Академический Документы

Профессиональный Документы

Культура Документы

DOJ Petition

Загружено:

Mike SniderАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

DOJ Petition

Загружено:

Mike SniderАвторское право:

Доступные форматы

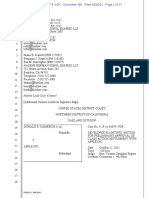

Case 3:16-cv-03777 Document 1 Filed 07/06/16 Page 1 of 4

CAROLINE D. CIRAOLO

Assistant Attorney General

2

3

4

5

6

7

8

JAMES E. WEAVER

Senior Litigation Counsel, Tax Division

AMY MATCHISON (CA SBN 217022)

Trial Attorney, Tax Division

United States Department of Justice

P.O. Box 683, Ben Franklin Station

Washington, D.C. 20044

Telephone: (202) 305-4929

Email: James.E.Weaver@usdoj.gov

Amy.T.Matchison@usdoj.gov

Attorneys for Petitioner

THE UNITED STATES OF AMERICA

9

IN THE UNITED STATES DISTRICT COURT FOR THE

NORTHERN DISTRICT OF CALIFORNIA

10

11

12

13

14

15

16

17

UNITED STATES OF AMERICA,

)

)

Petitioner,

)

)

v.

)

)

FACEBOOK, INC. AND SUBSIDIARIES

)

(a Consolidated Group),

)

)

Respondent.

)

_______________________________________)

Case No.

PETITION TO ENFORCE

INTERNAL REVENUE SERVICE

SUMMONSES

18

The United States of America, through undersigned counsel, petitions this Court for an

19

order enforcing Internal Revenue Service (IRS) summonses served on respondent Facebook,

20

Inc. and Subsidiaries (a Consolidated Group) (Facebook) pursuant to 26 U.S.C. 7602.

21

In support of this petition, the United States alleges as follows:

22

1.

23

This is a proceeding brought pursuant to Sections 7402(b) and 7604(a) of the

Internal Revenue Code (Title 26, United States Code) for judicial enforcement of the IRS

Petition to Enforce Internal

Revenue Service Summonses

Case 3:16-cv-03777 Document 1 Filed 07/06/16 Page 2 of 4

1

2

summonses described below.

2.

The Court has jurisdiction over this proceeding pursuant to Sections 7402(b) and

7604(a) of the Internal Revenue Code and 28 U.S.C. 1340 and 1345. Venue properly lies

within this district.

5

6

7

3.

This proceeding is appropriate for assignment to the San Francisco or Oakland

Divisions since Facebook is headquartered in San Mateo County.

4.

The IRS is conducting an examination of the federal income tax liability of

Facebook for the tax period ending December 31, 2010. Part of the IRSs examination concerns

matters arising under certain agreements between Facebook Inc. and Facebook Ireland Holdings

10

Limited (Facebook Ireland) purporting to transfer rights associated with Facebooks

11

worldwide business to Facebook Ireland, with the exception of the United States and Canada.

12

Declaration of Revenue Agent Nina Wu Stone (Stone Decl.) at 2, 17-18.

13

5.

Nina Wu Stone is a Revenue Agent employed in the Large Business and

14

International Division of the IRS, assigned to the aforementioned Facebook examination.

15

Revenue Agent Stone is authorized to issue administrative summonses pursuant to 26 U.S.C.

16

7602, 26 C.F.R. 301.7602-1, and IRS Delegation Order No. 25-1. Stone Decl. 1, 4, 5.

17

6.

In furtherance of the examination for 2010 and in accordance with 26 U.S.C.

18

7602, on June 1, 2016, Revenue Agent Stone issued six IRS summonses directing Facebook to

19

appear at 55 South Market Street, 6th floor, San Jose, California, 95113 on June 17, 2016, at

20

1:00 p.m. and to produce for examination books, records, papers and other data as described in

21

the summonses. Stone Decl. 6 & Exs. 1-6.

22

23

7.

