Академический Документы

Профессиональный Документы

Культура Документы

Financial Results, Limited Review Report For December 31, 2015 (Result)

Загружено:

Shyam SunderИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Results, Limited Review Report For December 31, 2015 (Result)

Загружено:

Shyam SunderАвторское право:

Доступные форматы

February 11, 2016

The Deputy Manager

Department of Corporate Services

BSE Limited

P. J. Towers, Dalal Street, Fort

Mumbai 400 001

The Company Secretary

The Calcutta Stock Exchange Association Ltd.

7, Lyons Range

Kolkata-700 001

Ref : Scrip Code CSE 26180, BSE - 535514

Sub: Submission of Q-III Results along with Limited Review Report by Statutory Auditors

Respected Sir or Madam,

With reference to the above and in compliance with Regulation 33(3) of SEBI LODR Regulations,

2015, we are enclosing with this letter, Provisional Financial Results (Un-audited) for the 3rd

quarter ended on 31st December 2015 (Q-III) for the financial year ending on 31st March 2016

along with Limited Review Report by Statutory Auditors.

This is for the information of Members.

Thanking You,

Yours Faithfully,

For PRIME CAPITAL MARKET LIMITED

SUSHIL KR. PUROHIT

DIN : 00073684

MANAGING DIRECTOR

Enclosed : a/a

PRIME CAPITAL MARKET LIMITED

Regd. Office : Office No. 18A, BJB Nagar, Bhubaneswar 751014

Administrative Office: P-27 Princep Street, 3rd Floor, Kolkata 700072

CIN- L67120OR1994PLC003649, Email : primecapital.kolkata@gmail.com, Wesbite : www.primecapitalmarket.com

Statement of Standalone Unaudited Financial Results for the Quarter & Nine months ended 31st December, 2015

Rs. in Lacs

Sr.

No.

Particulars

3 Months

ended

31.12.2015

Corresponding

Preceding 3

3 Months

Months ended

ended

30.09.2015

31.12.2014

Un-Audited

Income from Operations

a) Net Sales/Income from Operations

b) Other Operating Income

Total Income from Operations (Net)

Expenses

(a) Cost of Material Consumed

(b) Purchases of Stock-in-trade

(c) Changes in Inventories of Finished Goods, Work-inProgress and Stock-in-Trade

3

4

5

6

7

8

9

112.57

0.13

112.70

Year to date

figures for

current period

ended

31.12.2015

Year to date

figures for the

previous year

ended

31.12.2014

Year to date

figures as on

31.03.2015

Un-Audited

457.54

20.50

478.04

Audited

266.97

4.10

271.07

13.42

13.42

2.88

(1.15)

1.24

3.10

6.07

264.10

1.22

2.80

268.12

1.18

1.30

2.48

304.95

3.64

8.65

364.12

3.53

5.40

8.93

46.88

42.83

42.83

69.10

69.10

(d) Employees Benefit Expenses

(e) Depreciation & Amortization Expenses

(f) Other Expenses

Total Expenses

Profit/(Loss) from Operations before other Income, finance

cost and exceptional Expenses (1-2)

Other Income/(Loss)

106.63

-

2.95

-

10.94

-

113.92

-

33.90

-

Profit/(Loss) from ordinary activities before finance costs

and exceptional items (3+4)

Finance Costs

106.63

-

2.95

-

10.94

-

113.92

-

33.90

-

Profit/(Loss) from ordinary activities after finance cost but

before exceptional items (3+4)

Exceptional Items

106.63

-

2.95

-

10.94

-

113.92

-

33.90

-

106.63

-

2.95

-

10.94

-

113.92

-

33.90

-

106.63

106.63

-

2.95

2.95

-

10.94

10.94

-

113.92

113.92

-

33.90

33.90

-

106.63

1,000.01

2.95

1,000.01

10.94

1,000.01

113.92

1,000.01

33.90

1,000.01

Profit(+)/Loss(-) from ordinary activities before Tax (7-8)

10 Tax Expense

Net Profit (+)/Loss(-) from ordinary activities after tax (911 10)

Lac)

