Академический Документы

Профессиональный Документы

Культура Документы

Philex Mining Corp. v. CIR

Загружено:

romelamiguel_2015Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Philex Mining Corp. v. CIR

Загружено:

romelamiguel_2015Авторское право:

Доступные форматы

VII.

Distinguished from certain kinds of exactions

C. Special Assessment (Note: topic in this case is Debt vs Tax)

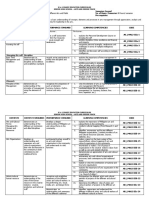

Philex Mining Corporation v. CIR

G.R. No. 125704, August 28, 1998

Romero, J.:

-Taxes cannot be subject to compensation for the simple reason that the

government and the taxpayer are not creditors and debtors of each other;

Debts are due to the Government in its corporate capacity, while taxes are

due to the Government in its sovereign capacity.Facts:

BIR sent a letter to Philex asking it to settle its tax liabilities amounting to

P123.8M.

Philex protested the demand for payment stating that it has pending

claims for VAT input credit/refund amounting to P119M. Therefore, these

claims for tax credit/refund should be applied against the tax liabilities.

In reply the BIR found no merit in Philexs position.

Saying that since these pending claims have not yet been

established or determined with certainty, it follows that no legal

compensation can take place. Hence, the BIR reiterated its demand

that Philex settle the amount plus interest.

On appeal, the CTA reduced the tax liability of Philex but still ordered

Philex to pay the remaining balance.

because in the course of the proceedings, the BIR issued Tax

Credit Certificate in the amount of 13.1M which it applied to the total

tax liability.

CA affirmed CTA decision. MFR denied.

However, a few days after the denial of MFR, Philex was able to

obtain VAT input/credit. In view of this, Philex now contends that the

same should, ipso jure, set-off its excise tax liabilities since both had

already become due and demandable, as well as fully liquidated;

hence, legal compensation can properly take place.

Issue: WON legal compensation can properly take place between the

VAT input credit/refund and the excise tax liabilities of Philex.

Held: No, legal compensation cannot take place.

There is a material distinction between a tax and debt.

Debts are due to the Government in its corporate capacity, while

taxes are due to the Government in its sovereign capacity. We find no

cogent reason to deviate from the aforementioned distinction.

Prescinding from this premise, in Francia v. Intermediate Appellate Court,

we categorically held that taxes cannot be subject to set-off or

compensation, thus:

We have consistently ruled that there can be no off-setting of taxes

against the claims that the taxpayer may have against the

government. A person cannot refuse to pay a tax on the ground

that the government owes him an amount equal to or greater

than the tax being collected. The collection of tax cannot await

the results of a lawsuit against the government.

The ruling in Francia has been applied to the subsequent case of Caltex

Philippines, Inc. v. Commission on Audit,[20] which reiterated that:

x x x a taxpayer may not offset taxes due from the claims that he may

have against the government. Taxes cannot be the subject of

compensation because the government and taxpayer are not

mutually creditors and debtors of each other and a claim for taxes

is not such a debt, demand, contract or judgment as is allowed to

be set-off.

Further, Philexs reliance on our holding in Commissioner of Internal

Revenue v. Itogon-Suyoc Mines, Inc., wherein we ruled that a pending

refund may be set off against an existing tax liability even though the

refund has not yet been approved by the Commissioner, is no longer

without any support in statutory law.

It is important to note that the premise of our ruling in the aforementioned

case was anchored on Section 51(d) of the National Revenue Code of

1939. However, when the National Internal Revenue Code of 1977 was

enacted, the same provision upon which the Itogon-Suyoc

pronouncement was based was omitted. Accordingly, the doctrine

enunciated in Itogon-Suyoc cannot be invoked by Philex.

Вам также может понравиться

- Applying for 501(c)(3) Tax-Exempt Status GuideДокумент14 страницApplying for 501(c)(3) Tax-Exempt Status GuideJikker Gigi Phatbeatzz BarrowОценок пока нет

- Sison Vs AnchetaДокумент6 страницSison Vs AnchetaMadelle PinedaОценок пока нет

- GOVERNMENT SAMPLES - Resumes, Selection Criteria & Cover LettersДокумент45 страницGOVERNMENT SAMPLES - Resumes, Selection Criteria & Cover LettersKellu Baba100% (3)

- Tax Case DigestsДокумент107 страницTax Case DigestsMenchu G. Maban100% (1)

- FS ModelДокумент13 страницFS Modelalfx216Оценок пока нет

- 14 NATIONAL COAL CORPORATION v. CIRДокумент1 страница14 NATIONAL COAL CORPORATION v. CIRTriciaОценок пока нет

- Bookkeeping Course Syllabus - SDPDFДокумент0 страницBookkeeping Course Syllabus - SDPDFjasonmendez2010Оценок пока нет

