Академический Документы

Профессиональный Документы

Культура Документы

City of Greensboro Starts Collection On Museum Loan Repayment

Загружено:

Devetta Blount0 оценок0% нашли этот документ полезным (0 голосов)

249 просмотров13 страницThe money has been paid out and now it's time to collect. The city of Greensboro loaned the International Civil Rights Center and Museum $1.5 million in 2013.

It's a forgivable loan. City Manager Jim Westmoreland explained that fundraising dollars raised between September 2013 and July 1, 2015 goes towards paying down that loan - dollar for dollar.

Оригинальное название

City of Greensboro Starts Collection on Museum Loan Repayment

Авторское право

© © All Rights Reserved

Доступные форматы

PDF или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThe money has been paid out and now it's time to collect. The city of Greensboro loaned the International Civil Rights Center and Museum $1.5 million in 2013.

It's a forgivable loan. City Manager Jim Westmoreland explained that fundraising dollars raised between September 2013 and July 1, 2015 goes towards paying down that loan - dollar for dollar.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

249 просмотров13 страницCity of Greensboro Starts Collection On Museum Loan Repayment

Загружено:

Devetta BlountThe money has been paid out and now it's time to collect. The city of Greensboro loaned the International Civil Rights Center and Museum $1.5 million in 2013.

It's a forgivable loan. City Manager Jim Westmoreland explained that fundraising dollars raised between September 2013 and July 1, 2015 goes towards paying down that loan - dollar for dollar.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

Вы находитесь на странице: 1из 13

June 24, 2016

‘Mrs. Deena Hayes ~ Greene, Chairman of the Board

Mr. John Swaine, Chief Executive Officer

International Civil Rights Center & Museum

134 South Elm Street

Greensboro, NC 27401

Dear Deena and John,

Pursuant to the terms and conditions outlined in our August 19, 2014 loan agreement, the City of

Greensboro Internal Audit Division has completed a review of the International Civil Rights Center and

Museum (ICRCM) records and documents to determine the amount of the $1.5 million loan that can be

forgiven by the City (see attached report from the internal Audit Division).

Based on the findings of the review, | am pleased to report that the City will be able to forgive $612,510

of the loan. This total credit will be applied to the first $750,000 installment provided to the ICRCM on

October 25, 2013 and, will leave an outstanding balance due to the City of $137,490 (plus 2% annual

interest since date of first installment of $7,498.43). The balance of $144,988.43 is due and payable to

the City on June 30, 2016.

In addition to balance due for the initial loan installment, the ICRCM will also be required to pay the City

an additional $500,000 (plus 2% annual interest from date of second installment of $25,444.76) on

February 20, 2017 and, $250,000 (plus 2% annual interest from date of third installment of $12,722.38)

on February 17, 2018. This leaves a current outstanding balance owed to the City at $887,490 (plus 2%

annual interest based on dates of loan installments of $45,665.57 for a current total principal and

Interest amount due to the City of $933,155.57).

On another matter, the City would also like to request a written update from the ICRCM on the status of

the tax credit structure completion and, the status of the put/call and collateral assignments as outlined

inour agreement. To follow-up, please provide us with a copy of your proposed lozn repayment plan

and requested tax credit information as soon as possible (and no later than Friday, July 22, 2016)

Sincerely,

Nn “r Vas Borreynrne

Nancy Vaughan, Mayor Jim Westmoreland, P.E., City Manager

City of Greensboro City of Greensboro

Attachment (Civil Rights Museum/Loan Offset Report - Internal Audit Division)

PO BOX 3136 - GREENSBORO NC 27402-3136 » WWW.GREENSBORO-NC.GOV + 336-373-CITY (2489)

GREENSBORO

DATE: June 17, 2016

Jim Westmoreland, City Manager

FROM: Internal Audit Division

SUBJECT: Civil Rights Museum / Loan Offset

(Written Response Required by July 1, 2016)

‘The Internal Audit Division has completed our review of the Civil Rights Museum’s Financial

Records/Documents as requested by the City Manager’s Office. This review involved the analysis of

items provided to us by the Intemational Civil Rights Center & Museum (ICRCM). The purpose of

this review is to verify eligible allowable net funds raised by the entity outside the normal course of

business for the period of September 3, 2013 to July 1, 2015 to “Offset” the Loan provided by the

