Академический Документы

Профессиональный Документы

Культура Документы

Charles C. Harbin and Patricia A. Harbin v. Assurance Company of America, A Corporation, 308 F.2d 748, 10th Cir. (1962)

Загружено:

Scribd Government DocsОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Charles C. Harbin and Patricia A. Harbin v. Assurance Company of America, A Corporation, 308 F.2d 748, 10th Cir. (1962)

Загружено:

Scribd Government DocsАвторское право:

Доступные форматы

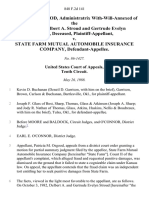

308 F.

2d 748

Charles C. HARBIN and Patricia A. Harbin, Appellants,

v.

ASSURANCE COMPANY OF AMERICA, a corporation,

Appellee.

No. 6988.

United States Court of Appeals Tenth Circuit.

Aug. 30, 1962.

Charles C. Spann, Albuquerque, N.M. (Grantham, spann & Sanchez,

Albuquerque, N.M., on the brief), for appellants.

John D. Robb, Albuquerque, N.M. (Rodey, Dickason, Sloan, Akin &

Robb, Albuquerque, N.M., on the brief), for appellee.

Before MURRAH, Chief Judge, and PHILLIPS and BREITENSTEIN,

Circuit judges.

BREITENSTEIN, Circuit Judge.

In this declaratory judgment action brought by appellee Assurance Company of

America (insurer) the question is whether the insurer is obligated to defend an

action brought against appellants (insureds) to recover damages for an assault.

The trial court held for the insurer on the ground that the policy afforded no

coverage. This appeal followed. Jurisdiction is based on diversity.

Insurer issued to insureds a policy providing personal liability coverage

whereby the insurer agreed to pay 'all sums which the insured shall become

legally obligated to pay as damages because of bodily injury * * * sustained by

any person.' The policy required the insurer to 'defend any suit against the

insured alleging such injury * * * and seeking damages on account thereof,

even if such suit is groundless, false or fraudulent; but this company may make

such investigation, negotiation and settlement of any claim or suit as it deems

expedient.' Specifically excluded from policy coverage was 'injury * * * caused

intentionally by or at the direction of the insured.'

Wiley Day, as plaintiff, filed suit in a New Mexico state court alleging that

Charles C. Harbin, one of the insureds, 'did wilfully, maliciously and

wrongfully assault, strike and beat Plaintiff with great force and violence,' and

seeking both compensatory and exemplary damages. Insurer then brought this

action in federal court for a declaratory judgment that the Day claim was

beyond the policy coverage. Thereafter in the state action a third-party

complaint was filed by the insureds against the insurer asserting policy

coverage. Day, on motion of the insureds, was joined as a defendant in the

federal case and, in that case, the insureds asserted by counterclaim the liability

of the insurer. The trial court granted insurer's motion for summary judgment.

The insurer says that it is not required to defend the state suit because the

complaint therein alleges an intentional injury. The insureds assert that the

obligation to defend is not determined by the allegations of the complaint, that

the insurer was under a duty to investigate, and that if it had investigated it

would have found that the conduct was not intentional.

The type of situation presented here places an insurer in a dilemma of

conflicting interests. It cannot possibly defend the state court action and protect

both its own interests and the interests of its insureds.1 If it tries to exculpate

itself by showing an intentional injury, it exposes the insured to a greater

liability and a possible award of exemplary damages. If it urges an

unintentional injury, it foregoes the exclusionary provision of the policy. In

such circumstances the control of the defense by the insurer carries with it the

potential of prejudice to the insureds and the assumption of such control

without a reservation of the right to deny liability would have obligated this

insurer to pay within the policy limits if the plaintiff should succeed.2

The insureds say that this circuit has adopted the rule that the obligation of an

insurer to defend is determined by the actual facts brought to the attention of

the insurer rather than the pertinent allegations of a complaint and they cite

Hardware Mut. Casualty Co. v. Hilderbrandt, 10 Cir., 119 F.2d 291; American

Motorists Insurance Company v. Southwestern Greyhound Lines, Inc., 10 Cir.,

283 F.2d 648; and Albuquerque Gravel Products Company v. American

Employers Insurance Company, 10 Cir., 282 F.2d 218. These cases are not

controlling because in each the action sought to impose liability on the insurer

after the facts had been established and in two of them the established facts

were contrary to the complaint allegations. In the case at bar we meet the

question on the threshold before the facts are established.