- Cir vs. Solidbank Corporation2Документ1 страницаCir vs. Solidbank Corporation2Raquel DoqueniaОценок пока нет

- CIR Vs MarubeniДокумент2 страницыCIR Vs MarubeniKervy Sanell SalazarОценок пока нет

- Gomez Vs PalomarДокумент2 страницыGomez Vs PalomarKim Lorenzo CalatravaОценок пока нет

- Philex Mining Corp. v. CIR, CA, and CTAДокумент2 страницыPhilex Mining Corp. v. CIR, CA, and CTAHappy Dreams PhilippinesОценок пока нет

- Torts and Damages - Case Digest Part IiiДокумент17 страницTorts and Damages - Case Digest Part IiiLIERAОценок пока нет

- Facture Apple Store UsДокумент2 страницыFacture Apple Store Usmelgayla9Оценок пока нет

- K to 12 Arts and Design Track Subject on Leadership and ManagementДокумент10 страницK to 12 Arts and Design Track Subject on Leadership and ManagementKarl Winn Liang100% (1)

- TRILLANA, Petitioner vs. QUEZON COLLEGE, INC., Respondent G.R. No. L-5003 June 27, 1953 FactsДокумент8 страницTRILLANA, Petitioner vs. QUEZON COLLEGE, INC., Respondent G.R. No. L-5003 June 27, 1953 FactsRaymond AlhambraОценок пока нет

- Caltex Vs Commission On Audit 1992Документ1 страницаCaltex Vs Commission On Audit 1992Praisah Marjorey PicotОценок пока нет

- 037 Pepsi Cola vs. City of ButuanДокумент2 страницы037 Pepsi Cola vs. City of ButuanlorenbeatulalianОценок пока нет

- CIR Vs S.C. Johnson and SonДокумент4 страницыCIR Vs S.C. Johnson and SonCARLOSPAULADRIANNE MARIANOОценок пока нет

- Manila Gas Corporation vs. CIRДокумент2 страницыManila Gas Corporation vs. CIRMark Alfred100% (2)

- Heacock Co. Vs MacondrayДокумент3 страницыHeacock Co. Vs Macondrayromelamiguel_2015100% (1)

- People Vs RepirogaДокумент7 страницPeople Vs RepirogaAbigail DeeОценок пока нет

- Philex Mining Vs CirДокумент2 страницыPhilex Mining Vs CirKim Lorenzo CalatravaОценок пока нет

- 1 - MANILA GAS vs. CIR - PabloДокумент2 страницы1 - MANILA GAS vs. CIR - PabloCherith MonteroОценок пока нет

- Tolentino Vs Secretary of FinanceДокумент2 страницыTolentino Vs Secretary of FinanceMatthew Chandler100% (2)

- Tatad vs. Garcia Case Digest on Foreign Ownership of Public Utility FacilitiesДокумент1 страницаTatad vs. Garcia Case Digest on Foreign Ownership of Public Utility Facilitiesromelamiguel_2015Оценок пока нет

- Roxas Vs CtaДокумент23 страницыRoxas Vs CtaMyra De Guzman PalattaoОценок пока нет

- Services Marketing BookДокумент314 страницServices Marketing BookMia KhalifaОценок пока нет

- Taxation CasesДокумент13 страницTaxation CasesmaeОценок пока нет

- Clavecilla Radio System vs. Antillon 19 Scra 379Документ5 страницClavecilla Radio System vs. Antillon 19 Scra 379albemartОценок пока нет

- 19.d Philex Mining Corporation vs. CIR (G.R. No. 125704 August 28, 1998) - H DigestДокумент1 страница19.d Philex Mining Corporation vs. CIR (G.R. No. 125704 August 28, 1998) - H DigestHarleneОценок пока нет

- Taxation 1 DigestsДокумент14 страницTaxation 1 DigestsgabbieseguiranОценок пока нет

- De Jacob vs. Puno DigestДокумент2 страницыDe Jacob vs. Puno DigestWayne Libao ForbesОценок пока нет

- American Bible Society vs. City of Manila (Religious Freedom)Документ2 страницыAmerican Bible Society vs. City of Manila (Religious Freedom)Earl LarroderОценок пока нет

- PAL Vs EDUДокумент1 страницаPAL Vs EDUCharlotte Louise MaglasangОценок пока нет

- City of Ozamis Vs LumapasДокумент2 страницыCity of Ozamis Vs LumapasMarie Mariñas-delos Reyes100% (1)

- Old Colony Trust Co V CirДокумент8 страницOld Colony Trust Co V CirKTОценок пока нет

- Invoice: Order No.: 52113272 Order Placed On: 02/01/2023Документ1 страницаInvoice: Order No.: 52113272 Order Placed On: 02/01/2023Alexandru BadanauОценок пока нет