City of Greensboro as forgivable amounts as outlined in the Executed Agreement dated August 19,

2014 “Item 15 — Offset Rights of Borrower”. (See Attached Agreement Executed August 19, 2014)

‘This entity is also known as “Sit-In Movement, Incorporated and Affiliated Entities”. The affiliated

entities include: Civil Rights Museum, LLC; International Civil Rights Center and Museum, LLC;

‘Museum Landlord, LLC; and Museum Tenant, LLC. Alll of these entities are related parties that were

formed in order to facilitate the development of the Museum at 132-134 South Elm Street in

Greensboro, NC.

‘On October 22, 2013, The City of Greensboro approved a $1,500,000 forgivable loan to Sit-n-

‘Movement, Incorporated (Borrower) provided that a dollar for dollar match is raised over the course

of the three (3) year period, 2013-2015, Borrower will assign to the City a security interest in the real

property located at 134 South Elm Street, Greensboro, North Carolina, The purpose of the Loan is to

provide operating support and development of the business located at 134 South Elm Street,

Greensboro, North Carolina (the “Business”) for the International Civil Rights Center and Museum,

Incorporated with the objectives of (1) satisfying debt requirements; (2) retaining existing jobs; and

(3) maintaining utilities of the Business.

Further, it is understood that the Project will have until July 1, 2015 to raise $1,500,000 in matching

(vet) funds from rental and fundraising activities to ensure that the liability to the City is fully

forgiven. The City holds two (2) board level seats as a result of the above loan arrangement.

We were originally provided a spreadsheet by Mr. John Swaine, Chief Executive Officer on

September 16, 2015 showing funds raised in the amount of $1,271,669.52. At the start of our review

date, March 16, 2016, we were provided an updated spreadsheet by Ms. Cassandra Garner,

‘Accounting Assistent showing funds raised in the amount $1,266,745.26 (Our Starting Point) which

PO BOX 3136 - GREENSBORO NC 27402-3136 - WWW.GREENSBORO-NC.GOV - 336-373-CITY (2489)

‘GREENSBORO

is $4,924.26 less than the original document. We attempted to verify the latter amount as outlined

below.

‘We reviewed the following eleven (11) items and reported amounts to determine the amount eligible

for Loan Offset:

1. GOLF $44,056

We reviewed the documentation for the Net Funds Raised (Revenues of $56,656 less Expenses of

$12,600) for the Golf Tournament in the amount of $44,056. We noted two items as follows: there

‘was a $2,500 contribution from Food Lion that was recorded as July 1, 2015. The deposit ticket from

the bank was dated July 3, 2015. The check was dated July 1, 2015. There was a $500 item from

Rental Works recorded as revenue. There was no documentation from the vendor to support this

item. It was noted that this was the donation of chairs for the golf event.

RECOMMENDATION

We recommend based on the two exceptions above the Golf Revenue should be reduced by $3,000 to

‘make the net amount for offset equal to $41,056.

2. GALA $132,392

‘The Gala is an annual banquet held by ICRCM in order to help raise funds via donations. We

reviewed the documentation for the Net Funds Raised (Revenues of $251,440.31 less Expenses of

$119,048.55) for the Gala in the amount of $132,391.76. For the period January 1, 2015 through July

1, 2015, the museum included a credit of $5,000 for Gala Expenses from the Sheraton Greensboro

that should not have been deducted.

RECOMMENDATION

‘We recommend that based on the exception above the expenses should be increased by $5,000

making the net amount raised for offset credit equal to $127,392.