The insurer's liability depends on whether the injury was caused intentionally

by the insured. The difficulty in the ascertainment of a state of mind needs no

amplification. Reasonable men may understandingly differ as to the intent of

another because they may draw conflicting inferences from physical facts. For

this reason the argument that the insurer should have conducted an

investigation and relied on the results thereof does not persuade us. Intent is to

be determined, not by the insurer's investigators, but by the finder of the facts in

the lawsuit brought by the claimant of the injuries.

8

The rights of the parties are fixed by the terms of the policy. 3 The policy

required the insurer to defend a suit 'alleging' an injury for which the policy

permits recovery. The record before us shows that in the state court action

judgment is sought for injuries resulting from an intentional assault. The policy

imposes no liability on the insurer for such injuries.

Additionally, the court should not force the insurer into the conflict of interests

position which will result if defense of the state action is required. The ultimate

question of the insurer's liability is not now before us as it was in Tenth Circuit

cases on which the insureds rely. If it should be determined that the injuries for

which the plaintiff seeks recovery in the state action were covered by the policy

and not within its exclusionary provisions, the insurer is liable to the insureds

under the policy.

10

That portion of the judgment below declaring that the policy does not cover 'the

matters alleged in the Complaint' in the state action is subject to the

interpretation that in no event is the insurer liable because of the claim there

asserted. This ignores the possibility that the claim may ultimately be

established to be within policy coverage. While at the moment we cannot

conceive of an unintentinal assault, the possibility remains that a judgment may

ultimately be entered in the state action imposing liability on the basis of

unintentional conduct of the insured. Under the Federal Rules of Civil

Procedure the dimensions of a lawsuit are not determined by the pleadings4

because the pleadings are not a rigid and unchangeable blueprint of the rights of

the parties.5 The Rules of Civil Procedure for the District Courts of New

Mexico6 are derived from the Federal Rules and in all respects pertinent hereto

are identical with the Federal Rules. The decisions in Johnson v. Citizens

Casualty Company of New York, 63 N.M. 460, 321 P.2d 640, 643, and State ex

rel. Gary v. Fireman's Fund Indemnity Company, 67 N.M. 360, 355 P.2d 291,

295, convince us that the functions of the pleadings in New Mexico are the

same as under the federal system, that the pleadings are not determinative of the

issues, and that recovery may be had on grounds not asserted in the complaint.

The possibility that recovery in the state court action may be within the policy

coverage cannot be ignored.

11

Accordingly, paragraph 2 of the judgment of the court below is modified so as

to declare that the plaintiff insurer is not obligated at this time to defend action

No. 87242 in the District Court of Bernalillo County, New Mexico, brought by

Wiley Day against Charles C. Harbin, and to declare that the judgment entered

herein is not determinative of the question of insurer's liability under the policy

in the event the facts as established are that the injuries asserted by Day come

within policy coverage.

12

As so modified the judgment is affirmed. No costs are allowed to either party.

Cf. Farm Bureau Mut. Automobile Ins. Co. v. Hammer, 4 Cir., 177 F.2d 793,

801, certiorari denied, Beverage v. Farm Bureau Mut. Ins. Co., 339 U.S. 914,

70 S.Ct. 575, 94 L.Ed. 1339; Stout v. Grain Dealers Mutual Insurance

Company, D.C.N.Car., 201 F.Supp. 647, 649

General Tire Co. of Minneapolis v. Standard Acc. Ins. Co., 8 Cir., 65 F.2d 237,

240; Claverie v. American Casualty Co. of Reading, Pa., 4 Cir., 76 F.2d 570,

572, certiorari denied, 296 U.S. 590, 56 S.Ct. 102, 80 L.Ed. 417; and

annotations in 81 A.L.R. 1326 and 38 A.L.R.2d 1148

Albuquerque Gravel Products Company v. American Employers Insurance

Company, supra, 282 F.2d p. 220

In Hickman v. Taylor, 329 U.S. 495, 501, 67 S.Ct. 385, 91 L.Ed. 451, it was

said that: 'The various instruments of discovery now serve * * * as a device,

along with the pre-trial hearing under Rule 16, to narrow and clarify the basic

issues between the parties, * * *.'

Blazer v. Black, 10 Cir., 196 F.2d 139, 144, points out that: '* * * the only

permissible pleading is a short and plain statement of the claim showing that

the pleader is entitled to relief on any legally sustainable grounds.'