- Tolentino V Secretary of FinanceДокумент2 страницыTolentino V Secretary of Financemark anthony mansueto100% (4)

- BERKENKOTER V CU UNJIENG Case Digest-2 PDFДокумент2 страницыBERKENKOTER V CU UNJIENG Case Digest-2 PDFAbigail TolabingОценок пока нет

- CIR vs. Algue, G.R. No. L-28896, February 17, 1988Документ8 страницCIR vs. Algue, G.R. No. L-28896, February 17, 1988Machida AbrahamОценок пока нет

- EO 97-A Does Not Violate Equal Protection ClauseДокумент1 страницаEO 97-A Does Not Violate Equal Protection ClauseLennart Reyes100% (2)

- Kuenzle v. CIRДокумент2 страницыKuenzle v. CIRTippy Dos Santos100% (2)

- Tio v. Videogram Regulatory BoardДокумент1 страницаTio v. Videogram Regulatory Boardromelamiguel_2015100% (1)

- Tio v. Videogram Regulatory BoardДокумент1 страницаTio v. Videogram Regulatory Boardromelamiguel_2015100% (1)

- Chapter 11 Capital Budgeting Cash Flows: Principles of Managerial Finance, 14e (Gitman/Zutter)Документ18 страницChapter 11 Capital Budgeting Cash Flows: Principles of Managerial Finance, 14e (Gitman/Zutter)chinyОценок пока нет

- Limpan Investment Corp v. CIRДокумент3 страницыLimpan Investment Corp v. CIRMuslimeenSalamОценок пока нет

- Globalizing the Local in Roman BritainДокумент14 страницGlobalizing the Local in Roman Britainkemal100% (1)

- Tolentino vs. Secretary of Finance, 235 SCRA 630 (1994)Документ4 страницыTolentino vs. Secretary of Finance, 235 SCRA 630 (1994)Julia Corpin100% (1)

- Progressive Development v. Quezon CityДокумент2 страницыProgressive Development v. Quezon CityR.D.B. Arcadio100% (1)

- Villegas vs. Hi Chiong Tsai Pao Ho - Invalid Delegation of PowerДокумент1 страницаVillegas vs. Hi Chiong Tsai Pao Ho - Invalid Delegation of PowerEleonor ToledoОценок пока нет

- Philex Mining Corp v. CIRДокумент2 страницыPhilex Mining Corp v. CIRautumn moon100% (1)

- City of Manila and White LightДокумент3 страницыCity of Manila and White LightJoey DealinoОценок пока нет

- CIR v. San Miguel CorporationДокумент1 страницаCIR v. San Miguel CorporationKym AlgarmeОценок пока нет

- Tax 1 CasesДокумент18 страницTax 1 CasesJurico AlonzoОценок пока нет

- Panhandle Oil Co. v. Mississippi Ex Rel. Knox, 277 U.S. 218 (1928)Документ5 страницPanhandle Oil Co. v. Mississippi Ex Rel. Knox, 277 U.S. 218 (1928)JupiterОценок пока нет

- Misamis Oriental Association vs. Dept. of Finance SecretaryДокумент5 страницMisamis Oriental Association vs. Dept. of Finance SecretaryMadelle PinedaОценок пока нет

- Lorenzo Vs Posadas 64 Phil 353Документ1 страницаLorenzo Vs Posadas 64 Phil 353Gina Portuguese GawonОценок пока нет

- CIR Vs CA & CastanedaДокумент1 страницаCIR Vs CA & CastanedaArmstrong BosantogОценок пока нет

- Taxation Case DoctrinesДокумент156 страницTaxation Case DoctrinesLibay Villamor IsmaelОценок пока нет

- Whether Stock Dividends and Share Exchanges Constitute Taxable IncomeДокумент17 страницWhether Stock Dividends and Share Exchanges Constitute Taxable IncomeJuris PasionОценок пока нет

- Cir Vs Estate of Benigno TodaДокумент2 страницыCir Vs Estate of Benigno TodaHarvey Leo RomanoОценок пока нет

- Afisco Insurance Corp. v. CIRДокумент6 страницAfisco Insurance Corp. v. CIRJB GuevarraОценок пока нет

- Pepsi-Cola Bottling Company of The Phil. vs. Mun. of TanauanДокумент10 страницPepsi-Cola Bottling Company of The Phil. vs. Mun. of TanauanMp CasОценок пока нет

- Delpher Trades Corp v IACДокумент1 страницаDelpher Trades Corp v IACHanna Liia GeniloОценок пока нет

- Carlos Superdrug Vs DSWD: Modes of Eliminating Double TaxationДокумент2 страницыCarlos Superdrug Vs DSWD: Modes of Eliminating Double TaxationGabriel HernandezОценок пока нет