3. SPECIAL PROGRAMS $15,808

Special Programs relate to particular events and exhibits that are at the Museum for a limited amount

of time. Examples include plays, concerts, and art exhibits. Some programs are free to the public,

while other events cost money to attend,

During the period of September 3, 2013 to July 1, 2015, ICRCM reported $10,017.82 of funds raised

from Special Programs. On the updated Schedule of Matching Funds given to us by the ICRCM

staff, we identified an amount recorded in December of 2013 as a debit of $2,895. Upon further

review, the amount should have been a credit. This changes the amount reported by the Museum for

funds raised to $15,807.34.

ut of the thirty-one transactions that compose the $15,807.34, seven transacti

made from individuals. ‘These seven transactions total $670.00. The remai

are payments

twenty-four

PO BOX 3136» GREENSBORO NC 27402-3136 » WWW.GREENSBORO-NC,GOV » 336-373-CITY (2489)

‘GREENSBORO

transactions totaling $15,137.34 are journal entries made to allocate revenue and expenses from the

Civil Rights Museum, LLC to Sit-In Movement, Inc. These transactions represent operating revenue

and expenses incurred through the day to day activities; for example admissions, gift shop sales,

touts, utilities, etc, and are not eligible for offset. According to Number 15 entitled “Offset Rights of

Borrower” listed under the Agreement section of the contract is states, “.. the obligation of Borrower

under this Agreement and Note shall be offset by the amount of net funds of Borrower and Sub-

Tenant, raised outside the normal course of business.”

RECOMMENDATION

‘Based on the loan agreement and the nature of the allocations made, the majority of the $15,807.34

reported during the period of September 3, 2013 to July 1, 2015 is not eligible for offset because the

‘majority of the transactions are from day to day activities and do not represent funds raised outside

the normal course of business or new fundraising. In summary, of the $15,807.34 reported by the

ICRCM for offset, $15,137.34 is not allowed for offset; leaving $670.00 as net funds raised by

Special Programs and eligible for offset. There were no expenses reported during the period under

review.

4. 1960 SOCIETY $49,036

‘The 1960 Society is a support campaign for the International Civil Rights Center and Museum. The

program is made up of citizens and orgenizations that pledge annual support for the Museum's

operations. In becoming a member of the 1960 Society, there are certain benefits that members

receive depending upon the amount of money pledged. ‘These benefits range from free admission

and complementary tickets to the Museum to priority invitations, reservations, and seating at special

events and activities. In addition, there is payment options for members to pay their pledges

depending upon the amount of money pledged. For amounts pledged from $1,000 to $2,499, the

member has the option of paying over a three year period. For pledges that are greater than $2,500,

‘members have the option to pay over a three to five year period.

During the period of September 3, 2013 to July 1, 2015, ICRCM reported $49,035.70 of funds raised

from the 1960 Society and $10,968.39 of fund raising expenses attributable to the 1960 Society.

‘The majority of money received during the period of review was for pledges made in the past where

members had taken the option to pay their pledges over a three year period or the three to five year

period offered by the Museum. This was determined by the Invoice Date listed on the member's

Payment Form. These dates ranged from November 2, 2009 — January 14, 2014; with the majority of

Invoice Dates occurring in 2010. For example, a $200.00 payment was received on September 23,

2013 (within the offset period); however, the Invoice Date on the Payment Form is January 16, 2010,

which indicates a pledge made in the past. The majority of the transactions is like the example above

and is not eligible for offset. According to Number | entitled “Definitions” listed under the

Agreement section of the contract dated August 19, 2014, “Fundraising” means the activities that

PO BOX 3136 « GREENSBORO NC 27402-3136 - WWW.GREENSBORO-NC.GOV » 336-373-CITY (2489)

a

(GREENSBORO

directly raise money for the Museum and Building, but shall not include; (i) pledges made before

June 30, 2013; (i) pledges made that will not be paid in full by July 1, 2015, (ii) admission fees.”

We noted one transaction wiere legal services were donated to the Museum. While the legal

services donated must be recognized as revenue, the nature of the transaction does not meet the

qualifications of funds raised outside of the normal course of business. Legal proceedings are

activities that occur in the normal course of business and the legal services would need to be

purchased if not provided through the donation, unless the decision was for the entity to represent

itself

We also noted nine transactions totaling $5.39 ranging from $0.01 to $2.00 in which the transaction

memo listed wes “Write Off.” These were included in the funds raised figure reported by the Sit-In

Movement.