See N.M.Stat.1953 21-1-1(1) et seq

Вам также может понравиться

- Burnham Shoes, Inc. v. West American Insurance Company and American Fire and Casualty Company, 813 F.2d 328, 11th Cir. (1987)Документ8 страницBurnham Shoes, Inc. v. West American Insurance Company and American Fire and Casualty Company, 813 F.2d 328, 11th Cir. (1987)Scribd Government DocsОценок пока нет

- Southwestern Investment Company, A Corporation v. Cactus Motor Company, Inc., A Corporation, and Parker Cullom, 355 F.2d 674, 10th Cir. (1966)Документ5 страницSouthwestern Investment Company, A Corporation v. Cactus Motor Company, Inc., A Corporation, and Parker Cullom, 355 F.2d 674, 10th Cir. (1966)Scribd Government DocsОценок пока нет

- United States Court of Appeals, Third CircuitДокумент11 страницUnited States Court of Appeals, Third CircuitScribd Government DocsОценок пока нет

- United States Court of Appeals For The Eighth CircuitДокумент8 страницUnited States Court of Appeals For The Eighth CircuitScribd Government DocsОценок пока нет

- United States Court of Appeals, Eleventh CircuitДокумент6 страницUnited States Court of Appeals, Eleventh CircuitScribd Government DocsОценок пока нет

- Thomas E. Moore, Trustee in Bankruptcy For Charley Delcoure, A Bankrupt v. United States Fidelity & Guaranty Company, A Corporation, 325 F.2d 972, 10th Cir. (1963)Документ4 страницыThomas E. Moore, Trustee in Bankruptcy For Charley Delcoure, A Bankrupt v. United States Fidelity & Guaranty Company, A Corporation, 325 F.2d 972, 10th Cir. (1963)Scribd Government DocsОценок пока нет

- Elmer E. Haury and Hazel Kelly v. Allstate Insurance Company, 384 F.2d 32, 10th Cir. (1967)Документ4 страницыElmer E. Haury and Hazel Kelly v. Allstate Insurance Company, 384 F.2d 32, 10th Cir. (1967)Scribd Government DocsОценок пока нет

- Janet S. Scivally, Plaintiff-Appellant/cross-Appellee v. Time Insurance Company, Defendant-Appellee/cross-Appellant, 724 F.2d 101, 10th Cir. (1983)Документ5 страницJanet S. Scivally, Plaintiff-Appellant/cross-Appellee v. Time Insurance Company, Defendant-Appellee/cross-Appellant, 724 F.2d 101, 10th Cir. (1983)Scribd Government DocsОценок пока нет

- American Paint Service, Inc., a Corporation of the State of New Jersey v. The Home Insurance Company of New York, a Foreign Corporation Authorized to Do Business in New Jersey, 246 F.2d 91, 3rd Cir. (1957)Документ5 страницAmerican Paint Service, Inc., a Corporation of the State of New Jersey v. The Home Insurance Company of New York, a Foreign Corporation Authorized to Do Business in New Jersey, 246 F.2d 91, 3rd Cir. (1957)Scribd Government DocsОценок пока нет

- United States v. John A. Lattauzio, Janet M. Lattauzio, Theodore M. Bennett and Carol Ann Bennett, 748 F.2d 559, 10th Cir. (1984)Документ5 страницUnited States v. John A. Lattauzio, Janet M. Lattauzio, Theodore M. Bennett and Carol Ann Bennett, 748 F.2d 559, 10th Cir. (1984)Scribd Government DocsОценок пока нет

- Hilario Sierra v. Merchants Mutual Casualty Company, Intervenor, 262 F.2d 287, 1st Cir. (1958)Документ2 страницыHilario Sierra v. Merchants Mutual Casualty Company, Intervenor, 262 F.2d 287, 1st Cir. (1958)Scribd Government DocsОценок пока нет

- Fireman's Insurance Company of Newark, New Jersey v. Raymond Dufresne, 676 F.2d 965, 3rd Cir. (1982)Документ6 страницFireman's Insurance Company of Newark, New Jersey v. Raymond Dufresne, 676 F.2d 965, 3rd Cir. (1982)Scribd Government DocsОценок пока нет

- United States Court of Appeals, Tenth CircuitДокумент7 страницUnited States Court of Appeals, Tenth CircuitScribd Government DocsОценок пока нет

- United States Court of Appeals Third CircuitДокумент9 страницUnited States Court of Appeals Third CircuitScribd Government DocsОценок пока нет

