Академический Документы

Профессиональный Документы

Культура Документы

JEIEJB - Tze San Ong PDF

Загружено:

Diela KasimИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

JEIEJB - Tze San Ong PDF

Загружено:

Diela KasimАвторское право:

Доступные форматы

Journal of Emerging Issues in Economics, Finance and Banking (JEIEFB)

An Online International Monthly Journal (ISSN: 2306 367X)

Volume:1 No.5 May 2013

Factors Affecting the Price of Housing in Malaysia

Tze San Ong

Department of Accounting and Finance,

Faculty of Economics and Management,

University Putra Malaysia,

Selangor, Malaysia.

E-mails: tzesan1108@gmail.com

______________________________________________________________________________

Abstract

The main purpose of this study is to measure the relationship between macroeconomic variables

and the housing price. This paper examines empirically whether the increasing trend in the

Malaysian housing price is related to changes in the gross domestic product (GDP), population,

inflations rate, costs of construction, interest rate and real property gains tax (RPGT). The paper

is exploratory in nature. The empirical data were collected from Valuation and Property Services

Department of the Ministry of Finance Malaysia from 2001 to 2010. The paper provides empirical

results that the gross domestic product (GDP), population and RPGT are the key determinants of

housing prices. However, changes in housing prices may not necessarily be influenced by the gross

domestic products (GDP), population and RPGT in Malaysia. The general finding of this paper

strongly suggests that housing bubbles in the Malaysian residential property market are becoming

bigger and stronger. The paper is useful for speculators, investors and buyers to know which

factors to account for in housing investment decision. This paper can serve as a guide for the

government in stabilizing the residential housing price in Malaysia.

______________________________________________________________________________

Keywords: housing price, economic variable, GDP, population, inflation rate, cost of construction,

interest rate, real property gains tax, Malaysia

JEL Codes: R2, E2, E5, E6

414

www.globalbizresearch.com

Journal of Emerging Issues in Economics, Finance and Banking (JEIEFB)

An Online International Monthly Journal (ISSN: 2306 367X)

Volume:1 No.5 May 2013

1. Introduction

Malaysia as a developing country has obtained benefits from the development of the housing

industry (Jarad, 2010). The Malaysian housing development has continued to fight in spite of

various constructions and restrictions (Agus, 1997). The housing industry has been using

conventional development methods for many years, because of the increasing demand for better

dwellings, the continuous changes in technology, the increase in the construction cost and the

tightness of the environmental policies and the concept of innovation, creation and state-of-the-art

design, all of which have begun to find their place in the industry (Yusof and Abidin, 2007).

The Government of Malaysia recognizes that housing is a basic need for every citizen. It is also

an important component of the urban economy. These have led to the method of policies and

programmers aimed at ensuring that all Malaysians have the chance to obtain an appropriate place

to stay and other related activities. Housing developments in Malaysia are carried out by both

parties, the public sector and the private sector, in terms of low-, medium- and high-cost houses.

The Malaysian Government has also established a housing policy that focuses on the involvement

of the private sector in housing production and delivery, especially in housing scheme development

(Asiah, 1999).

In recent years, rapid economic development has resulted in an increasing demand for

residential housing among urban areas in Malaysia. Reviewing the housing prices in Malaysia, the

prices have appreciated dramatically whether in major cities or smaller towns and depending on

specific location.

Over the past ten years, the residential property market in Malaysia has

experienced a significant price expansion throughout Malaysia, involving higher rates (Table 1).

Most people are wondering such a high annual increases in house prices is totally out of sync with

annual income increases in the general population. In fact, most of the people are afraid that they

are unable to cope with such a high property prices. So far, even with the housing prices almost

hitting the sky, yet the real factors behind the illogical rise are still open to question. Successive

governments and policy analysts have identified the lack of adequate and affordable housing as one

of the critical problems facing the country. House and land prices are spiraling and even middle

class Malaysian are facing difficulties to own a home. Based on the economic theory, house price

movements are inherent in the regional demographics and regional economics, such as population,

GDP, housing finance, inflation rate, RPGT and cost of construction.

According to the Valuation and Property Services Department (JPPH), the average of all houses

pricing has continued to increase from year to year from 2000 to 2010. There was an increase of

45% between 2001 and 2010.

415

www.globalbizresearch.com

Journal of Emerging Issues in Economics, Finance and Banking (JEIEFB)

An Online International Monthly Journal (ISSN: 2306 367X)

Volume:1 No.5 May 2013

As stated in the Seventh Malaysia Plan, Malaysia intended to construct about 800,000 units of

housing for the population. In fact, 585,000 units, constituting 73.1 per cent, were planned to be

low- and medium-cost houses. Nevertheless, the achievements are somewhat disappointing, with

only 20 per cent completed houses reported in spite of numerous incentives and promotions to

encourage housing developers to invest in such housing categories (Ismail, 2001).

Moreover, as stated in the Eighth Malaysia Plan, Malaysia will continue to develop affordable

and sustainable houses for those with a low and medium income. However, Malaysia is facing a

difficult task in accomplishing the target of 600,000800,000 houses during this period because the

conventional building system currently being practised by the construction industry is unable to

cope with the huge demand. Therefore, the former system must be replaced by an Industrialized

Building System (IBS) that will bring advantages in terms of productivity, indoor quality, durability

and cost (Incredible Expanding Mindfuck, 2001).