RECOMMENDATION

‘According to the loan agreement and the Invoice Dates of the Payment Forms reviewed and adjusting

for the “write off” transactions, the majority of the $49,035.70 received from September 3, 2013 to

July 1, 2015 is not eligible for offdet because the majority of the money received is for pledges made

before June 30, 2013 and does not represent new fumdraising. In summary, of the $49,035.70

reported by the ICRCM for offset, $41,952.70 is not allowed for offset; leaving $7,083.00 as gross

funds raised by the 1960 Society for the period above. When taking the expenses incurred by the

1960 Society of $10,968.39 for the period into consideration, the net funds raised by the 1960

Society is -$3,885.39. In other words, the money spent exceeded the new fundraising that was

generated by $3,885.39. Therefore, we do not recommend that any loan-offset credit be provided for

this item,

5, RENTALS $70,027

‘We reviewed the documentation for the Net Funds Raised for Rentals in the amount of $70,207. We

were able to see the details of the transactions and the general ledger totals. However, we were not

able to verify the credit cards amounts on the Bank Statements due to the fact that all Counter Sales

Deposits are combined into one deposit/credit total from the bank for Rentals, Gift Shop Sales and

Daily Tours. Also, there is an Account for Discounts in the amount of $30,117 that is not reflected on

the spreadsheets provided to us. We fel that this should be categorized as an Expense reducing the

Gross Sales of $70,207 to the Net Amount of $40,090.

RECOMMENDATION

‘The amount of credit available to reduce the City’s Loan should be in the amount of $40,090.

6. INTEREST FROM FUNDING $456,000

We reviewed the documentation for the Interest Revenue received on the Tax Credit Financing in the

amount of $456,500, This was verified without exception, This appears to be ordinary revenue

received by the museum which is generated fiom interest earnings associated with the Tax Credit

PO BOX 3136 « GREENSBORO NC 27402-3136 » WWW.GREENSBORO-NC.GOV + 336-373-CITY (2489)

4

GREENSBORO

Agreement/Project. The Project was formed under the laws of the State of North Carolina on June 2,

2009 to rehabilitate and operate a museum and commercial office space located in downtown

Greensboro, North Carolina.

RECOMMENDATION

ce the project was formed in 2009 and the Tax Credit Agreement was executed several years

before the City’s Loan Agreement with the museum in 2014 and, since the querterly interest

payments represent ordinary revenue received by the museum as part of its normal course of business

(and therefore cannot be considered fundraising), we do not recommend that any loan-offset credit be

provided for this item.

7. BUILDING AMERICA $12,076

Building a Better America through Core Democratic Values (“Building America”) is a fundraising

program to provide educational initiative for social studies students in grades 4, 5, 8 and 11. There

ate four (4) key components for which donations to the program are used:

1. Educational Fieldtrips ~ provides funding for 112,000 social studies students from across the

state to explore the International Civil Rights Center & Museum’s state of the art 16-pallery

experience, The Battlegrounds.

2, Lesson Plans — provides mote than forty (40) lesson plans to reinforce an understanding of

core democratic values ~ eg. liberty, right to vote, equal protection under the law, and others

~ conveyed in The Battlegrounds.

3. Teacher Training ~ ICRCM will offer onsite seminars as well as webinar to ensue effective

implementation of the lesson plans.

4. Recognition of Support - Donors may help to underwrite admission fees for students. Each

firnder’s name will appear on the ICRCM website, the Building a Better America donor wall

in the ICRCM’s lobby, and the Annual Report. (Per ICRCM personnel, most donations

during the period under review were used to underwrite admission fees for students.)

We reviewed the documentation for the Net Funds Raised for Building America in the amount of

$12,075.80. On August 31, 2014 a journal entry was made to allocate revenue of $581.30 from

ICROM to the Building America program, ICRCM personnel indicated that donations are deposited

throughout the month in a donation box located in the ICRCM lobby during business hours.

RECOMMENDATION

Since the above transaction is comprised of donations made during the normal course of business, we

recommend that $581.30 be removed from the reported total of $12,075.80; which makes the

allowable amount from Building America program equal to $11,494.50. There were no expenses

related to the program.

8, INDIVIDUAL GIFTS $103,926

PO BOX 3136 + GREENSBORO NC 27402-3136 « WWW.GREENSBORO-NC.GOV - 336-373-CITY (2489)

5

‘GREENSBORO

Individual Gifts are received by ICRCM in numerous ways (e.g., in person, by mail, in the donation

‘box, on-line, etc.)