- Edmond R. Glenn and William Burman v. State Farm Mutual Automobile Insurance Company, A Corporation, 341 F.2d 5, 10th Cir. (1965)Документ5 страницEdmond R. Glenn and William Burman v. State Farm Mutual Automobile Insurance Company, A Corporation, 341 F.2d 5, 10th Cir. (1965)Scribd Government DocsОценок пока нет

- Marion J. Brown and Allen Brown v. United States Fidelity and Guaranty Company, 314 F.2d 675, 2d Cir. (1963)Документ10 страницMarion J. Brown and Allen Brown v. United States Fidelity and Guaranty Company, 314 F.2d 675, 2d Cir. (1963)Scribd Government DocsОценок пока нет

- Higinio Aponte v. American Surety Company of New York, Etc., 276 F.2d 678, 1st Cir. (1960)Документ4 страницыHiginio Aponte v. American Surety Company of New York, Etc., 276 F.2d 678, 1st Cir. (1960)Scribd Government DocsОценок пока нет

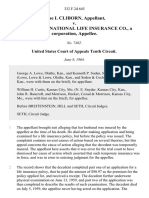

- Elise I. Cliborn v. The Lincoln National Life Insurance Co., A Corporation, 332 F.2d 645, 10th Cir. (1964)Документ4 страницыElise I. Cliborn v. The Lincoln National Life Insurance Co., A Corporation, 332 F.2d 645, 10th Cir. (1964)Scribd Government DocsОценок пока нет

- Public Service Company of Oklahoma, A Domestic Corporation v. Black & Veatch, Consulting Engineers, A Partnership, 467 F.2d 1143, 10th Cir. (1972)Документ4 страницыPublic Service Company of Oklahoma, A Domestic Corporation v. Black & Veatch, Consulting Engineers, A Partnership, 467 F.2d 1143, 10th Cir. (1972)Scribd Government DocsОценок пока нет

- E. A. Adriaenssens v. Allstate Insurance Company, Marie Epperson v. Allstate Insurance Company, 258 F.2d 888, 10th Cir. (1958)Документ5 страницE. A. Adriaenssens v. Allstate Insurance Company, Marie Epperson v. Allstate Insurance Company, 258 F.2d 888, 10th Cir. (1958)Scribd Government DocsОценок пока нет

- Rosaly Jean Sheppard v. Allstate Insurance Company, 21 F.3d 1010, 10th Cir. (1994)Документ9 страницRosaly Jean Sheppard v. Allstate Insurance Company, 21 F.3d 1010, 10th Cir. (1994)Scribd Government DocsОценок пока нет

- 76 Fair Empl - Prac.cas. (Bna) 373, 73 Empl. Prac. Dec. P 45,276 Conway Chevrolet-Buick, Inc. v. Travelers Indemnity Company, 136 F.3d 210, 1st Cir. (1998)Документ8 страниц76 Fair Empl - Prac.cas. (Bna) 373, 73 Empl. Prac. Dec. P 45,276 Conway Chevrolet-Buick, Inc. v. Travelers Indemnity Company, 136 F.3d 210, 1st Cir. (1998)Scribd Government DocsОценок пока нет

- Donald McGettrick v. Fidelity & Casualty Company of New York, 264 F.2d 883, 2d Cir. (1959)Документ7 страницDonald McGettrick v. Fidelity & Casualty Company of New York, 264 F.2d 883, 2d Cir. (1959)Scribd Government DocsОценок пока нет

- Robert P. O'Brien v. Government Employees Insurance Company, 372 F.2d 335, 3rd Cir. (1967)Документ10 страницRobert P. O'Brien v. Government Employees Insurance Company, 372 F.2d 335, 3rd Cir. (1967)Scribd Government DocsОценок пока нет

- United States Fidelity and Guaranty Company, A Maryland Corporation v. Henry H. Lembke, JR., 328 F.2d 569, 10th Cir. (1964)Документ5 страницUnited States Fidelity and Guaranty Company, A Maryland Corporation v. Henry H. Lembke, JR., 328 F.2d 569, 10th Cir. (1964)Scribd Government DocsОценок пока нет

- UnpublishedДокумент23 страницыUnpublishedScribd Government DocsОценок пока нет

- State Farm Mutual Automobile Insurance Company, A Mutual Insurance Company v. Fred Petsch, Irvin Petsch, Fred Petsch and Irvin Petsch, D/B/A Fred Petsch and Son, 261 F.2d 331, 10th Cir. (1958)Документ6 страницState Farm Mutual Automobile Insurance Company, A Mutual Insurance Company v. Fred Petsch, Irvin Petsch, Fred Petsch and Irvin Petsch, D/B/A Fred Petsch and Son, 261 F.2d 331, 10th Cir. (1958)Scribd Government DocsОценок пока нет