According to Angie (2009), CIMB research shows that the 5% RPGT was a shock to us as the

Government had suspended RPGT for two and half years from 2007 to give the housing sector a

boost and attract foreign purchasers. The Government encourages citizens to buy or sell houses in

the market. Because of that, those who have a higher income or speculators are buying a lot of

houses and reselling them. Therefore, the housing prices are increasing year by year. However, the

Government reimposed the RPGT on 1 January 2010. Any gain from selling a house within 5 years

will be taxed at 5%, so speculators are not encouraged to resell their property within 5 years.

However, the result of this strategy is not clear regarding whether it will help influence the housing

price to fall. The Government is implementing a number of activities to control the fluctuation of

the housing price; however, the effectiveness of those activities implemented by the Government

is still open to question. In addition, the housing price can still be influenced by macroeconomic

factors, such as the GDP, interest rate, cost of construction, population and inflation rate. These

factors can help relevant parties to handle the situation and stabilize the housing prices before the

condition become worse. The current situation of the housing environment is reflecting the

economic distortion; it is actually not what we call an economic take-off by the real economic

growth. Therefore, the property market could result in chaos if it is continuously growing like this.

As a result, this study aims to investigate the factors influencing the housing price in Malaysia.

The objectives of the present study are:

--To identify the causes of fluctuation in the housing price from 2001 to 2010;

--To investigate the economic variables that affect the housing price in Malaysia.

416

www.globalbizresearch.com

Journal of Emerging Issues in Economics, Finance and Banking (JEIEFB)

An Online International Monthly Journal (ISSN: 2306 367X)

Volume:1 No.5 May 2013

2. Housing Price Determinants

The research conducted by Tse (1999) states that the fluctuation in the housing price has

significant impacts on the economic conditions of the population and society. Moreover, the

demand for housing is increasing in the market. So, the housing price is expected to rise due to the

imbalance between buyers and sellers. Therefore, when there are more buyers than sellers, the

housing price will increase. This can cause a self-fulfilling speculative price bubble (Levin and

Wright, 1997).

2.1 Population

Nowadays, as the population in Malaysia is continuing to increase, people need more houses to

live in but the production of housing is slow due to the many laws, regulations and procedures

related to the building of houses. The finding by Vermeulen and Van Ommeran (2006) states that

people will move to another area where houses are built, but houses are not necessarily built in

the area where people would want to live. This might be because of job transfers. Normally, people

will buy a house in a particular area because they work there or the rental fees are equal to their

housing payment per month.

In Malaysia, lack of affordable options to own property forces many Malaysians into the rental

market and informal settlements, which is drastically increasing due to population growth and

urbanization. In the real economy, perhaps there are a lot more factors that affect housing

prices but we cannot deny the facts that one of the significant factors might be growing

population.

2.2 Gross Domestic Product

The gross domestic product (GDP) is one of the most popular indicators in macroeconomics

used by researchers to represent economic conditions (Maclennan and Pryce, 1996). The GDP is

considered a popular indicator because of the relationship between the macroeconomic activity and

the housing price (Wheeler and Chowdhury, 1993). The gross domestic product (GDP) is the total

market value overall for all final goods and services produced in a country in a particular year. The

formula for the GDP is equal to the total consumer, investment and government spending, plus the

value of exports minus the value of imports. Base on Hii, Latif and Nasir (1999), fluctuations in

the GDP are significantly related to the number of terraced, semi-detached and long houses

constructed in Sarawak. According to them, terraces increase when the GDP is growing. Detached

housing is found not to have any significant lead relation. That means buyers are not influenced by

the GDP when making their buying decision. Conversely, the demand for houses generates housing

industry investment and helps the recovery of the GDP growth rate (Qing, 2010). This result is

417

www.globalbizresearch.com

Journal of Emerging Issues in Economics, Finance and Banking (JEIEFB)

An Online International Monthly Journal (ISSN: 2306 367X)

Volume:1 No.5 May 2013

understandable, because housing investment is part of the GDP. An increase in a part will increase

the whole.

2.3 Labour Force

Little research exists on the impact of housing assistance on the labour supply. Two studies

(Reingold, 1997; Ong, 1998) examine the impact that the receipt of housing assistance for Aid to

Families with Dependent Children (AFDC) recipients has on the tendency of households to work.

If a large amount of the labour force is involved in construction, the cost of housing will increase.

Besides, construction involving a lot of professional workers with a high level of education, such

as engineering, compared with workers who are less educated, will cause the housing price to

increase because the cost of building a unit increases. The constructors, without doubt, will charge

the cost to the buyers. Therefore, the buyers are forced to buy at a higher price. Building activity is

stimulated by higher employment growth (Smith and Tesarek, 1991; Sternlieb and Hughes, 1997).

According to Hartzel (1993) , there are some disagreements regarding certain regional employment

characteristics that play a significant role in investors decisions.

2.4 Interest Rate

Bank lending may affect the housing price through various liquidity effects. The housing price

is just like the price of any asset. It can be determined by the discounted expected future stream of

cash flows. If the financial banks increase the availability of credit, it means that the bank will

provide lower lending rates and encourage current and future economic activity.

Basically, the better availability of credit will cause the demand for housing to increase when

the households are borrowing constrained (Barakova, 2003). The growth in demand will then be

reflected in higher housing prices. The relationship between housing prices and household

borrowing is two-sided. That is, housing prices may significantly influence household borrowing

through various wealth effects. When the housing finance interest rate is low, citizens will be

enabled to make some investments, such as buying more houses. The credit cycles have matched

the housing price cycles in a number of countries (see e.g. International Monetary Fund, 2000;

Bank for International Settlements, 2001).