- SMITH Bell and NatividadДокумент6 страницSMITH Bell and NatividadOlek Dela CruzОценок пока нет

- Medina Transportation liable for Bataclan's deathДокумент2 страницыMedina Transportation liable for Bataclan's deathAngel MaeОценок пока нет

- 4.3CIR v. Michel J. Lhuillier PawnshopДокумент1 страница4.3CIR v. Michel J. Lhuillier PawnshopChieney AguhobОценок пока нет

- Manuel v. Alfeche examines civil liability in libel caseДокумент4 страницыManuel v. Alfeche examines civil liability in libel caseJohnlery SicatОценок пока нет

- Rights of Co-Owners in Undivided Properties and Payment of Repair CostsДокумент3 страницыRights of Co-Owners in Undivided Properties and Payment of Repair CostsChachi SorianoОценок пока нет

- Taxation I Case Digest Compilation: Philex Mining v. CAДокумент2 страницыTaxation I Case Digest Compilation: Philex Mining v. CAPraisah Marjorey PicotОценок пока нет

- Philex Mining Corporation vs. CIR, G.R. No. 125704Документ8 страницPhilex Mining Corporation vs. CIR, G.R. No. 125704Shay GCОценок пока нет

- 029 - Philex v. CIRДокумент2 страницы029 - Philex v. CIRJaerelle HernandezОценок пока нет

- MHP Garments vs. CAДокумент6 страницMHP Garments vs. CAJeanОценок пока нет

- Aberca v. Ver, 160 SCRA 590 (1988)Документ13 страницAberca v. Ver, 160 SCRA 590 (1988)romelamiguel_2015Оценок пока нет

- 7 Civil Aeronatics v. CAДокумент8 страниц7 Civil Aeronatics v. CAAnonymous FBDGfUqHEОценок пока нет

- Metromedia V PastorinДокумент2 страницыMetromedia V Pastorinromelamiguel_2015Оценок пока нет

- Assignment 3Документ5 страницAssignment 3Amr MekkawyОценок пока нет

- 1601 CДокумент16 страниц1601 CROGELIO QUIAZON100% (1)

- Dost It Di 2017 Technologies Compen DereДокумент217 страницDost It Di 2017 Technologies Compen DereRcs CheОценок пока нет

- PPE Costs and ExchangesДокумент2 страницыPPE Costs and ExchangesRex AdarmeОценок пока нет

- Lass 12 Subject Economics Paper Set 1 With Solutions: (Macro Economics) Question 1: (Marks 1)Документ10 страницLass 12 Subject Economics Paper Set 1 With Solutions: (Macro Economics) Question 1: (Marks 1)sandeep11116Оценок пока нет

- Pay The PriceДокумент8 страницPay The PriceTinaStiffОценок пока нет

- Monastic SupremacyДокумент15 страницMonastic SupremacyPauloОценок пока нет

- MRA: PAYE Guide Mar 21 PDFДокумент55 страницMRA: PAYE Guide Mar 21 PDFZahir EmamdeeОценок пока нет

- TRTimes - 2012-02-12Документ28 страницTRTimes - 2012-02-12robertshepard1967Оценок пока нет

- Employment Income - Derivation, Exemptions, Types and DeductionsДокумент57 страницEmployment Income - Derivation, Exemptions, Types and DeductionsTeh Chu Leong100% (1)

- IASbaba's March Monthly Magazine PDFДокумент203 страницыIASbaba's March Monthly Magazine PDFsmilealways20Оценок пока нет

- Madison Schools Levy HistoryДокумент7 страницMadison Schools Levy HistoryThe News-HeraldОценок пока нет

- Ani SecДокумент149 страницAni SecMarivic ChuangОценок пока нет

- Pakistan Tobacco Company (PTC) : Taxation ProjectДокумент18 страницPakistan Tobacco Company (PTC) : Taxation ProjectAfnanОценок пока нет

- HSL ApplicationДокумент7 страницHSL ApplicationKOLD News 13Оценок пока нет

- INV0003114227 - 2021 Geobank Renewal - Brazil GB0432Документ1 страницаINV0003114227 - 2021 Geobank Renewal - Brazil GB0432Dailison SilvaОценок пока нет

- 12 Kundan CarsДокумент3 страницы12 Kundan CarsBalaji KambleОценок пока нет

- Philippines Sick ManДокумент3 страницыPhilippines Sick ManMarielle Ansherine GuzmanОценок пока нет

- GST May2023 V1Документ213 страницGST May2023 V1FhfhhОценок пока нет

- Sport Tourism Impact On Local Communities 1 - LibreДокумент11 страницSport Tourism Impact On Local Communities 1 - LibreEdmond-Cristian PopaОценок пока нет