- Continental Casualty Company v. P.D.C., Inc., Donald Craig Olsen, 931 F.2d 1429, 10th Cir. (1991)Документ4 страницыContinental Casualty Company v. P.D.C., Inc., Donald Craig Olsen, 931 F.2d 1429, 10th Cir. (1991)Scribd Government DocsОценок пока нет

- Nancy Bailey O'Neal v. Planet Insurance Company and United Pacific Insurance Company, Defendant, 848 F.2d 185, 4th Cir. (1988)Документ6 страницNancy Bailey O'Neal v. Planet Insurance Company and United Pacific Insurance Company, Defendant, 848 F.2d 185, 4th Cir. (1988)Scribd Government DocsОценок пока нет

- Connecticut Mutual Life Insurance Company v. Marilyn M. Wyman, 718 F.2d 63, 3rd Cir. (1983)Документ7 страницConnecticut Mutual Life Insurance Company v. Marilyn M. Wyman, 718 F.2d 63, 3rd Cir. (1983)Scribd Government DocsОценок пока нет

- Runde v. Manufacturers Casualty Ins. Co, 178 F.2d 130, 2d Cir. (1949)Документ4 страницыRunde v. Manufacturers Casualty Ins. Co, 178 F.2d 130, 2d Cir. (1949)Scribd Government DocsОценок пока нет

- United States Court of Appeals Tenth CircuitДокумент6 страницUnited States Court of Appeals Tenth CircuitScribd Government DocsОценок пока нет

- American Fidelity & Casualty Co., Inc. v. All American Bus Lines, Inc, 179 F.2d 7, 10th Cir. (1950)Документ5 страницAmerican Fidelity & Casualty Co., Inc. v. All American Bus Lines, Inc, 179 F.2d 7, 10th Cir. (1950)Scribd Government DocsОценок пока нет

- Oklahoma Natural Gas Company, A Corporation v. Mid-Continent Casualty Company, A Corporation (Formerly General Bonding and Insurance Company), 268 F.2d 508, 10th Cir. (1959)Документ5 страницOklahoma Natural Gas Company, A Corporation v. Mid-Continent Casualty Company, A Corporation (Formerly General Bonding and Insurance Company), 268 F.2d 508, 10th Cir. (1959)Scribd Government DocsОценок пока нет

- (A. Subject Matter) United Merchants Corporation vs. Country Bankers Insurance Corporation, 676 SCRA 382, G.R. No. 198588 July 11, 2012Документ16 страниц(A. Subject Matter) United Merchants Corporation vs. Country Bankers Insurance Corporation, 676 SCRA 382, G.R. No. 198588 July 11, 2012Alexiss Mace JuradoОценок пока нет

- United States Court of Appeals Tenth CircuitДокумент5 страницUnited States Court of Appeals Tenth CircuitScribd Government DocsОценок пока нет

- George H. Clement v. Prudential Property & Casualty Insurance Company, 790 F.2d 1545, 11th Cir. (1986)Документ7 страницGeorge H. Clement v. Prudential Property & Casualty Insurance Company, 790 F.2d 1545, 11th Cir. (1986)Scribd Government DocsОценок пока нет

- Velasco v. ApostolДокумент6 страницVelasco v. ApostoltrebororОценок пока нет

- United States Court of Appeals, Eleventh CircuitДокумент6 страницUnited States Court of Appeals, Eleventh CircuitScribd Government DocsОценок пока нет

- Farmers Alliance Mutual Insurance Company v. Alan Jones and Craig Lee McCracken, 570 F.2d 1384, 10th Cir. (1978)Документ7 страницFarmers Alliance Mutual Insurance Company v. Alan Jones and Craig Lee McCracken, 570 F.2d 1384, 10th Cir. (1978)Scribd Government DocsОценок пока нет

- Farmers Alliance Mutual Insurance Company v. Mary Bakke, Johnny Bakke, Jo Lynn Wood, Karla Vigil and Lawrence Vigil, 619 F.2d 885, 10th Cir. (1980)Документ10 страницFarmers Alliance Mutual Insurance Company v. Mary Bakke, Johnny Bakke, Jo Lynn Wood, Karla Vigil and Lawrence Vigil, 619 F.2d 885, 10th Cir. (1980)Scribd Government DocsОценок пока нет