According to Goodhart and Hofmann (2007), mutually reinforcing boombust cycles in housing

and credit markets may occur, which enhance the probability of a future financial crisis. However,

the two researchers cited suggest that the standards of both house prices and credit from their longrun trends are useful indicators for future investors. Moreover, Goodhart and Hofmann (2007)

mention three different ways to influence households credit demand through housing wealth.

Firstly, households may be facing borrowing constrictions due to the financial market

418

www.globalbizresearch.com

Journal of Emerging Issues in Economics, Finance and Banking (JEIEFB)

An Online International Monthly Journal (ISSN: 2306 367X)

Volume:1 No.5 May 2013

imperfections. As a result, if the instructors can offer more securities in the house, households will

wish to borrow more; in other words, the households borrow basically according to the capacity of

their securities net worth. Since the securities value of housing is quite high, an increase in housing

wealth opens up the borrowing constraints faced by households. Second, households recognized

lifetime assets may have a significant influence as a result of changes in housing wealth. An

increase in the recognized lifetime assets induces households to spend more today, which will mean

smooth consumption over the overall life cycle. Therefore, it will increase the demand for credit.

Lastly, the value of bank capital will also have an impact on housing price movements on credit

supply. That is, housing estimation increases the value of the dwellings owned by the bank. Besides

that, the values of loans are secured by housing loans. Therefore, a fluctuation in the housing price

will affect the risk-taking capacity of banks. So, banks are willing to lend more to the public.

In the nutshell, for homeowners, focus on changing interest rates because they have a direct

influence on real estate prices. However, interest rates also affect the availability of capital and the

demand for investment. These capital flows influence the supply and demand for property and, as

a result, they affect property prices.

2.5 Inflation Rate

Zhu (2004) showed the strong and long-lasting link between inflation and housing price. During

inflation, most things in the economy will increase their price. However, the cost of the raw material

for building a house will increase. According to Kearl (1979), an increase in inflation front loads

real payments on a long-term fixed-rate mortgage, and thus reduces the quantity of housing. It

must be noted due to the global scenario that increasing money supply causes inflation and house

prices to increase.

2.6 Real Preperty Gains Tax

The effect of the real property gains tax (RPGT) on housing satisfaction is also taken into

consideration. The RPGT was suspended in 2007, but the Governments reimposition of the RPGT

in the 2010 budget has caught some by surprise. According to Phun (2010), the RPGT effective

from 1 January 2010 means that any gain arising from property disposal within 5 years will be

subject to the payment of 5% tax. According to a previous study, Tan (2011) states that the impact

of the reimposition of 5% real property gains tax (RPGT) on housing satisfaction is not significant.

Therefore, buyers will not take into consideration the 5% RPGT when they want to sell their

property within 5 years. It is logical to believe that the 5% RPGT will contribute to lower housing

satisfaction among Malaysian homeowners.

419

www.globalbizresearch.com

Journal of Emerging Issues in Economics, Finance and Banking (JEIEFB)

An Online International Monthly Journal (ISSN: 2306 367X)

Volume:1 No.5 May 2013

Hypotheses developed:

H1: The population in Malaysia has a significant impact on the housing price.

H2: The gross domestic product (GDP) has a significant impact on the housing price in Malaysia.

H3: The interest rate has a significant impact on the housing price in Malaysia.

H4: The labour force has a significant impact on the housing price in Malaysia.

H5: Inflation has a significant impact on the housing price in Malaysia.

H6: The RPGT has a significant impact on the housing price in Malaysia.

Secondary data were obtained from Bursa Malaysia, the Department of Statistics of Malaysia

and Datastream. The study sample was identified from a database provided by the Valuation and

Property Services Department (JPPH) of the Ministry of Finance Malaysia. This department was

established on 1 June 1957. Currently, it has 2,101 members of staff, of whom 260 are professional

valuers. The responsibility of the Department has expanded to cover areas of expertise relevant to

and related to the real estate industry. The JPPH plays an important role in providing reliable, timely

and professional services in the development of the country as an advisor to the Government

relating to property and as a consultant to the Government in providing a property consultant

service, as well as assisting the Ministry of Finance in the implementation of policies related to

property, collecting, publishing and disseminating property information, providing training related

to property valuation and carrying out research and development in the field of real estate.

3. Research Variables and Operationalization

This research aims to determine the relationship that exists between macroeconomic variables

(GDP, interest rate, inflation, labour force, RPGT and population) and housing prices. The GDP is

the total value of goods and services produced within a given period (normally a year) after

deducting the cost of goods and services involved in the process of production. Before that, we

have to deduct allowances for the consumption of fixed capital as well. The GDP can be considered

as valued according to purchasers clues.

However, the interest rate is a rate that is an additional charge stemming from borrowing. An

interest rate is often expressed as an annual percentage of the principal. The construction cost is

expense incurred by a contractor for labour, raw material, equipment, financing from a bank and

the services involved in building the house. The labour force is the total number of the people who

are employed or seeking a job in Malaysia. The population means the whole number of people in

a country. Before performing regression analysis, tolerance and variation inflation factor (VIF)

tests, none of these tests detected multi-collinearity among the variables (VIF < 10, 16). Thus, it

shows no major problem for regression analysis.