We reviewed the documentation for the Net Funds Reised for Individual Gifts in the amount of

$103,951.20. There were several exceptions to this amount. (A) There was a $123.00 donation made

by check where the donor denoted “General Designation 2012 Campaign” under the description

column of the check stub. Section 1 of the written loan agreement dated August 19, 2014 (effective

as of October 22, 2013) defines “fundraising” as: the activities that directly raise money for the

Museum and the Building, but shall not include; (pledges made before June 30, 2013; (i)pledges

‘made that will not be paid in full by July 1, 2015; (tl) admission fees.”

(B) There were eighteen transactions totaling $10,235.71 where journal entries were made to

reallocate revenue from ICRM’s depository account to the individual donations account. ICRCM

personnel indicated that donations are deposited throughout the month in a donation box located in

the ICRCM lobby during business hours. This appears to be outside the normal course of business.

(© We also noted three (3) individual donations totaling $994.21 where the documentation attached

noted that the transaction was collected from the donation box.

RECOMMENDATION

Since these transactions are comprised of donations made during the normal course of business, we

recommend that $11,352.92 be removed from the total of $103,951.20; which makes the adjusted net

amount eligible for offset from individual gifts $92,598.28. There were no expenditures reported

during the period under review.

9. CORPORATE GIFTS $166,713

We reviewed the documentation for Corporate Gifts in the amount of $166,713. We agreed amounts

pper the spreadsheet to deposit slips, bank statements or credit card merchant email receipts to verify

amounts.

$100,000 of this amount was noted as “forgiveness of oan debt” by Carolina Bank in October 2014,

We did not see any correspondence from the bank confirming this amount. We were only provided

the October and November loan statements and noticed the amount decreased by $100,000,

RECOMMENDATION

‘We need to see a confirmation directly from the Bank.

10. DONATIONS IN THE MUSEUM $673

We reviewed two items that comprised Donations in the Museum. We agreed the April 2014

transaction in the amount of $379.05 without exception. The October 2013 transaction was a journal

entry of $294,00, We were not provided any documentation for this transaction,

PO BOX 3136 - GREENSBORO NC 27402-3136 - WWW.GREENSBORO-NC.GOV + 336-373-CITY (2489)

‘

GREENSBORO

RECOMMENDATION

‘We recommend that Donations amount should be reduced to $379 as the allowable amount for offset

credit.

11. GRANTS $232,117

We reviewed the documentation for the Net Funds Raised for Grants in the amount of $232,117.

‘These appear to be within the timeframe of the agreement without exception.

RECOMMENDATION

None.

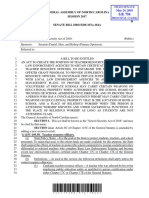

Please see a summary of the above analysis located in Attachment A.

We also received a summary from the Museum regarding all items mentioned above (See

Attachment B). However, we have not been provided any additional documentation regarding this

summary that would warrant us changing our report.

In summary, based on our observations and the Executed Agreement dated August 19, 2014, we

recommend that the amount of Offset Credit for the City’s Loan be in the amount of $612,510.

‘We would like to thank Mr. John Swaine, CEO and Ms. Cassandra Garner, Accounting Assistant for

the ICRCM for their courtesy and cooperation to us during this review. Please provide a written

response to the Internal Audit Division by July 1, 2016.

Please contact us with any questions that you may have,

4. Keto tye Kew

Mickey Kerans Ryan Kildoo

Internal Auditor Internal Auditor

Tira ZZ

Tina McKoy Garland Wells

Internal Auditor Intemal Auditor

PO BOX 3136 » GREENSBORO NC 27402-3136 - WWW.GREENSBORO-NC.GOV + 336-373-CITY (2489)