In furtherance of the examination and in accordance with 26 U.S.C. 7603, on

June 1, 2016, Ms. Stone served an attested copy of each of the summonses on Facebook by

Petition to Enforce Internal

Revenue Service Summonses

Case 3:16-cv-03777 Document 1 Filed 07/06/16 Page 3 of 4

personal delivery to David Wehner, the Chief Financial Officer for Facebook. Stone Decl. 7,

Exhibits 1-6.

8.

Facebook failed to appear on June 17, 2016, the date scheduled for compliance

with the summonses, and did not produce the books, records, papers, and other data demanded in

the summonses. Facebooks failure to comply with the summonses continues to this date. Stone

Decl. 8.

9.

The books, records, papers, and other data demanded in the summonses are not

already in the possession of the IRS. During the course of the examination, Facebook has

provided the IRS with some documents; however, Facebook has not provided documents in

10

response to the summonses at issue here. To the extent Facebook earlier provided documents

11

that would also be responsive to a summons request, the IRS is not seeking production of those

12

documents. Stone Decl. 10.

13

14

15

10.

All administrative steps as required by the Internal Revenue Code for issuance

and service of the summonses have been followed. Stone Decl. 11.

11.

There is no Justice Department referral, as that term is described in Section

16

7602(d)(2) of the Internal Revenue Code, in effect with respect to Facebook for the taxable

17

period ending December 31, 2010. Stone Decl. 12.

18

25.

In order to obtain enforcement of a summons, the petitioner must establish that

19

the summons: (1) is issued for a legitimate purpose; (2) seeks information relevant to that

20

purpose; (3) seeks information that is not already within the IRSs possession; and (4) satisfies

21

all administrative steps required by the Internal Revenue Code. United States v. Powell, 379

22

U.S. 48, 57-58, (1964).

23

26.

In further support of this Petition and incorporated herein by reference, the United

Petition to Enforce Internal

Revenue Service Summonses

Case 3:16-cv-03777 Document 1 Filed 07/06/16 Page 4 of 4

States submits the Declaration of Revenue Agent Nina Wu Stone. The United States has met the

Powell factors through these documents.

WHEREFORE, petitioner, the United States of America, seeks the following relief:

A. That this Court enter an order directing Facebook to show cause in writing why it

should not fully comply with and obey the aforementioned IRS summonses and every

requirement thereof as enumerated in the Declaration of Revenue Agent Nina Wu

Stone;

8

9

B. That this Court enter an order directing Facebook to appear before Revenue Agent

Stone, or any other proper officer or employee of the Internal Revenue Service, and

10

produce for examination books, records, papers and other data as required by the

11

summonses;

12

C. That the United States of America recover its costs in this action; and

13

D. That the Court grant such other further relief as it deems just and proper.

14

Dated this 6th day of July, 2016.

CAROLINE D. CIRAOLO

Assistant Attorney General

15

16

/s/ James E. Weaver

JAMES E. WEAVER

Senior Litigation Counsel, Tax Division

17

18

/s/ Amy Matchison

AMY MATCHISON (CA SBN 217022)

Trial Attorney, Tax Division

United States Department of Justice

P.O. Box 683, Ben Franklin Station

Washington, D.C. 20044

Telephone: (202) 305-4929

Email: James.E.Weaver@usdoj.gov

Amy.T.Matchison@usdoj.gov

19

20

21

22

23

Petition to Enforce Internal

Revenue Service Summonses

Вам также может понравиться

- Facebook V Martin Grunin - Case Management Statement 8-13Документ7 страницFacebook V Martin Grunin - Case Management Statement 8-13Jessica ShieldsОценок пока нет

- IRS Request For Coinbase SummonsДокумент3 страницыIRS Request For Coinbase SummonsCNET NewsОценок пока нет

- E-Filed: January 11, 2010Документ3 страницыE-Filed: January 11, 2010Chapter 11 DocketsОценок пока нет

- United States Court of Appeals, Fourth CircuitДокумент8 страницUnited States Court of Appeals, Fourth CircuitScribd Government DocsОценок пока нет