420

www.globalbizresearch.com

Journal of Emerging Issues in Economics, Finance and Banking (JEIEFB)

An Online International Monthly Journal (ISSN: 2306 367X)

Volume:1 No.5 May 2013

The regression model can be built as below:

Y = GDP + POP + INT + INF + COC + RPGT + E

where

Y = Housing Price

GDP = Gross Domestic Product

POP = Population

INT = Interest Rate

INF = Inflation

COC = Cost of Construction

RPGT = Real Property Gains Tax

E = Error

4. Result and Discussion

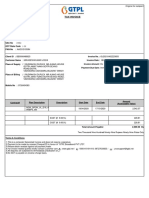

Graph 1 indicates the housing prices in Malaysia from 2001 to 2010. On average, the housing

price was around RM139,099 during the year 2000, and increased by around 41 per cent by the

year 2010 (RM196,720).

In Table 2, the output contains information that is useful for understanding the descriptive

qualities of the data.

The estimated regression equation can be written in a standard format as illustrated below:

Y= -24.191 +0.172X1 0.004X2 +1.937X3 0.004X4 + 0.002X5 + 0.002X6

(-6.438)* (4.274)* (-0.675) (7.569)* (-1.593) (0.653)

(3.895)*

R2 = 0.981

F statistic = 287.093

Figures in parenthesis denote t-statistics

*denotes rejection of the null hypothesis at the 1% level of significance

Y = housing price

X1 = ln(GDP)

X2 = ln(cost of construction)

X3 = ln(population)

X4 = inflation rate

X5 = interest rate

X6 = RPGT

From Table 3, it is apparent that the gross domestic product (GDP), population and real property

gains tax (RPGT) have a significant relationship with the housing price in Malaysia.

The GDP is found to be significantly and positively correlated with the housing price in

Malaysia. The increase in the GDP is because of the increase in personal consumption. The result

is consistent with research conducted by Qing (2010) showing that housing investment is part of

421

www.globalbizresearch.com

Journal of Emerging Issues in Economics, Finance and Banking (JEIEFB)

An Online International Monthly Journal (ISSN: 2306 367X)

Volume:1 No.5 May 2013

the GDP. Therefore, an increase in investment will lead to an increase in the GDP. According to

Chioma (2009), there is a causal relationship between the gross domestic product, which can be

measured as economic growth, and the consumption expenditure, which grows as a result of the

increase in consumption expenditure.

Another finding of this study indicates that the population is significantly and positively

correlated with the housing price. This could be due to the fact that when the number of family

members increases, they definitely need more houses in which to live. Nowadays, the young

generation prefers to work in urban areas, and will buy a house near to the place of work. The

demand from citizens will also affect the housing price. When the demand is greater than the

supply, it will cause the housing price to increase (Agus, 1997). As we know, building a large

number of houses will take a very long time. The constructors might face restrictions on the supply

of land in the area, finding a strategy location to build the houses and the type, density and timing

of the development (Monk, 1996; Asiah, 1999). Those are the factors that constructors have to take

into consideration. For example, there is limited land in Kuala Lumpur and the population is very

large. Therefore, they cannot strike a balance between the supply of housing and the demand for

housing. The Malaysian housing environment is different from that in some developed countries,

as in Malaysia lower-income earners are not provided with social security and they are required to

find their own accommodation. Conversely, in the UK, the Government provides housing benefit

to those earning a lower income. Therefore, an increase in the population in the UK will not affect

the housing price too greatly.

The result also reveals that the RPGT is negatively and significantly associated with the housing

price. The finding contradicts the previous study. Normally, when a government increases the tax

on certain products, it affects the demand for those products, such as alcohol, foreign cars and so

on. This is because citizens have to spend more money to obtain the product and this will create a

burden for them. Surprisingly, the Governments reimposition of the RPGT on 1 January 2010 has

not affected the housing price in Malaysia. This is because the 5% RPGT imposed by the Malaysian

Government is too little for speculators or high-income citizens. They are willing to pay the

additional 5% tax to the Government when they realize the gain from selling a house after deducting

all the costs. In addition, they expect the gain from housing price appreciation to be great enough

to cover the RPGT and still provide them with an attractive profit.

The finding shows that there is no significant relationship between the interest rate and the

housing price. As we know, if everyone is seeking the same thing, buyers or speculators will not

care about the interest rate charged by financial banks, as the demand and supply are unbalanced,

422

www.globalbizresearch.com

Journal of Emerging Issues in Economics, Finance and Banking (JEIEFB)

An Online International Monthly Journal (ISSN: 2306 367X)

Volume:1 No.5 May 2013

particularly during a good economy. This situation is also due to the fact that investors are confident

and optimistic about the housing market. From the speculators perspective, they might not hold

the houses for the long term and they will sell them in the short term. As a result, they might receive

the gain more than the cost. From the buyers perspective, they are willing to pay more to obtain

their desired type of house. Nowadays, constructors try to develop or design a number of houses

based on the customer demand, such as a security service, playground and so on. Therefore, it is an

undeniable fact that the price of the houses will increase.

5. Conclusion

In this research, 120 samples of data were collected from Bursa Malaysia, the Statistics

Department in Malaysia and Datastream. All the macroeconomic variables are on a monthly basis,

from 2001 to 2010. The research was conducted to verify the relationship between macroeconomic

variables and housing prices in Malaysia. Only three macroeconomic variables (GDP, population

and RPGT) were found to be positively and significantly correlated with the housing price. The

result is not surprising due to Wheeler and Chowdhurys (1993) statement that the GDP has a link

with the macroeconomic activity in the housing market, and based on the previous researchers Hii,

Latif and Nasir (1999), a fluctuation in the GDP has a significant relationship with the housing

price.