7

soz /s2/s

uojsita pny jeusoyuy Aq pasedoug

wa 3 aTaeT 3 FEURT 5 STVIOL

LIVeEe 7 $ LIVeez $s LIVeEe $ SINVYD 1

LE $ €L9 $ €L9 s OAS HHL NI SNOLLYNOd “01

€1L'99 $ E1L‘991 $s €1L‘991 $ SLHWO ALVUOTUOD 6

865°C6 s TS6'EOT s 976"E01 s ‘SLdID TVNGLAIGNE ‘8

S6vTL $ 940% $ 9L0'C s Vora ONICTING L

$ oos‘9sy $ ous‘9sr s ONIGNDA WOW STAINED

060°0r $ LZO'OL s LEO'OL s STV.INEY Ss

$ 980°6r $ 980°6r $ ALHIOOS 0961 -

oL9 s 308‘sT s sT0OT $ SWYvwOOd TYIORdS: €

WELZ s ‘TOETEL $s WETEL $ vivo %

9S0'lr s 980 $ 9s0ry s a0. T

INIONV FHVROTIV INDOWV OSTWIA INTONV IHSHSGVEEES SINTOOOV

ARVININNS 13530 NVOT- WN3SNIN SLHORE AID

‘VINSNFOVILY

May 31,2016 ATTACHMENT B

Good Evening Mr. Lucas,

‘There are a couple of Matters to be address in the draft report as follows:

‘A. Instead of Civil Rights Museum or Intemational Civil Rights Center & Museum, the draft

document should read “Sit-In Movement Inc”. This is the entity that entered into a

transaction with the City.

B. We actually agreed to “Fund Raising”, not “net funds”, as stated in the first paragraph.

C. In the fourth paragraph, itis important to note that the match was to be within the period

of release. ([had raised the point with the City that the last disbursement of $250,000

‘was outside of the matching period.) This was to have been corrected before the contract

was finalized in 2014,

D. Third Paragraph, Please change title to CEO on September 16, 2015.

E. Please adjust title for Ms. Gamer, as Accounting Assistant. She is not an employee of the

organization, only a contracted assistant.

1.0 Golf - According to my records, $2,500 check from Food Lion was delivered to the

Museum, after the banking time. It is common for receive checks in advance of the dates;

because, many of us set the dates ahead of the mailing time, Regarding the $500 that was

provided by rental works, this was the fair market value of the donated tents and other

equipment that were donated for the golf tournament. ‘There was a corresponding deduction

on the expense side as well. ‘The net effect is “0” because this is an in-kind donation.

Recommendation ~ Leave the funds raised as reported $41,056,

2.0 GALA - Please correct the “January 1, 2015” date to reflect September 3, 2013 thru July 1, 2015;

as this was the period of fund-raising for the three fundraising events. In looking at the review by

the City, there are insufficient details provided on the $5,000 credit. (Please forward the detail of

what is being referred to at this point. The only $5,000 transaction that is to be deducted was one

for a deposit dated 12/14/2014, totally within the fund-raising period. Please keep in mind, that

fundraising for the January 2015 Gala started as early as May and June of 2014 and expenses are

being paid in advance for certain bookings.

Recommendation ~ Leave the funds raised as reported, $132,392, are reported.

3.0 Special Programs - Each month special program revenues that are posted on Civil Rights

‘museum’s general ledger is reclassified over to Sit-In Movement’s ledger via journal entry to

account for the special educational revenues raised by the Museum, These funds are posted

there because all registers are tied to the Civil Rights GL. Further, Special Programming

fund-raising is often by donation, Once financial adjustments are completed, 1 JE is posted to

move these cost to the proper ledger. Included with the end of month transfer/allocations are

items like utilities and other expenses that are to be allocated over to the Sit-In Movement

general ledger. Its obvious that the December 2013 posting was posted as a debit for

special program discounts offered. This is not an error, rather the reclassification of two

number from Civil Rights Museum for a net of 1 on Sit-In Movement. These transactions do

not reptesent day-to-day operations. They are representative of community partnerships with

other non-profit organizations to build a larger community opportunity. Finally, many of

these programs of special purposes were designed as a direct result of fund-raising

requirements with the City and are far from routine.

Recommendation — Leave the funds raised as reported, $10,017.82.