12 Extra Ordinary Items (Net of Tax Expense of Rs.

13 Net Profit (+)/Loss(-) for the period (11-12)

14 Share of Profit/(Loss) of Associates*

15 Minority Interest*

Net Profit (+)/Loss(-) after tax, minority interest and Share

16 of Profit / (Loss) of Associates (13-14-15)

17 Paid-up Equity Share Capital (Face Value of Rs. 10/- each)

Reserves excluding revaluation Reserves as per last Balance

18 Sheet

4.68

8.81

13.49

55.61

55.61

55.61

55.61

10.42

45.19

45.19

-

45.19

1,000.01

Earnings Per Share (before extra-ordinary items) of Rs. 10/19 each (not annualized)

(i) a) Basic

b) Diluted

328.51

1.07

1.07

0.03

0.03

0.11

0.11

1.14

1.14

0.34

0.34

0.45

0.45

Earnings Per Share (after extra-ordinary items) of Rs. 10/19 each (not annualized)

(ii) a) Basic

b) Diluted

1.07

1.07

0.03

0.03

0.11

0.11

1.14

1.14

0.34

0.34

0.45

0.45

Notes :

1.

2.

3.

4.

Segmental Report as per AS-17 is not applicable for the current Quarter.

Above results were reviewed by Audit Committee taken on record in Board Meeting held on 11th February, 2016.

Provision for taxation will be made at the end of the Year.

The Auditors of the Company have carried out "Limited Review" of the above financial Results.

Place : Kolkata

Date : 11th February, 2016

For Prime Capital Market Limited

Sd/Sushil Kr. Purohit

Managing Director

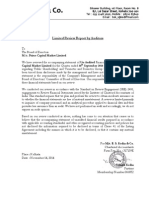

B. S. Kedia & Co.

Chartered Accountants

Limited Review Report by Auditors

To

The Board of Directors

M/s. Prime Capital Market Limited

We have reviewed the accompanying statement of Un-Audited Financial Results of M/s. Prime

Capital Market Limited for the Quarter ended 31st December 2015 except for the disclosures

regarding Public Shareholding and Promoter and Promoter Group Shareholding which have

been traced from disclosures made by the management and have not been audited by us. This

statement is the responsibility of the Companys Management and has been approved by the

Board of Directors/ Committee of Board of Directors. Our responsibility is to issue a report on

these financial statements based on our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2400,

engagements to Review Financial Statements issued by the Institute of Chartered Accountants of

India. This standard requires that we plan and perform the review to obtain moderate assurance as

to whether the financial statements are free of material misstatement. A review is limited primarily

to inquiries of company personnel and an analytical procedure applied to financial data and thus

provides less assurance than an audit. We have not performed an audit and accordingly, we do not

express an audit opinion.

Based on our review conducted as above, nothing has come to our attention that causes us to

believe that the accompanying statement of unaudited financial results prepared in accordance

with applicable accounting standards1 and other recognized accounting practices and policies has

not disclosed the information required to be disclosed in terms of Clause 41 of the Listing

Agreement including the manner in which it is to be disclosed, or that it contains any material

misstatement.

For M/s. B. S. Kedia & Co.

Chartered Accountants

Firm Reg. No. : 317159E

Place : Kolkata

Date : February 11, 2016

Vikash Kedia

Partner

Membership Number 066852

Вам также может понравиться

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ7 страницFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Документ4 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ7 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Документ3 страницыFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Документ6 страницStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Документ5 страницAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- PDF Processed With Cutepdf Evaluation EditionДокумент3 страницыPDF Processed With Cutepdf Evaluation EditionShyam SunderОценок пока нет

- Standalone Financial Results For September 30, 2016 (Result)Документ3 страницыStandalone Financial Results For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For March 31, 2016 (Result)Документ11 страницStandalone Financial Results For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Transcript of The Investors / Analysts Con Call (Company Update)Документ15 страницTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderОценок пока нет

- Investor Presentation For December 31, 2016 (Company Update)Документ27 страницInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Front Page of JoonixДокумент78 страницFront Page of JoonixJyoti YadavОценок пока нет

- Bai Tap 1Документ2 страницыBai Tap 1Đinh Đào Tặc100% (1)

- Who Is An Entrepreneur. Timothy MaheaДокумент21 страницаWho Is An Entrepreneur. Timothy MaheaMaheaОценок пока нет