Besides that, housing prices are related to the population. An increase in the population in

Malaysia increases the housing demand and therefore increases the housing price. If there is a

greater demand than a supply for housing, it will affect the housing price too. When there are fewer

houses in the market, people are willing to spend more money to buy a house. This will cause the

housing price to increase. However, those with a lower income cannot afford to buy a house, and

are forced to rent a house or stay with their parents after marriage. In the 2010 budget, the

Government reimposed the RPGT of 5% for those who sell their house within 5 years after

purchasing it. The purpose of reimposing the RPGT is to discourage speculators from selling their

house within 5 years. In addition, the Government wants to protect lower-income earners in

obtaining their first house.

In future studies, other measurements of the increase in the housing price in Malaysia, such as

investment, economy and personal income, can be used. However, in this research, these variables

are not included. Also, a limited number of studies have included these three variables

simultaneously. In the future, it is hoped that other researchers will pursue the fluctuation in housing

prices and those variables mentioned above. Besides, this research does not attempt to link the

423

www.globalbizresearch.com

Journal of Emerging Issues in Economics, Finance and Banking (JEIEFB)

An Online International Monthly Journal (ISSN: 2306 367X)

Volume:1 No.5 May 2013

housing price to the length of time in which the house was built with the fluctuation; however, this

is suggested to be pursued in the future.

Table 1: House Prices and Annual Change from 2000 to 2010

Year

Index 2000 = 100

(Quarter 4)

Change Over

All House

12 Months

Pricing (RM)

(%)

2001

101.9

0.3

141,494

2002

107.3

5.3

148,201

2003

111.2

3.7

153,580

2004

114.0

2.6

157,461

2005

116.9

2.6

161,500

2006

122.4

4.8

169,112

2007

125.9

2.9

174,410

2008

129.0

2.5

178,632

2009

136.1

5.6

188,542

2010

146.9

8.0

203,495

Table 2: Descriptive Analysis

Minimum

Maximum

Mean

Std Deviation

ln(Housing Price)

11.84

12.23

12.0115

.10445

ln(GDP)

18.26

19.13

18.7158

.27023

18.02

20.91

20.2960

.54351

16.99

17.12

17.0570

.04052

Inflation Rate (%) 4

6.26

1.203

Interest Rate (%)

3.2

7.7

5.742

1.0218

RPGT (%)

30

10.50

11.865

ln(Cost

of

Construction)

ln(Population)

Valid N (120)

424

www.globalbizresearch.com

Journal of Emerging Issues in Economics, Finance and Banking (JEIEFB)

An Online International Monthly Journal (ISSN: 2306 367X)

Volume:1 No.5 May 2013

Table 3: Coefficientsa

Unstandardized Standardized

Collinearity

Coefficients

Statistics

Coefficients

Std

Beta

Sig.

Tolerance VIF

Error

-24.191

3.757

.172

.040

.446

4.274 .000 .107

2.358

-.004

.005

-.019

-.675

.134

5.459

ln(Population) 1.937

.256

.752

7.569 .000 .151

3.610

-.004

.003

-.046

.092

4.868

Interest Rate

.002

.003

.020

.653

.518 .087

8.780

RPGT(%)

.002

.000

.219

3.895 .000 .167

6.125

(Constant)

ln(GDP)

ln(Cost

of

Construction)

Inflation Rate

6.438

1.593

.000

.505

.121

Dependent variable: Housing price

Graph 1: Housing Prices in Malaysia from 2001 to 2010

250,000

2001

2002

Housing Prices in Malaysia

200,000

2003

2004

150,000

2005

2006

100,000

2007

50,000

2008

2009

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

2010

Year (Quarterly)

425

www.globalbizresearch.com

Journal of Emerging Issues in Economics, Finance and Banking (JEIEFB)

An Online International Monthly Journal (ISSN: 2306 367X)

Volume:1 No.5 May 2013

References

Agus, M.R. (1997) Historical Perspective of Housing Development. In Housing a Nation: A

Definitive Study. Cagamas Berhad, Kuala Lumpur, pp 29-70.

Asiah Othman (1999). The Effect Of The Planning System On Housing Development: A Study Of

The Development: A Study Of Developers Behaviour In Kuala Lumpur and Johor Bahru, Malaysia.

University of Aberdeen: Ph.D. Thesis.

Barakova, I., Bostic, Bostic, R.W., Calem, P.S. and Wachter, S.M.(2003) Does credit quality for

homeownership. Journal of Housing Economics. Vol.12(4): pp 318-336.

Bayer, P., McMillan, R and Rueben, K. (2003) An equilibrium model of sorting in the urban

housing market: a study of the causes and consequences of residential segregation, Economic

Growth Center Discussion Paper, Vol. 860, no. 5

Bramley, G.(2003). Planning Regulation and Housing Supply In a Market Syatem. In: OSullivan,

T. and Gibb, K.eds. Journal of Housing Economics and Public Policy., pp. 193 - 217

Chen, N K (2001), Bank Net Worth, Asset prices and Economic Activity, Journal of Monetary

Economics, vol 48, pp 415-36.

Chioma, N. J (2009), Causal relationship between gross domestic product and personal

consumption expenditure of Nigeria, Journal of Mathematics and Computer Science Research

Vol. 2(8), pp. 179-183, September, 2009.

