simple moving average of volume of a stock.

VOLUME ANALYSIS

If today's volume exceeds the price of a 10 day sma VOLUME , the stock is bullish,if not, it is bearish

CMF(Chaikin Money Flow)

the indicator uses the difference between a 3-day exponentially-weighted moving average (EMA) of the

accumulation/distribution line and the 10-Day EMA of the Accumulation/Distribution Line

50 SMA

An analysis of 50 day simple moving average OF THE CLOSING PRICE of a stock.

HH,HL, LL

HH stands for Higher High, HL stands for Higher Low, and LL stands for Lower Low

If a stock have a HH and HL condition, it is BULLISH because it creates a new high in the HIGH and new high for the LOW of a stock for that day.

If a stock have a LL condition, this means a stock is BEARISH because it creates a new low in the HIGH and new low for the LOW of a stock for that day.

RSI(Relative Strenght Index)

a momentum oscillator that measures the speed and change of price movements. RSI oscillates between zero and 100.

Traditionally, and according to Wilder, RSI is considered overbought when above 70 and oversold when below 30.

STS(Stochastics

Readings above 80 for the 20-day Stochastic Oscillator would indicate that the underlying security was trading near the top of its 20-day high-low range

and it is considered OVERBOUGHT. Readings below 20 occur when a security is trading at the low end of its high-low range and it is considered

OVERSOLD.

SUPPORT AND RESISTANCE

SUPPORT is a level where the price tends to find support as it falls. This means the price is more likely to "bounce" off this level

rather than break through it. However, once the price has breached this level, by an amount exceeding some noise, it is likely to

continue falling until meeting another support level

RESISTANCE is a level where the price tends to find resistance as it rises. This means the price is more likely to "bounce" off this

level rather than break through it. However, once the price has breached this level, by an amount exceeding some noise, it is likely

to continue rising until meeting another resistance level.

The Materials Contained here are for guidance & Educational Purposes Only. All Indicators are carefully

analyzed to help assist traders in getting RELIABLE RESOURCES and INFORMATIONS that they can use

in their strategy in trading and further study.Due diligence before attempting to follow the signals stated

above.Thank You

ODIELON O. GAMBOA

Вам также может понравиться

- Bfa Dailyanalysis (1) AdaДокумент4 страницыBfa Dailyanalysis (1) Adaανατολή και πετύχετεОценок пока нет

- Bfa Dailyanalysis (2) AsdadДокумент4 страницыBfa Dailyanalysis (2) Asdadανατολή και πετύχετεОценок пока нет

- Best Firm Daily Analysis: Thursday, March 17, 2016Документ4 страницыBest Firm Daily Analysis: Thursday, March 17, 2016ανατολή και πετύχετεОценок пока нет

- Bfa DailyanalysisДокумент4 страницыBfa Dailyanalysisανατολή και πετύχετεОценок пока нет

- Best Portfolio Shares InvestmentsДокумент4 страницыBest Portfolio Shares Investmentssathi2317411Оценок пока нет

- 2007 MFI BenchmarksДокумент42 страницы2007 MFI BenchmarksVũ TrangОценок пока нет

- Intraday Traing Strategies Open High Low Top Gainers Top Index Top F&O 52 High Low Day High Low Gap Up 15 Min CandleДокумент4 страницыIntraday Traing Strategies Open High Low Top Gainers Top Index Top F&O 52 High Low Day High Low Gap Up 15 Min CandleGeorge Khris DebbarmaОценок пока нет

- Daily CallsДокумент7 страницDaily CallsparikshithbgОценок пока нет

- Dailycalls 26Документ7 страницDailycalls 26Shrikant KalantriОценок пока нет

- Technical Guide: FinancialsДокумент9 страницTechnical Guide: FinancialswindsingerОценок пока нет

- Daily Calls: November 8, 2016Документ18 страницDaily Calls: November 8, 2016SathishKumarОценок пока нет