- Hands-On Exercise No. 1 Batch-07 E-Commerce Management Total Marks: 10 Due Date: 25/06/2020Документ3 страницыHands-On Exercise No. 1 Batch-07 E-Commerce Management Total Marks: 10 Due Date: 25/06/2020mc180401877Оценок пока нет

- JD Evalueserve FS FS08 Equity Strategy RARBAДокумент2 страницыJD Evalueserve FS FS08 Equity Strategy RARBArahulОценок пока нет

- Group 7: Managing Risk and Reward in The Entrepreneurial VentureДокумент2 страницыGroup 7: Managing Risk and Reward in The Entrepreneurial VentureCONCORDIA RAFAEL IVANОценок пока нет

- Model Exit Exam - Fundamentals of Accounting IДокумент9 страницModel Exit Exam - Fundamentals of Accounting Inatnael0224Оценок пока нет

- 31 - Vinoya Vs NLRCДокумент8 страниц31 - Vinoya Vs NLRCArthur YamatОценок пока нет

- Format of Feasibility StudyДокумент10 страницFormat of Feasibility StudyHanna RiveraОценок пока нет

- AccountДокумент47 страницAccountAshwani KumarОценок пока нет

- Certification Body Requirements: Section 7Документ20 страницCertification Body Requirements: Section 7Nagasimha A RОценок пока нет

- CH 5 AnnaДокумент6 страницCH 5 Annamatt.yu666Оценок пока нет

- MJ Ebook Brand Storytelling GuideДокумент17 страницMJ Ebook Brand Storytelling GuideRuicheng ZhangОценок пока нет

- Chapter 8 and 9Документ3 страницыChapter 8 and 9Ajith GeorgeОценок пока нет

- Justifying WMSДокумент31 страницаJustifying WMSBunty Da100% (1)

- May 20 MTPДокумент8 страницMay 20 MTP7677 Sai PawarОценок пока нет

- Sales Quotation: Salesman Sign: Customer SignДокумент1 страницаSales Quotation: Salesman Sign: Customer SignjacobОценок пока нет

- Tendernotice 1Документ12 страницTendernotice 1Aaab NaaabОценок пока нет

- Crystal Rumbaugh: Career OverviewДокумент3 страницыCrystal Rumbaugh: Career Overviewapi-508568745Оценок пока нет

- Ferrell 12e PPT Ch02 RevДокумент39 страницFerrell 12e PPT Ch02 RevmichaelОценок пока нет

- Term Paper Financial Management On: Submitted To Submitted by L.S.BДокумент34 страницыTerm Paper Financial Management On: Submitted To Submitted by L.S.BavinoorharishОценок пока нет

- Basic Concepts in Business Policy and StrategyДокумент3 страницыBasic Concepts in Business Policy and Strategylance100% (1)

- KPMG China Pharmaceutical 201106Документ62 страницыKPMG China Pharmaceutical 201106merc2Оценок пока нет

- Ch3 IASC Conceptual Framework 2Документ30 страницCh3 IASC Conceptual Framework 2Ramchundar Karuna100% (1)

- Business Finance 2.2: Financial Ratios: Lecture NotesДокумент16 страницBusiness Finance 2.2: Financial Ratios: Lecture NotesElisabeth HenangerОценок пока нет

- Logistics Project ReportДокумент64 страницыLogistics Project Reportletter2lalОценок пока нет

- Cma p1 Mock Exam 2 A4-2Документ34 страницыCma p1 Mock Exam 2 A4-2july jees33% (3)

- Pengaruh Threat Emotions, Kepercayaan Merek Dan Harga Terhadap Keputusan Pembelian Produk Susu Anlene ActifitДокумент10 страницPengaruh Threat Emotions, Kepercayaan Merek Dan Harga Terhadap Keputusan Pembelian Produk Susu Anlene ActifitDiwan HYОценок пока нет

- ICMO 2024 Form ConstructionДокумент2 страницыICMO 2024 Form Constructionjonathankarta.hdkОценок пока нет

- A Project On Store Operation of Big BazaarДокумент25 страницA Project On Store Operation of Big BazaarSalman AghaОценок пока нет