4.0 1960 Society the 1960 Society was a support campaign for the Sit-In Movement Inc. The

campaign ended in February 2010, with many of the pledges to be fully paid over 3-5 years. The

Charter members had their names posted on the 1960 Society Wall and that was the end of the

campaign. Many members choose to renew their pledge commitments for the new campaign which

started in 2011 and @ new 2015 February One Society was initiated. The numbers that you have

were under the old structure offunds raised. In reviewing the report. There were actually $12,358

in new pledge payments made and received before July 1, 2015. The Museum is on an accrual basis,

s0 the old pledges would not show up on the financials as new money. Each month, tran a Cash

Basis Summary to show New Pledge payments that were recelved and removed the old pledges that

were before the September 2013 date. A three year pledge that had two years paid by July 1, 2015

does qualify for the match, for the funds collected on the pledge during the period and should not,

have been totally disallowed. I would suggest that revisiting the details of this particular line.

Recommendation ~ Leave the funds raised as reported, $12,358, | would also suggest that the

expenses related to this line of fund-raising be prorated with the schedule of funds received over

the three year period. Match the expense of $10,968.39 to the funds raised over three years

would support the Accounting Principle of Matching.

5.0 Rentals - The $70,027 raised from rentals should not be reduced by the discounts for

Jeasing the space. We have offered free and or discounted space to entice other

organizations to consider leasing the Museum for special functions and programs. Often,

these events generated revenues from tours and Museum Store purchases. Examples of

entities that use the building for free, The City of Greensboro, the Police Department, Social

Services, DGI, Rotary Club and many other entities with little or no budgets at all for the

payment of space. However, in a very direct manner, this was considered marketing the

facility to increase revenues for the operations. Therefore, the offset of $30,117 would

require the Museum to support community engagement without any support from the City

for public engagement.

Recommendation — Leave the funds raised as reported, $70,027.

6.0 Interest ~ As we have stated before, the funds raised for the Tax Credit Interest is funds raised

each quarter as a direct result of our investing, has been agreed previously that this could be

counted. | would suggest a revisit of the intent of this particular line for fund-raising. It is not the

same as.a pledge; rather, its totally outside of normal course of business ~ rather extraordinary

fund-raising that will benefit the entire community for years to come.

Recommendation — Leave the funds ralsed as reported, $456,500.

7.0 Building A Better America ~1 would suggest removing the 4 key points, asit will cause confusion

in the public, Many of the objectives have already occurred. It simply need to state that this is

money raised to serve title vii schools and help to pay admission fees to the Museum. The funds

that you are intending to disallow totaling $581.30 is being reduced in error. Customers visiting the

Museum learn about the student fundraising program and leave donations in the Museum Shop or

contribute funds in the donation box that sits in the Museum Lobby. This donation box that isin the

lobby of the Museum is part of our fund-raising efforts and the box was placed there to raise

additional funds. When donors make donations at the register or place funds in the box, they will

often request a receipt from the Museum, To eliminate the need to have a separate system in

place, and to have operations streamlined, all funds collected in the Museum and earmarked,

“Donation” are recorded in the Museum Store, deposited in the Civil Rights bank account, and a

separate journal entry is posted at the end of the month to move donations, special events,

memberships, allocated utilities and shared wages over to Sit-In Movement Inc, the only entity that

reports on fund-raising activities in the Museum. Donations are aways made during the normal

course ofa business/operating day. Nearly all non-profit organizations, especially museums, receive

additional funds in a donation box, as a segment of their standard operations and in the normal

course of operations.

Recommendation —Leave the funds raised as reported, $12,075.80

8.0 Individual Gifts ~ The donations that you're looking at are donations made during the normal

course of an operating day I would not reference this as normal course of business because the

downstairs area is Museum store sales and tours predominately # fundralsing activities gave rise to

us putting a donation box downstairs to take donations often donors would make donations to the

museum in the Museum Store at the end of the month a journal entry would be made and the funds

willbe transferred from Civil Rights Museum LLC over to sit-in movement. “2012 Campaign was

the Bullding A Better America Project” Ifa guest made a donation for the “2012 Campaign, the

question is when was it received? Our records were accounting for information starting September

2013, even though it was a prior campaign. | will need to see the actual documentation.

‘The eighteen transactions were allocations, or movements of funds from the Civil Rights General

Ledger over to the Sit-In Movement Ledger. This does not disqualify donations that were made by

guest In the Museum Store and had to be reclassified over at the end of the month. This isa normal

process for any multi-faceted organization and a standard accounting transaction for an end of

month closing.