- Safeco Insurance Company of America v. Marcia Wetherill, 622 F.2d 685, 3rd Cir. (1980)Документ11 страницSafeco Insurance Company of America v. Marcia Wetherill, 622 F.2d 685, 3rd Cir. (1980)Scribd Government DocsОценок пока нет

- Guardian Life Insurance v. Muniz, 101 F.3d 93, 11th Cir. (1996)Документ3 страницыGuardian Life Insurance v. Muniz, 101 F.3d 93, 11th Cir. (1996)Scribd Government DocsОценок пока нет

- Louis T. Gedeon v. State Farm Mutual Automobile Insurance Company, 342 F.2d 15, 3rd Cir. (1965)Документ4 страницыLouis T. Gedeon v. State Farm Mutual Automobile Insurance Company, 342 F.2d 15, 3rd Cir. (1965)Scribd Government DocsОценок пока нет

- United States Court of Appeals, Fifth CircuitДокумент6 страницUnited States Court of Appeals, Fifth CircuitScribd Government DocsОценок пока нет

- The Travelers Insurance Company v. Elizabeth M. Summers, 696 F.2d 1311, 11th Cir. (1983)Документ7 страницThe Travelers Insurance Company v. Elizabeth M. Summers, 696 F.2d 1311, 11th Cir. (1983)Scribd Government DocsОценок пока нет

- Linda Gilchrist v. State Farm Mutual, 390 F.3d 1327, 11th Cir. (2004)Документ12 страницLinda Gilchrist v. State Farm Mutual, 390 F.3d 1327, 11th Cir. (2004)Scribd Government DocsОценок пока нет

- Brooklyn Law School v. The Aetna Casualty and Surety Company and Aetna Life & Casualty, Defendants, 849 F.2d 788, 2d Cir. (1988)Документ4 страницыBrooklyn Law School v. The Aetna Casualty and Surety Company and Aetna Life & Casualty, Defendants, 849 F.2d 788, 2d Cir. (1988)Scribd Government DocsОценок пока нет

- The Insurance Company of The State of Pennsylvania v. Joe L. Smith and Amy Jane Smith, D/B/A Smith Mercantile Company, and Guarantee Insurance Company, 435 F.2d 1029, 10th Cir. (1971)Документ5 страницThe Insurance Company of The State of Pennsylvania v. Joe L. Smith and Amy Jane Smith, D/B/A Smith Mercantile Company, and Guarantee Insurance Company, 435 F.2d 1029, 10th Cir. (1971)Scribd Government DocsОценок пока нет

- Nationwide Mutual Insurance Company, a Corporation v. Fidelity & Casualty Company of New York, a Corporation, and United States Fidelity and Guaranty Company, a Corporation, 286 F.2d 91, 3rd Cir. (1961)Документ3 страницыNationwide Mutual Insurance Company, a Corporation v. Fidelity & Casualty Company of New York, a Corporation, and United States Fidelity and Guaranty Company, a Corporation, 286 F.2d 91, 3rd Cir. (1961)Scribd Government DocsОценок пока нет

- Manufacturers Casualty Insurance Company v. Odell Coker, As Administrator of The Estate of Willie Anderson Lemon, Deceased, 219 F.2d 631, 4th Cir. (1955)Документ5 страницManufacturers Casualty Insurance Company v. Odell Coker, As Administrator of The Estate of Willie Anderson Lemon, Deceased, 219 F.2d 631, 4th Cir. (1955)Scribd Government DocsОценок пока нет

- Annie Wiggins v. North American Equitable Life Assurance Company, 644 F.2d 1014, 4th Cir. (1981)Документ5 страницAnnie Wiggins v. North American Equitable Life Assurance Company, 644 F.2d 1014, 4th Cir. (1981)Scribd Government DocsОценок пока нет

- United States Court of Appeals, Fourth CircuitДокумент6 страницUnited States Court of Appeals, Fourth CircuitScribd Government DocsОценок пока нет

- American Home Assurance Company, Petitioner, vs. Antonio CHUA, RespondentДокумент20 страницAmerican Home Assurance Company, Petitioner, vs. Antonio CHUA, RespondentMaan ManagaytayОценок пока нет

- American Home Assurance Company v. Glenn Estess & Associates, Inc., D/B/A Sales Consultants of Birmingham, 763 F.2d 1237, 11th Cir. (1985)Документ6 страницAmerican Home Assurance Company v. Glenn Estess & Associates, Inc., D/B/A Sales Consultants of Birmingham, 763 F.2d 1237, 11th Cir. (1985)Scribd Government DocsОценок пока нет