- Daily Calls: SensexДокумент7 страницDaily Calls: Sensexdrsivaprasad7Оценок пока нет

- Stock CodeДокумент17 страницStock CodeTimberevilake HardjosantosoОценок пока нет

- M 65WДокумент52 страницыM 65WChelseaE82Оценок пока нет

- National Stock ExchangeДокумент8 страницNational Stock ExchangeCA Manoj GuptaОценок пока нет

- Signal Script Exchange Big - SL SL Open Low Dyn - Atp LTP HighДокумент18 страницSignal Script Exchange Big - SL SL Open Low Dyn - Atp LTP HighSriheri DeshpandeОценок пока нет

- Indices Auto Saved)Документ16 страницIndices Auto Saved)Ashu LeeОценок пока нет

- Technical Guide: FinancialsДокумент9 страницTechnical Guide: FinancialswindsingerОценок пока нет

- Paint Industry Date Asian Paints Shalimar Paints Berger Paints Akzo Nobel Kansai NerolacДокумент8 страницPaint Industry Date Asian Paints Shalimar Paints Berger Paints Akzo Nobel Kansai NerolacKhushboo RajОценок пока нет

- PFD CalculationsДокумент14 страницPFD CalculationsMUKESH KUMARОценок пока нет

- InsuranceДокумент5 страницInsuranceANISH KAFLEОценок пока нет

- Technical Guide: FinancialsДокумент9 страницTechnical Guide: FinancialswindsingerОценок пока нет

- Set History - EOD - 2017 05 15Документ55 страницSet History - EOD - 2017 05 15Anonymous r1azSbNRlmОценок пока нет

- Upd CatalogДокумент280 страницUpd CatalogRitz Voone ApaleОценок пока нет

- Data Ipm MelawiДокумент1 страницаData Ipm MelawiSadaluna LunaОценок пока нет

- IAPM AssignmentsДокумент29 страницIAPM AssignmentsMUKESH KUMARОценок пока нет

- Submission v2Документ32 страницыSubmission v2MUKESH KUMARОценок пока нет

- Daily Calls: ICICI Securities LTDДокумент15 страницDaily Calls: ICICI Securities LTDnectars59Оценок пока нет

- Technical Guide: FinancialsДокумент9 страницTechnical Guide: FinancialswindsingerОценок пока нет

- The Treasury High Quality Market (HQM) Corporate Bond Yield CurveДокумент35 страницThe Treasury High Quality Market (HQM) Corporate Bond Yield CurveDr Luis e Valdez ricoОценок пока нет

- Watchlist - 19 Feb 2024Документ9 страницWatchlist - 19 Feb 2024Apeksha TОценок пока нет

- GE 10 InterestДокумент4 страницыGE 10 InterestMark Julius CabasanОценок пока нет

- Details of Daily Margin Applicable For F&O Segment (F&O) For 06.05.2016Документ5 страницDetails of Daily Margin Applicable For F&O Segment (F&O) For 06.05.2016ShanKar PadmanaBhanОценок пока нет

- Analisis Trial SPM Utk Post MortemДокумент41 страницаAnalisis Trial SPM Utk Post MortemMaam Amin ManafОценок пока нет

- July Seasonality - Global Equity Indices: Changes Since End of JuneДокумент3 страницыJuly Seasonality - Global Equity Indices: Changes Since End of Juneapi-245850635Оценок пока нет

- PCT 175Документ3 страницыPCT 175Sai Krishna Chaitanya AddagallaОценок пока нет

- 8 Text FunctionsДокумент8 страниц8 Text FunctionsRageshChavanОценок пока нет

- C Unit-Business StudiesДокумент44 страницыC Unit-Business StudiesMahmudul HasanОценок пока нет

- Security-Wise Price Volume Delivery Pivot 04mar2018Документ438 страницSecurity-Wise Price Volume Delivery Pivot 04mar2018Ajazuddin MohammedОценок пока нет