Again, Funds in the Donation Box are a legitimate activity for the Civil Rights Museum. Please keep

in mind that Sit-In Movement own Civil Rights Museum 100%, so, related party activities are

necessary and essential.

Recommendation ~ Leave the funds raised as reported, $103,926

9. Corporate Gifts - A notice from Carolina Bank has been received by the Museum to be

reviewed by the city indicating that $100,000 of principle had been waived.

Recommendation ~ Leave the funds raised as reported, $166,713

10. Donations in Museum ~The October 2013 transaction was a journal entry of $294. The Back-up

should be on the general ledger for Civil Rights Museum. It s more than likely transfer of revenue

from Civil Rights Museum reclassified over to Sit-In Movement. End of Month Allocation. Backup is

available to substantiate the claim for the fund amount of $673,

Recommendation ~ Leave the funds raised as reported, $673

14, Grants—No exceptions

Вам также может понравиться

- TORRES Vs LEE COUNTY PDFДокумент17 страницTORRES Vs LEE COUNTY PDFDevetta BlountОценок пока нет

- CBS Sports 2019 NCAA Men's Basketball Tournament BracketДокумент1 страницаCBS Sports 2019 NCAA Men's Basketball Tournament BracketPennLive0% (2)

- TORRES Vs LEE COUNTY PDFДокумент17 страницTORRES Vs LEE COUNTY PDFDevetta BlountОценок пока нет

- Parents Get Letter From Health Department If Child's School Has High Number of Flu-Related IllnessesДокумент2 страницыParents Get Letter From Health Department If Child's School Has High Number of Flu-Related IllnessesDevetta BlountОценок пока нет

- DOJ: Wake Forest Volleyball Coach Named As Part of The 'Varsity Blues' Nationwide College Admissions ScamДокумент6 страницDOJ: Wake Forest Volleyball Coach Named As Part of The 'Varsity Blues' Nationwide College Admissions ScamDevetta BlountОценок пока нет

- Student Shoots Assistant Principal, Kills Self in A 1994 Grimsley High ShootingДокумент1 страницаStudent Shoots Assistant Principal, Kills Self in A 1994 Grimsley High ShootingDevetta BlountОценок пока нет

- Autopsy Report For Marcus Dion Smith Who Died While in Greensboro Police CustodyДокумент7 страницAutopsy Report For Marcus Dion Smith Who Died While in Greensboro Police CustodyDevetta BlountОценок пока нет

- Eureka Math: Why Are Kids Learning Math A Different Way?Документ2 страницыEureka Math: Why Are Kids Learning Math A Different Way?Devetta BlountОценок пока нет

- YouthTruth: 2018 Bullying Today ReportДокумент9 страницYouthTruth: 2018 Bullying Today ReportDevetta BlountОценок пока нет

- Man's Credit Card Fraud Accusation Leads To Raid of Homes and A BusinessДокумент6 страницMan's Credit Card Fraud Accusation Leads To Raid of Homes and A BusinessDevetta BlountОценок пока нет

- The Dangers of Marijuana WaxДокумент2 страницыThe Dangers of Marijuana WaxDevetta BlountОценок пока нет

- Halikerra Statement of DeficienciesДокумент18 страницHalikerra Statement of DeficienciesDevetta BlountОценок пока нет

- NC Trapping Season Rules, Regulations and MapДокумент2 страницыNC Trapping Season Rules, Regulations and MapDevetta BlountОценок пока нет

- School and Church Threats To Become A Felony in NCДокумент4 страницыSchool and Church Threats To Become A Felony in NCDevetta BlountОценок пока нет

- 2017 NC Animal Shelters ReportДокумент63 страницы2017 NC Animal Shelters ReportDevetta BlountОценок пока нет

- 2017 NC Animal Shelters ReportДокумент63 страницы2017 NC Animal Shelters ReportDevetta BlountОценок пока нет

- NC Bathroom Repeal Bill HB142 Lands in Federal CourtДокумент104 страницыNC Bathroom Repeal Bill HB142 Lands in Federal CourtDevetta BlountОценок пока нет

- NC School Security Act 2018Документ9 страницNC School Security Act 2018Devetta BlountОценок пока нет

- NC Coyote Management PlanДокумент200 страницNC Coyote Management PlanDevetta BlountОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)