Clark, W. A. V. and. Dieleman. F. M. (1996). Households and housing: Choice and outcomes in

the housing market. Journal of Centre for Urban Policy Research.

Clara H. M. (2006), Population and housing: A two-side relationship, Journal of peer-reviewed

research and commentary in the population science, Vol. 15, pp. 401 412.

Cruz, B.D.O. and Morais, M.D.P. (2000) Demand for housing and urban services in Brazil: a

hedonic approach, paper delivered at the EBRH 2000 conference in Gavle, Sweden 26-30 June

2000.

Garmaise, M and T Moskowitz (2004), Confronting Information Asymmetries: Evidence from

Real Estate Markets, Review of Financial Studies, vol 17, no2, pp 405-437.

Gerlach, S and W Peng (2005), Bank Lending and Property Prices in Hong Kong, Journal of

Banking and Finance, vol 29, pp 461-481.

Goodhart, C. and Hofmann, B. (2007) House Prices and the Macroeconomy: Implications for

Banking and Price Stability, Oxford University Press: Oxford.

Granger, C.W.J. (1969). Investigating Causal Realtion by Econometric Models and Cross-Spectral

methods, Econometrica, Vol.37, No.3 pp 424-438.

426

www.globalbizresearch.com

Journal of Emerging Issues in Economics, Finance and Banking (JEIEFB)

An Online International Monthly Journal (ISSN: 2306 367X)

Volume:1 No.5 May 2013

Hartzell, D., Eichholtz, P. and Selender, A. (1993), Economic diversification in European real

estate portfolios, Jornal of Property Research, Vol. 10, pp. 5-25.

Herring, R and S Wacheter (1999): Real Estate Booms and Banking Busts: An International

Perspective, Center for Financial Institutions Working Papers, no 99-27

Hii W.H., Latif I and Nasir A. (1999): Lead-lag relationship between housing and gross domestic

product in Sarawak, paper presented at The International Real Estate Society Conference 26-30th

July, 1999

Hilbers, P, Q Lei and L Zacho (2001): Real Estate Market Developments and Financial Sector

Soundness, IMF Working Paper, no WP/01/129.

Hofmann, B (2004): Bank Lending and Property Prices: Some International Evidence, Working

Paper.

Hui, H.C. (2009), The impact of property market developments on the real economy of Malaysia.

International Research Journal of Finance and Economics, Vol.30, pp. 66-86.

IEM (2001) A need for new building technologies. Bulletin of Institute of Engineer, Malaysia,

February.

IMF (2000) Word Economic Outlook, May 2000. Washington D.C: IMF

Ismail, E. (2001) Industrialised Building system for housing in Malaysia. The Sixth Asia-Pacific

Science and Technology Management Seminar, Tokyo.

Jarad, I.A., Yusof N.A., and Mohd Shafiei M.W. (2010). The organizational performance of

housing developers in Peninsular Malaysia. International Journal of Housing Markets and

Analysis. Vol. 3(2), pp. 146-162

Jalovaara, Marika. (2002). "Socioeconomic differentials in divorce risk by duration of marriage."

Journal of Demographic Research Vol. 7, pp. 537-564

Jud, Donald and Daniel W. (2002), The Dynamics of Metropolitan Housing prices, Journal of

Real Estate Research, Vol.23 (1-2), pp. 29-45.

Levin, E.J. and Wright, R.E. (1997), The impact of speculation on house prices in the United

Kingdom, Journal of Economic Modelling, Vol.14, pp. 567-585.

Maclennan, D. and Pryce, G. (1996), Global Economic Change, Labour Market Adjustment and

the Challenges for European Housing Policies, Journal of Urban Studies, Vol. 33, No. 10, pp.

1849-1865.

Malaysia Government, (1996), Seventh Malaysia Plan, Percetakan Nasional Berhad, Kuala

Lumpur.

427

www.globalbizresearch.com

Journal of Emerging Issues in Economics, Finance and Banking (JEIEFB)

An Online International Monthly Journal (ISSN: 2306 367X)

Volume:1 No.5 May 2013

Malaysia Government, (2001), Eight Malaysian Plan, Percetakan Plan, Percetakan Nasional

Berhad, Kuala Lumpur.

Megbolugbe, I.F. and Cho, M. (1993) An empirical analysis of metropolitan housing and mortgage

markets. Journal of Housing Research, Vol 4, no2, pp 191-210.

Mojon, B (2007), Monetary Policy, Output Composition, and the Great Moderation. Working

Paper WP 2007-07, Federal Reserve Bank of Chicago.

Monk, S., Whitehead, C.M E. (1996). Land Supply and Housing: A Case Study. Journal of Housing

Studies. Volume 3, pp 495 511.

Myers, D. (1990). Housing demography: Linking demographic structure and housing markets.

Madison, Wisc: University of Wisconsin Press.

Ng, A. (2006), Housing and mortgage markets in Malaysia, In: Kusmiarso B (Ed.), Housing and

Mortgage Markets in SEACEN Countries, SEACEN Publication, pp. 123-188

Qing P.M. (2010), Housing market in Chinas growth recovery and house price determination,

paper presented at The 21st CEA(UK) and 2nd CEA(Europe) Annual Conference, 12-13 July 2010.

Quigley, J.and Raphael, S. (2004). Is Housing Affordable? Why Isnt It More Affordable? Journal

of Economic Perspective No.18.