- Details of Daily Margin Applicable For F&O Segment (F&O) For 28.03.2016Документ5 страницDetails of Daily Margin Applicable For F&O Segment (F&O) For 28.03.2016SriОценок пока нет

- Perce Expet ReДокумент49 страницPerce Expet ReUju surtОценок пока нет

- Keputusan Peperiksaan Keseluruhan Set Eppd 1063Документ4 страницыKeputusan Peperiksaan Keseluruhan Set Eppd 1063yaniearolОценок пока нет

- Hasil Akhir Us TulisДокумент3 страницыHasil Akhir Us Tulisᮔᮔ᮪ᮓᮀ ᮞᮨᮒᮤᮃ ᮔᮥᮌᮢᮠОценок пока нет

- Complete Result MBAFT - 2016Документ33 страницыComplete Result MBAFT - 2016Ajitesh NayakОценок пока нет

- Technical Analysis For 2 CompaniesДокумент6 страницTechnical Analysis For 2 CompaniesShinchana KОценок пока нет

- Daily Calls: ICICI Securities LTDДокумент15 страницDaily Calls: ICICI Securities LTDcontactrnОценок пока нет

- Trading Book - AGДокумент7 страницTrading Book - AGAnilkumarGopinathanNairОценок пока нет

- Dily Gainers and LosersДокумент10 страницDily Gainers and LosersAnshuman GuptaОценок пока нет

- Term PaperДокумент9 страницTerm Paperkavya surapureddy100% (1)

- Banks and Financials: As Of: 8/4/2017Документ2 страницыBanks and Financials: As Of: 8/4/2017mitchОценок пока нет

- Details of Daily Margin Applicable For F&O Segment (F&O) For 02.11.2015Документ5 страницDetails of Daily Margin Applicable For F&O Segment (F&O) For 02.11.2015Rahul NaharОценок пока нет

- MonitorДокумент63 страницыMonitorJi YanbinОценок пока нет

- New Microsoft Excel WorksheetДокумент9 страницNew Microsoft Excel WorksheetSneha JadhavОценок пока нет

- Tire Size Chart - Metric - by Rim - Wheel DiameterДокумент3 страницыTire Size Chart - Metric - by Rim - Wheel DiameterVisweswaran RangasamyОценок пока нет

- EGX (30) Index: Trend Close CHG % CHG S/L 21-Nov-13Документ3 страницыEGX (30) Index: Trend Close CHG % CHG S/L 21-Nov-13api-237717884Оценок пока нет

- Aditya Birla Capital - FMCGДокумент9 страницAditya Birla Capital - FMCGNikita JaisinghaniОценок пока нет

- Option Chain (Equity Derivatives)Документ2 страницыOption Chain (Equity Derivatives)Subrata PaulОценок пока нет

- Game Trading Account - Assignment A: Group MembersДокумент5 страницGame Trading Account - Assignment A: Group MembersUsman NadeemОценок пока нет

- Analisa Agen No RepeatДокумент1 страницаAnalisa Agen No Repeatirfan edisonОценок пока нет

- Profitability of simple fixed strategies in sport betting: Soccer, Spain Primera Division (LaLiga), 2009-2019От EverandProfitability of simple fixed strategies in sport betting: Soccer, Spain Primera Division (LaLiga), 2009-2019Оценок пока нет

- Chartered Market Technician (CMT) Program Level 2: May 2013 Reading AssignmentsДокумент4 страницыChartered Market Technician (CMT) Program Level 2: May 2013 Reading Assignmentsανατολή και πετύχετεОценок пока нет

- Civil Procedure - MwNwIo5Rs6cBBO1gwlroДокумент815 страницCivil Procedure - MwNwIo5Rs6cBBO1gwlroTaj Martin100% (13)