- Washington AG: Facebook Lied in Lawsuit TestimonyДокумент13 страницWashington AG: Facebook Lied in Lawsuit TestimonyGeekWireОценок пока нет

- Reply Judicial Notice Cme ReadyДокумент3 страницыReply Judicial Notice Cme ReadyDavid T Saint AlbansОценок пока нет

- Jennifer Kay Shipman vs. Jason William ShipmanДокумент713 страницJennifer Kay Shipman vs. Jason William Shipmanf1339640Оценок пока нет

- 08-19-2016 ECF 1079 USA V A BUNDY Et Al - Declaration by Geoffrey A. BarrowДокумент3 страницы08-19-2016 ECF 1079 USA V A BUNDY Et Al - Declaration by Geoffrey A. BarrowJack RyanОценок пока нет

- FBI 2021.06.16 Response Ty Clevenger's RequestsДокумент4 страницыFBI 2021.06.16 Response Ty Clevenger's RequestsJim Hoft100% (1)

- Federal Reserve Board FOIA Logs 2016-2019Документ345 страницFederal Reserve Board FOIA Logs 2016-2019slavenumerounoОценок пока нет

- Preparing Family Law AnswersДокумент2 страницыPreparing Family Law AnswersPkernОценок пока нет

- CREW v. Dept. of The Treasury (IRS FOIA) 5/24/2006 - ComplaintДокумент11 страницCREW v. Dept. of The Treasury (IRS FOIA) 5/24/2006 - ComplaintCREWОценок пока нет

- DOJ Fisa Filing - AprilДокумент54 страницыDOJ Fisa Filing - AprilWashington ExaminerОценок пока нет

- P ' S R D S H M P I Case No 4:10-cv-00257 (SBA) sf-2884216Документ9 страницP ' S R D S H M P I Case No 4:10-cv-00257 (SBA) sf-2884216Equality Case FilesОценок пока нет

- Unopposed M Otion For Continuance of Trial - Page 1Документ5 страницUnopposed M Otion For Continuance of Trial - Page 1Jason Brad BerryОценок пока нет

- Crowd Siren V FacebookДокумент28 страницCrowd Siren V FacebookFindLawОценок пока нет

- Crowd Siren FB LawsuitДокумент28 страницCrowd Siren FB Lawsuitjonathan_skillingsОценок пока нет

- Facebook V TyposquattersДокумент37 страницFacebook V TyposquattersCNET NewsОценок пока нет

- (5/12/2020) Plaintiff's Motion For Judicial NoticeДокумент5 страниц(5/12/2020) Plaintiff's Motion For Judicial NoticeJoseph McGheeОценок пока нет

- Muhammad Ali FOIA Lawsuit Status ReportДокумент2 страницыMuhammad Ali FOIA Lawsuit Status ReportLaw&CrimeОценок пока нет

- DE260 AG Interpretation of CVRA Given in Order To Restrict DisclosureДокумент6 страницDE260 AG Interpretation of CVRA Given in Order To Restrict DisclosureOpDeathEatersUSОценок пока нет

- 1:13-cv-01225 #68Документ465 страниц1:13-cv-01225 #68Equality Case Files100% (1)

- Zuckerberg and Sandberg Ordered To TestifyДокумент14 страницZuckerberg and Sandberg Ordered To TestifyGMG EditorialОценок пока нет

- Stanford Appeal OrderДокумент19 страницStanford Appeal Orderjmaglich1Оценок пока нет

- EFF Lawsuit Against The FBIДокумент5 страницEFF Lawsuit Against The FBIRed PillОценок пока нет

- Brian Gaintner vs. Jennifur Gaintner 14-3-03909-2Документ221 страницаBrian Gaintner vs. Jennifur Gaintner 14-3-03909-2Eric YoungОценок пока нет

- Word of Faith World Outreach Center Church Inc. v. IRS Petition and DismissalДокумент23 страницыWord of Faith World Outreach Center Church Inc. v. IRS Petition and DismissalJasonTrahan100% (1)