Smith, B.A., and Tesarek, W.P. (1991), House prices and regional real estate cycles: Market

adjustment in Houston, Journal of the American Real Estate and Urban Economics Association,

Vol.19, pp.396-416.

Sternlib, G., and Hughes, J. W. (1997), Regional market variations: The Northeast versus the South,

Journal of the American Real Estate and Urban Economics Association, pp. 44-68.

Sutberry T. (1998), Implicit Price Deflator for Personal Consumption Expenditures Referendum

47s Measure of Inflation. MRSC Public Policy and Finance Consultant.

Tan T. H. (2010), Base Lending Rate and Housing Prices: Their Impacts on Residential Housing

Activities in Malaysia, Journal of Global Business and Economics, Vol.1, No.1

Tsatsaronis, K and Zhu H. (2004): What Drivers Housing Price Dynamics: Cross-Country

Evidence, BIS Quarterly Review, pp 65-78.

Tse, R.Y.C, Ho, C.W. and Gansesan, S. (1999), Matching housing supply and demand: an

empirical study of Hong Kongs market, Journal of Construction management and Economics,

Vol. 17, pp. 625-633.

Vermeulen, Wouter and Jos V. O... (2006). Housing supply and the interaction of regional

population and employment. The Hague: CPB (Netherlands Bureau for Economic Policy

Analysis).

428

www.globalbizresearch.com

Journal of Emerging Issues in Economics, Finance and Banking (JEIEFB)

An Online International Monthly Journal (ISSN: 2306 367X)

Volume:1 No.5 May 2013

Wheeler, M. and Chowdhury, A. R. (1993) The housing market, macroeconomic activity and

financial innovation: an empirical analysis of US data. Journal of Applied Economics, Vol.25, no

3, pp 385-392.

Yusof, N. and N. Zainul A. (2007), A proposed method for measuring the innovativeness of private

housing developers in Malaysia. Malaysia, Journal of Real Estate. Vol. 2(1), pp. 55-60.

Zhu Haibin, (2004), What drives housing price dynamics: cross country evidence, BIS

Quarterly Review, March 2004.

429

www.globalbizresearch.com

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Grievance Redrassal ManagementДокумент71 страницаGrievance Redrassal ManagementAzaruddin Shaik B Positive0% (1)

- Dolls House Note BookДокумент28 страницDolls House Note BookChirag J Pandya100% (2)

- New 7 QC ToolsДокумент106 страницNew 7 QC ToolsRajesh SahasrabuddheОценок пока нет

- NPD Ent600Документ26 страницNPD Ent600Aminah Ibrahm100% (2)

- Performance Analysis of Chinas Fast Fashion ClothДокумент10 страницPerformance Analysis of Chinas Fast Fashion ClothQuỳnh LêОценок пока нет

- Volvo CE Special Tool Catalog 02092023Документ647 страницVolvo CE Special Tool Catalog 02092023Bradley D Kinser0% (1)

- Generation Zombie Essays On The Living Dead in Modern Culture Zombies As Internal Fear or ThreatДокумент9 страницGeneration Zombie Essays On The Living Dead in Modern Culture Zombies As Internal Fear or Threatamari_chanderiОценок пока нет

- NOTICE: This Order Was Filed Under Supreme Court Rule 23 and May Not Be Cited As PrecedentДокумент20 страницNOTICE: This Order Was Filed Under Supreme Court Rule 23 and May Not Be Cited As PrecedentmikekvolpeОценок пока нет

- STP Maths 7A AnswersДокумент24 страницыSTP Maths 7A AnswersEzra Loganathan Muniandi100% (2)

- Black Book PDFДокумент69 страницBlack Book PDFManjodh Singh BassiОценок пока нет

- Credit Card Dues: Faculty of Business and Management, Universiti Teknologi MARA, MalaysiaДокумент7 страницCredit Card Dues: Faculty of Business and Management, Universiti Teknologi MARA, MalaysiaDiela KasimОценок пока нет

- Chapter Three: Research MethologyДокумент6 страницChapter Three: Research MethologyDiela KasimОценок пока нет

- BJM 134 PDFДокумент58 страницBJM 134 PDFDiela KasimОценок пока нет

- Ijhms 0101218 PDFДокумент3 страницыIjhms 0101218 PDFDiela KasimОценок пока нет

- 9559 11690 1 PB PDFДокумент15 страниц9559 11690 1 PB PDFDiela KasimОценок пока нет

- @@@6tan An Hedonic Model For House Prices in MalaysiaДокумент15 страниц@@@6tan An Hedonic Model For House Prices in MalaysiaDiela KasimОценок пока нет

- Huraian Sukatan Pelajaran Matematik Tahun 5Документ60 страницHuraian Sukatan Pelajaran Matematik Tahun 5Mat Jang100% (23)

- 1.saidov Elyor IlhomovichДокумент17 страниц1.saidov Elyor IlhomovichDiela KasimОценок пока нет

- 6446Документ9 страниц6446Diela KasimОценок пока нет

- Project Paper Abstract Form: Universiti Teknologi Mara, Johor Faculty of Business ManagementДокумент2 страницыProject Paper Abstract Form: Universiti Teknologi Mara, Johor Faculty of Business ManagementDiela KasimОценок пока нет

- Kepakaran Pensyarah Utk Pelajar Senarai AdvisorДокумент5 страницKepakaran Pensyarah Utk Pelajar Senarai AdvisorDiela KasimОценок пока нет