- MTA Curriculum DescriptionДокумент3 страницыMTA Curriculum Descriptionανατολή και πετύχετεОценок пока нет

- Bataclan vs. MedinaДокумент2 страницыBataclan vs. Medinaανατολή και πετύχετεОценок пока нет

- 2013spr cmt1Документ5 страниц2013spr cmt1Nguyễn Hữu TuấnОценок пока нет

- Complaint Affidavit SampleДокумент2 страницыComplaint Affidavit SampleDonna Gragasin78% (125)

- Law 125 SyllabusДокумент5 страницLaw 125 SyllabusJoshua LaronОценок пока нет

- PSY Chapter 1Документ83 страницыPSY Chapter 1Aedrian M LopezОценок пока нет

- HR-V1 WebДокумент70 страницHR-V1 WebsouОценок пока нет

- Labor Law Dau SchmidtДокумент49 страницLabor Law Dau Schmidtανατολή και πετύχετεОценок пока нет

- Labor Law - Craver - Fall 2003 - 3Документ45 страницLabor Law - Craver - Fall 2003 - 3champion_egy325Оценок пока нет

- Introduction To PsychologyДокумент45 страницIntroduction To PsychologyKhristine Lerie PascualОценок пока нет

- Labor Law ('94)Документ25 страницLabor Law ('94)NopeОценок пока нет

- CivilProcedure Memory AidДокумент38 страницCivilProcedure Memory AidIm In TroubleОценок пока нет

- PSPC Activist Shareholders Group: Presentation of Demands To The ManagementДокумент19 страницPSPC Activist Shareholders Group: Presentation of Demands To The Managementανατολή και πετύχετεОценок пока нет

- 2labor Law ReviewerДокумент152 страницы2labor Law ReviewerCharnette Cao-wat LemmaoОценок пока нет

- G.R. No. 127899 December 2, 1999: Supreme CourtДокумент7 страницG.R. No. 127899 December 2, 1999: Supreme Courtανατολή και πετύχετεОценок пока нет

- G.R. No. 89606 August 30, 1990: Supreme CourtДокумент8 страницG.R. No. 89606 August 30, 1990: Supreme Courtανατολή και πετύχετεОценок пока нет

- Our Top 3 Swing Trading Setups: Deron WagnerДокумент36 страницOur Top 3 Swing Trading Setups: Deron Wagnerανατολή και πετύχετεОценок пока нет

- Stock Market Research QuestionnaireДокумент4 страницыStock Market Research Questionnaireανατολή και πετύχετεОценок пока нет

- Best Firm Daily Analysis: Friday, March 18, 2016Документ4 страницыBest Firm Daily Analysis: Friday, March 18, 2016ανατολή και πετύχετεОценок пока нет

- FAPHL 2016 CONFERENCE PROGRAM FORMAT As of JUNE 23Документ5 страницFAPHL 2016 CONFERENCE PROGRAM FORMAT As of JUNE 23ανατολή και πετύχετεОценок пока нет

- (G.R. No. 123936. March 4, 1999) : SynopsisДокумент11 страниц(G.R. No. 123936. March 4, 1999) : Synopsisανατολή και πετύχετεОценок пока нет

- Learning About Content Marketing: by Ric OribianaДокумент5 страницLearning About Content Marketing: by Ric Oribianaανατολή και πετύχετεОценок пока нет

- InvesujighДокумент13 страницInvesujighανατολή και πετύχετεОценок пока нет

- 2007-2013 Political Law Philippine Bar Examination Questions and Suggested Answers (JayArhSals)Документ168 страниц2007-2013 Political Law Philippine Bar Examination Questions and Suggested Answers (JayArhSals)Jay-Arh92% (85)

- Esteban YafghdДокумент2 страницыEsteban Yafghdανατολή και πετύχετεОценок пока нет

- Evidence: Course OutlineДокумент12 страницEvidence: Course Outlineανατολή και πετύχετεОценок пока нет