- United States v. Robert Case, 180 F.3d 464, 2d Cir. (1999)Документ7 страницUnited States v. Robert Case, 180 F.3d 464, 2d Cir. (1999)Scribd Government DocsОценок пока нет

- Robert W. Monday v. United States of America, and Third-Party v. John A. Monday, Third-Party, 421 F.2d 1210, 3rd Cir. (1970)Документ10 страницRobert W. Monday v. United States of America, and Third-Party v. John A. Monday, Third-Party, 421 F.2d 1210, 3rd Cir. (1970)Scribd Government DocsОценок пока нет

- United States v. Johnson, 510 F.3d 521, 4th Cir. (2007)Документ12 страницUnited States v. Johnson, 510 F.3d 521, 4th Cir. (2007)Scribd Government DocsОценок пока нет

- Judicial Watch LawsuitДокумент4 страницыJudicial Watch LawsuitAustin Denean100% (1)

- Complaint To Clifford J. White III, Director, U.S. Trustees Re Judge Jerry FunkДокумент58 страницComplaint To Clifford J. White III, Director, U.S. Trustees Re Judge Jerry FunkNeil GillespieОценок пока нет

- Scheafnocker v. CIR, 642 F.3d 428, 3rd Cir. (2011)Документ28 страницScheafnocker v. CIR, 642 F.3d 428, 3rd Cir. (2011)Scribd Government DocsОценок пока нет

- JW V DOJ Garland School Threats Complaint 03389Документ4 страницыJW V DOJ Garland School Threats Complaint 03389alecОценок пока нет

- CREW v. Office of Administration: Regarding Lost White House Emails: 5/22/2007 - ComplaintДокумент28 страницCREW v. Office of Administration: Regarding Lost White House Emails: 5/22/2007 - ComplaintCREWОценок пока нет

- Ken Klippenstein FOIA Lawsuit Re Unauthorized Disclosure Crime ReportsДокумент5 страницKen Klippenstein FOIA Lawsuit Re Unauthorized Disclosure Crime ReportsTheNationMagazine100% (1)

- CU v. State Dept. FOIA Lawsuit (Biden Records)Документ5 страницCU v. State Dept. FOIA Lawsuit (Biden Records)Citizens UnitedОценок пока нет

- United States v. Joseph Catone, JR., 4th Cir. (2014)Документ23 страницыUnited States v. Joseph Catone, JR., 4th Cir. (2014)Scribd Government DocsОценок пока нет

- 233 Mueller PagesДокумент233 страницы233 Mueller PagesScott StedmanОценок пока нет

- Scott Binsack, Sr. V., 3rd Cir. (2011)Документ5 страницScott Binsack, Sr. V., 3rd Cir. (2011)Scribd Government DocsОценок пока нет

- United States Bankruptcy Court Central District of California DivisionДокумент6 страницUnited States Bankruptcy Court Central District of California DivisionChapter 11 DocketsОценок пока нет

- Dobrott vs. David Arciniega Garland Soccer Motion To CompelДокумент29 страницDobrott vs. David Arciniega Garland Soccer Motion To CompelHeather DobrottОценок пока нет

- The Federal Trade Commission Settlement Order With Facebook 7-24-19Документ30 страницThe Federal Trade Commission Settlement Order With Facebook 7-24-19Mike SniderОценок пока нет

- Fernando Flores-Maceda, A205 506 988 (BIA June 15, 2015)Документ6 страницFernando Flores-Maceda, A205 506 988 (BIA June 15, 2015)Immigrant & Refugee Appellate Center, LLCОценок пока нет

- Michael Alan Crooker v. United States Department of Justice, 632 F.2d 916, 1st Cir. (1980)Документ9 страницMichael Alan Crooker v. United States Department of Justice, 632 F.2d 916, 1st Cir. (1980)Scribd Government DocsОценок пока нет

- School Loans Hidden Within ObamacareДокумент4 страницыSchool Loans Hidden Within ObamacareSyndicated NewsОценок пока нет