- Atlantic & Pacific Insurance Company, a Colorado Insurance Corporation and Hollis H. Marshall v. Combined Insurance Company of America, an Illinois Insurance Corporation, 312 F.2d 513, 10th Cir. (1962)Документ4 страницыAtlantic & Pacific Insurance Company, a Colorado Insurance Corporation and Hollis H. Marshall v. Combined Insurance Company of America, an Illinois Insurance Corporation, 312 F.2d 513, 10th Cir. (1962)Scribd Government DocsОценок пока нет

- Filed: Patrick FisherДокумент20 страницFiled: Patrick FisherScribd Government DocsОценок пока нет

- Lawrence A. Clouse and Employers Mutual Liability Insurance Company of Wisconsin v. American Mutual Liability Insurance Company, 344 F.2d 18, 4th Cir. (1965)Документ8 страницLawrence A. Clouse and Employers Mutual Liability Insurance Company of Wisconsin v. American Mutual Liability Insurance Company, 344 F.2d 18, 4th Cir. (1965)Scribd Government DocsОценок пока нет

- Myers, Kevin v. State Farm Insurance Company, 842 F.2d 705, 3rd Cir. (1988)Документ8 страницMyers, Kevin v. State Farm Insurance Company, 842 F.2d 705, 3rd Cir. (1988)Scribd Government DocsОценок пока нет

- United States v. Garcia-Damian, 10th Cir. (2017)Документ9 страницUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- United States v. Kieffer, 10th Cir. (2017)Документ20 страницUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Payn v. Kelley, 10th Cir. (2017)Документ8 страницPayn v. Kelley, 10th Cir. (2017)Scribd Government Docs50% (2)

- Wilson v. Dowling, 10th Cir. (2017)Документ5 страницWilson v. Dowling, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Документ100 страницHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Olden, 10th Cir. (2017)Документ4 страницыUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Coyle v. Jackson, 10th Cir. (2017)Документ7 страницCoyle v. Jackson, 10th Cir. (2017)Scribd Government Docs100% (1)

- Brown v. Shoe, 10th Cir. (2017)Документ6 страницBrown v. Shoe, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Документ21 страницаCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Greene v. Tennessee Board, 10th Cir. (2017)Документ2 страницыGreene v. Tennessee Board, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Документ22 страницыConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Apodaca v. Raemisch, 10th Cir. (2017)Документ15 страницApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Kearn, 10th Cir. (2017)Документ25 страницUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Roberson, 10th Cir. (2017)Документ50 страницUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Pecha v. Lake, 10th Cir. (2017)Документ25 страницPecha v. Lake, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Magnan, 10th Cir. (2017)Документ27 страницUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Publish United States Court of Appeals For The Tenth CircuitДокумент10 страницPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsОценок пока нет

- Publish United States Court of Appeals For The Tenth CircuitДокумент24 страницыPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsОценок пока нет

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Документ9 страницNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Voog, 10th Cir. (2017)Документ5 страницUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Webb v. Allbaugh, 10th Cir. (2017)Документ18 страницWebb v. Allbaugh, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Publish United States Court of Appeals For The Tenth CircuitДокумент14 страницPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- United States v. Windom, 10th Cir. (2017)Документ25 страницUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Henderson, 10th Cir. (2017)Документ2 страницыUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Northglenn Gunther Toody's v. HQ8-10410-10450, 10th Cir. (2017)Документ10 страницNorthglenn Gunther Toody's v. HQ8-10410-10450, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Kundo, 10th Cir. (2017)Документ7 страницUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Muhtorov, 10th Cir. (2017)Документ15 страницUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Magnan, 10th Cir. (2017)Документ4 страницыUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Publish United States Court of Appeals For The Tenth CircuitДокумент17 страницPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsОценок пока нет

- Pledger v. Russell, 10th Cir. (2017)Документ5 страницPledger v. Russell, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Real estate sale by wife without husband's consent voidДокумент7 страницReal estate sale by wife without husband's consent voidChristian Edward CoronadoОценок пока нет

- Legal DocumentsДокумент12 страницLegal DocumentsLiam ByrneОценок пока нет

- Jha v. OLPCДокумент12 страницJha v. OLPCjanelle_lawrenceОценок пока нет

- CONSTI II - Digest Mun of Cordova Vs PathfinderДокумент2 страницыCONSTI II - Digest Mun of Cordova Vs PathfinderLizette Kaye EstilloreОценок пока нет