- Credit Card Dues: Faculty of Business and Management, Universiti Teknologi MARA, MalaysiaДокумент7 страницCredit Card Dues: Faculty of Business and Management, Universiti Teknologi MARA, MalaysiaDiela KasimОценок пока нет

- What Is The Issue That Is Being Addressed?Документ4 страницыWhat Is The Issue That Is Being Addressed?Diela KasimОценок пока нет

- Skema Jawapan MT t5 - Kertas 2Документ2 страницыSkema Jawapan MT t5 - Kertas 2nurОценок пока нет

- Industry ImpactsДокумент3 страницыIndustry ImpactsDiela KasimОценок пока нет

- The Economic Impact of An: Mckinsey OnДокумент7 страницThe Economic Impact of An: Mckinsey OnDiela KasimОценок пока нет

- Addition and SubtractionДокумент2 страницыAddition and SubtractionDiela KasimОценок пока нет

- Shape and Space (Volume) : Shape Length Breadth Height Length X Breadth X HeightДокумент2 страницыShape and Space (Volume) : Shape Length Breadth Height Length X Breadth X HeightAsyraf HashimОценок пока нет

- Earthquake, Tsunami, Meltdown - The Triple Disaster's Impact On Japan, Impact On The World - Brookings InstitutionДокумент4 страницыEarthquake, Tsunami, Meltdown - The Triple Disaster's Impact On Japan, Impact On The World - Brookings InstitutionDiela KasimОценок пока нет

- The House: Materials May Be Reproduced For Educational PurposesДокумент1 страницаThe House: Materials May Be Reproduced For Educational PurposesdyanaplusОценок пока нет

- Addition and SubtractionДокумент2 страницыAddition and SubtractionDiela KasimОценок пока нет

- Fukushima FalloutДокумент64 страницыFukushima FalloutAna MariaОценок пока нет

- Introduction To Physics 1 PDFДокумент27 страницIntroduction To Physics 1 PDFjgd2080Оценок пока нет

- F4C1 PhysicsДокумент15 страницF4C1 Physicsnicole1003Оценок пока нет

- Physic Form 4 FormulaДокумент17 страницPhysic Form 4 Formulaadria_elnes100% (2)

- AДокумент20 страницAShu85Оценок пока нет

- Fizik Chapter 5Документ36 страницFizik Chapter 5Nur HajarahОценок пока нет

- PriceListHirePurchase Normal6thNov2019Документ56 страницPriceListHirePurchase Normal6thNov2019Jamil AhmedОценок пока нет

- Integrated Review Ii: Advanced Financial Accounting and Reporting Module 3: Special Revenue Recognition I. Installment SalesДокумент18 страницIntegrated Review Ii: Advanced Financial Accounting and Reporting Module 3: Special Revenue Recognition I. Installment SalesDarren Joy CoronaОценок пока нет

- BSC Charting Proposal For Banglar JoyjatraДокумент12 страницBSC Charting Proposal For Banglar Joyjatrarabi4457Оценок пока нет

- Mplus FormДокумент4 страницыMplus Formmohd fairusОценок пока нет

- Design & Build Toyo Batangas WH Evaluation SUMMARYДокумент1 страницаDesign & Build Toyo Batangas WH Evaluation SUMMARYvina clarisse OsiasОценок пока нет

- Din 11864 / Din 11853: Armaturenwerk Hötensleben GMBHДокумент70 страницDin 11864 / Din 11853: Armaturenwerk Hötensleben GMBHkrisОценок пока нет

- 1-Pitch Types PDFДокумент6 страниц1-Pitch Types PDFDevansh SharmaОценок пока нет

- Chocolate Industry Final Case AnalysisДокумент10 страницChocolate Industry Final Case AnalysisSadia SaeedОценок пока нет

- Tax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 9984 GJДокумент1 страницаTax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 9984 GJMrugesh Joshi50% (2)

- Et Ref MessagesДокумент2 848 страницEt Ref MessagesNitish KumarОценок пока нет

- Walmart GRRДокумент174 страницыWalmart GRRPatricia DillonОценок пока нет

- Design Failure Mode and Effects Analysis: Design Information DFMEA InformationДокумент11 страницDesign Failure Mode and Effects Analysis: Design Information DFMEA InformationMani Rathinam Rajamani0% (1)

- American Ambulette SchedulesДокумент321 страницаAmerican Ambulette SchedulesMNCOOhioОценок пока нет

- I INVENTED THE MODERN AGE: The Rise of Henry Ford by Richard SnowДокумент18 страницI INVENTED THE MODERN AGE: The Rise of Henry Ford by Richard SnowSimon and SchusterОценок пока нет

- Sparsh Gupta AprДокумент4 страницыSparsh Gupta Aprshivamtyagihpr001Оценок пока нет

- F23 - OEE DashboardДокумент10 страницF23 - OEE DashboardAnand RОценок пока нет

- Obayomi & Sons Farms: Business PlanДокумент5 страницObayomi & Sons Farms: Business PlankissiОценок пока нет

- CH3Документ4 страницыCH3Chang Chun-MinОценок пока нет

- RBI FAQ of FDI in IndiaДокумент53 страницыRBI FAQ of FDI in Indiaaironderon1Оценок пока нет

- 01 Pengantar SCMДокумент46 страниц01 Pengantar SCMAdit K. BagaskoroОценок пока нет

- Talk About ImbalancesДокумент1 страницаTalk About ImbalancesforbesadminОценок пока нет