- Case 2:06-cv-00249-LKK - DAD Document 22 Filed 01/18/07 Page 1 of 10Документ10 страницCase 2:06-cv-00249-LKK - DAD Document 22 Filed 01/18/07 Page 1 of 10peny7Оценок пока нет

- Johnson Et Al v. USA Doc 13 Filed 19 Apr 16Документ7 страницJohnson Et Al v. USA Doc 13 Filed 19 Apr 16scion.scionОценок пока нет

- Durham DocsДокумент6 страницDurham DocsDaniel Chaitin0% (1)

- Reply To The Government's Sentencing MemorandumДокумент7 страницReply To The Government's Sentencing MemorandumfriendsofioaneОценок пока нет

- V HHS Fauci Complaint 02821Документ5 страницV HHS Fauci Complaint 02821Jonathan OffenbergОценок пока нет

- Attorneys For The Petitioner: Fil - EoДокумент8 страницAttorneys For The Petitioner: Fil - Eoscion.scionОценок пока нет

- Supreme Court Eminent Domain Case 09-381 Denied Without OpinionОт EverandSupreme Court Eminent Domain Case 09-381 Denied Without OpinionОценок пока нет

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)От EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)Оценок пока нет

- Guide to Government Grants Writing: Tools for SuccessОт EverandGuide to Government Grants Writing: Tools for SuccessОценок пока нет

- U.S. v. Sun Myung Moon 718 F.2d 1210 (1983)От EverandU.S. v. Sun Myung Moon 718 F.2d 1210 (1983)Оценок пока нет

- Motions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsОт EverandMotions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsРейтинг: 4.5 из 5 звезд4.5/5 (12)

- Meta Multistate ComplaintДокумент233 страницыMeta Multistate ComplaintMike SniderОценок пока нет

- Chick-fil-A Class ActionДокумент40 страницChick-fil-A Class ActionNational Content DeskОценок пока нет

- United States of America v. Joanne Marian SegoviaДокумент13 страницUnited States of America v. Joanne Marian SegoviaOrlando MayorquinОценок пока нет

- Epic vs. Apple ComplaintДокумент65 страницEpic vs. Apple ComplaintMike SniderОценок пока нет

- Burger King Impossible Whopper SuitДокумент15 страницBurger King Impossible Whopper SuitMike SniderОценок пока нет

- Lauren Hughes and Jane Doe vs. Apple, Inc.Документ43 страницыLauren Hughes and Jane Doe vs. Apple, Inc.Mike SniderОценок пока нет

- Jennings vs. City of Childersburg, Ala. ComplaintДокумент22 страницыJennings vs. City of Childersburg, Ala. ComplaintMike SniderОценок пока нет

- Filed Complaint - Crawford V McDonald's USA, LLCДокумент51 страницаFiled Complaint - Crawford V McDonald's USA, LLCMike SniderОценок пока нет

- Concerns From PETA Re: Vehicular Crash in Pennsylvania W AddendumДокумент6 страницConcerns From PETA Re: Vehicular Crash in Pennsylvania W AddendumMike SniderОценок пока нет

- Brad Amos Vs Ramsey SolutionsДокумент35 страницBrad Amos Vs Ramsey SolutionsMike SniderОценок пока нет

- Epic Versus Apple - Apple's CounterclaimДокумент67 страницEpic Versus Apple - Apple's CounterclaimMike WuertheleОценок пока нет

- T-Mobile-Sprint Merger DecisionДокумент173 страницыT-Mobile-Sprint Merger DecisionMike Snider100% (3)

- Motion To Dismiss Order For Case Filed by Rod Wheeler Against Fox News Network Et Al.Документ18 страницMotion To Dismiss Order For Case Filed by Rod Wheeler Against Fox News Network Et Al.Mike SniderОценок пока нет

- P - Microsoft Nintendo of America Sony Interactive Entertainment - List 4Документ7 страницP - Microsoft Nintendo of America Sony Interactive Entertainment - List 4michaelkan1Оценок пока нет

- Sonos District Court ComplaintДокумент96 страницSonos District Court ComplaintMike SniderОценок пока нет