- Petitioner Vs Vs Respondent Intervenor: First DivisionДокумент10 страницPetitioner Vs Vs Respondent Intervenor: First DivisionChristian Edward CoronadoОценок пока нет

- DMV-Declaration of Status of A Natural PersonДокумент6 страницDMV-Declaration of Status of A Natural PersonBruce Johnson100% (11)

- Offerte CebeoДокумент4 страницыOfferte CebeoBart De PauwОценок пока нет

- Farinas Vs Executive SecretaryДокумент4 страницыFarinas Vs Executive SecretaryMarlon BaltarОценок пока нет

- SN Aboitiz Vs Mun of AlonzoДокумент3 страницыSN Aboitiz Vs Mun of AlonzoPhillipCachapero50% (2)

- Mercury Drug CertificationДокумент2 страницыMercury Drug CertificationGerome Bautista VInluanОценок пока нет

- Five Tribes Thieves en RulesДокумент2 страницыFive Tribes Thieves en Rulesusako_chanОценок пока нет

- George E. Reich For Appellant. Roy and de Guzman For Appellees. Espeleta, Quijano and Liwag For Appellee HillДокумент68 страницGeorge E. Reich For Appellant. Roy and de Guzman For Appellees. Espeleta, Quijano and Liwag For Appellee HillCarmela SalazarОценок пока нет

- 2013.9.9 Motion To Dismiss Complaint (Filed) - Stein v. City of PhiladelphiaДокумент48 страниц2013.9.9 Motion To Dismiss Complaint (Filed) - Stein v. City of PhiladelphiaCristóbal SawyerОценок пока нет

- DC UnitedДокумент18 страницDC UnitedMartin AustermuhleОценок пока нет

- Heirs of Magdaleno Ypon vs. Gaudioso Ponteras RicaforteДокумент1 страницаHeirs of Magdaleno Ypon vs. Gaudioso Ponteras RicaforteJD DXОценок пока нет

- Braganza v. Villa AbrilleДокумент2 страницыBraganza v. Villa Abrillecmv mendozaОценок пока нет

- Trompa PDFДокумент2 страницыTrompa PDFPablo LopezОценок пока нет

- Devolution of Mitakshara Coparcenary Property Under Hindu Succession ActДокумент12 страницDevolution of Mitakshara Coparcenary Property Under Hindu Succession Actshrabana chatterjeeОценок пока нет

- 44 Phil 172Документ8 страниц44 Phil 172asnia07Оценок пока нет

- G.R. No. L-29043 - Enrile Vs VinuyaДокумент4 страницыG.R. No. L-29043 - Enrile Vs VinuyaKyle AlmeroОценок пока нет

- G.R. No. 160110 June 18, 2014 MARIANO C. MENDOZA and ELVIRA LIM, PetitionersДокумент5 страницG.R. No. 160110 June 18, 2014 MARIANO C. MENDOZA and ELVIRA LIM, PetitionersNombs NomОценок пока нет

- Business and Company Law AnswerДокумент13 страницBusiness and Company Law AnswerCheng Yuet JoeОценок пока нет

- Tumang Vs LaguioДокумент1 страницаTumang Vs Laguiocarlie lopezОценок пока нет

- Joint Hindu Family and Legal Issues Related To It PDFДокумент30 страницJoint Hindu Family and Legal Issues Related To It PDFLatest Laws Team100% (5)

- Succession Bellis vs. BellisДокумент4 страницыSuccession Bellis vs. BellisJeng PionОценок пока нет

- Contract of LeaseДокумент3 страницыContract of LeaseIsagani DionelaОценок пока нет

- Affidavit clarifying civil status for land transferДокумент1 страницаAffidavit clarifying civil status for land transferMichael Angelo LumboyОценок пока нет

- Escritor V IAC DigestДокумент2 страницыEscritor V IAC DigestSherwinBries100% (1)

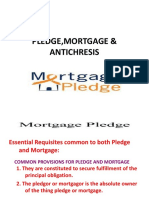

- Essential Requisites for Pledge and Mortgage ContractsДокумент184 страницыEssential Requisites for Pledge and Mortgage ContractsJanetGraceDalisayFabreroОценок пока нет

- Donation Inter Vivos Upheld in Property DisputeДокумент2 страницыDonation Inter Vivos Upheld in Property DisputeKeangela LouiseОценок пока нет