- House Democrats Letter To Sinclair Broadcast Group CEOДокумент6 страницHouse Democrats Letter To Sinclair Broadcast Group CEOMike Snider100% (1)

- The Federal Trade Commission Settlement Order With Facebook 7-24-19Документ30 страницThe Federal Trade Commission Settlement Order With Facebook 7-24-19Mike SniderОценок пока нет

- Apple FaceTime LawsuitДокумент30 страницApple FaceTime LawsuitMike SniderОценок пока нет

- Lazarus, Aberman, Margolis, Brodsky and Childs vs. Apple Inc.Документ20 страницLazarus, Aberman, Margolis, Brodsky and Childs vs. Apple Inc.Mike Snider100% (1)

- Tribune Media V Sinclair / Complaint For DamagesДокумент62 страницыTribune Media V Sinclair / Complaint For DamagesBill RuminskiОценок пока нет

- Motion To Dismiss Order For Suit Filed by Seth Rich's Parents Against Fox News Channel Et Al.Документ20 страницMotion To Dismiss Order For Suit Filed by Seth Rich's Parents Against Fox News Channel Et Al.Mike SniderОценок пока нет

- State Attorneys General Filing in U.S. Court of Appeals Net Neutrality CaseДокумент144 страницыState Attorneys General Filing in U.S. Court of Appeals Net Neutrality CaseMike SniderОценок пока нет

- Complaint Against Xiaolang ZhangДокумент15 страницComplaint Against Xiaolang Zhangjillianiles50% (2)

- FCC Order Repealing Net NeutralityДокумент210 страницFCC Order Repealing Net NeutralityDell Cameron67% (3)

- Sexual Harassment Suit Filed by Three Women Against Charlie Rose, CBS News and Charlie Rose Inc.Документ18 страницSexual Harassment Suit Filed by Three Women Against Charlie Rose, CBS News and Charlie Rose Inc.Mike SniderОценок пока нет

- Fox SuitДокумент33 страницыFox Suitmlcalderone100% (1)

- Stone Brewing Complaint 02-12-18 - ComplaintДокумент25 страницStone Brewing Complaint 02-12-18 - ComplaintMike SniderОценок пока нет

- Knight First Amendment Institute Letter To The White House About TwitterДокумент4 страницыKnight First Amendment Institute Letter To The White House About TwitterMike SniderОценок пока нет

- Reply Comments in Opposition To The Sinclair-Tribune Merger by The Attorneys General of The States of Illinois, Maryland, Massachusetts, and Rhode IslandДокумент8 страницReply Comments in Opposition To The Sinclair-Tribune Merger by The Attorneys General of The States of Illinois, Maryland, Massachusetts, and Rhode IslandMike SniderОценок пока нет

- CEOs Urge President Trump To Remain in Paris AccordДокумент1 страницаCEOs Urge President Trump To Remain in Paris AccordCNET NewsОценок пока нет

- Ignorance of Law or Corrupt Officials in Whatcom CountyДокумент2 страницыIgnorance of Law or Corrupt Officials in Whatcom CountyDeonet Wolfe100% (1)

- THE REPUBLIC vs. KWAME AGYEMANG BUDU AND 11 OTHERS EX PARTE, COUNTY HOSPITAL LTDДокумент21 страницаTHE REPUBLIC vs. KWAME AGYEMANG BUDU AND 11 OTHERS EX PARTE, COUNTY HOSPITAL LTDAbdul-BakiОценок пока нет

- Indian Constitutional Law - The New ChallengesДокумент15 страницIndian Constitutional Law - The New ChallengesshivanisinghОценок пока нет

- 08 ESCORPIZO v. UNIVERSITY OF BAGUIOДокумент6 страниц08 ESCORPIZO v. UNIVERSITY OF BAGUIOMCОценок пока нет

- Reaction Paper Miracle in Cell No 7Документ2 страницыReaction Paper Miracle in Cell No 7Joshua AmistaОценок пока нет

- Insurance Coverage RA 8042 Sec. 37-A As Amended CHECKLISTДокумент1 страницаInsurance Coverage RA 8042 Sec. 37-A As Amended CHECKLISTpiere_54759820Оценок пока нет

- Cameron, Et Al v. Apple - Proposed SettlementДокумент37 страницCameron, Et Al v. Apple - Proposed SettlementMikey CampbellОценок пока нет

- Grice v. Blanco Et Al (INMATE1) - Document No. 9Документ10 страницGrice v. Blanco Et Al (INMATE1) - Document No. 9Justia.comОценок пока нет

- The Geographical Indications of Goods Act ExplainedДокумент42 страницыThe Geographical Indications of Goods Act ExplainedtauriangalОценок пока нет

- TIMTA Annex A Instructional Guide-Feb. 17, 2021Документ7 страницTIMTA Annex A Instructional Guide-Feb. 17, 2021Jeanette LampitocОценок пока нет

- Princípios jurídicos: estrutura e aplicaçãoДокумент45 страницPrincípios jurídicos: estrutura e aplicaçãoElton Frank100% (1)

- Evidence LawДокумент12 страницEvidence LawJin KnoxvilleОценок пока нет

- List of Minimum Annual Leave by Country - WikipediaДокумент29 страницList of Minimum Annual Leave by Country - WikipediaJuan joseОценок пока нет

- Court Reinstates Civil Forfeiture Case Against Bank AccountsДокумент4 страницыCourt Reinstates Civil Forfeiture Case Against Bank AccountsJhon NiloОценок пока нет

- Narendra Modi's Visit To BhutanДокумент7 страницNarendra Modi's Visit To BhutanApoorv SrivastavaОценок пока нет

- Allied Bank (M) SDN BHD V Yau Jiok Hua - (20Документ14 страницAllied Bank (M) SDN BHD V Yau Jiok Hua - (20Huishien QuayОценок пока нет

- Calleon v. HZSC RealtyДокумент1 страницаCalleon v. HZSC RealtyljhОценок пока нет

- Antamoc Goldfields Mining Co. v. CIRДокумент4 страницыAntamoc Goldfields Mining Co. v. CIRJose Edmundo DayotОценок пока нет

- Remedial Law CasesДокумент23 страницыRemedial Law Casesmonica may ramosОценок пока нет

- Qatar TINДокумент6 страницQatar TINphilip.lambert.za8793Оценок пока нет

- Facts:: Ponente: PeraltaДокумент2 страницыFacts:: Ponente: PeraltaErwin BernardinoОценок пока нет

- Creating a World for Your Quest CampaignДокумент20 страницCreating a World for Your Quest CampaignTrowarОценок пока нет

- YseДокумент3 страницыYseHarris VickyОценок пока нет

- Affidavit of EmploymentДокумент2 страницыAffidavit of EmploymentReshiel B. CCОценок пока нет

- Betz: MEGACHURCHES AND PRIVATE INUREMENTДокумент29 страницBetz: MEGACHURCHES AND PRIVATE INUREMENTNew England Law Review100% (1)

- ICJ Rules on Vienna Convention Violations by US in Avena CaseДокумент20 страницICJ Rules on Vienna Convention Violations by US in Avena CasegiezeldaОценок пока нет

- DBP v. Bonita PerezДокумент3 страницыDBP v. Bonita PerezRaphael Emmanuel GarciaОценок пока нет

- Amherst College Flag Burning 2001Документ2 страницыAmherst College Flag Burning 2001Larry KelleyОценок пока нет

- Chapter Seventeen: Website Development and Maintenance Agreements Form 2.17.1 Website Development and Maintenance AgreementДокумент19 страницChapter Seventeen: Website Development and Maintenance Agreements Form 2.17.1 Website Development and Maintenance AgreementRambabu ChowdaryОценок пока нет

- Borlongan, Jr. vs. Peña, 620 SCRA 106, May 05, 2010Документ27 страницBorlongan, Jr. vs. Peña, 620 SCRA 106, May 05, 2010marvin ninoОценок пока нет